How Exchange Bigwig Duffy Returned to Deal Making With Cross-Atlantic Bid

March 29 2018 - 4:48PM

Dow Jones News

By Alexander Osipovich and Philip Georgiadis

Terrence Duffy spearheaded a series of deals that turned CME

Group Inc. into the world's biggest exchange operator. On Thursday,

the chairman and chief executive showed he's still in the game with

a $5.4-billion agreement to acquire the U.K.'s NEX Group PLC.

The deal is poised to strengthen CME's dominance in the exchange

business, which has become increasingly consolidated in recent

years. The company's market capitalization is $53.7 billion, while

its next-biggest rival, Intercontinental Exchange Inc., is worth

$41.7 billion.

The NEX acquisition is expected to be completed in the second

half of 2018, subject to approval by regulators and NEX

shareholders, the two companies said.

In an interview, Mr. Duffy, 59, said the deal took shape during

a series of lunches and dinners with NEX Group Chief Executive

Michael Spencer in New York restaurants, lubricated by French

wine.

"A lot of the discussions happened over a nice glass of red,"

Mr. Duffy said, adding that he had let Mr. Spencer -- one of

Britain's richest men and a famed bon vivant who has invested in

fine-wine businesses -- choose the bottle.

"Me being from the South Side of Chicago, I have no idea what it

is and I just drink it," Mr. Duffy said. A spokeswoman for NEX

Group declined to comment.

A former floor trader, Mr. Duffy used political savvy to rise to

the top of the Chicago Mercantile Exchange, which became a publicly

traded company in 2002. As chairman, he oversaw tie-ups with

crosstown rival the Chicago Board of Trade, the New York Mercantile

Exchange and the Kansas City Board of Trade. Those deals turned CME

into an exchange giant with markets ranging from energy to wheat to

gold.

The firm ruffled feathers along the way. CME faces a

long-running antitrust lawsuit, which was filed nearly 15 years ago

and is set to go to trial in June, from a subsidiary of Germany's

Eurex exchange. Eurex contends that its effort to break into U.S.

Treasury futures in 2003 was foiled by collusion between CME and

CBOT. CME denies the allegations.

Buying NEX will make CME a critical player in the trading of

U.S. government debt -- the world's biggest bond market, with $14.5

trillion of Treasury securities outstanding. NEX owns the largest

electronic-trading platform for Treasurys, BrokerTec, where an

average of $143 billion is traded daily, according to the NEX

website.

That complements CME's heavily traded U.S. interest-rate

futures, a market in which CME enjoys an effective monopoly. The

firm cemented that position through a previous deal led by Mr.

Duffy, the 2007 merger of CME and CBOT.

Mr. Spencer stands to make hundreds of millions of dollars from

the sale. He told reporters on Thursday that he would become a

"large and happy shareholder" in CME under the terms of the

cash-and-stock deal. He will join the CME board and remain with the

company as an adviser, the companies said.

The 62-year-old Mr. Spencer is one of the City of London's most

high-profile financiers, and has built himself a fortune and

significant political influence out of the expansion of the

derivatives markets over the past 35 years.

In the 1980s, having been fired from two previous jobs in

finance, he pulled together $60,000 with three partners to make a

play on the growing demand for brokers to help banks trade complex

derivatives products.

The company he founded, ICAP PLC, became one of the world's

biggest players in the over-the-counter derivatives markets, built

on a core business of brokering trades by telephone. But in 2016,

faced with technological shifts in the markets, ICAP sold its

voice-brokering unit to rival Tullett Prebon PLC. The remainder of

ICAP rebranded itself as NEX Group and refocused on electronic

trading.

Mr. Spencer was a prominent backer of the U.K.'s Conservative

Party under its previous leader, former Prime Minister David

Cameron, and was the party's treasurer between 2006 and 2010.

He hasn't shunned the limelight throughout his career. ICAP's

charity days became an iconic feature of the City of London's

calendar, with celebrities from Prince Harry to singer Rod Stewart

descending on the brokers' floor to man the phones and raise money

for charity, surrounded by newspaper photographers and traders in

eclectic costumes.

The events have raised nearly GBP135 million ($189 million) to

date and helped turn ICAP into one of the best-known names in the

City, despite the firm's often barely understood role in the

plumbing of financial markets.

(END) Dow Jones Newswires

March 29, 2018 17:33 ET (21:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

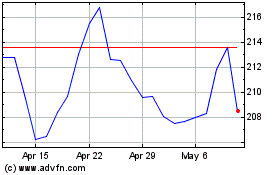

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

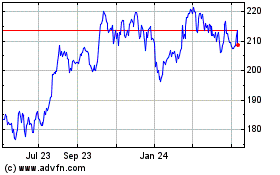

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024