Alpha Tau Medical Announces First Quarter 2023 Financial Results and Provides Corporate Update

May 23 2023 - 3:01PM

Alpha Tau Medical Ltd. ("Alpha Tau", or the “Company”) (NASDAQ:

DRTS, DRTSW), the developer of the innovative alpha-radiation

cancer therapy Alpha DaRT™, reported first quarter 2023 financial

results and provided a corporate update.

"This year we are focused on advancing our ReSTART U.S.

multicenter pivotal trial in recurrent cutaneous squamous cell

carcinoma, which is expected to produce data in 2024, and on

initiating a series of feasibility trials in difficult-to-treat

internal organ tumors with high unmet need, such as pancreatic and

liver cancers,” stated Alpha Tau CEO Uzi Sofer. "Read-outs

from the pivotal trial and these smaller feasibility programs

should represent meaningful inflection points for our growth story

and could pave the way for larger studies that may support

potential U.S. marketing authorizations in other indications. In

parallel, we are preparing for potential future product launches by

advancing our commercial planning activities and solidifying our

supply chain. Alpha Tau remains adequately capitalized to support

all of these programs over the coming years," he concluded.

Recent Corporate

Highlights:

- In March, the Company initiated and

treated the first patients in its U.S. multicenter pivotal ReSTART

trial in recurrent squamous cell carcinoma which remains on track.

For more information, please refer to NCT05323253.

- In April, the first patient with

advanced inoperable pancreatic cancer was treated in a feasibility

and safety study of Alpha DaRT at the Jewish General Hospital in

Montreal, Canada, which is an affiliated teaching hospital of

McGill University, Faculty of Medicine. For more information,

please refer to NCT04002479.

- In March, the Company received

Health Canada approval to open a liver cancer feasibility trial.

For more information, please refer to NCT05829291.

- In May, the results of the Company’s

U.S. multicenter pilot trial in skin cancer were published in JAMA

Network Open, showing a 100% Complete Response rate at 12 weeks

post treatment and no device-related serious adverse events or

systemic toxicity reported. For more information, please see the

publication here.

- In May, the first patient with

squamous cell carcinoma of the vulva was treated in an

investigator-initiated feasibility and safety study at Addenbrookes

Hospital of the Cambridge University Hospitals NHS Foundation

Trust.

- In March, the Company received an

amended radioactive license approval from the Israeli Ministry of

Environmental Protection that could expand production to up to

300,000 Alpha DaRT sources per year in the Company’s main

manufacturing facility in Jerusalem. The Company also received

approvals from the Israeli Ministry of Environmental Protection and

the Animal Testing Council at the Israeli Ministry of Health to

conduct pre-clinical experiments using mice and rats, to enable the

continued exploration of potential combinations between the Alpha

DaRT and systemic therapies.

Upcoming 2023

Milestones

- Planning to begin recruitment in

Israeli feasibility trials in lung and pancreatic tumors in the

middle of 2023, having already received all necessary trial

approvals.

- Targeting recruitment in the

Canadian liver cancer feasibility trial to begin in the middle of

2023.

- Planned submission of Alpha DaRT

pivotal trial results in head and neck cancer to Japan’s regulatory

authority, PMDA in the second half of 2023, for potential marketing

authorization.

- Currently compiling longer-term data

from patients treated with the Alpha DaRT for skin, superficial or

head and neck tumors, to be released and potentially submitted for

publication in a scientific journal by the end of 2023.

Financial results for

quarter ended March

31, 2023

R&D expenses for the quarter ended March 31,

2023 were $6.3 million, compared to $5.2 million for

the same period in 2022, due to increased employee compensation and

benefits, increased operating costs, and increased pre-clinical

study and clinical trial expenses particularly as related to its

U.S. multi-center pivotal trial.

Marketing expenses for the quarter

ended March 31, 2023 were $0.4 million, compared

to $0.2 million for the same period in 2022 due to

increased employee compensation and benefits, including share-based

compensation and the hiring of its chief commercial officer.

G&A expenses for the quarter

ended March 31, 2023 were $1.9 million, compared

to $3.3 million for the same period in 2022, due to a

reduction in one-off costs, including employee compensation and

benefits, associated with its financing transaction in the first

quarter of 2022.

Financial income, net, for the quarter ended

March 31, 2023 was $0.5 million, compared to $17.0 million of

financial expense, net, for the same period in 2022, due to lower

expense from remeasurement of warrants and an increase in interest

from bank deposits.

