UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

| ☒ |

Preliminary

Information Statement |

| ☐ |

Confidential,

for use of the Commission only (as permitted by Rule 14c-5(d)(2)) |

| ☐ |

Definitive

Information Statement |

| |

ELEVAI

LABS INC. |

|

| |

(Name of Registrant As Specified

In Charter) |

|

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with

preliminary materials. |

| ☐ |

Fee computed on table in

exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and

0-11 |

ELEVAI

LABS INC.

120

Newport Center Drive

Newport

Beach, CA 92660

INFORMATION

STATEMENT

(Preliminary)

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED

NOT TO SEND US A PROXY

NOTICE

OF SHAREHOLDER ACTION BY WRITTEN CONSENT

GENERAL

INFORMATION

To

the Holders of Common Stock of Elevai Labs Inc.:

This

Information Statement is first being mailed on or about August 15, 2024 to the holders of record of the outstanding voting stock, $0.0001 par

value per share (“Common Stock”), of Elevai Labs Inc., a Delaware corporation (the “Company”), as of the close

of business on July 15, 2024 (the “Record Date”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of

1934, as amended (the “Exchange Act”). This Information Statement relates to actions taken by written consent in lieu of

a meeting (the “Written Consent”) of the shareholders of the Company owning a majority of the voting power of the outstanding

shares of stock (the “Majority Shareholders”) as of the Record Date. Except as otherwise indicated by the context, references

in this Information Statement to “we,” “us” or “our” are references to Elevai Labs Inc., a Delaware

corporation.

The

Written Consent:

| 1. |

approved an amendment to

our third amended and restated certificate of incorporation (“Certificate of Incorporation”), to effect a reverse stock

split of our common stock at a reverse stock split ratio ranging from 1:2 to 1:10 inclusive, as determined by our Chief Executive

Officer in his sole discretion (the “Approval of Certificate of Incorporation Amendment”); and |

| |

|

| 2. |

approved the re-domestication

of the Company from a Delaware corporation to a Nevada corporation (the “Approval of Re-Domestication”). |

The

Written Consent constitutes the consent of a majority of the voting power of the outstanding shares of stock and is sufficient under

the Delaware General Corporation Law and our amended and restated bylaws (“Bylaws”) to approve the actions described herein.

Accordingly, the Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication are not presently being submitted

to our other shareholders for a vote. Pursuant to Rule 14c-2 under the Exchange Act, the action described herein will not be implemented

until a date at least twenty (20) days after the date on which this Information Statement has been first mailed to the shareholders.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

This

Information Statement has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is being furnished,

pursuant to Section 14C of the Exchange Act to the holders of voting and non-voting stock (“Shareholders”) to notify the

Shareholders of the approval of the Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication. Shareholders

of record at the close of business on July 15, 2024 are entitled to notice of the Written Consent. Because this action has been approved

by the holders of the required majority of the voting power of our outstanding shares of stock, no proxies were or are being solicited.

The Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication will not be effected until at least 20 calendar

days after the mailing of the Information Statement accompanying this notice. We will mail the Notice of Shareholder Action by Written

Consent to the Shareholders on or about August 15, 2024.

PLEASE

NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF SHAREHOLDERS AND NO SHAREHOLDERS MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED

HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING SHAREHOLDERS OF THE MATTERS DESCRIBED

HEREIN PURSUANT TO SECTION 14(C) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/

Braeden Lichti |

| |

Chairman of the Board of Directors |

| |

August 15, 2024 |

INTRODUCTION

This

Information Statement is being first mailed on or about August 15, 2024 to the Shareholders by the Board of Directors of the Company (“Board”)

to provide material information regarding the Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication

that have been approved by the Written Consent of the Majority Shareholders.

Only

one copy of this Information Statement is being delivered to two or more shareholders who share an address unless we have received contrary

instruction from one or more of such shareholders. We will promptly deliver, upon written or oral request, a separate copy of the Information

Statement to a security holder at a shared address to which a single copy of the document was delivered. If you would like to request

additional copies of the Information Statement, or if in the future you would like to receive multiple copies of information statements

or proxy statements, or annual reports, or, if you are currently receiving multiple copies of these documents and would, in the future,

like to receive only a single copy, please so instruct us by writing to the corporate secretary at the Company’s executive offices

at the address specified above.

PLEASE

NOTE THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE

MATTERS DESCRIBED HEREIN.

The

entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians,

fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the shares of stock held of record

by them.

AUTHORIZATION

BY THE BOARD OF DIRECTORS

AND

THE MAJORITY SHAREHOLDERS

Under

the Delaware General Corporation Law and the Company’s Bylaws, any action that can be taken at an annual or special meeting of

shareholders may be taken without a meeting, without prior notice and without a vote, if the holders of outstanding stock having not

less than the minimum number of votes that will be necessary to authorize or take such action at a meeting at which all shares entitled

to vote thereon were present and voted to consent to such action in writing. The approval of the Approval of Certificate of Incorporation

Amendment and the Approval of Re-Domestication requires the affirmative vote or written consent of a majority of the voting power of

the issued and outstanding shares of stock. Each holder of Common Stock is entitled to one vote per share of Common Stock held of record

on any matter which may properly come before the shareholders.

On the Record Date, the Company had 18,892,115

shares of Common Stock issued and outstanding, with the holders thereof being entitled to cast one vote per share. On July 23, 2024, the

Majority Shareholders adopted resolutions approving the Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication.

CONSENTING

SHAREHOLDERS

On

July 23, 2024, the Majority Shareholders, being the record holder of 11,395,682 shares of Common Stock adopted resolutions, among other

things, approving the adoption of the Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication. The voting

power held by the Majority Shareholders represented approximately 60.32% of the total voting power of all issued and outstanding stock

of the Company as of the Record Date.

We

are not seeking written consent from any other shareholder of the Company, and the other shareholders will not be given an opportunity

to vote with respect to the Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication. All necessary corporate

approvals have been obtained. This Information Statement is furnished solely for the purposes of advising shareholders of the action

taken by Written Consent and giving shareholders notice of such actions taken as required by the Exchange Act.

As

the Approval of Certificate of Incorporation Amendment and the Approval of Re-Domestication actions were taken by Written Consent, there

will be no security holders’ meeting and representatives of the principal accountants for the current year and for the most recently

completed fiscal year will not have the opportunity to make a statement if they desire to do so and will not be available to respond

to appropriate questions from our shareholders.

APPROVAL

OF CERTIFICATE OF INCORPORATION AMENDMENT TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A REVERSE STOCK SPLIT RATIO RANGING

FROM 1:2 TO 1:10, INCLUSIVE, AS DETERMINED BY OUR CHIEF EXECUTIVE OFFICER IN HIS SOLE DISCRETION

The

Majority Shareholders approved an amendment to our Certificate of Incorporation to effect a reverse stock split of our Common Stock at

a reverse stock split ratio ranging from 1:2 to 1:10, inclusive, as may be determined at the appropriate time by our Chief Executive

Officer, in his sole discretion (the “Reverse Stock Split”). This means that our Chief Executive Officer will be able to

decide whether and when to effect the Reverse Stock Split without further action from the stockholders.

