0001006045

false

0001006045

2023-10-18

2023-10-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

October 18, 2023

Date of Report (date of earliest event reported)

IRIDEX CORPORATION

(Exact name of registrant as specified

in its charter)

| Delaware |

000-27598 |

77-0210467 |

(State or other jurisdiction of

Employer incorporation

or organization) |

(Commission File Number) |

(I.R.S.

Identification Number) |

1212 Terra Bella Avenue

Mountain View, California 94043

(Address of principal executive offices, including

zip code)

(650) 940-4700

(Registrant’s telephone number,

including area code)

(Former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of

Class |

|

Trading

Symbol |

|

Name of Exchange

on Which Registered |

| Common Stock, par value $0.01 per share |

|

IRIX |

|

Nasdaq Global Market |

Delaware Section 205

Petition

On February 22, 1996, following the initial

public offering of IRIDEX Corporation (the “Company”), the Company filed an Amended and Restated Certificate of Incorporation

(the “Amended Charter”) with the Delaware Secretary of State. The Company believes that the Amended Charter was validly approved

in accordance with 8 Del. C. § 242, which requires, in relevant part, that a company’s

“board of directors shall adopt a resolution setting forth the amendment proposed, declaring its advisability, and either calling

a special meeting of the stockholders entitled to vote in respect thereof for the consideration of such amendment or directing that the

amendment proposed be considered at the next annual meeting of the stockholders.” The Company has treated the Amended Charter as

its governing charter for nearly 30 years.

On May 8, 2023, the Company received a letter

from a putative stockholder of the Company that raised uncertainty as to whether the Amended Charter was validly approved pursuant to

the Delaware General Corporation Law (the “DGCL”). Given the passage of time, the Company has been unable to locate documents

confirming the validity of the Amended Charter’s approval despite having conducted a good faith investigation.

To resolve any uncertainty with respect to the

validity of the Amended Charter caused by the passage of time and the unavailability of documentary evidence, on October 2, 2023, the

Company filed a petition in the Court of Chancery under Section 205 of the DGCL seeking to validate the filing and effectiveness of the

Amended Charter (the “Petition”). Section 205 of the DGCL permits the Court of Chancery, in its discretion, to ratify and

validate potentially defective corporate acts. A copy of the Petition in the form filed with the Court of Chancery is attached as Exhibit

99.1 to this Form 8-K. Concurrently with the Petition, the Company filed a motion to expedite the hearing on the Petition.

The Court of Chancery granted the motion to

expedite and directed the Company to (1) file this Form 8-K attaching the Petition (see Exhibit

99.1 to this Form 8-K for a copy of the Petition); and (2) notify stockholders that the Court of Chancery will hold a final hearing to

consider the merits of the Petition on November 1, 2023, at 1:30 p.m. Eastern Time, at the Leonard L. Williams Justice Center, 500 North

King Street, Wilmington, Delaware 19801 (the “Section 205 Hearing”).

This Current Report on Form 8-K constitutes

notice of the Section 205 Hearing. If any stockholder of the Company wishes to express a position on the Petition, such stockholder may

(1) appear at the Section 205 Hearing, or (2) file a written submission with the Register in Chancery, Leonard L. Williams Justice Center,

500 North King Street, Wilmington, Delaware 19801, referring to the case caption, In re Iridex Corp., C.A. No. 2023-0990-NAC (Del.

Ch.) in advance of the Section 205 Hearing, and any such written submission also should be emailed to the Company’s counsel, Jessica

Hartwell, Wilson Sonsini Goodrich & Rosati, Professional Corporation, at jhartwell@wsgr.com.

Forward-Looking Statements,

Risks and Uncertainties

This Current Report on Form 8-K contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Privates Securities Litigation Reform Act of 1995,

which involve substantial risks and uncertainties. These forward-looking statements include, but are not limited to, statements regarding

the outcome of the Company’s proceeding pursuant to DGCL Section 205 and the potential impacts of an unsuccessful outcome. The Section

205 proceeding is subject to inherent risks and uncertainties and is beyond the Company’s control and may not result in timely resolution

of the uncertainty regarding the validity of the Company’s Amended Charter, if at all. Forward-looking statements include all statements

that are not historical facts and can be identified by terms such as “believe,” “may,” “will,” “continue,”

