0000889971false--06-3000008899712025-02-132025-02-13iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

February 13, 2025

Date of Report (Date of earliest event reported)

LIGHTPATH TECHNOLOGIES, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 000-27548 | | 86-0708398 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

2603 Challenger Tech Court, Suite 100

Orlando, Florida 32826

(Address of principal executive office, including zip code)

(407) 382-4003

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 | LPTH | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards providing pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Membership Interest Purchase Agreement

On February 13, 2025, LightPath Technologies, Inc. (the “Company”) entered into a Membership Interest Purchase Agreement (the “Membership Interest Purchase Agreement”) by and among the Company, G5 Infrared, LLC, a New Hampshire limited liability company (“G5 Infrared”), the members of G5 Infrared (the “Sellers”), and Kenneth R. Greenslade, solely in his capacity as Sellers’ Representative, pursuant to which the Company has agreed to acquire from the Sellers all of the issued and outstanding membership interests of G5 Infrared.

Under the terms and conditions of the Membership Interest Purchase Agreement, upon closing, the Sellers will receive aggregate consideration consisting of (i) $20.25 million in cash (the “Cash Consideration”), and 1,972,531 shares of Class A Common Stock, par value $0.01 per share (“Common Stock”) of the Company (the “Stock Consideration” and together with the Cash Consideration, the “Consideration”), in each case subject to various purchase price adjustments set forth in the Membership Interest Purchase Agreement, and (ii) up to $23.0 million in earn-out consideration paid annually in fiscal years 2026 and 2027 subject to achievement of certain revenue and EBITDA targets set forth in the Membership Interest Purchase Agreement. The Company intends to fund the acquisition of G5 Infrared with proceeds from the concurrent private placement of its equity securities and senior secured promissory notes, as further described below. The board of directors of the Company (the “Board”) has unanimously approved the Membership Interest Purchase Agreement and the transactions contemplated thereby (the “Transaction”).

The Membership Interest Purchase Agreement contains customary representations, warranties, conditions and indemnification obligations of the parties. The Membership Interest Purchase Agreement also contains customary covenants and agreements, including, among others, covenants and agreements relating to the conduct of their respective businesses during the period between the execution of the Membership Interest Purchase Agreement and closing of the Transaction, the efforts of the parties to cause the Transaction to be completed, the non-solicitation of alternative acquisition proposals, and the Company’s good faith efforts to obtain financing for the purchase of G5 Infrared.

The closing of the Membership Interest Purchase Agreement is subject to the satisfaction or waiver of customary closing conditions set forth in the Membership Interest Purchase Agreement. The Transaction is expected to close on or before February 19, 2025.

Securities Purchase Agreement

On February 13, 2025, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with certain accredited investors (the “Purchasers”), pursuant to which the Purchasers have agreed to purchase from the Company (i) an aggregate of approximately 24,956 shares (the “Preferred Shares”) of a newly created series of preferred stock, with a stated value of $1,000 per share (the “Preferred Stock”), designated Series G Convertible Preferred Stock, which shall be convertible into shares of Common Stock (the shares of Common Stock issuable upon conversion of the Preferred Shares being referred to as the “Conversion Shares”), in accordance with the terms of the Company’s Certificate of Designations, Preferences and Rights of the Series G Convertible Preferred Stock to be filed with the Delaware Secretary of State (the “Certificate of Designations”), (ii) warrants to purchase an aggregate of 4,352,774 shares of Common Stock, with an exercise price of $2.58 per share (the “Warrants; the shares of Common Stock issuable upon exercise of the Warrants being referred to as the “Warrant Shares”), and (iii) senior secured promissory notes in the aggregate principal amount of $5,195,205 (the “Notes”), which are convertible into shares of Preferred Stock upon the occurrence of the event specified in the Notes (the “Preferred Conversion Shares”), which are in turn convertible into Conversion Shares (the Preferred Shares, Conversion Shares, Warrants, Warrant Shares, Notes and Preferred Conversion Shares, collectively the “Securities,” and the transactions contemplated by the Securities Purchase Agreement, the “Private Placement”). The Private Placement is expected to close immediately prior to the closing of the Transaction, subject to the satisfaction of customary closing conditions.

