false

--08-31

2025

Q1

0000885307

0000885307

2024-09-01

2024-11-30

0000885307

2025-01-14

0000885307

2024-11-30

0000885307

2024-08-31

0000885307

2023-09-01

2023-11-30

0000885307

us-gaap:CommonStockMember

2023-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2023-08-31

0000885307

us-gaap:RetainedEarningsMember

2023-08-31

0000885307

2023-08-31

0000885307

us-gaap:CommonStockMember

2023-11-30

0000885307

us-gaap:AdditionalPaidInCapitalMember

2023-11-30

0000885307

us-gaap:RetainedEarningsMember

2023-11-30

0000885307

2023-11-30

0000885307

us-gaap:CommonStockMember

2024-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2024-08-31

0000885307

us-gaap:RetainedEarningsMember

2024-08-31

0000885307

us-gaap:CommonStockMember

2023-09-01

2023-11-30

0000885307

us-gaap:AdditionalPaidInCapitalMember

2023-09-01

2023-11-30

0000885307

us-gaap:RetainedEarningsMember

2023-09-01

2023-11-30

0000885307

us-gaap:CommonStockMember

2023-12-01

2024-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2023-12-01

2024-08-31

0000885307

us-gaap:RetainedEarningsMember

2023-12-01

2024-08-31

0000885307

2023-12-01

2024-08-31

0000885307

us-gaap:CommonStockMember

2024-09-01

2024-11-30

0000885307

us-gaap:AdditionalPaidInCapitalMember

2024-09-01

2024-11-30

0000885307

us-gaap:RetainedEarningsMember

2024-09-01

2024-11-30

0000885307

us-gaap:CommonStockMember

2024-11-30

0000885307

us-gaap:AdditionalPaidInCapitalMember

2024-11-30

0000885307

us-gaap:RetainedEarningsMember

2024-11-30

0000885307

srt:MinimumMember

us-gaap:OfficeEquipmentMember

2024-11-30

0000885307

srt:MaximumMember

us-gaap:OfficeEquipmentMember

2024-11-30

0000885307

srt:MinimumMember

us-gaap:EquipmentMember

2024-11-30

0000885307

srt:MaximumMember

us-gaap:EquipmentMember

2024-11-30

0000885307

srt:MinimumMember

us-gaap:BuildingMember

2024-11-30

0000885307

srt:MaximumMember

us-gaap:BuildingMember

2024-11-30

0000885307

jctc:CarryingAmountMember

2024-11-30

0000885307

jctc:FairValueMember

2024-11-30

0000885307

jctc:CarryingAmountMember

2024-08-31

0000885307

jctc:FairValueMember

2024-08-31

0000885307

us-gaap:FairValueInputsLevel1Member

2024-11-30

0000885307

us-gaap:FairValueInputsLevel2Member

2024-11-30

0000885307

us-gaap:FairValueInputsLevel3Member

2024-11-30

0000885307

us-gaap:OfficeEquipmentMember

2024-11-30

0000885307

us-gaap:OfficeEquipmentMember

2024-08-31

0000885307

us-gaap:EquipmentMember

2024-11-30

0000885307

us-gaap:EquipmentMember

2024-08-31

0000885307

us-gaap:BuildingMember

2024-11-30

0000885307

us-gaap:BuildingMember

2024-08-31

0000885307

us-gaap:LandMember

2024-11-30

0000885307

us-gaap:LandMember

2024-08-31

0000885307

2024-05-01

2024-05-31

0000885307

2024-03-01

2024-03-31

0000885307

jctc:RestrictedSharePlanMember

2024-11-30

0000885307

jctc:RestrictedSharePlanMember

2022-09-01

2023-08-31

0000885307

jctc:RestrictedSharePlanMember

2023-08-31

0000885307

jctc:RestrictedSharePlanMember

srt:DirectorMember

2022-09-01

2023-08-31

0000885307

jctc:OfficersAndEmployeesMember

jctc:RestrictedSharePlanMember

2022-09-01

2023-08-31

0000885307

jctc:RestrictedSharePlanMember

2023-09-01

2024-08-31

0000885307

jctc:RestrictedSharePlanMember

2024-08-31

0000885307

jctc:RestrictedSharePlanMember

srt:DirectorMember

2023-09-01

2024-08-31

0000885307

jctc:OfficersAndEmployeesMember

jctc:RestrictedSharePlanMember

2023-09-01

2024-08-31

0000885307

jctc:RestrictedSharePlanMember

2024-09-01

2024-11-30

0000885307

jctc:RestrictedSharePlanMember

2023-09-01

2023-11-30

0000885307

jctc:IndustrialWoodProductsMember

2024-09-01

2024-11-30

0000885307

jctc:IndustrialWoodProductsMember

2023-09-01

2023-11-30

0000885307

jctc:LawnGardenPetAndOtherMember

2024-09-01

2024-11-30

0000885307

jctc:LawnGardenPetAndOtherMember

2023-09-01

2023-11-30

0000885307

jctc:SeedProcessingAndSalesMember

2024-09-01

2024-11-30

0000885307

jctc:SeedProcessingAndSalesMember

2023-09-01

2023-11-30

0000885307

jctc:CorporateAndAdministrativeMember

2024-09-01

2024-11-30

0000885307

jctc:CorporateAndAdministrativeMember

2023-09-01

2023-11-30

0000885307

jctc:IndustrialWoodProductsMember

2024-11-30

0000885307

jctc:IndustrialWoodProductsMember

2023-11-30

0000885307

jctc:LawnGardenPetAndOtherMember

2024-11-30

0000885307

jctc:LawnGardenPetAndOtherMember

2023-11-30

0000885307

jctc:SeedProcessingAndSalesMember

2024-11-30

0000885307

jctc:SeedProcessingAndSalesMember

2023-11-30

0000885307

jctc:CorporateAndAdministrativeMember

2024-11-30

0000885307

jctc:CorporateAndAdministrativeMember

2023-11-30

0000885307

country:US

2024-09-01

2024-11-30

0000885307

country:US

2023-09-01

2023-11-30

0000885307

country:CA

2024-09-01

2024-11-30

0000885307

country:CA

2023-09-01

2023-11-30

0000885307

jctc:MexicoLatinAmericaCaribbeanMember

2024-09-01

2024-11-30

0000885307

jctc:MexicoLatinAmericaCaribbeanMember

2023-09-01

2023-11-30

0000885307

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

jctc:TwoCustomersMember

2024-09-01

2024-11-30

0000885307

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

jctc:TwoCustomersMember

2023-09-01

2023-11-30

0000885307

2023-09-01

2023-09-30

0000885307

us-gaap:SubsequentEventMember

jctc:RestrictedSharePlanMember

jctc:OfficersDirectorsAndEmployeesMember

2024-12-01

2024-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(MARK ONE)

| x | QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY

PERIOD ENDED NOVEMBER 30, 2024 |

| ¨ | TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION

PERIOD FROM ________ TO ________ |

COMMISSION FILE NUMBER

000-19954

| JEWETT-CAMERON TRADING COMPANY LTD. |

| (Exact

Name of Registrant as Specified in its Charter) |

| british

columbiaA1 |

|

NONE 00-0000000 |

| (State

or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S.