Reasons

for a Reverse Stock Split

Maintaining

our Listing on Nasdaq

The

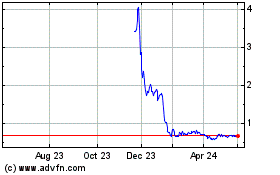

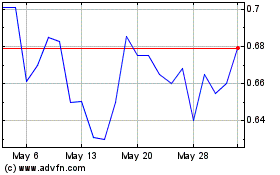

primary purpose of the Reverse Stock Split is to raise the per share trading price of our common stock in order to maintain our listing

on The Nasdaq Capital Market. Delisting from Nasdaq may adversely affect our ability to raise additional financing through the public

or private sale of our equity securities, may significantly affect the ability of investors to trade in our securities and may negatively

affect the value and liquidity of our Common Stock. Delisting may also have other negative impacts, including potential loss of employee

confidence, the loss of institutional investors, the loss of analyst coverage or the loss of business development opportunities.

Potentially

Improving the Marketability and Liquidity of our Common Stock

The

Board believes that an increased stock price may also improve the marketability and liquidity of our Common Stock. For example, many

brokerages, institutional investors and funds have internal policies that either prohibit them from investing in low-priced stocks or

tend to discourage individual brokers from recommending low-priced stocks to their customers by restricting or limiting the ability to

purchase such stocks on margin. Additionally, investors may be dissuaded from purchasing stocks below certain prices because brokers’

commissions, as a percentage of the total transaction value, can be higher for low-priced stocks.

Decreasing

the Risk of Market Manipulation of our Common Stock

The

Board believes that the potential increase in stock price may reduce the risk of market manipulation of our Common Stock, which we believe

is enhanced when our stock trades below $1.00 per share. By reducing market manipulation risk, we may also thereby potentially decrease

the volatility of our stock price.

Providing

us the Ability to Issue Additional Securities

A

Reverse Stock Split is expected to increase the number of authorized, but unissued and unreserved, shares of our common stock. These

additional shares would provide flexibility to us for raising capital; repurchasing debt; providing equity incentives to employees, officers,

directors, consultants and advisors (including pursuant to our equity compensation plan); expanding our business through the acquisition

of other businesses and for other purposes. However, at present, we do not have any specific plans, arrangements, understandings or commitments

for the additional shares that would become available.

Accordingly,

for these and other reasons, the Board believes that a Reverse Stock Split is in the best interests of us and our stockholders. A copy

of the draft of the amendment to our Certificate of Incorporation providing for the Reverse Stock Split is attached hereto as Annex A.

Criteria

to be Used for Determining Whether to Implement a Reverse Stock Split

This

proposal gives our Chief Executive Officer the discretion to select a Reverse Stock Split ratio from within a range between and including

1:2 and 1:10 on a date selected by him based on his then-current assessment of the factors below, and in order to maximize Company and

stockholder interests. In determining whether to implement the Reverse Stock Split, and which ratio to implement, if any, the Board may

consider, among other factors:

| |

● |

the historical

trading price and trading volume of our Common Stock; |

| |

● |

the then-prevailing trading

price and trading volume of our Common Stock and the expected impact of the Reverse Stock Split on the trading market in the short-

and long-term; |

| |

● |

the continued listing requirements

for our Common Stock on The Nasdaq Stock Market LLC (“Nasdaq”) or other applicable exchanges, if then applicable; |

| |

● |

the number of shares of

Common Stock outstanding; and |

| |

● |

which Reverse Stock Split

ratio would result in the least administrative cost to us; and |

| |

● |

the historical trading

price and trading volume of our Common Stock. |

Certain

Risks and Potential Disadvantages Associated with a Reverse Stock Split

We

cannot assure stockholders that the proposed Reverse Stock Split will sufficiently increase our stock price or, that our stock will trade

at a price that is equal to at least $1.00 per share for a period of 10 consecutive days prior to September 3, 2024, which is the

date that we must regain compliance with Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). If we do not regain compliance

with the Bid Price Rule prior to September 3, 2024, and we are not deemed eligible for an additional period of time to regain compliance

with the Bid Price Rule, our listed securities may be subject to delisting. The effect of a Reverse Stock Split on our stock price cannot

be predicted with any certainty, and the history of reverse stock splits for other companies in various industries is varied, particularly

since some investors may view a reverse stock split negatively. It is possible that our stock price after a Reverse Stock Split will

not increase in the same proportion as the reduction in the number of shares outstanding, causing a reduction in our overall market capitalization.

Further, even if we implement a Reverse Stock Split, our stock price may decline due to various factors, including our future performance

and general industry, market and economic conditions. This percentage decline, as an absolute number and as a percentage of our overall

market capitalization, may be greater than would occur in the absence of a Reverse Stock Split. If we fail to meet Nasdaq’s continued

listing requirements, Nasdaq could suspend trading in our Common Stock and commence delisting proceedings.

The

proposed Reverse Stock Split may decrease the liquidity of our Common Stock and result in higher transaction costs. The liquidity of

our Common Stock may be negatively impacted by the reduced number of shares outstanding after the Reverse Stock Split, which would be

exacerbated if the stock price does not increase following the split. In addition, a Reverse Stock Split would increase the number of

stockholders owning “odd lots” of fewer than 100 shares, trading in which generally results in higher transaction costs.

Accordingly, a Reverse Stock Split may not achieve the desired results of increasing marketability and liquidity as described above.

The

implementation of a Reverse Stock Split would result in an effective increase in the authorized number of shares of Common Stock available

for issuance, which could, under certain circumstances, have anti-takeover implications. The additional shares of Common Stock available

for issuance could be used by us to oppose a hostile takeover attempt or to delay or prevent changes in control or in our management.

Although the Reverse Stock Split has been prompted by business and financial considerations, and not by the threat of any hostile takeover

attempt (nor is the Board currently aware of any such attempts directed at us), stockholders should be aware that approval of the Reverse

Stock Split could facilitate future efforts by us to deter or prevent changes in control, including transactions in which stockholders

might otherwise receive a premium for their shares over then-current market prices.

Stockholders

should also keep in mind that the implementation of a Reverse Stock Split does not have an effect on the actual or intrinsic value of

our business or a stockholder’s proportional ownership interest (subject to the treatment of fractional shares). However, should

the overall value of our common stock decline after a Reverse Stock Split, then the actual or intrinsic value of shares held by stockholders

will also proportionately decrease as a result of the overall decline in value.

Effects

of a Reverse Stock Split

As

of the effective date of the Reverse Stock Split:

| |

● |

a certain number shares of Common Stock outstanding (depending on the

Reverse Stock Split ratio selected by the Chief Executive Officer) will be combined, automatically and without any action on the

part of the Company or its stockholders, into one new share of Common Stock; |

| |

● |

no fractional shares of

Common Stock will be issued; instead, stockholders who would otherwise receive a fractional share will receive a whole share in lieu

of any fractional share of Common Stock (as detailed below); |

| |

● |

proportionate adjustments

will be made to the number of shares issuable upon the exercise or vesting of all then-outstanding stock options and warrants which

will result in a proportional decrease in the number of shares of Common Stock reserved for issuance upon exercise or vesting of

such stock options and warrants and, in the case of stock options, a proportional increase in the exercise price of all such stock

options; |

| |

● |

the number of shares of

Common Stock then reserved for issuance under our equity compensation plan will be reduced proportionately; and |

| |

● |

the total number of authorized

shares of Common Stock will remain at 300,000,000. |

The

following table summarizes, for illustrative purposes only, the anticipated effects of a Reverse Stock Split on our shares available

for issuance based on information as of the Record Date (unless otherwise noted below) and without giving effect to the treatment of

fractional shares.