The Company expects to receive aggregate proceeds from the Private Placement of approximately $32.2 million, inclusive of the conversion of existing indebtedness, before deducting estimated offering expenses payable by the Company, which will be used to fund, in part, the Cash Consideration payable in connection with the Transaction.

The Securities Purchase Agreement contains customary representations, warranties, covenants, conditions and indemnification obligations of the parties. In addition, the Lead Investor (as defined in the Securities Purchase Agreement) has certain board designation rights as further described in the Securities Purchase Agreement and in Item 5.02 below.

The Company may not issue Conversion Shares and/or Warrant Shares to the extent such issuances would result in an aggregate number of shares of Common Stock exceeding 19.99% of the total shares of Common Stock issued and outstanding as of immediately prior to the closing of the Private Placement (the “Exchange Cap”), in accordance with the rules and regulations of Nasdaq unless the Company first obtains stockholder approval (the “Stockholder Approval”). Pursuant to the Securities Purchase Agreement and as required by Nasdaq, the Company agreed to file a proxy statement to obtain the Stockholder Approval and hold such meeting of stockholders of the Company not later than 120 days after the closing of the Private Placement.

Pursuant to an engagement letter agreement between the Company and Craig-Hallum Capital Group LLC (the “Placement Agent”) dated August 12, 2024 (the “Engagement Agreement”), the Placement Agent acted as the Company’s exclusive placement agent in connection with the Private Placement. Under the terms of the Engagement Agreement, the Company will pay the Placement Agent a transaction fee equal to 5.75% of the aggregate gross proceeds of the Private Placement upon closing.

Description of the Series G Convertible Preferred Stock

The terms of the Series G Convertible Preferred Stock are governed by the Certificate of Designations to be filed by the Company with the Delaware Secretary of State prior to the closing of the Transaction. Pursuant to the Certificate of Designations, the Company designated 35,111 shares of its preferred stock as Series G Convertible Preferred Stock. The following is a summary of the material terms of the Preferred stock:

| · | Dividends. The Preferred Stock bears dividends at a per annum rate of 6.5%, which accrues daily and compounds on quarterly basis from the issuance date on the stated value of $1,000 per share (the “Stated Value”). Dividends will not be paid or payable in cash, except, at the Company’s option, and subject to applicable law, such dividends may be payable quarterly in cash beginning on the five-year anniversary of the issuance date, with the period between the issuance date and such five-year anniversary being defined as the “Guaranteed Term.” Dividends will cease to accrue if, following the end of the Guaranteed Term, the closing price of the Common Stock on the principal market equals or exceeds three hundred percent (300%) of the then-applicable conversion price, as adjusted according to the Certificate of Designations, for a period of 30 consecutive trading days. Holders will also be entitled to receive dividends on shares of Preferred Stock equal (on an as-if converted-to-Common-Stock basis regardless of whether the Preferred Stock is then convertible or otherwise subject to conversion limitations) to and in the same form as dividends actually paid on shares of the Company’s Common Stock when, as and if such dividends are paid on shares of the Common Stock. To the extent that, during the Guaranteed Term, the Company undergoes certain fundamental events or effects a mandatory conversion of the Preferred Stock, then, immediately prior to the effective time of such event, the amount of accrued dividends shall by increased by an amount that would have otherwise accrued with respect to the Preferred Stock between the date of such event and the end of the Guaranteed Term (the “Make Whole Amount”). |

