FALSE000133349300013334932024-05-292024-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 29, 2024

EHEALTH, INC.

(Exact Name of Registrant as Specified in its Charter) | | | | | | | | |

| | |

| Delaware | 001-33071 | 56-2357876 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

13620 RANCH ROAD 620 N, SUITE A250

AUSTIN, TX 78717

(Address of principal executive offices) (Zip Code)

(737) 248-2340

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | EHTH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| Item 5.02 | | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On May 29, 2024, John Stelben notified eHealth, Inc. (the “Company”) of his decision to resign from his position as the Company’s senior vice president, chief financial officer, effective August 30, 2024. Mr. Stelben’s resignation is not the result of any disagreement regarding any matter related to the Company’s operations, policies or practices. As described below, Mr. Stelben will remain with the Company as a consultant to support the transition.

Effective May 29, 2024, the Company and Mr. Stelben entered into a consulting agreement with a term starting on or about September 1, 2024 and ending on or about December 31, 2024 (the “Consulting Agreement”), pursuant to which Mr. Stelben will receive a monthly fee in the amount of $10,000 per month in exchange for the performance of specified services to support the transition. The foregoing description of the Consulting Agreement is a summary only and does not purport to be complete. A copy of the Consulting Agreement will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

Mr. Stelben will not receive any severance payments in connection with his resignation of employment and will not vest in his Company equity following his resignation on August 30, 2024.

John Dolan, age 56, who has served as the Company’s senior vice president, chief accounting officer since May 2022, will succeed Mr. Stelben as the Company’s senior vice president, chief financial officer, effective August 31, 2024. In connection with his role as senior vice president, chief financial officer, Mr. Dolan will also serve as the Company’s principal financial and accounting officer. Prior to joining the Company, Mr. Dolan served as deputy controller of BNY Mellon, a global financial services company, from March 2017 to May 2022, where his responsibilities included SEC reporting and technical accounting. Prior to joining BNY Mellon, Mr. Dolan held various senior finance positions with American Express, a global financial products and travel services company, from April 2004 to March 2017, including vice president – Americas controller and global accounting policies & advisory, vice president, controller – global corporate services & enterprise growth and vice president – corporate segment & tax controller. He also held finance positions at GE Capital and Merrill Lynch and was previously a senior manager at PricewaterhouseCoopers. Mr. Dolan is a certified public accountant (inactive) and holds a B.S. in accounting from Manhattan College.

Mr. Dolan’s promotion with the Company provides for (i) an annual base salary of $440,000 and (ii) eligibility to participate in the Company’s cash incentive bonus plan, with an annual discretionary incentive bonus target equal to 75% of his annual base salary. His 2024 bonus payout will be prorated based on time served in each role.

Mr. Dolan will also receive, subject to the approval of the compensation committee of the board of directors of the Company, (i) a time-based restricted stock unit award covering 48,750 shares of the Company’s common stock, which award will be subject to annual vesting over three years, and (ii) a performance-based restricted stock unit award covering 26,250 shares of the Company’s common stock that will be eligible to vest based on the Company’s achievement of adjusted EBITDA margin goals over a two-year performance period, and which eligible performance-based restricted stock units (as applicable) will vest upon satisfaction of a service requirement over one-year service following the end of the performance period, in each case subject to Mr. Dolan’s continued service with the Company through each vesting date and potential acceleration of vesting upon certain terminations of employment.

In addition, Mr. Dolan will enter into the Company’s standard severance agreement (the “Severance Agreement”). Pursuant to the Severance Agreement, if Mr. Dolan is terminated by the Company “without cause” or if he voluntarily resigns for “good reason” (as such terms are defined in the Severance Agreement), Mr. Dolan will be entitled to receive the following severance payment and benefits (subject to his execution of a standard release of claims): (i) a single lump-sum cash payment (less applicable withholding taxes) in an amount equal to twelve months of his then-current annual base salary; and (ii) company-paid group health, dental and vision benefits for Mr. Dolan and his covered dependents for up to twelve months, subject to certain conditions. In addition, if Mr. Dolan is terminated by the Company “without cause” or if he voluntarily resigns for “good reason” during the one-year period following a change of control (as such term is defined in the Severance Agreement), then Mr. Dolan will also be entitled to receive the following severance payment and benefits (subject to his execution of a standard release of claims): (i) a single lump-sum cash payment (less applicable withholding taxes) in an amount equal to 100% of his then-current target annual bonus; and (ii) 100% vesting of any outstanding and unvested time-based equity awards granted to Mr. Dolan.

