false

0001434524

0001434524

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 1, 2024

CLEARSIGN TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in Charter)

| Delaware |

|

001-35521 |

|

26-2056298 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File No.) |

|

(IRS Employee

Identification No.) |

8023 E. 63rd Place, Suite 101

Tulsa,

Oklahoma 74133

(Address of Principal Executive Offices)

(918) 236-6461

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13(e)-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock |

|

CLIR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth

company ¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As

previously reported by ClearSign Technologies Corporation (the “Company”) on a Current Report on Form 8-K, Robert T. Hoffman,

Sr., who had served on the Company’s board of directors (the “Board”) as a designee of clirSPV LLC (the “SPV”)

pursuant to that certain Voting Agreement, dated July 12, 2018, between the Company and the SPV (the “Voting Agreement”),

resigned from the Board on June 16, 2024. As a result of Mr. Hoffman’s resignation, and in accordance with the Voting Agreement,

the SPV nominated G. Todd Silva as its successor designee for consideration by the Board’s nominating and corporate governance committee

(the “Governance Committee”). Upon recommendation of the Governance Committee, and effective as of August 1, 2024 (the “Effective

Date”), Mr. Silva was appointed to the Board as the SPV’s designee to fill the vacancy created by Mr. Hoffman’s resignation.

Mr.

Silva, age 59, brings over 30 years of leadership and finance experience in industries spanning from financial services, technology, health

care and others. Mr. Silva has served as the Chief Financial Officer of Radiance Therapeutics, Inc., a development stage medical device

company, since April 2023. Prior to this current role, Mr. Silva served as the Chief Financial Officer of Point Pickup Technologies, Inc.,

a logistics platform service, from June 2021 to March 2023, where he worked to consummate and integrate acquisitions, raise capital through

various private transactions and assist with corporate governance tasks for their board of directors. Additionally, from October 2020

to June 2021, Mr. Silva was the founder and director of Silva Partnership & Co., a firm that provided corporate advisory services

to early-stage technology businesses. Prior to Silva Partnership & Co., Mr. Silva was the executive director of corporate advisory

services at Las Olas Capital Partners, a registered investment advisor firm, from October 2017 to September 2019, where he advised a variety

of companies on mergers and acquisitions, capital raises, recapitalizations and the launch of special purpose vehicles to invest in corporate

and real estate transactions. Mr. Silva received an MBA from Columbia University focused in finance and accounting and a BS from Lehigh

University in economics and finance.

In

connection with his appointment, Mr. Silva received an offer letter from the Company, effective as of the Effective Date (the “Offer

Letter”), setting forth the terms of Mr. Silva’s services as a director and his compensation arrangement, which he accepted.

Pursuant to the Offer Letter and in accordance with the Company’s director compensation policies, Mr. Silva will be granted restricted

stock units (“RSUs”) under the Company’s 2021 Equity Incentive Plan on the first day of every quarter that Mr. Silva

serves on the Board (each, a “Grant Date”) in an amount of $15,000, payable on each Grant Date during Mr. Silva’s term

of service, with the value of the applicable RSUs determined at the applicable Grant Date. The initial grant amount of RSUs upon Mr. Silva’s

appointment will be pro-rated for the portion of the quarter ending September 30, 2024 during which Mr. Silva serves on the Board.

The

foregoing description of the Offer Letter does not purport to be a complete description of the rights and obligations of the parties thereunder

and is qualified in its entirety by reference to the Offer Letter, which is included as Exhibit 10.1 to this Current Report on Form 8-K

(this “Form 8-K”).

In

connection with his appointment, Mr. Silva also entered into the Company’s standard form of indemnification agreement, the form

of which was filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission

on November August 14, 2023.

Except

for the Voting Agreement, there are no other arrangements or understandings between Mr. Silva and any other person pursuant to which he

was selected as a director. There are no family relationships between Mr. Silva and any of our officers and directors and there is no

transaction between the Company and Mr. Silva that is required to be disclosed pursuant to Item 404(a) of Regulation S-K

| Item 7.01 |

Regulation FD Disclosure. |

A

copy of the Company’s press release announcing Mr. Silva’s appointment described in Item 5.02 is being furnished as Exhibit

99.1 to this Form 8-K. The information in this Item 7.01 of this Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, whether made before or after the date hereof and regardless

of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

(d) Exhibits.

