false000070754900007075492025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 29, 2025

LAM RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-12933 | | 94-2634797 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification Number) |

4650 Cushing Parkway

Fremont, California 94538

(Address of principal executive offices including zip code)

(510) 572-0200

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 Per Share | LRCX | The Nasdaq Stock Market |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

| | | | | | | | | | | | | | |

| | | | |

| Item 2.02. | | Results of Operations and Financial Condition | | |

| Item 9.01. | | Financial Statements and Exhibits | | |

| SIGNATURES | | |

| EX-99.1 | | |

| | | | |

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

On January 29, 2025, Lam Research Corporation (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended December 29, 2024, the text of which is attached hereto as Exhibit 99.1.

The information in this item of this Current Report on Form 8-K, including Exhibit 99.1, is furnished pursuant to Item 2.02 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section. Furthermore, the information in this item of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | January 29, 2025 | | LAM RESEARCH CORPORATION |

| | | (Registrant) |

| | | /s/ Douglas R. Bettinger |

| | | Douglas R. Bettinger |

| | | Executive Vice President and Chief Financial Officer |

| | | (Principal Financial Officer) |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Lam Research Corporation Reports Financial Results for the Quarter Ended December 29, 2024

FREMONT, Calif., January 29, 2025 - Lam Research Corporation (the "Company," "Lam," "Lam Research") today announced financial results for the quarter ended December 29, 2024 (the “December 2024 quarter”).

Highlights for the December 2024 quarter were as follows:

•Revenue of $4.38 billion.

•U.S. GAAP gross margin of 47.4%, U.S. GAAP operating income as a percentage of revenue of 30.5%, and U.S. GAAP diluted EPS of $0.92.

•Non-GAAP gross margin of 47.5%, non-GAAP operating income as a percentage of revenue of 30.7%, and non-GAAP diluted EPS of $0.91.

Key Financial Data for the Quarters Ended

December 29, 2024 and September 29, 2024

(in thousands, except per-share data, percentages, and basis points)

| | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP |

| | | December 2024 | | September 2024 | | Change Q/Q |

| Revenue | | $ | 4,376,047 | | | $ | 4,167,976 | | | + 5% |

| Gross margin as percentage of revenue | | 47.4 | % | | 48.0 | % | | - 60 bps |

| Operating income as percentage of revenue | | 30.5 | % | | 30.3 | % | | + 20 bps |

| Diluted EPS | | $ | 0.92 | | | $ | 0.86 | | | + 7% |

| | | | | | |

| Non-GAAP |

| | | December 2024 | | September 2024 | | Change Q/Q |

| Revenue | | $ | 4,376,047 | | | $ | 4,167,976 | | | + 5% |

| Gross margin as percentage of revenue | | 47.5 | % | | 48.2 | % | | - 70 bps |

| Operating income as percentage of revenue | | 30.7 | % | | 30.9 | % | | - 20 bps |

| Diluted EPS | | $ | 0.91 | | | $ | 0.86 | | | + 6% |

U.S. GAAP Financial Results

For the December 2024 quarter, revenue was $4,376 million, gross margin was $2,073 million, or 47.4% of revenue, operating expenses were $739 million, operating income was 30.5% of revenue, and net income was $1,191 million, or $0.92 per diluted share on a U.S. GAAP basis. This compares to revenue of $4,168 million, gross margin of $2,003 million, or 48.0% of revenue, operating expenses of $738 million, operating income of 30.3% of revenue, and net income of $1,116 million, or $0.86 per diluted share, for the quarter ended September 29, 2024 (the “September 2024 quarter”).

Non-GAAP Financial Results

For the December 2024 quarter, non-GAAP gross margin was $2,077 million, or 47.5% of revenue, non-GAAP operating expenses were $735 million, non-GAAP operating income was 30.7% of revenue, and non-GAAP net income was $1,175 million, or $0.91 per diluted share. This compares to non-GAAP gross margin of $2,009 million, or 48.2% of revenue, non-GAAP operating expenses of $722 million, non-GAAP operating income of 30.9% of revenue, and non-GAAP net income of $1,122 million, or $0.86 per diluted share, for the September 2024 quarter.

