Form 8-K - Current report

September 03 2024 - 8:19AM

Edgar (US Regulatory)

false000160616300016061632024-09-032024-09-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 3, 2024

LIMBACH HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36541 | 46-5399422 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

797 Commonwealth Drive, Warrendale, Pennsylvania 15086

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (412) 359-2100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value | LMB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On September 3, 2024, Limbach Holdings, Inc. issued a press release announcing the closing of the acquisition of Laurel, MD-based specialty mechanical contractor, Kent Island Mechanical, LLC, for an initial purchase price of $15 million to be paid in cash. The transaction also provides for an earnout of up to $5.0 million.

The information in this Current Report on Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | LIMBACH HOLDINGS, INC. | |

| | | | |

| | | | |

| | By: | /s/ Jayme L. Brooks | |

| | | Name: Jayme L. Brooks | |

| | | Title: Executive Vice President and Chief Financial Officer | |

Dated: September 3, 2024

Exhibit 99.1 797 COMMONWEALTH DRIVE WARRENDALE, PA 15086 P: 412.359.2100 | F: 412.359.2248 | limbachinc.com LIMBACH IS AN EQUAL OPPORTUNITY EMPLOYER Limbach Holdings Acquires Kent Island Mechanical A leading provider of building systems solutions in the Greater Washington, D.C. metro region WARRENDALE, PA - September 3, 2024 - Limbach Holdings, Inc. (Nasdaq: LMB) ("Limbach" or the "Company"), a building systems solutions firm that partners with building owners and facilities managers who have mission critical mechanical, electrical and plumbing infrastructure, today announced that it has acquired Kent Island Mechanical, LLC (“KIM”) for an initial purchase price of $15 million. Based in Laurel, Maryland and serving the Greater Washington, D.C. metro region, KIM is a leading service provider to facility owners who require solutions for maintaining complex building systems. Transaction Highlights ● The acquisition expands Limbach’s design, engineering, maintenance, capital project, and emergency mechanical solutions capabilities in key end-markets, including data centers, healthcare, life sciences, and higher education. ● KIM’s talented workforce, business model, and customer base complement and bolster Limbach’s existing Mid-Atlantic business and aligns with the Company’s strategy to expand Owner Direct Relationships (“ODR”) with owners of mission-critical facilities in core end- markets. ● Limbach’s current expectation is that KIM will contribute approximately $30 million in revenue and over $4 million in EBITDA annually beginning in 2025. ● Total consideration paid by Limbach at closing was $15 million (subject to typical working capital adjustments). The acquisition will be funded from available cash and has performance-based, contingent earn-outs totaling $5 million, which would potentially be payable over the next two years. Management Commentary Michael McCann, President and CEO of Limbach, said, “We are excited to welcome the KIM team to the Limbach family. The combination of KIM and our Mid-Atlantic operating unit will create a dominant mechanical systems solutions provider in the high growth, Mid-Atlantic region. KIM has an outstanding reputation for execution excellence and strong customer relationships that align with our strategy, values, and safety oriented and customer-centric culture. We anticipate a modest impact in 2024 to our

Page 2 of 3 revenue and earnings from the acquisition, and our primary focus will be on integrating operations and unlocking synergies in 2025. With the closing of this acquisition, Limbach has completed more than $50 million in transaction value in strategic acquisitions without issuing any stock as consideration for these transactions. We remain focused on additional potential transactions in the pipeline that fit with our culture and expand our footprint or add additional services. “I want to thank Kent Island’s founder Mark Bowen for nurturing a robust and capable organization that has attracted unbelievable talent, including its Director of Operations Kyle Benjamin who will join our leadership team for the Mid-Atlantic region. While Mark retired effective with the closing, we feel honored to carry his legacy forward. We view KIM as an ideal acquisition to support our strategic goals and are committed to carefully pursuing additional opportunities that generate growth and create long- term value for our stakeholders,” concluded McCann. Mark Bowen added, “I am thrilled to see my exceptional team join forces with a company that shares our core values and aligns with our long-term vision. As I transition into retirement, I do so with complete confidence, knowing that my legacy, my dedicated team and customers are in the most capable hands. I am excited for the next phase of KIM’s journey under the Limbach banner.” About Kent Island Mechanical Founded in 2002 by President Mark Bowen, KIM is a leading provider of building systems solutions in the Greater Washington, D.C. metro region, including suburban Maryland and Northern Virginia. KIM excels in designing, engineering, installing, servicing, and maintaining mechanical, HVAC and plumbing systems for complex facilities. Under the leadership of Director of Operations Kyle Benjamin, KIM has become a trusted partner for facility owners requiring a solutions-oriented approach to constructing and maintaining complex building systems. About Limbach Limbach is a building systems solution firm that partners with building owners and facilities managers who have mission critical mechanical (heating, ventilation and air conditioning), electrical and plumbing infrastructure. We strive to be an indispensable partner to our customers by providing services that are essential to the operation of their businesses. We work with building owners primarily in six vertical markets: healthcare, industrial and manufacturing, data centers, life science, higher education, and cultural and entertainment. We have more than 1,300 team members in 19 offices across the eastern United States. Our team members uniquely combine engineering expertise with field installation skills to provide custom solutions that leverage our full life-cycle capabilities, which allows us to address both the operational and capital projects needs of our customers.

Page 3 of 3 Forward-Looking Statements We make forward-looking statements in this press release within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations or forecasts for future events, including, without limitation, the expected contribution from and related to our acquisition of KIM (including expectations of revenue and EBITDA), our earnings, Adjusted EBITDA, revenues, expenses, backlog, capital expenditures or other future financial or business performance or strategies, results of operations or financial condition, and in particular statements regarding the impact of the COVID-19 pandemic on the construction industry in future periods, timing of the recognition of backlog as revenue, the potential for recovery of cost overruns, and the ability of Limbach to successfully remedy the issues that have led to write-downs in various business units. These statements may be preceded by, followed by or include the words "may," "might," "will," "will likely result," "should," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "continue," "target" or similar expressions. These forward-looking statements are based on information available to us as of the date they were made and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak and there may be additional risks that we consider immaterial or which are unknown. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Please refer to our most recent annual report on Form 10-K, as well as our subsequent filings on Form 10-Q and Form 8-K, which are available on the SEC's website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements in this press release. Investor Relations Financial Profiles, Inc. Julie Kegley LMB@finprofiles.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

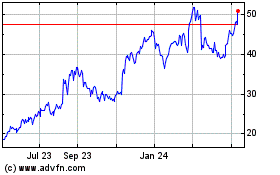

Limbach (NASDAQ:LMB)

Historical Stock Chart

From Nov 2024 to Dec 2024

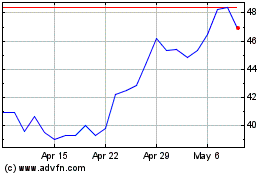

Limbach (NASDAQ:LMB)

Historical Stock Chart

From Dec 2023 to Dec 2024