Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-271324

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated April 18, 2023)

5,044,885

SHARES OF COMMON STOCK

We

are offering to certain institutional and accredited investors 5,044,885 shares of

our common stock, par value $0.001 per share (“common stock”) in a registered direct offering, at an offering price of $3.035

per share and accompanying Common Warrant (as defined below).

In

a concurrent private placement, we are also selling to such investors unregistered warrants to purchase up to 5,044,885

shares of our common stock (the “Common Warrants” and the shares of common stock issuable upon the exercise

of the Common Warrants, the “Common Warrant Shares”), which represents 100% of the number of shares of our common stock

being purchased in this offering. Each Common Warrant will be exercisable for one share of our common stock at an exercise price of $2.91

per share, will be immediately exercisable, and will have a term of five years from the initial issuance date.

At any time after the date that is 120 days following the closing of this offering, the Common Warrants can be exercised on a cashless

basis if there is no effective registration statement registering, or no current prospectus available for, the resale of the Common Warrant

Shares. Additionally, at any time following receipt of approval of our stockholders, the Common Warrants may be “alternatively

cashlessly exercised,” pursuant to which holders may receive a number of Warrant Shares equal to the product of (i) the number

of Common Warrant Shares they would have received had the Common Warrant been exercised for cash and (ii) 0.75. The Common Warrants

and the Common Warrant Shares are not being registered under the Securities Act of 1933, as amended (the “Securities Act”)

and are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder,

and are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

Our

common stock is currently listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “GWAV.” On June

10, 2024, the last reported sales price per share of our common stock on Nasdaq was $2.91. There is no established public

trading market for the Common Warrants, and we do not expect a market to develop. In addition, we do not intend to list the Common Warrants

on the Nasdaq, any other national securities exchange or any other nationally recognized trading system.

We

have retained Dawson James Securities, Inc. to act as our exclusive placement agent in connection with this offering (the “placement

agent” or “Dawson”). The placement agent is not purchasing the securities offered by us in this offering, and is not required

to sell any specific number or dollar amount of securities, but will assist us in this offering on a reasonable best efforts basis.

We have agreed to pay the placement agent the placement agent fees set forth in the table below, which assumes that we

sell all of the securities we are offering. See “Plan of Distribution” on page S-11 of this prospectus

supplement.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled

“Risk Factors” beginning on page S-6 of this prospectus supplement and page 3 of the accompanying prospectus

and under similar headings in the other documents that are incorporated by reference into this prospectus supplement.

There

is no arrangement for funds to be received in escrow, trust or similar arrangement.

| | |

Per Share and Accompanying Common

Warrant | | |

Total | |

| Offering price | |

$ | 3.035 | | |

$ | 15,311,225.98 | |

| Placement Agent fees (1) | |

$ | 0.1821 | | |

$ | 918,673.56 | |

| Proceeds, before expenses, to us (2) | |

$ | 2.8529 | | |

$ | 14,392,552.42 | |

| (1) |

In

addition, we have agreed (i) to issue to the placement agent, or its designees, warrants (the “Placement Agent

Warrants”) to purchase up to 504,489 shares of common stock, at an

exercise price equal to 125% of the offering price per share and accompanying Common Warrant, or $3.79375 per share, and (ii) to reimburse certain expenses of

the placement agent in connection with this offering. |

| (2) |

The

amount of the offering proceeds to us presented in this table does not give effect to the sale or exercise, if any, of the Common

Warrants being issued in the concurrent private placement. |

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

on the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

Delivery

of the shares of common stock offered hereby is expected to take place on or about June 12, 2024, subject to satisfaction of customary

closing conditions.

Dawson James Securities, Inc.

Prospectus

supplement dated June 10, 2024

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

You

should rely only on the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus.

We have not, and the placement agent has not, authorized any other person to provide you with different information. If anyone

provides you with different or inconsistent information, you should not rely on it. We are not, and the placement agent is not,

making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information

appearing in this prospectus supplement, the accompanying prospectus or in any documents incorporated by reference herein or therein

is accurate only as of the date of the applicable document. Our business, financial condition, results of operations and prospects may

have changed since that date.

This

prospectus supplement is not an offer to sell or a solicitation of an offer to buy securities in any jurisdiction in which such offer

or solicitation is illegal.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities and

Exchange Commission (the “SEC”) on Form S-3 (File No. 333-271324) utilizing a “shelf” registration process. This

document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to and

updates information contained in the accompanying prospectus as well as the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus. The second part, the accompanying prospectus, gives more general information about securities

we may offer from time to time, some of which does not apply to this offering. This prospectus supplement and the accompanying prospectus

incorporate by reference important business and financial information about us that is not included in or delivered with this prospectus

supplement and the accompanying prospectus.

You

should rely only on the information we have provided or incorporated by reference in this prospectus supplement or in the accompanying

prospectus. If information in this prospectus supplement is inconsistent with the accompanying prospectus or any document incorporated

by reference therein filed prior to the date of this prospectus supplement, you should rely on this prospectus supplement; provided that

if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies

or supersedes the earlier statement. We have not authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in this prospectus or the applicable prospectus

supplement. You must not rely on any unauthorized information or representation. You should assume that the information in this prospectus

supplement and accompanying prospectus is accurate only as of the dates on the front of the respective document and that any information

we have incorporated by reference is accurate only as of the date of the document incorporated by reference. Our business, financial

condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying

prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus when making your

investment decision.

As

used in this prospectus, unless context otherwise requires, the words “we,” “us,” “our,” “the

Company,” “Greenwave,” and “Registrant” refer to Greenwave Technology Solutions, Inc. and its subsidiaries.

Additionally, any reference to “Empire” refers to the Company’s wholly owned subsidiary, “Empire Services, Inc.”

and the assets used in its operation. Also, any reference to “common share” or “common stock,” refers to our

$0.001 par value common stock.

On June 3, 2024, we effected

a one-for-150 reverse stock split of our common stock (the “reverse stock split”. All share and per share data reflect the

reverse stock split on a retroactive basis. All common stock, stock options, and per share amounts in this prospectus supplement and

have been retroactively adjusted for all periods presented to give effect to the reverse stock split, however, certain of the documents

filed with the SEC prior to June 3, 2024, do not give effect to the reverse stock split.

Unless

otherwise stated, the information which appears on our website www.GWAV.com is not part of this prospectus supplement and is specifically

not incorporated by reference.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus supplement, in the accompanying prospectus or in documents

incorporated by reference. This summary does not contain all of the information that you should consider before making an investment

decision. This prospectus supplement and the accompanying prospectus include or incorporate by reference information about this offering,

our business and our financial and operating data. You should carefully read the entire prospectus supplement, the accompanying prospectus,

including under the sections titled “Risk Factors” included therein, and the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus, before making an investment decision.

