UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 22, 2014

VALUEVISION MEDIA, INC.

(Exact name of registrant as specified in its charter)

|

Minnesota

|

0-20243

|

41-1673770

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

6740 Shady Oak Road,

Eden Prairie, Minnesota 55344-3433

(Address of principal executive offices)

(952) 943-6000

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

|

(b) Resignation of Keith Stewart as Director and Chief Executive Officer

On June 22, 2014, Keith Stewart resigned as a member of the Board of Directors (the “Board”) of ValueVision Media, Inc. (the “Company”) and as Chief Executive Officer of the Company, in each case, effective immediately. Mr. Stewart did not resign due to any material disagreement with the Company, known to an executive officer of the Company, on any matter relating to the Company’s operations, policies or practices or otherwise. Also on June 22, 2014, Mr. Stewart entered into a Separation Agreement with the Company (the “Separation Agreement”).

Under the Separation Agreement, Mr. Stewart and the Company agreed that Mr. Stewart’s separation from the Company would be treated as a result of an “Event” and for reasons other than “Cause,” as those terms are defined in Mr. Stewart’s Second Amended and Restated Employment Agreement, dated April 1, 2014 (the “Employment Agreement”). Under the Separation Agreement, the Company will pay to Mr. Stewart all accrued and earned (but unpaid) base salary, vacation and other accrued amounts, as well as all outstanding expense reimbursements in accordance with the Employment Agreement. The Company will also provide to Mr. Stewart the following severance pay and benefits: (i) severance pay of $1,427,108, representing two (2) times Mr. Stewart’s annual base salary; (ii) severance bonus pay of $1,070,331, representing two (2) times Mr. Stewart’s target annual incentive bonus of 75% of his annual base salary; (iii) for a period of twenty-four (24) months, continued group health, dental and life insurance benefits to the extent such benefits were in effect for Mr. Stewart and his family as of his resignation date, subject to Mr. Stewart’s timely payment of his share of the applicable premiums at the same rate he was paying prior to his resignation date; and (iv) the lapse of any restrictions on 59,500 shares of previously granted restricted stock awards and the accelerated vesting of 119,000 stock option awards. Due to the application of Section 409A of the Internal Revenue Code, the Company currently anticipates that its payment to Mr. Stewart of a significant portion of the severance pay described above will be deferred until six (6) months after Mr. Stewart’s resignation date or, if earlier, Mr. Stewart’s death, as contemplated by Section 2(g) of the Separation Agreement.

In order to receive the severance pay and benefits described above, Mr. Stewart must comply with the following conditions: (i) Mr. Stewart must sign and deliver to the Company a customary release of claims in favor of the Company in an agreed form; (ii) Mr. Stewart must not revoke such release; (iii) the rescission periods provided by law for such release must have expired; and (iv) Mr. Stewart must be in substantial compliance with the material terms of the Separation Agreement and the Employment Agreement, which include customary non-competition, non-disparagement and confidentiality and non-disclosure provisions, as of the dates of the payments. A copy of the Separation Agreement is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

(c) Appointment of Mark Bozek as Chief Executive Officer

Following Mr. Stewart’s resignation, the Board unanimously appointed Mark Bozek as Chief Executive Officer of the Company, effective June 22, 2014. Mr. Bozek will initially receive an annualized base salary of $713,554 for his service as Chief Executive Officer. Mr. Bozek has not yet entered into an employment agreement with the Company specifying any additional terms of employment. The Company will file an amendment to this Form 8-K to disclose the terms of any such employment agreement or other material plan, contract or arrangement entered into between the Company and Mr. Bozek within four business days after the execution of any such agreement, plan, contract or arrangement.

Mr. Bozek, age 55, served as the Chief Executive Officer of Home Shopping Network (HSN), a multi-channel retailer and television network specializing in home shopping, from January 1999 to January 2003. He is also the Co-Founder of, and has served as Chief Executive Officer of, Dollars Per Minute Inc., a merchandising and entertainment company. Prior to forming Dollars Per Minute, Inc. in 2011, Mr. Bozek formed and operated the media and consulting company Galgos Entertainment LLC, where he has served as a principal since 2007. Through Galgos Entertainment, Mr. Bozek acted as a consultant for private equity firms (including Goldman Sachs and Bain Capital) on various retail and commerce related ventures. Prior to Galgos Entertainment, Mr. Bozek worked for 14 years with Barry Diller. Mr. Bozek also served as a director of Sykes Enterprises, Inc. from August 2003 until April 2013.

There are no arrangements or understandings between Mr. Bozek and any other person(s) pursuant to which Mr. Bozek was or is to be selected as an officer of the Company, other than arrangements or understandings with directors of the Company acting solely in their capacities as such. There are no family relationships between Mr. Bozek and any other director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company. There are no current or proposed transactions in which Mr. Bozek or any related person of Mr. Bozek has an interest that are required to be disclosed under Item 404(a) of Regulation S-K promulgated by the Securities and Exchange Commission.

(d) Appointment of Ronald Frasch as Director

Also on June 22, 2014, as permitted by the Amended and Restated By-Laws of the Company and Minnesota corporate law, the Board appointed Ronald Frasch as a member of the Board to fill the vacancy created by Mr. Stewart’s resignation from the Board. Mr. Frasch’s term began on June 22, 2014 and will continue until the Company’s 2015 Annual Meeting of Shareholders or until his successor is elected and qualifies, or until his earlier death resignation, removal or disqualification. Mr. Frasch will receive a grant of stock options to purchase 30,000 shares of the Company’s common stock, which will vest immediately, and a restricted stock grant of 8,000 shares of the Company’s common stock, which will vest the day before the Company’s 2015 Annual Meeting of Shareholders, all in accordance with the Company’s current director equity compensation guidelines. Mr. Frasch will serve as the Chairman of the Human Resources and Compensation Committee of the Board.

