Posts record revenue and profitability

Fourth quarter revenue and profitability growth accelerate from the

third quarter Delivers on full-year guidance of double-digit

topline growth with margin expansion Drives largest annual share

repurchase on record at over $2 billion

Expedia Group, Inc. (NASDAQ: EXPE) announced financial results

today for the fourth quarter and full year ended December 31,

2023.

"We delivered on our full year guidance and drove record

results, all while completing a massive transformation and

navigating the inherent volatility that comes with that. Our work

is finally starting to deliver results, and we are in the best

place we've ever been technologically," said Peter Kern, Vice

Chairman and CEO, Expedia Group. "Moving forward, we are now able

to execute without the numerous constraints we have faced in recent

years. We will continue to focus on acquiring and retaining the

right customers, driving share growth in our B2C and B2B

businesses, and providing the best product and partner experience

in the industry. It is really exciting to be in position to go back

on offense and lead the industry."

Key Highlights

- Record full year lodging gross bookings growing 11% with record

hotel gross bookings growing 18%, compared to 2022.

- Highest ever full year and fourth quarter revenue, both of

which grew 10%, compared to 2022.

- Fourth quarter year over year B2C revenue growth accelerates

from the third quarter.

- Record quarterly and full year B2B revenue, increasing 28% and

33%, respectively, compared to 2022.

- Highest ever full year GAAP net income grew 127%, compared to

2022.

- Record full year adjusted EBITDA grew 14%, compared to

2022.

- Significant adjusted EBITDA margin expansion at over 130 basis

points for the fourth quarter and nearly 75 basis points for the

year, compared to 2022.

- Repurchased over 19 million shares for a record $2 billion in

2023.

Financial Summary & Operating Metrics

(In millions, except per share amounts) - Fourth Quarter

2023

Expedia Group, Inc.

Metric

Q4 2023

Q4 2022

Δ Y/Y

Booked room nights

77.4

70.8

9%

Gross bookings

$21,672

$20,511

6%

Revenue

$2,887

$2,618

10%

Operating income

$104

$128

(19)%

Net income attributable to Expedia Group

common stockholders

$132

$177

(25)%

Diluted earnings per share

$0.92

$1.11

(17)%

Adjusted EBITDA

$532

$449

19%

Adjusted net income

$242

$196

24%

Adjusted EPS

$1.72

$1.26

37%

Net cash provided by (used in) operating

activities

$(238)

$(182)

31%

Free cash flow

$(415)

$(359)

16%

* A reconciliation of non-GAAP financial

measures to the most comparable GAAP measures is provided at the

end of this release.

Financial Summary & Operating Metrics

(In millions, except per share amounts) - Full Year 2023

Expedia Group, Inc.

Metric

2023

2022

Δ Y/Y

Booked room nights

350.9

312.0

12%

Gross bookings

$104,079

$95,049

10%

Revenue

$12,839

$11,667

10%

Operating income

$1,033

$1,085

(5)%

Net income attributable to Expedia Group

common stockholders

$797

$352

127%

Diluted earnings per share

$5.31

$2.17

144%

Adjusted EBITDA

$2,680

$2,349

14%

Adjusted net income

$1,418

$1,072

32%

Adjusted EPS

$9.69

$6.79

43%

Net cash provided by operating

activities

$2,690

$3,440

(22)%

Free cash flow

$1,844

$2,778

(34)%

* A reconciliation of non-GAAP financial

measures to the most comparable GAAP measures is provided at the

end of this release.

Conference Call

Expedia Group, Inc. will webcast a conference call to discuss

fourth quarter 2023 financial results and certain forward-looking

information on Thursday, February 8, 2024 at 1:30 p.m. Pacific Time

(PT). The webcast will be open to the public and available via

ir.expediagroup.com. Expedia Group expects to maintain access to

the webcast on the IR website for approximately twelve months

subsequent to the initial broadcast.

About Expedia Group

Expedia Group, Inc. brands power travel for everyone, everywhere

through our global platform. Driven by the core belief that travel

is a force for good, we help people experience the world in new

ways and build lasting connections. We provide industry-leading

technology solutions to fuel partner growth and success, while

facilitating memorable experiences for travelers. Our organization

is made up of three pillars: Expedia Brands, housing all our

consumer brands; Expedia Product & Technology, focused on the

group’s product and technical strategy and offerings; and Expedia

for Business, consisting of business-to-business solutions and

relationships throughout the travel ecosystem.

Expedia Group’s three flagship consumer brands includes:

Expedia®, Hotels.com®, and Vrbo®. One Key™ is our comprehensive

loyalty program that unifies Expedia, Hotels.com and Vrbo into one

simple, flexible travel rewards experience. To enroll in One Key,

download Expedia, Hotels.com and Vrbo mobile apps for free on iOS

and Android devices. One Key is currently available in the U.S. and

will become available globally soon.

© 2024 Expedia, Inc., an Expedia Group company. All rights

reserved. Trademarks and logos are the property of their respective

owners. CST: 2029030-50

Expedia Group, Inc.

