As filed with the Securities and Exchange Commission

on February 14, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

LogicMark, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

7381 |

|

46-0678374 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

LogicMark, Inc.

2801 Diode Lane

Louisville, KY 40299

(502) 442-7911

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Mark Archer

Chief Financial Officer

LogicMark, Inc.

2801 Diode Lane

Louisville, KY 40299

(502) 442-7911

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

|

David E. Danovitch, Esq.

Michael DeDonato, Esq.

Hermione M. Krumm, Esq.

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, NY 10020

(212) 660-3060 |

|

M. Ali Panjwani, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 421-4100 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following

box: ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☒ 333-284135

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Exchange Act. ☐

This Registration Statement shall become effective

upon filing in accordance with Rule 462(b) under the Securities Act.

EXPLANATORY NOTE AND INCORPORATION OF CERTAIN

INFORMATION BY REFERENCE

LogicMark, Inc. a Nevada corporation (the “Registrant”)

is filing this Registration Statement on Form S-1 (this “Registration Statement”) pursuant to Rule 462(b) under the Securities

Act of 1933, as amended (the “Securities Act”). The information set forth in the Registration Statement on Form S-1, as amended

(File No. 333-284135) (the “Prior Registration Statement”), which the Registrant originally filed with the United States Securities

and Exchange Commission (the “Commission”) on January 3, 2025, and which the Commission declared effective on February 14,

2025, including all amendments, supplements and exhibits thereto and each of the documents filed by the Registrant with the Commission

and incorporated or deemed to be incorporated therein, are incorporated by reference into this Registration Statement.

The Registrant is filing this Registration

Statement for the sole purpose of increasing the securities offered by the Registrant in the public offering (the “Additional Securities”). The Additional Securities that are being registered for sale are in an amount and

at a price that together represent no more than 20% of the maximum aggregate offering price set forth in Exhibit 107 to the Prior

Registration Statement.

The required opinion of counsel and related consent

and accountant’s consent are listed on the Exhibit Index attached hereto and filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in the city of Louisville, State of Kentucky, on February 14, 2025.

| |

LOGICMARK, INC. |

| |

|

|

| |

By: |

/s/ Mark Archer |

| |

|

Name: |

Mark Archer |

| |

|

Title: |

Chief Financial Officer |

Pursuant to the requirements of the Securities

Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and on the dates indicated

below.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| * |

|

Chief Executive Officer and Director |

|

February 14, 2025 |

| Chia-Lin Simmons |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| * |

|

Chief Financial Officer |

|

February 14, 2025 |

| Mark Archer |

|

(Principal Financial Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

| * |

|

Director |

|

February 14, 2025 |

| Carine Schneider |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

February 14, 2025 |

| John Pettitt |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

February 14, 2025 |

| Barbara Gutierrez |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

February 14, 2025 |

| Robert Curtis |

|

|

|

|

| * |

By: |

/s/ Mark Archer, as attorney-in-fact |

|

| |

Name: |

Mark Archer |

|

EXHIBIT INDEX

| * | Filed herewith. |

| ** | Previously filed. |

3

Exhibit 5.1

February 14, 2025

LogicMark, Inc.

2801 Diode Lane

Louisville, KY 40299

Ladies and Gentlemen:

We have acted as special counsel to LogicMark,

Inc., a Nevada corporation (the “Company”), in connection with its preparation and filing of (i) a Registration

Statement on Form S-1, as amended (File No. 333-284135) (the “Initial Registration Statement”), initially filed

with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the

“Securities Act”) on January 3, 2025, and (ii) a Registration Statement on Form S-1 filed pursuant to Rule 462(b)

of the Securities Act (the “462(b) Registration Statement” and together with the Initial Registration Statement,

the “Registration Statement”) on the date hereof, with respect to the offering by the Company, as detailed in

the Registration Statement, of up $12,000,000 of units (collectively, the “Units”), consisting of (x) up to

$12,000,000 of shares (collectively, the “Shares”) of common stock of the Company, par value $0.0001 per share

(the “Common Stock”), (y) Series C warrants to purchase Common Stock (collectively, the “Series

C Warrants”), exercisable for up to $12,000,000 of shares of Common Stock (collectively, the “Series C Warrant