Mr. Frasch, age 65, is currently an operating partner at Castanea Partners, a consumer-focused private-equity firm, which he joined in February 2014, and the principal of Ron Frasch Associates, LLC, a consulting firm. From February 2007 until November 2013, Mr. Frasch served as President and Chief Merchandising Officer of Saks Fifth Avenue, a division of Saks, Incorporated, a NYSE-listed luxury fashion retailer. From November 2004 until January 2007, he was Vice Chairperson and Chief Merchant of Saks Fifth Avenue. He has served as a member of the board of directors of Crocs, Inc., an apparel footwear and accessories company, since October 2006. From 2000 to 2004, he was President and Chief Executive Officer of Bergdorf Goodman and was previously President of GFT North America from 1996 to 2000 and President and Chief Executive Officer of Escada USA from 1994 to 1996. Mr. Frasch’s qualifications for director include his extensive executive expertise in the fashion retail industry and his experience on the board of directors of a public company.

There are no arrangements or understandings between Mr. Frasch and any other person(s) pursuant to which Mr. Frasch was or is to be selected as a director of the Company, other than arrangements or understandings with directors of the Company acting solely in their capacities as such. There are no family relationships between Mr. Frasch and any other director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company. There are no current or proposed transactions in which Mr. Frasch or any related person of Mr. Frasch has an interest that are required to be disclosed under Item 404(a) of Regulation S-K promulgated by the Securities and Exchange Commission.

Following Mr. Frasch’s appointment, the Board consists of the following eight directors: Thomas Beers, Mark Bozek, John Buck, Ronald Frasch, Landel Hobbs, Lowell Robinson, Bob Rosenblatt and Fred Siegel. On June 22, 2014, the Board unanimously elected Mr. Rosenblatt to serve as Non-Executive Chairman of the Board, effective immediately.

On June 23, 2014, the Company issued a press release relating to the matters described under Item 5.02 above. A copy of the press release is filed as Exhibit 99.1 hereto.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

The following exhibits are being filed with this Current Report on Form 8-K.

| |

Exhibit No.

|

|

Description

|

| |

|

|

|

| |

10.1

|

|

Separation Agreement, dated June 22, 2014, by and between ValueVision Media, Inc. and Keith R. Stewart

|

| |

|

|

|

| |

99.1

|

|

Press Release, dated June 23, 2014

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

Date: June 25, 2014

|

VALUEVISION MEDIA, INC.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Teresa Dery

|

| |

|

Teresa Dery

Senior Vice President and General Counsel

|

EXHIBIT INDEX

|

No.

|

|

Description

|

| |

|

|

|

10.1

|

|

Separation Agreement, dated June 22, 2014, by and between ValueVision Media, Inc. and Keith R. Stewart

|

| |

|

|

|

99.1

|

|

Press Release, dated June 23, 2014

|

Exhibit 10.1

SEPARATION AGREEMENT

THIS SEPARATION AGREEMENT (the “Agreement”) is entered into on June 22, 2014 (the “Agreement Date”), by and between ValueVision Media, Inc., a Minnesota corporation (the “Company”), and Keith R. Stewart (“Executive”). The Company and Executive may be referred to individually, as a “Party” and collectively, as the “Parties”.

WHEREAS, the Company is a multichannel electronic retailer which currently operates under the ShopHQ brand; and

WHEREAS, Executive serves as Chief Executive Officer for the Company pursuant to the terms and conditions of the Second Amended and Restated Employment Agreement dated April 1, 2014 (the “Employment Agreement”), by and between Executive and the Company; and

WHEREAS, at the Company’s request, Executive has, subject to the terms of this Agreement, tendered his resignation from the Company and from the Board of Directors of the Company (the “Board”), and the Company and the Board have accepted Executive’s resignation, effective immediately; and

WHEREAS, the Company and Executive agree that Executive’s separation from the Company is as a result of an “Event,” as defined in Section 1(k)(ii) of the Employment Agreement, and for reasons other than “Cause,” as defined in Section 1(g) of the Employment Agreement; and

WHEREAS, the Parties desire to amicably resolve any dispute arising out of Executive’s employment and resignation thereof, with the understanding that such resolution shall not constitute evidence of or be an admission of wrongful conduct, liability, or fault on the part of Executive or the Company.

NOW, THEREFORE, in consideration of the foregoing premises and the respective agreements of the Company and Executive set forth below, the Company and Executive, intending to be legally bound, agree as follows:

1. Resignation of Employment.

Executive hereby resigns effective immediately from his position as Chief Executive Officer, as an employee, as a member of the Board, and all other titles, positions and appointments Executive may hold with the Company or any of its subsidiaries or affiliates (the “Resignation Date”). The Company shall promptly pay to Executive all accrued, but unpaid Base Salary, vacation and other accrued amounts, as well as all outstanding expense reimbursements in accordance with the Employment Agreement and consistent with the Company’s normal expense reimbursement policies.

2. Severance Pay and Benefits. In return for the execution of this Agreement and Executive honoring all of the terms and conditions of this Agreement, the Company shall provide to Executive the following Severance Pay and Benefits:

(a) Severance Pay of $1,427,108.00, which is two (2) times Executive’s annual Base Salary of $713,554.00 (the “Severance Pay”). The Company shall issue this Severance Pay in a lump sum, less applicable withholdings, on the first business day following expiration of all applicable rescission periods provided Executive has complied with the requirements of Section 2(e).

(b) Severance Bonus Pay of $1,070,331.00, which is two (2) times Executive’s target annual incentive bonus actual payment of 75% of Executive’s annual Base Salary (the “Severance Bonus Pay”). The Company shall issue this Severance Bonus Pay to Executive in a lump sum payment, less applicable withholdings, on the first business day following expiration of all applicable rescission periods provided Executive has complied with the requirements of Section 2(e).

(c) Provided Executive elects continuation coverage pursuant to COBRA or similar state laws and timely completes and returns to the Company the documents and payments required for such election, the Company shall continue to provide to Executive and his dependents (as applicable) for a period of twenty-four (24) consecutive months after the Resignation Date, group health, dental and life insurance benefits (the “Severance Benefits”) to the extent that such benefits were in effect for Executive and his family as of the Resignation Date, subject to Executive’s timely payment of his share of the applicable premiums at the same rate (if any) he was paying prior to the Resignation Date.