“Lam is executing at a high level at a pivotal moment for semiconductor manufacturing. Increasing demands on chip performance play into Lam’s strengths, with advanced deposition and etch applications set to comprise a growing share of WFE,” said Tim Archer, Lam Research's President and Chief Executive Officer. “Our investments to win at key technology inflections are paying off, with more exciting opportunities ahead.”

Balance Sheet and Cash Flow Results

Cash, cash equivalents, and restricted cash balances decreased to $5.7 billion at the end of the December 2024 quarter compared to $6.1 billion at the end of the September 2024 quarter. The decrease was primarily the result of cash deployed for capital return activities and capital expenditures during the quarter, partially offset by cash generated from operating activities.

Deferred revenue at the end of the December 2024 quarter decreased to $2,032 million compared to $2,047 million as of the end of the September 2024 quarter. Lam's deferred revenue balance does not include shipments to customers in Japan, to whom control does not transfer until customer acceptance. Shipments to customers in Japan are classified as inventory at cost until the time of acceptance. The estimated future revenue from shipments to customers in Japan was approximately $453 million as of December 29, 2024 and $184 million as of September 29, 2024.

Revenue

The geographic distribution of revenue during the December 2024 quarter is shown in the following table:

| | | | | |

| Region | Revenue |

| China | 31% |

| Korea | 25% |

| Taiwan | 17% |

| United States | 9% |

| Japan | 8% |

| Southeast Asia | 7% |

| Europe | 3% |

The following table presents revenue disaggregated between system and customer support-related revenue: | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| December 29,

2024 | | September 29,

2024 | | December 24,

2023 | | | | |

| (In thousands) |

| Systems revenue | $ | 2,625,649 | | | $ | 2,392,730 | | | $ | 2,299,286 | | | | | |

| Customer support-related revenue and other | 1,750,398 | | | 1,775,246 | | | 1,458,973 | | | | | |

| $ | 4,376,047 | | | $ | 4,167,976 | | | $ | 3,758,259 | | | | | |

| | | | | | | | | |

Systems revenue includes sales of new leading-edge equipment in deposition, etch and clean markets.

Customer support-related revenue includes sales of customer service, spares, upgrades, and non-leading-edge equipment from our Reliant® product line.

Outlook

For the quarter ended March 30, 2025, Lam is providing the following guidance:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | | Reconciling Items | | Non-GAAP |

| | | | | | | | | | |

| Revenue | $4.65 Billion | +/- | $300 Million | | — | | $4.65 Billion | +/- | $300 Million |

| Gross margin as a percentage of revenue | 47.9% | +/- | 1% | | $ | 2.8 | | Million | | 48.0% | +/- | 1% |

| Operating income as a percentage of revenue | 31.9% | +/- | 1% | | $ | 3.4 | | Million | | 32.0% | +/- | 1% |

| Net income per diluted share | $1.00 | +/- | $0.10 | | $ | 3.9 | | Million | | $1.00 | +/- | $0.10 |

| Diluted share count | 1.29 Billion | | — | | 1.29 Billion |

The information provided above is only an estimate of what the Company believes is realizable as of the date of this release and does not incorporate the potential impact of any business combinations, asset acquisitions, divestitures, restructuring, balance sheet valuation adjustments, financing arrangements, other investments, or other significant arrangements that may be completed or realized after the date of this release, except as described below. U.S. GAAP to non-GAAP reconciling items provided include only those items that are known and can be estimated as of the date of this release. Actual results will vary from this model and the variations may be material. Reconciling items included above are as follows:

•Gross margin as a percentage of revenue - amortization related to intangible assets acquired through business combinations, $2.8 million.

•Operating income as a percentage of revenue - amortization related to intangible assets acquired through business combinations, $3.4 million.

•Net income per diluted share - amortization related to intangible assets acquired though business combinations, $3.4 million; amortization of debt discounts, $0.8 million; and associated tax benefit for non-GAAP items ($0.3 million); totaling $3.9 million.

Use of Non-GAAP Financial Results

In addition to U.S. GAAP results, this press release also contains non-GAAP financial results. The Company’s non-GAAP results for both the December 2024 and September 2024 quarters exclude amortization related to intangible assets acquired through business combinations, the effects of elective deferred compensation-related assets and liabilities, amortization of note discounts, and the net income tax effect of non-GAAP items. Additionally, the non-GAAP results for the December 2024 quarter exclude the income tax benefit from a change in tax law.