For the quarter ended March 31, 2023, the

Company had a net loss of $8.2 million, or $0.12 per share,

compared to a net loss of $25.7 million, or $0.54 per share,

in the first quarter of 2022.

Balance Sheet Highlights

As of March 31, 2023, the Company had

cash and cash equivalents, restricted cash and deposits in the

amount of $100.5 million, compared to $105.4

million at December 31, 2022. The Company expects

that this cash balance will be sufficient to fund anticipated

operations for at least two years.

About Alpha

DaRT™

Alpha DaRT (Diffusing Alpha-emitters Radiation Therapy) is

designed to enable highly potent and conformal alpha-irradiation of

solid tumors by intratumoral delivery of radium-224 impregnated

sources. When the radium decays, its short-lived daughters are

released from the sources and disperse while emitting high-energy

alpha particles with the goal of destroying the tumor. Since the

alpha-emitting atoms diffuse only a short distance, Alpha DaRT aims

to mainly affect the tumor, and to spare the healthy tissue around

it.

About Alpha Tau Medical Ltd.Founded in 2016,

Alpha Tau is an Israeli medical device company that focuses on

research, development, and potential commercialization of the Alpha

DaRT for the treatment of solid tumors. The technology was

initially developed by Prof. Itzhak Kelson and Prof. Yona Keisari

from Tel Aviv University.

Forward-Looking Statements

This press release includes "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995. When used herein, words including "anticipate," "being,"

"will," "plan," "may," "continue," and similar expressions are

intended to identify forward-looking statements. In addition, any

statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking. All forward-looking

statements are based upon Alpha Tau's current expectations and

various assumptions. Alpha Tau believes there is a reasonable basis

for its expectations and beliefs, but they are inherently

uncertain. Alpha Tau may not realize its expectations, and its

beliefs may not prove correct. Actual results could differ

materially from those described or implied by such forward-looking

statements as a result of various important factors, including,

without limitation: (i) Alpha Tau's ability to receive regulatory

approval for its Alpha DaRT technology or any future products or

product candidates; (ii) Alpha Tau's limited operating history;

(iii) Alpha Tau's incurrence of significant losses to date; (iv)

Alpha Tau's need for additional funding and ability to raise

capital when needed; (v) Alpha Tau's limited experience in medical

device discovery and development; (vi) Alpha Tau's dependence on

the success and commercialization of the Alpha DaRT technology;

(vii) the failure of preliminary data from Alpha Tau's clinical

studies to predict final study results; (viii) failure of Alpha

Tau's early clinical studies or preclinical studies to predict

future clinical studies; (ix) Alpha Tau's ability to enroll

patients in its clinical trials; (x) undesirable side effects

caused by Alpha Tau's Alpha DaRT technology or any future products

or product candidates; (xi) Alpha Tau's exposure to patent

infringement lawsuits; (xii) Alpha Tau's ability to comply with the

extensive regulations applicable to it; (xiii) the ability to meet

Nasdaq's listing standards; (xiv) costs related to being a public

company; (xv) changes in applicable laws or regulations; and the

other important factors discussed under the caption "Risk Factors"

in Alpha Tau's annual report filed on form 20-F with the SEC on

March 9, 2023, and other filings that Alpha Tau may make with the

United States Securities and Exchange Commission. These and other

important factors could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management's estimates as of the date of this press release. While

Alpha Tau may elect to update such forward-looking statements at

some point in the future, except as required by law, it disclaims

any obligation to do so, even if subsequent events cause its views

to change. These forward-looking statements should not be relied

upon as representing Alpha Tau's views as of any date subsequent to

the date of this press release.

