false

0001760542

0001760542

2025-02-20

2025-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 20, 2025

HOOKIPA

Pharma Inc.

(Exact name of registrant as specified

in its Charter)

| Delaware |

|

001-38869 |

|

81-5395687 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

350

Fifth Avenue, 72nd Floor,

Suite

7240 |

|

|

| New

York,

New

York |

|

10118 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: +43 1

890 63 60

Not applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instructions A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each

class |

|

Trading

Symbol(s) |

|

Name of each

exchange

on which registered |

| Common

Stock, $0.0001 par value per share |

|

HOOK |

|

The

Nasdaq Capital

Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Information.

As

previously reported, on January 2, 2025, HOOKIPA Pharma Inc. (the “Company”) and Poolbeg Pharma plc (“Poolbeg”)

released an announcement pursuant to Rule 2.4 of the U.K. City Code on Takeovers and Mergers (the “Code”) that the Company

and Poolbeg entered into non-binding discussions for the potential acquisition by the Company of the entire issued share capital of Poolbeg.

On February 20, 2025, the Company issued

an announcement (the “Announcement”) pursuant to Rule 2.8 of the Code disclosing that the Company’s board of directors

has determined that it does not intend to make an offer for Poolbeg under Rule 2.7 of the Code. A copy of the Announcement is attached

hereto as Exhibit 99.1 and is incorporated by reference into this Item 8.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 20, 2025 |

HOOKIPA Pharma Inc. |

| |

|

|

| |

By: |

/s/ Terry Coelho |

| |

Name: |

Terry Coelho |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS

OF THAT JURISDICTION.

THIS IS AN ANNOUNCEMENT FALLING UNDER RULE

2.8 OF THE CITY CODE ON TAKEOVERS AND MERGERS (“THE CODE”).

THIS ANNOUNCEMENT CONSTITUTES INSIDE INFORMATION

AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU) NO. 596/2014, AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018.

For immediate release

20 February 2025

HOOKIPA

Pharma Inc. (“HOOKIPA”)

Statement

regarding potential combination for Poolbeg Pharma plc (“Poolbeg”)

Further to the announcement

on 2 January 2025 regarding the non-binding discussions for an all-share acquisition by HOOKIPA of Poolbeg and the announcement on

30 January 2025 regarding the PUSU extension, the HOOKIPA Board has determined that it does not intend to make an offer for Poolbeg

under Rule 2.7 of the Code.

This announcement is

made in accordance with Rule 2.8 of the Code.

Under Note 2 on Rule 2.8

of the Code, HOOKIPA and any person(s) acting in concert with it reserve the right to set aside the restrictions in Rule 2.8

of the Code in the following circumstances:

| a) | with the agreement of the board of Poolbeg; |

| b) | following the announcement of a firm intention to make an offer for Poolbeg, by or on behalf of a third

party; |

| c) | following the announcement by Poolbeg of a Rule 9 waiver (as described in Note 1 on the Notes on

Dispensations from Rule 9 of the Code) or a reverse takeover (as defined in the Code); or |

| d) | where the Panel on Takeovers and Mergers has determined that there has been a material change of circumstances. |

The person responsible

for arranging the release of this announcement on behalf of HOOKIPA is Malte Peters, Chief Executive Officer of HOOKIPA.

|

Enquiries:

|

|

| HOOKIPA Pharma Inc. |

+43 1 890 63 60 |

| Malte Peters, CEO |

IR@hookipapharma.com |

| Terry Coelho, EVP & CFO |

Chuck@LifeSciAdvisors.com |

| |

|

| Moelis & Company |

+44 (0) 207 634 3500 |

|

(Financial Adviser to HOOKIPA)

|

|

|

London

Chris Raff

Simon Chaudhuri |

|

|

New York

Ashish Contractor |

|

Important information

This announcement is

not intended to, and does not, constitute or form part of any offer, invitation or solicitation of any offer to purchase, otherwise acquire,

subscribe for, sell or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction, whether pursuant

to this announcement or otherwise.

The release, distribution

or publication of this announcement in jurisdictions outside the United Kingdom may be restricted by laws of the relevant jurisdictions

and therefore persons into whose possession this announcement comes should inform themselves about, and observe, any such restrictions.

Any failure to comply with the restrictions may constitute a violation of the securities law of any such jurisdiction.

Disclaimer

Moelis & Company

LLC (“Moelis”) is acting as financial adviser to HOOKIPA in connection with the matters set out in this announcement

and for no one else and will not be responsible to anyone other than HOOKIPA for providing the protections afforded to its clients nor

for providing advice in relation to the matters set out in this announcement. Neither Moelis nor any of its subsidiaries, branches or

affiliates and their respective directors, officers, employees or agents owes or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Moelis in

connection with this announcement, any statement contained herein or otherwise

Publication on Website

A

copy of this announcement will be made available (subject to certain restrictions relating to persons resident in restricted jurisdictions)

on HOOKIPA’s website - https://ir.hookipapharma.com/potential-combination# by no later than 12 noon (London time)

on the business day following the release of this announcement in accordance with Rule 26.1 of the Code. The content of the website

referred to in this announcement is not incorporated into and does not form part of this announcement.

This announcement is

not intended to, and does not, constitute, represent or form part of any offer, invitation or solicitation of an offer to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of any securities or the solicitation of any vote or approval in any jurisdiction whether

pursuant to this announcement or otherwise.

v3.25.0.1

Cover

|

Feb. 20, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 20, 2025

|

| Entity File Number |

001-38869

|

| Entity Registrant Name |

HOOKIPA

Pharma Inc.

|

| Entity Central Index Key |

0001760542

|

| Entity Tax Identification Number |

81-5395687

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

350

Fifth Avenue, 72nd Floor

|

| Entity Address, Address Line Two |

Suite

7240

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10118

|

| City Area Code |

+43

|

| Local Phone Number |

1

890 63 60

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

HOOK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

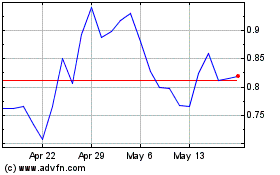

HOOKIPA Pharma (NASDAQ:HOOK)

Historical Stock Chart

From Jan 2025 to Feb 2025

HOOKIPA Pharma (NASDAQ:HOOK)

Historical Stock Chart

From Feb 2024 to Feb 2025