(d) Notwithstanding any provision to the contrary set forth in the ValueVision Media, Inc. 2011 Omnibus Incentive Plan, as amended (the “Plan”), the Company agrees that:

|

|

(i)

|

In November 2013, Executive was granted 59,500 shares of Restricted Stock and, pursuant to Section 13(d)(x) of the Employment Agreement, these restrictions shall lapse immediately provided Executive has complied with the requirements of Section 2(e); and

|

|

|

(ii)

|

In November 2013, Executive was awarded 119,000 stock options and, pursuant to Section 13(d)(y) of the Employment Agreement, these stock options shall vest and immediately become exercisable in full provided Executive has complied with the requirements of Section 2(e).

|

The acceleration and vesting under this Section 2(d) shall be collectively referred to as the “Acceleration Benefits”.

(e) Notwithstanding the foregoing provisions of this Section 2, the Company shall not be obligated to provide to Executive any Severance Pay, Severance Bonus Pay, Severance Benefits or Acceleration Benefits under this Section 2 unless (i) Executive signs and delivers the Release of Claims in favor of the Company as set forth in Exhibit A attached hereto; (ii) Executive has not revoked the Release of Claims; (iii) the rescission periods provided by law have expired; and (iv) Executive is in substantial compliance with the material terms of this Agreement and the Employment Agreement as of the dates of the payments. The Parties agree

that Executive, through his counsel, received this Agreement and Release of Claims on June 21, 2014, and any requested changes or modifications by Executive shall not extend the 21 day consideration period referenced in Section 5(b) of the Release of Claims attached as Exhibit A.

(f) If Executive is in material breach of any covenant in Sections 6, 7, 8, or 9 of the Employment Agreement, then, in addition to other available remedies provided in the Employment Agreement or under applicable law, Executive shall cease to be eligible for the Severance Pay, Severance Bonus Pay, Severance Benefits and Acceleration Benefits under this Section 2 and, upon the Company’s written request, must promptly repay to the Company any Severance Pay, Severance Bonus Pay, Severance Benefits and/or Acceleration Benefits previously received under this Section 2. Notwithstanding and without limiting the foregoing, Executive shall retain $5,000.00 of the Severance Pay previously paid to Executive as good and valuable consideration for Executive’s execution of the Release of Claims in favor of the Company as set forth in Exhibit A attached hereto.

(g) Executive acknowledges and agrees that Executive is considered a “specified employee” within the meaning of Section 409A as of the Resignation Date. As a result, notwithstanding the foregoing, the payment of any amounts under this Section 2 that is considered deferred compensation subject to 409A and is to be paid on account of Executive’s separation from service shall be deferred, as required by Section 409A(a)(2)(B)(i) of the Code, for six (6) months after the Resignation Date or, if earlier, Executive’s death (the “409A Deferral Period”). To the fullest extent permissible under 409A, the Company shall make any payments to Executive under this Section 2 prior to expiration of the 409A Deferral Period. Any payments that otherwise would have been made during the 409A Deferral Period shall be paid in a lump sum on the date after the 409A Deferral Period expires, and the balance of any payments shall be made as described herein.

3. Limitation on Parachute Payments.

(a) Notwithstanding any provision to the contrary set forth in this Agreement, or any other plan, arrangement or agreement to the contrary, if any of the payments or benefits provided or to be provided by the Company or its affiliates to Executive or for Executive’s benefit pursuant to the terms of this Agreement or otherwise (“Covered Payments”) constitute parachute payments (“Parachute Payments”) within the meaning of Section 280G of the Code and would, but for this Section 3, be subject to the excise tax imposed under Section 4999 of the Code (or any successor provision thereto) or any similar tax imposed by state or local law or any interest or penalties with respect to such taxes (collectively, the “Excise Tax”), then the Covered Payments shall be payable either (i) in full or (ii) reduced to the minimum extent necessary to ensure that no portion of the Covered Payments is subject to the Excise Tax, whichever of the foregoing (i) or (ii) results in Executive’s receipt on an after-tax basis of the greatest amount of benefits after taking into account the applicable federal, state, local and foreign income, employment and excise taxes (including the Excise Tax).

(b) The Covered Payments shall be reduced in a manner that maximizes Executive’s economic position. In applying this principle, the reduction shall be made in a manner consistent with the requirements of Section 409A of the Code, and where two economically equivalent amounts are subject to reduction but payable at different times, such

amounts shall be reduced on a pro rata basis but not below zero.

(c) Any determination required under this Section 3(c) shall be made in writing in good faith by an accounting firm selected by the Company, which is reasonably acceptable to Executive and whose consent shall not be unreasonably withheld (the “Accountants”), which shall provide detailed supporting calculations to the Company and the Executive as required by the Company or Executive. The Company and Executive shall provide the Accountants with such information and documents as the Accountants may reasonably request in order to make a determination under this Section 3(c). The Company shall be responsible for all fees and expenses of the Accountants.

(d) It is possible that after the determinations and selections made pursuant to this Section 3 Executive will receive Covered Payments that are in the aggregate more than the amount provided under this Section 3 (“Overpayment”) or less than the amount provided under this Section 3 (“Underpayment”).

|

|

(i)

|

In the event that: (A) the Accountants determine, based upon the assertion of a deficiency by the Internal Revenue Service against either the Company or Executive which the Accountants believe has a high probability of success, that an Overpayment has been made or (B) it is established pursuant to a final determination of a court or an Internal Revenue Service proceeding that has been finally and conclusively resolved that an Overpayment has been made, then Executive shall pay any such Overpayment to the Company.

|

|

|

(ii)

|

In the event that: (A) the Accountants, based upon controlling precedent or substantial authority, determine that an Underpayment has occurred or (B) a court of competent jurisdiction determines that an Underpayment has occurred, any such Underpayment will be paid promptly by the Company to or for the benefit of Executive.

|

4. Non-Disparagement.

(a) Executive’s Obligations. Executive will not malign, defame or disparage the reputation, character, image, products or services of the Company, or the reputation or character of the Company’s directors, officers, employees or agents, provided that nothing in this Section 4(a) shall be construed to limit or restrict Executive from taking any action that Executive in good faith reasonably believes is necessary to fulfill Executive’s fiduciary obligations to the Company or from providing truthful information in connection with any legal proceeding, government investigation or other legal matter.

