Ebang International Holdings Inc. (Nasdaq: EBON, the “Company,”

“we” or “our”), a global blockchain technology and Fintech company,

today announced its unaudited financial results for the first six

months of fiscal year 2023.

Operational and Financial Highlights for

the First Six Months of Fiscal Year 2023

Total net revenues in the

first six months of 2023 were US$4.09 million, representing an

83.69% period-over-period decrease from US$25.06 million in the

same period of 2022.

Gross profit in the first

six months of 2023 was US$0.99 million compared to the gross profit

of US$14.24 million in the same period of 2022.

Net loss in the first six

months of 2023 was US$8.38 million compared to US$10.92 million in

the same period of 2022.

Mr. Dong Hu, Chairman and Chief Executive

Officer of the Company, commented, “The first half of 2023 was a

challenging period. Industry fluctuations and macroeconomic impacts

have not yet led to a qualitative improvement in our performance,

our cryptocurrency exchange business and cross-border payment and

foreign exchange business have been developing steadily. Still, we

have seen signs of gradual stability in consumer demand and the

prospects for a sustainable economic market. We will continue to

focus on providing personalized and diversified technology

platforms and services, so that our customers can enjoy safer and

more stable, efficient, and sustainable products and services, and

we will continue to strive for customer satisfaction. Additionally,

we have improved our cost control and capital utilization.”

Mr. Hu continues, “Looking forward to the

future, we will continue to expand our business within selected

regulated markets, adhere to technological innovation as our core

driving force, develop and implement a new business strategy to

achieve consistent growth, and actively embrace various

opportunities while tackling challenges in the future. We are

confident in our long-term prospects.”

Unaudited Financial Results for the

First Six Months of Fiscal Year 2023

Total net revenues in the

first six months of 2023 were US$4.09 million, representing an

83.69% period-over-period decrease from US$25.06 million in the

same period of 2022. The period-over-period decrease in total net

revenues was due to the combined impact of: 1) a decrease in sale

of products in the first six months of 2023; and 2) the receipt of

payment from a former customer as a result of a court mediation in

the first six months of 2022.

Cost of revenues in the

first six months of 2023 was US$3.09 million, representing a 71.40%

period-over-period decrease from US$10.82 million in the same

period of 2022. The period-over-period decrease in cost of revenues

was mainly due to the combined impact of a decrease in the

Company’s sales of products, and decreased inventory write-downs

for the potentially obsolete and slow-moving inventories for the

first six months of 2023, compared to the same period in 2022.

Gross profit in the first

six months of 2023 was US$0.99 million, compared to the gross

profit of US$14.24 million in the same period of 2022.

Total operating

expenses in the first six months of 2023 were

US$13.64 million compared to US$24.59 million in the same period of

2022.

- Selling

expenses in the first six months of 2023 were US$0.75

million compared to US$1.69 million in the same period of 2022. The

period-over-period decrease in selling expenses was mainly caused

by decreased general advertising and marketing expenses due to the

adoption of precise advertising and other marketing methods related

to our Fintech business for the first six months of 2023.

- General and administrative

expenses in the first six months of 2023 were

US$12.89 million compared to US$22.90 million in the same period of

2022. The period-over-period decrease in general and administrative

expenses was mainly due to the combined impact of 1) the Company’s

optimization of its internal cost control; 2) lower bad debt

expenses and depreciation expenses; 3) lower amortization expenses

due to full impairment of intangible assets during the year of

2022.

Loss from operations in

the first six months of 2023 was US$12.64 million compared to

US$10.34 million in the same period of 2022.

Interest income in the

first six months of 2023 was US$3.22 million compared to US$1.16

million in the same period of 2022. The period-over-period increase

in interest income was mainly caused by an increase in interest

rate for US dollar deposits and the Company had more fixed-term

deposit with large principals for the first six months of 2023,

compared to the same period in 2022.

