MINNEAPOLIS, MN , a 24-hour TV shopping network, today reported

financial results for its first fiscal quarter ended May 3, 2008.

These results are consistent with what the Company previously

announced on May 12.

First quarter revenues were $156 million, a 17% decrease

compared with revenues of $188 million in the first quarter of

2007. EBITDA, as adjusted, was ($12) million compared with ($1.2)

million in the year-ago period. Net Loss for Q1 was ($18) million

vs. Net Income for the same quarter last year of $34.4 million,

driven by a $40 million gain on the sale of the Company's equity

interest in Polo.com. Included in the first quarter results is a

non-cash inventory impairment charge of $3.8 million.

"We are in a transitional period at ShopNBC, and I am confident

that we can successfully address the challenges before us," said

Rene Aiu, ShopNBC's president and CEO. "ShopNBC has a compelling

business model with tremendous underlying strength and assets: a

strong cash position, national cable and satellite distribution, a

strategic relationship with NBC Universal, and a new, experienced

management team that understands what it takes to succeed in TV

shopping. Importantly, we have a plan and are taking steps to

improve future performance and deliver long-term shareholder value

by returning to a focus on the basics that make home shopping

companies thrive."

EBITDA and EBITDA, as adjusted

The Company defines EBITDA as net income (loss) from continuing

operations for the respective periods excluding depreciation and

amortization expense, interest income (expense) and income taxes.

The Company defines EBITDA, as adjusted, as EBITDA excluding

non-recurring non-operating gains (losses) and equity in income of

Ralph Lauren Media, LLC; non-recurring restructuring and CEO

transition costs; and non-cash share-based payment expense.

Management has included the term EBITDA, as adjusted, in order to

adequately assess the operating performance of the Company's "core"

television and Internet businesses and in order to maintain

comparability to its analyst's coverage and financial guidance.

Management believes that EBITDA, as adjusted, allows investors to

make a more meaningful comparison between our core business

operating results over different periods of time with those of

other similar small cap, higher growth companies. In addition,

management uses EBITDA, as adjusted, as a metric measure to

evaluate operating performance under its management and executive

incentive compensation programs. EBITDA, as adjusted, should not be

construed as an alternative to operating income (loss) or to cash

flows from operating activities as determined in accordance with

GAAP and should not be construed as a measure of liquidity. EBITDA,

as adjusted, may not be comparable to similarly entitled measures

reported by other companies.

About ShopNBC

ShopNBC reaches 70 million homes in the United States via cable

affiliates and satellite: Dish Network channel 228 and Direct TV

channel 316. ShopNBC.com is recognized as a top e-commerce site.

ShopNBC is owned and operated by ValueVision Media (NASDAQ: VVTV).

For more information, please visit www.ShopNBC.com.

Forward-Looking Information

This release contains certain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations and are accordingly subject to uncertainty and changes

in circumstances. Actual results may vary materially from the

expectations contained herein due to various important factors,

including (but not limited to): consumer spending and debt levels;

interest rates; competitive pressures on sales, pricing and gross

profit margins; the level of cable distribution for the Company's

programming and the fees associated therewith; the success of the

Company's e-commerce and rebranding initiatives; the performance of

its equity investments; the success of its strategic alliances and

relationships; the ability of the Company to manage its operating

expenses successfully; risks associated with acquisitions; changes

in governmental or regulatory requirements; litigation or

governmental proceedings affecting the Company's operations; and

the ability of the Company to obtain and retain key executives and

employees. More detailed information about those factors is set

forth in the Company's filings with the Securities and Exchange

Commission, including the Company's annual report on Form 10-K,

quarterly reports on Form 10-Q, and current reports on Form 8-K.

The Company is under no obligation (and expressly disclaims any

such obligation to) update or alter its forward-looking statements

whether as a result of new information, future events or

otherwise.

VALUE VISION MEDIA, INC.

Key Performance Metrics*

(Unaudited)

Q1

For the three months ending

-------------------------------

5/3/2008 5/5/2007 %

--------- --------- ---------

Program Distribution

Cable FTEs 42,361 40,379 5%

Satellite FTEs 28,394 27,136 5%

--------- --------- ---------

Total FTEs (Average 000s) 70,755 67,515 5%

Net Sales per FTE (Annualized) $ 8.72 $ 10.98 -21%

Product Mix

Jewelry 44% 40%

Apparel, Fashion Accessories and Health

& Beauty 10% 9%

Computers & Electronics 17% 23%

Watches, Coins & Collectibles 20% 15%

Home & All Other 9% 13%

Shipped Units (000s) 1,004 1,149 -13%

Average Price Point - shipped units $ 228 $ 225 1%

--------- --------- ---------

*Includes ShopNBC TV and ShopNBC.com only.

