UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Check the appropriate box:

| ☐ |

Preliminary Information Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☒ |

Definitive Information Statement |

GROM SOCIAL ENTERPRISES, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) |

(1) Title

of each class of securities to which transaction applies:

(2) Aggregate

number of securities to which transaction applies:

(3) Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

(4) Proposed

maximum aggregate value of transaction:

(5) Total

fee paid:

| ☐ |

Fee paid previously with preliminary materials. |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount

previously paid:

(2) Form,

Schedule, or Registration Statement No.:

(3) Filing

Party:

(4) Date

Filed:

2060 NW Boca Raton Blvd., Suite #6

Boca Raton, FL 33431

NOTICE OF ACTION BY WRITTEN CONSENT OF STOCKHOLDERS

AND INFORMATION STATEMENT

December 1,

2023

Dear Shareholders:

The enclosed Information Statement is being furnished

to the holders of record of the shares of the common stock, with a par value of $0.001 per share (the “Common Stock”), and

Series C 8% convertible preferred stock, with a par value of $0.001 per share (the “Series C Stock”), of Grom Social Enterprises,

Inc., a Florida corporation (the “Company”), as of the close of business on the record date, November 8, 2023 (the “Record

Date”). The purpose of this Information Statement is to notify our shareholders that on November 20, 2023, the Company received

a written consent in lieu of a meeting (the “Board Consent”) from the members of the board of directors of the Company (the

“Board”) and on November 21, 2023, the Company received a written consent in lieu of a meeting from the holders of approximately

77% of the voting stock (the “Consenting Shareholders”) of the Company (the “Shareholder Consent”, and together

with the Board Consent, the “Written Consents”).

On November 9, 2023, the Company entered into

a Securities Purchase Agreement (as amended on November 20, 2023, the “SPA”) with Generating Alpha Ltd., a Saint Kitts and

Nevis Corporation (the “Investor”) pursuant to which the Company has agreed to sell two convertible promissory notes of the

Company (each, a “Note” and collectively, the “Notes”), with each Note having an initial principal amount of $4,000,000,

for a price of $3,640,000 per Note. In connection with the purchase and sale of the Notes, the Company has agreed to issue to the Investor

warrants (each, a “Warrant” and collectively, the “Warrants”) to acquire a total of 3,028,146 shares of the Common

Stock (the issuance of the Warrants together with the purchase and sale of the Notes, the “Transactions”).

The Written Consents approved the SPA and the

Transactions.

You are urged to read this Information Statement

in its entirety for a description of the actions taken by the Consenting Shareholders of the Company. The actions will become effective

on a date that is not earlier than twenty (20) calendar days after this Information Statement is first mailed to our shareholders.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The enclosed

Information Statement is being furnished to you to inform you that the foregoing actions have been approved by the Consenting Shareholders.

Because the Consenting Shareholders have voted in favor of the foregoing actions, and have sufficient voting power to approve such actions,

no other shareholder consents will be solicited in connection with the transactions described in this Information Statement. The Board

is not soliciting your proxy, and proxies are not requested from shareholders.

This Information Statement is being mailed on

or about December 1, 2023 to shareholders of record on the Record Date.

| |

Sincerely, |

| |

|

| |

/s/ Darren Marks |

| |

Darren Marks |

| |

Chief Executive Officer |

2060 NW Boca Raton Blvd., Suite #6

Boca Raton, Florida 33431

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

_____________________________________

NO VOTE OR OTHER ACTION OF THE COMPANY’S

SHAREHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

The enclosed Information Statement is being furnished

to the holders of record of the shares of the common stock, with a par value of $0.001 per share (the “Common Stock”), and

Series C 8% convertible preferred stock, with a par value of $0.001 per share (the “Series C Stock”), of Grom Social Enterprises,

Inc., a Florida corporation (the “Company”), as of the close of business on the record date, November 8, 2023 (the “Record

Date”). The purpose of this Information Statement is to notify our shareholders that on November 20, 2023, the Company received

a written consent in lieu of a meeting (the “Board Consent”) from the members of the board of directors of the Company (the

“Board”) and on November 21, 2023, the Company received a written consent in lieu of a meeting from the holders of approximately

77% of the voting stock (the “Consenting Shareholders”) of the Company (the “Shareholder Consent”, and together

with the Board Consent, the “Written Consents”).

