Form S-3 - Registration statement under Securities Act of 1933

January 31 2025 - 3:31PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on January 31, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Helius Medical Technologies, Inc.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

36-4784690

(I.R.S. Employer

Identification Number)

|

|

642 Newtown Yardley Road, Suite 100

Newtown, Pennsylvania 18940

(215) 944-6100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dane C. Andreeff

President and Chief Executive Officer

Helius Medical Technologies, Inc.

642 Newtown Yardley Road, Suite 100

Newtown, Pennsylvania 18940

(215) 944-6100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Phillip D. Torrence

Emily Johns

Honigman LLP

650 Trade Centre Way, Suite 200

Kalamazoo, Michigan 49002

(269) 337-7700

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐

|

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☒

|

|

|

Smaller reporting company ☒

|

|

| |

|

|

|

|

|

|

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 31, 2025

PROSPECTUS

Helius Medical Technologies, Inc.

6,213,888 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders named herein, or their pledgees, donees, transferees or other successors in interest, from time to time, of up to 6,213,888 shares of our Class A common stock (“common stock”) issuable upon exercise of warrants granted to certain investors in connection with warrant exercise inducement letters entered into on January 21, 2025. The shares of common stock issuable upon exercise of the warrants are referred to herein as the Securities. We are registering the Securities on behalf of the selling stockholders, to be offered and sold from time to time, to satisfy certain registration rights that we have granted to the selling stockholders.

The selling stockholders may resell or dispose of the Securities, or interests therein, at fixed prices, at prevailing market prices at the time of sale or at prices negotiated with purchasers, to or through underwriters, broker-dealers, agents, or through any other means described in the section of this prospectus entitled “Plan of Distribution”. The selling stockholders will each bear their respective commissions and discounts, if any, attributable to the sale or disposition of the Securities, or interests therein, held by such selling stockholder. We will bear all costs, expenses and fees in connection with the registration of the Securities. We will not receive any of the proceeds from the sale of the Securities by the selling stockholders.

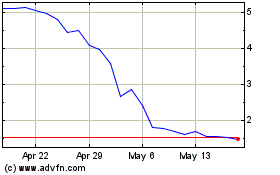

Our common stock is listed on the Nasdaq Capital Market under the symbol “HSDT.” On January 30, 2025, the last reported sale price of our common stock on the Nasdaq Capital Market was $0.635 per share.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROSPECTUS CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025.

CONTENTS

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

5 |

|

|

| |

|

|

|

|

|

6 |

|

|

| |

|

|

|

|

|

7 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

10 |

|

|

| |

|

|

|

|

|

14 |

|

|

| |

|

|

|

|

|

16 |

|

|

| |

|

|

|

|

|

16 |

|

|

| |

|

|

|

|

|

17 |

|

|

| |

|

|

|

|

|

18

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using a shelf registration statement, the selling stockholders may sell up to 6,213,888 shares of our common stock from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale by the selling stockholders of the Securities offered pursuant to this prospectus.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

Neither we, nor the selling stockholders, have authorized anyone to provide you with any information or to make any representations other than those contained or incorporated by reference in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the selling stockholders take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. We and the selling stockholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any post-effective amendment or any prospectus supplement may contain or incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information.

Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be incorporated by reference in this prospectus, any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” incorporated by reference in this prospectus, any post-effective amendment and any applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

When we refer to “Helius,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Helius Medical Technologies, Inc. and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the potential purchasers of the Securities.

This prospectus contains references to trademarks belonging to us and other entities. Solely for convenience, the trademarks and trade names referred to this prospectus, including logos, artwork and other visual displays, may appear without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”). Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “anticipates,” “could,” “should,” “will,” “would,” “may,” “potential,” “contemplates,” “estimates,” “plans,” “projects,” “predicts,” “targets,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” and similar words or phrases. Accordingly, these statements involve estimates, assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus, and in particular those factors included in the sections entitled “Risk Factors” in this prospectus and our most recent Annual Report on Form 10-K, which is on file with the SEC and incorporated herein by reference.

Because the factors referred to in the preceding paragraph could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements we make, you should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should carefully read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein or therein by reference as described under the section titled “Incorporation of Certain Information by Reference,” and with the understanding that our actual future results may materially differ from what we expect.

Except as required by law, forward-looking statements speak only as of the date they are made, and we assume no obligation to update any forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available.

SUMMARY

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you need to consider before making an investment decision. For a more complete understanding of our company, you should read and consider carefully the more detailed information included or incorporated by reference in this prospectus and any applicable prospectus supplement, including the factors described under the heading “Risk Factors” of this prospectus, as well as the information incorporated by reference from our most recent Annual Report on Form 10-K and our most recent Quarterly Reports on Form 10-Q, before making an investment decision.

