LINCOLN ELECTRIC HOLDINGS INC false 0000059527 0000059527 2024-05-23 2024-05-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 23, 2024

LINCOLN ELECTRIC HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Ohio |

|

0-1402 |

|

34-1860551 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

22801 St. Clair Avenue

Cleveland, Ohio 44117

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (216) 481-8100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of exchange

on which registered |

| Common Shares, without par value |

|

LECO |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On May 23, 2024, Lincoln Electric Holdings, Inc. (the “Company”) updated its investor presentation materials (the “Investor Presentation) to reflect an update to its full year 2024 financial assumptions.

A copy of the Investor Presentation is attached hereto as Exhibit 99.1.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| LINCOLN ELECTRIC HOLDINGS, INC. |

|

|

| By: |

|

/s/ Jennifer I. Ansberry |

| Name: |

|

Jennifer I. Ansberry |

| Title: |

|

Executive Vice President, General Counsel and Secretary |

Date: May 23, 2024

LINCOLN ELECTRIC HOLDINGS, INC. Over

view MAY 23, 2024 UPDATE Exhibit 99.1

Safe Harbor and Regulation G

Disclosures Forward-Looking Statements: Statements made during this presentation which are not historical facts may be considered forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual events

or results to differ materially from those expressed or implied. Forward-looking statements generally can be identified by the use of words such as “may,” “will,” “expect,” “intend,”

“estimate,” “anticipate,” “believe,” “forecast,” “guidance” or words of similar meaning. For further information concerning issues that could materially affect financial performance related

to forward-looking statements, please refer to Lincoln Electric’s quarterly earnings releases and periodic filings with the Securities and Exchange Commission, which can be found on www.sec.gov or on www.lincolnelectric.com. Non-GAAP Measures:

Our management uses non-GAAP financial measures in assessing and evaluating the Company’s performance, which exclude items we consider unusual or special items. We believe the use of such financial measures and information may be useful to

investors. Non-GAAP financial measures should be read in conjunction with the GAAP financial measures, as non-GAAP measures are a supplement to, and not a replacement for, GAAP financial measures. Please refer to the attached schedule for a

reconciliation of non-GAAP financial measures to the related GAAP financial measures.

Lowering Full Year 2024 Assumptions Q2

demand trends slowing at a mid single-digit percent decline vs. prior year on weakening industrial activity and capital investment Risks Economic and geopolitical headwinds Inflation (raw materials & labor) Opportunities (not in assumptions)

Velion™ DC Fast Charger Large-scale 3D printing /Additive Updated Full Year Assumptions Mid-single digit % organic sales decline* Neutral price/cost Adj. operating income margin of approximately 17.5%* $45 to $50 million interest expense

Low-to-mid 20% tax rate $90 to $110 million in cap-ex 100+% cash conversion *Reflects updated assumption

High-Performance Industry Leader

Targeting Superior Value Through the Cycle #1 Leader in Growing Arc Welding & Cutting Industry Innovation & Operational Excellence Advances Profitability Strong Cash Generation Through the Cycle Earnings Compounder Through the Cycle

Disciplined Capital Deployment Delivers Top Quartile ROIC Predictable Model With Annual Dividend Increases Accelerating Growth with Automation & M&A +200 bps in Average Operating Margin Goal (2020-2025) High Teens to Low 20% EPS CAGR Goal

(2020-2025) 100+% Cash Conversion Goal 28 Years of Dividend Increases 11% CAGR (2019-2023) 18% to 20% ROIC Goal (2020-2025)

125+ Years of Market-Leading Solutions

Broadest Portfolio of Solutions in the Industry1 FILLER METALS ARC WELDING EQUIPMENT ACCESSORIES (PPE, FUME, GUNS, TOOLS) CUTTING SOLUTIONS DIGITAL SOLUTIONS AUTOMATION INTEGRATION SERVICES AUTOMATED JOINING & CUTTING ANCILLARY AUTOMATED

FUNCTION & CELL COMPONENTS (TOOLING, POSITIONERS, BENDING, AGVs, ASSEMBLY, END OF LINE TESING) ADDITIVE / 3D PRINTING EDUCATION PRODUCTS, CURRICULUMS & SCHOOL WELDING & CUTTING SOLUTIONS AUTOMATION GAS MANAGEMENT SOLUTIONS (INDUSTRIAL