* Filed herewith.

** Previously filed.

*** Furnished herewith.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated: August 6, 2024

| |

CLEARSIGN TECHNOLOGIES CORPORATION |

| |

|

|

| |

By: |

/s/ Colin James Deller |

| |

Name: |

Colin James Deller |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

July 19, 2024

Re: Board of Directors of ClearSign Technologies

Corporation - Offer Letter

Dear Mr. G. Todd Silva:

On behalf of ClearSign Technologies

Corporation (the “Company,” “ClearSign,” “we,” “our” or “us”)

and our Board of Directors (“Board”), I am pleased to offer you a position as a non-independent member of our Board

and as the director nominated by clirSPV in accordance with the terms of the Stock Purchase Agreement dated July 12, 2018. We look forward

to working with you on the Board. Should you choose to accept this position as a member of the Board, this letter shall constitute an

agreement (the “Agreement”) between you and the Company and contains all the terms and conditions relating to the services

to be provided.

1. Term.

This Agreement shall be through the date of the next annual shareholders’ meeting expected in early June 2025 and commencing on

the date you and the Company execute this Agreement although your actual start date can be mutually agreed to be on that date, or a later

date, but it is our expectation that this will not be later than August 2nd 2024. Your term as director shall continue for as long as

clirSPV nominates you as its designee, and you are determined to be qualified and elected, or until your successor is nominated by clirSPV

and is duly qualified and elected. The position shall be up for re-election each year at the annual shareholders’ meeting and upon

re-election, the terms and provisions of this Agreement shall remain in full force and effect. You also agree to resign from the Board

of Directors if requested by a majority of the then-sitting members of the Board. This Agreement shall be in effect as long as you are

a director on the Board.

2. Services.

You shall render services in the area of managing or directing the Company’s property, affairs and business (hereinafter, your “Duties”).

You shall consult with other members of the Board at meetings held quarterly, or more regularly if required, in locations determined by

the Chief Executive Officer of the Company. You agree that your relationship with the Company will be that of a director and not that

of an employee. Nothing in this Agreement is intended to replace, supersede or diminish any of your duties to the Company as a director

under state law. You also agree to comply with all federal and state securities laws as well as Company policies, as applicable.

3. Services

for Others. You are free to represent or perform services for other persons during the term of this Agreement. However, you agree

that you do not presently perform and do not intend to perform, during the term of this Agreement, similar Duties, consulting or other

services for companies whose businesses are or would be, in any way, in conflict or competitive with the Company (except for companies

previously disclosed by you to the Company in writing). Should you propose to perform similar Duties, consulting or other services for

any such company, you agree to notify the Company in writing in advance (specifying the name of the organization for whom you propose

to perform such services) and to provide sufficient information to the Company to allow it to determine if the performance of such services

would conflict with areas of interest to the Company.

4. Compensation

to Independent Directors. In consideration for your service as a member of the Board, you will receive an award of restricted stock

units valued at $15,000 on the grant date, which grant date will be the first day of every quarter that you serve on the Board. These

restricted stock units will vest upon death, departure from the board or a “change of control,” as such term is defined in

the applicable Agreement as determined by the Board’s Compensation Committee and in accordance with the terms and conditions of

the Company's 2021 Equity Incentive Plan. The Company will also reimburse you for reasonable expenses incurred in connection with the

performance of your Duties as a director in accordance with the Company’s expense policy then in effect. Should you join the Board

or any committee of the Board after the first day of any quarter, you will receive an award of restricted stock units that is pro-rated

for the number of days remaining in such quarter.

5. D&O

Insurance Policy. You will be entitled to coverage under our Directors and Officers liability insurance as then in effect.

6. Assignment.

Because of the personal nature of the services to be rendered by you, this Agreement may not be assigned by you. The Company shall be

free to transfer any of its rights under this Agreement to any affiliate or third party.

7. Confidential

Information; Non-Disclosure. In consideration of your access to the premises of the Company and your access to certain Confidential

Information of the Company, in connection with your business relationship with the Company, you hereby represent and agree as follows:

a. Definition.