Our

Business

We

were formed on April 26, 2013 as a technology platform developer under the name MassRoots, Inc. In October 2021, we changed our corporate

name from “MassRoots, Inc.” to “Greenwave Technology Solutions, Inc.” We sold all of our social media assets

on October 28, 2021 for cash consideration equal to $10,000 and have discontinued all operations related to our social media business.

On September 30, 2021, we closed our acquisition of Empire Services, Inc. (“Empire”), which operates 13 metal recycling

facilities in Virginia, North Carolina, and Ohio. The acquisition was effective October 1, 2021 upon the effectiveness of the Certificate

of Merger in Virginia.

Upon

the acquisition of Empire, we transitioned into the scrap metal industry which involves collecting, classifying and processing appliances,

construction material, end-of-life vehicles, boats, and industrial machinery. We process these items by crushing, shearing, shredding,

separating, and sorting, into smaller pieces and categorize these recycled ferrous, nonferrous, and mixed metal pieces based on density

and metal prior to sale. In cases of scrap cars, we remove the catalytic converters, aluminum wheels, and batteries for separate processing

and sale prior to shredding the vehicle. We have designed our systems to maximize the value of metals produced from this process.

We

operate an automotive shredder at our Kelford, North Carolina location and a second automotive shredder at our Carrollton, Virginia location

is expected to come online in the second quarter of 2024. Our shredders are designed to produce a denser product and, in concert with

advanced separation equipment, more refined recycled ferrous metals, which are more valuable as they require less processing to produce

recycled steel products. In totality, this process reduces large metal objects like auto bodies into baseball-sized pieces of shredded

recycled metal.

The

shredded pieces are then placed on a conveyor belt under magnetized drums to separate the ferrous metal from the mixed nonferrous metal

and residue, producing consistent and high-quality ferrous scrap metal. The nonferrous metals and other materials then go through a number

of additional mechanical systems which separate the nonferrous metal from any residue. The remaining nonferrous metal is further processed

to sort the metal by type, grade, and quality prior to being sold as products, such as zorba (mainly aluminum), zurik (mainly stainless

steel), and shredded insulated wire (mainly copper and aluminum).

One

of our main corporate priorities is to open a facility with rail or deep-water port access to enable us to efficiently transport our

products to domestic steel mills and overseas foundries. Because this would greatly expand the number of potential buyers of our processed

scrap products, we believe opening a facility with port or rail access could result in an increase in both the revenue and profitability

of our existing operations.

Empire

is headquartered in Chesapeake, Virginia and employs 134 people as of June 11, 2024.

Products

and Services

Our

main product is selling ferrous metal, which is used in the recycling and production of finished steel. It is categorized into heavy

melting steel, plate and structural, and shredded scrap, with various grades of each of those categorizations based on the content, size

and consistency of the metal. All of these attributes affect the metal’s value.

We

also process nonferrous metals such as aluminum, copper, stainless steel, nickel, brass, titanium, lead, alloys and mixed metal products.

Additionally, we sell the catalytic converters recovered from end-of-life vehicles to processors which extract the nonferrous precious

metals such as platinum, palladium and rhodium.

We

provide metal recycling services to a wide range of suppliers, including large corporations, industrial manufacturers, retail customers,

and government organizations.

We

also provide hauling services to corporate clients, hauling sand, asphalt, metal and other materials to job sites.

Nasdaq

Listing Deficiency

On

November 21, 2023, we received a written notice (the “Notice”) from the Listing Qualifications Department of Nasdaq indicating

that Nasdaq had determined that we had failed to comply with Nasdaq Listing Rules 5550(b)(1), (b)(2) and (b)(3). Nasdaq Listing Rules

5550(b)(1), (b)(2) and (b)(3) require that for continued listing, companies listed on Nasdaq maintain either (i) a minimum of $2,500,000

in stockholders’ equity, (ii) a market value of listed securities of at least $35,000,000 or (iii) net income from continuing operations

of at least $500,000 in the most recently completed fiscal year or in two of the three most recently completed fiscal quarters. On April

2, 2024, we received a letter from the Listing Qualifications Department of Nasdaq notifying us that we had regained compliance with

Nasdaq Listing Rule 5550(b)(2). However, if we fail to evidence compliance with NASDAQ Listing

Rules 5550(b)(1), (b)(2) and (b)(3) upon filing our next periodic report, we may be subject to delisting.

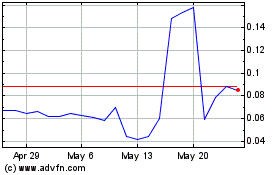

On

October 3, 2023, we received a letter from Nasdaq indicating that for the previous 30 consecutive business days, the bid price for our

common stock closed below the minimum $1.00 per share requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(a)(2).

We were provided 180 calendar days, or until April 1, 2024, to regain compliance. On April 3, 2024, based on our compliance with Nasdaq

Listing Rule 5550(b)(2) and all other applicable Nasdaq listing requirements with the exception of the minimum bid price requirement

and our written notice of our intention to cure the minimum bid price deficiency during such additional compliance period, including

by effecting a reverse stock split if necessary, the Nasdaq Listing Qualifications Department granted us an additional 180 calendar days,

or until September 30, 2024, to regain compliance with the minimum bid price requirement. On May 7, 2024, we received notice from

Nasdaq indicating that the bid price for our common stock had closed below $0.10 per share for the 10-consecutive trading day period

ended May 6, 2024 and, accordingly, we are subject to the provisions contemplated under Nasdaq Listing Rule 5810(c)(3)(A)(iii) and could

be subject to delisting from Nasdaq. A hearing before the Nasdaq Hearings Panel (the “Panel”) is scheduled

for June 25, 2024, which has stayed any further action by Nasdaq at least until the hearing is held and the expiration of

any extension period that may be granted by the Panel. Our common stock will continue to trade on Nasdaq under the symbol “GWAV”

pending completion of the hearing process. There can be no assurance that the Panel will grant our request for continued listing or that

we will be able meet the continued listing requirements during any compliance period that may be granted by the Panel.

Reverse Stock Split

On

May 29, 2024, we filed a Certificate of Amendment to our Second Amended and Restated Certificate of Incorporation to effect the reverse

stock split of our common stock, which was effective at 11:59 p.m. eastern on May 31, 2024. The common stock began trading on a split-adjusted

basis at the market open on Monday, June 3, 2024.