Assuming

the Reverse Stock Split is implemented by the Board:

| Status |

|

Number of

Shares of

Common

Stock

Authorized |

|

|

Number of

Shares of

Common

Stock

Issued and

Outstanding |

|

|

Number of

Shares of

Common

Stock

Reserved

for Future

Issuance(1) |

|

|

Number of

Shares of

Common

Stock

Authorized but

Unissued and

Unreserved |

|

|

Hypothetical

Initial

Market

Value of

Shares of

Common

Stock

Authorized but

Unissued and

Unreserved* |

|

| Pre-Reverse Stock Split |

|

|

300,000,000 |

|

|

|

18,892,115 |

|

|

|

281,107,885 |

|

|

|

279,072,923 |

|

|

$ |

110,233,804 |

|

| Post-Reverse Stock Split 1:2 |

|

|

300,000,000 |

|

|

|

9,446,058 |

|

|

|

290,553,942 |

|

|

|

289,536,462 |

|

|

$ |

114,366,902 |

|

| Post-Reverse Stock Split 1:10 |

|

|

300,000,000 |

|

|

|

1,889,212 |

|

|

|

298,110,788 |

|

|

|

297,907,292 |

|

|

$ |

117,673,380 |

|

| * |

Based on a hypothetical post-split stock price calculated by multiplying

the closing stock price on August 2, 2024 of $0.395 by the split ratio. |

| (1) |

Includes shares

of Common Stock reserved for issuance (i) upon the exercise of currently exercisable warrants and options and (ii) under

the Elevai Labs Inc. 2022 Equity Incentive Plan less any exercised or converted awards. |

A Reverse Stock Split would affect all stockholders

uniformly. As of the effective date of the Reverse Stock Split which shall be determined by the Chief Executive Officer in his sole discretion

(“Effective Date”), each stockholder would own a reduced number of shares of Common Stock. Percentage ownership interests,

voting rights and other rights and preferences would not be affected, except to the extent that the Reverse Stock Split would result in

fractional shares (as described below).

A

Reverse Stock Split would not affect the registration of our Common Stock under Section 12(b) of the Exchange Act and

we would continue to be subject to the periodic reporting and other requirements of the Exchange Act. Barring delisting by Nasdaq,

our Common Stock would continue to be listed on Nasdaq under the symbol “ELAB,” but would have a new Committee on Uniform

Securities Identification Procedures number after the effective date.

Fractional

Shares

No

fractional shares of common stock will be issued as a result of the Reverse Stock Split. In lieu of any fractional shares to which a

stockholder of record would otherwise be entitled, we will issue a whole share in lieu of any fractional share of Common Stock.

As of August 5, 2024, there were 56 common stockholders

of record. We do not intend for this transaction to be the first step in a series of plans or proposals of a “going private transaction”

within the meaning of Rule 13e-3 of the Exchange Act.

Procedure

for Effecting a Reverse Stock Split

Beneficial

Holders of Common Stock

Stockholders

who hold their shares through a bank, broker or other nominee will be treated in the same manner as registered stockholders who hold

their shares in their names. Banks, brokers and other nominees will be instructed to effect the Reverse Stock Split for beneficial owners

of such shares. However, banks, brokers or other nominees may implement different procedures than those to be followed by registered

stockholders for processing the Reverse Stock Split, particularly with respect to the treatment of fractional shares. Stockholders whose

shares of Common Stock are held in the name of a bank, broker or other nominee are encouraged to contact their bank, broker or other

nominee with any questions regarding the procedures for implementing the Reverse Stock Split with respect to their shares.

Registered

Holders of Common Stock

Registered

stockholders hold shares electronically in book-entry form under the direct registration system (i.e., do not have stock certificates

evidencing their share ownership but instead have a statement reflecting the number of shares registered in their accounts) and, as a

result, do not need to take any action to receive post-split shares. If they are entitled to receive post-split shares, they will automatically

receive, at their address of record, a transaction statement indicating the number of post-split shares held following the Effective

Date.

Material

U.S. Federal Income Tax Consequences

The

following is a summary of material U.S. federal income tax consequences of a Reverse Stock Split to stockholders. This summary is

based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations, administrative

rulings and judicial decisions, all as in effect on the date of this filing, and all of which are subject to change or differing interpretations,

possibly with retroactive effect. Any such change or differing interpretation could affect the tax consequences described below.

We

have not sought and will not seek an opinion of counsel or ruling from the Internal Revenue Service (the “IRS”) with respect

to the statements made and the conclusions reached in the following summary, and there can be no assurance that the IRS or a court will

agree with such statements and conclusions.

This

summary is limited to stockholders that are U.S. holders, as defined below, and that hold our Common Stock as a capital asset (generally,

property held for investment).

This

summary is for general information only and does not address all U.S. federal income tax considerations that may be applicable to

a holder’s particular circumstances or to holders that may be subject to special tax rules, such as, for example, brokers and dealers

in securities, currencies or commodities, banks and financial institutions, regulated investment companies, real estate investment trusts,

expatriates, tax-exempt entities, governmental organizations, traders in securities that elect to use a mark-to-market method of accounting

for their securities, certain former citizens or long-term residents of the U.S., insurance companies, persons holding shares of our

Common Stock as part of a hedging, integrated or conversion transaction or a straddle or persons deemed to sell shares of our Common

Stock under the constructive sale provisions of the Code, persons that hold more than 5% of our Common Stock, persons that hold our Common

Stock in an individual retirement account, 401(k) plan or similar tax-favored account or partnerships or other pass-through entities

for U.S. federal income tax purposes and investors in such entities.

This

summary does not address any U.S. federal tax consequences other than U.S. federal income tax consequences (such as estate

or gift tax consequences), the Medicare tax on net investment income, the alternative minimum tax or any U.S. state, local or foreign

tax consequences. This summary also does not address any U.S. federal income tax considerations relating to any other transaction

other than the Reverse Stock Split.

For

purposes of this summary, a “U.S. holder” means a beneficial owner of our Common Stock that is, for U.S. federal

income tax purposes:

| |

● |

an individual who is a

citizen or resident of the U.S.; |

| |

● |

a corporation created or

organized in or under the laws of the U.S., any state thereof or the District of Columbia; |

| |

● |

an estate the income of

which is subject to U.S. federal income taxation regardless of its source; or |

| |

● |

a trust if (1) it

is subject to the primary supervision of a court within the U.S. and one or more U.S. persons have the authority to control

all substantial decisions of the trust or (2) it has a valid election in effect under applicable U.S. Treasury regulations

to be treated as a U.S. person. |

If

an entity (or arrangement) classified as a partnership for U.S. federal income tax purposes holds shares of our Common Stock, the

tax treatment of a partner in the partnership will generally depend upon the status of the partner and the activities of the partnership.

If a holder of our Common Stock is a partner of a partnership holding shares of our Common Stock, such holder should consult his or her

own tax advisor.

This

summary of certain U.S. federal income tax consequences is for general information only and is not tax advice. Stockholders are

urged to consult their own tax advisor with respect to the application of U.S. federal income tax laws to their particular situation

as well as any tax considerations arising under other U.S. federal tax laws (such as the estate or gift tax laws) or under the laws

of any state, local, foreign or other taxing jurisdiction or under any applicable tax treaty.