On November 9, 2023, the Company entered into

a Securities Purchase Agreement (as amended on November 20, 2023, the “SPA”) with Generating Alpha Ltd., a Saint Kitts and

Nevis Corporation (the “Investor”) pursuant to which the Company has agreed to sell two convertible promissory notes of the

Company (each, a “Note” and collectively, the “Notes”), with each Note having an initial principal amount of $4,000,000,

for a price of $3,640,000 per Note. In connection with the purchase and sale of the Notes, the Company has agreed to issue to the Investor

warrants (each, a “Warrant” and collectively, the “Warrants”) to acquire a total of 3,028,146 shares of the Common

Stock (the issuance of the Warrants together with the purchase and sale of the Notes, the “Transactions”).

The Written Consents approved the SPA and the

Transactions.

The actions will become effective on a date that

is not earlier than twenty (20) calendar days after this Information Statement is first mailed to our shareholders.

Because the Consenting Shareholders have voted

in favor of the foregoing actions, and have sufficient voting power to approve such actions, no other shareholder consents will be solicited

in connection with the transactions described in this Information Statement. The Board is not soliciting proxies in connection with the

adoption of these actions, and proxies are not requested from shareholders.

In accordance with our bylaws, our Board has fixed

the close of business on November 8, 2023 as the record date for determining the shareholders entitled to notice of the above noted actions.

This Information Statement is being mailed on or about December 1, 2023 to shareholders of record on the Record Date.

Under Florida law, shareholders have no appraisal

or dissenters’ rights in connection with the matters described in this Information Statement and we will not independently provide

our shareholders with any such right.

VOTE REQUIRED; MANNER OF APPROVAL

Approval to authorize the Board to implement the

SPA and the Transactions requires the affirmative vote of the holders of a majority of the voting power of the Company. In accordance

with the Company’s bylaws, the Board has fixed November 8, 2023, as the Record Date for determining the shareholders entitled to

vote or give written consent.

As of the Record Date, there were (i) 1,967,829

shares of Common Stock outstanding, with each share of Common Stock entitled to one vote, (ii) no shares of Series A preferred stock and

Series B preferred stock outstanding, and (iii) 9,281,809 shares of Series C Stock outstanding. The holders of Series C Stock vote together

as a single class with the holders of the Common Stock and the holders of any other class or series of shares entitled to vote with the

Common Stock. Darren Marks, Chief Executive Officer and Chairman of the Board, holds proxies from holders of approximately 88% of the

shares of Series C Stock granting Mr. Marks the power to vote all of the shares held by such holders of Series C Stock until May 20, 2025.

As a result, as of the Record Date, Mr. Marks has 77.3% of the Company’s combined voting power. On November 21, 2023, by delivery

of the Shareholder Consent, Mr. Marks and other Consenting Shareholders approved the SPA and the Transactions, by providing written consents

as to 3,716 votes and 12,730,976 votes, respectively, representing an aggregate of 12,734,692 votes, or approximately 77% of the voting

capital of the Company. Accordingly, the majority of votes necessary to authorize the SPA and the Transactions was received.

No other shareholder consents will be solicited

in connection with the transactions described in this Information Statement. The Board is not soliciting proxies in connection

with the adoption of these proposals, and proxies are not requested from shareholders.