Employer Identification No.) |

| 32275 N.W. Hillcrest, North Plains, Oregon |

|

97133 |

| (Address

Of Principal Executive Offices) |

|

(Zip

Code) |

| (503)

647-0110 |

| (Registrant’s

Telephone Number, Including Area Code) |

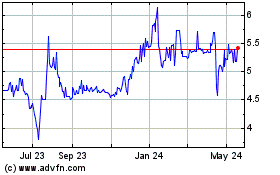

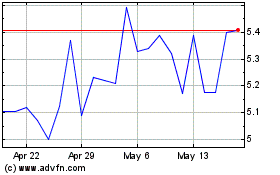

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of Each Class |

Trading

Symbol(s) |

Name

of Each Exchange on Which Registered |

| Common

Stock, no par value |

JCTC |

NASDAQ Capital Market |

Indicate by check mark

whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. x Yes ¨

No

Yes

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, or a non-accelerated filer

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| Non-accelerated filer x |

Smaller Reporting Company x |

| |

Emerging growth company ¨ |

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨

No x

APPLICABLE ONLY TO CORPORATE

ISSUERS:

Indicate the number

of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. Common Stock, no par value

– 3,518,119 common shares as of January 14, 2025.

Jewett-Cameron Trading

Company Ltd.

Index to Form 10-Q

| Item 1. | Financial

Statements |

JEWETT-CAMERON TRADING

COMPANY LTD.

CONSOLIDATED FINANCIAL

STATEMENTS

(Expressed in U.S.

Dollars)

(Unaudited –

Prepared by Management)

NOVEMBER 30, 2024

JEWETT-CAMERON TRADING COMPANY LTD.

CONSOLIDATED

BALANCE SHEETS

(Expressed

in U.S. Dollars)

(Prepared

by Management)

(Unaudited)

| | |

| | | |

| | |

| | |

November

30, 2024 | | |

August

31, 2024 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,039,391 | | |

$ | 4,853,367 | |

| Accounts receivable, net of allowance of $0 (August 31, 2024 - $0) | |

| 4,183,710 | | |

| 3,668,815 | |

| Inventory, net of allowance of $550,000 (August 31, 2024 - $550,000) (note 3) | |

| 13,491,547 | | |

| 13,157,243 | |

| Asset held for sale (note 4) | |

| 566,022 | | |

| 566,022 | |

| Prepaid expenses | |

| 978,302 | | |

| 891,690 | |

| Prepaid income taxes | |

| 19,950 | | |

| 50,326 | |

| | |

| | | |

| | |

| Total current assets | |

| 22,278,922 | | |

| 23,187,463 | |

| | |

| | | |

| | |

| Property, plant and equipment, net (note 4) | |

| 3,806,242 | | |

| 3,849,800 | |

| | |

| | | |

| | |

| Intangible assets, net (note 5) | |

| 112,014 | | |

| 112,222 | |

| | |

| | | |

| | |

| Deferred tax assets (Note 6) | |

| 548,034 | | |

| 341,029 | |

| | |

| | | |

| | |

| Total assets | |

$ | 26,745,212 | | |

$ | 27,490,514 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| | |

| | | |

| | |

| Accounts payable | |

$ | 1,102,166 | | |

$ | 1,237,988 | |

| Accrued liabilities | |

| 1,450,619 | | |

| 1,401,382 | |

| | |

| | | |

| | |

| Total liabilities | |

| 2,552,785 | | |

| 2,639,370 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

Capital stock (notes 8, 9)

Authorized

21,567,564 common shares, no par value

10,000,000 preferred shares, no par value

Issued

3,504,802 common shares (August 31, 2024 – 3,504,802) | |

| 826,861 | | |

| 826,861 | |

| Additional paid-in capital | |

| 795,726 | | |

| 795,726 | |

| Retained earnings | |

| 22,569,840 | | |

| 23,228,557 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 24,192,427 | | |

| 24,851,144 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 26,745,212 | | |

$ | 27,490,514 | |

Subsequent

event (Note 15)

The accompanying

notes are an integral part of these consolidated financial statements.

JEWETT-CAMERON TRADING COMPANY

LTD.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Expressed

in U.S. Dollars)

(Prepared

by Management)

(Unaudited)

| | |

| | | |

| | |

| | |

Three

Months Ended November

30, 2024 | | |

Three

Months Ended November

30, 2023 | |

| | |

| | |

| |

| SALES | |

$ | 9,267,001 | | |

$ | 9,805,841 | |

| | |

| | | |

| | |

| COST OF SALES | |

| 7,573,099 | | |

| 7,849,760 | |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 1,693,902 | | |

| 1,956,081 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 809,213 | | |

| 948,481 | |

| Depreciation and amortization (notes 4, 5) | |

| 81,066 | | |

| 97,903 | |

| Wages and employee benefits | |

| 1,661,768 | | |

| 1,698,920 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 2,552,047 | | |

| 2,745,305 | |

| | |

| | | |

| | |

| Loss from operations | |

| (858,145 | ) | |

| (789,224 | ) |

| | |

| | | |

| | |

| OTHER ITEMS | |

| | | |

| | |

| Gain on sale of property, plant and equipment | |

| 800 | | |

| 89,655 | |

| Other income (note 14) | |

| — | | |

| 2,450,000 | |

| Interest income (expense) | |

| 21,998 | | |

| (6,855 | ) |

| | |

| | | |

| | |

| Total other items | |

| 22,798 | | |

| 2,532,800 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Income tax recovery (expense) | |

| 176,630 | | |

| (452,035 | ) |

| | |

| | | |

| | |

| Net (loss) income | |

$ | (658,717 | ) | |

$ | 1,291,541 | |

| | |

| | | |

| | |

| Basic (loss) income per common share | |

$ | (0.19 | ) | |

$ | 0.37 | |

| | |

| | | |

| | |

| Diluted (loss) income per common share | |

$ | (0.19 | ) | |

$ | 0.37 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | |

| Basic | |

| 3,504,802 | | |

| 3,498,899 | |

| Diluted | |

| 3,504,802 | | |

| 3,498,899 | |

The accompanying

notes are an integral part of these consolidated financial statements.

JEWETT-CAMERON

TRADING COMPANY LTD.

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS' EQUITY

(Expressed

in U.S. Dollars)

(Prepared

by Management)

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| Capital

Stock | | |

| | | |

| | | |

| | |

| |

| Number

of Shares | | |

| Amount | | |

| Additional

paid-in capital | | |

| Retained

earnings | | |

| Total | |

| August 31, 2023 | |

| 3,498,899 | | |

$ | 825,468 | | |

$ | 765,055 | | |

$ | 22,506,804 | | |

$ | 24,097,327 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| — | | |

| — | | |

| — | | |

| 1,291,541 | | |

| 1,291,541 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| November 30, 2023 | |

| 3,498,899 | | |

$ | 825,468 | | |

$ | 765,055 | | |

$ | 23,798,345 | | |

$ | 25,388,868 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share issued pursuant to compensation plans (note 9) | |

| 5,903 | | |

| 1,393 | | |

| 30,671 | | |

| — | | |

| 32,064 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (569,788 | ) | |

| (569,788 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| August 31, 2024 | |

| 3,504,802 | | |

$ | 826,861 | | |

$ | 795,726 | | |

$ | 23,228,557 | | |

$ | 24,851,144 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (658,717 | ) | |

| (658,717 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| November 30, 2024 | |

| 3,504,802 | | |

$ | 826,861 | | |

$ | 795,726 | | |

$ | 22,569,840 | | |

$ | 24,192,427 | |

The accompanying notes

are an integral part of these consolidated financial statements.