“anticipate,” “assume,” or similar expressions and the negatives of those terms. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results

to differ materially from those expected or implied by the forward-looking statements. Investors are cautioned not to place undue reliance

on the forward-looking statements. All information provided in this Current Report on Form 8-K and in the exhibits is as of the date hereof

and is based on then-current expectations and the beliefs and assumptions of management. We undertake no duty to update this information

unless required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

IRIDEX CORPORATION |

| By: |

/s/

David I. Bruce |

| |

David I. Bruce

President and Chief Executive Officer |

Date: October 18, 2023

Exhibit 99.1

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

| In re IRIDEX CORP. |

) |

C.A. No. 2023 __________ |

| |

) |

|

VERIFIED PETITION FOR RELIEF PURSUANT TO 8 DEL.

C. § 205

Petitioner

IRIDEX Corporation (“IRIDEX” or the “Company”), by and through its undersigned counsel, petitions the Court pursuant

to 8 Del. C. § 205 as follows:

NATURE OF THE ACTION

1.

IRIDEX seeks a declaration that its Amended and Restated Certificate of Incorporation filed with the Delaware Secretary of State in February

1996 (the “Operative Charter”)1 is the valid charter of the Company, despite an allegation by one of IRIDEX’s

putative stockholders that its adoption and approval nearly 30 years ago was potentially defective and because the Company lacks sufficient

documentation to prove otherwise.

2. In

November 1995, IRIDEX was incorporated in Delaware to effect the reincorporation of a California entity into the state of Delaware.

IRIDEX’s original Certificate of Incorporation was filed with the Delaware Secretary of State in November 1995 and was amended

twice before the Operative Charter was filed.

1 Ex. 1.

3. In February

1996, IRIDEX went public through an initial public offering (“IPO”) and the Operative Charter was filed with the Delaware

Secretary of State shortly thereafter. The Operative Charter was intended to amend and restate the Company’s Certificate of Incorporation

in compliance with the Delaware General Corporation Law (“DGCL”). The Company has treated the Operative Charter as the governing

charter for the past nearly 30 years.

4. Recently,

however, it was brought to the Company’s attention by counsel to one of its putative stockholders that the February 1996 amendment

and restatement may have been defective. Despite an exhaustive search, the Company has been unable to locate records of certain required

approvals by the Company’s stockholders and the board of directors (the “Board” or the “IRIDEX Board”).

5. This

discovery has created a cloud of uncertainty with respect to the prior corporate acts taken by the Company pursuant to the Operative Charter,

including the composition of the Board. In the future, such uncertainty could affect, among other actions, the Company’s ability

to raise capital, issue additional securities, and engage in other potentially beneficial transactions and could call into question the

validity of director elections.

6. Accordingly,

the Company asks this Court to validate the Operative Charter, retroactive to its February 22, 1996 filing date with the Delaware Secretary

of State, and to grant such other relief as the Court deems appropriate.

FACTUAL ALLEGATIONS

7. Petitioner

IRIDEX Corporation is an ophthalmic medical technology company focused on the development and commercialization of breakthrough products

and procedures to treat sight-threatening eye conditions such as glaucoma and retinal diseases. It merged with a pre-existing California

entity through a reincorporation merger into Delaware in 1995 (the “Reincorporation”) and went public through an IPO in 1996.

I. Formation

of the Company

8.

IRIDEX’s predecessor, IRIS Medical Instruments, Inc. (“IRIDEX California”),

was incorporated in California in February 1989.2 On October 17, 1995, the board of directors of IRIDEX California (the

“California Board”) adopted resolutions approving the incorporation of IRIDEX as a Delaware corporation to become a

wholly-owned subsidiary of IRIDEX California.3 In those resolutions, the California Board also approved a Certificate of

Incorporation for IRIDEX (the “Original Charter”) and approved the merger of IRIDEX California

2 IRIDEX

California changed its name several times, first to Prospero Surgical, Inc. in 1994, then to Trilogy Medical Systems, Inc. in

1995, and finally to IRIDEX Corporation on January 10, 1996.

3 Ex. 2 at 5, 7–11.

with and into IRIDEX,

with IRIDEX continuing as the surviving entity following the merger.4

II. The Original

Charter

9.

