The Markets Are Wild While You're Asleep

April 21 2020 - 6:29AM

Dow Jones News

By Gunjan Banerji

Trading in overnight stock futures has skyrocketed, adding to a

nearly nonstop stretch of market activity and luring more investors

to join in the action.

Among the most-traded are E-mini S&P 500 futures contracts,

whose overnight trading volumes have surged to a record this year,

according to CME Group Inc. data through March. Daily average

volumes have topped 500,000 contracts, more than double the number

recorded in 2017. The overnight session begins at 6 p.m. ET on

Sundays and weeknights and ends the following day at 9 a.m.

These are some of the most popular derivatives contracts among

investors, who often use them to hedge their portfolios or make

directional bets on the stock market. The S&P 500 is down 13%

in 2020.

The higher activity has helped amplify volatility in what has

been the most tumultuous period for investors in recent years. To

some analysts, it signals that markets around the world are more

interconnected than ever, with traders globally embracing

derivatives tied to major U.S. indexes as they trade around the

clock. Trading in these contracts also extends to the regular stock

trading session and concludes at 5 p.m.

Exchange operator CME has had a longstanding rule limiting price

swings in futures overnight to 5% up or down. On Sunday, March 8,

futures linked to the S&P 500 fell 5%, hitting limit-down, the

maximum drop allowed in a single session, for the first time since

the U.S. presidential election in 2016. The volatility hasn't let

up: Those stock futures have now hit limit-up or limit-down nine

times this year.

The wild swings have lured more traders looking for the

opportunity to profit in exchange for some sleepless nights.

Futures tied to the Dow Jones Industrial Average and the

tech-focused Nasdaq-100 index have been heavily traded as well.

Neel Shah, an options trader at Peak6 Capital Management, said

he started ramping up bets in the overnight market in late February

when market turbulence surged. By then, worries about the

coronavirus spreading around the globe had sparked a sharp selloff

in the stock market. On Feb. 28, U.S. stocks finished what was then

the worst week since the global financial crisis -- and the big

moves were extending to the overnight session.

"Now there isn't just one trading day," Mr. Shah said. "There's

multiple trading days in a 24-hour period."

He says he typically holds on to big options positions overnight

and puts out offers to buy or sell futures in the overnight

session. He gets automated alerts on his phone and computer that

tell him when a buyer or seller has taken him up on a trade.

Mr. Shah said he has "definitely lost a lot of sleep over the

last couple weeks."

Futures linked to the S&P 500 are tapped by big asset

managers, hedge funds and other traders around the globe. Despite

the increased interest, several analysts said it can be harder to

get in and out of positions overnight, leading to bigger

swings.

"They don't have as much liquidity," said Stino Milito, co-chief

operating officer at brokerage Dash Financial Technologies. "Which

is probably why you see the futures banging around so much."

Some analysts have said declining liquidity in the market for

E-mini S&P 500 futures during the latest market selloff also

exacerbated volatility in the broader stock market.

In one measure of the dramatic moves overnight, investing in the

biggest S&P 500 exchange-traded fund at the closing price and

selling at the opening price the next morning would yield about a

21% negative return this year, according to Dow Jones Market Data.

On the other hand, buying at the opening price and selling at the

end of the day would generate a positive 8% return.

Big exchange operators have taken steps to cater to the interest

in trading around the clock in recent years. Cboe Global Markets

Inc. extended trading in options on the Cboe Volatility Index, or

VIX, and S&P 500 index from 3 a.m. to 9:15 a.m. on weekdays in

2015.

It also started disseminating values every 15 seconds overnight

for the VIX index, a gauge of expected market swings, in April

2016. Arianne Criqui, Cboe's head of derivatives and global client

services, said there has been an uptick in individual investors

looking to trade futures tied to the VIX in places including Taiwan

and Australia.

The result: Few hours of the week are completely devoid of

trading activity.

Mr. Milito's firm has enlisted an extra trader to work overnight

and take orders for clients. Now two traders arrive around 2:30

a.m. ET, before the overnight S&P 500 and VIX options market

kicks off.

The resurgence in volatility has also drawn market watchers

eager to see how the futures market will react to the latest bit of

news on the economy. Outside of regular stock-trading hours -- 9:30

a.m. to 4 p.m. -- news from the White House and the Federal Reserve

and updates on the pandemic's spread around the world often draw

swift moves in the futures market.

Dash's Mr. Milito said he recently started watching the open of

trading for S&P 500 futures on Sundays at 6 p.m., something he

hadn't done in years. He has a group chat with colleagues in which

they exchange friendly wagers on where the market will open. Often,

the session is unpredictable, and investors are eager to see how

the market reacts to the latest news.

"It's sort of a fun game we play," Mr. Milito said. "We watch it

every week...the futures are whipping around pretty good."

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

April 21, 2020 07:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

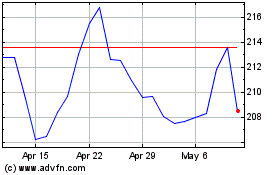

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

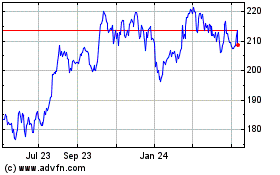

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024