Trended Metrics

(All figures in

millions)

The metrics below are intended to

supplement the financial statements in this release and in our

filings with the SEC, and do not include adjustments for one-time

items, acquisitions, foreign exchange or other adjustments. The

definition or methodology of any of our supplemental metrics are

subject to change, and such changes could be material. We may also

discontinue certain supplemental metrics as our business evolves

over time. In the event of any discrepancy between any supplemental

metric and our historical financial statements, you should rely on

the information included in the financial statements filed with or

furnished to the SEC.

2021

2022

2023

Full Year

Y/Y Growth

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2021

2022

2023

Q423

2023

Units sold

Booked room nights

54.0

68.4

65.4

59.7

77.0

82.5

81.6

70.8

94.5

89.7

89.3

77.4

247.5

312.0

350.9

9%

12%

Booked air tickets

8.9

13.4

12.7

11.3

13.1

13.5

12.2

11.1

14.0

13.6

12.8

11.4

46.3

49.9

51.9

3%

4%

Gross bookings by business model

Agency

$6,737

$10,362

$8,855

$8,325

$11,346

$12,773

$10,904

$9,469

$13,425

$12,370

$10,927

$9,439

$34,279

$44,492

$46,161

—%

4%

Merchant

8,685

10,453

9,870

9,138

13,066

13,366

13,083

11,042

15,976

14,951

14,758

12,233

38,146

50,557

57,918

11%

15%

Total

$15,422

$20,815

$18,725

$17,463

$24,412

$26,139

$23,987

$20,511

$29,401

$27,321

$25,685

$21,672

$72,425

$95,049

$104,079

6%

10%

Lodging gross bookings

$12,002

$14,431

$13,046

$12,000

$17,756

$17,867

$17,099

$14,117

$21,055

$19,167

$18,513

$15,253

$51,479

$66,839

$73,987

8%

11%

Revenue by segment

B2C

$1,025

$1,715

$2,351

$1,730

$1,740

$2,420

$2,707

$1,874

$1,921

$2,415

$2,819

$1,958

$6,821

$8,741

$9,113

4%

4%

B2B

184

305

490

481

432

650

788

676

668

861

995

864

1,460

2,546

3,388

28%

33%

trivago (third-party revenue)

37

91

121

68

77

111

124

68

76

82

115

65

317

380

338

(5)%

(11)%

Total

$1,246

$2,111

$2,962

$2,279

$2,249

$3,181

$3,619

$2,618

$2,665

$3,358

$3,929

$2,887

$8,598

$11,667

$12,839

10%

10%

Revenue by product

Lodging

$903

$1,533

$2,300

$1,713

$1,610

$2,400

$2,881

$2,014

$2,029

$2,698

$3,233

$2,304

$6,449

$8,905

$10,264

14%

15%

Air

50

78

61

65

74

95

100

93

113

111

100

86

254

362

410

(7)%

13%

Advertising and media(1)

88

161

202

152

166

213

222

176

175

201

240

205

603

777

821

16%

6%

Other(2)

205

339

399

349

399

473

416

335

348

348

356

292

1,292

1,623

1,344

(13)%

(17)%

Total

$1,246

$2,111

$2,962

$2,279

$2,249

$3,181

$3,619

$2,618

$2,665

$3,358

$3,929

$2,887

$8,598

$11,667

$12,839

10%

10%

Revenue by geography

U.S. points of sale

$1,001

$1,736

$2,177

$1,655

$1,656

$2,208

$2,358

$1,717

$1,748

$2,172

$2,440

$1,787

$6,569

$7,939

$8,147

4%

3%

Non-U.S. points of sale

245

375

785

624

593

973

1,261

901

917

1,186

1,489

1,100

2,029

3,728

4,692

22%

26%

Total

$1,246

$2,111

$2,962

$2,279

$2,249

$3,181

$3,619

$2,618

$2,665

$3,358

$3,929

$2,887

$8,598

$11,667

$12,839

10%

10%

Adjusted EBITDA by segment(3)

B2C

$106

$316

$879

$481

$188

$582

$943

$411

$148

$653

$1,056

$468

$1,782

$2,124

$2,325

14%

10%

B2B

(57)

(4)

74

97

80

156

221

142

133

206

266

193

110

599

798

36%

33%

Other(4)

(107)

(111)

(98)

(99)

(95)

(90)

(85)

(104)

(96)

(112)

(106)

(129)

(415)

(374)

(443)

25%

18%

Total

$(58)

$201

$855

$479

$173

$648

$1,079

$449

$185

$747

$1,216

$532

$1,477

$2,349

$2,680

19%

14%

Net income (loss) attributable to Expedia

Group common stockholders(5)

$(606)

$(301)

$362

$276

$(122)

$(185)

$482

$177

$(145)

$385

$425

$132

$(269)

$352

$797

(25)%

127%

(1) Our advertising and media business consists of Expedia Group

Media Solutions, which is responsible for generating advertising

revenue on our global online travel brands, and trivago, a leading

hotel metasearch site. (2) Other revenue primarily includes

insurance, car rental, destination services and cruise revenue. (3)

See the section below titled "Tabular Reconciliations for Non-GAAP

Measures — Adjusted EBITDA by segment" for additional details. (4)

Other is comprised of trivago, corporate and intercompany

eliminations. (5) Expedia Group does not calculate or report net

income (loss) by segment.

