CFIUS Approval Obtained for the Planned Merger of North American Stainless, Inc. and Haynes International, Inc.

June 27 2024 - 7:22PM

Haynes International, Inc. (NASDAQ GM: HAYN) (the “Company”), a

leading developer, manufacturer and marketer of technologically

advanced high-performance alloys, is pleased to announce that

clearance has been obtained from the Committee on Foreign

Investment in the United States (CFIUS) related to the planned

merger with North American Stainless, Inc.

As previously disclosed, on February 4,

2024, Haynes International, Inc., a Delaware corporation,

entered into an Agreement and Plan of Merger (the “Merger

Agreement”) with North American Stainless, Inc., a Delaware

corporation (“Parent”), Warhol Merger Sub, Inc., a Delaware

corporation and a wholly owned subsidiary of Parent (“Merger Sub”),

and solely for purposes specified therein, Acerinox S.A., a Spanish

sociedad anonima (“Guarantor”). Pursuant to the Merger Agreement,

Merger Sub will be merged with and into the Company, with the

Company surviving as a wholly owned subsidiary of Parent (the

“Merger”).

The Merger remains subject to regulatory

approval from applicable regulatory authorities in the United

Kingdom and Austria. All other regulatory approvals and clearances

where the applicable authorities have asserted jurisdiction have

been obtained. The Company continues to expect that the Merger will

close in the fourth calendar quarter of 2024.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains statements that

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, each as amended. All statements other than

statements of historical fact, including statements regarding

market and industry prospects and future results of operations or

financial position, made in this press release are forward-looking.

In many cases, you can identify forward-looking statements by

terminology, such as “may”, “should”, “expects”, “intends”,

“plans”, “anticipates”, “believes”, “estimates”, “predicts”,

“potential” or “continue” or the negative of such terms and other

comparable terminology. Statements in this communication that are

forward looking may include, but are not limited to, statements

regarding the benefits of the proposed acquisition of the Company

by Parent and the associated integration plans, expected synergies

and capital expenditure commitments, anticipated future operating

performance and results of the Company, the expected management and

governance of the Company following the acquisition and expected

timing of the closing of the proposed acquisition and other

transactions contemplated by the Merger Agreement.

There may also be other statements of

expectations, beliefs, future plans and strategies, anticipated

events or trends and similar expressions concerning matters that

are not historical facts. Readers are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, many of which are difficult to

predict and are generally outside the Company’s control, that could

cause actual performance or results to differ materially from those

expressed in, or implied or projected by, the forward-looking

statements. Such risks and uncertainties include, but are not

limited to: the occurrence of any event, change or other

circumstance that could give rise to the right of the Company or

Parent or both of them to terminate the Merger Agreement, including

circumstances requiring a party to pay the other party a

termination fee pursuant to the Merger Agreement; the failure to

obtain applicable regulatory approvals in a timely manner or

otherwise; the risk that the acquisition may not close in the

anticipated timeframe or at all due to one or more of the other

closing conditions to the transaction not being satisfied or

waived; the risk that there may be unexpected costs, charges or

expenses resulting from the proposed acquisition; risks that the

proposed transaction disrupts the Company’s current plans and

operations; the risk that certain restrictions during the pendency

of the proposed transaction may impact the Company’s ability to

pursue certain business opportunities or strategic transactions;

risks related to disruption of each company’s management’s time and

attention from ongoing business operations due to the proposed

transaction; continued availability of capital and financing and

rating agency actions; the risk that any announcements relating to

the proposed transaction could have adverse effects on the market

price of the Company’s common stock, credit ratings or operating

results; the risk that the proposed transaction and its

announcement could have an adverse effect on the ability of the

Company to retain and hire key personnel, to retain customers and

to maintain relationships with each of their respective business

partners, suppliers and customers and on their respective operating

results and businesses generally; the risk of litigation that could

be instituted against the parties to the Merger Agreement or their

respective directors, managers or officers and/or regulatory

actions related to the proposed acquisition, including the effects

of any outcomes related thereto; risks related to unpredictable and

severe or catastrophic events, including but not limited to acts of

terrorism, war or hostilities, cyber attacks, or the impact of the

COVID-19 pandemic or any other pandemic, epidemic or outbreak of an

infectious disease in the United States or worldwide on the

Company’s business, financial condition and results of operations,

as well as the response thereto by each company’s management; and

other business effects, including the effects of industry, market,

economic, political or regulatory conditions.

Also, the Company’s actual results may differ

materially from those contemplated by the forward-looking

statements for a number of additional reasons as described in the

Company’s filings with the SEC, including those set forth in the

Risk Factors section and under any “Forward-Looking Statements” or

similar heading in the Company’s most recently filed Annual Report

on Form 10-K filed November 16, 2023, the Company’s Definitive

Proxy Statement filed March 18, 2024 and the Company’s Current

Reports on Form 8-K.

The Company has based these forward-looking

statements on its current expectations and projections about future

events. Although the Company believes that the assumptions on which

the forward-looking statements contained herein are based are

reasonable, any of those assumptions could prove to be inaccurate.

As a result, the forward-looking statements based upon those

assumptions also could be incorrect. Except to the extent required

by law, the Company undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. These forward-looking

statements speak only as of the date hereof.

Contact:

Daniel MaudlinVice President of Finance and

Chief Financial OfficerHaynes International, Inc.765-456-6102

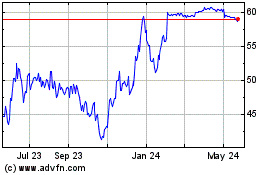

Haynes (NASDAQ:HAYN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Haynes (NASDAQ:HAYN)

Historical Stock Chart

From Jan 2024 to Jan 2025