The

reverse stock split and the form of Certificate of Amendment were previously approved by the Company’s Board of Directors and the

Company’s stockholders. No fractional shares will be issued as a result of the reverse stock split. Instead, any fractional shares

that would have resulted from the Reverse Stock Split will be rounded up to the next whole number. The reverse stock split affects all

stockholders uniformly and will not alter any stockholder’s percentage interest in our outstanding common stock, except for adjustments

that may result from the treatment of fractional shares. The number of authorized shares of common stock and number of authorized, issued,

and outstanding shares of the preferred stock were not changed. All common stock, stock options, and per share amounts in this prospectus supplement and have been retroactively

adjusted for all periods presented to give effect to the reverse stock split, however, certain of the documents filed with the SEC prior

to June 3, 2024, do not give effect to the reverse stock split.

May

2024 Registered Direct Offering and Concurrent Private Placement

On

May 16, 2024, we and certain institutional and accredited investors, pursuant to which we sold an aggregate of 2,803,975 shares of our

common stock in a registered direct offering, and accompanying warrants to purchase up to 2,803,975 shares of common stock in a concurrent

private placement for gross proceeds of $21,871,000.06, before deducting the financial advisor’s fees and other estimated offering

expenses (the “May 2024 Offering”).

The

warrants sold are exercisable on or after the date of stockholder approval, have an exercise price of $15.00 per share and will expire

five years from the date we obtains stockholder approval for the issuance of such warrants and the shares issuable upon exercise of such

warrants. The warrants can be exercised on a cashless basis if there is no effective registration statement registering, or no current

prospectus available for, the resale of the shares underlying the warrants. The offering closed on May 20, 2024.

We

also agreed to pay Dawson, a cash fee equal to $777,777.77, and to reimburse Dawson for certain expenses, including legal fees and

expenses of $50,000 in the aggregate. In addition, we agreed to issue to the Dawson or its designees warrants (the “May

Financial Advisor Warrants”) to purchase up to 51,851 shares of common stock. The May Financial Advisor Warrants have

generally the same terms and conditions as the warrants issued to the purchasers, except that the May Financial Advisor Warrants

will have a term of five years from the commencement of sales and an exercise price equal to $18.75 per share.

May

2024 Note Exchange

On

May 10, 2024, we entered into an exchange agreement (the “May 2024 Exchange Agreement”) with DWM Properties LLC

(“DWM”), whereby we and DWM agreed to exchange 1,000 shares of our Series D Preferred Stock, par value $0.001 per share

held by DWM for 1,333,333 shares of our common stock.

April

2024 Registered Direct Offering and Concurrent Private Placement

On

April 22, 2024, we and certain institutional and accredited investors entered into a securities purchase agreement, pursuant to which

we sold an aggregate of 300,391 shares of our common stock in a registered direct offering, and accompanying warrants to purchase up

to 300,391 shares of common stock in a concurrent private placement, for gross proceeds of $5,258,340, before deducting the financial

advisor’s fees and other estimated offering expenses. The purchase price for each share of common stock and the accompanying warrant

to purchase one share of common stock is $17.51 (the “April 2024 Offering”).

The

warrants sold are exercisable on or after the date of stockholder approval and have an exercise price of $0.30 per share, and expire

five years from the date we obtain stockholder approval for the issuance of such warrants and shares issuable upon exercise of such warrants.

The warrants can be exercised on a cashless basis if there is no effective registration statement registering, or no current prospectus

available for, the resale of the shares underlying the warrants. The offering closed on April 24, 2024.

We

also agreed to pay Dawson a cash fee equal to $250,000, and to reimburse Dawson for certain expenses, including legal fees and

expenses of $50,000 in the aggregate. In addition, we agreed to issue to Dawson or its designees warrants (the “April

Financial Advisor Warrants”) to purchase up to 25,186 shares of common Stock. The April Financial Advisor Warrants have

generally the same terms and conditions as the warrants issued to the purchasers, except that the April Financial Advisor Warrants

will have a term of five years from the commencement of sales and an exercise price equal to $56.25 per share.

Note

Exchange

On

April 22, 2024, we entered into an exchange agreement (the “April 2024 Exchange Agreement”) with DWM, whereby we and DWM

agreed to exchange the remaining $7,218,350 of that certain Secured Promissory Note, dated July 31, 2023, issued by us to DWM for

412,360 shares of our common stock. In connection with the April 2024 Exchange Agreement, we and DWM entered into a voting

agreement, pursuant to which DWM agreed that at any meeting of our stockholders, DWM will vote all of the shares of common stock

which DWM is or becomes entitled to vote, at any meeting of our stockholders or by written consent in lieu of a meeting, in favor of

the approval for the issuance of the warrants issued in the April 2024 Offering and the shares of common stock issuable upon exercise of the warrants issued in the April 2024 Offering.

Corporate

Information

Our principal executive

office is located at 4016 Raintree Rd., Ste 300, Chesapeake, VA 23321, and our telephone number is (800) 490-5020. Our Internet website

address is www.GWAV.com. We were incorporated in the State of Delaware on April 26, 2013.

THE

OFFERING

| Common

stock offered by us |

|

5,044,885

shares of our common stock. |

| |

|

|

| Common

stock outstanding before this offering (1) |

|

7,705,743

shares. |

| |

|

|

| Common

stock to be outstanding immediately after this offering (1) |

|

12,750,528

shares (excluding shares issuable upon the exercise

of the Common Warrants to be issued in the concurrent private placement and shares issuable upon the exercise of the Placement

Agent Warrants issued in connection with this offering). |

| |

|

|

| Offering

price per share |

|

$3.035

per share. |

| |

|

|

| Concurrent

private placement of Common Warrants |

|

In

a concurrent private placement, we are selling to the institutional and accredited investors Common Warrants to purchase up

to 5,044,885 shares of our common stock, which represent 100% of the number of shares of our common stock being purchased

in this offering. Each Common Warrant will be exercisable for one share of our common stock at an exercise price of $2.91

per share, will be exercisable immediately, and will have a term of five years from the initial date of issuance. At

any time after the date that is 120 days following the closing of this offering, the Common Warrants can be exercised on a cashless

basis if there is no effective registration statement registering, or no current prospectus available for, the resale of the Common

Warrant Shares. Additionally, at any time following receipt of approval of our stockholders, the Common Warrants may be “alternatively

cashlessly exercised,” pursuant to which holders may receive a number of Warrant Shares equal to the product of (i) the number

of Common Warrant Shares they would have received had the Common Warrant been exercised for cash and (ii) 0.75. The Common Warrants

and Common Warrant Shares are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act, and

Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. |

| |

|

|

| Use

of proceeds |

|

We

currently intend to use the net proceeds from this offering for expansion of our metal recycling operations, to bring our copper

extraction system online, to pay off certain outstanding indebtedness and for general corporate purposes, as further described

in “Use of Proceeds.” |

| |

|

|

| Risk

factors |

|

An

investment in our company involves a high degree of risk. Please refer to the sections titled “Risk Factors,” “Special