Management uses non-GAAP gross margin, operating expense, operating income, operating income as a percentage of revenue, net income, and net income per diluted share to evaluate the Company’s operating and financial results. The Company believes the presentation of non-GAAP results is useful to investors for analyzing business trends and comparing performance to prior periods, along with enhancing investors’ ability to view the Company’s results from management’s perspective. Tables presenting reconciliations of non-GAAP results to U.S. GAAP results are included at the end of this press release and on the Company’s website at https://investor.lamresearch.com.

Caution Regarding Forward-Looking Statements

Statements made in this press release that are not of historical fact are forward-looking statements and are subject to the safe harbor provisions created by the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to, but are not limited to: our outlook and guidance for future financial results, including revenue, gross margin, operating income and net income; our operational execution; the prospects for semiconductor manufacturing and for demand for wafer fabrication equipment (“WFE”); chip performance demands; the competitive positioning of Lam’s products; growth in the significance of advanced deposition and etch applications as a proportion of wafer fabrication equipment spending; the success of our investments at key technology inflections; and the opportunities ahead of us. Some factors that may affect these forward-looking statements include: the actions of our customers and competitors may be inconsistent with our expectations; business, political and/or regulatory conditions in the consumer electronics industry, the semiconductor industry and the overall economy may deteriorate or change; trade regulations, export controls, trade disputes, and other geopolitical tensions may inhibit our ability to sell our products; supply chain cost increases and other inflationary pressures have impacted and may continue to impact our profitability; supply chain disruptions or manufacturing capacity constraints may limit our ability to manufacture and sell our products; and natural and human-caused disasters, disease outbreaks, war, terrorism, political or governmental unrest or instability, or other events beyond our control may impact our operations and revenue in affected areas; as well as the other risks and uncertainties that are described in the documents filed or furnished by us with the Securities and Exchange Commission, including specifically the Risk Factors described in our annual report on Form 10-K for the fiscal year ended June 30, 2024, and our quarterly report on Form 10-Q for the fiscal quarter ended September 29, 2024. These uncertainties and changes could materially affect the forward-looking statements and cause actual results to vary from expectations in a material way. The Company undertakes no obligation to update the information or statements made in this release.

Lam Research Corporation is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam's equipment and services allow customers to build smaller and better performing devices. In fact, today, nearly every advanced chip is built with Lam technology. We combine superior systems engineering, technology leadership, and a strong values-based culture, with an unwavering commitment to our customers. Lam Research (Nasdaq: LRCX) is a FORTUNE 500® company headquartered in Fremont, Calif., with operations around the globe. Learn more at www.lamresearch.com. (LRCX)

Consolidated Financial Tables Follow.

###

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data and percentages)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | December 29,

2024 | | September 29,

2024 | | December 24,

2023 | | December 29,

2024 | | December 24,

2023 |

| Revenue | $ | 4,376,047 | | | $ | 4,167,976 | | | $ | 3,758,259 | | | $ | 8,544,023 | | | $ | 7,240,321 | |

| Cost of goods sold | 2,303,066 | | | 2,165,293 | | | 1,985,847 | | | 4,468,359 | | | 3,805,267 | |

| Restructuring charges, net - cost of goods sold | — | | | — | | | 14,957 | | | — | | | 22,897 | |

| Total cost of goods sold | 2,303,066 | | | 2,165,293 | | | 2,000,804 | | | 4,468,359 | | | 3,828,164 | |

| Gross margin | 2,072,981 | | | 2,002,683 | | | 1,757,455 | | | 4,075,664 | | | 3,412,157 | |

| Gross margin as a percent of revenue | 47.4 | % | | 48.0 | % | | 46.8 | % | | 47.7 | % | | 47.1 | % |

| Research and development | 494,947 | | | 495,358 | | | 469,712 | | | 990,305 | | | 892,341 | |

| Selling, general and administrative | 244,150 | | | 243,128 | | | 228,843 | | | 487,278 | | | 435,866 | |