Shares”), and (z) Series D warrants to purchase Common Stock (collectively, the “Series D Warrants”

and, collectively with the Series C Warrants, the “Warrants”), exercisable for up to $42,000,000 of shares of

Common Stock (inclusive of additional shares of Common Stock if the Series D Warrants are exercised using the alternative cashless exercise

provision contained therein, assuming receipt of Stockholder Approval (as defined therein)) (collectively, the “Series D Warrant

Shares” and, collectively with the Series C Warrant Shares, the “Warrant Shares”) and (ii) up

to $12,000,000 of pre-funded units (collectively, the “Pre-Funded Units”) in lieu of the Units that would otherwise

result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of outstanding Common Stock, consisting of (x) up

to $12,000,000 of pre-funded warrants (collectively, the “Pre-Funded Warrants”) and the shares of Common Stock

issuable upon their exercise (collectively, the “Pre-Funded Warrant Shares”), (y) Series C Warrants exercisable

for up to $12,000,000 of shares of Common Stock, and (z) Series D Warrants exercisable for up to $42,000,000 of shares of Common Stock.

The Units, the Shares, the Warrants, the Warrant Shares, the Pre-Funded Units, the Pre-Funded Warrants and the Pre-Funded Warrant Shares

are collectively referred to herein as the “Securities”. The Securities will be sold pursuant to the Registration

Statement, one or more securities purchase agreements (collectively, the “Agreements”) by and among the Company

and certain accredited investors or qualified institutional buyers identified on the signature pages thereto (collectively, the “Investors”),

and a placement agency agreement between the Company and Roth Capital Partners, LLC (the “Placement Agency Agreement”),

which will use its reasonable best efforts to solicit offers to purchase the Securities in this offering (the “Placement Agent”).

As noted in the Registration Statement, for each Pre-Funded Unit sold, the number of Units sold will be decreased on a one-for-one basis.

As counsel to the Company in connection with the

proposed potential issuance and sale of the Securities, we have examined: (i) the Company’s articles of incorporation, as amended,

and bylaws, each as currently in effect; (ii) certain resolutions of the Company’s board of directors relating to the issuance and

sale of the Securities (the “Resolutions”); (iii) the form of Agreement; (iv) the form of Series C Warrant;

(v) the form of Series D Warrant; (vi) the form of Pre-Funded Warrant; (vii) the form of Placement Agency Agreement, (viii) the form of

warrant agency agreement between the Company and Nevada Agency and Transfer Company (the “Warrant Agency Agreement”);

(ix) the Registration Statement; and (x) such other proceedings, documents, and records as we have deemed necessary to enable us to render

this opinion. In all such examinations, we have assumed the genuineness of all signatures, the authenticity of all documents, certificates,

and instruments submitted to us as originals, and the conformity with the originals of all documents, certificates, and instruments submitted

to us as copies. We have also assumed the due execution and delivery of all documents where due execution and delivery are prerequisite

to the effectiveness thereof. With respect to the Warrants and Warrant Shares, we express no opinion to the extent that, notwithstanding

the Company’s current reservation of shares of Common Stock, future issuances of securities of the Company, including the Shares

and/or anti-dilution adjustments to outstanding securities of the Company, including the Warrants, may cause each of the Warrants to be

exercisable for more shares of Common Stock than the number that then remain authorized but unissued.

Our opinions set forth below with respect to the

validity or binding effect of any security or obligation may be limited by (i) bankruptcy, insolvency, reorganization, fraudulent conveyance,

marshaling, moratorium or other similar laws affecting the enforcement generally of the rights and remedies of creditors and secured parties

or the obligations of debtors, (ii) general principles of equity (whether considered in a proceeding in equity or at law), including but

not limited to principles limiting the availability of specific performance or injunctive relief, and concepts of materiality, reasonableness,

good faith and fair dealing, (iii) the possible unenforceability under certain circumstances of provisions providing for indemnification,

contribution, exculpation, release or waiver that may be contrary to public policy or violative of federal or state securities laws, rules

or regulations, and (iv) the effect of course of dealing, course of performance, oral agreements or the like that would modify the terms

of an agreement or the respective rights or obligations of the parties under an agreement.