Note Regarding Forward-Looking Statements” and other information included or incorporated by reference in this prospectus supplement

and the accompanying prospectus for a discussion of factors you should carefully consider before investing our securities. |

| Dividend

Policy |

|

We

have never declared or paid cash or stock dividends on our common stock and do not anticipate paying any dividends on the shares

of our common stock in the foreseeable future. Our current policy is to retain earnings, if any, for use in our operations and in

the development of our business. Any future determination to declare dividends on common stock will be made at the discretion of

our board of directors and will depend on our financial condition, operating results, capital requirements, general business conditions

and other factors that our board of directors may deem relevant. |

| |

|

|

| Trading

Symbol |

|

“GWAV”

There

is no established public trading market for the Common Warrants, and we do not expect a market to develop. In addition, we do not

intend to list the Common Warrants on Nasdaq, any other national securities exchange or any other nationally recognized

trading system. |

| (1) |

The

number of shares of common stock to be outstanding after this offering is based on 7,705,743 shares of our common stock outstanding

as of June 10, 2024, which number is adjusted for the reverse stock split that we effected on June 3, 2024, and

which excludes as of such date: |

| ● |

754

shares of common stock issuable upon the exercise

of certain vested options with a weighted average exercise price of $24,089 per share; and |

| ● |

16,538

shares of common stock issuable upon the exercise

of outstanding warrants (excluding the Common Warrants) with a weighted average exercise price of $2.89 per share. |

Unless otherwise indicated, all information in this

prospectus supplement assumes no exercise of the Common Warrants offered or sold in the concurrent private placement, or the Placement

Agent Warrants to be issued to the placement agent or its designees as compensation in connection with this offering.

RISK

FACTORS

An

investment in our company involves a high degree of risk. Before you make a decision to invest in our securities, you should consider

carefully the risks described below, as well as the risks described in or incorporated by reference in this prospectus supplement and

the accompanying prospectus, including the risks and uncertainties discussed under the section titled “Risk Factors” in our

most recent Annual Report for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended March 31,

2024 any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other documents incorporated by reference

into this prospectus supplement and accompanying prospectus, as updated by our subsequent filings under the Securities Exchange Act of

1934, as amended (the “Exchange Act”).

Any

of these risks could have a material adverse effect on our business, prospects, financial condition and results of operations. In any

such case, the trading price of our securities could decline and you could lose all or part of your investment. Additional risks not

presently known to us or that we currently deem immaterial may also adversely affect our business operations.

Risks Related to Our Common Stock and this Offering

Our

independent registered accounting firm has expressed concerns about our ability to continue as a going concern.

The

report of our independent registered accounting firm expresses concern about our ability to continue as a going concern based on our

historical losses from operations and the potential need for additional financing to fund our operations. It is not possible at this

time for us to predict with assurance the potential success of our business. If we cannot continue as a viable entity, we may be unable

to continue our operations and you may lose some or all of your investment in our securities.

There

may be future sales of our securities or other dilution of our equity, which may adversely affect the market price of our common stock.

With

limited exceptions, we are generally not restricted from issuing additional common stock, including any securities that are convertible

into or exchangeable for, or that represent the right to receive, common stock. The market price of our common stock could decline as

a result of sales of common stock or securities that are convertible into or exchangeable for, or that represent the right to receive,

common stock after this offering or the perception that such sales could occur.

You

will experience immediate dilution in book value of any shares of common stock you purchase.

Because

the effective price per share of common stock being offered is substantially higher than our net tangible book value per share of common

stock, you will suffer dilution in the net tangible book value of any shares of common stock you purchase in this offering. After giving

effect to the Pro Forma Adjustments (as defined herein) and the issuance and sale by us of an aggregate of 5,044,885 shares

of common stock and the Common Warrants to purchase up to 5,044,885 shares of common stock at an offering price of $3.035

per share and Common Warrant and assuming no exercise of any Common Warrants, and after deducting placement agent fees and other offering

expenses payable by us, the pro forma as adjusted net tangible book value of our shares of common stock would have been approximately

$21,676,537, or $1.353 per share, as of March 31, 2024 (an increase in net tangible book value of approximately $3.035

per share to our existing shareholders, relative to the as adjusted net tangible book value per share). If you purchase shares of

common stock in this offering, you will suffer immediate and dilution of approximately $1.375 per share, after deducting the placement

agent fees and estimated offering expenses payable by us. See “Dilution” on page S-10 for a more detailed discussion

of the dilution you will incur in connection with this offering.

If

we are unable to satisfy the applicable continued listing requirements of Nasdaq, our common stock could be delisted.

On

November 21, 2023, we received the Notice from the Listing Qualifications Department of Nasdaq” indicating that Nasdaq had determined

that we had failed to comply with Nasdaq Listing Rules 5550(b)(1), (b)(2) and (b)(3). Nasdaq Listing Rules 5550(b)(1), (b)(2) and (b)(3)

require that for continued listing, companies listed on Nasdaq maintain either (i) a minimum of $2,500,000 in stockholders’ equity,

(ii) a market value of listed securities of at least $35,000,000 or (iii) net income from continuing operations of at least $500,000

in the most recently completed fiscal year or in two of the three most recently completed fiscal quarters. On April 2, 2024, we received

a letter from the Listing Qualifications Department of Nasdaq notifying us that we had regained compliance with Nasdaq Listing Rule 5550(b)(2).

However, if we fail to evidence compliance with NASDAQ Listing Rules 5550(b)(1), (b)(2) and (b)(3)

upon filing our next periodic report, we may be subject to delisting.

On

October 3, 2023, we received a letter from Nasdaq indicating that for the previous 30 consecutive business days, the bid price for our

common stock closed below the minimum $1.00 per share requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(a)(2).

We were provided 180 calendar days, or until April 1, 2024, to regain compliance. On April 3, 2024, based on our compliance with Nasdaq

Listing Rule 5550(b)(2) and all other applicable Nasdaq listing requirements with the exception of the minimum bid price requirement

and our written notice of our intention to cure the minimum bid price deficiency during such additional compliance period, including

by effecting a reverse stock split if necessary, the Nasdaq Listing Qualifications Department granted us an additional 180 calendar days,

or until September 30, 2024, to regain compliance with the minimum bid price requirement. If we do not regain compliance by September

30, 2024, Nasdaq will notify us that our securities will be subject to delisting. In the event of such a notification, we may appeal

the Nasdaq staff’s determination to delist our securities. There can be no assurance that the Nasdaq staff would grant our request

for continued listing subsequent to any delisting notification. Even if we do regain compliance with the Nasdaq listing requirements,

there is no guarantee that we would remain in compliance in the future.

