ShopNBC Announces Preliminary First Quarter Fiscal 2008 Results

May 12 2008 - 3:15PM

Marketwired

MINNEAPOLIS, MN , a 24-hour TV shopping network, today announced

preliminary results for its first fiscal quarter ended May 3,

2008.

Based on preliminary estimates, first quarter revenues are

expected to be approximately $156 million, a 17% decrease compared

with revenues of $188 million in the first quarter of 2007. EBITDA,

as adjusted, is expected to be a loss of approximately ($12)

million compared with a loss of ($1) million in the year-ago

period. Estimated net loss for Q1 is expected to be approximately

($18) million vs. net income for the same quarter last year of $34

million, driven by a $40 million gain on the sale of the Company's

equity interest in Polo.com. Included in the 2008 first quarter

results is a non-cash inventory impairment charge of $3.8

million.

"Our results in the first quarter were disappointing and

considerably below expectations," said John Buck, ShopNBC's

Executive Chairman of the Board. "Like many other retailers, we

continued to face a difficult consumer economy and a slowdown in

discretionary spending. We also began shifting away from consumer

electronics, a category which drives top-line sales, but typically

results in one-time customers who contribute less to long-term

success. This mix change accounted for 4% of the decline in our

sales. In addition, to reduce inventory levels of high-ticket

jewelry items, we took aggressive clearance markdowns at the end of

the first quarter, which reduced margins."

The Company noted that in the first quarter:

-- It further bolstered its senior management team by adding three

industry veterans with over 50 years of combined experience in TV shopping

who oversee key areas of the business: Glenn Leidahl as COO; Terry Curtis

as SVP of Customer Analytics and Sales Planning; and John Gunder as SVP of

Media and On-Air Sales.

-- It reduced operating expenses by 9% versus last year's first quarter,

driving savings through lower headcount and reduced marketing spend.

-- It maintained a strong balance sheet, with approximately $85 million

in cash and securities.

-- ShopNBC.com continued to increase its relative size of total Company

sales, representing 33% of revenue compared with 28% in the first quarter

last year.

In March, Rene Aiu joined the Company as President and CEO. She

brings over 22 years of experience in TV shopping and e-commerce,

both in the U.S. and internationally.

Ms. Aiu commented: "ShopNBC has tremendous underlying assets,

including national cable distribution in over 70 million homes, a

loyal customer base, an asset-rich balance sheet, and a strategic

relationship with NBC Universal. Our goal is to reposition this

business to deliver long-term shareholder value by returning to a

focus on the basics that make home shopping companies thrive.

"We will:

-- Make changes to achieve a more balanced merchandise mix accompanied by

appropriate price point adjustments, which will in turn help us improve

margins.

-- Expand our core customer base, and encourage frequent, repeat

business.

-- Return the business to being item-focused and driven by higher-unit

volume sales of fewer SKUs. We also are working with our product vendors to

improve our gross margins while providing unique products.

-- Manage costs aggressively so the Company can reach profitability at a

lower revenue base.

-- Continue our focus on expanding our promising e-commerce business and

identifying other innovative sales channels.

-- Strengthen our strategic relationship with GE/NBC Universal to

leverage the marketing power and operational scale of our largest

shareholder.

"Lastly, by working with our partners at NBC Universal, I

believe that we will be successful in renegotiating our cable

distribution agreements, solidifying our presence in homes

nationwide."

ShopNBC's preliminary first fiscal quarter results of 2008 are

subject to review by the Company as well as its independent

auditors. The Company's final results for the fiscal first quarter

will be released later this month.

Conference Call Information

The Company has scheduled a conference call at 11 a.m. EDT / 10

a.m. CDT on May 13, 2008, to discuss the preliminary results for

the fiscal first quarter. To participate, please dial

1-800-857-9866 (pass code SHOPNBC) five to ten minutes prior to the

start time. A replay of the call will be available for 30 days. To

access the replay, please dial 1-800-925-2388 (pass code SHOPNBC.)

You may also participate via live audio stream by logging on to

https://e-meetings.verizonbusiness.com. To access the audio stream,

please use conference number 4635615 (pass code SHOPNBC.) A

rebroadcast of the audio stream will be available using the same

access information for 30 days after the initial broadcast.

EBITDA and EBITDA, as adjusted

The Company defines EBITDA as net income (loss) from continuing

operations for the respective periods excluding depreciation and

amortization expense, interest income (expense) and income taxes.

The Company defines EBITDA, as adjusted, as EBITDA excluding

non-recurring non-operating gains (losses) and equity in income of

Ralph Lauren Media, LLC; non-recurring restructuring and CEO

transition costs; and non-cash share-based payment expense.

Management has included the term EBITDA, as adjusted, in order to

adequately assess the operating performance of the Company's "core"

television and Internet businesses and in order to maintain

comparability to its analyst's coverage and financial guidance.

Management believes that EBITDA, as adjusted, allows investors to

make a more meaningful comparison between our core business

operating results over different periods of time with those of

other similar small cap, higher growth companies. In addition,

management uses EBITDA, as adjusted, as a metric measure to

evaluate operating performance under its management and executive

incentive compensation programs. EBITDA, as adjusted, should not be

construed as an alternative to operating income (loss) or to cash

flows from operating activities as determined in accordance with

GAAP and should not be construed as a measure of liquidity. EBITDA,

as adjusted, may not be comparable to similarly entitled measures

reported by other companies.

About ShopNBC

ShopNBC reaches 70 million homes in the United States via cable

affiliates and satellite: Dish Network channel 228 and Direct TV

channel 316. ShopNBC.com is recognized as a top e-commerce site.

ShopNBC is owned and operated by ValueVision Media (NASDAQ: VVTV).

For more information, please visit www.ShopNBC.com.

Forward-Looking Information

This release contains certain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations and are accordingly subject to uncertainty and changes

in circumstances. Actual results may vary materially from the

expectations contained herein due to various important factors,

including (but not limited to): consumer spending and debt levels;

interest rates; competitive pressures on sales, pricing and gross

profit margins; the level of cable distribution for the Company's

programming and the fees associated therewith; the success of the

Company's e-commerce and rebranding initiatives; the performance of

its equity investments; the success of its strategic alliances and

relationships; the ability of the Company to manage its operating

expenses successfully; risks associated with acquisitions; changes

in governmental or regulatory requirements; litigation or

governmental proceedings affecting the Company's operations; and

the ability of the Company to obtain and retain key executives and

employees. More detailed information about those factors is set

forth in the Company's filings with the Securities and Exchange

Commission, including the Company's annual report on Form 10-K,

quarterly reports on Form 10-Q, and current reports on Form 8-K.

The Company is under no obligation (and expressly disclaims any

such obligation to) update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

CONTACT: Frank Elsenbast Chief Financial Officer

952-943-6262

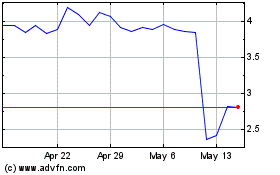

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

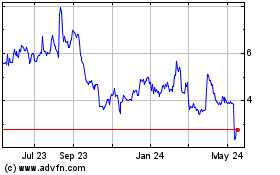

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024