| · | Conversion. At any time or times on or after the issuance date, any holder of Preferred Shares will be entitled to convert any whole number of Preferred Shares into fully paid and nonassessable shares of Common Stock at the Conversion Rate (as defined below). The number of Conversion Shares issuable upon conversion of each of the Preferred Shares will be determined according to the quotient (the “Conversion Rate”) of (i) the Stated Value per share plus an amount per share equal to any accrued and unpaid dividends and, if applicable, any Make Whole Payment (the “Liquidation Preference”), divided by (ii) $2.15, subject to adjustment as provided by the Certificate of Designation (the “Conversion Price”). In addition, on or after the three-year anniversary of the issuance date, if (x) the closing price of the Common Stock on the principal market equals or exceeds three hundred percent (300%) of the then-applicable Conversion Price, for 20 trading days during any 30 consecutive trading day period, and (y) at the time the preceding clause (x) is satisfied, the Company’s EBITDA for the four consecutive calendar quarterly immediately preceding such date equals or exceeds $20.0 million, then the Company will have the right, upon ten trading days’ written notice, to cause the conversion of all of the outstanding Preferred Shares into Conversion Shares at the Conversion Rate. Notwithstanding anything to the contrary, in no event will any holder be entitled or required to convert Preferred Shares for a number of Conversion Shares in excess of that number of Conversion Shares that, upon giving effect to such conversion, would either (i) cause the aggregate number of shares of Common Stock beneficially owned by the holder and its affiliates and any other persons or entities whose beneficial ownership of Common Stock would be aggregated with the holder’s for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, including shares held by any “group” of which the holder is a member, to exceed 19.99% or, if elected by such holder, a lesser percentage of the number of shares of Common Stock outstanding immediately after giving effect to the issuance of Conversion Shares issuable upon conversion of a holder’s Preferred Shares, or (ii) cause the aggregate number of shares of Common Stock issued as Conversion Shares upon conversion of any Preferred Shares and issued upon the exercise of any Warrants issued pursuant to the Securities Purchase Agreement, to exceed the Exchange Cap. |

| | |

| · | Voting Rights. The holders of Preferred Shares will be entitled to notice of all stockholder meetings at which holders of Common Stock are entitled to vote. Each holder of Preferred Shares will be entitled to vote such Preferred Shares on an as-converted basis (based upon the aggregate number of conversion shares into which such holder’s Preferred Shares are then convertible, giving effect to any limitations on conversion set forth in the Certificate of Designations) with respect to all matters on which holders of Common Stock are entitled to vote, voting together with the Common Stock as a single class, and will otherwise be entitled to such voting rights as required by applicable law. |

| | |

| · | Redemption. At any time after the Guaranteed Term, each of the Company and the Lead Investor shall have the right to require the Company to redeem all of the Preferred Shares at a price per Preferred Share equal to the greater of (i) 150% of the then-applicable Liquidation Preference and (ii) the product of (A) the Conversion Rate on the applicable redemption date multiplied by (B) the VWAP (as defined in the Certificate of Designations) of the Common Stock for the five trading day period immediately preceding the applicable redemption date. In the event that the amount determined pursuant to clause (B) exceeds the amount determined pursuant to Clause (A), the number of shares that the Company will be required to redeem will be proportionately reduced, and the Company will have the right to cause the conversion of any remaining shares of Preferred Stock thereafter, subject to certain limitations. Further, simultaneous with or after the occurrence of a Fundamental Transaction (as defined in the Certificate of Designations), the Company will be obligated to redeem all outstanding Preferred Shares at a price per Preferred Share equal to the greater of (i) the applicable Liquidation Preference, and (ii) the product of (A) the Conversion Rate at such time, multiplied by (B) either (x) in the event of a Fundamental Transaction in which all of the outstanding shares are exchanged for, or converted into the right to receive, consideration consisting solely of cash, then the consideration per share of Common Stock payable in such Fundamental Transaction, or (y) otherwise, the VWAP on the date immediately preceding the closing of the Fundamental Transaction. |

| | |

| · | Liquidation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of the Preferred Shares will be entitled to receive in cash out of the assets of the Company, whether from capital or from earnings available for distribution to its stockholders, before any amount shall be paid to the holders of any of the capital stock of the Company of any class junior in rank to the Preferred Shares in respect of the preferences as to the distributions and payments on the liquidation, dissolution and winding up of the Company, an amount per Preferred Share equal to the greater of (i) the Liquidation Preference, or (b) such amount per share as would have been payable had all Preferred Shares been converted into Common Stock immediately prior to such liquidation, dissolution or winding up (collectively, the “Preferred Funds”), subject to proration among holders of Preferred Shares and pari passu securities in the event that the Preferred Funds are insufficient to pay the full amount due. |

Description of Warrants

At the closing of the Securities Purchase Agreement, the Company will issue to the Purchasers Warrants to purchase an aggregate of 4,352,774 shares of Common Stock, or the Warrant Shares. The exercise price of the Warrants is $2.58 (the “Exercise Price”). The Exercise Price and the number of underlying shares of Common Stock is subject to proportional adjustment in the event of customary stock splits, stock dividends, combinations or similar events.