Overview of the Company

We are a neurotechnology company focused on neurological wellness. Our purpose is to develop, license or acquire non-implantable technologies targeted at reducing symptoms of neurological disease or trauma.

Our product, known as the Portable Neuromodulation Stimulator, or PoNS®, is an innovative non-implantable medical device, inclusive of a controller and mouthpiece, which delivers mild electrical stimulation to the surface of the tongue to provide treatment of gait deficit and chronic balance deficit. PoNS Therapy® is integral to the overall PoNS solution and is the physical therapy applied by patients during use of the PoNS device. PoNS has marketing clearance in the U.S. for use in the U.S. as a short-term treatment of gait deficit due to mild-to-moderate symptoms for multiple sclerosis (“MS”) and is to be used as an adjunct to a supervised therapeutic exercise program in patients 22 years of age and over by prescription only. We began accepting prescriptions for PoNS in the U.S. in March 2022, and commercial sales of PoNS commenced in April 2022. PoNS is authorized for sale in Canada for three indications: (i) as a short term treatment (14 weeks) of chronic balance deficit due to mild-to-moderate traumatic brain injury, or mmTBI, and is to be used in conjunction with physical therapy; (ii) as a short term treatment (14 weeks) of gait deficit due to mild and moderate symptoms from MS and it is to be used in conjunction with physical therapy; and (iii) for use as a short term treatment (14 weeks) of gait deficit due to mild and moderate symptoms from stroke, to be used in conjunction with physical therapy. It has been commercially available in Canada since March 2019. PoNS is authorized for sale as a Class IIa medical device in Australia and we have been seeking a business partner to commercialize and distribute PoNS in Australia.

Recent Developments

Warrant Inducement

On January 21, 2025, we entered into warrant exercise inducement offer letters (the “Inducement Letters”) with certain holders (the “Holders”) of our then-existing Series A warrants and Series B warrants to purchase shares of the Company’s Class A common stock (the “Public Warrants”), pursuant to which the Holders agreed to exercise for cash their Public Warrants to purchase an aggregate of 4,971,110 shares of our common stock, in the aggregate, at a reduced exercise price of $0.751 per share, in exchange for our agreement to issue new Series C Warrants and Series D Warrants (the “Inducement Warrants”) on substantially the same terms as the Public Warrants described below, to purchase up to 6,213,888 shares of common stock (the “Inducement Warrant Shares”). We received aggregate gross proceeds of approximately $3.7 million from the exercise of the Public Warrants by the Holders. We engaged Roth Capital Partners, LLC (“Roth”) to act as our financial advisor with the transactions summarized above and paid Roth $0.2 million for its services, in addition to reimbursement for certain expenses.

We also agreed to file a registration statement on Form S-3 within ten (10) calendar days of the date of the Inducement Letters. In the Inducement Letters, we agreed not to issue any shares of common stock or common stock equivalents or to file any other registration statement with the SEC (in each case, subject to certain exceptions) for sixty (60) calendar days. We also has agreed not to effect or agree to effect any variable rate transaction (as defined in the Inducement Letters) for seventy-five (75) calendar days from the date of the Inducement Letters.

We have agreed to hold an annual or special meeting of stockholders on or prior to the date that is ninety (90) calendar days following the date of the Inducement Letters for the purpose of obtaining

stockholder approval, with the recommendation of the Company’s board of directors that such proposals are approved. If we do not obtain stockholder approval at the first meeting, we have agreed to call a meeting to seek stockholder approval every ninety (90) calendar days until the date that the Inducement Warrants are no longer outstanding.

Nasdaq Matters

On August 9, 2024, we received a Notification Letter from the Listing Qualifications Staff (the “Staff”) of Nasdaq notifying us that because the closing bid price of our common stock was below $1.00 per share for the prior 30 consecutive business days, we are not in compliance with the minimum bid price requirement for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Marketplace Rule 5550(a)(2) (the “Minimum Bid Price Requirement”).

In accordance with Nasdaq Marketplace Rule 5810(c)(3)(A), we have a period of 180 calendar days from August 9, 2024, or until February 5, 2025, to regain compliance with the Minimum Bid Price Requirement. If at any time before February 5, 2025, the closing bid price of our common stock closes at or above $1.00 per share for a minimum of 10 consecutive business days (which number days may be extended by Nasdaq), Nasdaq will provide written notification that we have achieved compliance with the Minimum Bid Price Requirement, and the matter would be resolved.