Notes:

- All trivago revenue is classified as Non-U.S. point of

sale.

- B2B includes Egencia, our former full-service travel management

company, through its sale in November 2021.

- Some numbers may not add due to rounding. All percentages

throughout this release are calculated on precise, unrounded

numbers.

EXPEDIA GROUP, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except share and

per share data)

(Unaudited)

Three months ended

December 31,

Year ended

December 31,

2023

2022

2023

2022

Revenue

$

2,887

$

2,618

$

12,839

$

11,667

Costs and expenses:

Cost of revenue (exclusive of depreciation

and amortization shown separately below) (1)

340

412

1,573

1,657

Selling and marketing - direct

1,370

1,199

6,107

5,428

Selling and marketing - indirect (1)

193

177

756

672

Technology and content (1)

357

317

1,358

1,181

General and administrative (1)

199

186

771

748

Depreciation and amortization

208

199

807

792

Impairment of goodwill

—

—

297

—

Intangible and other long-term asset

impairment

114

—

129

81

Legal reserves, occupancy tax and

other

2

—

8

23

Operating income

104

128

1,033

1,085

Other income (expense):

Interest income

45

27

207

60

Interest expense

(61

)

(60

)

(245

)

(277

)

Gain on debt extinguishment, net

—

—

—

49

Gain on sale of business, net

1

4

25

6

Other, net

82

84

(2

)

(385

)

Total other income (expense), net

67

55

(15

)

(547

)

Income before income taxes

171

183

1,018

538

Provision for income taxes

(35

)

(8

)

(330

)

(195

)

Net income

136

175

688

343

Net (income) loss attributable to

non-controlling interests

(4

)

2

109

9

Net income attributable to Expedia

Group, Inc.

$

132

$

177

$

797

$

352

Earnings per share attributable to

Expedia Group, Inc. available to common stockholders:

Basic

$

0.96

$

1.14

$

5.50

$

2.24

Diluted

0.92

1.11

5.31

2.17

Shares used in computing earnings per

share (000's):

Basic

138,184

155,404

144,967

156,672

Diluted

144,470

159,532

150,228

161,751

(1) Includes stock-based compensation as

follows:

Cost of revenue

$

4

$

4

$

14

$

14

Selling and marketing

19

17

79

67

Technology and content

33

29

138

111

General and administrative

43

44

182

182

EXPEDIA GROUP, INC.

CONSOLIDATED BALANCE

SHEETS

(In millions, except number of

shares which are reflected in thousands and par value)

December 31, 2023

December 31, 2022

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

4,225

$

4,096

Restricted cash and cash equivalents

1,436

1,755

Short-term investments

28

48

Accounts receivable, net of allowance of

$46 and $40

2,786

2,078

Income taxes receivable

47

40

Prepaid expenses and other current

assets

708

774

Total current assets

9,230

8,791

Property and equipment, net

2,359

2,210

Operating lease right-of-use assets

357

363

Long-term investments and other assets

1,238

1,184

Deferred income taxes

586

661

Intangible assets, net

1,023

1,209

Goodwill

6,849

7,143

TOTAL ASSETS

$

21,642

$

21,561

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable, merchant

$

2,041

$

1,709

Accounts payable, other

1,077

947

Deferred merchant bookings

7,723

7,151

Deferred revenue

164

163

Income taxes payable

26

21

Accrued expenses and other current

liabilities

752

787

Total current liabilities

11,783

10,778

Long-term debt

6,253

6,240

Deferred income taxes

33

52

Operating lease liabilities

314

312

Other long-term liabilities

473

451

Commitments and contingencies

Stockholders’ equity:

Common stock: $.0001 par value; Authorized

shares: 1,600,000

—

—

Shares issued: 282,149 and 278,264; Shares

outstanding: 131,522 and 147,757

Class B common stock: $.0001 par value;

Authorized shares: 400,000

—

—

Shares issued: 12,800 and 12,800; Shares

outstanding: 5,523 and 5,523

Additional paid-in capital

15,398

14,795

Treasury stock - Common stock and Class B,

at cost; Shares 157,903 and 137,783

(13,023

)

(10,869

)

Retained earnings (deficit)

(632

)

(1,409

)

Accumulated other comprehensive income

(loss)

(209

)

(234

)

Total Expedia Group, Inc. stockholders’

equity

1,534

2,283

Non-redeemable non-controlling

interest

1,252

1,445

Total stockholders’ equity

2,786

3,728

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

21,642

$

21,561

EXPEDIA GROUP, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In millions)

(Unaudited)

Year ended

December 31,

2023

2022

Operating activities:

Net income

$

688

$

343

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation of property and equipment,

including internal-use software and website development

748

704

Amortization of stock-based

compensation

413

374

Amortization of intangible assets

59

88

Impairment of goodwill, intangible and

other long-term assets

426

81

Deferred income taxes

62

70

Foreign exchange (gain) loss on cash,

restricted cash and short-term investments, net

(16

)

128

Realized loss on foreign currency

forwards, net

—

78

(Gain) loss on minority equity

investments, net

(16

)

345

Gain on debt extinguishment, net

—

(49

)

Gain on sale of business, net

(25

)

(6

)

Other

80

23

Changes in operating assets and

liabilities, net of effects from acquisitions and dispositions:

Accounts receivable

(741

)

(838

)

Prepaid expenses and other assets

98

55

Accounts payable, merchant

332

375

Accounts payable, other, accrued expenses

and other liabilities

101

194

Tax payable/receivable, net

(91

)

11

Deferred merchant bookings

572

1,464

Net cash provided by operating

activities

2,690

3,440

Investing activities:

Capital expenditures, including

internal-use software and website development

(846

)

(662

)

Purchases of investments

(28

)

(60

)

Sales and maturities of investments

49

205

Cash and restricted cash divested from

sale of business, net of proceeds

25

4

Proceeds from initial exchange of

cross-currency interest rate swaps

—

337

Payments for initial exchange of

cross-currency interest rate swaps

—

(337

)

Other, net

—

(67

)

Net cash used in investing

activities

(800

)

(580

)

Financing activities:

Payment of long-term debt

—

(2,141

)

Debt extinguishment costs

—

(22

)

Purchases of treasury stock

(2,137

)

(607

)

Proceeds from exercise of equity awards

and employee stock purchase plan

101

131

Other, net

(60

)

15

Net cash used in financing

activities

(2,096

)

(2,624

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash and cash equivalents

16

(190

)

Net increase (decrease) in cash, cash

equivalents and restricted cash and cash equivalents

(190

)

46

Cash, cash equivalents and restricted cash

and cash equivalents at beginning of year

5,851

5,805

Cash, cash equivalents and restricted

cash and cash equivalents at end of year

$

5,661

$

5,851

Supplemental cash flow

information

Cash paid for interest

$

231

$

291

Income tax payments, net

281

102

Notes & Definitions:

Booked Room Nights: Represents

booked hotel room nights and property nights for our B2C reportable

segment and booked hotel room nights for our B2B reportable

segment. Booked hotel room nights include both merchant and agency

hotel room nights. Property nights are related to our alternative

accommodation business.

Booked Air Tickets: Includes both

merchant and agency air bookings.

Gross Bookings: Generally represent

the total retail value of transactions booked, recorded at the time

of booking reflecting the total price due for travel by travelers,

including taxes, fees and other charges, adjusted for cancellations

and refunds.

Lodging Metrics: Reported on a

booked basis except for revenue, which is on a stayed basis.

Lodging consists of both merchant and agency model hotel and

alternative accommodations.

B2C: The B2C segment (formerly

referred to as Retail) provides a full range of travel and

advertising services to our worldwide customers through a variety

of consumer brands including: Expedia, Hotels.com, Vrbo, Orbitz,

Travelocity, Wotif Group, ebookers, Hotwire.com, and

CarRentals.com.

B2B: The B2B segment fuels a wide

range of travel and non-travel companies including airlines,

offline travel agents, online retailers, corporate travel

management and financial institutions, who leverage our leading

travel technology and tap into our diverse supply to augment their

offerings and market Expedia Group rates and availabilities to

their travelers.

trivago: The trivago segment

generates advertising revenue primarily from sending referrals to

online travel companies and travel service providers from its

localized hotel metasearch websites.

Corporate: Includes unallocated

corporate expenses.

Non-GAAP Measures

Expedia Group reports Adjusted EBITDA, Adjusted EBITDA Margin,

Leverage Ratio, Adjusted Net Income (Loss), Adjusted EPS, Free Cash

Flow and Adjusted Expenses (non-GAAP cost of revenue, non-GAAP

selling and marketing, non-GAAP technology and content and non-GAAP

general and administrative), all of which are supplemental measures

to GAAP and are defined by the SEC as non-GAAP financial measures.

These measures are among the primary metrics by which management

evaluates the performance of the business and on which internal

budgets are based. Management believes that investors should have

access to the same set of tools that management uses to analyze our

results. These non-GAAP measures should be considered in addition

to results prepared in accordance with GAAP, but should not be

considered a substitute for or superior to GAAP. Adjusted EBITDA,

Adjusted Net Income (Loss) and Adjusted EPS have certain

limitations in that they do not take into account the impact of

certain expenses to our consolidated statements of operations. We

endeavor to compensate for the limitation of the non-GAAP measures

presented by also providing the most directly comparable GAAP

measures and descriptions of the reconciling items and adjustments

to derive the non-GAAP measures. Adjusted EBITDA, Adjusted Net

Income (Loss) and Adjusted EPS also exclude certain items related

to transactional tax matters, which may ultimately be settled in

cash. We urge investors to review the detailed disclosure regarding

these matters in the Management Discussion and Analysis and Legal

Proceedings sections, as well as the notes to the financial

statements, included in the Company's annual and quarterly reports

filed with the Securities and Exchange Commission. The non-GAAP

financial measures used by the Company may be calculated

differently from, and therefore may not be comparable to, similarly

titled measures used by other companies.