The Warrants will expire on the six year anniversary of issuance, and will be exercisable at any time on or after the issuance date.

A holder may not exercise any portion of the Warrants, to the extent that after giving effect to such issuance exercise, either (i) the holder (together with the holder’s affiliates and any other persons acting as a group together with the holder or any of the holder’s affiliates would beneficially own in excess of 19.99%, or, if elected be such holder, a lesser percentage of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon exercise of the Warrant, or (ii) the aggregate number of shares of Common Stock issued upon exercise of the Warrant, the exercise of any other Warrants issued pursuant to the Securities Purchase Agreement, and upon conversion of Preferred Stock, exceeds the Exchange Cap (as adjusted to reflect any share splits, reverse share splits or similar recapitalizations that occur after the Issue Date).

Description of Notes

At the closing of the Securities Purchase Agreement, the Company will issue the Notes. The Notes accrue interest at the rate between 10-12% per annum, based on the ratio of indebtedness to EBIDTA of the Company, unless an event of default (as defined in the Notes) occurs, at which time the Notes would accrue interest at 15% per annum. The Notes will mature on the second anniversary of the issuance date.

The Notes will convert into shares of Preferred Stock if the EBIDTA reported by the Company for the calendar year ending December 31, 2025 is less than $4,921,875.00, which are in turn convertible into Conversion Shares. All or part of the Notes may be redeemed by the Company prior to the maturity date at a redemption price equal to the portion of principal so redeemed plus all accrued and unpaid interest thereon, provided that if the funds used for redemption were not generated internally by Company operations, the redemption amount will be multiplied by 102%.

In addition, following an event of default or upon a change of control, the Purchaser may require the Company to redeem all or any portion of the Notes. Notwithstanding anything to contrary, upon any bankruptcy event of default, the Company will immediately pay the holder an amount in cash representing all outstanding principal and accrued and unpaid interest.

The Notes include customary affirmative and negative covenants and events of default. Additionally, the Notes include financial covenants requiring the Company to maintain a Total Leverage Ratio (as defined in the Notes) of not greater than 4.00:1:00 and a Fixed Charge Covered Ratio (as defined in the Notes) of greater than 1.20:1.00 for each fiscal quarter beginning with the fiscal quarter ending December 31, 2025.

Registration Rights Agreement

At the closing of the Securities Purchase Agreement, the Company and the Purchasers will enter into a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the Company has agreed to register all Conversion Shares and Warrant Shares (the “Registrable Securities”) under the Securities Act of 1933, as amended (the “Securities Act”). The Company agreed to file a registration statement covering the resale of such Registrable Securities within 75 days of the date of closing. The Company will use its reasonable best efforts to cause such registration statement to be declared effective under the Securities Act as soon as possible but, in any event, no later than 90 days following the date of closing and will use its reasonable best efforts to keep such registration statement continuously effective under the Securities Act. If the Company fails to meet these deadlines, or upon the occurrence of other events set forth in the Registration Rights Agreement, the Company will be subject to liquidated damages payable to the holders of the Registrable Securities in certain circumstances.

Class A Common Securities Purchase Agreement and Related Exchange of Debt

On February 13, 2025, the Company entered into a Securities Purchase Agreement (the “Class A Common Securities Purchase Agreement”) with Lytton-Kambara Foundation (the “Buyer”), pursuant to which Buyer has agreed to purchase from the Company: (i) 455,192 shares of Common Stock at a purchase price of approximately $2.15 per share, plus warrants to purchase 37.5% of the number of shares, or 170,697 shares of Common Stock, with an exercise price of $2.58 per share; and (ii) 232,558 shares of Common Stock at a purchase price of approximately $2.15 per share (the “Common Offering”). The consideration aggregate of $1.5 million to be paid consists of: 1) $500,000 cash; and 2) the remaining $1,000,000 by exchange of an equal amount of principal and accrued and unpaid interest outstanding under that certain existing indebtedness of the Company held by the Buyer as evidenced by that certain Bridge Note in the original principal amount of $3,000,000 dated August 6, 2024, by the Company in favor of the Buyer (the “Existing Note”). Upon such exchange under the Class A Common Securities Purchase Agreement, and a like exchange for the remaining balance of the Existing Note in connection with the Buyer purchasing Preferred Stocks and Notes in the Private Placement, all of the Company’s obligations under the Existing Note shall be deemed satisfied in full, waived or terminated and the Existing Note will be deemed cancelled and of no force or effect. The Common Offering is expected to close immediately prior to the closing of the Transaction.