The Notification Letter also disclosed that in the event we do not regain compliance with the Rule by February 5, 2025, we may be eligible for additional time. To qualify for additional time, we would be required to meet the applicable market value of publicly held shares requirement for continued listing and all other applicable standards for initial listing on The Nasdaq Capital Market, with the exception of the bid price requirement, and would need to provide written notice of our intention to cure the deficiency during the second compliance period. If we meet these requirements, Nasdaq will inform us that it has been granted an additional 180 calendar days. However, if it appears to the Staff that we will not be able to cure the deficiency, or if we are otherwise not eligible, Nasdaq will provide notice that our securities will be subject to delisting.

We intend to continue actively monitor the closing bid price for our common stock between now and February 5, 2025, and will consider available options to resolve the deficiency and regain compliance with the Minimum Bid Price Requirement. If we do not regain compliance within the allotted compliance period, including any extensions that may be granted by Nasdaq, Nasdaq will provide notice that our common stock will be subject to delisting. We would then be entitled to appeal that determination to a Nasdaq hearings panel. There can be no assurance that we will regain compliance with the Minimum Bid Price Requirement during the 180-day compliance period, secure a second period of 180 calendar days to regain compliance, or maintain compliance with the other Nasdaq listing requirements.

If our common stock is delisted from Nasdaq, our ability to raise capital through public offerings of our securities and to finance our operations could be adversely affected. We also believe that delisting would likely result in decreased liquidity and/or increased volatility in our common stock and could harm our business and future prospects. In addition, we believe that, if our common stock is delisted, our stockholders would likely find it more difficult to obtain accurate quotations as to the price of the common stock and it may be more difficult for stockholders to buy or sell our common stock at competitive market prices, or at all.

Our Corporate Information

We are incorporated in the state of Delaware under the name Helius Medical Technologies, Inc. Our principal executive offices are located at 642 Newtown Yardley Road, Suite 100, Newtown, Pennsylvania 18940, and our telephone number is (215) 944-6100. Our website address is www.heliusmedical.com. We have included our website address in this prospectus solely as an inactive textual reference. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase securities.

THE OFFERING

6,213,888 shares of our common stock, issuable upon the exercise of Series C Warrants and Series D Warrants.

The selling stockholders will each determine when and how they will sell the Securities offered in this prospectus, as described in the “Plan of Distribution.”

Terms of the Series C Warrants and Series D Warrants

Each Series C Warrant entitles the holder to purchase one share of common stock, subject to any adjustments, at an exercise price of $0.751 per share. The Series C Warrants will expire five years from the date of stockholder approval.

Each Series D Warrant entitles the holder to purchase one share of common stock, subject to any adjustments, at an exercise price of $0.751 per share. The Series D Warrants will expire two years from the date of stockholder approval.

We will not receive any proceeds from the sale of the Securities by the selling stockholders in this offering. See “Use of Proceeds.”

See the section under the heading “Risk Factors” in this prospectus and the other information included in, or incorporated by reference into, this prospectus or any prospectus supplement for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock.

Nasdaq Capital Market symbol

“HSDT”

RISK FACTORS

Investment in the Securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference herein from our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, and our recently filed Current Reports on Form 8-K, as well as any subsequent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such Securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered Securities.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the Securities covered by this prospectus and any accompanying prospectus supplement. All proceeds from the sale of the Securities will be for the respective accounts of the selling stockholders named herein. We will bear all other costs, fees and expenses incurred in effecting the registration of the Securities covered by this prospectus and any accompanying prospectus supplement, including, without limitation, all registration and filing fees, Nasdaq listing fees and fees and expenses of our counsel and our accountants. Each selling stockholder will each pay any discounts, commissions, and fees of underwriters, selling brokers, dealer managers or similar securities industry professionals incurred by such selling stockholder in disposing of the Securities covered by this prospectus.

SELLING STOCKHOLDERS

We have prepared this prospectus to allow the selling stockholders or their pledgees, donees, transferees or other successors in interest, to sell or otherwise dispose of, from time to time, up to 6,213,888 shares of our common stock issuable upon (i) the exercise of the Series C Warrants, and (ii) the exercise of the Series D Warrants.

We are registering the above-referenced Securities to permit the selling stockholders and their donees, pledgees, transferees or other successors in interest that receive Securities after the date of this prospectus to resell or otherwise dispose of the Securities in the manner contemplated under “Plan of Distribution” below.