On May

7, 2024, we received notice from Nasdaq indicating that the bid price for our common stock had closed below $0.10 per share for the 10-consecutive

trading day period ended May 6, 2024 and, accordingly, we are subject to the provisions contemplated under Nasdaq Listing Rule 5810(c)(3)(A)(iii)

and could be subject to delisting from Nasdaq. A hearing before the Nasdaq Hearings Panel (the “Panel”) is scheduled for

June 25, 2024, which has stayed any further action by Nasdaq at least until the hearing is held and the expiration of any extension period

that may be granted by the Panel. Our common stock will continue to trade on Nasdaq under the symbol “GWAV” pending completion

of the hearing process. There can be no assurance that the Panel will grant our request for continued listing or that we will be able

meet the continued listing requirements during any compliance period that may be granted by the Panel. On June 3, 2024, we effected

a one-for-150 reverse stock split of our common stock, and on June 10, 2024, the last reported sales price per share of our common

stock on Nasdaq was $2.91.

If

our common stock is delisted, it could reduce the price of our common stock and the levels of liquidity available to our stockholders.

In addition, the delisting of our common stock could materially adversely affect our access to the capital markets and any limitation

on liquidity or reduction in the price of our common stock could materially adversely affect our ability to raise capital. Delisting

from Nasdaq could also result in other negative consequences, including the potential loss of confidence by suppliers, customers and

employees, the loss of institutional investor interest and fewer business development opportunities.

The

primary intent for the reverse stock split is an anticipated increase in the price of our common stock immediately following and resulting

from a reverse stock split due to a reduction in the number of issued and outstanding shares of our common stock to help us meet the

continued listing requirements pursuant to Nasdaq Rules. It cannot be assured that the reverse stock split will result in any sustained

proportionate increase in the market price of our common stock, which is dependent upon many factors, including the business and financial

performance of the company, general market conditions, and prospects for future success, which are unrelated to the number of shares

of our common stock outstanding. It is not uncommon for the market price of a company’s common stock to decline in the period following

a reverse stock split.

A

substantial number of shares of common stock may be sold in this offering, which could cause the price of our common stock to decline.

In

this offering we will sell 5,044,885 shares of common stock. In addition, in a concurrent private placement, we are selling unregistered

warrants to purchase up to 5,044,885 shares of common stock at an exercise price of $2.91 per share. This sale and any

future sales of a substantial number of shares of common stock in the public market, or the perception that such sales may occur, could

adversely affect the price of the common stock on Nasdaq. We cannot predict the effect, if any, that market sales of those shares of

common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

Our

management has significant flexibility in using the net proceeds of this offering.

We

currently intend to use the net proceeds from this offering for expansion of our metal recycling operations, bringing our copper extraction

system online and general corporate purposes, as further described in “Use of Proceeds” on page S-9.

Our management will have significant flexibility in applying the net proceeds of this offering. Management’s failure to use these

funds effectively would have an adverse effect on the value of our common stock and could make it more difficult and costly to raise

funds in the future.

We

do not intend to apply for any listing of the Common Warrants on any exchange or nationally recognized trading system, and we do not

expect a market to develop for the unregistered warrants.

We

do not intend to apply for any listing of the Common Warrants on Nasdaq or any other securities exchange or nationally

recognized trading system, and we do not expect a market to develop for the Common Warrants. Without an active market, the liquidity

of the Common Warrants will be limited. Further, the existence of the Common Warrants may act to reduce both the trading volume and the

trading price of our common stock.

Except

as otherwise provided in the Common Warrants, holders of the Common Warrants will have no rights as stockholders of our common stock

until such holders exercise their Common Warrants.

The

Common Warrants offered do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive

dividends, but rather merely represent the right to acquire our common stock at a fixed price. Specifically, a holder of a Common Warrant

may exercise the right to acquire common stock at an exercise price of $2.91 per share any time during the five years

following the date of issuance. Upon exercise of the Common Warrants, the holders thereof will be entitled to exercise the rights of

a holder of common stock only as to matters for which the record date occurs after the exercise date.

The

market price of our common stock may be volatile and adversely affected by several factors.

Our

share price is highly volatile. During the past 12 months, the closing price of our common stock ranged from a high of $168.00

per share to a low of $2.91 per share (in each case, as adjusted for the reverse stock split). The stock market in general has experienced

extreme volatility that has often been unrelated to the operating performance of particular companies; however, the fluctuation in the

price of our common stock is still larger than the stock market in general. As a result of this volatility, you may not be able to sell

your common stock at or above the price at which you purchased your common stock and you may lose some or all of your investment. In

addition to the general volatility risks of the market, our common stock may experience extreme stock price volatility unrelated to our

actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the

rapidly changing value of our common stock. As a company with a relatively small public float, our common stock may experience greater

stock price volatility, extreme price run-ups, lower trading volume, large spreads in bid and asked prices, and less liquidity than large-capitalization companies.

Trading in our common stock may be unrelated to our actual or expected operating performance, financial condition or prospects, making

it difficult for prospective investors to assess the value of our common stock. Because of the low public float and the absence of any

significant trading volume, the public offering price may not reflect the price at which you would be able to sell shares if you want

to sell any shares you own or buy shares if you wish to buy share. If the trading volumes of our common stock are low, persons buying

or selling in relatively small quantities may easily influence the prices of our common stock. A low volume of trades could also cause

the price of our common stock to fluctuate greatly, with large percentage changes in price occurring in any trading day session.

Broad market fluctuations and general economic and political conditions may also adversely affect the market price of our common stock.

The volatility also could adversely affect our ability to issue additional common stock or other securities and our ability to obtain

stock market based financing in the future. No assurance can be given that an active market in our common stock will develop or be sustained.

The

reverse stock split may decrease the liquidity of the shares of our common stock and warrants.

The

liquidity of our common stock and certain of our warrants may be affected adversely by the reverse stock split given the reduced number

of shares of our common stock that are outstanding following the reverse stock split, especially if the market price of our common stock

does not increase as a result of the reverse stock split. In addition, the reverse stock split may increase the number of stockholders

who own odd lots (less than 100 shares) of our common stock, creating the potential for such stockholders to experience an increase in

the cost of selling their shares of common stock and greater difficulty effecting such sales.