The agreements described in this Item 1.01 contain representations, warranties, and covenants that are customary for transactions such as the Transaction, the Private Placement and the Common Offering, which were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties. Accordingly, such agreements are incorporated herein by reference only to provide investors with information regarding the terms of such agreements, and not to provide investors with any other factual information regarding the Company or its business, and should be read in conjunction with the disclosures in the Company’s periodic reports and other filings with SEC.

The foregoing descriptions of the Certificate of Designations, the form of Warrant, the form of Note, the Securities Purchase Agreement, the Registration Rights Agreement and the Class A Common Securities Purchase Agreement do not purport to be complete and are qualified in their entirety by reference to the Certificate of Designations, the form of Warrant, the form of Note, the Securities Purchase Agreement, the Registration Rights Agreement and the Class A Common Securities Purchase Agreement, respectively, which are filed as Exhibits 3.1, 4.1, 4.2, 10.2, 10.3 and 10.4 hereto, respectively, and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 above is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information included in Item 1.01 above is incorporated by reference into this Item 3.02. The Securities described in this Current Report on Form 8-K were offered and will be issued in reliance upon exemptions from registration provided by Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder and corresponding provisions of state securities laws. Accordingly, none of the securities to be issued in the Transaction, the Private Placement or the Common Offering, will have been registered under the Securities Act as of the closing date of such transactions, and until registered, these securities may not be offered or sold in the United States absent registration or availability of an applicable exemption from registration.

Item 3.03 Material Modifications to Rights of Security Holders.

The information included in Item 1.01 above is incorporated by reference into this Item 3.03.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the Securities Purchase Agreement, and subject to and effective as of the closing thereunder, the Company and the Company’s Board of Directors have agreed to increase the size of the Board to eight members and appoint a director nominee affiliated with the Lead Investor and an independent board nominee. Thomas Ellis, an affiliate of the Lead Investor, will serve as a Class II Director until his successor is duly elected and qualified or until his death, resignation, or removal. The independent director nominee will be appointed at a later date.

Mr. Ellis, age 55, has served as a Co-Managing Member at North Run, a public security investment firm, since December 2002. Prior to co-founding North Run in 2002, Mr. Ellis, was a Principal at Berkshire Partners, LLC, a private equity firm, an Analyst at MHR Fund Management, a hedge fund and distressed debt fund, and an Associate in the Investment Banking Division of Goldman, Sachs & Co. Mr. Ellis has served on the boards of directors of LENSAR, Inc. since May 2023 and of Guerrilla RF, Inc. since August 2024. Mr. Ellis received an A.B. degree from Princeton University and a J.D. degree from Harvard Law School.

Mr. Ellis will be entitled to the standard compensation received by non-employee directors of the Company. The Company’s director compensation program is more fully described in the Company’s definitive Proxy Statement on Schedule 14A, filed with the SEC on October 7, 2024. Other than the Private Placement, the Company is not aware of any transactions or proposed transactions in which the Company was or is to be a participant since July 1, 2023, in which the amount involved exceeds $120,000, and in which Mr. Ellis had, or will have, a direct or indirect material interest. Mr. Ellis has not been appointed to the membership of any committees of the Board, and there are no committee appointments currently contemplated with respect to Mr. Ellis.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information included in Item 1.01 above is incorporated by reference into this Item 5.03.

Item 7.01 Regulation FD Disclosure.