In connection with certain registration rights that we granted to the selling stockholders, we filed with the SEC a Registration Statement on Form S-3, of which this prospectus forms a part, with respect to the resale or other disposition of the Securities offered by this prospectus from time to time on Nasdaq, in privately negotiated transactions or otherwise.

The following table sets forth the names of each of the selling stockholders and the aggregate number of Securities that the selling stockholders may offer and sell pursuant to this prospectus, as well as other information regarding the beneficial ownership (as determined under Section 13(d) of the Exchange Act and the rules and regulations thereunder) of the shares of common stock of the Company held by the selling stockholder.

The selling stockholders may sell some, all or none of the Securities. We do not know how long the selling stockholders will hold the Securities before selling them, and we currently have no agreements, arrangements or understandings with any selling stockholder regarding the sale or other disposition of any of the Securities. The Securities may be offered and sold from time to time by the selling stockholders pursuant to this prospectus. The information below assumes the offer and sale of all Securities beneficially owned by the selling stockholders and available for sale under this prospectus and assumes no further acquisitions or dispositions of Securities by the selling stockholders. The information set forth below is based upon information obtained from the selling stockholders. The percentages of shares owned after the offering are based on 5,674,222 shares of common stock outstanding as of January 24, 2025.

Please see the section titled “Plan of Distribution” for further information regarding the selling stockholders’ method of distributing these shares.

|

Name

|

|

|

Number of Shares of

Common Stock

Beneficially Owned

Prior to the Offering

|

|

|

Number of Shares of

Common Stock

Registered for Sale

Hereby

|

|

|

Number of Shares of

Common Stock

Beneficially Owned

After the Offering

|

|

|

Percent of Shares of

Common Stock Owned

After the Offering

|

|

|

Armistice Capital, LLC(1)

|

|

|

|

|

7,683,011 |

|

|

|

|

|

4,444,445 |

|

|

|

|

|

3,238,566 |

|

|

|

|

|

21.6% |

|

|

|

Bigger Capital Fund LP(2)

|

|

|

|

|

555,555 |

|

|

|

|

|

555,555 |

|

|

|

|

|

0 |

|

|

|

|

|

* |

|

|

|

District 2 Capital Fund LP(3)

|

|

|

|

|

555,555 |

|

|

|

|

|

555,555 |

|

|

|

|

|

0 |

|

|

|

|

|

* |

|

|

|

Intracoastal Capital LLC(4)

|

|

|

|

|

333,923 |

|

|

|

|

|

333,333 |

|

|

|

|

|

590 |

|

|

|

|

|

* |

|

|

|

Porter Partners, L.P.(5)

|

|

|

|

|

631,424 |

|

|

|

|

|

325,000 |

|

|

|

|

|

306,424 |

|

|

|

|

|

2.58% |

|

|

*

Less than 1%

(1)

Consists of: (i) 108,010 shares of our common stock and 3,130,556 shares which are held by us in abeyance for the benefit of the Selling Stockholder, and (ii) 4,444,445 shares of our common stock (underlying the Inducement Warrants) being offered by this prospectus. The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The Inducement Warrants are subject to a beneficial ownership limitation of 9.99%, which limitation restricts the holder from exercising that portion of the warrants that would result in such holder and its affiliates owning, after exercise, a number of shares of common stock in excess of the

beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022.

(2)

Consists of 555,555 shares of our common stock (underlying the Inducement Warrants) being offered by this prospectus. Michael Bigger, Managing Member of Bigger Capital Fund LP, has sole voting and dispositive power over the shares of our common stock held by, or issuable to, Bigger Capital Fund LP. The principal business address of Bigger Capital Fund LP is 11700 W Charleston Blvd 170-659, Las Vegas, NV 89135. Mr. Bigger disclaims beneficial ownership in such securities, except for his pecuniary interest therein.

(3)

Consists of 555,555 shares of our common stock (underlying the Inducement Warrants) being offered by this prospectus. Michael Bigger, Managing Member of the GP of District 2 Capital Fund LP, has sole voting and dispositive power over the shares of our common stock held by, or issuable to, District 2 Capital Fund LP. The principal business address of District 2 Capital Fund LP is 14 Wall St., 2nd Fl., Huntington, NY 11743. Mr. Bigger disclaims beneficial ownership in such securities, except for his pecuniary interest therein.

(4)

Consists of: (i) 590 shares issuable underlying outstanding warrants, and (ii) 333,333 shares of our common stock (underlying the Inducement Warrants) being offered by this prospectus. Mitchell P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act) of the securities reported herein that are held by Intracoastal. The address for Intracoastal is 245 Palm Trail, Delray Beach, FL 33483.