On November 21, 1995, the Original Charter was filed with the Delaware Secretary of State.5

The Original Charter authorized 33,783,330 total shares: 30,000,000 shares of common stock, par value $0.01 per share (the “Common

Stock”) and 3,783,330 shares of preferred stock, par value $0.01 per share (the “Preferred Stock”). The Preferred Stock

was further divided into eight series: Series A, Series A1, Series B, Series B1, Series C, Series C1, Series D, and Series D1.6

10.

On January 3, 1996, the Company filed an amendment to the Original Charter with the Delaware Secretary of State to change the name of

the Company to “IRIDEX Corporation” (the “First Amendment”).7 In addition, the First Amendment changed

Article FOURTH, Section 6(a)(1) of the Original Charter governing the right of the Preferred Stock to convert into shares of Common

Stock.

4 Id.

5 Ex. 3.

6 Id. at 1.

7 Ex. 4.

The

First Amendment recited that “[t]he corporation has not received any payment for any of its stock.”8

11. On

January 10, 1996, the Company filed a second amendment to the Original Charter with the Delaware Secretary

of State (the “Second Amendment”).9 The Second Amendment made another unrelated change to Article FOURTH,

Section 6(a)(1), and it similarly recited that “[t]he corporation has not received any payment for any of its stock.”10

III. The Merger

and IPO

12.

On January 9, 1996, IRIDEX’s Board signed a unanimous written consent to approve the sale of

the Company’s Common Stock to IRIDEX California, with the Company becoming IRIDEX California’s wholly-owned subsidiary, and

also to approve the merger with IRIDEX California to effect the Reincorporation.11 The IRIDEX Board also approved the

election of officers of the Company and approved the IPO.12

8 Id. at

1.

9 Ex. 5.

10 Id. at 1.

11 Ex. 6 at 13, 4–8.

12 Id. at 2, 8–13.

13.

Also on January 9, 1996, IRIDEX California, in its new capacity as sole stockholder of the Company,

executed a written consent approving the merger of IRIDEX California with and into the Company for the purpose of the Reincorporation

and also approved an Amended and Restated Certificate of Incorporation for IRIDEX, which the Company believes is the Operative Charter.13

14.

The stockholder consent referred to an amended and restated certificate of incorporation

attached to the consent as Exhibit A;14 however, the Company recently investigated its corporate history and has been

unable to recover a copy of the consent that includes the referenced exhibit. It therefore cannot confirm that the Operative Charter

filed with the Secretary of State on February 22, 199615 is the same as the version of the amended charter approved by

the stockholder consent on January 9, 1996.

13

Ex. 7 at 3. Though the stockholder consent was effective as of January 9, 1996, the Secretary’s certificate attached to the

Agreement and Plan of Merger between IRIDEX California and the Company executed on February 9, 1996 states that the merger was approved

by written consent of the Company’s sole stockholder on February 9, 1996. See Ex. 8 at 1; Ex. 9 at 1. It is possible

that the February 9 date listed on the Secretary’s certificate is a typo.

14

Ex. 7 at 3.

15

Ex. 1.

15. On January

30, 1996, IRIDEX California began soliciting written consents from its stockholders to approve the Reincorporation, IPO, and Operative

Charter.

16.

An Agreement and Plan of Merger between IRIDEX California and the Company was executed on February

9, 1996 (the “Merger Agreement”).16 The Merger Agreement provided that the merger would be effected through the

conversion of common and preferred shares of IRIDEX California into an equivalent number of shares of Common Stock and Preferred Stock

of the Company.17 The Merger Agreement recited that the requisite board approvals had been obtained and that the Merger Agreement

would be submitted to the stockholders of both companies for approval as well.18 Importantly, the Merger Agreement provided

that the Original Charter, as amended, would be the effective charter for the surviving

16

Ex. 8 (filing the Merger Agreement, among other documents, with the Delaware Secretary of State); see also Ex. 9 (filing

the Merger Agreement, among other documents, with the California Secretary of State). The Merger Agreement is reproduced on one through

eight of each document. Citations in the form “Merger Agr.” refer to that portion of both documents.

17

See Merger Agr. §§ 3.1–3.5.

18

Id. at 2 (“The respective Boards of Directors of IRIDEX-Delaware and IRIDEX- California have approved [the Merger

Agreement] and have directed that [the Merger Agreement] be submitted to a vote of their respective stockholders and executed by the

undersigned officers.”).

corporation (IRIDEX)

“until duly amended in accordance with the provisions thereof and of applicable law.”19

17.