Following

the reverse stock split, the resulting market price of our common stock may not attract new investors, including institutional investors,

and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Although

we believe that a higher market price of our common stock may help generate greater or broader investor interest, there can be no assurance

that the reverse stock split will result in a share price that will attract new investors, including institutional investors. In addition,

there can be no assurance that the market price of our common stock will satisfy the investing requirements of those investors. As a

result, the trading liquidity of our common stock may not necessarily improve.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the

accompanying prospectus contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and

Section 21E of the Exchange Act. Forward-looking statements can be identified by words such as “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “will,” “would” and variations of these words and similar references to future periods,

although not all forward-looking statements contain these identifying words. Forward-looking statements are neither historical facts

nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future

of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject to inherent risks, uncertainties, and changes in circumstances, including

but not limited to risk factors incorporated by reference under “Item 1A. Risk Factors” to Part I of our Annual Report on

Form 10-K for the fiscal year ended December 31, 2023 and other factors described elsewhere in this prospectus supplement, the

accompanying prospectus or in our current and future filings with the SEC. As a result, our actual results may differ materially from

those expressed or forecasted in the forward-looking statements, and you should not rely on such forward-looking statements. You should

carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated by reference herein

and therein as described under the sections titled “Where You Can Find More Information,” completely and with the understanding

that our actual future results may be materially different from what we expect. We can give no assurances that any of the events anticipated

by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial

condition. Important factors that could cause our actual results and financial condition to differ materially from those indicated in

the forward-looking statements include, among others, the following:

| ● |

our

ability to continue as a going concern; |

| |

|

| ● |

our

reliance on third party vendors; |

| |

|

| ● |

our

dependence on our executive officers; |

| |

|

| ● |

our

financial performance guidance; |

| |

|

| ● |

material

weaknesses in our internal control over financial reporting; |

| |

|

| ● |

regulatory

developments in the United States and foreign countries; |

| |

|

| ● |

the

impact of laws, regulations, accounting standards, regulatory requirements, judicial decisions and guidance issued by authoritative

bodies; |

| |

|

| ● |

our

estimates regarding expenses, future revenue and cash flow, capital requirements and needs for additional financing; |

| |

|

| ● |

our

financial performance; |

| |

|

| ● |

our ability to regain and maintain compliance with the

listing standards of Nasdaq; and |

| |

|

| ● |

the

ability to recognize the anticipated benefits of our business combination and/or divestitures. |

Any

forward-looking statement made by us in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus is based only on information currently available to us and speaks only

as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether as a result

of new information, future developments or otherwise. However, you should carefully review the risk factors set forth in other reports

or documents we file from time to time with the SEC.

USE

OF PROCEEDS

We

expect to receive net proceeds from this offering of approximately $14,392,552 million after deducting the placement agent

fees and estimated offering expenses payable by us, and excluding the proceeds we may receive from the exercise of the Common Warrants

issued in the concurrent private placement, if any.

We

currently intend to use the net proceeds from this offering for expansion of our metal recycling operations, to bring our copper

extraction system online, to pay off certain outstanding indebtedness with interest rates ranging from 6.5% to 10.5% and maturity

dates ranging from September 2025 to September 2032, and for general corporate purposes. However, the amount and timing of what

we actually spend for these purposes may vary and will depend on a number of factors, including our future revenue and cash

generated by operations, if any, and the other factors described in “Risk Factors.” Accordingly, our management will

have discretion and flexibility in applying the net proceeds of this offering.

DIVIDEND

POLICY

We

have never declared or paid cash or stock dividends on our common stock and do not anticipate paying any dividends on the shares of our

common stock in the foreseeable future. Our current policy is to retain earnings, if any, for use in our operations and in the development

of our business. Any future determination to declare dividends on common stock will be made at the discretion of our board of directors

and will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that

our board of directors may deem relevant.

DILUTION

If

you purchase our common stock in this offering, your ownership interest will be immediately diluted to the extent of the difference between

the effective price per share you pay and the net tangible book value per share of our common stock immediately after this offering.

Net tangible book value per share is determined by dividing the number of shares of common stock outstanding as of March 31, 2024

by our total tangible assets less total liabilities.

Our

net tangible book value as of March 31, 2024 was approximately $(14,839,988) or $(50.747) per share, based on 292,432

shares of our common stock outstanding as of that date, which number is adjusted for the reverse stock split.

After

giving effect to (i) the exchange by us, pursuant to the April 2024 Exchange Agreement, of the remaining $7,218,350 of that certain

secured promissory note, dated July 31, 2023, issued by us to DWM for 412,360 shares of common stock, (ii) the issuance and sale by

us of 300,391 shares of common stock and accompanying unregistered warrants to purchase up to 300,391 shares of common stock in a

registered direct offering and concurrent private placement for aggregate net proceeds of $5,008,340 in the April 2024 Offering,

after deducting financial advisory fees and other offering expenses payable by us, (iii) the exchange by us, pursuant to the May

2024 Exchange Agreement, of 1,000 shares of our issued and outstanding Series D

Preferred Stock held by DWM for 1,333,334 shares of common stock, (iv) the issuance by us of 2,035,501 shares for the conversion of

convertible debt in the principal amount of $12,212,997, and (v) the issuance and sale by us of 2,803,975 shares of our common stock

and accompanying unregistered warrants to purchase up to 2,803,975 shares for net proceeds of $20,921,000 in the May 2024 Offering,

after deducting financial advisory fees and other offering expenses payable by us, in each case subsequent to March 31, 2024

(collectively, the “Pro Forma Adjustments”), our pro forma net tangible book value as of March 31, 2024 would have been

approximately $21,676,537, or $1.353 per share

After

giving further effect to the issuance and sale by us of 5,044,885 shares of common stock by us at an offering

price of $3.035 per share and accompanying Common Warrants to purchase up to 5,044,885 shares of common stock, for aggregate

gross proceeds of approximately $15,311,225.98, and after deducting the placement agent fees and estimated offering expenses

payable by us, our pro forma as adjusted net tangible book value as of March 31, 2024 would have been approximately $35,459,000 or $1.66 per share. This represents an immediate decrease in pro forma as adjusted net tangible book value

of $0.323 per share to existing stockholders and an immediate dilution of $1.375 per share to new investors in this offering,

as illustrated by the following table:

| Offering price per share | |

$ | 3.035 | |

| Net tangible book value per share as of March 31, 2024 | |

$ | (50.747 | ) |

| Increase in net tangible book value per share attributable to the Pro Forma

Adjustments | |

$ | 52,174 | |

| | |

| | |

| Pro forma net tangible book value per share as of March 31, 2024 after

giving effect to the Pro Forma Adjustments | |

$ | 1.353 | |

| Decrease in pro forma as adjusted net tangible book value per share attributable

to this offering | |

$ | 0.323 | |

| Pro forma as adjusted net tangible book value per share as of March 31, 2024

after giving effect to this offering | |

$ | 1.66 | |

| Dilution in net tangible book value per share to new investors in this offering | |

$ | 1.375 | |

The

number of shares of common stock to be outstanding after this offering is based on 292,432 shares of our common stock outstanding

as of March 31, 2024, which number is adjusted for the reverse stock split that we effected on June 3, 2024, and which

excludes as of such date:

| ● |

754

shares of common stock issuable upon the exercise of certain vested options with a weighted average exercise price of $24,089 per

share; |

| ● |

218,157

shares of common stock issuable upon the exercise

of outstanding warrants (excluding the Common Warrants) with a weighted average exercise price of $30.60 per share; and |

| ● |

613,783

shares of common stock issuable upon the conversion

of certain outstanding convertible promissory notes, based on a conversion price of $29.40. |

The

above illustration of dilution per share to the investors participating in this offering assumes no exercise of the Common Warrants or

the Placement Agent Warrants, or outstanding options or warrants to purchase shares of our common stock. In addition, we may offer

shares of our common stock or other securities exercisable or convertible into shares of common stock in other offerings due to market

conditions or strategic considerations. To the extent we issue such shares of common stock and/or securities, and such securities are

converted or exercised for shares of our common stock, investors may experience further dilution.