(5)

Consists of: (i) 306,424 shares of our common stock and (ii) 325,000 shares of our common stock (underlying the Inducement Warrants) being offered by this prospectus. The address for Porter Partners, L.P. is 300 Drakes Landing Road, Suite 171, Greenbrae, CA 94904.

Material Relationships with the Selling Stockholders

Below is a description of material relationships in the past three years between the Company, its predecessors or affiliates and the selling stockholders.

2024 Public Offering

On May 6, 2024, the Company entered into a placement agency agreement (the “Placement Agency Agreement”) with Craig-Hallum Capital Group LLC (the “Placement Agent”) for the purchase and sale, in a registered public offering by the Company (the “2024 Public Offering”) of 704,999 shares of common stock and 2,147,222 pre-funded warrants, each to purchase one share of common stock at an exercise price of $0.001 per share (the “Pre-funded Warrants”) together with accompanying Series A Warrants to purchase up to 2,852,221 shares of its common stock and Series B Warrants to purchase up to 2,852,221 shares of its common stock. The public offering price per share of common stock and accompanying Series A Warrants and Series B Warrants is $2.25, the public offering price per Pre-Funded Warrant and accompanying Series A Warrants and Series B Warrants is $2.249, resulting in gross proceeds to the Company of approximately $6.4 million before deducting the Placement Agent’s fees and other estimated offering expenses. The 2024 Public Offering closed on May 9, 2024. Each of the selling stockholders participated in the 2024 Public Offering.

Warrant Exercise

On January 21, 2025, the Company entered into warrant exercise Inducement Letters with each of the selling stockholders, pursuant to which the selling stockholders each agreed to exercise for cash their Series A Warrants and Series B Warrants to purchase 4,971,110 shares of the Company’s common stock, in the aggregate, at a reduced exercise price of $0.751 per share, in exchange for the Company’s agreement to issue new Inducement Warrants on substantially the same terms as the Series A Warrants and Series B Warrants, to purchase up to 6,213,888 of the Inducement Warrant Shares. The Company received aggregate gross proceeds of approximately $3.7 million from the exercise of the Public Warrants by the selling stockholders.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock and provisions of our Certificate of Incorporation and Second Amended and Restated Bylaws are summaries. You should also refer to the Certificate of Incorporation and the Second Amended and Restated Bylaws, which are filed as exhibits to the registration statement of which this prospectus is a part.

General

Our Certificate of Incorporation authorizes us to issue up to 150,000,000 shares of common stock and 10,000,000 shares of preferred stock, par value $0.001 per share, all of which shares of preferred stock are currently undesignated. Our board of directors may establish the rights and preferences of the preferred stock from time to time.

As of December 31, 2024, there were (i) 3,728,172 shares of common stock outstanding; (ii) no outstanding shares of preferred stock; (iii) 2,092,461 shares of common stock issuable upon the exercise of outstanding stock options; (iv) 6,472,934 shares of common stock issuable upon the exercise of outstanding warrants; and (v) no restricted stock units.

Common Stock

Voting

Each holder of our common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. Our stockholders do not have cumulative voting rights. Because of this, the holders of a majority of the shares of common stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose.

Dividends

Subject to preferences that may be applicable to any then-outstanding preferred stock, holders of our common stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by the board of directors out of legally available funds.

Liquidation

In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then-outstanding shares of preferred stock.

Rights and Preferences

Holders of our common stock have no preemptive, conversion or subscription rights and there are no redemption or sinking fund provisions applicable to the common stock. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate in the future.

Preferred Stock

Our board of directors has the authority under our Certificate of Incorporation, without further action by our stockholders, to issue up to 10,000,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each such series, to fix the rights, preferences and privileges of the shares of each wholly unissued series and any qualifications, limitations or restrictions thereon, and to increase or decrease the number of shares of any such series, but not below the number of shares of such series then outstanding.

Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our common stock. The purpose

of authorizing our board of directors to issue preferred stock and determine its rights and preferences is to eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of us and may adversely affect the market price of our common stock and the voting and other rights of the holders of our common stock. It is not possible to state the actual effect of the issuance of any shares of preferred stock on the rights of holders of common stock until the board of directors determines the specific rights attached to that preferred stock.

Anti-Takeover Provisions

Section 203 of the Delaware General Corporation Law

We are subject to Section 203 of the Delaware General Corporation Law, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

•

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

•

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding, but not the outstanding voting stock owned by the interested stockholder, those shares owned (1) by persons who are directors and also officers and (2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least 662∕3% of the outstanding voting stock that is not owned by the interested stockholder.