On February 9, 1996, IRIDEX California filed the following with the California Secretary of State:

a Certificate of Approval of Agreement and Plan of Merger, indicating that the Merger Agreement had been approved by the California Board

and a majority of its stockholders; the Merger Agreement; and a Certificate of Secretary, certifying on behalf of IRIDEX Delaware that

the Merger Agreement was “duly approved and adopted by a unanimous vote of the outstanding stock entitled to vote thereon by written

consent of the sole stockholder of the Corporation.”20 That same day, the Company filed the same documents with the

Delaware Secretary of State.21

18. On

February 16, 1996, the Company went public through the IPO, by selling 2.55 million shares of Common Stock

at a price of $9.00 per share.22

19 Id. §

2.1.

20 Ex. 9 at 1–8,

10, 11.

21 Ex. 8 at 1–8,

10, 11.

22 Ex. 10.

IV. The Operative

Charter

19.

On February 22, 1996, the Company filed the Operative Charter with the Delaware Secretary of State.23

The Operative Charter was intended to replace the Original Charter, as amended, as the governing document for the new post- Reincorporation,

post-IPO Company.

20.

The Operative Charter states that it was approved under Section 241 of the DGCL, which allows an

amendment to a certificate of incorporation to “be adopted by a majority of the incorporators, if directors were not named in the

original certificate of incorporation or have not yet been elected, or, if directors were named in the original certificate of incorporation

or have been elected and have qualified, by a majority of the directors.”24

21.

But approval under Section 241 of the DGCL is only available “[b]efore a

corporation has received any payment for any of its stock.”25 Because the Operative Charter may have been adopted after

the Company had issued stock to the predecessor corporation, the streamlined amendment process afforded by Section 241 may

not have been available.

23 Ex. 1.

24 8 Del. C. §

241(b).

25 Id. §

241(a) (emphasis added).

22.

The Company believes, based on its recent investigation, that the reference to Section 241 in the

Operative Charter was an error, and the Operative Charter should have referenced Section 242 of the DGCL instead. Unlike Section 241,

Section 242 provides for amendment of a certificate of incorporation after receipt of payment for stock. Section 242 requires,

in relevant part, that a company’s “board of directors shall adopt a resolution setting forth the amendment proposed, declaring

its advisability, and either calling a special meeting of the stockholders entitled to vote in respect thereof for the consideration

of such amendment or directing that the amendment proposed be considered at the next annual meeting of the stockholders. . . .”26

23. The

Company appears to have attempted to comply with the board and stockholder approval requirements of Section 242.

A. Evidence of Board Approval

24.

Evidence of the IRIDEX Board’s effort to approve the Operative Charter includes a letter

from outside counsel to the Board members dated January 17, 1996, providing Board resolutions for approval of the Operative Charter

in advance of the January 23, 1996 Board meeting. The letter states:

26 Id. §

242(b)(1).

As

you know, IRIDEX Corporation, a Delaware corporation was formed for the purpose of reincorporating the Company into the State of Delaware

effective upon the company’s initial public offering. All of the directors of IRIDEX California have been appointed to the Board

of IRIDEX Delaware and the Action by Written Consent adopts resolutions similar to the resolutions already approved by the Board

of IRIDEX California. Please execute the Written Consent and bring your signature page to the Board meeting[.]27

25.

The letter states that the referenced Action by Written Consent containing the IRIDEX Board resolutions

is enclosed, but the Company has not located a copy of this consent in its files. The Company believes, based on its investigation, that

the California Board resolutions referenced in the letter are the October 17, 1995 resolutions approving the Original Charter.28

Therefore, the Company believes, based on its investigation, that the IRIDEX Board resolutions referenced in, and enclosed with,

the January 17, 1996 letter were to approve the Operative Charter.

26. The

Company has been unable to verify this, however. Unfortunately, the minutes of the January 23, 1996 IRIDEX Board meeting do not reference

or attach any Board resolutions approving the Operative Charter. Despite a thorough search by the Company and its counsel, the Company

has been unable to locate a copy of the Board consent or any resolutions approving the Operative Charter.

27 Ex. 11 at 1 (emphasis

added).