The

Reverse Stock Split is intended to be treated as a recapitalization for U.S. federal income tax purposes. Assuming the Reverse Stock

Split qualifies as a recapitalization, except as described below with respect to cash received in lieu of a fractional share, a U.S. holder

will not recognize any gain or loss for U.S. federal income tax purposes upon the Reverse Stock Split. In the aggregate, a U.S. holder’s

tax basis in the Common Stock received pursuant to the Reverse Stock Split (excluding the portion of the tax basis that is allocable

to any fractional share) will equal the U.S. holder’s tax basis in its Common Stock surrendered in the Reverse Stock Split

in exchange therefor, and the holding period of the U.S. holder’s Common Stock received pursuant to the Reverse Stock Split

will include the holding period of the Common Stock surrendered in the Reverse Stock Split in exchange therefor.

In

general, a U.S. holder who receives a cash payment in lieu of a fractional share will recognize capital gain or loss equal to the

difference between the amount of cash received in lieu of the fractional share and the portion of the U.S. holder’s tax basis

of the Common Stock surrendered in the Reverse Stock Split that is allocable to the fractional share. Such gain or loss generally will

be long-term capital gain or loss if the U.S. holder’s holding period in its Common Stock surrendered in the Reverse Stock

Split is more than one year as of the date of the Reverse Stock Split. The deductibility of net capital losses by individuals and corporations

is subject to limitations. Depending on a stockholder’s individual facts and circumstances, it is possible that cash received in

lieu of a fractional share could be treated as a distribution under Section 301 of the Code, so stockholders should consult their

own tax advisors as to that possibility and the resulting tax consequences to them in that event.

U.S. holders

that have acquired different blocks of our Common Stock at different times or at different prices are urged to consult their own tax

advisors regarding the allocation of their aggregated adjusted basis among, and the holding period of, our Common Stock.

Information

returns generally will be required to be filed with the IRS with respect to the payment of cash in lieu of a fractional share made pursuant

to the Reverse Stock Split unless such U.S. holder is an exempt recipient and timely and properly establishes with the applicable

withholding agent the exemption. In addition, payments of cash in lieu of a fractional share made pursuant to the Reverse Stock Split

may, under certain circumstances, be subject to backup withholding, unless a U.S. holder timely provides to the applicable withholding

agent proof of an applicable exemption or a correct taxpayer identification number, and otherwise complies with the applicable requirements

of the backup withholding rules. Any amounts withheld under the backup withholding rules are not additional tax and may be refunded or

credited against the U.S. holder’s U.S. federal income tax liability, provided that the U.S. holder timely furnishes

the required information to the IRS. U.S. holders should consult their tax advisors regarding their qualification for an exemption

from backup withholding and the procedures for obtaining such an exemption.

Accounting

Consequences

The

par value per share of our Common Stock will remain unchanged at $0.0001 per share following a Reverse Stock Split. As a result, as of

the Effective Date, the stated capital on our balance sheets attributable to Common Stock will be reduced proportionally based on the

Reverse Stock Split ratio, and the additional paid-in capital will be credited with the amount by which the capital is reduced. The net

income or loss per share of Common Stock will be increased as a result of the fewer shares of common stock outstanding. The Reverse Stock

Split will be reflected retroactively in our consolidated financial statements.

APPROVAL

OF RE-DOMESTICATION FROM DELAWARE TO NEVADA

The

following discussion summarizes certain aspects of the Re-Domestication from the State of Delaware to the State of Nevada pursuant to

the Agreement and Plan of Merger (the “Merger Agreement”) to be entered into between one of our wholly owned subsidiaries

and our existing Delaware corporation. This summary is not intended to be complete and is subject to, and qualified in its entirety by,

reference to the Merger Agreement, a form of which is attached to this Information Statement as Exhibit A, the Articles of Incorporation

of PMGC Holdings Inc., a Nevada corporation (the “Nevada Articles”), a form of which is attached to this Information Statement

as Exhibit B and the Bylaws of PMGC Holdings Inc. (Nevada) (the “Nevada Bylaws”), a form of which is attached to this Information

Statement as Exhibit C. Our directors and majority shareholders have already approved the forms of Merger Agreement, Nevada Articles

and Nevada Bylaws and the directors approved the name change from “Elevai Labs Inc.” to “PMGC Holdings Inc.”

to be effected in connection with the Re-Domestication. In this discussion of the Re-Domestication, the terms, “we,” the

“Company” or “Elevai Labs Inc.” refer to the existing Delaware corporation and the term “PMGC Holdings

Inc.” refers to the new Nevada corporation, which will be the successor to the Company.

Principal

Reasons for the Re-Domestication

The

principal reason for Re-Domestication from Delaware to Nevada is to eliminate our obligation to pay the annual Delaware franchise tax

that will result in significant savings to us in the future. Under Nevada law, there is no obligation to pay annual franchise taxes and

there are no capital stock taxes or inventory taxes. In addition, under Nevada law, there are minimal reporting and corporate disclosure

requirements and the identity of the corporate shareholders is not a part of the public record. Otherwise, the general corporation laws

of the States of Delaware and Nevada are quite similar as both states have liberal incorporation laws and favorable tax policies. As

detailed below under “The Rights of the Shareholders Will Now be Governed by Nevada Law instead of Delaware Law,”

there are differences in Delaware law and Nevada law that may affect the rights of shareholders. However, in the formation of PMGC Holdings

Inc., we will endeavor to make no substantive changes in the provisions and terms of the Nevada Articles and Nevada Bylaws from the provisions

and terms of Elevai Labs Inc.’s Third Amended and Restated Certificate of Incorporation (“Delaware Certificate”) and

Bylaws (“Delaware Bylaws”).

The

Re-Domestication is not being effected to prevent a change in control, nor is it in response to any present attempt known to our Board

to acquire control of the Company or obtain representation on our Board. Nevertheless, certain effects of the proposed Re-Domestication

may be considered to have anti-takeover implications simply by virtue of being subject to Nevada law. For example, in responding to an

unsolicited bidder, the Nevada Revised Statutes authorizes directors to consider not only the interests of stockholders, but also the

interests of employees, suppliers, creditors, customers, the economy of the state and nation, the interests of the community and society

in general, and the long-term as well as short-term interests of the corporation and its stockholders, including the possibility that

these interests may be best served by the continued independence of the corporation. For a discussion of these and other differences

between the laws of Delaware and Nevada, see “Significant Differences Between Delaware and Nevada Law” below.

Possible

Disadvantages of Re-Domestication

Delaware

has historically been the state in which a majority of public companies incorporate. A potential disadvantage of re-domesticating from

Delaware to Nevada is that Delaware for many years has followed a policy of encouraging incorporation in that State and, in furtherance

of that policy, has adopted comprehensive, modern and flexible corporate laws that Delaware periodically updates and revises to meet

changing business needs. Because of Delaware’s prominence as a state of incorporation for many large corporations, the Delaware

courts have developed considerable expertise in dealing with corporate issues and a substantial body of case law has developed construing

Delaware law and establishing public policies with respect to Delaware corporations. Because Nevada case law concerning the effects of

its statutes and regulations is more limited, the Company and its stockholders may experience less predictability with respect to legality

of corporate affairs and transactions and stockholders’ rights to challenge them.

However,

it appears that Nevada is emulating, and in certain cases surpassing, Delaware in creating a corporation-friendly environment.

We

will endeavor to adapt as closely as possible the Nevada incorporation and bylaws documents to the existing Delaware documents.