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands except share and per share data)

May 3, February 2,

2008 2008

----------- -----------

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 44,367 $ 25,605

Short-term investments 17,886 33,473

Accounts receivable, net 72,100 109,489

Inventories 69,254 79,444

Prepaid expenses and other 4,632 4,172

----------- -----------

Total current assets 208,239 252,183

Long term investments 23,802 26,306

Property and equipment, net 35,818 36,627

FCC broadcasting license 31,943 31,943

NBC Trademark License Agreement, net 9,801 10,608

Cable distribution and marketing agreement, net 676 872

Other assets 526 541

----------- -----------

$ 310,805 $ 359,080

=========== ===========

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 52,895 $ 73,093

Accrued liabilities 36,936 44,609

Deferred revenue 678 648

----------- -----------

Total current liabilities 90,509 118,350

Deferred revenue 2,258 2,322

Series A Redeemable Convertible Preferred Stock,

$.01 par value, 5,339,500 shares authorized;

5,339,500 shares issued and outstanding 43,971 43,898

Shareholders' equity:

Common stock, $.01 par value, 100,000,000

shares authorized; 33,550,834 and 34,070,422

shares issued and outstanding 336 341

Warrants to purchase 2,036,858 shares of

common stock 12,041 12,041

Additional paid-in capital 271,856 274,172

Accumulated other comprehensive losses (2,998) (2,454)

Accumulated deficit (107,168) (89,590)

----------- -----------

Total shareholders' equity 174,067 194,510

----------- -----------

$ 310,805 $ 359,080

=========== ===========

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

Reconciliation of EBITDA, as adjusted, to Net Income (Loss):

First First

Quarter Quarter

3-May-08 4-May-07

---------- ----------

EBITDA, as adjusted (000's) $ (12,394) $ (1,249)

Less:

Non-operating gains (losses) and equity in

income of RLM - 40,849

Restructuring costs (330) -

CEO transition costs (277) -

Non-cash share-based compensation (1,068) (593)

---------- ----------

EBITDA (as defined) (a) (14,069) 39,007

---------- ----------

A reconciliation of EBITDA to net income (loss) is

as follows:

EBITDA, as defined (14,069) 39,007

Adjustments:

Depreciation and amortization (4,319) (5,586)

Interest income 825 1,240

Income taxes (15) (281)

---------- ----------

Net income (loss) $ (17,578) $ 34,380

========== ==========

(a) EBITDA as defined for this statistical presentation represents net

income (loss) from continuing operations for the respective periods

excluding depreciation and amortization expense, interest income (expense)

and income taxes. The Company defines EBITDA, as adjusted, as EBITDA

excluding non-recurring non-operating gains (losses) and equity in income

of Ralph Lauren Media, LLC; non-recurring restructuring and CEO transition

costs; and non-cash share-based compensation expense.

Management has included the term EBITDA, as adjusted, in its EBITDA

reconciliation in order to adequately assess the operating performance of

the Company's "core" television and Internet businesses and in order to

maintain comparability to its analyst's coverage and financial guidance.

Management believes that EBITDA, as adjusted, allows investors to make a

more meaningful comparison between our core business operating results over

different periods of time with those of other similar small cap, higher

growth companies. In addition, management uses EBITDA, as adjusted, as a

metric measure to evaluate operating performance under its management and

executive incentive compensation programs. EBITDA, as adjusted, should not

be construed as an alternative to operating income (loss) or to cash flows

from operating activities as determined in accordance with GAAP and should

not be construed as a measure of liquidity. EBITDA, as adjusted, may not

be comparable to similarly entitled measures reported by other companies.

VALUEVISION MEDIA, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

For the Three Month

Periods Ended

----------------------

May 3, May 5,

2008 2007

---------- ----------

Net sales $ 156,288 $ 188,109

Cost of sales 106,332 121,996

(exclusive of depreciation and amortization

shown below)

Operating expense:

Distribution and selling 57,083 60,460

General and administrative 6,335 7,495

Depreciation and amortization 4,319 5,586

Restructuring costs 330 -

CEO transition costs 277 -

---------- ----------

Total operating expense 68,344 73,541

---------- ----------

Operating loss (18,388) (7,428)

---------- ----------

Other income:

Interest income 825 1,240

---------- ----------

Total other income 825 1,240

---------- ----------

Loss before income taxes and equity in net income

of affiliates (17,563) (6,188)

Gain on sale of RLM investment - 40,240

Equity in income of affiliates - 609

Income tax provision (15) (281)

---------- ----------

Net income (loss) (17,578) 34,380

Accretion of redeemable preferred stock (73) (72)

---------- ----------

Net income (loss) available to common shareholders $ (17,651) $ 34,308

========== ==========

Net income (loss) per common share $ (0.53) $ 0.80

========== ==========

Net income (loss) per common share

---assuming dilution $ (0.53) $ 0.80

========== ==========

Weighted average number of common shares

outstanding:

Basic 33,577,899 42,938,624

========== ==========

Diluted 33,577,899 42,938,684

========== ==========

Contact Info: Frank Elsenbast CFO 952-943-6262

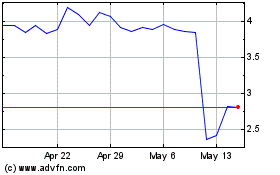

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

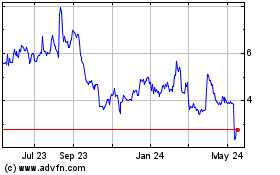

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024