Based upon, subject to and limited by the foregoing

we are of the opinion that following (i) execution and delivery by the Company, the Placement Agent, Nevada Agency and Transfer Company

and each of the Investors of the Agreements, the Placement Agency Agreement, the Warrant Agency Agreement, and of each of the Warrants

and Pre-Funded Warrants, as applicable, (ii) effectiveness of the Registration Statement, (iii) issuance of the Securities pursuant to

the terms of the Agreements, the Warrant Agency Agreement and the Placement Agency Agreement, as applicable, and (iv) receipt by the Company

of the applicable consideration for the Securities:

(i) each of the Units and

the Pre-Funded Units will be duly authorized for issuance and, when issued, delivered and paid for in accordance with the terms of the

Agreements and the Placement Agency Agreement, and in accordance with and in the manner described in the Registration Statement, each

of the Units and the Pre-Funded Units will be validly issued, fully paid and non-assessable;

(ii) the Shares will be duly

authorized for issuance and, when issued, delivered and paid for in accordance with the terms of the Agreements and the Placement Agency

Agreement, and in accordance with and in the manner described in the Registration Statement, will be validly issued, fully paid and nonassessable

shares of Common Stock;

(iii) provided that each of

the Warrants and Pre-Funded Warrants have been duly executed and delivered by the Company against payment therefor pursuant to their respective

terms, and pursuant to the Agreements, the Placement Agency Agreement and the Warrant Agency Agreement, such Warrants and Pre-Funded Warrants,

when each sold and issued as contemplated in the Registration Statement, will be valid and binding obligations of the Company enforceable

against the Company in accordance with their respective terms; and

(iv) each of the Warrant Shares

and the Pre-Funded Warrant Shares issuable upon payment to the Company of the required consideration, when issued and sold by the Company

and paid for in accordance with the terms of each of the Agreements, the Warrant Agency Agreement, the applicable Warrants and the Pre-Funded

Warrants, as applicable, as described in the Registration Statement, will be validly issued, fully paid and non-assessable shares of Common

Stock.

It is understood that this opinion is to be used

only in connection with the offer, sale, and issuance of the Securities while the Registration Statement is in effect.

This opinion speaks only as of the date hereof

and we assume no obligation to update or supplement this opinion if any applicable laws change after the date of this opinion or if we

become aware after the date of this opinion of any facts, whether existing before or arising after the date hereof, that might change

the opinions expressed above. This opinion is furnished in connection with the filing of the Registration Statement and may not be relied

upon for any other purpose without our prior written consent in each instance. Further, no portion of this opinion may be quoted, circulated

or referred to in any other document for any other purpose without our prior written consent.

We hereby consent to the filing of this opinion

with the SEC as Exhibit 5.1 to the 462(b) Registration Statement and to the use of our name under the caption “Legal Matters”

in the Initial Registration Statement. In giving such consent, we do not thereby admit that we come within the category of persons whose

consent is required under Section 7 of the Securities Act or the rules and regulations of the SEC promulgated thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Sullivan & Worcester LLP |

| |

Sullivan & Worcester LLP |

3

Exhibit 23.1

Consent

of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement on Form S-1 filed pursuant to Rule 462(b) of the Securities

Act of 1933 of the reference to our firm under the caption “Experts” and to the incorporation by reference of our report dated

April 16, 2024, with respect to the financial statements of LogicMark, Inc., included in its Annual Report (Form 10-K) for the year ended

December 31, 2023 and which appear in Amendment No. 3 to the Registration Statement on Form S-1 (File No. 333-284135), filed with the

Securities and Exchange Commission.