(b) Company Obligations. The Company has instructed the following individuals to refrain from making any statements, written or oral, on behalf of the Company, which would malign, defame or disparage the reputation or character of Executive: Named Executive Officers, as listed in the Company’s most recent proxy statement and as of the Agreement Date, and members of the Company’s Board of Directors as of the Agreement Date. None of the provisions set forth in this Section 4(b) shall be construed to limit or restrict the

Company from taking any action that the Company in good faith reasonably believes is necessary to fulfill the Company’s obligations owed to its shareholders, or from providing truthful information in connection with any legal proceeding, government investigation or other legal matter.

5. Continued Obligations.

Following the Resignation Date, Executive shall continue to adhere to the terms and conditions set forth in Section 8 (Restrictive Covenants), Section 9 (Patents, Copyrights and Related Materials), and Section 15 (Other Post-Termination Obligations) of the Employment Agreement. Executive agrees that such terms and conditions are reasonable and necessary to protect the legitimate interests of the Company and that any violation of these sections of the Employment Agreement by Executive may cause substantial and irreparable harm to the Company. Executive agrees that the Company may seek any Remedies set forth in Section 10 of the Employment Agreement should Executive violate Section 8, Section 9 or Section 15 of the Employment Agreement and/or Section 4. The Parties specifically agree that Section 8, Section 9, Section 10 and Section 15 of the Employment Agreement are incorporated hereto by reference and integrated herein.

6. Miscellaneous.

(a) Defined Terms. Capitalized terms not otherwise defined herein shall have the meanings ascribed to them in this Agreement and the sections of the Employment Agreement integrated into this Agreement. For the sake of clarity, references to “Section(s)” herein without more shall refer to the Sections of this Agreement; references to sections of the Employment Agreement, including those integrated into this agreement, include a reference to the Employment Agreement.

(b) Tax Matters. Executive acknowledges that the Company shall deduct from any compensation payable to Executive or payable on his behalf under this Agreement all applicable federal, state, and local income and employment taxes and other taxes and withholdings required by law.

(c) Public Announcement. The Company shall give Executive a reasonable opportunity to review and comment on any public announcement relating to this Agreement.

(d) Company Approvals. The Company represents and warrants to Executive that it (and to the extent required, the Board) has taken all corporate action necessary to authorize this Agreement.

(e) No Mitigation. In no event shall Executive be obligated to seek other employment or take any other action to mitigate the amounts payable to Executive under any of the provisions of this Agreement, nor shall the amount of any payment hereunder be reduced by any compensation earned as a result of Executive’s employment by another employer.

(f) Enforcement. If the Company fails to pay any amount provided under this Agreement when due, the Company shall pay interest on such amount at a rate equal to the rate of interest charged from time to time by the Company’s principal revolving credit lender, or if

there is no principal revolving credit lender, the prime commercial lending rate announced by Wells Fargo Bank (or its successor) as in effect from time to time; but in no event more than the highest legally permissible interest rate permitted for this Agreement by applicable law. In the event of any proceeding, arbitration or litigation for breach of this Agreement, the prevailing party shall be entitled to recover his or its reasonable costs and attorney’s fees.

(g) Beneficiary. If Executive dies before receiving all of the amounts payable to him in accordance with the terms and conditions of this Agreement, such amounts shall be paid to the beneficiary (“Beneficiary”) designated by Executive in writing to the Company during his lifetime, or if no such Beneficiary is designated, to Executive’s estate. Executive may change his designation of Beneficiary or Beneficiaries at any time or from time to time without the consent of any prior Beneficiary, by submitting to the Company in writing a new designation of Beneficiary.

(h) Governing Law. All matters relating to the interpretation, construction, application, validity and enforcement of this Agreement shall be governed by the laws of the State of Minnesota without giving effect to any choice or conflict of law provision or rule, whether of the State of Minnesota or any other jurisdiction, that would cause the application of laws of any jurisdiction other than the State of Minnesota.

(i) Jurisdiction; Venue. Because (i) the Company is a Minnesota corporation based in Hennepin County, Minnesota, (ii) its significant contracts are governed by Minnesota law, and (iii) it is mutually agreed that it is in the best interests of Company customers, vendors, suppliers and employees that a uniform body of law consistently interpreted be applied to the relationships that the Company has with other such persons and entities, this Agreement is deemed entered into in the State of Minnesota between the Company and Executive. The Hennepin County District Court or the United States District Court for the District of Minnesota will have exclusive jurisdiction and venue over any disputes between the Company and Executive in any action arising out of or related to either Executive’s or the Company’s obligations under this Agreement. Executive and the Company consent to jurisdiction of those courts and hereby waive any defense of lack of personal jurisdiction or forum non conveniens.

(j) Entire Agreement. Except as otherwise provided herein, this Agreement contains the entire agreement of the parties relating to the subject matter hereof and supersedes all prior agreements and understandings with respect to such subject matter, including the Employment Agreement, with the exception of those sections of the Employment Agreement that have been integrated pursuant to Section 5, and the Parties hereto have made no agreements, representations or warranties relating to the subject matter of this Agreement that are not set forth herein.

(k) Amendments. No amendment or modification of this Agreement shall be deemed effective unless made in writing and signed by the parties hereto.

(l) No Waiver. No term or condition of this Agreement shall be deemed to have been waived, except by a statement in writing signed by the party against whom enforcement of the waiver is sought. Any written waiver shall not be deemed a continuing waiver unless specifically stated, shall operate only as to the specific term or condition waived

and shall not constitute a waiver of such term or condition for the future or as to any act other than that specifically waived.

(m) Assignment. This Agreement shall not be assignable, in whole or in part, by either party without the written consent of the other party, except that the Company may, without the written consent of Executive, assign its rights and obligations under this Agreement to any corporation or other business entity (i) with which the Company may merge or consolidate, or (ii) to which the Company may sell or transfer all or substantially all of its assets or capital stock. No such assignment without the written consent of Executive shall discharge the Company from liability hereunder, and such assignee jointly and severally with the Company shall thereafter be deemed to be the “Company” for purposes of all terms and conditions of this Agreement, including this Section 6(m).