Adjusted EBITDA is defined as net

income (loss) attributable to Expedia Group adjusted for: (1) net

income (loss) attributable to non-controlling interests; (2)

provision for income taxes; (3) total other expenses, net; (4)

stock-based compensation expense, including compensation expense

related to certain subsidiary equity plans; (5) acquisition-related

impacts, including

(i) amortization of intangible assets and

goodwill and intangible asset impairment, (ii) gains (losses)

recognized on changes in the value of contingent consideration

arrangements; and (iii) upfront consideration paid to settle

employee compensation plans of the acquiree;

(6) certain other items, including restructuring; (7) items

included in legal reserves, occupancy tax and other, which includes

reserves for potential settlement of issues related to

transactional taxes (e.g. hotel and excise taxes), related to court

decisions and final settlements, and charges incurred, if any, for

monies that may be required to be paid in advance of litigation in

certain transactional tax proceedings; (8) that portion of gains

(losses) on revenue hedging activities that are included in other,

net that relate to revenue recognized in the period; and (9)

depreciation.

The above items are excluded from our Adjusted EBITDA measure

because these items are non-cash in nature, or because the amount

and timing of these items is unpredictable, not driven by core

operating results and renders comparisons with prior periods and

competitors less meaningful. We believe Adjusted EBITDA is a useful

measure for analysts and investors to evaluate our future on-going

performance as this measure allows a more meaningful comparison of

our performance and projected cash earnings with our historical

results from prior periods and to the results of our competitors.

Moreover, our management uses this measure internally to evaluate

the performance of our business as a whole and our individual

business segments. In addition, we believe that by excluding

certain items, such as stock-based compensation and

acquisition-related impacts, Adjusted EBITDA corresponds more

closely to the cash operating income generated from our business

and allows investors to gain an understanding of the factors and

trends affecting the ongoing cash earnings capabilities of our

business, from which capital investments are made and debt is

serviced.

Adjusted Net Income (Loss)

generally captures all items on the statements of operations that

occur in normal course operations and have been, or ultimately will

be, settled in cash and is defined as net income (loss)

attributable to Expedia Group plus the following items, net of

tax(a): (1) stock-based compensation expense, including

compensation expense related to equity plans of certain

subsidiaries and equity-method investments; (2) acquisition-related

impacts, including;

(i) amortization of intangible assets,

including as part of equity-method investments, and goodwill and

intangible asset impairment; (ii) gains (losses) recognized on

changes in the value of contingent consideration arrangements;

(iii) upfront consideration paid to settle employee compensation

plans of the acquiree; and (iv) gains (losses) recognized on

non-controlling investment basis adjustments when we acquire or

lose controlling interests;

(3) currency gains or losses on U.S. dollar denominated cash;

(4) the changes in fair value of equity investments; (5) certain

other items, including restructuring charges; (6) items included in

legal reserves, occupancy tax and other, which includes reserves

for potential settlement of issues related to transactional taxes

(e.g., hotel occupancy and excise taxes), related court decisions

and final settlements, and charges incurred, if any, for monies

that may be required to be paid in advance of litigation in certain

transactional tax proceedings, including as part of equity method

investments; (7) discontinued operations; (8) the non-controlling

interest impact of the aforementioned adjustment items; and (9)

unrealized gains (losses) on revenue hedging activities that are

included in other, net. Adjusted Net Income (Loss) includes

preferred share dividends. We believe Adjusted Net Income (Loss) is

useful to investors because it represents Expedia Group's combined

results, taking into account depreciation, which management

believes is an ongoing cost of doing business, but excluding the

impact of certain expenses and items not directly tied to the core

operations of our businesses.

(a)Effective January 1, 2023, we changed our methodology for the

computation of the effective tax rate on pretax adjusted net income

to a long-term projected tax rate as our management believes this

tax rate provides better consistency across reporting periods and

produces results that are reflective of Expedia Group’s long-term

effective tax rate. This projected effective tax rate excludes the

income tax effects of Adjusted Net Income items described above and

eliminates the effects of non-recurring and period specific income

tax items which can vary in size and frequency. Based on our

current long-term projections, we are using an effective tax rate

on pretax adjusted net income of 21.5% for 2023.

Adjusted EPS is defined as Adjusted

Net Income (Loss) divided by adjusted weighted average shares

outstanding, which, when applicable, include dilution from our

convertible debt instruments per the treasury stock method for

Adjusted EPS. The treasury stock method assumes we would elect to

settle the principal amount of the debt for cash and the conversion

premium for shares. If the conversion prices for such instruments

exceed our average stock price for the period, the instruments

generally would have no impact to adjusted weighted average shares

outstanding. This differs from the GAAP method for dilution from

our convertible debt instruments, which include them on an

if-converted method. We believe Adjusted EPS is useful to investors

because it represents, on a per share basis, Expedia Group's

consolidated results, taking into account depreciation, which we

believe is an ongoing cost of doing business, as well as other

items which are not allocated to the operating businesses such as

interest expense, taxes, foreign exchange gains or losses, and

minority interest, but excluding the effects of certain expenses

not directly tied to the core operations of our businesses.