JEWETT-CAMERON

TRADING COMPANY LTD.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Expressed

in U.S. Dollars)

(Prepared

by Management)

(Unaudited)

| | |

| | | |

| | |

| | |

Three

Months Ended November

30, 2024 | | |

Three

Months Ended November

30, 2023 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net (loss) income | |

$ | (658,717 | ) | |

$ | 1,291,541 | |

| Items not involving an outlay of cash: | |

| | | |

| | |

| Depreciation and amortization | |

| 81,066 | | |

| 97,903 | |

| Gain on sale of property, plant and equipment | |

| (800 | ) | |

| (89,655 | ) |

| Write-down of intangible assets | |

| — | | |

| 21,790 | |

| Deferred income taxes | |

| (207,005 | ) | |

| 90,813 | |

| | |

| | | |

| | |

| Changes in non-cash working capital items: | |

| | | |

| | |

| (Increase) decrease in accounts receivable | |

| (514,895 | ) | |

| 2,269,494 | |

| (Increase) decrease in inventory | |

| (334,304 | ) | |

| 825,631 | |

| (Increase) decrease in prepaid expenses | |

| (86,612 | ) | |

| 17,430 | |

| Decrease in prepaid income taxes | |

| 30,376 | | |

| — | |

| (Decrease) in accounts payable and accrued liabilities | |

| (86,585 | ) | |

| (95,032 | ) |

| Increase in income taxes payable | |

| — | | |

| 202,116 | |

| | |

| | | |

| | |

| Net cash provided by (used by) operating activities | |

| (1,777,476 | ) | |

| 4,632,031 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Proceeds on sale of property, plant and equipment | |

| 800 | | |

| 101,700 | |

| Purchase of property, plant and equipment | |

| (37,300 | ) | |

| — | |

| | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| (36,500 | ) | |

| 101,700 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| (Repayment of) proceeds from bank indebtedness | |

| — | | |

| (1,259,259 | ) |

| | |

| | | |

| | |

| Net cash (used) provided by financing activities | |

| — | | |

| (1,259,259 | ) |

| | |

| | | |

| | |

| Net (decrease) increase in cash | |

| (1,813,976 | ) | |

| 3,474,472 | |

| | |

| | | |

| | |

| Cash, beginning of period | |

| 4,853,367 | | |

| 83,696 | |

| | |

| | | |

| | |

| Cash, end of period | |

$ | 3,039,391 | | |

$ | 3,558,168 | |

Supplemental

disclosure with respect to cash flows (Note 13)

The accompanying notes

are an integral part of these consolidated financial statements.

JEWETT-CAMERON TRADING

COMPANY LTD.

NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS

(Expressed

in U.S. Dollars)

November

30, 2024

(Unaudited)

Jewett-Cameron

Trading Company Ltd. was incorporated in British Columbia on July 8, 1987 as a holding company for Jewett-Cameron Lumber Corporation

(“JCLC”), incorporated September 1953. Jewett-Cameron Trading Company, Ltd. acquired all the shares of JCLC through a stock-for-stock

exchange on July 13, 1987, and at that time JCLC became a wholly owned subsidiary. Effective September 1, 2013, the Company reorganized

certain of its subsidiaries. JCLC’s name was changed to JC USA Inc. (“JC USA”), and a new subsidiary, Jewett-Cameron

Company (“JCC”), was incorporated.

JC

USA has the following wholly owned subsidiaries incorporated under the laws of the State of Oregon: Jewett-Cameron Seed Company, (“JCSC”),

incorporated October 2000, Greenwood Products, Inc. (“Greenwood”), incorporated February 2002, and JCC, incorporated September

2013. Jewett-Cameron Trading Company Ltd. and its subsidiaries (the “Company”) have no significant assets in Canada.

The

Company, through its subsidiaries, operates out of facilities located in North Plains, Oregon. JCC’s business consists of the manufacturing

and distribution of pet, fencing and other products, wholesale distribution to home centers, other retailers, on-line as well as direct

to end consumers located primarily in the United States. Greenwood is a processor and distributor of industrial wood and other specialty

building products principally to customers in the marine and transportation industries in the United States. JCSC was a processor and

distributor of agricultural seeds in the United States. JC USA provides professional and administrative services, including accounting

and credit services, to its subsidiary companies.

Effective

August 31, 2023, the Company ended seed cleaning operations at its JCSC. During the year ended August 31, 2024, JCSC ended its active

operations and sold most of its remaining equipment in preparation of being wound-up.

The

Company’s operations and general workforce can be negatively affected by a number of external factors. Examples include, but are

not limited to, the COVID-19 global pandemic and political conflict in other regions that may affect economies and financial markets

globally. It is not possible for the Company to predict the duration or magnitude of adverse results of such external factors and their

effect on the Company’s business, financial condition, or ability to raise funds.

| 2. | | SIGNIFICANT ACCOUNTING POLICIES |

Basis

of presentation

These

unaudited consolidated interim financial statements have been prepared in conformity with generally accepted accounting principles of

the United States of America (“US GAAP”) for interim financial information and the rules and regulations of the Securities

and Exchange Commission (“SEC").

Principles

of consolidation

These

consolidated financial statements include the accounts of the Company and its current wholly owned subsidiaries, JC USA, JCC, JCSC, and

Greenwood, all of which are incorporated under the laws of Oregon, U.S.A.

All

inter-company balances and transactions have been eliminated upon consolidation.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

| 2. | | SIGNIFICANT ACCOUNTING POLICIES (cont’d…) |

Estimates

The

preparation of consolidated financial statements in conformity with generally accepted accounting principles in the United States of

America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. Significant estimates incorporated into the Company’s consolidated financial statements include the estimated

useful lives for depreciable and amortizable assets, the estimated allowances for doubtful accounts receivable and inventory obsolescence,

possible product liability and possible product returns, and litigation contingencies and claims. Actual results could differ from those

estimates.

Cash and

cash equivalents

The

Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash

equivalents. At November 30, 2024, cash and cash equivalents were $3,039,391

compared to $4,853,367

at August 31, 2024.

Accounts

receivable

Trade

and other accounts receivable are reported at face value less any provisions for uncollectible accounts considered necessary. Accounts

receivable primarily includes trade receivables from customers. The Company estimates doubtful accounts on an item-by-item basis and

includes over aged accounts as part of allowance for doubtful accounts, which are generally ones that are ninety days or greater overdue.

The

Company extends credit to domestic customers and offers discounts for early payment. When extension of credit is not advisable, the Company

relies on either prepayment or a letter of credit.

Inventory

Inventory,

which consists primarily of finished goods, is recorded at the lower of cost, based on the average cost method, and market. Market is

defined as net realizable value. An allowance for potential non-saleable inventory due to excess stock or obsolescence is based upon

a review of inventory components.

Property,

plant and equipment

Property,

plant and equipment are recorded at cost less accumulated depreciation. The Company provides for depreciation over the estimated life

of each asset on a straight-line basis over the following periods:

| Schedule of estimated life of assets |

|

| Office equipment |

3-7 years |

| Warehouse equipment |

2-10 years |

| Buildings |

5-30 years |

Intangibles

The Company’s

intangible assets have a finite life and are recorded at cost. Amortization is calculated using the straight-line method over the remaining

life of the asset. The intangible assets are reviewed annually for impairment.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

| 2. | | SIGNIFICANT ACCOUNTING POLICIES (cont’d…) |

Asset

retirement obligations

The Company

records the fair value of an asset retirement obligation as a liability in the period in which it incurs a legal obligation associated

with the retirement of tangible long-lived assets that result from the acquisition, construction, development, and normal use of the

long-lived assets. The Company also records a corresponding asset which is amortized over the life of the asset. Subsequent to the initial

measurement of the asset retirement obligation, the obligation is adjusted at the end of each period to reflect the passage of time (accretion

expense) and changes in the estimated future cash flows underlying the obligation (asset retirement cost). The Company does not have

any significant asset retirement obligations.