Principal

Features of the Re-Domestication

The

Re-Domestication will be effected by the merger (the “Merger”) of Elevai Labs Inc. with and into PMGC Holdings Inc., a wholly

owned subsidiary of Elevai Labs Inc. that will be incorporated under Nevada law for the purposes of the Merger. PMGC Holdings Inc. will

be the surviving corporation in the Merger and will continue under the name “PMGC Holdings Inc.” Elevai Labs Inc. will cease

to exist as a result of the Merger.

The

Merger will not become effective until the Merger Agreement or an appropriate certificate of merger is filed with the Secretary of State

of the State of Nevada and the Secretary of State of the State of Delaware, which will not take place until at least 20 days after the

mailing of this Information Statement to our shareholders.

At

the effective time of the Merger, the Nevada Articles, the Nevada Bylaws and Nevada law will govern our corporation’s operations

and activities. However, there are no substantial differences in the Nevada Articles and Nevada Bylaws from the Delaware Certificate

and Delaware Bylaws.

Upon

completion of the Merger, each outstanding share of Common Stock will be converted into one share of common stock, $0.0001 par value

per share, of PMGC Holdings Inc. As a result, the existing shareholders of Elevai Labs Inc. will automatically become shareholders of

PMGC Holdings Inc. (Nevada), Elevai Labs Inc. will cease to exist and PMGC Holdings Inc. will continue to operate our business under

the name “PMGC Holdings Inc.” Elevai Labs Inc. stock certificates will be deemed to represent the same number of PMGC Holdings

Inc. shares as were represented by such Elevai Labs Inc. stock certificates prior to the Re-Domestication.

You

will not have to take any action to exchange your stock certificates as a result of the Merger. The current certificates representing

shares of the Company’s common stock will automatically represent an equal number of shares of PMGC Holdings Inc.’s common

stock following the Re-Domestication.

Upon

completion of the Re-Domestication, the authorized capital stock of PMGC Holdings Inc. will consist of 300,000,000 shares of common stock,

$0.0001 par value, and 75,000,000 shares of preferred stock, $0.0001 par value, which is identical to the authorized capital stock of

Elevai Labs Inc.

The Re-Domestication will not result in any change

to our daily business operations or the present location of our principal executive offices in Newport Beach, California. The financial

condition and results of operations of PMGC Holdings Inc. immediately after the consummation of the Re-Domestication will be identical

to that of Elevai Labs Inc. immediately prior to the consummation of the Re-Domestication. In addition, at the effective time of the Merger,

the directors of PMGC Holdings Inc. will be Braeden Lichti, Graydon Bensler, Jeffrey Parry, Juliana Daley, George Kovalyov and

Jordan Plews. Currently, Graydon Bensler serves as our Chief Executive Officer and Chief Financial Officer and he will serve in the same

capacities for PMGC Holdings Inc. Our directors and majority shareholders have already approved the forms of Merger Agreement, Nevada

Articles and Nevada Bylaws, copies of which are attached as exhibits to this Information Statement.

Differences

between Delaware and Nevada Law

The

rights of the Company’s stockholders are currently governed by Delaware law and the Delaware Certificate and Delaware Bylaws. The

Merger Agreement provides that, at the effective time of the Merger, the separate corporate existence of the Company will cease and the

former stockholders of the Company will become stockholders of PMGC Holdings Inc. Accordingly, after the effective time of the Merger,

your rights as a stockholder will be governed by Nevada law and the articles of incorporation and the bylaws of PMGC Holdings Inc. The

statutory corporate laws of the State of Nevada, as governed by the Nevada Revised Statutes, are similar in many respects to those of

Delaware, as governed by the Delaware General Corporation Law. However, there are certain differences that may affect your rights as

a stockholder, as well as the corporate governance of the corporation. The following are summaries of material differences between the

current rights of stockholders of the Company and the rights of stockholders of PMGC Holdings Inc. following the merger.

The

following discussion is a summary. It does not give you a complete description of the differences that may affect you. You should also

refer to the Nevada Revised Statutes, as well as the form of the Articles of Incorporation of PMGC Holdings Inc., which is attached as

Exhibit B to this Information Statement, and the Bylaws of PMGC Holdings Inc., which will come into effect concurrently with the effectiveness

of the Merger as provided in the Merger Agreement. In this section, we use the term “charter” to describe either the certificate

of incorporation under Delaware law or the Articles of Incorporation under Nevada law.

General

As

discussed above under “Potential Disadvantages of the Re-Domestication,” Delaware for many years has followed a policy

of encouraging incorporation in that State and, in furtherance of that policy, has adopted comprehensive, modern and flexible corporate

laws that Delaware periodically updates and revises to meet changing business needs. Because of Delaware’s prominence as a state

of incorporation for many large corporations, the Delaware courts have developed considerable expertise in dealing with corporate issues

and a substantial body of case law has developed construing Delaware law and establishing public policies with respect to Delaware corporations.

Because Nevada case law concerning the governing and effects of its statutes and regulations is more limited, the Company and its stockholders

may experience less predictability with respect to legality of corporate affairs and transactions and stockholders’ rights to challenge

them.

Removal

of Directors

Under

Delaware law, directors of a corporation without a classified board may be removed with or without cause by the holders of a majority

of shares then entitled to vote in an election of directors. Under Nevada law, any one or all of the directors of a corporation may be

removed by the holders of not less than two-thirds of the voting power of a corporation’s issued and outstanding stock. Nevada

does not distinguish between removal of directors with or without cause.

Limitation

on Personal Liability of Directors

Under

Nevada law it is not necessary to adopt provisions in the articles of incorporation limiting personal liability as this limitation is

provided by statute. A Delaware corporation is permitted to adopt provisions in its certificate of incorporation limiting or eliminating

the liability of a director to a company and its stockholders for monetary damages for breach of fiduciary duty as a director, provided

that such liability does not arise from certain proscribed conduct, including breach of the duty of loyalty, acts or omissions not in

good faith or which involve intentional misconduct or a knowing violation of law or liability to the corporation based on unlawful dividends

or distributions or improper personal benefit.

While

Nevada law has a similar provision permitting the adoption of provisions in the articles of incorporation limiting personal liability,

the Nevada provision differs in three respects. First, the Nevada provision applies to both directors and officers. Second, while the

Delaware provision excepts from the limitation on liability a breach of the duty of loyalty, the Nevada counterpart does not contain

this exception. Third, Nevada law expressly excludes directors and officers from liabilities owed to creditors of the corporation. Thus,

the Nevada provision expressly permits a corporation to limit the liability not only of directors, but also of officers, and permits

limitation of liability arising from a breach of the duty of loyalty and from obligations to the corporation’s creditors.

Indemnification

of Officers and Directors and Advancement of Expenses

Although

Delaware and Nevada law have substantially similar provisions regarding indemnification by a corporation of its officers, directors,

employees and agents, Delaware and Nevada law differ in their provisions for advancement of expenses incurred by an officer or director

in defending a civil or criminal action, suit or proceeding. Delaware law provides that expenses incurred by an officer or director in

defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of

the final disposition of the action, suit or proceeding upon receipt of an undertaking by or on behalf of the director or officer to

repay the amount if it is ultimately determined that he is not entitled to be indemnified by the corporation. A Delaware corporation

has the discretion to decide whether or not to advance expenses, unless its certificate of incorporation or bylaws provide for mandatory

advancement. Under Nevada law, the articles of incorporation, bylaws or an agreement made by the corporation may provide that the corporation

must pay advancements of expenses in advance of the final disposition of the action, suit or proceedings upon receipt of an undertaking

by or on behalf of the director or officer to repay the amount if it is ultimately determined that he is not entitled to be indemnified

by the corporation.

