CME Group to Exit OTC Credit-Default-Swap Clearing Business

September 14 2017 - 8:10PM

Dow Jones News

By Maria Armental

CME Group Inc. (CME) plans to exit the over-the-counter

credit-default-swap clearing business next year, a move that would

free $650 million to clearing members, the exchange operator said

Thursday.

Chicago-based CME, the world's most valuable exchange group with

a market capitalization of nearly $45 billion, said it would shift

focus to interest-rate swaps and foreign exchange.

The exchange giant intends to start offering OTC

foreign-exchange options clearing by the end of the year and add

several currencies, including the Chinese yuan, to its

interest-rate swaps offerings.

Shares closed Thursday at $132.12, just shy of a 9-year set

during regular trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

September 14, 2017 20:55 ET (00:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

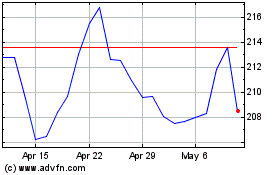

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

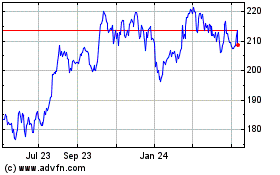

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024