28 Ex. 2.

Accordingly,

given the passage of time and potentially incomplete records, the Company cannot conclude with certainty that the IRIDEX Board formally

declared advisable and approved the Operative Charter pursuant to Section 242 of the DGCL prior to approval of the Operative Charter

by the Company’s sole stockholder (at the time, IRIDEX California).29

B. Evidence of Stockholder Approval

27.

The Company also has located evidence of stockholder approval for the Operative Charter. The

January 9, 1996 stockholder consent, signed on behalf of IRIDEX California as the sole stockholder of IRIDEX, adopted resolutions

approving an amendment to IRIDEX’s Certificate of Incorporation. Specifically, it provides: “RESOLVED: That the Amended

and Restated Certificate of Incorporation of IRIDEX Corporation, a copy of which is attached as Exhibit A hereto,

is hereby approved.”30 The Company has been unable to locate Exhibit A to

29

The Company recognizes it is also possible the Board or its incorporator approved the Operative Charter pursuant to Section 241,

as indicated on the document, prior to payment for the Company’s capital stock by IRIDEX California. Such an act could have taken

place between the time of the Company’s incorporation on November 21, 1995, and IRIDEX California’s payment for its issuance

of stock on January 9, 1996. As discussed below, however, the Company’s and its counsel’s recent investigation has not uncovered

evidence of such approval and it seems more likely based on the facts and circumstances that the Operative Charter was approved (or intended

to be approved) pursuant to Section 242.

30

Ex. 7 at 3.

determine

whether the reference to the “Amended and Restated Certificate of Incorporation” is, in fact, referring to the Operative

Charter.

28.

Even if the January 9, 1996 stockholder consent did attach the Operative Charter and it was identical

to the version filed with the Delaware Secretary of State on February 22, 1996, and the Company therefore could confirm the January 9,

1996 stockholder consent intended to approve the Operative Charter, that approval would not have satisfied the requirements of the DGCL.

That stockholder approval occurred on January 9, 1996—before the January 23, 1996 meeting where the Board is believed to

have declared the Operative Charter advisable and approved it. Section 242 requires that the board of directors of a Delaware corporation

approve, adopt, and declare advisable a charter amendment before stockholder approval can be obtained for the amendment.31

V. The Company Has Conducted

Business Under the Operative Charter for Nearly 30 Years

29. In

light of the recently discovered uncertainty surrounding the approval and adoption of the Operative Charter—a document that has

governed the Company for the past nearly 30 years—the Company seeks the Court’s validation of the Operative Charter.

31 8 Del. C.

§ 242(b)(1)–(2).

30.

Failure to validate the Operative Charter could have numerous and significant consequences. Importantly,

if the Operative Charter was not “duly amended in accordance with the provisions thereof and of applicable law,” then the

Company’s pre-merger, pre-IPO Original Charter arguably continues to govern, per the Merger Agreement.32

31.

Unlike the Operative Charter, however, the Original Charter provides for cumulative voting for

the election of directors under Section 214 of the DGCL.33 Based on its investigation, the Company believes the provision

for cumulative voting rights may have been an error. The October 17, 1995 California Board resolutions approving the Original

Charter specifically state that “the Certificate of Incorporation of Subsidiary [i.e., IRIDEX] shall provide, among other

things, that there shall be no cumulative voting rights for stockholders. . . .”34 It is unclear why

the Original Charter provides for cumulative voting rights despite this clear intent not to provide for cumulative voting. In any

event, the Operative Charter does not provide for cumulative voting rights consistent with the California Board’s apparent intent.

32 Merger Agr. at

§ 2.1.

33 Compare Ex.

3 at Article EIGHTH with Ex. 1 at 1–2.

34 Ex. 2 at 7 (emphasis

added).

32. The Operative

Charter also significantly streamlines the Company’s capital structure, eliminating the various series of preferred stock authorized

by the Original Charter, removing the related rights and preferences of each series and giving the Board “blank check” authority

to designate one or more new series of preferred stock for use in other contexts. In fact, the Company relied on this authority when the

Board designated certain preferred stock as Series A Preferred Stock in a certificate of designation filed on August 31, 2007 in connection

with a Series A Preferred Stock financing. Again, reverting to the Original Charter would cause confusion with respect to the Company’s

current capital structure and all stock issuances since the time of the Operative Charter’s intended adoption in 1996.