& LIFE SCIENCES) Our Guiding Principle: The Golden Rule Founded 1895 Renowned business model with high-performance culture HQ in Cleveland, Ohio, USA 12,000 employees 71 manufacturing & automation system integration facilities across 21

countries Distribution to 160+ countries BRAZING & SOLDER ALLOYS 1 Diagram does not represent net sales mix by product area

Diversified Products and Reach 1

Reflects mix of FY2023 Net sales of $4.2 billion Americas Welding includes North and South American welding and cutting solutions and 80% of automation. International Welding includes EMEA and Asia Pacific welding and cutting solutions with EMEA

representing approximately 75% of segment revenue. Harris Products Group offers brazing, soldering, oxy-fuel cutting and specialty gas solutions. Serves HVAC, refrigeration, plumbing, life sciences & general industries. HPG manages the retail

channel for all Lincoln products.

Leading Provider Across Diverse End

Markets LECO is one of only three global providers to offer a complete solution Approximately 4% of revenue serves EV applications and 5% in clean & renewable energy applications4 $23B to $25B Global Arc Welding Market and Share Estimates1

Lincoln Electric Revenue Mix by End Market Sector2 Others Regional Competitors 1 Company estimate of the 2023 market 2 Company estimate of 2023 revenue mix (direct & distributor channels) 3 Heavy Industries includes heavy fabrication, ship

building and maintenance & repair 4 Clean and renewable energy includes nuclear, wind, geothermal, and hydropower Global Competitors LSD% average organic growth 28% General Fabrication 13% Construction & Infrastructure 17% Energy &

Process Industries 23% Automotive & Transportation 19% Heavy Industries3

Accelerating Growth Through the Cycle

Accelerate growth: innovation, automation, additive, and M&A Increase profitability: +200 bps to average adjusted operating income margin vs. last cycle on operational excellence Maintain high-performing ROIC and working capital performance

Advance ESG initiatives Sales CAGR: High Single-Digit to Low Double-Digit % Avg. Adj. Op Income Margin: 16% (+/- 150 bps) Adj. EPS CAGR: High Teens to Low 20% Avg. ROIC: 18% - 20% (top quartile) Avg. Op Working Capital: 15% (top decile) Segment Adj.

EBIT Margin Ranges: Americas Welding: 17% - 19% International Welding: 12% - 14% Harris Products Group: 13% - 15% Higher Standard 2025 Strategy Financial Targets (2020 Baseline)

Higher Standard 2025 Strategy and

High-Performance Culture Generates Superior Value Standardizing tools & processes EH&S commitment Training & development ~57% 2023 equipment sales from new products Automation leader Broadest product portfolio & expertise Growth

initiatives Key growth driver Proven integration process Strong ROIC track record Automation expands M&A opportunities 100+% cash conversion Prioritize growth investments Investment-grade profile Consecutive annual dividend increases and

opportunistic share repurchases Brand strength Customer loyalty Trusted performance Balanced Capital Allocation & Strong Cash Generation Disciplined M&A Solutions & Value Operational Excellence & Employee Development Customer-Focused

Drives compounded earnings growth across cycles 2020-2025 Targets High Single-Digit to Low Double-Digit % Sales Growth 16% Average Adj. Operating Margin (+/- 150bps) High Teens to Low 20% EPS growth 18% to 20% ROIC 15% Working Capital 2025 ESG Goals

v v v + +

2003-2008 Commodity Super-Cycle

2009-2013 Post Great Recession 2015-2019 Mini Industrial Recessions 2020-2025 Higher Standard 2025 Strategy Market share strategy BRIC-focused Balance sheet positioned for large acquisitions ROIC and margin-focused strategy Pruned $110M to richen

mix Invested in automation Accelerated automation Improved HPG and ALW margin performance Pruned $275M to richen mix Optimized balance sheet Accelerate growth thru innovation, automation & additive +200bps operating margin Maintain top quartile

ROIC Advance ESG initiatives Sales CAGR 19% 13%1 4%1 HSD to LDD% Sales CAGR 12%2 Average Adj. Operating Margin 10.3% 11.7% 13.7% Average 16% (+/- 150 bps) 15.3% Adj. EPS CAGR 32% 45% 8% High Teens to Low 20% 31% Average Adj. ROIC 14.8% 14.6% 18.9%