Action

by Written Consent of Directors

Both

Delaware and Nevada law provide that, unless the articles or certificate of incorporation or the bylaws provide otherwise, any action

required or permitted to be taken at a meeting of the directors or a committee thereof may be taken without a meeting if all members

of the board or committee, as the case may be, consent to the action in writing.

Actions

by Written Consent of Stockholders

Both

Delaware and Nevada law provide that, unless the articles or certificate of incorporation provides otherwise, any action required or

permitted to be taken at a meeting of the stockholders may be taken without a meeting if the holders of outstanding stock having at least

the minimum number of votes that would be necessary to authorize or take the action at a meeting at which all shares entitled to vote

consent to the action in writing. Delaware law requires a corporation to give prompt notice of the taking of corporate action without

a meeting by less than unanimous written consent to those stockholders who did not consent in writing. Nevada law does not require notice

to the stockholders of action taken by less than all of the stockholders.

Dividends

Delaware

law is more restrictive than Nevada law with respect to when dividends may be paid. Under Delaware law, unless further restricted in

the certificate of incorporation, a corporation may declare and pay dividends out of surplus, or if no surplus exists, out of net profits

for the fiscal year in which the dividend is declared and/or the preceding fiscal year (provided that the amount of capital of the corporation

is not less than the aggregate amount of the capital represented by the issued and outstanding stock of all classes having a preference

upon the distribution of assets). In addition, Delaware law provides that a corporation may redeem or repurchase its shares only if the

capital of the corporation is not impaired and such redemption or repurchase would not impair the capital of the corporation.

Nevada

law provides that no distribution (including dividends on, or redemption or repurchase of, shares of capital stock) may be made if, after

giving effect to such distribution, the corporation would not be able to pay its debts as they become due in the usual course of business,

or, except as specifically permitted by the articles of incorporation, the corporation’s total assets would be less than the sum

of its total liabilities plus the amount that would be needed at the time of a dissolution to satisfy the preferential rights of preferred

stockholders.

Restrictions

on Business Combinations

Both

Delaware and Nevada law contain provisions restricting the ability of a corporation to engage in business combinations with an interested

stockholder. Under Delaware law, a corporation that is listed on a national securities exchange or held of record by more than 2,000

stockholders, is not permitted to engage in a business combination with any interested stockholder for a three-year period following

the time the stockholder became an interested stockholder, unless: (i) the transaction resulting in a person becoming an interested stockholder,

or the business combination, is approved by the board of directors of the corporation before the person becomes an interested stockholder;

(ii) the interested stockholder acquires 85% or more of the outstanding voting stock of the corporation in the same transaction that

makes it an interested stockholder (excluding shares owned by persons who are both officers and directors of the corporation, and shares

held by certain employee stock ownership plans); or (iii) on or after the date the person becomes an interested stockholder, the business

combination is approved by the corporation’s board of directors and by the holders of at least two-thirds of the corporation’s

outstanding voting stock at an annual or special meeting, excluding shares owned by the interested stockholder. Delaware law defines

“interested stockholder” generally as a person who owns 15% or more of the outstanding shares of a corporation’s voting

stock.

Nevada

law regulates business combinations more stringently. Nevada law defines an interested stockholder as a beneficial owner (directly or

indirectly) of 10% or more of the voting power of the outstanding shares of the corporation. In addition, combinations with an interested

stockholder remain prohibited for three years after the person became an interested stockholder unless (i) the transaction is approved

by the board of directors or the holders of a majority of the outstanding shares not beneficially owned by the interested party, or (ii)

the interested stockholder satisfies certain fair value requirements. As in Delaware, a Nevada corporation may opt out of the statute

with appropriate provisions in its articles of incorporation.

Special

Meetings of the Stockholders

Delaware

law permits special meetings of stockholders to be called by the board of directors or by any other person authorized in the certificate

of incorporation or bylaws to call a special stockholders meeting. Nevada law permits special meetings of stockholders to be called by

the entire board of directors, any two directors, or the President, unless the articles of incorporation or bylaws provide otherwise.

Annual

Meetings Pursuant to Petition of Stockholders

Delaware

law provides that a director or a stockholder of a corporation may apply to the Court of Chancery of the State of Delaware if the corporation

fails to hold an annual meeting for the election of directors or there is no written consent to elect directors instead of an annual

meeting for a period of 30 days after the date designated for the annual meeting or, if there is no date designated, within 13 months

after the last annual meeting. Nevada law is more restrictive. Under Nevada law, stockholders having not less than 15% of the voting

interest may petition the district court to order a meeting for the election of directors if a corporation fails to call a meeting for

that purpose within 18 months after the last meeting at which directors were elected. The Re-Domestication may make it more difficult

for our stockholders to require that an annual meeting be held without the consent of the board of directors.

Adjournment

of Stockholder Meetings

Under

Delaware law, if a meeting of stockholders is adjourned due to lack of a quorum and the adjournment is for more than 30 days, or if after

the adjournment a new record date is fixed for the adjourned meeting, notice of the adjourned meeting must be given to each stockholder

of record entitled to vote at the meeting. At the adjourned meeting the corporation may transact any business that might have been transacted

at the original meeting. Under Nevada law, a corporation is not required to give any notice of an adjourned meeting or of the business

to be transacted at an adjourned meeting, other than by announcement at the meeting at which the adjournment is taken, unless the board

fixes a new record date for the adjourned meeting or the meeting date is adjourned to a date more than 60 days later than the date set

for the original meeting, in which case a new record date must be fixed and notice given.

Duration

of Proxies

Under

Delaware law, a proxy executed by a stockholder will remain valid for a period of three years, unless the proxy provides for a longer

period. Under Nevada law, a proxy is effective only for a period of six months, unless it is coupled with an interest or unless otherwise

provided in the proxy, which duration may not exceed seven years. Nevada law also provides for irrevocable proxies, without limitation

on duration, in limited circumstances.

Stockholder

Vote for Mergers and Other Corporate Reorganizations

Delaware

law requires authorization by an absolute majority of outstanding shares entitled to vote, as well as approval by the board of directors,

with respect to the terms of a merger or a sale of substantially all of the assets of the corporation. A Nevada corporation may provide

in its articles of incorporation that the corporation may sell, lease or exchange all or substantially all of its assets upon approval

by the board of directors without the requirement of stockholder approval. Currently, no such provision is contemplated to be contained

in the articles of incorporation of PMGC Holdings Inc. Delaware law does not require a stockholder vote of the surviving corporation

in a merger (unless the corporation provides otherwise in its certificate of incorporation) if: (a) the plan of merger does not amend

the existing certificate of incorporation; (b) each share of stock of the surviving corporation outstanding immediately before the effective

date of the merger is an identical outstanding share after the merger; and (c) either no shares of common stock of the surviving corporation

and no shares, securities or obligations convertible into such stock are to be issued or delivered under the plan of merger, or the authorized

unissued shares or shares of common stock of the surviving corporation to be issued or delivered under the plan of merger plus those

initially issuable upon conversion of any other shares, securities or obligations to be issued or delivered under such plan do not exceed

20% of the shares of common stock of such constituent corporation outstanding immediately prior to the effective date of the merger.

Nevada law does not require a stockholder vote of the surviving corporation in a merger under substantially similar circumstances.