33. The

Company has conducted its business for the last 27 years under the Operative Charter, raised secondary financings and described the terms

of the Operative Charter in public filings as forming the underpinning of its corporate governance, unaware of any possible deficiency.

Absent validation of the Operative Charter, countless corporate acts could be called into question.

VI. The Stockholder Letter

34. On or

about May 8, 2023, the Company received a letter from a putative stockholder challenging the Board’s proposal for stockholder approval

of a charter amendment to provide for exculpation of officers pursuant to Section 102(b)(7) of

the

DGCL at the Company’s June 14, 2023 Annual Meeting.35 In addition, the putative stockholder’s letter questioned

the validity of the Operative Charter, contending the Operative Charter was not properly approved and adopted pursuant to Sections 241(b)

and 245 of the DGCL and therefore is ultra vires, null, and void.36

35.

According to the putative stockholder’s letter, the Operative Charter was filed after

the Company’s IPO, suggesting it also was approved after the IPO, in which case Section 241 of the DGCL, which is referenced in

the Operative Charter, could not apply because the Company amended its charter after receiving payment for its stock.37 In

addition, the letter contends there is no evidence that the Operative Charter was approved by the Company’s stockholders and that

it also violates Section 245 of the DGCL.38 Thus, the letter concludes, the Original Charter is the governing certificate

of incorporation for the Company.39

35

Ex. 13.

36

Id. at 7–10.

37

Id. at 8.

38

Id. at 8–10.

39

Id. at 3. The letter takes particular issue with two purported changes from the Original Charter to the Operative Charter:

(1) the removal of the cumulative voting provision, and (2) the addition of a director exculpation clause. Id. at 2–3, 10.

The second purported change is inaccurate; Article NINTH of the Original Charter is a director exculpation provision. See Ex.

3 at Article NINTH.

36.

The putative stockholder’s letter demands, among other things, that the Company: (i) seek to

ratify the Operative Charter in accordance with Section 204 of the DGCL by submitting it for approval at the next stockholder meeting,

with the proxy explaining the changes in the Operative Charter and “the pros and cons” of adopting it; and (ii) file the

Original Charter and the Operative Charter with the U.S. Securities and Exchange Commission (the “SEC”) and hyperlink the

Operative Charter to the Company’s Forms 10-K and other SEC filings in the future.40

VII. The Company’s

Investigation

37. After

receiving the stockholder’s letter, the Company thoroughly investigated the issues raised to the extent possible after nearly a

30-year delay, including by searching its corporate files, the files of its counsel, and its public filings with the SEC and the Delaware

Secretary of State for documents evidencing whether the Operative Charter was properly adopted.

38.

The Company and its counsel retrieved materials from its archives and closely reviewed the Company’s and counsel’s paper

files of minute books and other corporate and legal documents as well as various electronic repositories. The Company also searched

several public resources for relevant SEC filings, but those electronic resources generally do not contain records dating back to

1995 and 1996.

40 Ex. 13 at

3. The letter complains that the hyperlink to the Company’s Operative Charter in its SEC filings is defective and the charter therefore

cannot be accessed.

The

Company also worked with an archivist from Intelligize to attempt to locate relevant SEC filings. Intelligize searched for the Form SB-2

filed by the Company on February 15, 1996 in connection with its IPO that attached the Operative Charter, but the archivist was unable

to locate that filing. The archivist also was unable to find the original Form SB-2 that was filed with the SEC on January 16, 1996.41

39.

In addition, at the Company’s request, Intelligize made a request to the SEC pursuant to

the Freedom of Information Act (“FOIA”) in the hope of locating the Forms SB-2 and their exhibits filed on January 16

and February 15, 1996. That FOIA request was initiated on June 2, 2023. On September 26, 2023, the SEC confirmed that after a

thorough search of its various record systems, it did not locate any documents responsive to the Company’s request.

