Freedom Holding Corp. Reports Strong Revenue Growth in Q3 2025 Fiscal Year, Driven by Brokerage and Banking Segments

February 07 2025 - 8:33AM

Freedom Holding Corp. (NASDAQ: FRHC), a U.S.-based financial

services company, has announced its financial results for the

quarter ended December 31, 2024. The holding company reported a 57%

increase in total revenue, with revenues reaching $655.2 million

compared to $418.6 million in the same quarter of 2023. Total

assets increased to $9.1 billion from $8.3 billion as of March 31,

2024.

The company’s revenue has surged due to the increase of net gain

on trading securities, which has risen from a $5.1 million loss to

a $89.6 million gain. Additionally, company’s performance was

significantly bolstered by its insurance underwriting income, which

surged by 125% to $177.5 million, reflecting the expansion of

pension annuities and accident insurance operations. The banking

segment also demonstrated robust growth, with a 47% increase in

revenue compared to the same period last year.

"In the era of globalization, we are building the Freedom

ecosystem as a unified platform where diverse business segments —

ranging from banking and insurance to lifestyle services —

seamlessly interact to serve over 7 million clients. Recently, the

holding’s revenue has become significantly more diversified; while

brokerage was once the primary income driver, revenue is now evenly

distributed across the insurance and banking segments, creating a

more stable and balanced ecosystem," Timur Turlov, the founder of

Freedom Holding, said.

Segment Performance

Brokerage: Revenue increased by 29% to $213.3

million, driven by an increase in net gains on trading securities

and fee and commission income.

Banking: Revenue rose by 47% to $206.4

million, supported by net gains on trading securities and

derivatives.

Insurance: Revenue doubled to $197.8

million, reflecting strategic growth in insurance underwriting

income.

Other Segments: Revenue grew by 120% to

$37.7 million, largely due to net gains on foreign exchange

operations.

Despite strong revenue growth, the company's net income declined

by 19% to $78.1 million, compared to $96.1 million in the previous

year’s quarter. This was due to increased fees and commission

expenses, general and administrative expenses, payroll and bonuses,

advertising costs and stock-based compensation expenses. Total

expenses for the quarter amounted to $556.9 million, up from $307.0

million in Q3 2024 fiscal year.

During the same period, fee and commission income increased from

$120.2 million to $143.4 million.

Freedom Holding Corp. remains committed to expanding its product

portfolio, improving operational efficiencies, capitalizing on

emerging market opportunities, and considering selective

acquisitions. In October 2024, the company acquired EliteCom, a

telecommunications services company, for $3 million. The acquired

licenses and assets will be used to develop Freedom Holding's own

telecommunications business.

About Freedom Holding Corp.

Freedom Holding Corp. is an international financial and

investment services group specializing in capital markets, asset

management, and brokerage services.

Freedom Holding Corp.'s common shares are registered with the

United States Securities and Exchange Commission and trade on the

Nasdaq Capital Market under the symbol FRHC. The Company has its

principal market of operation in Kazakhstan and operates through

its subsidiaries in 22 countries. With a strong presence in Central

Asia, Europe, and the U.S., the company is committed to delivering

innovative financial products to individual and institutional

investors.

For more information, visit www.freedomholdingcorp.com

Natalia Kharlashina

PR Department

Freedom Holding Corp.

prglobal@ffin.kz

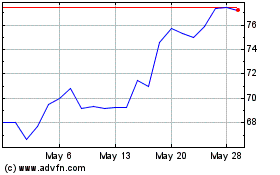

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Jan 2025 to Feb 2025

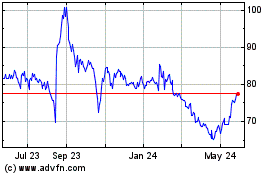

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Feb 2024 to Feb 2025