Adjusted Net Income (Loss) and Adjusted EPS have similar

limitations as Adjusted EBITDA. In addition, Adjusted Net Income

(Loss) does not include all items that affect our net income (loss)

and net income (loss) per share for the period. Therefore, we think

it is important to evaluate these measures along with our

consolidated statements of operations.

Free Cash Flow is defined as net

cash flow provided by operating activities less capital

expenditures. Management believes Free Cash Flow is useful to

investors because it represents the operating cash flow that our

operating businesses generate, less capital expenditures but before

taking into account other cash movements that are not directly tied

to the core operations of our businesses, such as financing

activities, foreign exchange or certain investing activities. Free

Cash Flow has certain limitations in that it does not represent the

total increase or decrease in the cash balance for the period, nor

does it represent the residual cash flow for discretionary

expenditures. Therefore, it is important to evaluate Free Cash Flow

along with the consolidated statements of cash flows.

Adjusted Expenses (cost of revenue, direct

and indirect selling and marketing, technology and content and

general and administrative expenses) exclude stock-based

compensation related to expenses for stock options, restricted

stock units and other equity compensation under applicable

stock-based compensation accounting standards. Expedia Group

excludes stock-based compensation from these measures primarily

because they are non-cash expenses that we do not believe are

necessarily reflective of our ongoing cash operating expenses and

cash operating income. Moreover, because of varying available

valuation methodologies, subjective assumptions and the variety of

award types that companies can use when adopting applicable

stock-based compensation accounting standards, management believes

that providing non-GAAP financial measures that exclude stock-based

compensation allows investors to make meaningful comparisons

between our recurring core business operating results and those of

other companies, as well as providing management with an important

tool for financial operational decision making and for evaluating

our own recurring core business operating results over different

periods of time. There are certain limitations in using financial

measures that do not take into account stock-based compensation,

including the fact that stock-based compensation is a recurring

expense and a valued part of employees' compensation. Therefore, it

is important to evaluate both our GAAP and non-GAAP measures. See

the Notes to the Consolidated Statements of Operations for

stock-based compensation by line item.

Expedia Group, Inc. (excluding

trivago) In order to provide increased transparency on the

transaction-based component of the business, Expedia Group is

reporting results both in total and excluding trivago.

Tabular Reconciliations for Non-GAAP

Measures

Adjusted EBITDA (Adjusted Earnings Before

Interest, Taxes, Depreciation & Amortization) by Segment(1)

Three months ended December

31, 2023

B2C

B2B

trivago

Corporate &

Eliminations

Total

(In millions)

Operating income (loss)

$

328

$

163

$

4

$

(391

)

$

104

Realized gain (loss) on revenue hedges

7

(2

)

—

—

5

Legal reserves, occupancy tax and

other

—

—

—

2

2

Stock-based compensation

—

—

—

99

99

Intangible and other long-term asset

impairment

—

—

—

114

114

Amortization of intangible assets

—

—

—

15

15

Depreciation

133

32

1

27

193

Adjusted EBITDA(1)

$

468

$

193

$

5

$

(134

)

$

532

Three months ended December

31, 2022

B2C

B2B

trivago

Corporate &

Eliminations

Total

(In millions)

Operating income (loss)

$

260

$

114

$

20

$

(266

)

$

128

Realized gain (loss) on revenue hedges

23

5

—

—

28

Stock-based compensation

—

—

—

94

94

Amortization of intangible assets

—

—

—

22

22

Depreciation

128

23

1

25

177

Adjusted EBITDA(1)

$

411

$

142

$

21

$

(125

)

$

449

Year ended December 31,

2023

B2C

B2B

trivago

Corporate &

Eliminations

Total

(In millions)

Operating income (loss)

$

1,810

$

681

$

51

$

(1,509

)

$

1,033

Realized gain (loss) on revenue hedges

(11

)

4

—

—

(7

)

Legal reserves, occupancy tax and

other

—

—

—

8

8

Stock-based compensation

—

—

—

413

413

Impairment of goodwill

—

—

—

297

297

Intangible and other long-term asset

impairment

—

—

—

129

129

Amortization of intangible assets

—

—

—

59

59

Depreciation

526

113

5

104

748

Adjusted EBITDA(1)

$

2,325

$

798

$

56

$

(499

)

$

2,680

Year ended December 31,

2022

B2C

B2B

trivago

Corporate &

Eliminations

Total

(In millions)

Operating income (loss)

$

1,617

$

518

$

105

$

(1,155

)

$

1,085

Realized gain (loss) on revenue hedges

(2

)

(4

)

—

—

(6

)