Mr. Dolan will also enter into the Company’s standard indemnification agreement for directors and officers (the “Indemnification Agreement”) which, among other things, requires the Company to indemnify Mr. Dolan to the fullest extent

permitted by Delaware law, including indemnification of expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by Mr. Dolan in any action or proceeding, including any action or proceeding by or in right of the Company, arising out of Mr. Dolan’s services as an executive officer.

There are no family relationships between Mr. Dolan and any director or executive officer of the Company that require disclosure under Item 401(d) of Regulation S-K. Other than the Severance Agreement, the Indemnification Agreement and his existing employment relationship with the Company, there are no transactions between Mr. Dolan or any member of his immediate family, on the one hand, and the Company or any of its subsidiaries, on the other hand, that require disclosure under Item 404(a) of Regulation S-K. Furthermore, there are no arrangements or understandings between Mr. Dolan and any other persons pursuant to which Mr. Dolan was selected as the senior vice president, chief financial officer of the Company.

The foregoing descriptions of the Severance Agreement and the Indemnification Agreement are summaries only and do not purport to be complete. A copy of the Severance Agreement will be filed with the next periodic report after the Severance Agreement has been executed.

| | | | | | | | |

| Item 7.01 | | Regulation FD Disclosure. |

On May 30, 2024, the Company issued a press release announcing Mr. Stelben’s resignation and retirement at the end of August 2024 and Mr. Dolan’s appointment effective as of August 31, 2024. A copy of such press release is attached hereto as Exhibit 99.1.

The information in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. Except as shall be expressly set forth by specific reference in such filing, the information contained herein and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any filing with the Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | eHealth, Inc. |

| Date: | May 30, 2024 | /s/ Gavin G. Galimi |

| | Gavin G. Galimi SVP, General Counsel and Corporate Secretary |

PRESS RELEASE

eHealth Chief Financial Officer John Stelben to Retire in August

eHealth’s Chief Accounting Officer John Dolan to be Named Chief Financial Officer

AUSTIN, TX – May 30, 2024 – eHealth, Inc. (Nasdaq: EHTH) (eHealth.com), a leading online private health insurance marketplace, announced today that John Stelben, its chief financial officer (CFO), is returning to retirement and will depart the company at the end of August 2024. Mr. Stelben will serve as a retained advisor through the end of 2024 to ensure a seamless transition.

John Dolan, eHealth’s chief accounting officer will be appointed SVP, CFO on August 31, 2024. In connection with his role as SVP, CFO, Mr. Dolan will also serve as the company’s principal financial and accounting officer.

“We thank John Stelben for his financial leadership during his time at eHealth. John played a pivotal role in steering eHealth through its transformation period, helping to position the company for sustainable profitable growth. We thank him for his leadership and his contributions to eHealth’s important progress and wish him the very best in retirement,” said eHealth chief executive officer and director, Fran Soistman. “I am pleased to appoint John Dolan as eHealth’s new chief financial officer in August. John brings a wealth of experience and a proven track record of financial stewardship that will be invaluable as we continue to execute on our strategic initiatives and drive profitable growth. I am confident that John’s experience and vision will further support the continued success of eHealth.”

“I want to thank Fran, the board of directors, and everyone at eHealth,” said John Stelben. “I leave holding eHealth in the highest regard. I am enormously proud of the strides we’ve made and equally excited about eHealth’s future.”

# # #

About eHealth (NASDAQ: EHTH)

We’re Matchmakers. For over 25 years, eHealth has helped millions of Americans find the healthcare coverage that fits their needs at a price they can afford. As a leading independent licensed insurance agency and advisor, eHealth offers access to over 180 health insurers, including national and regional companies.

For more information, visit ehealth.com or follow us on LinkedIn, Facebook, Instagram, and X. Open positions can be found on our career page.

Investor inquiries:

Kate Sidorovich

SVP, Investor Relations & Strategy

investors@ehealth.com

Media inquiries:

Lara Sasken

Chief Communications Officer

pr@ehealth.com

v3.24.1.1.u2

Cover Page

|

May 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 29, 2024

|

| Entity Registrant Name |

EHEALTH, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33071

|

| Entity Tax Identification Number |

56-2357876

|

| Entity Address, Address Line One |

13620 RANCH ROAD 620 N, SUITE A250

|

| Entity Address, City or Town |

AUSTIN

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78717

|

| City Area Code |

737

|

| Local Phone Number |

248-2340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

EHTH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001333493

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

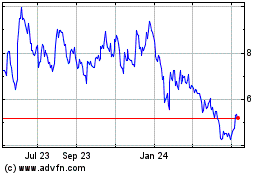

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Dec 2024 to Jan 2025

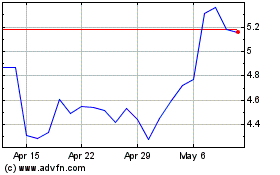

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Jan 2024 to Jan 2025