For purposes of this Agreement the term “Confidential Information” means:

i. Any

information which the Company possesses that has been created, discovered or developed by or for the Company, and which has or could have

commercial value or utility in the business in which the Company is engaged; or

ii. Any

information that is related to the business of the Company and is generally not known by non-Company personnel.

iii. By

way of illustration, but not limitation, Confidential Information includes trade secrets and any information concerning products, processes,

formulas, designs, inventions (whether or not patentable or registrable under copyright or similar laws, and whether or not reduced to

practice), discoveries, concepts, ideas, improvements, techniques, methods, research, development and test results, specifications, data,

know-how, software, formats, marketing plans, and analyses, business plans and analyses, strategies, forecasts, customer and supplier

identities, characteristics and Agreements.

b. Exclusions.

Notwithstanding the foregoing, the term Confidential Information shall not include:

i. Any

information which becomes generally available to the public other than as a result of a breach of the confidentiality portions of this

Agreement, or any other Agreement requiring confidentiality between the Company and you;

ii. Information

received from a third party in rightful possession of such information who is not restricted from disclosing such information; and

iii. Information

known by you prior to receipt of such information from the Company, which prior knowledge can be documented.

8. Documents.

You agree that, without the express written consent of the Company, you will not remove from the Company's premises, any notes, formulas,

programs, data, records, machines or any other documents or items which in any manner contain or constitute Confidential Information,

nor will you make reproductions or copies of same. In the event you receive any such documents or items by personal delivery from any

duly designated or authorized personnel of the Company, you shall be deemed to have received the express written consent of the Company.

In the event that you receive any such documents or items, other than through personal delivery as described in the preceding sentence,

you agree to inform the Company promptly of your possession of such documents or items. You agree to promptly return any such documents

or items, along with any reproductions or copies to the Company upon the Company's demand or upon termination of this Agreement or your

departure from the Board.

9. Non-Disparagement.

You agree to forbear from making, causing to be made, publishing, ratifying or endorsing any and all disparaging remarks, derogatory statements

or comments to any third party with respect to the Company and its affiliates, including, without limitation, the Company’s parent,

subsidiaries, officers, directors and employees (collectively, “Company Parties”). Further, you hereby agree to forbear

from making any public or non-confidential statement with respect to any of the Company Parties. The duties and obligations of this paragraph

9 shall continue following the termination of this Agreement.

10. Non-Solicitation.

You agree and covenant not to directly or indirectly solicit, hire, or recruit for your own benefit or the benefit of any other person,

or so attempt to solicit, hire, or recruit, any employee of the Company, or induce any other employee of the Company to terminate their

employment for two (2) years immediately following your cessation of services to the Company, regardless of the reason. This non-solicitation

paragraph explicitly covers all forms of oral, written, or electronic communication, including, but not limited to, communications by

email, regular mail, express mail, telephone, fax, instant message, and social media, including, but not limited to, Facebook, LinkedIn,

Instagram, and Twitter, and any other social media platform, whether or not in existence at the time of entering into this Agreement.

11. No

Disclosure. You agree that you will hold in trust and confidence all Confidential Information and will not disclose to others, directly

or indirectly, any Confidential Information or anything relating to such information without the prior written consent of the Company,

except as maybe necessary in the course of this business relationship with the Company. You further agree that you will not use any Confidential

Information without the prior written consent of the Company, except as may be necessary in the course of your business relationship with

the Company, and that the provisions of this paragraph 11 shall survive termination of this Agreement.

12. Termination.

This Agreement shall terminate in the event of your resignation or termination as a director, or your refusal to stand for re-election

or decision not to be nominated or if you are not re-elected for additional terms as a director, effective on the date of your departure

from the Board.

13. Entire

Agreement; Amendment; Waiver. Other than any requirements and duties under applicable law, this Agreement expresses the entire understanding

with respect to the subject matter hereof and supersedes and terminates any prior oral or written Agreements with respect to the subject

matter hereof. Any term of this Agreement may be amended and observance of any term of this Agreement may be waived only with the written

consent of the parties hereto. Waiver of any term or condition of this Agreement by any party shall not be construed as a waiver of any

subsequent breach or failure of the same term or condition or waiver of any other term or condition of this Agreement. The failure of

any party at any time to require performance by any other party of any provision of this Agreement shall not affect the right of any such

party to require future performance of such provision or any other provision of Agreement.

