The Herzfeld Caribbean Basin Fund, Inc. (NASDAQ: CUBA) (the “Fund”)

is pleased to announce that May 20, 2024 marks 30 years since the

Fund’s common stock commenced trading on the NASDAQ Capital Market.

The original date of May 20th was selected to honor Cuban

Independence Day and to emphasize the importance of Cuba to the

economic future of the Caribbean Basin. The Fund was launched

through a continuous offering which began in 1993 and closed in the

first quarter of 1994. Trading was then delayed until May 20, 1994.

Thomas J. Herzfeld, Founder and Chairman of the

Board of Directors of the Fund, stated: “I believed then and even

more now that there is enormous potential for investment in Cuba

once the U.S. trade embargo with that country is lifted. We

continue to manage the Fund strategically with that view.

Furthermore, my expectation is that an economic boom in Cuba will

have a positive impact throughout the countries of the Caribbean

Basin.”

The Fund also announced the extension of its

Managed Distribution Plan (the “Plan”) to June 30, 2025, with

certain modifications discussed below. The Plan has the following

two components:

Managed Distribution Policy

Under the Plan, the Fund’s Managed Distribution

Policy (“MDP”) will be extended to June 30, 2025.

The primary purpose of the MDP is to provide

stockholders with a constant, but not guaranteed, fixed minimum

rate of distribution. The MDP as originally adopted set quarterly

distributions at an annual rate of 15% of the Fund’s NAV as

determined on a date determined by the Fund’s Board of Directors.

The Board recently amended the policy to maintain the 15% annual

rate of distribution, but at quarterly, semi-annual or annual

periods of distribution to be reviewed by the Board each quarter.

The purpose of the modification is to allow the Fund to maintain

its 15% annual distribution of NAV, but provide flexibility in

determining the timing of those distributions in order to account

for required year-end regulatory distributions of capital gains

necessary to maintain the Fund’s tax-free status. The Fund has

capital gains as of May 15, 2024 of approximately $3.6 million.

The Fund cannot predict what effect, if any, the

MDP will have on the market price of its shares or whether such

market price will reflect a greater or lesser discount to net asset

value as compared to prior to the adoption of the MDP.

Under the MDP, the Fund will distribute all

available investment income to its stockholders, consistent with

its investment objective and as required by the Internal Revenue

Code of 1986, as amended (the “Code”). The amount

distributed per share is subject to change at the discretion of the

Board. If sufficient investment income is not available

for distribution, the Fund will distribute long-term capital gains

and/or return capital to its stockholders in order to maintain its

managed distribution level. The Fund is currently not relying on

any exemptive relief from Section 19(b) of the Investment Company

Act of 1940, as amended (the “1940 Act”). The Fund may make

additional distributions from time to time, including additional

capital gain distributions at the end of the taxable year, if

required to meet requirements imposed by the Code and/or the 1940

Act.

The Fund expects that distributions under the

MDP will exceed investment income and available capital gains and

thus expects that distributions under the MDP will likely include

returns of capital for the foreseeable future. A return of capital

may occur, for example, when some or all of a stockholder’s

investment is paid back to the stockholder. A return of capital

distribution does not necessarily reflect the Fund’s investment

performance and should not be confused with ‘yield’ or ‘income.’