Increasing

or Decreasing Authorized Shares

Nevada

law allows the board of directors of a corporation, unless restricted by the articles of incorporation, to increase or decrease the number

of authorized shares in the class or series of the corporation’s shares and correspondingly effect a forward or reverse split of

any such class or series of the corporation’s shares without a vote of the stockholders, so long as the action taken does not change

or alter any right or preference of a stockholder and does not include any provision or provisions pursuant to which only money will

be paid or scrip issued to stockholders who hold 10% or more of the outstanding shares of the affected class and series, and who would

otherwise be entitled to receive fractions of shares in exchange for the cancellation of all of their outstanding shares. Delaware law

allows the board of directors of a corporation, unless restricted by the certificate of incorporation, to increase or decrease the number

of authorized shares in the class or series of the corporation’s shares and correspondingly effect a forward split of any such

class or series of the corporation’s shares without a vote of the stockholders, provided that the corporation has only one class

of outstanding stock and that class is not divided into series.

Stockholder

Inspection Rights

Under

Delaware law, any stockholder or beneficial owner of shares may, upon written demand under oath stating the proper purpose thereof, either

in person or by attorney, inspect and make copies and extracts from a corporation’s stock ledger, list of stockholders and its

other books and records for any proper purpose. Under Nevada law, certain stockholders have the right to inspect the books of account

and records of a corporation for any proper purpose. The right to inspect the books of account and all financial records of a corporation,

to make copies of records and to conduct an audit of such records is granted only to a stockholder who owns at least 15% of the issued

and outstanding shares of a corporation, or who has been authorized in writing by the holders of at least 15% of such shares. A Nevada

corporation may require a stockholder to furnish the corporation with an affidavit that such inspection is for a proper purpose related

to his or her interest as a stockholder of the corporation.

The

Rights of the Shareholders Will Now be Governed by Nevada Law instead of Delaware Law

The

general corporation laws of the State of Nevada will now govern the rights of our stockholders rather than the general corporation laws

of the State of Delaware. In the formation of PMGC Holdings Inc. we have made an effort not to make any substantive changes in the Nevada

Articles or Nevada Bylaws from the Delaware Certificate and Delaware Bylaws. Such items such as PMGC Holdings Inc.’s duration,

the authorized capitalization, rights to issue preferred stock, no cumulative voting rights and the par values of the classes of shares

remain the same.

Furthermore,

Nevada law and Delaware law are quite similar with respect to the governing of corporate actions and shareholders’ rights. Nonetheless,

there are a few differences in the laws, which may affect your rights or interests. The following is a summary of certain of those considerations.

Delaware

has a well-developed body of case law interpreting shareholders rights. Nevada case law concerning the governing and effects of its statutes

and regulations is limited and thus you will have more uncertainty concerning the legality of corporate transactions and your right to

challenge those transactions.

Under

Nevada Law, a director may be removed by a 2/3 vote of the shareholders. Previously, under Delaware Law a vote by only a majority of

the shareholders is required to remove a director. The majority of the directors present at a meeting of the board may fill vacancies

in the board under Nevada Law even if no quorum is present.

Nevada

Law permits greater latitude in indemnifying officers and directors and the ability to shield the officers and directors for liabilities.

However, the Nevada Articles and Nevada Bylaws provide the same indemnification and liability protections as the current Delaware documents.

Termination,

Abandonment or Amendment of the Merger Agreement

We

anticipate that the Re-Domestication will become effective at the earliest practicable date. However, the Merger Agreement will provide

that at any time before the effective date, the Merger Agreement may be terminated and the Merger may be abandoned for any reason whatsoever

by the board of directors of either Elevai Labs Inc. or PMGC Holdings Inc. or both, notwithstanding the approval of the Merger Agreement

by the holders of a majority of the votes of Elevai Labs Inc. entitled to be cast or by the sole stockholder of PMGC Holdings Inc., or

by both. The boards of directors of Elevai Labs Inc. and PMGC Holdings Inc. may amend the Merger Agreement at any time prior to the filing

of the Merger Agreement (or certificate in lieu thereof) with the Secretary of State of the State of Nevada, provided that an amendment

made subsequent to the adoption of the Merger Agreement by the stockholders of either corporation shall not: (i) alter or change the

amount or kind of shares, securities, cash, property and/or rights to be received in exchange for or on conversion of all or any of the

shares of any class or series thereof of such corporation, (ii) alter or change any term of the Nevada Articles to be effected by the

Merger, or (iii) alter or change any of the terms and conditions of the Merger Agreement if such alteration or change would adversely

affect the holders of any class of shares or series of capital stock of either corporation.

Federal

Income Tax Consequences of the Re-Domestication

The

Company intends the Re-Domestication to be a tax-free reorganization under the Internal Revenue Code of 1986, as amended. Assuming the

Re-Domestication qualifies as a tax-free reorganization, the holders of the Company’s common stock will not recognize any gain

or loss under the federal tax laws as a result of the occurrence of the Re-Domestication, and neither will the Company or Elevai Labs

Inc. Each stockholder will have the same basis in PMGC Holdings Inc. common stock received as a result of the Re-Domestication as that

holder has in the corresponding common stock of the Company held at the time the Re-Domestication occurs. Each holder’s holding

period in PMGC Holdings Inc.’s common stock received as a result of the Re-Domestication will include the period during which such

holder held the corresponding common stock of the Company at the time the Re-Domestication occurs, provided the latter was held by such

holder as a capital asset at the time of consummation of the Re-Domestication.

This

Information Statement only discusses U.S. federal income tax consequences and has done so only for general information. It does not address

all of the federal income tax consequences that may be relevant to particular stockholders based upon individual circumstances or to

stockholders who are subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers

in securities, foreign holders or holders who acquired their shares as compensation, whether through employee stock options or otherwise.

This Information Statement does not address the tax consequences under state, local or foreign laws.

This

discussion is based on the Internal Revenue Code, laws, regulations, rulings and decisions in effect as of the date of this Information

Statement, all of which are subject to differing interpretations and change, possibly with retroactive effect. The Company has neither

requested nor received a tax opinion from legal counsel or rulings from the Internal Revenue Service regarding the consequences of the

Re-Domestication. There can be no assurance that future legislation, regulations, administrative rulings or court decisions would not

alter the consequences discussed above.

You

should consult your own tax advisor to determine the particular tax consequences to you of the Re-Domestication, including the applicability

and effect of federal, state, local, foreign and other tax laws.

Accounting

Consequences

We

do not anticipate that any significant accounting consequences would arise as a result of the Re-Domestication.

Appendixes

The

forms of the Merger Agreement of the Company into PMGC Holdings Inc., the Articles of Incorporation of PMGC Holdings Inc. and the Bylaws

of PMGC Holdings Inc. are attached to this Information Statement as Exhibits A, B and C, respectively.

Approval

of Merger

On

July 23, 2024, our Board and majority shareholders approved the Re-Domestication, including the Merger.

Dissenters’

Rights of Appraisal

We

are a Delaware corporation and are governed by the DGCL. Holders of our Common Stock do not have appraisal or dissenter’s rights

under the DGCL in connection with the Re-Domestication or the filing of the certificate of merger as approved by Board of Directors and

the stockholders of the Company.