(top quartile) 18% to 20% (top quartile) 22.1% Average Operating Working Capital 24.8% 17.2% 16.9% 15% (top decile) 17.1% 2025 Strategy Advances Performance vs. Prior Cycles 1 Approximately $385 million of revenue decline from 2009 to 2019 from

strategic pruning and the deconsolidation and closure of our Venezuela business 2 A maximum 2% of annual price is used in the measure of sales growth 2X- 3X 200+ bps 2X 2020-2023 Progress

High Single-Digit % to Low

Double-Digit % Sales CAGR (2020-2025) +300-400 bps +200-300 bps +100-200 bps Industrial Production New Initiatives / Innovation Automation / Additive Anticipated M&A Robust Topline Growth More than 2x growth expected vs. underlying market *

graph is not to scale

Attractive Trends Drive Growth

Industrial Sector Tailwinds Labor Shortage & Inflation Automation offering services customer growth and reshoring Education solutions train new and upskill professional welders Easy-to-use “Ready.Set.Weld” technology and cobots help

welders achieve higher productivity and quality Electrification, Renewable & Infrastructure Investment Extensive portfolio and expertise for renewable, EV & infrastructure applications Adoption of new metals for light-weighting favors

Lincoln Electric 10% to 15% of revenue serves these attractive growth areas Safer and Energy-Efficient Solutions Product stewardship team engineers safer and more sustainable products PPE and fume management growth opportunities Proprietary software

solutions deliver more productive and efficient welding performance

Adoption of Automation Accelerates

Growth Leading automation offering places LECO at the forefront of industry transformation 2025 Target: $1B sales & mid-teens percent operating income margin Automation Overview Large-scale 3D Printing Overview Automated Assembly & Material

Handling Overview An automation leader with $941M 2023 sales growing at an HSD% organic sales rate with a low-teens % operating income margin1 1 Data reflects FY2023 results Automation Sales Mix1 Our Scale & Reach 2,000+ automation team 2

million ft2 build space 32 automation facilities 10 country presence Cobots to Lights Out Automation System integrator with global build, design, and application expertise Proprietary automated welding, cutting, laser, tooling/positioners, material

handling, industrial AGVs, module assembly, and end of line testing solutions Broadest portfolio of automation solutions serving low volume/high mix operations to high volume, full line builds Largest provider worldwide of large-scale metal wire 3D

printing for spare parts, molds and prototypes International Welding End Market Mix1 Automotive / Transportation General Industries Heavy Industries, Energy & Structural Demand Drivers Labor shortages Increased productivity Operational

efficiency New models/platforms Onshoring/reshoring Americas Welding

Leading Innovation and End Sector

Expertise Drives Growth Extensive R&D, 500+ technical sales & industry application experts & 2,000+ automation team ~42% 2023 total sales from new products ~57% 2023 equipment sales from new products IP Leader Leading global welding

industry solutions provider and patent filer 40 Infrastructure of global technology centers drives collaboration and customized solutions for customers Vitality Index1 Speed-to-Market Regional co-development of new products and solutions using

standardized platforms accelerates innovation 1 Vitality Index reflects the percent of net sales from new products launched in the last five years, excluding customized automation sales.

Solutions Engineered to Deliver

Measurable Value

Supporting Clean Tech Applications

Product Stewardship Visit https://sustainability.lincolnelectric.com to view our sustainability report and additional information Innovation includes designing greater energy efficiency into our products to reduce their carbon footprint and help

customers achieve their sustainability goals. Our product sustainability council focuses on: reducing the energy intensity and greenhouse gas emissions of our welding equipment reducing products’ scale & weight reducing fume generation

streamlining packaging and using recyclable or reusable materials improving the overall speed, efficiency quality & safety of our products in use Our Precision Power Laser™ solution for EV battery tray fabrication Virtual training

solutions Our Long Stick Out® solution for wind turbine fabrication Our Velion™ DC Fast Charger for electrification of transportation (150kW to 1MW) Our Additive Manufacturing technology 3D prints large-scale, mission-critical parts fast

with minimal waste

Disciplined Acquisition Program

Creates Value Acquisitions are a core growth driver of our Higher Standard 2025 Strategy Mid-Teens $1.1B Cumulative M&A Investment 2014 - 2023 18 $60B 3.4% Dedicated Acquisitions and integrations executed 2014 - 2023 Targeted addressable market