| Restructuring charges, net - operating expenses | — | | | — | | | 1,688 | | | — | | | 3,709 | |

| Total operating expenses | 739,097 | | | 738,486 | | | 700,243 | | | 1,477,583 | | | 1,331,916 | |

| Operating income | 1,333,884 | | | 1,264,197 | | | 1,057,212 | | | 2,598,081 | | | 2,080,241 | |

| Operating income as a percent of revenue | 30.5 | % | | 30.3 | % | | 28.1 | % | | 30.4 | % | | 28.7 | % |

| Other income (expense), net | 14,262 | | | 30,081 | | | 29,839 | | | 44,343 | | | 32,440 | |

| Income before income taxes | 1,348,146 | | | 1,294,278 | | | 1,087,051 | | | 2,642,424 | | | 2,112,681 | |

| Income tax expense | (157,128) | | | (177,834) | | | (132,785) | | | (334,962) | | | (271,017) | |

| Net income | $ | 1,191,018 | | | $ | 1,116,444 | | | $ | 954,266 | | | $ | 2,307,462 | | | $ | 1,841,664 | |

| Net income per share: | | | | | | | | | |

| Basic | $ | 0.93 | | | $ | 0.86 | | | $ | 0.72 | | | $ | 1.78 | | | $ | 1.39 | |

| Diluted | $ | 0.92 | | | $ | 0.86 | | | $ | 0.72 | | | $ | 1.78 | | | $ | 1.39 | |

| Number of shares used in per share calculations: | | | | | | | | | |

| Basic | 1,287,109 | | | 1,299,236 | | | 1,316,293 | | | 1,293,173 | | | 1,321,067 | |

| Diluted | 1,291,469 | | | 1,304,066 | | | 1,322,201 | | | 1,297,767 | | | 1,326,933 | |

| Cash dividend declared per common share | $ | 0.23 | | | $ | 0.23 | | | $ | 0.20 | | | $ | 0.46 | | | $ | 0.40 | |

| | | | | | | | | |

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | | | | | | | | | | | | |

| December 29,

2024 | | September 29,

2024 | | June 30,

2024 |

| (unaudited) | | (unaudited) | | (1) |

| ASSETS | | | | | |

| Cash and cash equivalents | $ | 5,665,379 | | | $ | 6,067,471 | | | $ | 5,847,856 | |

| | | | | |

| Accounts receivable, net | 3,304,946 | | | 2,937,217 | | | 2,519,250 | |

| Inventories | 4,358,152 | | | 4,209,878 | | | 4,217,924 | |

| Prepaid expenses and other current assets | 284,370 | | | 277,802 | | | 298,190 | |

| Total current assets | 13,612,847 | | | 13,492,368 | | | 12,883,220 | |

| Property and equipment, net | 2,313,590 | | | 2,214,269 | | | 2,154,518 | |

| | | | | |

| Goodwill and intangible assets | 1,761,021 | | | 1,758,344 | | | 1,765,073 | |

| Other assets | 2,152,458 | | | 2,067,508 | | | 1,941,917 | |

| Total assets | $ | 19,839,916 | | | $ | 19,532,489 | | | $ | 18,744,728 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

| Current portion of long-term debt and finance lease obligations | $ | 504,136 | | | $ | 504,682 | | | $ | 504,814 | |

| Other current liabilities | 4,846,160 | | | 4,837,986 | | | 3,833,624 | |

| Total current liabilities | 5,350,296 | | | 5,342,668 | | | 4,338,438 | |

| Long-term debt and finance lease obligations | 4,478,148 | | | 4,479,087 | | | 4,478,520 | |

| Income taxes payable | 669,747 | | | 664,717 | | | 813,304 | |

| Other long-term liabilities | 533,699 | | | 574,126 | | | 575,012 | |

| Total liabilities | 11,031,890 | | | 11,060,598 | | | 10,205,274 | |

| | | | | |

| Stockholders’ equity (2) | 8,808,026 | | | 8,471,891 | | | 8,539,454 | |

| Total liabilities and stockholders’ equity | $ | 19,839,916 | | | $ | 19,532,489 | | | $ | 18,744,728 | |

| | | | | |

| | | | | |

| (1) | Derived from audited financial statements. |

| (2) | Common shares issued and outstanding were 1,284,956 as of December 29, 2024, 1,291,958 as of September 29, 2024, and 1,303,769 as of June 30, 2024. |