Legal reserves, occupancy tax and

other

—

—

—

23

23

Stock-based compensation

—

—

—

374

374

Intangible and other long-term asset

impairment

—

—

—

81

81

Amortization of intangible assets

—

—

—

88

88

Depreciation

509

85

8

102

704

Adjusted EBITDA(1)

$

2,124

$

599

$

113

$

(487

)

$

2,349

(1) Adjusted EBITDA for our B2C and B2B

segments includes allocations of certain expenses, primarily cost

of revenue and facilities, the total costs of our global travel

supply organizations, the majority of platform and marketplace

technology costs, and the realized foreign currency gains or losses

related to the forward contracts hedging a component of our net

merchant lodging revenue. We base the allocations primarily on

transaction volumes and other usage metrics. We do not allocate

certain shared expenses such as accounting, human resources,

certain information technology and legal to our reportable

segments. We include these expenses in Corporate and Eliminations.

Our allocation methodology is periodically evaluated and may

change.

Adjusted EBITDA (Adjusted Earnings Before

Interest, Taxes, Depreciation & Amortization)

Three months ended

December 31,

Year ended

December 31,

2023

2022

2023

2022

(In millions)

Net income attributable to Expedia Group,

Inc.

$

132

$

177

$

797

$

352

Net income (loss) attributable to

non-controlling interests

4

(2

)

(109

)

(9

)

Provision for income taxes

35

8

330

195

Total other (income) expense, net

(67

)

(55

)

15

547

Operating income

104

128

1,033

1,085

Gain (loss) on revenue hedges related to

revenue recognized

5

28

(7

)

(6

)

Legal reserves, occupancy tax and

other

2

—

8

23

Stock-based compensation

99

94

413

374

Depreciation and amortization

208

199

807

792

Impairment of goodwill

—

—

297

—

Intangible and other long-term asset

impairment

114

—

129

81

Adjusted EBITDA

$

532

$

449

$

2,680

$

2,349

Net income margin(1)

4.6

%

6.8

%

6.2

%

3.0

%

Adjusted EBITDA margin(1)

18.5

%

17.2

%

20.9

%

20.1

%

Long-term debt

$

6,253

$

6,240

Long-term debt to net income ratio

7.8

17.7

Long-term debt

$

6,253

$

6,240

Unamortized discounts and debt issuance

costs

41

54

Adjusted debt

$

6,294

$

6,294

Leverage ratio(2)

2.3

2.7

(1) Net income and Adjusted EBITDA margins

represent net income (loss) attributable to Expedia Group, Inc. or

Adjusted EBITDA divided by revenue.

(2) Leverage ratio represents adjusted

debt divided by TTM Adjusted EBITDA.

Adjusted Net Income (Loss) & Adjusted

EPS

Three months ended

December 31,

Year ended

December 31,

2023

2022

2023

2022

(In millions, except share and

per share data)

Net income attributable to Expedia Group,

Inc.

$

132

$

177

$

797

$

352

Less: Net (income) loss attributable to

non-controlling interests

(4

)

2

109

9

Less: Provision for income taxes

(35

)

(8

)

(330

)

(195

)

Income before income taxes

171

183

1,018

538

Amortization of intangible assets

15

22

59

88

Stock-based compensation

99

94

413

374

Legal reserves, occupancy tax and

other

2

—

8

23

Impairment of goodwill

—

—

297

—

Intangible and other long-term asset

impairment

114

—

129

81

Unrealized (gain) loss on revenue

hedges

2

12

13

(3

)

(Gain) loss on minority equity

investments, net

(89

)

(78

)

(16

)

345

Gain on debt extinguishment, net

—

—

—

(49

)

TripAdvisor tax indemnification

adjustment

—

—

(67

)

—

Gain on sale of business, net

(1

)

(4

)

(25

)

(6

)

Adjusted income before income taxes

313

229

1,829

1,391

GAAP Provision for income taxes

(35

)

(8

)

(330

)

(195

)

Provision for income taxes for

adjustments

(32

)

(26

)

(63

)

(100

)

Total Adjusted provision for income

taxes

(67

)

(34

)

(393

)

(295

)

Total Adjusted income tax rate

21.5

%

14.8

%

21.5

%

21.2

%

Non-controlling interests

(4

)

1

(18

)

(24

)

Adjusted net income attributable to

Expedia Group, Inc.

$

242

$

196

$

1,418

$

1,072

GAAP diluted weighted average shares

outstanding (000's)

144,470

159,532

150,228

161,751

Adjustment to dilutive securities

(000's)

(3,921

)

(3,921

)

(3,921

)

(3,921

)

Adjusted weighted average shares

outstanding (000's)

140,549

155,611

146,307

157,830

GAAP diluted earnings per share

$

0.92

$

1.11

$

5.31

$

2.17

Adjusted earnings per share attributable

to Expedia Group, Inc.

$

1.72

$

1.26

$

9.69

$

6.79

Ex-trivago Adjusted Net Income and

Adjusted EPS

Adjusted net income attributable to

Expedia Group, Inc.

