Assure Holdings Corp. (the “Company” or “Assure”) (NASDAQ: IONM), a

provider of intraoperative neuromonitoring (“IONM”) and remote

neurology services, would like to thank its stockholders for their

support of Proposal 1 – To approve the amendment of the Company’s

Articles of Incorporation, to increase the number of authorized

shares (the “Authorized Share Increase”) in the Company’s common

shares from 9,000,000 to 250,000,000, and remind those stockholders

that have not yet voted to vote without delay "FOR" Proposal 1 and

the other proposals in the Company's proxy statement for the

special meeting of its stockholders to be held on May 14, 2024 at

2:00 p.m. Pacific Time.

"The overwhelming majority of Assure stockholders who have

submitted their votes have voted in favor of Proposal 1. However,

more votes are needed to meet the required threshold for the

proposal to pass," stated John Farlinger, Chief Executive Officer

and Chairman of Assure.

"Assure has thousands of stockholders and many of them hold

relatively small positions. For the proposals to pass, it is

necessary also for stockholders with smaller positions to submit

their votes in favor of the proposals. Larger stockholders cannot

carry this forward alone," continued Mr. Farlinger. "I encourage

everyone who owned Assure shares on April 11th, the record date for

this meeting, to exercise their right to vote and help make this

critical increase in capital a reality.”

Assure stockholders should note that the authorized shares

proposal (Proposal 1) must be approved by greater than 50% of the

shareholders for the proposal to pass. Failure to vote or an

abstention from voting will have the same effect as a vote

"AGAINST" the increase proposal. All stockholders are asked to vote

"FOR" all proposals now. If you previously voted against any of

these proposals and would now like to change your vote, you can do

so by contacting Assure's proxy solicitor.

THE INCREASE IN CAPITAL CANNOT BE

OBTAINED UNLESSTHE PROPOSAL IS

APPROVED.Assure stockholders – Please

vote TODAY!

How to VoteAssure stockholders as of the close

of business on April 11, 2024, are entitled to vote at the special

meeting and have received copies of the Company's proxy

statement/prospectus/ information statement dated April 16, 2024.

If you are a Assure stockholder and you have questions or require

assistance in submitting your proxy or voting your shares, please

contact Assure's proxy solicitor:

ADVANTAGE PROXY,

INC.Toll Free:

1-877-870-8565Collect:

1-206-870-8565Email:

ksmith@advantageproxy.com

In addition, Assure's proxy solicitor may contact stockholders

on behalf of the Company. If you are a Assure stockholder and you

have not yet voted, please anticipate, and answer these incoming

calls and messages.

About Assure Holdings

Assure Holdings Corp. is a best-in-class provider of outsourced

intraoperative neuromonitoring and remote neurology services. The

Company delivers a turnkey suite of clinical and operational

services to support surgeons and medical facilities during invasive

procedures that place the nervous system at risk including

neurosurgery, spine, cardiovascular, orthopedic and ear, nose, and

throat surgeries. Assure employs highly trained technologists that

provide a direct point of contact in the operating room. Physicians

employed through Assure subsidiaries simultaneously monitor the

functional integrity of patients’ neural structures throughout the

procedure communicating in real-time with the surgeon and

technologist. Accredited by The Joint Commission, Assure’s mission

is to provide exceptional surgical care and a positive patient

experience. For more information, visit the company’s website at

www.assureneuromonitoring.com.

Additional Information and Where to Find It

In connection with the Authorized Share Increase and the special

meeting of stockholders of Assure, Assure has filed a definitive

proxy statement on Schedule 14A with the the United States

Securities and Exchange Commission, or the SEC, on April 16, 2024,

as amended on April 24, 2024. This communication is not a

substitute for the definitive proxy statement for the special

meeting. Investors and securityholders may obtain free copies of

the definitive proxy statement on Assure’s website at

www.assureneuromonitoring.com, on the SEC’s website at www.sec.gov

or by directing a request to Assure at 7887 E. Belleview Ave.,

Suite 240, Denver, Colorado, USA 80111, Attention: John Farlinger,

Chief Executive Officer; or by email at ir@assureiom.com,

This communication may be deemed to be solicitation material

with respect to the proposed transactions between Assure and Danam

Health Inc. In connection with the proposed transaction, Assure has

filed relevant materials with the SEC, including a registration

statement on Form S-4, filed with the SEC on May 3, 2024, that

contains a prospectus and a proxy statement. Assure will mail the

proxy statement/prospectus to the Assure and Danam stockholders,

and the securities may not be sold or exchanged until the

registration statement becomes effective.