Impairment

of long-lived assets and long-lived assets to be disposed of

Long-lived

assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not

be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future

net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is

measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are

reported at the lower of the carrying amount and the fair value less costs to sell.

Currency

and foreign exchange

These financial

statements are expressed in U.S. dollars which is also the functional currency of the Company and its subsidiaries as the Company's operations

are primarily based in the United States.

The

Company does not have non-monetary or monetary assets and liabilities that are in a currency other than the U.S. dollar. Any statement

of operations transactions in a foreign currency are translated at rates that approximate those in effect at the time of translation.

Gains and losses from translation of foreign currency transactions into U.S. dollars are included in current results of operations.

Earnings

(loss) per share

Basic earnings

(loss) per common share is computed by dividing net income (loss) available to common shareholders by the weighted average number of

common shares outstanding in the period. Diluted earnings (loss) per common share takes into consideration common shares outstanding

(computed under basic earnings per share) and potentially dilutive common shares.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

| 2. | | SIGNIFICANT ACCOUNTING POLICIES (cont’d…) |

Earnings

(loss) per share (cont’d…)

The

earnings (loss) for the three month periods ended November 30, 2024 and 2023 are as follows:

| Schedule of earnings (loss) per share | |

| | |

| |

| | |

Three

Month Periods ended

November 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net (loss) income | |

$ | (658,717 | ) | |

$ | 1,291,541 | |

| | |

| | | |

| | |

| Basic weighted average number of common shares outstanding | |

| 3,504,802 | | |

| 3,498,899 | |

| | |

| | | |

| | |

| Effect of dilutive securities Stock

options | |

| — | | |

| — | |

| | |

| | | |

| | |

| Diluted weighted average number of common shares outstanding | |

| 3,504,802 | | |

| 3,498,899 | |

Comprehensive

income (loss)

The Company

has no items of other comprehensive income or loss in any period presented. Therefore, net income or loss presented in the consolidated

statements of operations equals comprehensive income or loss.

Stock-based

compensation

The

Company accounts for stock-based compensation in accordance with ASC 718, “Compensation - Stock Compensation” (“ASC

718”). Equity awards are accounted for at their “fair value” which is measured on the grant date for stock-settled

awards. For “full-value” awards, fair value is equal to the underlying value of the stock that have time vesting conditions.

Stock-based

compensation to employees are recognized as compensation expense in the financial statements based on their fair values. That expense

is recognized over the period during which an employee is required to provide services in exchange for the award. Stock-based compensation

expense recognized during the period is based on the value of the portion of share-based payment awards that is ultimately expected to

vest during the period, or in the period of grant for awards that vest immediately without any future service condition. For awards that

vest over time, previously recognized compensation cost is reversed if the service or performance conditions are not satisfied and the

award is forfeited. The Company also grants employees and non-employees restricted stock awards (“RSAs”). The fair value

of the RSAs is determined using the fair value of the common shares on the date of the grant. Forfeitures are accounted for as they occur.

The Company

has not adopted a stock option plan and has not granted any stock options.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

| 2. | | SIGNIFICANT ACCOUNTING POLICIES (cont’d…) |

Financial

instruments

The Company

uses the following methods and assumptions to estimate the fair value of each class of financial instruments for which it is practicable

to estimate such values:

Cash and

cash equivalents - the carrying amount approximates fair value because the amounts consist of cash held at a bank and cash held in

short term investment accounts.

Accounts

receivable - the carrying amounts approximate fair value due to the short-term nature and historical collectability.

Bank indebtedness

- the carrying amount approximates fair value due to the short-term nature of the obligations.

Accounts

payable and accrued liabilities - the carrying amount approximates fair value due to the short-term nature of the obligations.

The

estimated fair values of the Company's financial instruments as of November 30, 2024 and August 31, 2024 follows:

| Schedule of estimated fair values | |

| | | |

| | | |

| | | |

| | |

| | |

November

30, 2024 | | |

August

31, 2024 | |

| | |

Carrying | | |

Fair | | |

Carrying | | |

Fair | |

| | |

Amount | | |

Value | | |

Amount | | |

Value | |

| Cash and cash equivalents | |

$ | 3,039,391 | | |

$ | 3,039,391 | | |

$ | 4,853,367 | | |

$ | 4,853,367 | |

| Accounts receivable, net of allowance | |

| 4,183,710 | | |

| 4,183,710 | | |

| 3,668,815 | | |

| 3,668,815 | |

| Accounts payable and accrued liabilities | |

| 2,552,785 | | |

| 2,552,785 | | |

| 2,639,370 | | |

| 2,639,370 | |

The

following table presents information about the assets that are measured at fair value on a recurring basis as of November 30, 2024 and

indicates the fair value hierarchy of the valuation techniques the Company utilized to determine such fair value. In general, fair values

determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets. Fair values determined by Level

2 inputs utilize data points that are observable such as quoted prices, interest rates and yield curves. Fair values determined by Level

3 inputs are unobservable data points for the asset or liability, and included situations where there is little, if any, market activity

for the asset:

| Schedule of assets measured at fair value on a recurring basis | |

| | | |

| | | |

| | | |

| | |

| | |

November

30, 2024 | | |

Quoted

Prices

in Active

Markets

(Level 1) | | |

Significant

Other

Observable

Inputs

(Level 2) | | |

Significant

Unobservable

Inputs

(Level 3) | |

| Assets: | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,039,391 | | |

$ | 3,039,391 | | |

$ | — | | |

$ | — | |

The fair

values of cash are determined through market, observable and corroborated sources.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

| 2. | | SIGNIFICANT ACCOUNTING POLICIES (cont’d…) |

Income

taxes

A

deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss

carry forwards. Deferred tax expense (benefit) results from the net change during the year of deferred tax assets and liabilities.

Deferred

tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all

of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws

and rates on the date of enactment.

Shipping

and handling costs

The Company

incurs certain expenses related to preparing, packaging and shipping its products to its customers, mainly third-party transportation

fees. All costs related to these activities are included as a component of cost of sales in the consolidated statements of operations.

All costs billed to the customer are included as sales in the consolidated statements of operations.

Revenue

recognition

The

Company recognizes revenue from the sales of lumber, building supply products, industrial wood products, specialty metal products, and

other specialty products and tools, when the products are shipped, title passes, and the ultimate collection is reasonably assured. Revenue

from the Company's seed operations was generated from seed processing, handling and storage services provided to seed growers, and by

the sales of seed products. Revenue from the provision of these services and products is recognized when the services have been performed,

products are sold, and collection of the amounts is reasonably assured.

Recent

Accounting Pronouncements

The

Company has evaluated all recently issued, but not yet effective, accounting pronouncements and determined that it does not believe that

any, if currently adopted, would have a material effect on the Company’s financial statements.