Under Section 607.0704 of the Florida Business

Corporation Act (“FBCA”), shareholders may take action without a meeting of the shareholders, and without prior notice, if

a consent or consents in writing, setting forth the action so taken, is signed by the holders of the outstanding voting shares holding

not less than the minimum number of votes that would be necessary to approve such action at a shareholders meeting. The action is

effective when written consents from holders of record of a majority of the outstanding shares of voting stock are executed and delivered

to the Company. This Information Statement constitutes notice to you under Section 607.0704 of the FBCA of the actions taken by the Written

Consents. On November 20, 2023, the Board, and on November 21, 2023, the Consenting Shareholders executed and delivered to the Company

their respective Written Consents. Accordingly, in compliance with the FBCA, at least a majority of the total voting stock of the Company

have approved the SPA and the Transactions. As a result, no vote or proxy is required by the shareholders to approve the adoption of such

actions.

This Information Statement is being furnished

to all holders of the Company’s Common Stock and Series C Stock pursuant to Section 14(c) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, solely for the purpose of informing

shareholders of these corporate actions before they take effect. In accordance with Exchange Act Rule 14c-2, the Shareholder Consent will

become effective no sooner than 20 calendar days following the mailing of this Information Statement.

THE SPA AND THE TRANSACTIONS

General

On November 9, 2023, the Company entered into

a Securities Purchase Agreement (as amended on November 20, 2023, the “SPA”) with Generating Alpha Ltd., a Saint Kitts and

Nevis Corporation (the “Investor”) pursuant to which the Company has agreed to sell two convertible promissory notes of the

Company (each, a “Note” and collectively, the “Notes”), with each Note having an initial principal amount of $4,000,000,

for a price of $3,640,000 per Note. In connection with the purchase and sale of the Notes, the Company has agreed to issue to the Investor

warrants (each, a “Warrant” and collectively, the “Warrants”) to acquire a total of 3,028,146 shares of the Common

Stock (the issuance of the Warrants together with the purchase and sale of the Notes, the “Transactions”). Capitalized words

and phrases not otherwise defined herein have the meanings assigned thereto in the SPA.

Note Terms

The Note in the aggregate principal amount of $4,000,000 has five (5)

year maturity with an interest at nine (9) percent per calendar year and carries a nine (9) percent of original issue discount. The Company

has agreed to make amortization payments each month in the amount of $83,033.42 in cash or in kind.

The Note is convertible at the discretion of the Investor into Common

Stock at a price of $1.50. The Investor may choose the alternate conversion price equal to 85% of the average of the three lowest trading

prices during the previous ten (10) trading day period ending on the latest complete trading day prior to notice of conversion.

The conversion price is subject to full ratchet anti-dilution protections

in the event that the Company issues any Common Stock at a per share price (each a “Dilutive Price”) lower than the conversion

price then in effect, provided, however, that Investor shall have the sole discretion in deciding whether to utilize such Dilutive Price

instead of the conversion price otherwise in effect at the time of the respective conversion.

In the event of default, the conversion price shall be equal to seventy

(70) percent multiplied by the lower of (i) the lowest intraday trading price in the forty (40) trading days prior to the applicable conversion

date or (ii) the lowest closing bid price in the forty (40) trading days prior to the applicable conversion date.

Warrant Terms

Pursuant to the SPA, the issuance of the Notes

and the Warrants shall occur at two closings (the “First Closing” and the “Second Closing”, each a “Closing”).

The Warrants to be issued at the First Closing shall be (i) a Warrant for 757,036 shares of Common Stock with an exercise price of $1.78

per share of Common Stock and (ii) a Warrant for 757,036 shares of Common Stock with an exercise price of $.001 per share of Common Stock

(together, the “First Closing Warrants”). The Warrants to be issued at the Second Closing shall be (i) a Warrant for 757,036

shares of Common Stock with an exercise price of $1.78 per share of Common Stock and (ii) a Warrant for 757,036 shares of Common Stock

with an exercise price of $.001 per share of Common Stock (together, the “Second Closing Warrants”).