(n) Separate Representation. Executive hereby acknowledges that he has sought and received independent advice from counsel of Executive’s own selection in connection with this Agreement and has not relied to any extent on any director, officer, or stockholder of, or counsel to, the Company in deciding to enter into this Agreement. The Company shall promptly reimburse Executive for reasonable attorneys’ fees and costs incurred by Executive in obtaining legal advice in connection with the negotiation and execution of this Agreement, upon receipt by the Company of appropriate documentation of such fees and costs.

(o) Notices. Any notice hereunder shall be in writing and shall be deemed to have been duly given if delivered by hand, sent by reliable next-day courier, or sent by registered or certified mail, return receipt requested, postage prepaid, to the party to receive such notice addressed as follows:

If to the Company:

ValueVision Media, Inc.

6740 Shady Oak Road

Eden Prairie, MN 55344-3433

Attention: General Counsel

and to:

ValueVision Media, Inc.

6740 Shady Oak Road

Eden Prairie, MN 55344-3433

Attention: Board of Directors

If to Executive:

Keith R. Stewart

20305 Lakeview Avenue

Deephaven, MN 55331

or addressed to such other address as may have been furnished to the sender by notice hereunder. All notices shall be deemed given on the date on which delivered if delivered by hand or on the date sent if sent by overnight courier or certified mail, except that notice of change of address will be effective only upon receipt by the other party.

(p) Counterparts. This Agreement may be executed in any number of counterparts, and such counterparts executed and delivered, each as an original, shall constitute but one and the same instrument.

(q) Severability. Subject to Section 5, to the extent that any portion of any provision of this Agreement shall be invalid or unenforceable, it shall be considered deleted herefrom and the remainder of such provision and of this Agreement shall be unaffected and shall continue in full force and effect.

(r) Captions and Headings. The captions and paragraph headings used in this Agreement are for convenience of reference only and shall not affect the construction or interpretation of this Agreement or any of the provisions hereof.

[Signature page immediately following]

IN WITNESS WHEREOF, Executive and the Company have executed this Transition and Separation Agreement as of the Agreement Date.

| |

VALUEVISION MEDIA, INC. |

| |

|

|

| |

By

|

/s/ Teresa Dery

|

| |

|

Teresa Dery

|

| |

|

Senior Vice President and General Counsel

|

| |

|

|

| |

|

|

| |

|

|

| |

/s/ Keith R. Stewart

|

| |

KEITH R. STEWART

|

EXHIBIT A

RELEASE OF CLAIMS

This Release of Claims (“Agreement”) is made and entered into by and between ValueVision Media, Inc. (the “Company”) and Keith R. Stewart (the “Executive”).

BACKGROUND

A. The Company and Executive are parties to a Separation Agreement, dated June 22, 2014, that, among its terms, provides that the Company will pay Executive certain individually tailored severance benefits (the “Severance”) upon the termination of Executive’s employment under certain circumstances (the “Separation Agreement”).

B. Under the Separation Agreement, the Company is not obligated to pay the Severance unless Executive has signed a release of claims in favor of the Company. The parties intend this Agreement to be that release of claims.

NOW, THEREFORE, based on the foregoing and the terms and conditions below, the Company and Executive, desiring to amicably resolve any and all existing and potential disputes between them as of the date each executes this Agreement, and in consideration of the obligations and undertakings set forth below and intending to be legally bound, agree as follows.

1. Company’s Obligations. In return for “Executive’s Obligations” (as defined in Section 2 below), and provided that Executive signs this Agreement and does not exercise Executive’s rights to revoke or rescind Executive’s waivers of certain discrimination claims (as described in Section 5 below), the Company will pay to Executive the Severance.

2. Executive’s Obligations. In return for the Company’s Obligations in Section 1 above, Executive knowingly and voluntarily agrees to the following:

(a) Executive hereby fully, finally and forever releases, waives, and discharges, to the maximum extent that the law permits, any and all legal and equitable claims against the Company that Executive has through the date on which Executive signs this Agreement. This full and final release, waiver, and discharge extends to all and each of every legal and equitable claim(s) of any kind or nature whatsoever including, without limitation, the following:

(i) All claims that Executive has now, whether Executive now knows about or suspects such claims;

(ii) All claims for attorney’s fees;

(iii) All rights and claims of age discrimination and retaliation under the Age Discrimination in Employment Act (“ADEA”) as amended by the Older Workers Benefit Protection Act of 1990 (“OWBPA”); and discrimination and retaliation claims of any kind or nature whatsoever under federal, state, or local law, including, for example, claims of discrimination and retaliation under Title VII of the Civil Rights Act of 1964,

the Americans With Disabilities Act (“ADA”), and the Minnesota Human Rights Act (“MHRA”);

(iv) All claims arising out of Executive’s employment and Executive’s separation from employment with the Company including, for example, any alleged breach of contract, breach of implied contract, wrongful or illegal termination, defamation, invasion of privacy, fraud, promissory estoppel, and infliction of emotional distress;

(v) All claims for any other compensation, including vacation pay, other paid time off, severance pay, other severance benefits, incentive opportunity pay, other grants of incentive compensation, grants of stock, and stock options;

(vi) All claims under the Employee Retirement Security Act of 1974, as amended (“ERISA”); and

(vii) All claims for any other alleged unlawful employment practices arising out of or relating to Executive’s employment or separation from employment with the Company.

(b) Executive will not commence any civil actions against the Company except as necessary to enforce its obligations under this Agreement. The Severance that Executive is receiving in this Agreement has a value that is greater than anything to which Executive is entitled. Other than what Executive is receiving in this Agreement, the Company owes Executive nothing else in return for Executive’s Obligations.

(c) The Parties agree that this Section 2 does not prohibit Executive from enforcing the terms and obligations imposed upon the Company under the Separation Agreement should the Company be in breach of said Separation Agreement.