3. INVENTORY

A

summary of inventory is as follows:

| Schedule of inventory | |

| | |

| |

| | |

November

30, 2024 | | |

August

30, 2024 | |

| | |

| | |

| |

| Pet, fencing, and other products | |

$ | 12,656,990 | | |

$ | 12,407,495 | |

| Industrial wood products | |

| 834,557 | | |

| 749,748 | |

| | |

| | | |

| | |

| Inventory net | |

$ | 13,491,547 | | |

$ | 13,157,243 | |

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

4. PROPERTY,

PLANT AND EQUIPMENT

A summary

of property, plant, and equipment is as follows:

| Schedule of property, plant, and equipment | |

| | |

| |

| | |

November

30, 2024 | | |

August

31 2024 | |

| | |

| | |

| |

| Office equipment | |

$ | 668,260 | | |

$ | 668,260 | |

| Warehouse equipment | |

| 1,322,578 | | |

| 1,285,278 | |

| Buildings | |

| 5,211,588 | | |

| 5,211,588 | |

| Land | |

| 158,500 | | |

| 158,500 | |

| | |

| 7,360,926 | | |

| 7,323,626 | |

| | |

| | | |

| | |

| Accumulated depreciation | |

| (3,554,684 | ) | |

| (3,473,826 | ) |

| | |

| | | |

| | |

| Net book value | |

$ | 3,806,242 | | |

$ | 3,849,800 | |

In the event

that facts and circumstances indicate that the carrying amount of an asset may not be recoverable and an estimate of future discounted

cash flows is less than the carrying amount of the asset, an impairment loss will be recognized. Management's estimates of revenues,

operating expenses, and operating capital are subject to certain risks and uncertainties which may affect the recoverability of the Company's

investments in its assets. Although management has made its best estimate of these factors based on current conditions, it is possible

that changes could occur which could adversely affect management's estimate of the net cash flow expected to be generated from its operations.

In connection

with the wind-up of the Company’s JCSC operations, the Company listed for sale in July 2024 its 11.6 acre property that formerly

housed operations. The carrying value of this property of $566,022 is recorded as an asset held for sale as of November 30, 2024 ($566,022

– August 31, 2024).

5. INTANGIBLE

ASSETS

A

summary of intangible assets is as follows:

| Schedule of intangible assets | |

| | |

| |

| | |

November

30, 2024 | | |

August

31, 2024 | |

| | |

| | |

| |

| Intangible assets | |

| 131,405 | | |

| 131,405 | |

| | |

| | | |

| | |

| Accumulated amortization | |

| (19,391 | ) | |

| (19,183 | ) |

| | |

| | | |

| | |

| Net book value | |

$ | 112,014 | | |

$ | 112,222 | |

Deferred

income tax asset as of November 30, 2024 of $548,034 (August 31, 2024 - $341,029) reflect the net tax effects of temporary differences

between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

The

Company has a line of credit agreement in the form of a Contract of Sale & Assignment Agreement with Northrim Funding Services

(“Northrim”). Under the terms of the agreement, Northrim will provide short-term operating capital by either purchasing

the Company’s accounts receivable invoices (“AR invoices”) or as a loan against the Company’s inventory

position. The

maximum amount of AR invoices Northrim will purchase at one time is limited to an amount equal to 80% of the net eligible accounts

but is not to exceed $6,000,000. Borrowing against the Company’s inventory is computed as an amount equal to 25% of all

eligible inventory but is not to exceed $4,000,000. The maximum total draw the Company may borrow under the line is

$6,000,000. Interest is computed at the prime rate plus 4.75% with floor of 11% and is secured by certain assets of the

Company. The line expires on June 30, 2025. As of November 30, 2024 and August 31, 2024, the Company’s indebtedness under the

line of credit was $Nil

0.

Prior

to June 2024, the Company formerly had a different Bank Line of Credit of $5,000,000,

which was reduced from $10,000,000

in March 2024. The line was secured by an assignment of accounts receivable and inventory. Calculation of the interest rate was

based on the one-month Secured Overnight Financing Rate (SOFR) of the one-month SOFR plus 157 basis points, which as of November 30,

2023 was 6.90%

(5.33% + 1.57%). All amounts borrowed under this former line were repaid in full during the first quarter of fiscal 2024, and

indebtedness under the line as of November 30, 2023 was $Nil 0.

Common

Stock

Holders

of common stock are entitled to one vote for each share held. There are no restrictions that limit the Company's ability to pay dividends

on its common stock. The Company has not declared any dividends since incorporation.

The Company

has a Restricted Share Plan (the “Plan”) as approved by shareholders on February 8, 2019. The Plan allows the Company to

grant, from time to time, restricted shares as compensation to directors, officers, employees and consultants of the Company. The Restricted

Shares are subject to restrictions, including the period under which the shares will be restricted (the “Restricted Period”)

and subject to forfeiture which is determined by the Board at the time of the grant. The recipient of Restricted Shares is entitled to

all of the rights of a shareholder, including the right to vote such shares and the right to receive any dividends, except that the shares

granted under the Plan are nontransferable during the Restricted Period.

The

maximum number of Common Shares reserved for issuance under the Plan will not exceed 1% of the then issued and outstanding number of

Common Shares at the time of the grant. As of November 30, 2024 the maximum number of shares available to be issued under the Plan was

16,072.

The

Board of Directors has set the compensation for non-executive Directors under the Plan at 25 common shares for each quarter of service.

The cumulative amount of shares earned each fiscal year to be granted shortly after the close of that fiscal year. Non-executive Directors

also received a one-time initial grant of 225 common shares which were issued in December 2020.

During the

year ended August 31, 2023, 3,557 common shares were issued under the Plan at an average price of $6.55 per share. 500 shares were granted

to Directors without a Restricted Period under the Company’s S-8 Registration Statement. 3,057 common shares were granted to Officers

and Employees and have a three-year Restricted Period.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

9. RESTRICTED

SHARE PLAN (cont’d…)

During

the year ended August 31, 2024, 5,903 common shares were issued under the Plan at an average price of $5.43 per share. 575 were granted

to Officers and Directors without a Restricted Period under the Company’s S-8 Registration Statement. 5,328 common shares were

granted to Officers and Employees and have a three-year Restricted Period.

During

the three-month period ended November 30, 2024, the Company issued no common shares (three months ended November 2023 – no common

shares) to officers, directors and employees under the RSA.

10. PENSION

AND PROFIT-SHARING PLANS

The

Company has a deferred compensation 401(k) plan for all employees with at least 6 months of service pending a monthly enrollment time.

The plan allows for a non-elective discretionary contribution plus matching employee contributions up to a specific limit. The percentages

of contribution remain the discretion of the Board and are reviewed with management annually. For the three-month periods ended November

30, 2024 and 2023 the 401(k) compensation expense were $76,811 and $96,470, respectively.

11. SEGMENT INFORMATION

The

Company has three principal reportable segments. These reportable segments were determined based on the nature of the products offered.

Reportable segments are defined as components of an enterprise about which separate financial information is available that is evaluated

regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance.

The

Company evaluates performance based on several factors, of which the primary financial measure is business segment income before taxes.

The following tables show the operations of the Company's reportable segments.