Subject to the terms and conditions set forth in the SPA, the First

Closing shall occur on the first business day following the receipt of the Shareholder Approval, and the Second Closing shall occur thirty-five

(35) business days following the date that the Registration Statement (as defined below) has been declared effective by the Securities

and Exchange Commission (the “SEC”).

Registration Rights

Pursuant to the Registration Rights Agreement (the “Registration

Rights Agreement”), the Company is required to file a registration statement (the “Registration Statement”) with the

SEC five (5) days following the date that the Shareholder Approval has been obtained, and go effective no later than the sixtieth (60th)

calendar day following the filing date, provided, however, that in the event the Company is notified by the SEC that the Registration

Statement will not be reviewed or is no longer subject to further review and comments, the effectiveness date as to such Registration

Statement shall be the fifth (5th) trading day following the date on which the Company is so notified if such date precedes the dates

otherwise required above.

Shareholder Approval

Pursuant to the SPA, the Company has agreed to

secure shareholder approval (the “Shareholder Approval”) for the SPA and the Transactions at a special meeting or via a written

consent in lieu of a meeting.

Accordingly, the Board of Directors has solicited

the Shareholder Approval to comply with the terms of the SPA in connection with the Transactions.

No Appraisal Rights

Under the FBCA, our shareholders are not entitled

to appraisal rights with respect to the SPA or the Transactions, and we will not independently provide our shareholders with any such

rights.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table lists, as of November 8, 2023,

the number of shares of Common Stock and Series C Stock beneficially owned by (i) each person, entity or group (as that term is used in

Section 13(d)(3) of the Exchange Act) known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock

or Series C Stock; (ii) each of our directors; (iii) each of our executive officers; and (iv) all executive officers and directors as

a group. Information relating to beneficial ownership of our Common Stock and Series C Stock by our principal stockholders and management

is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the SEC. Under

these rules, a person is deemed to be a beneficial owner of a security if that person directly or indirectly has or shares voting power,

which includes the power to vote or direct the voting of the security, or investment power, which includes the power to dispose or direct

the disposition of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to

acquire beneficial ownership within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same

securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest.

Except as noted below, each person has sole voting and investment power with respect to the shares beneficially owned and each stockholder’s

address is c/o Grom Social Enterprises, Inc., 2060 NW Boca Raton Blvd., Suite #6, Boca Raton, Florida, 33431.

The percentages below are calculated based on

1,967,829 shares of common stock and 9,281,809 shares of Series C Stock issued and outstanding as of November 8, 2023.

| Name of Beneficial Owner | |

Common

Stock | |

|

Percentage of

Common

Stock | |

Series C

Preferred

Stock | | |

Percentage

of

Series C

Stock | | |

Combined

Voting

Power | |

| Executive Officers and Directors: | |

| | |

|

| |

| | | |

| | | |

| | |

| Darren Marks | |

| 1,187 | (1) |

|

* | |

| – | | |

| – | | |

| 77.3% | (9) |

| Melvin Leiner | |

| 30 | (2) |

|

* | |

| – | | |

| – | | |

| * | |

| Jason Williams | |

| 17 | |

|

* | |

| – | | |

| – | | |

| * | |

| Robert Stevens | |

| 14 | (3) |

|

* | |

| – | | |

| – | | |

| * | |

| Norman Rosenthal | |

| 16 | (4) |

|

* | |

| – | | |

| – | | |

| * | |

| Thomas J. Rutherford | |

| 129 | |

|

* | |

| – | | |

| – | | |

| * | |

| All officers and directors as a group (6 persons) | |

| 1,393 | (5) |

|

* | |

| – | | |

| – | | |

| 77.3% | (10) |

| | |

| | |

|

| |

| | | |

| | | |

| | |

| 5% or Greater Holders: | |

| | |

|

| |

| | | |

| | | |

| | |

Denis J. Kerasotes

31 Fairview Lane

Springfield, Illinois 62711 | |

| * | (6) |

|

* | |

| 3,816,105 | (11) | |

| 41.1% | | |

| – | |

| | |

| | |

|

| |

| | | |

| | | |

| | |

Condor Equities, LLC (6)

