CorVel Announces Revenues and Earnings

February 04 2025 - 5:15AM

CorVel Corporation (NASDAQ: CRVL) announced the results for the

quarter ended December 31, 2024. Revenues for the quarter were $228

million, an increase from $202 million in the December quarter of

2023. Earnings per share for the quarter were $0.46, compared to

$0.33 in the same quarter of the prior year. Revenues for the nine

months ended December 31, 2024 were $664 million, an increase from

$588 million during the nine months ended December 31, 2023.

Earnings per share for the nine months ended December 31, 2024 were

$1.32, compared to $1.09 during the nine months ended December 31,

2023. The earnings per share numbers for the current and prior year

have been adjusted to reflect the three-for-one stock split of its

common stock which was paid on December 24, 2024.

Third Quarter Fiscal Year 2025 Highlights

- Revenue increased 13% to $228 million, compared to the third

quarter of fiscal year 2024.

- Gross profit increased 25% to $52.9 million, at 23.2% gross

margin, compared to the third quarter of fiscal year 2024 gross

profit of $42.2 million.

- Diluted earnings per share increased 39% to $0.46, compared to

the third quarter of fiscal year 2024 diluted earnings per share of

$0.33.

- Exited the quarter with $163 million cash, cash equivalents,

and no borrowings.

- The Company repurchased $9.6 million of common stock during the

quarter.

A key to CorVel’s success and differentiation in technological

innovation is the development team’s structure, the depth and

tenure of the employees, and the lack of impedance in translating

business needs into the development and implementation of

functioning systems. Due to the depth and strength of the IT team,

system updates, and new features are released weekly, which enables

rapid progress on enhancements and advancements in automation and

innovation. In the December quarter, generative-AI-based

functionality was released to streamline document processing and

identify claim milestones, and improvements are planned to enhance

the integrated communication platform. These enhancements can

optimize outcomes, improve the experience of injured workers, and

make day-to-day tasks easier, which allows CorVel professionals to

focus on higher-level activities.

During the quarter in the healthcare market, the persistent

upward trend of medical costs is causing Administrative Services

Only, ASO, customers to seek additional medical savings and greater

cost efficiency in claims. CERIS is ideally equipped to solve the

growing demand by offering multiple audits and lowering claim

thresholds. With substantial expertise in prepay, CERIS is able to

accommodate ASOs and Payers with the tools needed to reduce medical

spend without additional administrative overhead.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

All statements included in this press release, other than

statements or characterizations of historical fact, are

forward-looking statements. These forward-looking statements are

based on the Company’s current expectations, estimates and

projections about the Company, management’s beliefs, and certain

assumptions made by the Company, and events beyond the Company’s

control, all of which are subject to change. Such forward-looking

statements include, but are not limited to, improved productivity

resulting from automation and augmentation across enterprise

business systems. These forward-looking statements are not

guarantees of future results and are subject to risks,

uncertainties and assumptions that could cause the Company’s actual

results to differ materially and adversely from those expressed in

any forward-looking statement results of operations and financial

condition is greater than our initial assessment. The risks and

uncertainties referred to above include but are not limited to

factors described in this press release and the Company’s filings

with the Securities and Exchange Commission, including but not

limited to “Risk Factors” in the Company’s Annual Report on Form

10-K for the year ended March 31, 2024, and the Company’s Quarterly

Report on Form 10-Q for the quarters ended June 30, 2024 and

September 30, 2024. The forward-looking statements in this press

release speak only as of the date they are made. The Company

undertakes no obligation to revise or update publicly any

forward-looking statement for any reason.

CorVel CorporationQuarterly Results –

Income StatementQuarters and Nine Months Ended

December 31, 2024 (unaudited) and December 31, 2023

(unaudited)