Following

is a summary of segmented information for the three-month periods ended November 30, 2024 and 2023

| Schedule of segmented information | |

| | |

| |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Sales to unaffiliated customers: | |

| | | |

| | |

| Industrial wood products | |

$ | 842,033 | | |

$ | 1,134,351 | |

| Lawn, garden, pet and other | |

| 8,424,968 | | |

| 8,622,972 | |

| Seed processing and sales | |

| — | | |

| 48,518 | |

| | |

$ | 9,267,001 | | |

$ | 9,805,841 | |

| | |

| | | |

| | |

| Income (loss) before income taxes: | |

| | | |

| | |

| Industrial wood products | |

$ | (23,830 | ) | |

$ | 61,617 | |

| Lawn, garden, pet and other | |

| (920,237 | ) | |

| 1,385,659 | |

| Seed processing and sales | |

| — | | |

| 33,043 | |

| Corporate and administrative | |

| 108,720 | | |

| 263,257 | |

| | |

$ | (835,347 | ) | |

$ | 1,743,576 | |

| | |

| | | |

| | |

| Identifiable assets: | |

| | | |

| | |

| Industrial wood products | |

$ | 1,327,943 | | |

$ | 985,386 | |

| Lawn, garden, pet and other | |

| 16,682,685 | | |

| 20,359,711 | |

| Seed processing and sales | |

| — | | |

| 37,629 | |

| Corporate and administrative | |

| 8,734,584 | | |

| 8,555,243 | |

| | |

$ | 26,745,212 | | |

$ | 29,937,969 | |

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

11. SEGMENT INFORMATION (cont’d…)

| | |

| | |

| |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Depreciation and amortization: | |

| | | |

| | |

| Industrial wood products | |

$ | — | | |

$ | — | |

| Lawn, garden, pet and other | |

| 19,125 | | |

| 17,452 | |

| Seed processing and sales | |

| — | | |

| 870 | |

| Corporate and administrative | |

| 61,941 | | |

| 79,581 | |

| | |

$ | 81,066 | | |

$ | 97,903 | |

The

following table lists sales made by the Company to customers which were in excess of 10% of total sales for the three months ended November

30, 2024 and 2023:

| Schedule of sales | | |

| | |

| |

| | | |

| 2024 | | |

| 2023 | |

| | | |

| | | |

| | |

| Sales | | |

$ | 6,875,719 | | |

$ | 6,125,113 | |

The

Company conducts business primarily in the United States, but also has limited amounts of sales in foreign countries. The following table

lists sales by country for the three months ended November 30, 2024 and 2023:

| Schedule of sales by country | |

| | |

| |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| United States | |

$ | 8,929,258 | | |

$ | 9,132,072 | |

| Canada | |

| 197,110 | | |

| 673,769 | |

| Mexico/Latin America/Caribbean | |

| 140,633 | | |

| — | |

All of the

Company’s significant identifiable assets were located in the United States as of November 30, 2024 and 2023.

12. RISKS

Credit

risk

Financial

instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash and accounts receivable.

The Company places its cash with a high quality financial institution. The Company has concentrations of credit risk with respect to

accounts receivable as large amounts of its accounts receivable are concentrated geographically in the United States amongst a small

number of customers.

At November

30, 2024, two customers accounted for accounts receivable greater than 10% of total accounts receivable at 52%. At November 30, 2023,

two customers accounted for accounts receivable greater than 10% of total accounts receivable at 65%. The Company controls credit risk

through credit approvals, credit limits, credit insurance and monitoring procedures. The Company performs credit evaluations of its commercial

customers but generally does not require collateral to support accounts receivable.

Volume

of business

The Company

has concentrations in the volume of purchases it conducts with its suppliers. For the three months ended November 30, 2024, there were

four suppliers that each accounted for 10% or greater of total purchases, and the aggregate purchases amounted to $5,280,375. For the

three months ended November 30, 2023, there were three suppliers that each accounted for 10% or greater of total purchases, and the aggregate

purchases amounted to $4,879,797.

JEWETT-CAMERON TRADING COMPANY LTD. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Expressed in U.S. Dollars) November 30, 2024 (Unaudited) |

13. SUPPLEMENTAL

DISCLOSURE WITH RESPECT TO CASH FLOWS

Certain

cash payments for the three months ended November 30, 2024 and 2023 are summarized as follows:

| Schedule of cash payments | |

| | |

| |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash paid during the periods for: | |

| | | |

| | |

| Interest | |

$ | 1,246 | | |

$ | 29,671 | |

| Income taxes | |

$ | — | | |

$ | 173,717 | |

There

were no non-cash investing or financing activities during the periods presented.

14. CONTINGENCIES

In

fiscal 2021, the Company initiated arbitration against a former distributor asserting a breach of the distribution agreement and seeking

damages. The liability arbitration hearing was held in December 2022. In February 2023, the arbitrator issued its decision and ruled

in favor of the Company on the majority of its claims. In September 2023, the Company settled the arbitration for a cash payment of $2,450,000

which was received by the Company in October 2023.

In December

2024, the Company issued 13,317 common shares to officers, directors and employees under the Company’s Restricted Share Plan. The

value of these shares was $59,927.

| Item 2. | Management’s Discussion

and Analysis of Financial Condition and Results of Operations. |

These unaudited financial

statements are those of the Company and its wholly owned subsidiaries. In the opinion of management, the accompanying consolidated financial

statements of Jewett-Cameron Trading Company Ltd., contain all adjustments, consisting only of normal recurring adjustments, necessary

to fairly state its financial position as of November 30, 2024 and August 31, 2024 and its results of operations and cash flows for the

three month periods ended November 30, 2024 and 2023 in accordance with U.S. GAAP. Operating results for the three month period ended

November 30, 2024 are not necessarily indicative of the results that may be experienced for the fiscal year ending August 31, 2025. Overall,

the operating results of JCC are seasonal with the first two quarters of the fiscal year historically being slower than the final two

quarters of the fiscal year.

Business Description

We are committed to

improving the lives of professionals and do-it-yourselfers with innovative products that enrich outdoor spaces in their quality, performance,

and ease to work with.

The Company’s

operations are classified into three reportable operating segments and the parent corporate and administrative segment, which were determined

based on the nature of the products offered along with the markets being served. The segments are as follows:

- Pet, Fencing and Other

- Industrial wood products

- Seed processing and sales

- Corporate and administrative

services

Pet, Fencing and

Other Operating Segment

We have concentrated

on building a customer base for Pet, Fencing and our sustainable related products. Management believes this market is less sensitive

to downturns in the U.S. economy than the market for new home construction as its products serve both new and existing home and pet owners.

However, the home improvement business is seasonal, with higher levels of sales occurring between February and August. Inventory buildup

occurs until the start of the season in February and then gradually declines to seasonal low levels at the end of the summer.

Our wood products,

distributed through JCC, are not unique and are available from multiple suppliers and retail outlets. However, the metal products that

JCC manufactures and distributes may be somewhat differentiated from similar products available from other suppliers. We have been successful

in garnering key patents and trademarks on multiple products that assist their ability to continue to differentiate based on design and

functionality.

We own the patents

and manufacturing rights connected with the Adjust-A-Gate® and Fit-Right® products, which are the gate support systems for wood,

vinyl, chain link, and composite fences, in addition to our trade secret industry practices and well-known trademarked brands. We believe

the ownership of these patents and trademarks is an important competitive advantage for these and certain other products. We completed

our purchase of the full global trademark rights for Adjust-A-Gate® and filed its registration with the US Patent and Trademark Office

in February 2023. As of the close of fiscal 2024, the Company owns 7 US Patents and

1 patent application pending in the US, CA, and MX pertaining to its fencing products.

Backlog orders have

typically not been a factor in this business as customers may place firm priced orders for products for shipments to take place three

to four months in the future which gives us time to order, manufacture and receive the goods at our warehouse in time to fulfil the customer’s

order.