PLAN

OF DISTRIBUTION

Pursuant

to placement agency agreement (the “Placement Agency Agreement”), we have retained Dawson James Securities,

Inc. to act as our exclusive placement agent in connection with this offering. Under the terms of the Placement Agency

Agreement, the placement agent is not purchasing the securities offered by us in this offering, and is not required to sell any

specific number or dollar amount of securities, but will assist us in this offering on a reasonable best efforts basis. The terms of

this offering were subject to market conditions and negotiations between us, the placement agent and prospective investors. The

placement agent will have no authority to bind us by virtue of the Placement Agency Agreement. We may not sell the entire

amount of securities offered pursuant to this prospectus supplement.

We

will only sell to investors who have entered into the securities purchase agreement with us.

Delivery

of the securities offered hereby is expected to take place on or about June 12, 2024, subject to satisfaction of certain conditions.

Fees and Expenses

We

have agreed to pay the placement agent a cash fee equal to $918,673.56, which is equal to 6.0% of the aggregate gross proceeds

raised in this offering. In addition, subject to FINRA Rule 5110(f)(2)(d)(i), we have also agreed to reimburse the placement agent

at closing of $25,000 for fees and expenses of its legal counsel and other out-of-pocket expenses in connection with

this offering.

Placement Agent Warrants

In

addition, we have agreed to issue to the placement agent or its designees the Placement Agent Warrants to purchase up to 504,489

shares of common stock. The Placement Agent Warrants are exercisable commencing on the closing of this offering and have substantially

the same terms as the Common Warrants, except that the Placement Agent Warrants will be exercisable for five years from the date

of the commencement of sales in this offering and have an exercise price an exercise price of $3.79375 per share (representing 125%

of the offering price per share and accompanying Common Warrant).

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the

requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule

10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by the

placement agent acting as principal. Under these rules and regulations, the placement agent:

| ● |

may

not engage in any stabilization activity in connection with our securities; and |

| ● |

may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution. |

Tail

We

have also agreed to pay the placement agent a tail fee equal to the cash and warrant compensation in this offering, if any investor,

subject to certain exceptions, who with our written approval was contacted or introduced to us by the placement agent during the term

of its engagement, provides us with capital in any public or private offering or other financing or capital raising transaction during

the twelve (12)-month period following expiration or termination of the Placement Agency Agreement, subject to certain exceptions.

Indemnification

We

have agreed to indemnify the placement agent and certain other persons against certain liabilities under the Securities Act relating

to or arising out of the placement agent’s activities under the Placement Agency Agreement. We have also agreed to

contribute to payments the placement agent may be required to make in respect of such liabilities.

Regulation

M

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements

of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and

Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of common stock by Wainwright

acting as principal. Under these rules and regulations, the placement agent:

| ● | may

not engage in any stabilization activity in connection with our securities; and |

| ● | may

not bid for or purchase any of our securities or attempt to induce any person to purchase

any of our securities, other than as permitted under the Exchange Act, until it has completed

its participation in the distribution. |

Electronic

Distribution

This

prospectus supplement and the accompanying prospectus may be made available in electronic format on websites or through other online

services maintained by the placement agent, or by an affiliate. Other than this prospectus supplement and the accompanying prospectus

in electronic format, the information on the placement agent’s websites and any information contained in any other website

maintained by the placement agent is not part of this prospectus supplement and the accompanying prospectus or the registration

statement of which this prospectus supplement and the accompanying prospectus form a part, has not been approved and/or endorsed by us

or the placement agent, and should not be relied upon by investors.

Other

Relationships

From

time to time, the placement agent and its respective affiliates may in the future provide various investment banking, placement

agency and other services to us and our affiliates for which services they may receive customary fees. In the course of their businesses,

the placement agent and its respective affiliates may actively trade our securities or loans for their own account or for the

accounts of customers, and, accordingly, the placement agent and its respective affiliates may at any time hold long or short

positions in such securities or loans. Except for services provided in connection with this offering and registered direct offerings

and private placements that closed on August 1, 2023, August 22, 2023, between March 18, 2024 and March 26, 2024, on

April 24, 2024 and on May 20, 2024, as applicable, and disclosed in our Current Reports on Form 8-K filed with the SEC

on August 3, 2023, August 22, 2023, March 18, 2024 (as amended on Form 8-K/A on April 2, 2024) and April 22, 2024, and in our Quarterly

Report on Form 10-Q filed with the SEC on May 20, 2024, respectively, for which the placement agent received cash and warrant

compensation in connection therewith, the placement agent has not provided any investment banking or other financial services

during the 180-day period preceding the date of this prospectus supplement.

The

foregoing does not purport to be a complete statement of the terms and conditions of the Placement Agency Agreement and securities

purchase agreement. A copy of the form of securities purchase agreement with the investors has been included as an exhibit

to our Current Report on Form 8-K that was filed with the SEC on June 11, 2024, and incorporated by reference into the

registration statement of which this prospectus supplement and the accompanying prospectus form a part.

The

transfer agent and registrar for our common stock is Equity Stock Transfer, Inc. The transfer agent and registrar’s address is

237 W 37th St #602, New York, NY 10018, phone number (212) 575-5757.

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

We

are offering 5,044,885 shares of common stock at an offering price of $3.035 per share. The material terms and provisions

of our common stock and each other class of our securities that qualifies or limits our Common Stock are described under the caption

“Description of Capital Stock” starting on page 6 of the accompanying prospectus.

CONCURRENT

PRIVATE PLACEMENT OF COMMON WARRANTS

In

a concurrent private placement, we are selling to each institutional investor in this offering Common Warrants to purchase one share

of common stock for each share of common stock purchased in this offering by each such investor. The aggregate number of Common Warrant

Shares issuable pursuant to the Common Warrants is up to 5,044,885.