Other income in the first

six months of 2023 was US$1.04 million compared to US$0.57 million

in the same period of 2022. The period-over-period increase in

other income was mainly due to the Company taking possession of

customer deposits collected from previous years as a result of

defaults by customers under their respective contracts with the

Company.

Other expense in the first

six months of 2023 was US$0.04 million compared to US$0.39 million

in the same period of 2022.

Net loss in the first six

months of 2023 was US$8.38 million compared to US$10.92 million in

the same period of 2022.

Net loss attributable to Ebang

International Holdings Inc. in the first six months

of 2023 was US$7.82 million compared to US$10.08 million in the

same period of 2022.

Basic and diluted net loss per

share in the first six months of 2023 were both

US$1.25 compared to US$1.61 in the same period of 2022.

About Ebang International Holdings

Inc.

Ebang International Holdings Inc. is a global

blockchain technology and Fintech company with strong

application-specific integrated circuit (ASIC) chip design

capability. With years of industry experience and expertise, it has

become a global Bitcoin mining machine producer. Based on its deep

understanding of the Fintech industry and compliance with laws and

regulations in various jurisdictions, it has launched professional,

convenient and innovative Fintech service platforms. It strives to

expand into the upstream and downstream markets of the blockchain

and Fintech industry value chain to achieve diversified products

and services. For more information, please visit

https://ir.ebang.com/.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, the

Company’s development plans and business outlook, which can be

identified by terminology such as “may,” “will,” “expects,”

“anticipates,” “aims,” “potential,” “future,” “intends,” “plans,”

“believes,” “estimates,” “continue,” “likely to,” and other similar

expressions intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Such statements are not historical facts, and

are based upon the Company’s current beliefs, plans and

expectations, and the current market and operating conditions.

Forward-looking statements include, but are not limited to,

statements regarding our future operating results and financial

position, our business strategy and plans, expectations relating to

our industry, the regulatory environment, market conditions, trends

and growth, expectations relating to customer behaviors and

preferences, our market position and potential market

opportunities, and our objectives for future operations.

Forward-looking statements involve inherent known or unknown risks,

uncertainties and other factors, all of which are difficult to

predict and many of which are beyond the Company’s control, which

may cause the Company’s actual results, performance and

achievements to differ materially from those contained in any

forward-looking statement. These risks and uncertainties include

our ability to successfully execute our business and growth

strategy and maintain future profitability, market acceptance of

our products and services, our ability to further penetrate our

existing customer base and expand our customer base, our ability to

develop new products and services, our ability to expand

internationally, the success of any acquisitions or investments

that we make, the efforts of increased competition in our markets,

our ability to stay in compliance with applicable laws and

regulations, market conditions across the blockchain, Fintech and

general market, political and economic conditions. Further

information regarding these and other risks, uncertainties or

factors is included in the Company’s filings with the U.S.

Securities and Exchange Commission. These forward-looking

statements are made only as of the date indicated, and the Company

undertakes no obligation to update or revise the information

contained in any forward-looking statements as a result of new

information, future events or otherwise, except as required under

applicable law.

Investor Relations Contact

For investor and media inquiries, please contact:

Ebang International Holdings Inc.Email: ir@ebang.com

Ascent Investor Relations LLCMs. Tina XiaoTel: (917)

609-0333Email: tina.xiao@ascent-ir.com

EBANG INTERNATIONAL HOLDINGS

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)(Stated in

US dollars)