3. Certain Definitions. For purposes of Section 2, “Executive” means Keith R. Stewart and any person or entity that has or obtains any legal rights or claims through Keith R. Stewart. Further, the “Company” means ValueVision Media, Inc.; and any parent, subsidiary, and affiliated organization or entity in the present or past related to ValueVision Media, Inc.; and past and present officers, directors, members, governors, attorneys, employees, agents, insurers, successors, and assigns of, and any person who acted on behalf of or instruction of ValueVision Media, Inc.

4. Other Provisions.

(a) The Company has paid or will pay Executive in full for all reimbursable business expenses, earned annualized salary, bonus pay, and any other earnings through the last day of Executive’s employment.

(b) This Agreement does not prohibit Executive from filing an administrative charge of discrimination with, or cooperating or participating in an investigation or proceeding conducted by, the Equal Employment Opportunity Commission or other federal or state regulatory or law enforcement agency.

(c) Nothing in this Agreement affects Executive’s rights in any benefit plan or program in which Executive was a participant while employed by the Company. The terms of such plans and programs control Executive’s rights.

(d) The Company will indemnify Executive as permitted by and pursuant to any agreement or policy that the Company has adopted relating to indemnification of directors, officers, and employees; and as permitted by and pursuant to any provision of the Company’s articles or by-laws relating to such indemnification.

(e) Executive will continue to be covered as permitted by and pursuant to any policy of directors and/or officers liability insurance policy on the terms and conditions of the applicable policy documents.

(f) The Company agrees to maintain directors and/or officers liability insurance covering Executive in amount, form and substance comparable to the policy in effect on the date hereof for a period of three (3) years following the date hereof.

5. Executive’s Rights to Counsel, Consider, Revoke and Rescind.

(a) The Company hereby advises Executive to consult with an attorney prior to signing this Agreement.

(b) Executive further understands that Executive has 21 days to consider Executive’s release of rights and claims of age discrimination under the ADEA and OWBPA, beginning the date on which Executive receives this Agreement. Executive agrees that he was provided this Agreement on June 21, 2014 for consideration. If Executive signs this Agreement, Executive understands that Executive is entitled to revoke Executive’s release of any rights or claims under the ADEA and OWBPA within seven days after Executive has executed it, and Executive’s release of any rights or claims under the ADEA and OWBPA will not become effective or enforceable until the seven-day period has expired.

(c) Executive understands that Executive may rescind Executive’s waiver of discrimination claims under the MHRA within 15 calendar days after the date on which Executive signs this Agreement. To rescind this waiver, Executive must put the rescission in writing and deliver it to the Company by hand or mail within the 15-day period. If Executive delivers the rescission by mail it must be: (i) Postmarked within 15 calendar days after the date on which Executive signs this Agreement; (ii) addressed to the Company, c/o Teresa Dery, 6740 Shady Oak Road, Eden Prairie, MN Minneapolis, MN 55344-3433; and (iii) sent by certified mail return receipt requested.

If Executive revokes or rescinds Executive’s waivers of discrimination claims as provided above, this Agreement will be null and void.

6. Non-Admission. The Company and Executive enter into this Agreement expressly disavowing fault, liability and wrongdoing, liability at all times having been denied. Neither this Agreement, nor anything contained in it, will be construed as an admission by either of them of any liability, wrongdoing or unlawful conduct whatsoever. If this Agreement is not executed, no term of this Agreement will be deemed an admission by either party of any right that he/it may have with or against the other.

7. No Oral Modification or Waiver. This Agreement may not be changed orally. No breach of any provision hereof can be waived by either party unless in writing. Waiver of

any one breach by a party will not be deemed to be a waiver of any other breach of the same or any other provision hereof.

8. Governing Law. This Agreement will be governed by the substantive laws of the State of Minnesota without regard to conflicts of law principles.

9. Forum Selection-Jurisdiction and Venue. Any disputes arising out of or related to this Agreement or any breach or alleged breach hereof shall be exclusively decided by the Hennepin County District Court in Minnesota. Executive hereby irrevocably consents to the personal jurisdiction of this court in connection with any dispute related to this Agreement, and he expressly waives any defense of inconvenient forum. He further waives any bond, surety, or other security that might be required of the Company with respect to any such dispute.

10. Counterparts. This Agreement may be executed in any number of counterparts, and each such counterpart will be deemed to be an original instrument, and all such counterparts together will constitute but one agreement.

11. Blue Pencil Doctrine. In the event that any provision of this Agreement is unenforceable under applicable law, the validity or enforceability of the remaining provisions will not be affected. To the extent any provision of this Agreement is judicially determined to be unenforceable, a court of competent jurisdiction may reform any such provision to make it enforceable. The provisions of this Agreement will, where possible, be interpreted so as to sustain its legality and enforceability.

12. Agreement Freely Entered Into. Executive and the Company have voluntarily and free from coercion entered into this Agreement. Each has read this Agreement carefully and understands all of its terms, and has had the opportunity to discuss this Agreement with his/its own attorney prior to its execution. In agreeing to sign this Agreement, neither party has relied on any statements or explanations made by the other party, their respective agents or attorneys except as set forth in this Agreement. Both parties agree to abide by this Agreement.

|

Dated

|

|

|

|

|

| |

|

|

Keith R. Stewart

|

| |

|

|

|

|

|

Dated

|

|

|

ValueVision Media, Inc.

|

| |

|

|

|

| |

|

|

By

|

|

| |

|

|

Its

|

|

13

Exhibit 99.1

VALUEVISION MEDIA RECONSTITUTES BOARD OF DIRECTORS TO INCLUDE FIVE NEW MEMBERS;

MARK BOZEK, FORMER HSN CHIEF, NAMED CHIEF EXECUTIVE OFFICER

BOB ROSENBLATT NAMED CHAIRMAN OF THE BOARD

MINNEAPOLIS, MN – June 23, 2014 – ValueVision Media, Inc. (NASDAQ: VVTV), a multichannel electronic retailer operating as ShopHQ via TV, Internet and mobile, today announced it has reconstituted its Board of Directors and has unanimously appointed Mark Bozek Chief Executive Officer and Bob Rosenblatt Non-Executive Chairman of the Board, effective immediately. Mr. Bozek succeeds Keith Stewart, who has resigned as Chief Executive Officer and as a director of the Company. Mr. Bozek has more than 20 years of senior executive experience in the multi-channel commerce, electronic retailing and entertainment industries, including having served as CEO of HSN, Inc., Senior Vice President of QVC, Inc., and as a producer at Fox Television.