2535 Webb Girth Road

Gainesville, Georgia 30507 | |

| * | (8) |

|

* | |

| 3,131,300 | (11) | |

| 33.7% | | |

| – | |

| | |

| | |

|

| |

| | | |

| | | |

| | |

Section 3 Developments (7)

2415 Alta Monte Drive

Cedar Park, Texas 78613 | |

| * | |

|

* | |

| 520,000 | (11) | |

| 5.6% | | |

| – | |

| | |

| | |

|

| |

| | | |

| | | |

| | |

Eileen F. Kerasotes Family Trust (8)

4747 County Road 501

Bayfield, CO 81122 | |

| * | |

|

* | |

| 472,420 | (11) | |

| 5.0% | | |

| – | |

* Less than 1%

(1) Represents 1,187 shares of common stock held

by Family Tys, LLC (“Family Tys”), of which Mr. Marks is the managing member and over which Mr. Marks has voting and dispositive

power. Does not include an aggregate of (i) 8,147,825 shares of Series C Stock (with 1.5625 votes per share, or 12,730,976 votes in the

aggregate) and (ii) 2,353 shares of common stock, for which Mr. Marks has a voting proxy until May 20, 2025.

(2) Represents 30 shares of common stock held

by 4 Life LLC (“4 Life”), of which Mr. Leiner is the managing member and over which Mr. Leiner has voting and dispositive

power. On April 22, 2022, Melvin Leiner resigned from his positions as the Company’s Chief Operating Officer, Executive Vice President

and Director.

(3) Represents shares held by Thistle Investments,

LLC, of which Mr. Stevens is managing member and over which Mr. Stevens has sole voting and dispositive power.

(4) Represents shares held by Tempest Systems,

Inc., of which Mr. Rosenthal is chief executive officer and over which Mr. Rosenthal has sole voting and dispositive power.

(5) Does not include an aggregate of (i) 8,147,825

shares of Series C Stock (with 1.5625 votes per share, or 12,730,976 votes in the aggregate), and (ii) 2,353 shares of common stock, for

which Mr. Marks has a voting proxy until May 20, 2025.

(6) Dale Nabb, manager of Condor Equities, LLC

(“Condor”), has sole voting and dispositive power of the shares held by Condor.

(7) Michael Tapajna, chief executive officer of

Section 3 Developments, Inc. (“Section 3”), has sole voting and dispositive power of the shares held by Section 3.

(8) John G. Kerasotes, as trustee of the Eileen

F. Kerasotes Trust, has sole voting and dispositive power over the shares held by such Trust.

(9) Based upon (i) 1,187 shares of common stock

held by Family Tys of which Mr. Marks is the managing member and over which Mr. Marks has voting and dispositive power and (ii) the voting

rights to an aggregate of (A) 2,353 shares of common stock held by certain holders of our Series C Stock, and (B) 8,147,825 shares of

Series C Stock, having the right to 1.5625 votes for each share of Series B Stock for which Mr. Marks has a voting proxy until May 20,

2025.

(10) Includes 9,281,809 shares of Series C Stock

(with 1.5625 votes per share, or 14,502,827 votes in the aggregate).

(11) Darren Marks, the Company’s Chief Executive

Officer, President, and a director, has the voting rights to such shares of Series C Stock and common stock until May 20, 2025, pursuant

to voting proxies from such shareholders.