|

|

June 30,2023 |

|

December 31,2022 |

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

248,861,659 |

|

$ |

251,294,952 |

|

|

Restricted cash, current |

|

39,076 |

|

|

29,039 |

|

|

Short-term investments |

|

869,805 |

|

|

5,835,377 |

|

|

Accounts receivable, net |

|

1,818,940 |

|

|

3,334,727 |

|

|

Advances to suppliers |

|

1,095,080 |

|

|

1,178,168 |

|

|

Inventories, net |

|

548,233 |

|

|

440,064 |

|

|

Prepayments |

|

52,703 |

|

|

281,611 |

|

|

Other current assets, net |

|

3,065,188 |

|

|

6,711,422 |

|

| Total current

assets |

|

256,350,684 |

|

|

269,105,360 |

|

| |

|

|

|

|

|

|

| Non-current

assets: |

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

33,892,642 |

|

|

36,549,278 |

|

|

Intangible assets, net |

|

6,176,539 |

|

|

6,890,738 |

|

|

Operating lease right-of-use assets |

|

4,569,216 |

|

|

5,343,608 |

|

|

Operating lease right-of-use assets - related parties |

|

741,695 |

|

|

519,140 |

|

|

Restricted cash, non-current |

|

973,034 |

|

|

903,125 |

|

|

Goodwill |

|

2,239,453 |

|

|

2,299,628 |

|

|

VAT recoverables |

|

20,085,172 |

|

|

21,132,898 |

|

|

Other assets |

|

904,382 |

|

|

1,421,309 |

|

| Total non-current

assets |

|

69,582,133 |

|

|

75,059,724 |

|

| |

|

|

|

|

|

|

| Total

assets |

$ |

325,932,817 |

|

$ |

344,165,084 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

$ |

629,685 |

|

$ |

1,456,577 |

|

|

Accrued liabilities and other payables |

|

7,041,128 |

|

|

11,519,091 |

|

|

Operating lease liabilities, current |

|

946,906 |

|

|

1,217,604 |

|

|

Operating lease liabilities - related parties, current |

|

519,288 |

|

|

283,567 |

|

|

Income taxes payable |

|

75,185 |

|

|

- |

|

|

Advances from customers |

|

2,749 |

|

|

1,010,852 |

|

| Total current

liabilities |

|

9,214,941 |

|

|

15,487,691 |

|

| |

|

|

|

|

|

|

| Non-current

liabilities: |

|

|

|

|

|

|

|

Deferred tax liabilities |

|

1,043,942 |

|

|

1,133,539 |

|

|

Operating lease liabilities, non-current |

|

4,242,577 |

|

|

5,755,973 |

|

| Total non-current

liabilities |

|

5,286,519 |

|

|

6,889,512 |

|

| |

|

|

|

|

|

|

| Total

liabilities |

|

14,501,460 |

|

|

22,377,203 |

|

| |

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

Class A ordinary share, HKD0.03 par value, 11,112,474 shares

authorized, 4,726,424 and 4,700,852 shares issued and outstanding

as of June 30, 2023 and December 31, 2022, respectively |

|

18,178 |

|

|

18,080 |

|

|

Class B ordinary share, HKD0.03 par value, 1,554,192 shares

authorized, issued and outstanding as of June 30, 2023 and December

31, 2022, respectively |

|

5,978 |

|

|

5,978 |

|

|

Additional paid-in capital |

|

398,505,590 |

|

|

397,620,927 |

|

|

Statutory reserves |

|

11,079,649 |

|

|

11,079,649 |

|

|

Accumulated deficit |

|

(85,886,519 |

) |

|

(78,068,522 |

) |

|

Accumulated other comprehensive loss |

|

(14,373,681 |

) |

|

(11,724,531 |

) |

| Total Ebang

International Holdings Inc. shareholders’ equity |

|

309,349,195 |

|

|

318,931,581 |

|

| Non-controlling interest |

|

2,082,162 |

|

|

2,856,300 |

|

| Total

equity |

|

311,431,357 |

|

|

321,787,881 |

|

| |

|

|

|

|

|

|

| Total liabilities and

equity |

$ |

325,932,817 |

|

$ |

344,165,084 |

|

EBANG INTERNATIONAL HOLDINGS

INC.INTERIM CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONSAND COMPREHENSIVE