Industrial Wood

Products - Greenwood

Greenwood is a wholesale

distributor of a variety of specialty wood products. Current products are focused on the transportation industry. Greenwood’s total

sales for fiscal 2024 and 2023 were 8% and 5%, respectively, of total Company sales.

The primary market

in which Greenwood competes has decreased in economic sensitivity as users are incorporating products into the municipal and mass transit

transportation sectors. However, these markets sustained some contractions in recent years due to COVID-19 as work shifted from offices

to homes, and many individuals utilized public transit less due to concerns over exposure. In addition, this segment is prone to disruption

of supply chain support which can impact other commodities outside of those specific to the disruption.

Greenwood utilizes

contract manufacturers to supply its products. Inventory is maintained at non-owned warehouses and wood treating facilities throughout

the United States and is primarily shipped to customers on a just-in-time basis. Inventory is generally not purchased on a speculative

basis in anticipation of price changes as we order the products from the manufacturers and warehouses once a customer places an order

with us.

Greenwood has no significant

backlog of orders.

Seed Processing and Sales - JCSC

JCSC operated out of

a Company-owned 11.6 acre facility located adjacent to North Plains, Oregon. JCSC processed and distributed agricultural seed. Most of

this segment’s sales came from selling seed to distributors with a lesser amount of sales derived from cleaning seed. Sales of

seed has seasonality, but it is most affected by weather patterns in multiple parts of the United States that utilize cyclical planting.

The annual weather plays an important part in year-to-year sales volatility and specific crop demand.

We ended regular operations

at JCSC effective August 31, 2023 and have sold all of our remaining seed inventory and are working to sell the remaining JCSC equipment.

Seed storage operations continued through July, 2024.

In July 2024, we listed

the JCSC property for sale or lease. The combined size of the buildings is approximately 109,500 square feet. One of the buildings is

specialized for the seed industry, while most are metal warehouse buildings with power, allowing a wide array of possible uses. The property

is currently zoned “Rural Industrial” (RIND), which allows for use of the existing property, or development of the site,

as approved by Washington County. We are exploring the potential to re-zone the property, or revise the existing code, to expand the

list of permitted uses. The listed sale price of the property is $9,000,000. This is the current asking price, and there is no guarantee

the property will sell for this amount. If we are able to complete a sale, the net proceeds will be reduced by brokers’ commissions,

expenses related to the sale, and taxes.

Corporate and Administrative Services

– JC USA

JC USA is the parent

company for Greenwood, JCC and JCSC as described above. JC USA operates out of our offices in North Plains, Oregon and provides professional

and administrative services, including warehousing, accounting and credit services, to JCTC’s subsidiary companies.

Company Products

The Company’s

mission is to improve the lives of professionals and do-it-yourselfers with innovative products that enrich outdoor spaces. We design,

source, commercialize and distribute our products. Many are patent protected and all are well crafted for their quality, performance,

and ease to work with.

The Fencing, Pet and

Other businesses are conducted by JCC, which operates out of a 5.6 acre owned facility located in North Plains, Oregon that includes

offices, a warehouse, and a paved yard. JCC uses contract manufacturers to make all products. Some of the products that JCC distributes

flow through our distribution center located in North Plains, Oregon, and some are shipped direct to the customer from the manufacturer.

Primary customers are home centers, eCommerce providers, other retailers, and direct sales to consumers.

The Industrial Wood

Products segment is conducted by Greenwood, a processor and distributor that operates out of the same facilities in North Plains, Oregon.

Greenwood contracts with custom manufacturers for its products. Inventory is maintained at non-owned warehouses and wood treating facilities

throughout the United States and is primarily shipped to customers on a just-in-time basis.

Fencing Products

Our fencing business

crafts durable, functional fencing solutions that bolster security, privacy, and beauty. Our primary products include:

| |

· |

The Adjust-A-Gate® family of products are straightforward, lifelong

solutions that eliminate measurement issues. Complete steel frame gate kits to perfectly fit openings for wood fences and

never sag. Easy enough for homeowners, but with superior quality that meets the demands of the professional contractor. |

| |

· |

Fit-Right® is a fully adjustable gate system for chain link gates.

This custom solution is perfect for when a special sized chain link gate opening is needed. Equipped with all the necessary parts,

building a gate on-site eliminates measurement issues for the right fit the first time and every time. |

| |

· |

Lifetime Steel Post® offers unmatched strength and versatility

in fencing. This post offers versatile support for a range of fence designs and styles, allowing flexibility to showcase the posts

or keep them discreetly hidden. |

| |

· |

Euro Fence offers the beauty of wood without the upkeep, featuring

durable wood/plastic composite materials. With locking tongue & groove composite and aluminum boards, it provides UV protection,

never needs paint or stain, and installs easily in-ground or mounted. |

| |

· |

Perimeter Patrol® Portable Security Panels create an enclosed space

or linear fence for outdoor areas. Perfect for crowd control, job site security, outdoor events, enclosed storage areas and more. |

| |

· |

Cedar fencing is a premium softwood known for its unique blend of beauty

and durability. Its natural resistance to decay enhances its longevity, while its ease of cutting, sawing, and nailing with standard

tools makes it a preferred choice for versatile applications. |

Pet Products

Our Lucky Dog®

brand is dedicated to keeping pets safe and happy with exceptional quality, long-lasting products that put your pet first. Our primary

pet products are:

| |

· |

Lucky Dog® STAY Series Studio Kennels built with long-lasting steel

frames and powder coated finish. The waterproof polyester cover offers UPF 50+ protection and is designed for ultimate comfort. |

| |

· |

Lucky Dog® Outdoor Kennel Covers provide durable, waterproof protection

with UPF 50+ sun defense. Designed for year-round comfort, they fit securely over Lucky Dog® Kennels. |

| |

· |

Lucky Dog® Dwell Series® Crates offers peace of mind with secure

latches, rust-resistant E-coating along with a patented sliding side door and patented corner stabilizers. With a top handle for

easy transport and a divider panel for flexible space, they offer durability and convenience. |

| |

· |

Lucky Dog® Exercise Pens provide a secure space for pets with sturdy,

rust-resistant wire construction. Featuring a step-thru door, tool-free setup, and fold-flat design for easy storage, these pens

are perfect for both indoor and outdoor use. |

Sustainable Products

Our newest product

category is Sustainable and Post-Consumer Recycled (“PCR”) bag products. Sold under the MyEcoWorld® brand, it is making

a tangible, positive difference to the planet by working to reduce conventional single-use plastic in our daily lives.

We offer two types

of bag products. The Compostable bags are made with 30% corn. The PCR Products are certified to the Global Recycled Standard (GRS) to

contain recycled material that has been independently verified at each stage of the supply chain, from the source to the final product,

and cost less than compostable bags.

Our primary Sustainable

Products are:

| |

· |

Food Waste Bags that are certified compostable and worm-safe. These

durable bags offer puncture resistance, odor control, and pest deterrence, ensuring reliable use and a cleaner kitchen environment. |

| |

· |

Yard Waste Bags that are suitable for a variety of composting methods,

including home, curbside pickup, and industrial composting facilities. |

| |

· |

Pet Poop Bags that ensure no breaks or leaks while keeping the user’s

hands clean. |

Industrial Wood

Products

Greenwood Products

specializes in engineering advanced noise and vibration reduction panels for transit buses, motor coaches, light rail cars, and boats.