In general, Section 203 defines a “business combination” to include the following:

•

merger or consolidation involving the corporation or any direct or indirect majority-owned subsidiary of the corporation and the interested stockholder;

•

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder (in one transaction or a series of transactions);

•

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation or by any direct or indirect majority-owned subsidiary of the corporation of any stock of the corporation or of such subsidiary to the interested stockholder;

•

any transaction involving the corporation or any direct or indirect majority-owned subsidiary of the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

•

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or through the corporation.

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation.

Certificate of Incorporation and the Second Amended and Restated Bylaws

Our Certificate of Incorporation provides that the authorized number of directors may be changed only by resolution of the board of directors, and vacancies and newly created directorships on the board of

directors may, except as otherwise required by law or determined by the board of directors, only be filled by a majority vote of the directors then serving on the board of directors, even though less than a quorum.

Our Second Amended and Restated Bylaws provide that all stockholder actions must be effected at a duly called meeting of stockholders and eliminate the right of stockholders to act by written consent without a meeting. Our Second Amended and Restated Bylaws also provide that only our Chairman of the board of directors, Chief Executive Officer or the board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders.

Our Second Amended and Restated Bylaws also provide that stockholders seeking to present proposals before a meeting of stockholders to nominate candidates for election as directors at a meeting of stockholders must provide timely advance notice in writing, and specify requirements as to the form and content of a stockholder’s notice. At any meeting of stockholders for the election of directors at which a quorum is present, the election will be determined by a plurality of the votes cast by the stockholders entitled to vote at the election.

Our Certificate of Incorporation and the Second Amended and Restated Bylaws provide that the stockholders cannot amend many of the provisions described above except by a vote of 662∕3% or more of our outstanding common stock. As described above, our Certificate of Incorporation gives our board of directors the authority, without further action by our stockholders, to issue up to 10,000,000 shares of preferred stock in one or more series.

The combination of these provisions will make it more difficult for our existing stockholders to replace our board of directors as well as for another party to obtain control of us by replacing our board of directors. Since our board of directors has the power to retain and discharge our officers, these provisions could also make it more difficult for existing stockholders or another party to effect a change in management. In addition, the authorization of undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change our control.

These provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and its policies and to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to reduce our vulnerability to hostile takeovers and to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect of discouraging others from making tender offers for our shares and may have the effect of delaying changes in our control or management. As a consequence, these provisions may also inhibit fluctuations in the market price of our stock that could result from actual or rumored takeover attempts. We believe that the benefits of these provisions, including increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure our Company, outweigh the disadvantages of discouraging takeover proposals, because negotiation of takeover proposals could result in an improvement of their terms.

Choice of Forum

Our Certificate of Incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for:

•

any derivative action or proceeding brought on our behalf;

•

any action asserting a breach of fiduciary duty;

•

any action asserting a claim against us arising pursuant to the Delaware General Corporation Law, our Certificate of Incorporation or our Second Amended and Restated Bylaws; or

•

any action asserting a claim against us that is governed by the internal affairs doctrine.

The provision does not apply to suits brought to enforce a duty or liability created by the Exchange Act.

The enforceability of similar choice of forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that, in connection with any action, a court could

find the choice of forum provisions contained in our Certificate of Incorporation to be inapplicable or unenforceable in such action. Our Certificate of Incorporation further provides that the federal district courts of the United States will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act, subject to and contingent upon a final adjudication in the State of Delaware of the enforceability of such exclusive forum provision.

Registration Rights

Pursuant to the terms of convertible notes issued to A&B (HK) Company Limited in October 2015 and December 2015, we agreed to register any shares issued upon the conversion of such convertible notes upon the request of A&B (HK) Company Limited. As of December 31, 2024, A&B (HK) Company Limited beneficially owned 1,426 shares of common stock that were issued upon the conversion of such convertible notes.

Transfer Agent and Registrar

Our transfer agent and the registrar is Equiniti Trust Company, LLC, 6201 15th Avenue, Brooklyn, New York 11219; Telephone: 800-937-5449.

PLAN OF DISTRIBUTION

The selling stockholders, including their pledgees, donees, transferees, distributees, beneficiaries or other successors in interest, may from time to time offer some or all of the Securities by this prospectus. We will not receive any of the proceeds from the sale of the Securities covered by this prospectus by the selling stockholders. The selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. We will bear all fees and expenses incident to our obligation to register the Securities covered by this prospectus.

The selling stockholders may each sell all or a portion of the Securities beneficially owned by it and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the Securities are sold through underwriters or broker-dealers, the selling stockholders will each be responsible for underwriting discounts or commissions or agent’s commissions in connection with the Securities held by such selling stockholders. The Securities may be sold on any national securities exchange or quotation service on which the Securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at privately negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions.