Any such returns of capital will decrease the Fund’s total assets

and, therefore, could have the effect of increasing the Fund’s

expense ratio. In addition, in order to maintain the level of

distributions called for under its MDP, the Fund may have to sell

portfolio securities at a less than opportune time. No

conclusions should be drawn about the Fund’s investment performance

from the amount of the Fund’s distributions or from the terms of

the Plan. The amount distributed per share is subject

to change at the discretion of the Board. The MDP is subject to

ongoing review by the Board to determine whether it should be

continued, modified or terminated. The Board may amend the terms of

the MDP, suspend the MDP, or terminate the MDP at any time without

prior notice to the Fund’s stockholders if it deems such actions to

be in the best interest of the Fund or its stockholders. The

amendment or termination of the MDP could have an adverse effect on

the market price of the Fund's shares. With each distribution that

does not consist solely of net investment income, the Fund will

issue a notice to stockholders and an accompanying press release

that will provide detailed information regarding the amount and

composition of the distribution and other related information. The

amounts and sources of distributions reported in the notice to

stockholders are only estimates and are not being provided for tax

reporting purposes. The actual amounts and sources of the amounts

for tax reporting purposes will depend upon the Fund’s investment

experience during its full fiscal year and may be subject to

changes based on tax regulations. The Fund will send stockholders a

Form 1099-DIV for the respective calendar year that will tell them

how to report these distributions for federal income tax purposes.

Stockholders should consult their tax advisor for proper tax

treatment of the Fund’s distributions.

Self-Tender Policy

The Plan also includes a Self-Tender Policy,

which has similarly been extended to June 30, 2025. Under the

Self-Tender Policy, the Fund has undertaken to commence a tender

offer by October 31, 2024 of up to 5% of outstanding shares of the

Fund at 97.5% of NAV if the average discount was greater than 10%

for the fiscal year ending June 30, 2024. The determination of the

percentage of shares to be repurchased under any Tender Offer will

be made after the conclusion of the Fund’s fiscal year.

The formal offer and detailed terms of any

Tender Offer will be announced prior to October 31, 2024.

Management Fee Waiver

In support of the Plan’s objective of addressing

the Fund’s trading discount to NAV per share, HERZFELD/CUBA, a

division of Thomas J. Herzfeld Advisors, Inc. (“TJHA”), the

investment adviser for the Fund, previously agreed to waive its

management fee by ten (10) basis points (from 1.45% to 1.35%) for

any fiscal year if the Fund’s average discount to NAV during the

preceding fiscal year is greater than 5%. TJHA has extended that

fee waiver through June 30, 2025 and has further agreed to

voluntarily waive its management fee on the Fund’s net assets in

excess of $30 million by an additional ten (10) basis points.

Accordingly, if the Fund’s average discount to NAV during the

current fiscal year ending June 30, 2024 is greater than 5%, TJHA’s

management fee after the voluntary waiver will be (i) 1.35% of the

Fund’s assets up to and including $30 million and (ii) 1.25% of the

Fund’s assets in excess of $30 million.

Tender Offer Statement

The above statements are not intended to

constitute an offer to participate in any tender offer.

Shareholders will be notified of the terms of the tender offer in

accordance with the requirements of the Securities Exchange Act of

1934, as amended, and the Investment Company Act of 1940, as

amended, either by publication or mailing or both. Any tender offer

will be made by an offer to purchase, a related letter of

transmittal, and other documents filed with the SEC. Shareholders

of the Fund should read the offer to purchase and tender offer

statement and related exhibits when those documents are filed and

become available, as they will contain important information about

the tender offer. These and other filed documents will be available

to investors for free both at the website of the SEC (www.sec.gov)

and from the Fund (www.herzfeld.com/cuba).

The Fund’s investment adviser is HERZFELD/CUBA,

a division of Thomas J. Herzfeld Advisors, Inc. and the Fund’s

shares trade on the NASDAQ Capital Market under the symbol

“CUBA.” Thomas J. Herzfeld Advisors, Inc. specializes in the

field of closed-end funds. Information about the investment

adviser and the Fund can be found

at www.herzfeld.com. This announcement is not an

offer to sell securities and the Fund is not soliciting an offer to

buy securities in any state where the offer or sale is not

permitted.

NASDAQ Capital Market: CUBACUSIP: 42804T106

About Thomas J. Herzfeld Advisors, Inc.

Thomas J. Herzfeld Advisors, Inc., founded in 1984, is an

SEC-registered investment advisor, specializing in investment

analysis and account management in closed-end funds. The Firm also

specializes in investment in the Caribbean Basin. The HERZFELD/CUBA

division of Thomas J. Herzfeld Advisors, Inc. serves as the

investment advisor to The Herzfeld Caribbean Basin Fund, Inc. a

publicly traded closed-end fund (NASDAQ: CUBA).