/s/ BPM LLP

Walnut Creek, California

February 14, 2025

Exhibit 107

Calculation of Filing Fee Tables

Form S-1

(Form Type)

LogicMark, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward

Securities

| |

|

Security

Type |

|

Security

Class Title |

|

Fee

Calculation

or Carry

Forward

Rule |

|

Amount

To Be

Registered (1) |

|

|

Maximum

Offering

Price Per

Share (2) |

|

|

Maximum

Aggregate

Offering

Price (1) |

|

|

Fee Rate |

|

|

Amount of

Registration

Fee |

|

|

Carry

Forward

Form

Type |

|

|

Carry Forward

File

Number |

|

|

Carry

Forward

Initial

Effective

Date |

|

|

Filing Fee

Previously

Paid in

Connection

with Unsold

Securities

to be

Carried

Forward |

|

| Newly Registered Securities |

| Fees to be Paid |

|

Equity |

|

Units consisting of: (3) |

|

Rule 457(o) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Fees to be Paid |

|

Equity |

|

(i) Common stock, $0.0001 par value per share (4) |

|

Rule 457(o) and Rule 457(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Fees to be Paid |

|

Equity |

|

(ii) Series C Warrants to purchase shares of common

stock (4) |

|

Rule 457(o) and Rule 457(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Equity |

|

(iii) Series D Warrants to purchase shares of common

stock (4) |

|

Rule 457(o) and Rule 457(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Equity |

|

Common stock, $0.0001 par value per share, issuable

upon the exercise of the Series C Warrants included in the units and pre-funded units (3) |

|

Rule 457(o) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Equity |

|

Common stock, $0.0001 par value per share, issuable

upon the exercise of the Series D Warrants included in the units and pre-funded units (3)(5) |

|

Rule 457(o) |

|

|

— |

|

|

|

— |

|

|

|

$6,000,000 |

|

|

|

0.0001531 |

|

|

|

$918.60 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Equity |

|

Pre-funded units consisting of: (3) |

|

Rule 457(o) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Equity |

|

(i) Pre-funded common stock purchase warrants to

purchase shares of common stock (4) |

|

Rule 457(o) and Rule 457(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Fees

to be Paid |

|

Equity |

|

(ii) Series C Warrants

to purchase shares of common stock (4) |

|

Rule 457(o) and Rule

457(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Equity |

|

(ii) Series D Warrants to purchase shares of common

stock (4) |

|

Rule 457(o) and Rule 457(g) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Fees

to be Paid |

|

Equity |

|

Common stock, $0.0001

par value per share, issuable upon the exercise of the pre-funded common stock purchase warrants (3) |

|

Rule 457(o) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Carry Forward Securities |

| Carry Forward Securities |

|

— |

|

— |

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total Offering Amounts |

|

|

|

|

|

|

|

|

|

$ |

6,000,000 |

|

|

|

|

|

|

$ |

918.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Fee Offset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

918.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) | Estimated solely for the

purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities

Act”). Represents only the additional securities being registered. This does not include the securities that the Registrant previously

registered on the Registration Statement on Form S-1, as amended (File No. 333-284135) (the “Initial Registration Statement”). |

| (2) | Pursuant to Rule 416(a)

under the Securities Act, this registration statement shall also cover an indeterminate number of shares of common stock, par value $0.0001

per share, of the registrant (the “Common Stock”) that may become issuable to prevent dilution resulting from stock splits,

stock combinations, stock dividends, recapitalizations or similar transactions with respect to the Common Stock. |

| (3) | The proposed maximum offering

price of the units of the registrant proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering

price of any pre-funded units of the registrant offered and sold in the offering. |

| (4) | No separate fee is required

pursuant to Rule 457(g) under the Securities Act. |

| (5) | As estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act,

the proposed maximum offering price of the additional shares of Common Stock issuable upon exercise of such Series D warrants included

in the units or pre-funded units, as applicable, proposed to be sold in the offering and registered on the Initial Registration Statement,

is $6,000,000, which represents the difference between the $12,000,000 of such warrants registered on the Initial Registration Statement

and 150% of $12,000,000 of such warrants, as each such warrant is exercisable at a per share exercise price equal to 150% of the public

offering price of the units proposed to be sold in the offering and each share of Common Stock included in each unit of the registrant

to be sold in this offering (and each pre-funded common stock purchase warrant included in each pre-funded unit of the registrant to be

sold in this offering) will receive a Series D warrant to purchase one share of Common Stock. |

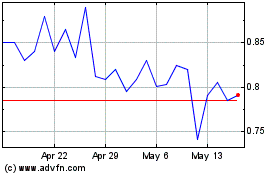

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Jan 2025 to Feb 2025

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Feb 2024 to Feb 2025