ValueVision also announced that IVS Associates, Inc., the independent inspector of elections, has certified the voting results at the Company's Annual Meeting, held on June 18, 2014. Four ValueVision nominees and four nominees of the Clinton Group, Inc. were elected to the ValueVision Board of Directors. The Board has appointed former President of Saks Fifth Avenue, also a fifth Clinton Group nominee, Ronald Frasch, as a director following Mr. Stewart’s resignation. Accordingly, the Board will consist of: Thomas Beers, Mark Bozek, John Buck, Ronald Frasch, Landel Hobbs, Lowell Robinson, Bob Rosenblatt and Fred Siegel. The newly reconstituted Board will focus on further strengthening the Company’s financial and operating performance and delivering meaningful returns for all ValueVision shareholders.

John Buck said, “We are pleased to welcome Mark Bozek, a pioneer and innovator in the retail and electronic retailing industries, as our new CEO. Mark has a proven track record of building consumer brands and driving revenue at both HSN and QVC, and we expect to leverage his expertise as ValueVision embarks on its very exciting next stage. As the Board’s longest tenured director, I welcome the energy and fresh perspectives of Mark and our other new directors, and look forward to working closely with them to transform the ShopHQ brand into the preeminent commerce and media franchise we know it can become.”

Mark Bozek said, “I am thrilled to join the team at ShopHQ and humbled by the opportunity to work with a talented Board and dedicated employees. ValueVision has great assets and our vision of all that comes next is ambitious; we plan to evolve the business, creating more robust platforms that enable us to become a far more relevant player in the multi-channel worlds of TV, online and mobile commerce and entertainment.

“By instilling a culture of accountability, respect and passion for the unique world of a “dollars per minute” business, we believe ShopHQ has boundless potential. We will work tirelessly in the coming months to develop a comprehensive strategic plan for growth – one that includes employees, our loyal customers, as well as our valued product and brand creators – enabling ValueVision to create long-term shareholder value.”

Mr. Buck concluded, “On behalf of the Board, I would like to thank Keith Stewart, along with the other outgoing directors – Jill Botway, William Evans, Sean Orr and Randy Ronning – for their many contributions to ValueVision. We wish them all good things in their future endeavors.”

ValueVision shareholders also approved all proposals submitted for a vote at the Annual Meeting, including the approval of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2015. The results of the Annual Meeting have been filed with the Securities and Exchange Commission.

Board of Directors Biographies

Thomas Beers – Since September 2012, Mr. Beers has been CEO of Fremantle Media N.A., Inc., where he is responsible for Fremantle's management and business performance as well as the development, production and operations of more than 600 hours of programming per year including “American Idol,” “America's Got Talent,” “The X Factor,” “Let's Make a Deal,” “Family Feud,” and “The Price is Right.” Prior to joining Fremantle, Mr. Beers was the founder and Chief Executive Officer of Original Productions, where he was the creator and driving force behind the Primetime Emmy® winning “Deadliest Catch,” and Emmy nominee “Ice Road Truckers,” and top-rated shows “Storage Wars,” “Monster Garage” and “Black Gold.” His catalogue of more than 40 series is firmly entrenched across cable powerhouses Discovery, HISTORY, A&E, Spike TV, The National Geographic Channel, and truTV.

Mark Bozek – Mr. Bozek is the former CEO of Home Shopping Network (HSN). Mr. Bozek generated over $6 billion in sales and $1 billion in profits while managing 6,000 employees at HSN. Mr. Bozek transformed HSN's merchandising through innovation and strategic leadership. Mr. Bozek built multiple $100+ million proprietary brands while running the company, including Ingenious Designs. He also was responsible for the development and growth of HSN's current top selling brands including Andrew Lessman, Diane Gilman, Wolfgang Puck and Serious Skin Care. In 1998, Bozek launched HSN.com. He grew this online business to over $100 million in 18 months. Mr. Bozek was also responsible for the international launches of HSN in Japan, Europe and China. Mr. Bozek's merchandising and media success began as a producer at Fox Television and then as a Senior Vice President at QVC. Mr. Bozek was at Fox Television at its inception in 1998, where he was a three-time Emmy nominee. Bozek has previously served as a director of Sykes Enterprises.

John Buck – Mr. Buck currently serves as non-executive chairman of the board of Medica, Minnesota’s second largest health insurer, and previously served as chief executive officer of Medica from 2001 until his retirement in 2003. From October 2007 to March 2008, and again from August 2008 through January 2009, he served as interim chief executive officer of ValueVision. Previously, Mr. Buck worked for Fingerhut Companies where he held senior executive positions, including president and chief operating officer. Mr. Buck also previously held executive positions at Graco Inc., Honeywell Inc., and Alliant Techsystems Inc. Mr. Buck currently serves on the board of directors of Patterson Companies, Inc.

Ronald Frasch – Mr. Frasch is currently an operating partner at Castanea Partners, a consumer-focused private-equity firm, and the principal of Ron Frasch Associates, LLC, a consulting firm. From 2007 to 2013, Mr. Frasch served as President and Chief Merchandising Officer of Saks Fifth Avenue, a division of Saks, Incorporated, a NYSE-listed luxury fashion retailer. From 2004 to 2007, he was Vice Chairperson and Chief Merchant of Saks Fifth Avenue. He has served as a member of the board of directors of Crocs, Inc., an apparel footwear and accessories company, since 2006. From 2000 to 2004, he was President and Chief Executive Officer of Bergdorf Goodman and was previously President of GFT North America from 1996 to 2000 and President and Chief Executive Officer of Escada USA from 1994 to 1996.