14. Enforcement.

a. Applicable

Law. This Agreement and the rights and remedies of each party arising out of or relating to this Agreement (including, without limitation,

equitable remedies) shall be solely governed by, interpreted under, and construed and enforced in accordance with the laws (without regard

to the conflicts of law principles thereof) of the State of Delaware, as if this Agreement were made, and as if its obligations are to

be performed, wholly within the State of Oklahoma.

b. Consent

to Jurisdiction and Venue. Any action or proceeding arising out of or relating to this Agreement shall be filed in and heard and litigated

solely before the state or federal courts of Oklahoma within Tulsa County.

c. Attorneys’

Fees. If court proceedings are required to enforce any provision of this Agreement, the substantially prevailing or successful party

shall be entitled to an award of the reasonable and necessary expenses of litigation, including reasonable attorneys’ fees.

I appreciate your willingness

to serve on our Board and look forward to working with you to serve the Company together. Please indicate your acceptance by signing and

returning the enclosed copy of this letter.

SIGNATURE PAGE FOLLOWS

| |

ClearSign Technologies Corporation |

|

|

/s/ Colin James Deller |

| |

Dr. Colin James Deller, Chief Executive Officer |

| ACCEPTED AND AGREED: |

|

|

|

|

| /s/ G. Todd Silva |

|

| Name: G. Todd Silva |

|

| Date: August 1, 2024 |

|

Exhibit 99.1

ClearSign Technologies Appoints G. Todd Silva

to Board of Directors

TULSA, Okla.,

August 6, 2024 -- ClearSign Technologies Corporation (Nasdaq: CLIR) (“ClearSign” or the “Company”),

an emerging leader in industrial combustion and sensing technologies that improve energy, operational efficiency and safety while dramatically

reducing emissions, announces that G. Todd Silva has been appointed to serve as a member of the Company’s Board of Directors (the

“Board”), effective as of August 1, 2024. Mr. Silva was nominated by clirSPV LLC to serve as its director designee.

Mr. Silva brings over 30 years of leadership

and finance experience in industries spanning from financial services, technology, health care and others. Mr. Silva has served as the

Chief Financial Officer of Radiance Therapeutics, Inc., a development stage medical device company, since April 2023. Prior to this current

role, Mr. Silva served as the Chief Financial Officer of Point Pickup Technologies, Inc., a logistics platform service where he worked

to consummate and integrate acquisitions, raise capital through various private transactions and assist with corporate governance tasks

for their board of directors. Additionally, Mr. Silva was the founder and director of Silva Partnership & Co., a firm that provided

corporate advisory services to early-stage technology businesses. Prior to Silva Partnership & Co., Mr. Silva was the executive director

of corporate advisory services at Las Olas Capital Partners, a registered investment advisor firm where he advised a variety of companies

on mergers and acquisitions, capital raises, recapitalizations and the launch of special purpose vehicles to invest in corporate and

real estate transactions. Mr. Silva received an MBA from Columbia University focused in finance and accounting and a BS from Lehigh University

in economics and finance.

“On behalf of the Company and the Board,

I want to welcome Todd to ClearSign,” said Jim Deller, Ph.D., Chief Executive Officer of ClearSign. “Todd has a wealth

of experience and I look forward to working with him as we continue to expand and develop ClearSign’s business.”

About ClearSign Technologies Corporation

ClearSign Technologies Corporation designs and

develops products and technologies for the purpose of improving key performance characteristics of industrial and commercial systems,

including operational performance, energy efficiency, emission reduction, safety and overall cost-effectiveness. Our patented technologies,

embedded in established OEM products as ClearSign Core™ and ClearSign Eye™ and other sensing configurations, enhance

the performance of combustion systems and fuel safety systems in a broad range of markets, including the energy (upstream oil production

and down-stream refining), commercial/industrial boiler, chemical, petrochemical, transport and power industries. For more information,

please visit www.clearsign.com.

For further information:

Investor Relations:

Matthew Selinger

Firm IR Group for ClearSign

+1 415-572-8152

mselinger@firmirgroup.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

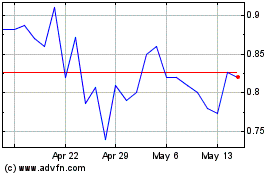

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

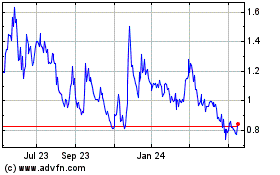

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Dec 2023 to Dec 2024