41

The archivist was able to find an amended version of the Form SB-2 that was filed on February 7, 1996 (Ex. 14), which does attach

a Form of Amended Charter as Exhibit 3.2. Ex. 15. That Form of Amended Charter is substantially similar to the Operative Charter filed

with the Delaware Secretary of State. The only difference between the two versions of the charter is non-substantive: Paragraph A of

the Form of Amended Charter provides that “The name of this Corporation is IRIDEX Corporation,” while Paragraph A of the

Operative Charter provides that “The name of this Corporation is IRIDEX Corporation, originally incorporated under the name of

Trilogy Medical Systems, Inc.” Compare Ex. 15 at 1 with Ex. 1 at 1. It is possible this difference resulted from

the Secretary of State rejecting the initial filing because the document needed to include the Company’s original name.

VIII. The Stockholder’s

Review and Approval of the Petition

40. Following

discussions between the Company’s counsel and the stockholder’s counsel, the stockholder and her counsel reviewed a draft

of this petition and agree with the Company’s conclusions from the investigation and the relief the Company is seeking herein.

ALL SECTION 205 FACTORS SUPPORT VALIDATION

41. The

Company seeks relief from the Court in the form of an order pursuant to Section 205 of the DGCL validating the Operative Charter.

42.

The five factors for approval of a Section 205 petition all support validation:42

| |

(1) |

Whether the defective corporate act was approved or effectuated with the belief that the approval

or effectuation was in compliance with the provisions of the DGCL, the charter or the bylaws of the corporation |

43.

The Operative Charter was adopted, approved, and filed with the Delaware Secretary of State with

the good faith belief that such approval complied with the DGCL and all other governing documents and applicable law. The approval

was part of a series of corporate acts in connection with the reincorporation of IRIDEX California into a Delaware entity and

IRIDEX’s IPO. The Company and its counsel would not have intentionally jeopardized that process by filing a charter

42 8 Del. C.

§ 205(d)(1)–(5).

with the Delaware Secretary of State and the SEC that

had not been properly approved under Delaware law.

44. As described

above, the Company appears to have intended to obtain, and may have in fact obtained, both Board and stockholder approval for the Operative

Charter, based on the documents currently available. Because of the passage of time, the unavailability of personnel that may have had

access to the relevant records, and the difficulty with obtaining certain requested documents from the SEC, the Company has been unable

to locate all records from those early time periods that would potentially confirm that these approvals were obtained.

45. As

further evidence of the Company’s belief that the Operative Charter was approved properly, the Company has been acting under the

authority of the Operative Charter as its governing document since 1996. Until recently, no one questioned the validity of the Operative

Charter or challenged the governance of the Company under it.

| |

(2) |

Whether the corporation and the board of directors has treated the defective corporate act as a valid act and whether any person acted

in reliance on the public record that the defective corporate act was valid |

46. As mentioned,

for the past three decades, the Company and its Board and management believed the Operative Charter was properly adopted and conducted

business under it accordingly. Not only has the Company taken numerous actions in reliance on the validity of its Operative Charter, but

also third parties,

including financing sources, key

business partners, stockholders, directors, officers, and employees, have relied on the validity of the Operative Charter and have treated

all acts in reliance upon it as valid.

| |

(3) |

Whether anyone was or will be harmed by the ratification or validation of the defective corporate act, excluding any harm that would

have resulted if the defective act had been valid when approved or effectuated |

47. No one will

be harmed if the Operative Charter is validated. To the contrary, validation will put the Company, as well as its past and current directors,

officers, and stockholders, in the position they expected to have been in had the Operative Charter been properly adopted 27 years ago.

If the Operative Charter is validated, the Company will be able to file a certificate of correction to remove the reference to Section

241 in the Operative Charter and replace it with a reference to approval under Section 242, should the Court believe such action to be

appropriate. Such validation and clarification will only serve to benefit the Company and its stockholders and achieves the outcome desired

under the putative stockholder’s letter, albeit in a different manner. Further the putative stockholder supports the Company’s

efforts to seek validation through Section 205.

| |

(4) |

Whether anyone will be harmed by the failure to ratify or validate the defective corporate act |

48. Conversely,

the Company and its stockholders face substantial harm if the Operative Charter is not validated. Absent relief, all corporate acts in

reliance

on the validity of the Operative

Charter for the past three decades, including director elections, stock issuances, and other important transactions, could be called into

question. The Company also would face significant uncertainty with respect to any future corporate acts.

| |

(5) |

Any other factors or considerations the Court deems just and equitable |

49. In addition

to the other factors, considerations of equity support validation. Validating the Operative Charter will place the Company and its stockholders

in the position they believed and expected to be since the Operative Charter was intended to be adopted and approved and then filed with

the Secretary of State in 1996. There will be no harm in validation, only good.