Landel Hobbs – Mr. Hobbs is Chief Executive Officer of LCH Enterprises LLC, a consulting firm that operates in the broader telecommunications and media space. Mr. Hobbs had been Chief Operating Officer of Time Warner Cable from 2005 until 2010 and was previously Chief Financial Officer from 2001 until 2005. He was Vice President of Financial Analysis and Operations Support at AOL Time Warner from 2000 to 2001. Mr. Hobbs served in various positions, including Senior Vice President, Controller and Chief Accounting Officer, of Turner Broadcasting System, Inc. from 1993 until 2000. Before joining Turner in 1993, he was Senior Vice President and Audit Director of Banc One Illinois Corporation and Senior Manager with KPMG Peat Marwick. He is Lead Director of Allconnect and a current Trustee of the National 4H Council and The Dyslexia Resource Trust. He was previously Chair and a Director of CSPAN, a Trustee of Women in Cable Television (WICT), and a Broadcasting and Cable Hall of Fame Member.

Lowell W. Robinson -- Former Chief Financial Officer and Chief Operating Officer of MIVA, Inc.

Lowell W. Robinson served as the Chief Financial Officer and Chief Operating Officer of MIVA, Inc., an online advertising network, from August 2007 through March 2009. He joined MIVA in 2006 as Chief Financial Officer and Chief Administrative Officer. He had previously served as the President of LWR Advisors from 2002 to 2006 and as the Chief Financial Officer and Chief Administrative Officer at HotJobs.com from 2000 to 2002. He previously held senior financial positions at Advo, Inc., Citigroup Inc. and Kraft Foods, Inc. Mr. Robinson recently served as a director of The Jones Group from 2005-2014 and has served on the Board of Directors of Local.com Corporation from 2011 to 2012, the Board of Advisors for the University of Wisconsin School of Business from 2006 to 2010, the Board of Directors of International Wire Group, Inc., from 2003 to 2009, and the Board of Directors of Independent Wireless One, Diversified Investment Advisors and Edison Schools Inc. He currently serves as a director at Higher One and is a member of the Smithsonian Libraries Advisory Board and the Board of the Metropolitan Opera Guild.

Bob Rosenblatt – Bob has more than 25 years of experience leading mid and large sized retail organizations, including Tommy Hilfiger, HSN (formerly the Home Shopping Network), and Bloomingdale's. Last year he was Interim President of Ideeli.com, a flash sales company based in NY that was sold a few of months ago to Groupon. As Group President and COO of Tommy Hilfiger Corporation, he grew revenues and profitability and built the company's first transactional web site. Bob co-managed the process which culminated in the Tommy Hilfiger Company successfully being sold to Apax Partners in 2006. Bob also previously served as CFO, COO and President of HSN , where he significantly increased company value. Bob introduced and built HSN's online operation, which achieved profitability within three months of inception. As CFO of Bloomingdale's, Bob was responsible for the P&L of the corporation, financial planning, and administrative management.

For the past seven years, Bob has been CEO of Rosenblatt Consulting, LLC, which specializes in helping investment firms determine value in both public and private companies in the consumer products sector, as well as helping retail firms maximize profitability. He has been and is currently serving on several public and private boards in the retail and technology industry including PepBoys (NYSE: PBY), debShops, RetailNext and I.Predictus. Bob served on the Board of Directors of the Electronic Retailing Association.

Fred Siegel – Mr. Siegel was Senior Vice President and marketing head for QVC from 1993 to 1998, overseeing all off-air consumer touch-points including all marketing and communications, leading special on-air events, and attracting and securing marquee brand-name vendors, helping QVC become the category-defining brand. After QVC, Mr. Siegel was marketing lead for Excite and Excite @ Home where he oversaw all marketing and communications activities. He is responsible for many Internet firsts including strategic partnerships with television networks, the first large-scale voting event on the web (with the Prime Time Emmys) and the first Online Town Hall meeting with President Clinton. He currently advises various companies from Google Ventures-backed Sidecar to the twenty-something organization, Our Time. Mr. Siegel won a Daytime Emmy Award in 2011 and has won a Clio.

About ValueVision Media/ShopHQ (www.shophq.com/ir)

ValueVision Media, Inc. operates as ShopHQ, a multichannel retailer that enables customers to shop and interact via TV, phone, Internet and mobile in the merchandise categories of Home & Consumer Electronics, Beauty, Health & Fitness, Fashion & Accessories, and Jewelry & Watches. The ShopHQ television network reaches over 87 million cable and satellite homes and is also available nationwide via live streaming at www.shophq.com. Please visit www.shophq.com/ir for more investor information.

Forward-Looking Information

This release may contain certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements contained herein that are not statements of historical fact may be deemed forward-looking statements. These statements are based on management's current expectations and accordingly are subject to uncertainty and changes in circumstances. Actual results may vary materially from the expectations contained herein due to various important factors, including (but not limited to): consumer preferences, spending and debt levels; the general economic and credit environment; interest rates; seasonal variations in consumer purchasing activities; the ability to achieve the most effective product category mixes to maximize sales and margin objectives; competitive pressures on sales; pricing and gross sales margins; the level of cable and satellite distribution for our programming and the associated fees; our ability to establish and maintain acceptable commercial terms with third-party vendors and other third parties with whom we have contractual relationships, and to successfully manage key vendor relationships; our ability to manage our operating expenses successfully and our working capital levels; our ability to remain compliant with our long-term credit facility covenants; our ability to successfully transition our brand name; the market demand for television station sales; our management and information systems infrastructure; challenges to our data and information security; changes in governmental or regulatory requirements; litigation or governmental proceedings affecting our operations; significant public events that are difficult to predict, or other significant television-covering events causing an interruption of television coverage or that directly compete with the viewership of our programming; and our ability to obtain and retain key executives and employees. More detailed information about those factors is set forth in the Company's filings with the Securities and Exchange Commission, including the Company's annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this announcement. The Company is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

CONTACTS:

Sard Verbinnen & Co

Jonathan Gasthalter/Renee Soto/Jared Levy

(212) 687-8080

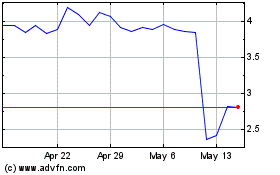

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

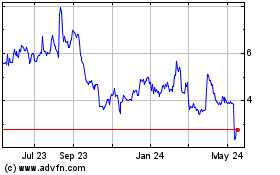

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024