Interest

of Certain Persons in Matters to be Acted Upon

No

director, executive officer, associate of any director or executive officer or any other person has any substantial interest, direct

or indirect, by security holdings or otherwise, in the Re-Domestication that is not shared by all other stockholders of ours.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

table below sets forth information regarding the beneficial ownership of the common stock by (i) our directors and named executive officers;

(ii) all the named executives and directors as a group and (iii) any other person or group that to our knowledge beneficially owns more

than five percent of our outstanding shares of common stock.

We have determined beneficial ownership in accordance

with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such

person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right

to acquire such powers within 60 days. Shares of common stock subject to options that are currently exercisable or exercisable within

60 days of August 5, 2024, are deemed to be outstanding and beneficially owned by the person holding the options. Shares issuable pursuant

to stock options or warrants are deemed outstanding for computing the percentage ownership of the person holding such options or warrants

but are not deemed outstanding for computing the percentage ownership of any other person. Except as indicated by the footnotes below,

we believe, based on the information furnished to us, that the persons and entities named in the table below will have sole voting and

investment power with respect to all shares of common stock that they will beneficially own, subject to applicable community property

laws. The percentage of beneficial ownership is based on 18,892,115 shares of common stock outstanding on August 5, 2024.

| Name and Address of Beneficial Owner(1) |

|

Amount and Nature of Beneficial Ownership |

|

|

Percentage of Beneficial Ownership |

|

| 5% or Greater Shareholders: |

|

|

|

|

|

|

| BWL Investments Ltd.(2) |

|

1,906,414 |

|

|

10.1 |

% |

| JP Bio Consulting LLC(3) |

|

|

2,851,454 |

|

|

|

15.1 |

% |

| Hatem Abou-Sayed MD MBA FACS, a Professional Medical Corporation(4) |

|

|

1,371,905 |

|

|

|

7.3 |

% |

| Hongyu Wang(5) |

|

|

1,184,747 |

|

|

|

6.2 |

% |

| Hatem Abou-Sayed(6) |

|

|

1,546,905 |

|

|

|

8.1 |

% |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Directors, Named Executive Officers and Other Executive Officers: |

|

|

|

|

|

|

|

|

| Jordan R. Plews, former Chief Executive Officer and Director |

|

|

3,034,787 |

(7) |

|

|

15.9 |

% |

| Graydon Bensler, Chief Executive Officer, Chief Financial Officer and Director |

|

|

1,024,787 |

(8) |

|

|

5.4 |

% |

| Braeden Lichti, Chairman of the Board |

|

|

3,794,798 |

(9) |

|

|

19.8 |

% |

| Jeffrey Parry, Director |

|

|

71,667 |

(10) |

|

|

0.4 |

% |

| George Kovalyov, Director |

|

|

- |

|

|

|

0.0 |

% |

| Juliane Daley, Director |

|

|

26,200 |

(11) |

|

|

0.1 |

% |

| All executive officers and directors as a group (7 persons) |

|

|

9,507,477 |

(12) |

|

|

48.2 |

% |

| * |

Denotes less than one (1%)

percent. |

| (1) |

Unless otherwise indicated, the business address of each of the individuals is our address of c/o Elevai Labs, Inc., 120 Newport Center Drive, Ste. 250, Newport Beach, CA 92660. |

| |

|

| (2) |

Braeden Lichti has sole voting and dipositive power over the shares

held by BWL Investments Ltd. The address of BWL Investments Ltd. is 650 West Georgia Street #3200, British Columbia Canada V6B 4P7. |

| (3) |

Jordan R. Plews has sole voting and dipositive power over the shares

held by JP Bio Consulting LLC. The address of JP Bio Consulting LLC is 2615 Q Street, #1, Sacramento, CA 95816. |

| (4) |

Consists of (i) 1,359,342 shares of Common Stock and (ii) 12,563 shares

of Common Stock underlying warrants. Hatem Abou-Sayed has sole voting and dipositive power over the shares held by Hatem Abou-Sayed MD

MBA FACS, a Professional Medical Corporation. The address of Hatem Abou-Sayed MD MBA FACS is 4510 Executive Drive, Suite 210, San Diego, CA 92121. |

| (5) |

Consists of (i) 1,121,710 shares of Common Stock and (ii) 63,037 shares of Common Stock underlying warrants. |

| |

|

| (6) |

Consists of (i) 1,359,342 shares of Common Stock held by Hatem Abou-Sayed

MD MBA FACS of which Dr. Abou-Sayed has sole voting and dipositive power over the shares, (ii) 12,563 shares of Common Stock underlying

warrants and (iii) 175,000 shares of Common Stock that Dr. Abou-Sayed has the right to acquire from us within 60 days of August 5, 2024,

pursuant to the exercise of stock options granted under the 2020 Equity Incentive Plan. |

| (7) |

Consists of (i) 2,851,454 shares of Common Stock held by JP Bio Consulting LLC of which Dr. Plews has sole voting and dipositive power over the shares and (ii) 183,333 shares of Common Stock that Dr. Plews has the right to acquire from us within 60 days of August 5, 2024, pursuant to the exercise of stock options granted under the 2020 Equity Incentive Plan. |

| (8) |

Consists of (i) 841,454 shares of Common Stock held by GB Capital Ltd.

of which Mr. Bensler has sole voting and dipositive power over the shares and (ii) 183,333 shares of Common Stock that Mr. Bensler has

the right to acquire from us within 60 days of August 5, 2024 pursuant to the exercise of stock options granted under the 2020 Equity

Incentive Plan. |

| (9) |

Consists of (i) 170,833 shares of Common Stock that Mr. Lichti has

the right to acquire from us within 60 days of August 5, 2024 pursuant to the exercise of stock options granted under the 2020 Equity

Incentive Plan, (ii) 1,906,414 shares of Common Stock held by BWL Investments Ltd. of which Mr. Lichti has sole voting and dipositive

power over the shares, (iii) 828,000 shares of Common Stock held by BWL Holdings Ltd. of which Mr. Lichti has sole voting and dipositive

power over the shares, (iv) 828,000 shares of Common Stock held by Northstrive Fund II LP of which Mr. Lichti has sole voting and dipositive

power over the shares and (v) 61,551 shares of Common Stock underlying warrants held by BWL Investments Ltd. |

| (10) |

Consists of (i) 41,667 shares of Common Stock

and (ii) 30,000 shares of Common Stock that Mr. Parry has the right to acquire from us within 60 days of August 5, 2024, pursuant to the

exercise of stock options granted under the 2020 Equity Incentive Plan.

|

| (11) |

Consists of (i) 1,200 shares of Common Stock

and (ii) 25,000 shares of Common Stock that Ms. Daley has the right to acquire from us within 60 days of August 5, 2024, pursuant to the

exercise of stock options granted under the 2020 Equity Incentive Plan. |

| (12) |

Consists

of (i) 8,657,531 shares of Common Stock beneficially owned by our directors and executive officers and (ii) 775,832 shares of Common

Stock underlying outstanding options, exercisable within 60 days of August 5, 2024 and (iii) 74,114 shares of common stock

underlying warrants. |

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

No

person who has been our officer or director, or to our knowledge, any of their associates, has any substantial interest, direct or indirect,

by security holdings or otherwise in any matter to be acted upon. None of our directors opposed the actions to be taken by the Company.

ADDITIONAL

INFORMATION

The

Company files annual, quarterly and current reports and other information with the SEC under the Exchange Act. You may obtain copies

of this information by mail from the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may

obtain information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet

website that contains reports and other information about issuers that file electronically with the SEC. The address of that website

is www.sec.gov.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If