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | December 29,

2024 | | September 29,

2024 | | December 24,

2023 | | December 29,

2024 | | December 24,

2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | |

| Net income | $ | 1,191,018 | | | $ | 1,116,444 | | | $ | 954,266 | | | $ | 2,307,462 | | | $ | 1,841,664 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | |

| Depreciation and amortization | 96,200 | | | 94,295 | | | 90,941 | | | 190,495 | | | 181,420 | |

| Deferred income taxes | (82,854) | | | (108,722) | | | (88,747) | | | (191,576) | | | (112,985) | |

| Equity-based compensation expense | 81,959 | | | 80,011 | | | 69,901 | | | 161,970 | | | 137,112 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other, net | (8,592) | | | (457) | | | 4,182 | | | (9,049) | | | 4,032 | |

| Changes in operating assets and liabilities | (535,789) | | | 386,900 | | | 423,297 | | | (148,889) | | | 353,760 | |

| Net cash provided by operating activities | 741,942 | | | 1,568,471 | | | 1,453,840 | | | 2,310,413 | | | 2,405,003 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | |

| Capital expenditures and intangible assets | (188,349) | | | (110,588) | | | (115,276) | | | (298,937) | | | (192,268) | |

| | | | | | | | | |

| Net maturities and sales of available-for-sale securities | — | | | — | | | 15,841 | | | — | | | 23,116 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other, net | 12,974 | | | 37 | | | (2,523) | | | 13,011 | | | (7,489) | |

| Net cash used for investing activities | (175,375) | | | (110,551) | | | (101,958) | | | (285,926) | | | (176,641) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | |

| | | | | | | | | |

| Principal payments on debt, including finance lease obligations | (1,032) | | | (934) | | | (986) | | | (1,966) | | | (254,095) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Treasury stock purchases, including excise tax payments | (697,688) | | | (997,035) | | | (645,458) | | | (1,694,723) | | | (1,488,696) | |

| Dividends paid | (297,634) | | | (260,985) | | | (264,414) | | | (558,619) | | | (494,746) | |

| Reissuance of treasury stock related to employee stock purchase plan | 60,557 | | | — | | | 53,081 | | | 60,557 | | | 53,081 | |

| Proceeds from issuance of common stock, net issuance costs | (194) | | | (43) | | | 1,704 | | | (237) | | | 4,522 | |

| | | | | | | | | |

| Other, net | 761 | | | (324) | | | (3,821) | | | 437 | | | (5,972) | |

| Net cash used for financing activities | (935,230) | | | (1,259,321) | | | (859,894) | | | (2,194,551) | | | (2,185,906) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (26,022) | | | 22,682 | | | 6,725 | | | (3,340) | | | (4,306) | |

| Net change in cash, cash equivalents, and restricted cash | (394,685) | | | 221,281 | | | 498,713 | | | (173,404) | | | 38,150 | |

Cash, cash equivalents, and restricted cash at beginning of period (1) | 6,072,084 | | | 5,850,803 | | | 5,126,809 | | | 5,850,803 | | | 5,587,372 | |

Cash, cash equivalents, and restricted cash at end of period (1) | $ | 5,677,399 | | | $ | 6,072,084 | | | $ | 5,625,522 | | | $ | 5,677,399 | | | $ | 5,625,522 | |

| | | | | | | | | |

| | | | | |

| (1) | Restricted cash is reported within Other assets in the Condensed Consolidated Balance Sheets |

Non-GAAP Financial Summary

(in thousands, except percentages and per share data)