More information about the advisor can be found at

www.herzfeld.com.

Past performance is no guarantee of future performance. An

investment in the Fund is subject to certain risks, including

market risk. In general, shares of closed-end funds often trade at

a discount from their net asset value and at the time of sale may

be trading on the exchange at a price which is more or less than

the original purchase price or the net asset value. An investor

should carefully consider the Fund’s investment objective, risks,

charges and expenses. Please read the Fund’s disclosure documents

before investing.

Forward-Looking Statements

This press release, and other statements that TJHA or the Fund

may make regarding management’s future expectations, beliefs,

intentions, goals, strategies, plans or prospects, including

statements relating to: management’s beliefs that the cash and

stock distribution will allow the Fund to strengthen its balance

sheet and to be in a position to capitalize on potential future

investment opportunities, when there can be no assurance either

will occur; the tax consequences of the distributions to

stockholders; and other factors may contain forward looking

statements within the meaning of the Private Securities Litigation

Reform Act, with respect to the Fund’s or TJHA’s future financial

or business performance, strategies or expectations.

Forward-looking statements are typically identified by words or

phrases such as “trend,” “potential,” “opportunity,” “pipeline,”

“believe,” “comfortable,” “expect,” “anticipate,” “current,”

“intention,” “estimate,” “position,” “assume,” “outlook,”

“continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and

similar expressions, or future or conditional verbs such as “will,”

“would,” “should,” “could,” “may” or similar expressions. TJHA and

the Fund caution that forward-looking statements are subject to

numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and TJHA and the Fund assume no duty to and do not undertake

to update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical performance.

With respect to the Fund, the following factors, among others,

could cause actual events to differ materially from forward-looking

statements or historical performance: (1) changes and volatility in

political, economic or industry conditions, particularly with

respect to Cuba and other Caribbean Basin countries, the interest

rate environment, foreign exchange rates or financial and capital

markets, which could result in changes in demand for the Fund or in

the Fund’s net asset value; (2) the relative and absolute

investment performance of the Fund and its investments; (3) the

impact of increased competition; (4) the unfavorable resolution of

any legal proceedings; (5) the extent and timing of any

distributions or share repurchases; (6) the impact, extent and

timing of technological changes; (7) the impact of legislative and

regulatory actions and reforms, including the Dodd-Frank Wall

Street Reform and Consumer Protection Act, and regulatory,

supervisory or enforcement actions of government agencies relating

to the Fund or TJHA, as applicable; (8) terrorist activities,

international hostilities and natural disasters, which may

adversely affect the general economy, domestic and local financial

and capital markets, specific industries or TJHA or the Fund; (9)

TJHA’s and the Fund’s ability to attract and retain highly talented

professionals; (10) the impact of TJHA electing to provide support

to its products from time to time; (11) the impact of problems at

other financial institutions or the failure or negative performance

of products at other financial institutions; and (12) the effects

of an epidemic, pandemic or public health emergency, including

without limitation, COVID-19. Annual and Semi-Annual Reports and

other regulatory filings of the Fund with the SEC are accessible on

the SEC’s website at www.sec.gov and on TJHA’s website at

www.herzfeld.com/cuba, and may discuss these or other factors that

affect the Fund. The information contained on TJHA’s website is not

a part of this press release.

Contact:Tom MorganChief Compliance OfficerThomas J. Herzfeld

Advisors, Inc.1-305-777-1660

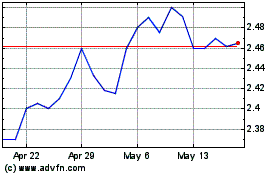

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From May 2024 to Jun 2024

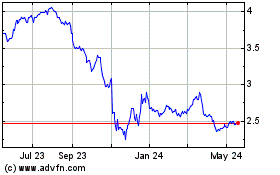

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Jun 2023 to Jun 2024