INTEREST OF CERTAIN PERSONS IN OR IN

OPPOSITION TO MATTERS TO BE ACTED UPON

Except in their capacity as shareholders (which

interest does not differ from that of the other holders of Company’s Common Stock), none of our officers, directors or any of their

respective affiliates or associates will have any interest in the SPA or the Transactions.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this Information Statement, which means that we can disclose important information to you by referring you to other documents

that we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this Information

Statement. This Information Statement incorporates by reference the following documents:

| |

4. |

Our Current Reports on

Form 8-K, dated August 8, 2023, September

7, 2023, September 12, 2023, November

9, 2023, and November 20, 2023, filed with the SEC on August 10, 2023, September 11, 2023, September 12, 2023, November

15, 2023, and November 21, 2023. |

WHERE YOU CAN FIND MORE INFORMATION

You may read and copy any reports,

statements or other information filed by us at the public reference facilities maintained by the SEC in Room 1590, 100 F

Street, N.E., Washington, D.C. 20549. The SEC maintains a website that contains reports, proxy and information statements and other

information, including those filed by us, at http://www.sec.gov. You may also access the SEC filings and obtain other

information about us through our website, which is http://www.gromsocial.com. The information contained on the website is not

incorporated by reference in, or in any way part of, this Information Statement.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING

AN ADDRESS

The Company will provide without charge to

each person, including any beneficial owner of such person, to whom a copy of this Information Statement has been delivered, on

written or oral request, within one business day of receipt of such request, a copy of any and all of the documents referred to

above that have been or may be incorporated by reference herein other than exhibits to such documents (unless such exhibits are

specifically incorporated by reference herein). Requests should be directed to Grom Social Enterprises, Inc. c/o Jason Williams at

the below address or telephone number.

If hard copies of the materials are requested,

we will send only one Information Statement and other corporate mailings to shareholders who share a single address unless we received

contrary instructions from any shareholder at that address. This practice, known as “householding”, is designed to reduce

our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of this Information

Statement to a shareholder at a shared address to which a single copy of this Information Statement was delivered. You may make such a

written or oral request by sending a written notification stating (a) your name, (b) your shared address, and (c) the address to which

the Company should direct the additional copy of this Information Statement, to Grom Social Enterprises, Inc. c/o Jason Williams at the

below address or telephone number. Additionally, if current shareholders with a shared address received multiple copies of this Information

Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to shareholders at the shared address,

notification of such request may also be made in the same manner by mail or telephone to the Company’s principal executive offices.

FORWARD-LOOKING STATEMENTS

This Information Statement may contain certain

“forward-looking” statements (as that term is defined in the Private Securities Litigation Reform Act of 1995 or by the SEC

in its rules, regulations, and releases) representing our expectations or beliefs regarding us. These forward-looking statements include,

but are not limited to, statements concerning our operations, economic performance, financial condition, and prospects and opportunities.

For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements.

Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,”

“anticipate,” “intend,” “could,” “estimate,” “might,” or “continue”

or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements,

by their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially

depending on a variety of important factors, including factors discussed in this and other of our filings with the SEC.

OTHER MATTERS

The Board knows of no other matters other than

those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the

Company’s voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION

STATEMENT, PLEASE CONTACT:

Grom Social Enterprises, Inc.

2060 NW Boca Raton Blvd., Suite #6

Boca Raton, Florida 33431

(561) 287-5776

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR YOUR

VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF CERTAIN TRANSACTIONS ENTERED INTO BY THE COMPANY.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

| |

By Order of the Board,

|

|

| |

|

|

| |

/s/ Darren Marks |

|

| |

Darren Marks |

|

| |

Chief Executive Officer |

|

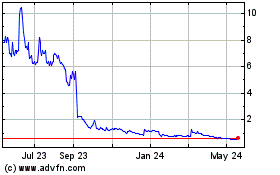

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Jan 2025 to Feb 2025

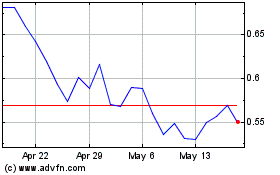

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Feb 2024 to Feb 2025