(unaudited)

| | | | | | | | | | | |

| Three Months Ended |

| December 29,

2024 | | September 29,

2024 |

| Revenue | $ | 4,376,047 | | | $ | 4,167,976 | |

| Gross margin | $ | 2,077,151 | | | $ | 2,009,022 | |

| Gross margin as percentage of revenue | 47.5 | % | | 48.2 | % |

| Operating expenses | $ | 734,501 | | | $ | 722,148 | |

| Operating income | $ | 1,342,650 | | | $ | 1,286,874 | |

| Operating income as a percentage of revenue | 30.7 | % | | 30.9 | % |

| Net income | $ | 1,175,000 | | | $ | 1,121,507 | |

| Net income per diluted share | $ | 0.91 | | | $ | 0.86 | |

| Shares used in per share calculation - diluted | 1,291,469 | | | 1,304,066 | |

Reconciliation of U.S. GAAP Net Income to Non-GAAP Net Income

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | | |

| December 29,

2024 | | September 29,

2024 | | | | | | |

| U.S. GAAP net income | $ | 1,191,018 | | | $ | 1,116,444 | | | | | | | |

| Pre-tax non-GAAP items: | | | | | | | | | |

| Amortization related to intangible assets acquired through certain business combinations - cost of goods sold | 2,817 | | | 3,076 | | | | | | | |

| Elective deferred compensation ("EDC") related liability valuation increase - cost of goods sold | 1,353 | | | 3,263 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| EDC related liability valuation increase - research and development | 2,432 | | | 8,136 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Amortization related to intangible assets acquired through certain business combinations - selling, general and administrative | 538 | | | 692 | | | | | | | |

| EDC related liability valuation increase - selling, general and administrative | 1,626 | | | 7,510 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Amortization of note discounts - other income (expense), net | 772 | | | 765 | | | | | | | |

| | | | | | | | | |

| Gain on EDC related asset - other income (expense), net | (4,502) | | | (17,420) | | | | | | | |

| | | | | | | | | |

| Net income tax benefit on non-GAAP items | (276) | | | (959) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Income tax benefit from a change in tax law | (20,778) | | | — | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Non-GAAP net income | $ | 1,175,000 | | | $ | 1,121,507 | | | | | | | |

| Non-GAAP net income per diluted share | $ | 0.91 | | | $ | 0.86 | | | | | | | |

| U.S. GAAP net income per diluted share | $ | 0.92 | | | $ | 0.86 | | | | | | | |

| U.S. GAAP and non-GAAP number of shares used for per diluted share calculation | 1,291,469 | | | 1,304,066 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Reconciliation of U.S. GAAP Gross Margin, Operating Expenses and Operating Income to Non-GAAP Gross Margin, Operating Expenses and Operating Income

(in thousands, except percentages)

(unaudited)

| | | | | | | | | | | |

| Three Months Ended |

| December 29,

2024 | | September 29,

2024 |

| U.S. GAAP gross margin | $ | 2,072,981 | | | $ | 2,002,683 | |

| Pre-tax non-GAAP items: | | | |

| Amortization related to intangible assets acquired through certain business combinations | 2,817 | | | 3,076 | |

| EDC related liability valuation increase | 1,353 | | | 3,263 | |

| | | |

| | | |

| | | |

| | | |

| Non-GAAP gross margin | $ | 2,077,151 | | | $ | 2,009,022 | |

| U.S. GAAP gross margin as a percentage of revenue | 47.4 | % | | 48.0 | % |

| Non-GAAP gross margin as a percentage of revenue | 47.5 | % | | 48.2 | % |

| U.S. GAAP operating expenses | $ | 739,097 | | | $ | 738,486 | |

| Pre-tax non-GAAP items: | | | |

| Amortization related to intangible assets acquired through certain business combinations | (538) | | | (692) | |

| EDC related liability valuation increase | (4,058) | | | (15,646) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Non-GAAP operating expenses | $ | 734,501 | | | $ | 722,148 | |

| U.S. GAAP operating income | $ | 1,333,884 | | | $ | 1,264,197 | |

| Non-GAAP operating income | $ | 1,342,650 | | | $ | 1,286,874 | |

| U.S. GAAP operating income as percent of revenue | 30.5 | % | | 30.3 | % |

| Non-GAAP operating income as a percent of revenue | 30.7 | % | | 30.9 | % |

Lam Research Corporation Contacts:

Ram Ganesh, Investor Relations, phone: 510-572-1615, e-mail: investor.relations@lamresearch.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

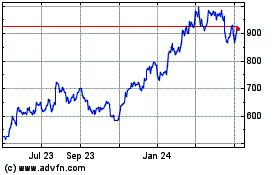

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jan 2024 to Jan 2025