The selling stockholders may use any one or more of the following methods when disposing of Securities or interests therein:

•

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•

block trades in which the broker-dealer will attempt to sell the Securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an over-the-counter distribution;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

short sales effected after the effective date of the registration statement of which this prospectus is a part;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

•

through trading plans entered into by the selling stockholders pursuant to Rule 10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans;

•

through firm-commitment underwritten public offerings;

•

a combination of any such methods of sale; or

•

any other method permitted pursuant to applicable law.

The selling stockholders may each, from time to time, pledge or grant a security interest in some or all of the Securities owned and, if any selling stockholder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the Securities, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of the selling stockholders to include the pledgee, transferee, or other successors in interest as the selling stockholders under this prospectus. The selling stockholders also may transfer the

Securities in other circumstances, in which case the transferees, pledgees or other successors in interest will be the beneficial owners for purposes of this prospectus.

In connection with the sale of Securities, or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions it assumes. The selling stockholders may also sell Securities short and deliver the Securities to close out any such short positions, or loan or pledge the Securities to broker-dealers that in turn may sell these Securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of Securities offered by this prospectus, which Securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Broker-dealers engaged by the selling stockholders may arrange for other broker-dealers to participate in sales. If the selling stockholders effect certain transactions by selling Securities to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from such selling stockholders or commissions from purchasers of the Securities for whom they may act as agent or to whom they may sell as principal. Such commissions will be in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction will not be in excess of a customary brokerage commission in compliance with applicable rules of the Financial Industry Regulatory Authority, or FINRA, and in the case of a principal transaction, a markup or markdown in compliance with applicable FINRA rules.

The aggregate proceeds to the selling stockholders from the sale of the Securities offered will be the purchase price of the Securities less discounts or commissions, if any. The selling stockholders reserve the right to accept and, together with their respective agents from time to time, to reject, in whole or in part, any proposed purchase of Securities to be made directly or through agents. The selling stockholders also may resell all or a portion of the Securities in open market transactions in reliance upon Rule 144 under the Securities Act, rather than under this prospectus, provided that each meets the criteria and conforms to the requirements of that rule.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the Securities, or interests therein, may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the Securities may be underwriting discounts and commissions under the Securities Act. If selling securities pursuant to this prospectus, the selling stockholders are subject to the prospectus delivery requirements of the Securities Act.

To the extent required pursuant to Rule 424(b) under the Securities Act, the Securities to be sold, the names of the selling stockholders, the purchase price and public offering price, the names of any agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Securities may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Securities may not be sold unless they have been registered or qualified for sale, or an exemption from registration or qualification requirements is available and the selling stockholder complies with such exemption’s requirements.

The selling stockholders and any other person participating in a sale of the Securities registered under this prospectus will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the Securities by the selling stockholders and any other participating person.

All of the foregoing may affect the marketability of the Securities and the ability of any person or entity to engage in market-making activities with respect to the Securities. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling

stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. We have agreed to indemnify the selling stockholders against certain liabilities, including certain liabilities under the Securities Act, the Exchange Act or other federal or state law. We and the selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the Securities against certain liabilities, including liabilities arising under the Securities Act.

LEGAL MATTERS

Honigman LLP will pass upon certain legal matters relating to the issuance and sale of the common stock offered hereby on behalf of Helius Medical Technologies, Inc.

EXPERTS

The consolidated financial statements as of December 31, 2023 and 2022, and for the years then ended, incorporated by reference in this Prospectus and in the Registration Statement have been so incorporated in reliance on the reports of Baker Tilly US, LLP, an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting. The report on the consolidated financial statements contains an explanatory paragraph regarding our ability to continue as a going concern.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our web site address is https://www.heliusmedical.com/. The information contained in, or accessible through, our web site, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

INCORPORATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information.

Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

•

•

•

Our Current Reports on Form 8-K, filed with the SEC on February 9, 2024, March 4, 2024, March 15, 2024, April 5, 2024, May 6, 2024, May 9, 2024, May 31, 2024, June 3, 2024, June 28, 2024, August 9, 2024, November 18, 2024, December 23, 2024, and January 15, 2025, and January 24, 2025.

•

•

The description of our common stock included in our registration statement on Form 8-A filed on April 4, 2018, including any amendments or reports filed for the purposes of updating this description.

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering, including all such documents we may file with the SEC after the date of filing of this registration statement and prior to the effectiveness of this registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

Helius Medical Technologies, Inc.