(TAM) size for acquisitions with the addition of automation growth opportunities CAGR from M&A sales growth 2014 - 2023 Average ROIC performance of acquisitions M&A team and experienced integration managers optimize and align operations %

Operational Initiatives Advance 200

bps Margin Improvement (vs. prior cycle average) Safety-focused operating plan emphasizes reduction in emissions, energy intensity, waste and water use Lean initiatives and broad six-sigma training advances continuous improvement and productivity

Standardizing tools, processes, KPIs and goals to align activities Optimizing our manufacturing and administrative processes through automation and digitization Expanding regional shared services for administrative functions

Protecting the Environment at Every

Step Water Use 2025 Goal: 14% Reduction vs. 2018 25% Reduction (2023 vs. 2018) Energy Intensity 2025 Goal: 16.2% Reduction vs. 2018 10% Reduction (2023 vs. 2018) GHG Emissions 2025 Goal: 10% Reduction vs. 2018 16% Reduction (2023 vs. 2018) Landfill

Avoidance 2025 Goal: 97% landfill avoidance 94% landfill avoidance in 2023 Recycling 2025 Goal: 80% recycle rate 76.5% recycle rate in 2023 * Visit https://sustainability.lincolnelectric.com to view our sustainability report and additional

information Safety 2025 Goal: 52% Reduction vs. 2018 38% Reduction (2023 vs. 2018) Operational initiatives support achieving HS2025 Strategy EH&S goals

Strong Cash Generation and Top

Quartile ROIC Cash Flow From Operations ($M) & Cash Conversion (%) Return on Invested Capital (Adj. ROIC) 83% Average Cash Conversion2 Target >100% Cash Conversion 23.6% Average Adjusted ROIC 1 Lower cash conversion ratios in 2021 and 2022

reflect strategically elevated inventory levels to mitigate supply chain constraints 2 Cash Conversion is defined as Cash Flow from Operations less Capital Expenditures divided by Adjusted Net Income 81%1 64%1 105%

Growth and Return Focused Capital

Allocation Strategy DISCIPLINED ACQUISITIONS CONSECUTIVE 26-YEAR DIVIDEND INCREASE Opportunistic Share Repurchases Investment grade PROFILE balance Sheet Prioritizing Growth Investments Growth: capital expenditure and acquisitions Return to

Shareholders: share repurchases and dividends 2004-2008 Commodity Super-Cycle 2009-2013 Post Great Recession 2015-2019 Mini Industrial Recessions 2020-2025 Higher Standard 2025 Strategy

Strong Social and Governance Track

Record 1Composition of 2024 Director nominees Learn more about our governance and social programs at https://sustainability.lincolnelectric.com ESG Governance Board oversight and extensive ESG governance structure ESG strategy aligns to our Higher

Standard 2025 Strategy Committed to Employee Development & Engagement Record employee engagement levels from our 2023 survey Extensive global training and development programs Support employee resource group programming Provide $125,000 student

loan repayment per U.S. employee Committed to Our Communities Broad programming to support workforce development 85+ years of welding & community support by the James F. Lincoln Foundation & the Lincoln Electric Foundation Employee matching

and volunteer programs

Proven Strategy and

High-Performance Culture Generates Superior Value Standardizing tools & processes EH&S commitment Training & development ~57% 2023 equipment sales from new products Automation leader Broadest product portfolio & expertise Growth

initiatives Key growth driver Proven integration process Strong ROIC track record Automation expands M&A opportunities 100+% cash conversion Prioritize growth investments Investment-grade profile Consecutive annual dividend increases and

opportunistic share repurchases Brand strength Customer loyalty Trusted performance Balanced Capital Allocation & Strong Cash Generation Disciplined M&A Solutions & Value Operational Excellence & Employee Development Customer-Focused

Drives compounded earnings growth across cycles 2020-2025 Targets High Single-Digit to Low Double-Digit % Sales Growth 16% Average Operating Margin (+/- 150bps) High Teens to Low 20% EPS growth 18% to 20% ROIC 15% Working Capital 2025 ESG Goals v v

v + +

Contact: Amanda Butler Vice

President, Investor Relations & Communications Amanda_Butler@lincolnelectric.com 216.383.2534