On February 13, 2025, the Company issued a press release announcing the execution of the agreements related to the Transaction, the Private Placement and Common Offering. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Forward Looking Statement

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation statements regarding: future expectations, plans and prospects for the Company, G5 Infrared and the combined company following the anticipated consummation of the proposed Transaction; the anticipated size of and investors in the proposed Private Placement and Common Offering; the anticipated benefits of the Transaction; the anticipated timing of the closing the acquisition, the Private Placement and the Common Offering; the anticipated use of proceeds of the Private Placement and Common Offering; and other statements containing the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” “will,” “working” and similar expressions. Any forward-looking statements are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in, or implied by, such forward-looking statements. The combined company may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. These risks and uncertainties include, but are not limited to, important risks and uncertainties associated with: completion of the proposed acquisition and concurrent Private Placement in a timely manner or on the anticipated terms or at all; the satisfaction (or waiver) of closing conditions to the consummation of the acquisition and the Private Placement; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Membership Interest Purchase Agreement, the Securities Purchase Agreement or the Class A Common Securities Purchase Agreement; the effect of the announcement or pendency of the acquisition on the Company’s or G5 Infrared’s business relationships, operating results and business generally; the ability of the combined company to timely and successfully achieve or recognize the anticipated benefits of the acquisition; the outcome of any legal proceedings that may be instituted against the Company or G5 Infrared following any announcement of the proposed acquisition and related transactions; costs related to the proposed acquisition, including unexpected costs, charges or expenses resulting from the acquisition; changes in applicable laws or regulation; the possibility that the Company or G5 Infrared may be adversely affected by other economic, business and/or competitive factors; competitive responses to the transactions; achieving the Company’s other business objectives. For a discussion of other risks and uncertainties, and other important factors, any of which could cause the Company’s actual results to differ materially from those contained in the forward-looking statements, see the “Risk Factors” section, as well as discussions of potential risks, uncertainties and other important factors, in the Company’s most recent filings with the SEC. In addition, the forward looking statements included in this Current Report on Form 8-K represent the Company’s views as of the date hereof and should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof. The Company anticipates that subsequent events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibit No. | | Description |

3.1 | | Form of Certificate of Designations, Preferences and Rights of Series G Convertible Preferred Stock |

4.1 | | Form of Warrant |

4.2 | | Form of Note |

10.1* | | Form of Membership Interest Purchase Agreement, dated February 13, 2025, by and among LightPath Technologies, Inc., G5 Infrared, LLC, the members of G5 Infrared, LLC, and Kenneth R. Greenslade, solely in his capacity as Sellers’ Representative. |

10.2* | | Form of Securities Purchase Agreement, dated February 13, 2025, by and among LightPath Technologies, Inc. and the investors listed on the Schedule of Buyers attached thereto. |

10.3 | | Form of Registration Rights Agreement, dated February 13, 2025, by and among LightPath Technologies, Inc. and each of the several purchasers signatory thereto. |

10.4* | | Form of Securities Purchase Agreement, dated February 13, 2025, by and between LightPath Technologies, Inc. and Lytton-Kambara Foundation. |

99.1 | | Press Release of LightPath Technologies, Inc., dated February 13, 2025. |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Schedules and certain exhibits have been omitted pursuant to Items 601(a)(5) and/or 601(b)(10)(iv) of Regulation S-K. The issuer hereby undertakes to furnish supplementally a copy of any omitted schedule or exhibit to such agreement to the U.S. Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this Report to be signed in its behalf by the undersigned, thereunto duly authorized.

| LIGHTPATH TECHNOLOGIES, INC. | |

| | | |

Dated: February 13, 2025 | By: | /s/ Albert Miranda | |

| | Albert Miranda, Chief Financial Officer | |

nullnullnullnullnullnullnullnull

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

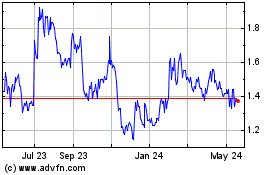

Lightpath Technologies (NASDAQ:LPTH)

Historical Stock Chart

From Jan 2025 to Feb 2025

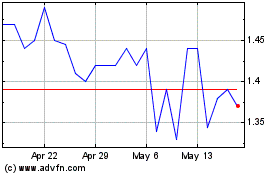

Lightpath Technologies (NASDAQ:LPTH)

Historical Stock Chart

From Feb 2024 to Feb 2025