50. Validation

pursuant to Section 205 is appropriate for another reason. Given the uncertainty surrounding the Operative Charter, which impacts every

corporate act since its adoption in 1996, ratification of the Operative Charter pursuant to Section 204 is likely not feasible. A Section

204 ratification might require careful analysis to distinguish holders of valid stock from holders of putative stock that may have been

issued after the IPO and getting comfort that the current directors have power as the Board to take such actions, all of which may be

subject to challenge. Without knowing definitively which charter governs, a cloud of uncertainty hangs over every Board decision, including

any decision to adopt the

resolutions required for ratification under Section

204. Accordingly, Section 204 is likely not reasonably available for ratification here.

51. Finally,

before seeking relief pursuant to Section 205, the Company considered other ways to rectify the potential defects surrounding the Operative

Charter, including filing a certificate of correction with the Delaware Secretary of State to change the reference from Section 241 to

Section 242 in Paragraph C of the Operative Charter. But that would only fix part of the potential problem, without addressing the uncertainty

regarding whether the Board and stockholders properly approved the Operative Charter under Section 242 back in 1996. Without being able

to conclude with certainty that the Operative Charter was adopted pursuant to Section 242 and that the reference to Section 241 was an

error, the Company did not believe a certificate of correction would be appropriate unless and until the Court validates the Operative

Charter.

CAUSE OF ACTION

Validation of Corporate Acts Under 8 Del. C. §

205

52. The Company repeats and reiterates

the allegations above as if fully set forth herein.

53. The

Company is authorized to bring this petition under 8 Del. C. § 205(a).

54.

Pursuant to 8 Del. C. § 205(a), this Court has authority to determine the validity of

any defective corporate act. Defective corporate acts can include acts purportedly taken by the corporation that are within the power

of a corporation but are void or voidable due to a failure of authorization. A failure of authorization includes, among other things,

failure to authorize or effect an act or transaction in compliance with “(A) the provisions of [the DGCL], [or] (B) the certificate

of incorporation or bylaws of the corporation . . . if and to the extent such failure would render such act or transaction void or voidable.”43

55. The

Company filed and effectuated the Operative Charter with the good faith belief that it was adopted in compliance with Delaware law.

56. The

Company has treated the Operative Charter as valid and treated all acts in reliance upon it as valid.

57.

The Company does not believe anyone would be harmed by the validation of the Operative Charter.

IRIDEX California, as the Company’s sole stockholder prior to the Reincorporation, likely approved the Operative Charter and

thereafter the document was filed with the Delaware Secretary of State, and numerous actions have been taken by the Company and its

stockholders in the past 27 years in good faith reliance thereon.

43 Id. §

204(h)(2).

58. As discussed above, the Company

and its stockholders may be significantly and irreparably harmed absent the relief requested.

59.

Considerations of equity support validation, and ratification under Section 204 is likely unavailable.

PRAYER FOR RELIEF

WHEREFORE,

the Company respectfully requests that this Court enter judgment as follows:

A. Validating

and declaring effective, retroactive to the time that such instrument was filed with the Delaware Secretary of State on February 22, 1996,

the Operative Charter; and

B. Granting such other and further relief as this

Court deems proper.

| |

WILSON, SONSINI, GOODRICH |

| |

& ROSATI, P.C. |

| |

|

| |

|

| |

/s/ Shannon E. German

|

| |

Shannon E. German (#5172)

Jessica A. Hartwell (#5645)

Joshua A. Manning (#6859) |

| |

222 Delaware Avenue, Suite 800 |

| |

Wilmington, DE 19801

(302) 304-7600 |

| |

|

| |

Counsel for Petitioner

IRIDEX Corporation |

| |

|

Dated: October 2, 2023

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

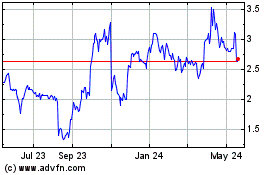

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Nov 2024 to Dec 2024

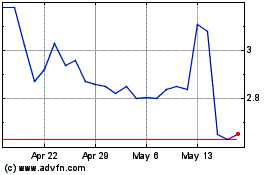

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Dec 2023 to Dec 2024