Our dB-Ply® proprietary acoustical panel is a cost-effective product designed to reduce vibration and sound transmission to meet

mandated interior noise requirements. Greenwood’s other products include durable, high-performance structural panels tailored for

a wide range of industrial applications, and Jumbo Concrete Forms designed to reduce installation time and lower job-site labor costs.

Seed Segment

The Company formerly

operated agricultural seed processing, distribution and sales through JCSC. Most of this segment’s sales were derived from selling

seed to distributors with a lesser amount of sales derived from cleaning seed. During the fiscal year ended August 31, 2023, the Company

decided to close its JCSC seed subsidiary effective August 31, 2023. JCSC has now been wound up and all remaining assets have been transferred

to JC USA.

Tariffs

Our metal and other

products have historically been mostly manufactured in China and are imported into the United States. The Office of the United States

Trade Representative (“USTR”) instituted new tariffs on the importation of a number of products into the United States from

China effective September 24, 2018. These new tariffs are a response to what the USTR considers to be certain unfair trade practices

by China. The tariffs began at 10%, and subsequently were increased to 25% as of May 10, 2019. A number of our products manufactured

in China remain subject to duties of 25% when imported into the United States.

During fiscal 2024,

we engaged suppliers in countries outside of China, including Bangladesh, Vietnam, Malaysia, Taiwan, and Canada. Products manufactured

in and imported from these countries are not subject to the China-specific tariffs, but may be subject to other duties and fees that

are typically much lower than the current 25% tariff on Chinese manufactured metal products.

The incoming US Presidential

administration has stated its intention to impose new or increased tariff rates on imported goods from a number of countries, including

China and Canada. The details of these tariffs, including which countries, which products would be included, the new rates, and the potential

timing, are currently unknown.

Results of Operations

During the first quarter,

we continued the implementation of our strategic plan to increase our sales, improve operational efficiency to lower our costs, and monetize

our surplus assets, with the goal to improve our profitability.

The rollout of our

new in-store displays for our Lifetime Steel Posts® (“LTP”) and the expansion of our existing Adjust-A-Gate® display

units continues on schedule. At the end of August, our LTP displays were in 100 stores. During the first quarter, we ramped up the roll

out and nearly doubled our in-store LTP display units to almost 200 installations as of the end of November 2024. This expansion of display

units drove a 19% increase in our metal fence product sales in this quarter compared to the first quarter of fiscal 2024. These in-aisle

display units are positioned adjacent to the lumber bays, which may result in additional sales of complementary wood products. Our wood

product sales rose 4% in this quarter vs. the comparable quarter of the prior year. These efforts to expand our fence product displayers

in stores aligns with the seasonally high fence installations during the Spring and Summer months, and is expected to have a positive

impact on our sales for in the second half of fiscal 2025.

To help us expand and

maintain these display units, we engaged Continental Sales & Marketing, Inc. (“CSM”) in October 2024. CSM is a nationally

recognized, multifaceted, strategic business partner with over 49 years of experience with national and regional home improvement retailers.

In addition to capitalizing on their deep distribution relationships with retailers across the United States, CSM will also help us manage

the installed units and the expected product reorders to ensure the in-store displays are well-stocked and inventory is available for

consumers. Each Lifetime Steel Post® display contains 96 posts and each Adjust-A-Gate® display contains 20 units and 4 drop rods

kits. A typical fence project may contain 1 or 2 gates and upwards of 24 or more posts. Each display unit will require replenishment

throughout the year, which is expected to provide increased reorder demand for each product. CSM will also work to increase the online

presence of our other products through our retail partners, including key national and regional home improvement retailers, which will

provide additional visibility and sales opportunities to expand distribution of our various product lines.

The development of

new products and upgrading and improving our existing products is an important component of our strategic plan. In December 2024, we

launched our innovative new Adjust-A-Gate® Unlimited. The Unlimited is a complete gate kit that features a low profile, corner bracket

solution that allows for fully adjustable gate designs that provides both professionals and DIYers with greater control to create gates

tailored to their specific needs. The kit supports both horizontal and vertical gate designs and accommodates sizes up to 72 inches high

and 84 inches wide with patented anti-sag technology that ensures gates stay straight and secure over time. The Adjust-A-Gate® Unlimited

is sold as an all-in-one complete integrated system at a competitive price point and does not require the consumer to buy any additional

parts such as latches, hinges, or other components. Adjust-A-Gate® Unlimited is the first of five new and enhanced products set to

launch over the next 12 months. We are committed to continuing to innovate by improving and expanding our existing product lines in addition

to adding new products that solve problems, meet unmet needs, and enrich outdoor spaces.

Demand

for high performing sustainable products is growing as consumers desire high quality alternatives to disposable single-use plastics combined

with bans of traditional plastics being legislated throughout the United States. Our MyEcoWorld® sustainable and Post-Consumer Recycled

(PCR) bags continue to gain traction in the marketplace. MyEcoWorld® compostable bin liners

and pet waste bags are building sales online and being scheduled for in-store placement at multiple grocery chains during calendar 2025.

Our recently launched lower-cost PCR pet waste bags have had initial successful sales internationally.

The diversification

of our suppliers has been a primary focus of management for several years. The addition of new suppliers with factories in Bangladesh,

Vietnam, Malaysia, and Taiwan, along with our other suppliers in Canada and China for our fence, dog containment, and MyEcoWorld®

products not only reduces our dependence and systematic risk of dependence upon a single supplier in China, it also mitigates the current

25% tariff on Chinese metal goods imported in the US. We are currently receiving products from these new suppliers in addition to our

original supplier in China which we also continue to use. We are working through our current inventory of the higher cost tariffed products

on many of our lines, but as those products are replaced by the non-tariffed products our margins will improve and will help us to maintain

competitive pricing.

During the first quarter,

we shifted a number of our existing employees to support our strategic plans, including adding personnel at Greenwood, where we feel

there is significant potential to add new customers outside of transit operators. We have also recently hired several new employees in

key areas, including sales, marketing, and product innovation. These strategic additions and realignments are an important component

of our focus on increasing sales in our core products and creation of both new products and new innovations and improvements to our existing

products.

As of November 30th,

our current ratio (current assets divided by current liabilities) is 8.79, and our cash position was $3.04 million. To date, we have

not drawn against our line of credit, although we may need to draw against our line during our second fiscal quarter to fund our customary

inventory build prior to our historically busiest outdoor selling season beginning in Spring. Our overall inventory level as of November

30 is appropriate for the end of the quarter with the exception of our pet products, where demand continues to be weak. For our slower

moving pet products, we continue to explore opportunities to accelerate sales in those items.

Ocean shipping issues

which began in the fourth quarter of fiscal 2024 persisted into the current quarter. These issues delayed the arrival of some shipments

containing a number of our metal products. The costs for these shipments were also significantly higher during the last two quarters

beginning in May 2024. These higher costs have compressed our margins, and although the ocean shipping prices have fallen from the peaks

achieved during our most recent quarter, they remain more than 50% higher than the prevailing prices during the same periods of a year

ago.

Active operations at

JCSC ended as of December 31, 2023, and the final seed storage ended in July 2024. With the final closure of the segment, the 11.6 acres

of land and 105,000 square feet of buildings were listed for sale at a price of $9,000,000, which is a competitive price based on comparable

properties in the area. This is the current asking price, and there is no guarantee the property will sell for this amount. The land