Non-GAAP Information Adjusted

operating income, Adjusted net income, Adjusted EBIT, Adjusted effective tax rate, Adjusted diluted earnings per share, Organic sales, Cash conversion, and Return on invested capital are non-GAAP financial measures. Management uses non-GAAP measures

to assess the Company's operating performance by excluding certain disclosed special items that management believes are not representative of the Company's core business. Management believes that excluding these special items enables them to make

better period-over-period comparisons and benchmark the Company's operational performance against other companies in its industry more meaningfully. Furthermore, management believes that non-GAAP financial measures provide investors with meaningful

information that provides a more complete understanding of Company operating results and enables investors to analyze financial and business trends more thoroughly. Non-GAAP financial measures should not be viewed in isolation, are not a substitute

for GAAP measures and have limitations including, but not limited to, their usefulness as comparative measures as other companies may define their non-GAAP measures differently.

($ in millions) Period Ended

December 31, 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Operating income: $80.9 $108.1 $153.5 $232.2 $266.1 $283.5 $115.3 $200.2 $305.7 $376.8 $413.7 $367.1 $324.6 $283.6 $376.9 $375.5

$370.9 $282.1 $461.7 $612.3 $717.8 Special items: Rationalization and asset impairment charges / (gains) 1.7 2.4 1.8 3.5 (0.2) 19.4 29.9 (0.4) 0.3 9.4 8.5 30.1 20.0 - 6.6 25.3 15.2 45.5 9.8 (11.8) (11.3) (Gains) losses on sale of assets - - 1.9

(9.0) - - - - - - 0.7 - - - - - (3.0) - - - - Venezuelan devaluation and deconsolidation charges (gains) - - - - - - - 3.1 - 1.4 12.2 21.1 27.2 34.3 - - - - - - - Acquisition-related net charges (gains) (1) - - - - - - - - - - - - - - (30.1) 4.5 4.8

0.8 7.7 7.1 12.3 Retirement Costs - 4.5 - - - - - - - - - - - - - - - - - - - Adjusted operating income: $82.6 $115.1 $157.2 $226.7 $265.9 $302.9 $145.1 $202.9 $306.0 $387.5 $435.1 $418.3 $371.8 $318.0 $353.5 $405.3 $387.9 $328.3 $479.2 $631.2

$718.8 Net sales $1,040.6 $1,333.7 $1,601.2 $1,971.9 $2,280.8 $2,479.1 $1,729.3 $2,070.2 $2,694.6 $2,853.4 $2,852.7 $2,813.3 $2,535.8 $2,274.6 $2,624.4 $3,028.7 $3,003.3 $2,655.4 $3,234.2 $3,761.2 $4,191.6 Op income margin 7.8% 8.1% 9.6% 11.8% 11.7%

11.4% 6.7% 9.7% 11.3% 13.2% 14.5% 13.0% 12.8% 12.5% 14.4% 12.4% 12.4% 10.6% 14.3% 16.3% 17.1% Adjusted operating income margin: 7.9% 8.6% 9.8% 11.5% 11.7% 12.2% 8.4% 9.8% 11.4% 13.6% 15.3% 14.9% 14.7% 14.0% 13.5% 13.4% 12.9% 12.4% 14.8% 16.8% 17.1%

Reconciliation of Operating Income and Operating Income Margin to Non-GAAP Adjusted Operating Income and Adjusted Operating Income Margin Non-GAAP Financial Measures (1) Acquisition-related net charges (gains) includes acquisition transaction and

integration costs, amortization of step up in value of acquired inventories, gain on change in control and bargain purchase gain

1 Return on Invested Capital is

defined as rolling 12 months of Adjusted Net Income excluding tax-effected interest income and expense divided by Invested Capital. 2 Invested Capital is defined as Total Debt plus Total Equity. 3 EPS and Adjusted EPS have been adjusted to reflect

stock splits. ($ in millions) Period Ended December 31, 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Net income: $54.5 $80.6 $122.3 $175.0 $202.7 $212.3 $48.6 $130.2 $217.2 $257.4 $293.8

$254.7 $127.5 $198.4 $247.5 $287.1 $293.1 $206.1 $276.5 $472.2 $545.2 Special items: Rationalization and asset impairment charges / (gains) 1.7 2.4 1.8 3.5 (0.2) 19.4 29.9 (0.4) 0.3 9.4 8.5 30.1 20.0 - 6.6 25.3 15.2

