Ethanol Producers Facing Negative Profit Margins as Recent Drought Sends Corn Prices Soaring

August 17 2012 - 7:20AM

Marketwired

Skyrocketing corn prices and lower gasoline demand in the U.S. has

seen profits of ethanol producers drop drastically. Producers have

begun to idle plants and/or slow production as a result. "Even the

most profitable plants out there are barely breaking even in the

current environment," said Matthew Farwell, a New York-based

analyst for Imperial Capital LLC. Five Star Equities examines the

outlook for companies in the Ethanol Industry and provides equity

research on Pacific Ethanol Inc. (NASDAQ: PEIX) and Gevo, Inc.

(NASDAQ: GEVO).

Access to the full company reports can be found at:

www.FiveStarEquities.com/PEIX

www.FiveStarEquities.com/GEVO

Ethanol producers have battled record high corn prices, and

tight domestic supply. The drought in the Farm Belt has drove

corn-futures to an all-time high in July. Prices have relaxed a bit

since then but have still surged over 40 percent since early June.

It is estimated that approximately 40 percent of the nation's corn

output is consumed by the ethanol sector. Major producer Archer

Daniels Midland recently stated that their ethanol margins had

crumbled to a loss of over 20 cents per gallon.

Five Star Equities releases regular market updates on the

Ethanol Industry so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.FiveStarEquities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

Pacific Ethanol's mission is to be the leading marketer and

producer of low-carbon renewable fuels in the Western United

States. Pacific Ethanol owns a 34% interest in and operates four

ethanol plants in the Western United States with a combined

operating capacity of 200 million gallons. The company recently

reported net sales in the second quarter of 2012 were $205.4

million, compared to $214.6 million in the second quarter of

2011.

Gevo is a leading renewable chemical and advanced biofuels

company. They are developing bio-based alternatives to

petroleum-based products using a combination of synthetic biology

and chemistry. The company retrofits existing ethanol plants to

make isobutanol, a second-generation biofuel.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.FiveStarEquities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

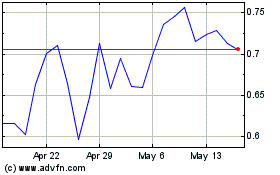

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jul 2023 to Jul 2024