$

242

$

196

$

1,418

$

1,072

Less: Adjusted net income attributable to

trivago

2

3

27

49

Adjusted net income excluding trivago

$

240

$

193

$

1,391

$

1,023

Adjusted earnings per share attributable

to Expedia Group, Inc.

$

1.72

$

1.26

$

9.69

$

6.79

Less: Adjusted earnings per share

attributable to trivago

0.01

0.02

0.18

0.31

Adjusted earnings per share excluding

trivago

$

1.71

$

1.24

$

9.50

$

6.48

Free Cash Flow

Three months ended

December 31,

Year ended

December 31,

2023

2022

2023

2022

(In millions)

Net cash provided by (used in) operating

activities

$

(238

)

$

(182

)

$

2,690

$

3,440

Less: Total capital expenditures

(177

)

(177

)

(846

)

(662

)

Free cash flow

$

(415

)

$

(359

)

$

1,844

$

2,778

Adjusted Expenses (Cost of revenue, direct

and indirect selling and marketing, technology and content and

general and administrative expenses)

Three months ended

December 31,

Year ended

December 31,

2023

2022

2023

2022

(In millions)

Cost of revenue

$

340

$

412

$

1,573

$

1,657

Less: stock-based compensation

4

4

14

14

Adjusted cost of revenue

$

336

$

408

$

1,559

$

1,643

Less: trivago cost of revenue(1)

3

4

17

17

Adjusted cost of revenue excluding

trivago

$

333

$

404

$

1,542

$

1,626

Selling and marketing expense - direct

$

1,370

$

1,199

$

6,107

$

5,428

Less: trivago selling and marketing

expense - direct(2)

32

22

173

160

Adjusted selling and marketing expense

excluding trivago - direct

$

1,338

$

1,177

$

5,934

$

5,268

Selling and marketing expense -

indirect

$

193

$

177

$

756

$

672

Less: stock-based compensation

19

17

79

67

Adjusted selling and marketing expense -

indirect

$

174

$

160

$

677

$

605

Less: trivago selling and marketing

expense - indirect(1)

3

2

11

12

Adjusted selling and marketing expense

excluding trivago - indirect

$

171

$

158

$

666

$

593

Technology and content expense

$

357

$

317

$

1,358

$

1,181

Less: stock-based compensation

33

29

138

111

Adjusted technology and content

expense

$

324

$

288

$

1,220

$

1,070

Less: trivago technology and content

expense(1)

12

11

46

47

Adjusted technology and content expense

excluding trivago

$

312

$

277

$

1,174

$

1,023

General and administrative expense

$

199

$

186

$

771

$

748

Less: stock-based compensation

43

44

182

182

Adjusted general and administrative

expense

$

156

$

142

$

589

$

566

Less: trivago general and administrative

expense(1)

10

7

34

30

Adjusted general and administrative

expense excluding trivago

$

146

$

135

$

555

$

536

Total adjusted overhead expenses(3)

$

654

$

590

$

2,486

$

2,241

Note: Some numbers may not add due to

rounding.

(1) trivago amount presented without

stock-based compensation as those are included with the

consolidated totals above.

(2) Selling and marketing expense adjusted

to add back B2C direct marketing spend on trivago eliminated in

consolidation.

(3) Total adjusted overhead expenses is

the sum of adjusted expenses for Selling and marketing - indirect,

Technology and content, and General and administrative.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This release may contain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties. These forward-looking

statements are based on assumptions that are inherently subject to

uncertainties, risks and changes in circumstances that are

difficult to predict. The use of words such as “believe,”

“estimate,” “expect” and “will,” or the negative of these terms or

other similar expressions, among others, generally identify

forward-looking statements. However, these words are not the

exclusive means of identifying such statements. In addition, any

statements that refer to expectations, projections or other

characterizations of future events or circumstances are

forward-looking statements and may include statements relating to

future revenues, expenses, margins, profitability, net income

(loss), earnings per share and other measures of results of

operations and the prospects for future growth of Expedia Group,

Inc.’s business. Actual results may differ materially from the

results predicted and reported results should not be considered as

an indication of future performance. The potential risks and

uncertainties that could cause actual results to differ from the

results predicted include, among others, those described in the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of our most

recently filed periodic reports on Form 10-K and Form 10-Q, which

are available on our investor relations website at

ir.expediagroup.com and on the SEC website at www.sec.gov. All

information provided in this release is as of February 8, 2024.

Undue reliance should not be placed on forward-looking statements

in this release, which are based on information available to us on

the date hereof. We undertake no duty to update this information

unless required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208053551/en/

Investor Relations ir@expediagroup.com

Communications press@expediagroup.com

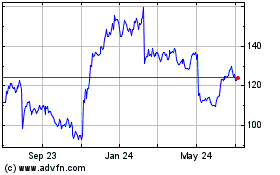

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Jan 2025 to Feb 2025

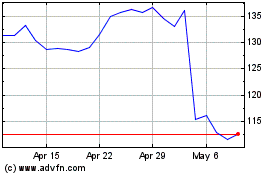

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Feb 2024 to Feb 2025