45.5 9.8 11.8 (11.3) (Gains) or losses on sale of assets - - 1.9 - - - (5.7) - - - 0.7 - - - - - (3.6) - - - (1.6) Acquisition-related net charges (gains) - - - - - - 7.9 - - - - - - - (30.1) 4.5 (2.8) 0.8 7.7 7.1 12.3 Loss on deconsolidation of

Venezuela & devaluation charges - - - - - - - 3.1 - 1.4 12.2 21.1 27.2 34.3 - - - - - - - Pension settlement loss (gain) - - - - - - (2.1) - - - - - 142.7 - 8.2 6.7 - 8.1 126.5 (4.3) 0.8 Non-controlling interests - - - - - - 0.6 1.8 - - (1.1)

(0.8) - - - - - - - - - Retirement costs - 4.5 - - - - - - - - - - - - - - - - - - - Settlement of legal disputes - - (1.4) - - - - - - - - - - - - - - - - - - Tax effect of Special items (0.4) (2.1) (11.8) 1.8 0.1 (1.1) (6.1) (5.2) (4.9) (2.4)

(0.9) 0.8 (57.2) (8.3) 20.5 (6.9) (7.4) (10.6) (47.2) (1.2) (2.5) Adj. Net income: $55.9 $85.5 $112.7 $171.3 $202.6 $230.6 $ 73.1 $ 129.6 $ 212.6 $ 265.8 $ 313.2 $ 305.9 $ 260.2 $ 224.5 $252.7 $316.6 $294.6 $249.9 $373.3 $485.7 $547.9 Plus: Interest

expense (after-tax) 4.9 3.7 4.9 6.3 7.1 7.6 5.3 4.2 4.2 2.6 1.8 6.4 13.5 11.8 14.9 18.4 19.5 17.9 17.8 23.3 38.0 Less: Interest income (after-tax) 1.9 1.8 2.5 3.6 5.1 5.5 2.2 1.5 1.9 2.5 2.0 1.9 1.7 1.3 3.0 5.2 1.9 1.5 1.2 1.2 5.0 Adjusted net

operating profit after taxes 58.9 87.3 115.2 173.9 204.6 232.7 76.2 132.3 214.8 265.9 312.9 310.5 272.0 234.9 264.7 329.8 312.1 266.4 390.0 507.7 580.9 Invested Capital2 652.6 750.8 824.6 1,024.0 1,219.4 1,152.2 1,209.4 1,247.2 1,296.6 1,378.6

1,549.8 1,356.4 1,287.1 1,417.8 1,638.7 1,590.3 1,566.3 1,508.4 1,633.7 2,237.9 2,414.1 Adjusted ROIC: 9.0% 11.6% 14.0% 17.0% 16.8% 20.2% 6.3% 10.6% 16.6% 19.3% 20.2% 22.9% 21.1% 16.6% 16.2% 20.7% 19.9% 17.7% 23.9% 22.7% 24.1% Diluted EPS3 $0.66

$0.97 $1.45 $2.04 $2.34 $2.47 $0.57 $1.54 $2.56 $3.06 $3.54 $3.18 $1.70 $2.91 $3.71 $4.37 $4.68 $3.42 $4.60 $8.04 $9.37 Special Items Impact 0.01 0.06 (0.12) (0.05) (0.01) 0.21 0.29 (0.02) (0.05) 0.10 0.23 0.64 2.12 0.38 0.08 0.45 0.02 0.73 1.62

0.23 $0.04 Adjusted Diluted EPS3 $0.67 $1.03 $1.33 $1.99 $2.33 $2.68 $0.86 $1.52 $2.51 $3.16 $3.77 $3.82 $3.48 $3.29 $3.79 $4.82 $4.70 $4.15 $6.22 $8.27 $9.41 Non-GAAP Financial Measures Return on Invested Capital1 & Reconciliation of Diluted

EPS to Non-GAAP Diluted Adjusted EPS

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

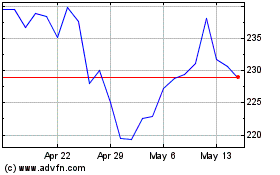

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From May 2024 to Jun 2024

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Jun 2023 to Jun 2024