LOSS(Unaudited)(Stated in US

dollars)

|

|

For the

six monthsended June

30, 2023 |

|

For thesix

monthsended June

30, 2022 |

|

|

|

|

|

|

|

|

Product revenue |

$ |

1,146,384 |

|

$ |

25,059,635 |

|

| Service revenue |

|

2,939,958 |

|

|

- |

|

| Total

revenues |

|

4,086,342 |

|

|

25,059,635 |

|

| Cost of revenues |

|

3,093,730 |

|

|

10,816,229 |

|

| Gross

profit |

|

992,612 |

|

|

14,243,406 |

|

| |

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

| Selling expenses |

|

745,381 |

|

|

1,685,425 |

|

| General and administrative

expenses |

|

12,891,709 |

|

|

22,901,323 |

|

| Total operating

expenses |

|

13,637,090 |

|

|

24,586,748 |

|

| |

|

|

|

|

|

|

| Gain from disposal of

subsidiaries |

|

(7,524 |

) |

|

|

|

| |

|

|

|

|

|

|

| Loss from

operations |

|

(12,636,954 |

) |

|

(10,343,342 |

) |

| |

|

|

|

|

|

|

| Other income

(expenses): |

|

|

|

|

|

|

| Interest income |

|

3,221,667 |

|

|

1,162,470 |

|

| Other income |

|

1,042,669 |

|

|

571,462 |

|

| Gain from investment |

|

803,605 |

|

|

- |

|

| Exchange gain (loss) |

|

(787,895 |

) |

|

(1,932,890 |

) |

| Government grants |

|

12,800 |

|

|

2,505 |

|

| Other expenses |

|

(43,518 |

) |

|

(390,051 |

) |

| Total other income

(expenses) |

|

4,249,328 |

|

|

(586,504 |

) |

| |

|

|

|

|

|

|

| Loss before income

taxes benefit |

|

(8,387,626 |

) |

|

(10,929,846 |

) |

| |

|

|

|

|

|

|

| Income taxes benefit |

|

3,349 |

|

|

10,683 |

|

| |

|

|

|

|

|

|

| Net loss |

|

(8,384,277 |

) |

|

(10,919,163 |

) |

| Less: net loss attributable to

non-controlling interest |

|

(566,280 |

) |

|

(844,096 |

) |

| Net loss attributable

to Ebang International Holdings Inc. |

$ |

(7,817,997 |

) |

$ |

(10,075,067 |

) |

| |

|

|

|

|

|

|

| Comprehensive

loss |

|

|

|

|

|

|

| Net loss |

$ |

(8,384,277 |

) |

$ |

(10,919,163 |

) |

| Other comprehensive

loss: |

|

|

|

|

|

|

| Foreign currency translation

adjustment |

|

(2,857,279 |

) |

|

(3,857,482 |

) |

| |

|

|

|

|

|

|

| Total comprehensive

loss |

|

(11,241,556 |

) |

|

(14,776,645 |

) |

| Less: comprehensive loss

attributable to non-controlling interest |

|

(774,138 |

) |

|

(313,096 |

) |

| Comprehensive loss

attributable to Ebang International Holdings Inc. |

$ |

(10,467,418 |

) |

$ |

(14,463,549 |

) |

| |

|

|

|

|

|

|

| Net loss per ordinary

share attributable to Ebang International Holdings

Inc. |

|

|

|

|

|

|

|

Basic(1) |

$ |

(1.25 |

) |

$ |

(1.61 |

) |

|

Diluted(1) |

$ |

(1.25 |

) |

$ |

(1.61 |

) |

| |

|

|

|

|

|

|

| Weighted average

ordinary shares outstanding |

|

|

|

|

|

|

|

Basic(1) |

|

6,269,529 |

|

|

6,243,040 |

|

|

Diluted(1) |

|

6,269,529 |

|

|

6,243,040 |

|

|

|

(1) Retrospectively adjusted for the effect of

the Reverse Stock Split effected on November 20, 2022.

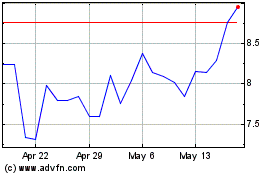

Ebang (NASDAQ:EBON)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ebang (NASDAQ:EBON)

Historical Stock Chart

From Dec 2023 to Dec 2024