LogicMark, Inc. Announces Closing of $14.4 Million Public Offering

February 18 2025 - 4:56PM

LogicMark, Inc. (NASDAQ: LGMK) (the “Company”), a

provider of personal emergency response systems, health

communications devices, and technology for the growing care

economy, today announced the closing of its public offering.

The public offering consisted of 2,260,000 units and 22,146,750

pre-funded units, with each unit consisting of one share of common

stock (or for each pre-funded unit, one pre-funded warrant in lieu

of one share of common stock), one Series C warrant to purchase one

share of common stock and one Series D warrant to purchase one

share of common stock. Gross proceeds, before deducting placement

agent fees and estimated offering expenses, were approximately

$14.4 million. The Company currently intends to use the net

proceeds from the offering for sales and marketing support of its

legacy and new products, working capital and general corporate

purposes.

Each unit was sold at a public offering price of $0.59 per

unit (or $0.589 per pre-funded unit). Each of the Series C warrants

and Series D warrants are only exercisable upon receipt of

stockholder approval and, if applicable, upon effectiveness of a

charter amendment effecting a reverse stock split or increasing the

Company’s number of authorized shares of capital stock. Each of the

Series C warrants are exercisable at a price of $0.59 per

share and each of the Series D warrants are exercisable at a price

of $0.885 per share, with the Series C warrants expiring

5 years from the date of their issuance and the Series D warrants

expiring 2.5 years from the date of their issuance. The shares of

common stock (or pre-funded warrants included in the pre-funded

units) and accompanying Series C warrants and Series D warrants

included in the units and in the pre-funded units were purchased

together in the offering but were issued separately and were

immediately separable upon issuance.

The offering was conducted pursuant to the Company's

registration statement on Form S-1, as amended (File No.

333-284135), which was declared effective by the U.S.

Securities and Exchange Commission (“SEC”), on February

14, 2025 and the Registration Statement on Form S-1MEF (File No.

333-284997) filed by the Company with the SEC on February 14, 2025

pursuant to Rule 462(b) of the Securities Act of 1933, as amended.

A final prospectus relating to the offering was filed with

the SEC on February 18, 2025 and is available on the

SEC’s website at http://www.sec.gov. Electronic copies of the

final prospectus relating to the offering may also be obtained by

contacting Roth Capital Partners, LLC at 888 San Clemente Drive,

Newport Beach CA 92660, by phone at (800) 678-9147.

Roth Capital Partners acted as exclusive placement agent and

Sullivan & Worcester LLP served as special counsel for the

Company in connection with the offering.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

All press releases, SEC filings, and webcast replays are

accessible on the LogicMark, Inc. investor relations

website.

About Us LogicMark,

Inc. (Nasdaq: LGMK) is on a mission to let people of all ages

lead a life with dignity, independence, and the joy of

possibility. The Company provides personal safety and

emergency response systems, health communications devices, personal

safety apps, services, and technologies to create a Connected Care

Platform. Made up of a team of leading technologists with a deep

understanding of IoT, AI, and machine learning and a passionate

focus on understanding consumer needs, LogicMark is

dedicated to building a ‘’Care Village’’ with proprietary

technology and creating innovative solutions for the care economy.

The Company’s PERS technologies are sold through the United

States Veterans Health Administration, dealers, distributors, and

direct-to-consumer. LogicMark has been awarded a contract

by the U.S. General Services Administration that enables

the Company to distribute its products to federal, state, and local

governments. For more information visit LogicMark.com.

Cautionary Statement Regarding Forward-Looking

Statements This press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements reflect management’s current expectations, as of the

date of this press release, and involve certain risks and

uncertainties. Forward-looking statements include statements herein

with respect to, among other things, the anticipated use of

proceeds from such offering, and the successful execution of the

Company’s business strategy. The Company’s actual results could

differ materially from those anticipated in these forward-looking

statements as a result of various factors. Such risks and

uncertainties include, among other things, our ability to establish

and maintain the proprietary nature of our technology through the

patent process, as well as our ability to possibly license from

others patents and patent applications necessary to develop

products; the availability of financing; the Company’s ability to

implement its long-range business plan for various applications of

its technology; the Company’s ability to enter into agreements with

any necessary marketing and/or distribution partners; the impact of

competition, the obtaining and maintenance of any necessary

regulatory clearances applicable to applications of the Company’s

technology; the Company’s ability to maintain its Nasdaq listing

for its common stock; and management of growth and other risks and

uncertainties that may be detailed from time to time in the

Company’s reports filed with the SEC. Should one or more of these

risks or uncertainties materialize, or should assumptions

underlying forward-looking statements prove incorrect, actual

results may differ materially from those described in this press

release as intended, planned, anticipated, believed, estimated or

expected. Any forward-looking statement made by us in this press

release is based on information currently available to us and

speaks only as of the date on which it is made. Except to the

extent required by law, we undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events, a change in events, conditions,

circumstances or assumptions underlying such statements, or

otherwise.

Investor Relations

Contact investors@logicmark.com

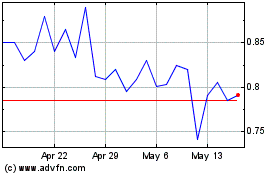

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Jan 2025 to Feb 2025

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Feb 2024 to Feb 2025