642 Newtown Yardley Road, Suite 100

Attn: Jeffrey Mathiesen

Phone: (215) 944-6100

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

6,213,888 Shares of Common Stock

PROSPECTUS

, 2025

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth estimated expenses in connection with the issuance and distribution of the shares of common stock being registered hereby. Each item listed is estimated, except for the SEC registration fee:

| |

SEC registration Fee

|

|

|

|

$ |

618.38 |

|

|

| |

Accounting fees and expenses

|

|

|

|

|

*

|

|

|

| |

Legal fees and expenses

|

|

|

|

|

*

|

|

|

| |

Transfer agent and registrar fees and expenses

|

|

|

|

|

*

|

|

|

| |

Printing and miscellaneous expenses

|

|

|

|

|

*

|

|

|

| |

Total

|

|

|

|

$ |

*

|

|

|

*

Except for the SEC registration fee, estimated expenses are not presently known. The foregoing sets forth the general categories of expenses (other than underwriting discounts and commissions) that we anticipate we will incur in connection with the offering of shares of our common stock under this Registration Statement. To the extent required, any applicable prospectus supplement will set forth the estimated aggregate amount of expenses payable in respect of any offering of shares of our common stock under this Registration Statement.

Item 15. Indemnification of Directors and Officers

We are incorporated under the laws of the State of Delaware. Section 102 of the Delaware General Corporation Law permits a corporation to eliminate the personal liability of directors of a corporation to the corporation or its stockholders for monetary damages for a breach of fiduciary duty as a director, except where the director breached his or her duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit.

Section 145 of the Delaware General Corporation Law provides that a corporation has the power to indemnify a director, officer, employee or agent of the corporation and certain other persons serving at the request of the corporation in related capacities against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlements actually and reasonably incurred by the person in connection with an action, suit or proceeding to which he or she is or is threatened to be made a party by reason of such position, if such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful, except that, in the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the adjudication of liability but in view of all of the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Our certificate of incorporation provides that the liability of the directors for monetary damages shall be eliminated to the fullest extent under applicable law. Additionally, as permitted by the Delaware General Corporation Law, our Second Amended and Restated Bylaws provide that: (1) we are required to indemnify our directors and executive officers to the fullest extent permitted by the Delaware General Corporation Law; (2) we may, in our discretion, indemnify our other officers, employees and agents as set forth in the Delaware General Corporation Law; (3) we are required, upon satisfaction of certain conditions, to advance all expenses incurred by our directors and executive officers in connection with certain legal proceedings; (4) the rights conferred in the bylaws are not exclusive; (5) we are authorized to enter into indemnification agreements with our directors, officers, employees and agents; and (6) we may secure insurance on behalf of

any director, officer, employee or other agent for any liability arising out of his or her actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under the provisions of Delaware law.

We have entered into indemnification agreements with our directors and officers. These agreements provide broader indemnity rights than those provided under the Delaware General Corporation Law and our Certificate of Incorporation. The indemnification agreements are not intended to deny or otherwise limit third-party or derivative suits against us or our directors or officers, but to the extent a director or officer were entitled to indemnity or contribution under the indemnification agreement, the financial burden of a third-party suit would be borne by us, and we would not benefit from derivative recoveries against the director or officer. Such recoveries would accrue to our benefit but would be offset by our obligations to the director or officer under the indemnification agreement.

We maintain a directors’ and officers’ liability insurance policy. The policy insures directors and officers against unindemnified losses arising from certain wrongful acts in their capacities as directors and officers and reimburses us for those losses for which we have lawfully indemnified the directors and officers. The policy contains various exclusions.

Item 16. Exhibits

| |

Exhibit

Number

|

|

|

Description

|

|

| |

4.1

|

|

|

|

|

| |

4.2

|

|

|

|

|

| |

4.3

|

|

|

|

|

| |

4.4

|

|

|

|

|

| |

4.5

|

|

|

|

|

| |

5.1*

|

|

|

|

|

| |

23.1*

|

|

|

|

|

| |

23.2*

|

|

|

|

|

| |

24.1*

|

|

|

|

|

| |

107*

|

|

|

|

|

*

filed herewith.

Item 17. Undertakings

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously

disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communications that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Newton, state of Pennsylvania, on January 31, 2025.

| |

|

|

|

HELIUS MEDICAL TECHNOLOGIES, INC.

|

|

| |

|

|

|

By:

|

|

|

/s/ Dane C. Andreeff

Dane C. Andreeff

President, Chief Executive Officer and Director

|

|

POWER OF ATTORNEY