Investors and securityholders of Assure and Danam are urged to

read these materials when they become available because they will

contain important information about Assure, Danam and the proposed

transactions. This communication is not a substitute for the

registration statement, definitive proxy statement/prospectus or

any other documents that Assure may file with the SEC or send to

securityholders in connection with the proposed transactions.

Investors and securityholders may obtain free copies of the

documents filed with the SEC, once available, on Assure’s website

at www.assureneuromonitoring.com, on the SEC’s website at

www.sec.gov or by directing a request to Assure at 7887 E.

Belleview Ave., Suite 240, Denver, Colorado, USA 80111, Attention:

John Farlinger, Chief Executive Officer; or by email at

ir@assureiom.com.

This communication shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Participants in the Solicitation

Each of Assure and Danam and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from the stockholders of Assure in

connection with the proposed transaction. Information about the

executive officers and directors of Assure are set forth in

Assure’s Definitive Proxy Statement on Schedule 14A relating to the

2023 Annual Meeting of Stockholders of Assure, filed with the SEC

on December 5, 2023 and in Assure’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, filed with the SEC on

April 26, 2024. Other information regarding the interests of such

individuals, who may be deemed to be participants in the

solicitation of proxies for the stockholders of Assure are set

forth in the proxy statement/prospectus, which is included in

Assure’s registration statement on Form S-4 filed with the SEC on

May 3, 2024. You may obtain free copies of these documents as

described above.

Cautionary Statements Regarding Forward-Looking

Statements

This press release contains forward-looking statements based

upon the current expectations of Assure and Danam. Forward-looking

statements involve risks and uncertainties and include, but are not

limited to, statements about the structure, timing and completion

of the proposed transactions; the listing of the combined company

on Nasdaq after the closing of the proposed merger; expectations

regarding the ownership structure of the combined company after the

closing of the proposed merger; the expected executive officers and

directors of the combined company; the expected cash position of

each of Assure and Danam and the combined company at the closing of

the proposed merger; the future operations of the combined company;

and other statements that are not historical fact. Actual results

and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of these

risks and uncertainties, which include, without limitation: (i) the

risk that the conditions to the closing of the proposed transaction

are not satisfied, including the failure to timely obtain

stockholder approval for the transaction, if at all; (ii)

uncertainties as to the timing of the consummation of the proposed

transaction and the ability of each of Assure and Danam to

consummate the proposed merger, as applicable; (iii) risks related

to Assure’s ability to manage its operating expenses and its

expenses associated with the proposed transactions pending closing;

(iv) risks related to the failure or delay in obtaining required

approvals from any governmental or quasi-governmental entity

necessary to consummate the proposed transactions; (v) the risk

that as a result of adjustments to the exchange ratio, Assure

stockholders and Danam stockholders could own more or less of the

combined company than is currently anticipated; (vi) risks related

to the market price of Assure’s common stock; (vii) unexpected

costs, charges or expenses resulting from either or both of the

proposed transaction; (viii) potential adverse reactions or changes

to business relationships resulting from the announcement or

completion of the proposed transactions; (ix) risks related to the

inability of the combined company to obtain sufficient additional

capital to continue to advance its business plan; and (x) risks

associated with the possible failure to realize certain anticipated

benefits of the proposed transactions, including with respect to

future financial and operating results. Actual results and the

timing of events could differ materially from those anticipated in

such forward-looking statements as a result of these risks and

uncertainties. These and other risks and uncertainties are more

fully described in periodic filings with the SEC, including the

factors described in the section titled “Risk Factors” in Assure’s

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the SEC, and in other filings that Assure makes and will

make with the SEC in connection with the proposed transaction,

including the proxy statement/prospectus described under

“Additional Information and Where to Find It.” You should not place

undue reliance on these forward-looking statements, which are made

only as of the date hereof or as of the dates indicated in the

forward-looking statements. Except as required by law, Assure

expressly disclaims any obligation or undertaking to update or

revise any forward-looking statements contained herein to reflect

any change in its expectations with regard thereto or any change in

events, conditions or circumstances on which any such statements

are based.

ContactsBrett Maas, Managing PrincipalHayden

IRionm@haydenir.com(646) 536-7331

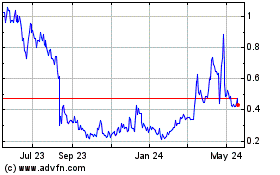

Assure (NASDAQ:IONM)

Historical Stock Chart

From Nov 2024 to Dec 2024

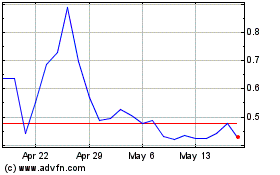

Assure (NASDAQ:IONM)

Historical Stock Chart

From Dec 2023 to Dec 2024