Investor Relations Contact:IR@alphatau.com

|

CONSOLIDATED BALANCE SHEET |

|

|

|

|

U.S. dollars in thousands |

|

|

|

|

| |

|

March

31, |

|

|

December

31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

Unaudited |

|

Audited |

| |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

899 |

|

|

$ |

5,836 |

|

|

Restricted cash |

|

|

840 |

|

|

|

850 |

|

|

Short-term deposits |

|

|

98,755 |

|

|

|

98,694 |

|

|

Prepaid expenses and other receivables |

|

|

528 |

|

|

|

1,097 |

|

| |

|

|

|

|

|

|

|

|

Total current assets |

|

|

101,022 |

|

|

|

106,477 |

|

| |

|

|

|

|

|

|

|

| LONG-TERM

ASSETS: |

|

|

|

|

|

|

|

|

Long term prepaid expenses |

|

|

441 |

|

|

|

391 |

|

|

Property and equipment, net |

|

|

7,399 |

|

|

|

7,471 |

|

|

Right-of-use asset |

|

|

7,191 |

|

|

|

5,810 |

|

| |

|

|

|

|

|

|

|

|

Total long-term assets |

|

|

15,031 |

|

|

|

13,671 |

|

| |

|

|

|

|

|

|

|

|

Total assets |

|

$ |

116,053 |

|

|

$ |

120,149 |

|

| |

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEET |

|

|

|

U.S. dollars in thousands |

|

|

|

| |

|

March

31, |

|

December

31, |

| |

|

2023 |

|

2022 |

| |

|

Unaudited |

|

Audited |

| |

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| |

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

Trade Payables |

|

$ |

2,068 |

|

|

$ |

1,423 |

|

|

Other payables and accrued expenses |

|

|

2,433 |

|

|

|

2,246 |

|

|

Current maturities of operating lease liabilities |

|

|

828 |

|

|

|

669 |

|

| |

|

|

|

|

|

Total current liabilities |

|

|

5,329 |

|

|

|

4,338 |

|

| |

|

|

|

|

| LONG-TERM

LIABILITIES: |

|

|

|

|

|

Warrants liability |

|

|

5,929 |

|

|

|

5,630 |

|

|

Operating lease liabilities |

|

|

5,618 |

|

|

|

4,524 |

|

| |

|

|

|

|

|

Total long-term liabilities |

|

|

11,547 |

|

|

|

10,154 |

|

| |

|

|

|

|

|

Total liabilities |

|

|

16,876 |

|

|

|

14,492 |

|

| |

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

Share capital |

|

|

|

|

| Ordinary

shares of no-par value per share – |

|

|

|

|

|

|

|

|

|

Authorized: 362,116,800 shares as of March 31, 2023 and December

31, 2022; Issued and outstanding: 69,275,603 and 69,105,000 shares

as of March 31, 2023 and December 31, 2022, respectively |

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

193,966 |

|

|

|

192,259 |

|

|

Accumulated deficit |

|

|

(94,789 |

) |

|

|

(86,602 |

) |

| |

|

|

|

|

|

Total shareholders' equity |

|

|

99,177 |

|

|

|

105,657 |

|

| |

|

|

|

|

|

Total liabilities and shareholders' equity |

|

$ |

116,053 |

|

|

$ |

120,149 |

|

| |

|

|

|

|

|

CONSOLIDATED STATEMENT OF OPERATIONS |

|

U.S. dollars in thousands (except share and per share

data) |

| |

|

Three months

ended |

| |

|

March

31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

| |

|

Unaudited |

| |

|

|

|

|

| Research and

development, net |

|

$ |

6,306 |

|

|

$ |

5,235 |

|

| |

|

|

|

|

| Marketing

expenses |

|

|

400 |

|

|

|

208 |

|

| |

|

|

|

|

| General and

administrative expenses |

|

|

1,938 |

|

|

|

3,338 |

|

| |

|

|

|

|

| Total

operating loss |

|

|

8,644 |

|

|

|

8,781 |

|

| |

|

|

|

|

| Financial

(income) expenses, net |

|

|

(478 |

) |

|

|

16,961 |

|

| |

|

|

|

|

| Loss before

taxes on income |

|

|

8,166 |

|

|

|

25,742 |

|

| |

|

|

|

|

| Tax on

income |

|

|

21 |

|

|

|

2 |

|

| |

|

|

|

|

| Net

loss |

|

|

8,187 |

|

|

|

25,744 |

|

| |

|

|

|

|

| Net

comprehensive loss |

|

|

8,187 |

|

|

|

25,744 |

|

| |

|

|

|

|

| Net loss per

share, basic and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.54 |

) |

| |

|

|

|

|

|

Weighted-average shares used in computing net loss per share, basic

and diluted |

|

|

69,205,654 |

|

|

|

47,504,979 |

|

| |

|

|

|

|

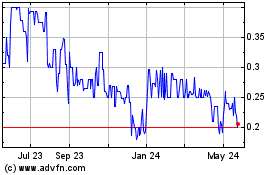

Alpha Tau Medical (NASDAQ:DRTSW)

Historical Stock Chart

From Oct 2024 to Nov 2024

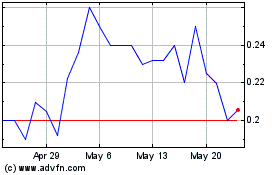

Alpha Tau Medical (NASDAQ:DRTSW)

Historical Stock Chart

From Nov 2023 to Nov 2024