| Quarter

Ended |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Revenues |

|

$ |

227,973,000 |

|

|

$ |

202,303,000 |

|

| Cost of

revenues |

|

|

175,115,000 |

|

|

|

160,143,000 |

|

| Gross

profit |

|

|

52,858,000 |

|

|

|

42,160,000 |

|

| General

and administrative |

|

|

22,058,000 |

|

|

|

19,798,000 |

|

| Income

from operations |

|

|

30,800,000 |

|

|

|

22,362,000 |

|

| Income

tax provision |

|

|

7,029,000 |

|

|

|

5,267,000 |

|

| Net

income |

|

$ |

23,771,000 |

|

|

$ |

17,095,000 |

|

| Earnings

Per Share: |

|

|

|

|

|

|

|

Basic |

|

$ |

0.46 |

|

|

$ |

0.33 |

|

|

Diluted |

|

$ |

0.46 |

|

|

$ |

0.33 |

|

| Weighted

Shares |

|

|

|

|

|

|

|

Basic |

|

|

51,388,000 |

|

|

|

51,318,000 |

|

|

Diluted |

|

|

52,038,000 |

|

|

|

51,978,000 |

|

| Nine Months

Ended |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Revenues |

|

$ |

664,075,000 |

|

|

$ |

588,078,000 |

|

| Cost of

revenues |

|

|

512,528,000 |

|

|

|

459,788,000 |

|

| Gross

profit |

|

|

151,547,000 |

|

|

|

128,290,000 |

|

| General

and administrative |

|

|

64,043,000 |

|

|

|

55,786,000 |

|

| Income

from operations |

|

|

87,504,000 |

|

|

|

72,504,000 |

|

| Income

tax provision |

|

|

18,758,000 |

|

|

|

15,706,000 |

|

| Net

income |

|

$ |

68,746,000 |

|

|

$ |

56,798,000 |

|

| Earnings

Per Share: |

|

|

|

|

|

|

|

Basic |

|

$ |

1.34 |

|

|

$ |

1.11 |

|

|

Diluted |

|

$ |

1.32 |

|

|

$ |

1.09 |

|

| Weighted

Shares |

|

|

|

|

|

|

|

Basic |

|

|

51,384,000 |

|

|

|

51,372,000 |

|

|

Diluted |

|

|

51,999,000 |

|

|

|

52,056,000 |

|

|

|

|

|

|

|

|

|

|

|

CorVel CorporationQuarterly Results –

Condensed Balance SheetDecember 31, 2024

(unaudited) and March 31, 2024

|

|

|

December 31, 2024 |

|

|

March 31, 2024 |

|

|

Cash |

|

$ |

162,944,000 |

|

|

$ |

105,563,000 |

|

| Customer

deposits |

|

|

99,496,000 |

|

|

|

88,142,000 |

|

| Accounts

receivable, net |

|

|

106,178,000 |

|

|

|

97,108,000 |

|

| Prepaid

taxes and expenses |

|

|

14,543,000 |

|

|

|

11,418,000 |

|

|

Property, net |

|

|

91,256,000 |

|

|

|

85,892,000 |

|

| Goodwill

and other assets |

|

|

42,420,000 |

|

|

|

42,498,000 |

|

|

Right-of-use asset, net |

|

|

21,940,000 |

|

|

|

24,058,000 |

|

|

Total |

|

$ |

538,777,000 |

|

|

$ |

454,679,000 |

|

| Accounts

and taxes payable |

|

$ |

16,630,000 |

|

|

$ |

16,631,000 |

|

| Accrued

liabilities |

|

|

200,108,000 |

|

|

|

167,868,000 |

|

|

Long-term lease liabilities |

|

|

21,189,000 |

|

|

|

22,533,000 |

|

| Paid-in

capital |

|

|

246,698,000 |

|

|

|

233,632,000 |

|

| Treasury

stock |

|

|

(822,514,000 |

) |

|

|

(793,905,000 |

) |

| Retained

earnings |

|

|

876,666,000 |

|

|

|

807,920,000 |

|

|

Total |

|

$ |

538,777,000 |

|

|

$ |

454,679,000 |

|

| Contact: Melissa Storan |

| Phone: 949-851-1473 |

| www.corvel.com |

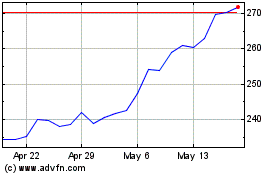

CorVel (NASDAQ:CRVL)

Historical Stock Chart

From Jan 2025 to Feb 2025

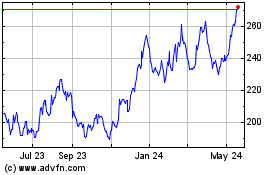

CorVel (NASDAQ:CRVL)

Historical Stock Chart

From Feb 2024 to Feb 2025