The

Common Warrants and the Common Warrant Shares are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities

Act and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying

prospectus. There is no established public trading market for the Common Warrants and we do not expect a market to develop. In addition,

we do not intend to list the Common Warrants on Nasdaq, any other national securities exchange or any other nationally recognized trading

system. All purchasers are required to be “accredited investors” as such term is defined in Rule 501(a) under the Securities

Act. The summary of certain terms and provisions of the Common Warrants is not complete and is subject to, and qualified in its entirety

by, the provisions of the form of the Common Warrants which is filed as an exhibit to a Current Report on Form 8-K and which is incorporated

by reference herein.

Exercise

Price. The Common Warrants will be exercisable at an exercise price of $2.91 per share. The exercise price and number of Common

Warrant Shares issuable upon the exercise of the Common Warrants will be subject to anti-dilution adjustments and adjustment in the event

of any stock dividend and split, reverse stock split, recapitalization, reorganization or similar transaction, as described in the Common

Warrants.

Exercisability

and Term. Each Common Warrant shall be exercisable beginning on the date on which the Common Warrants are issued. At any time after the date that is 120 days following the closing of this offering, the Common Warrants can be

exercised on a cashless basis if there is no effective registration statement registering, or no current prospectus available for, the

resale of the Common Warrant Shares. Additionally, at any time following receipt of approval of our stockholders, the Common Warrants

may be “alternatively cashlessly exercised,” pursuant to which holders may receive a number of Common Warrant Shares equal

to the product of (i) the number of Common Warrant Shares they would have received had the Common Warrant been exercised for cash and

(ii) 0.75.

Exercise

Limitations. Subject to limited exceptions, a holder of Common Warrants will not have the right to exercise any portion of its Common

Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% of the number of shares of our common

stock outstanding immediately after giving effect to such exercise, provided that the holder may increase or decrease the beneficial

ownership limitation up to 9.99% upon election by the holder prior to the issuance of any Common Warrants. Any increase in the beneficial

ownership limitation shall not be effective until 61 days following notice of such change to the Company.

Adjustments.

The Common Warrants contain exercise price reset provisions triggered by any intervening reverse

stock splits.

Fundamental

Transaction. In certain circumstances, upon a fundamental transaction, the holder will have the right to require us to repurchase

its Common Warrants at the Black Scholes (as defined in the Common Warrant) value; provided, however, that if the fundamental transaction

is not within the Company’s control, including not approved by the Company’s Board of Directors, the holder shall only be

entitled to receive from the Company the Black Scholes value of the unexercised portion of its Common Warrant.

Transferability.

Subject to applicable laws, the Common Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange

Listing. There is no established public trading market for the Common Warrants, and we do not expect a market to develop. In addition,

we do not intend to list the Common Warrants on Nasdaq, any other national securities exchange or any other nationally

recognized trading system.

Rights

as a Stockholder. Except as otherwise provided in the Common Warrants or by virtue of such holder’s ownership of our common

shares, the holder of a Common Warrant does not have the rights or privileges of a holder of our common shares, including any voting

rights, until the holder exercises the Common Warrant.

Registration

Rights. We have agreed to file a registration statement covering the resale of the Common Warrant Shares within 20 calendar

days of the date of the securities purchase agreement entered into between the purchasers and us. We must use commercially reasonable

efforts to cause such registration statement to become effective within 120 days following the closing date of this offering and

to keep such registration statement effective at all times until the purchasers no longer own any Common Warrants and Common Warrant

Shares.

Stockholder Approval.

We have agreed to hold a special meeting of stockholders to seek approval as may be required by the applicable rules and regulations

of The Nasdaq Stock Market LLC (or any successor entity) from our stockholders with respect to the issuance of the Common Warrant Shares

upon the “alternative cashless exercise” of the Common Warrants, as discussed above under “Exercisability and Term.”.

LEGAL

MATTERS

The

validity of the issuance of the securities offered hereby will be passed upon for us by Pryor Cashman LLP, New York, New York. Haynes

and Boone, LLP, New York, New York is acting as counsel for the placement agent in connection with this offering.

EXPERTS

Our

consolidated balance sheets as of December 31, 2023 and 2022 and the related consolidated statement of operations, stockholders’

equity and cash flows for the years ended December 31, 2023 and 2022 incorporated by reference in this prospectus supplement and the

accompanying prospectus have been audited by RBSM LLP, independent registered public accounting firm, as indicated in their report

with respect thereto, and have been so included in reliance upon the report of such firm given on their authority as experts in accounting

and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities being offered hereby.

This prospectus supplement and the accompanying prospectus, which constitute a part of the registration statement, do not contain all

of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information about

us and the securities offered hereby, we refer you to the registration statement and the exhibits filed thereto. Statements contained

in this prospectus supplement and the accompanying prospectus regarding the contents of any contract or any other document that is filed

as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference

to the full text of such contract or other document filed as an exhibit to the registration statement.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including

us. The SEC’s Internet site can be found at http://www.sec.gov. In addition, we make available on or through our Internet

site copies of these reports as soon as reasonably practicable after we electronically file or furnished them to the SEC. Our Internet

site can be found at www.GWAV.com. The information contained in, or that can be accessed through, our website is not incorporated

by reference in, and is not part of, this prospectus. Because our common stock is listed on Nasdaq, you may also inspect reports,

proxy statements and other information at the offices of Nasdaq.

INFORMATION

INCORPORATED BY REFERENCE

We

are incorporating by reference into this prospectus supplement and the accompanying prospectus certain information that we file with

the SEC, which means that we are disclosing important information to you by referring you to those documents. The information incorporated

by reference is deemed to be part of this prospectus supplement and the accompanying prospectus, except for information incorporated

by reference that is superseded by information contained in this prospectus supplement and the accompanying prospectus. This means that

you must look at all of the SEC filings that we incorporate by reference to determine if any statements in this prospectus supplement,

the accompanying prospectus or any document previously incorporated by reference have been modified or superseded. This prospectus supplement

incorporates by reference the documents set forth below that we have previously filed with the SEC:

| ● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on April 16, 2024; |

| |

|

| ● |

our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, which was filed with the SEC on May 20, 2024; |

| |

|

| ● |

our

Current Reports on Form 8-K filed with the SEC on March

18, 2024, April

1, 2024 (as amended on Form 8-K/A on April

2, 2024), April

4, 2024, April

22, 2024, May

3, 2024, May

9, 2024, May

10, 2024,

May 16, 2024, June 3, 2024, June

3, 2024, and June 11, 2024

(in each case other than information “furnished” under Items 2.02 or 7.01, or corresponding information furnished

under Item 9.01 or included as an exhibit); and |

| |

|

| ● |

the

description of our common stock contained in the registration statement on Form 8-A, dated July 21, 2022, File No. 001-41452, as

updated by Exhibit 4.2 to our Annual Report on Form 10-K for the year ended December 31, 2023 and any other amendment or report filed

for the purpose of updating such description. |

Any

information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information

in this prospectus supplement or accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated

herein by reference modifies or replaces such information.

We