LSI Industries Inc. (Nasdaq: LYTS, “LSI” or the “Company”) a

leading U.S. based manufacturer of commercial lighting and display

solutions, today reported financial results for the fiscal 2025

second quarter ended December 31, 2024.

FISCAL 2025 SECOND QUARTER

RESULTS

- Net sales of $147.7 million, + 36% y/y

- Organic net sales +14% y/y

- Net income of $5.6 million, or $0.18 per diluted share

- Adjusted Net Income $8.0 million or $0.26 per diluted

share

- EBITDA of $11.5 million; Adjusted EBITDA of $13.3 million

- Free cash flow of $8.8 million

- Ratio of net debt to TTM Adjusted EBITDA of 0.6x

LSI delivered significant year-over-year growth in sales and

profitability in the fiscal second quarter, driven by broad-based

demand strength across its vertical markets. Fiscal second quarter

results benefitted from solid organic growth within the Display

Solutions segment, together with contributions from the EMI

acquisition completed in April 2024.

The Company reported net sales of $147.7 million in the fiscal

second quarter, an increase of 36% versus the prior year period.

Net sales, excluding contributions from the EMI acquisition,

increased 14% versus the fiscal second quarter of 2024.

LSI reported net income of $5.6 million, or $0.18 per diluted

share, in the second quarter, while adjusted net income was $8.0

million, or $0.26 per diluted share. The Company generated adjusted

EBITDA of $13.3 million or 9.0% of net sales, an increase of more

than 20% versus the year-ago period. A reconciliation of GAAP and

non-GAAP financial results is included in this press release.

The Company generated free cash flow of $8.8 million in the

second quarter, or nearly $41.4 million on a trailing twelve-month

basis. Given continued strength in cash generation, LSI reduced its

ratio of net debt to trailing twelve-month Adjusted EBITDA to 0.6x,

down from 1.3x at the time of the EMI acquisition in April 2024. At

the end of the second quarter, LSI had cash and availability on its

credit facility totaling $67 million.

The Company declared a regular cash dividend of $0.05 per share

payable on February 11, 2025, to shareholders of record on February

3, 2025.

MANAGEMENT COMMENTARY

“LSI delivered 14% organic sales growth in the fiscal second

quarter, supported by strong demand across our core refueling,

c-store, and grocery verticals,” stated James A. Clark, President

and Chief Executive Officer of LSI. “Including contributions from

our most recent acquisition of EMI, which continues to perform

ahead of initial expectations, LSI generated total sales growth of

36% in the second quarter, while adjusted net income, adjusted

EBITDA and free cash flow generation all increased

on-a-year-over-year basis.

“Our integrated, solutions-based model is gaining significant

traction in the marketplace, positioning us for a solid start to

our fiscal third quarter,” continued Clark. “Second quarter order

rates increased versus the prior year, resulting in a 12%

year-over-year increase in backlog entering the fiscal third

quarter. Display Solutions segment orders increased 25% on a

year-over-year basis in the second quarter driven by balanced

growth across all major verticals. We anticipate that order rates

will remain positive into the second half of our fiscal year, given

current and projected customer activity across our vertical

markets.

“Our Display Solutions segment generated organic sales growth of

50% in the second quarter, driven by increased sales across product

categories and vertical markets. We continue to execute on a

significant backlog of multi-year contracts with large national and

international refueling/c-store customer programs where our

integrated solutions remain in high demand. Notably, second quarter

sales to refueling/c-store customers increased by more than 60%,

when compared to the year-ago period. We enter the third quarter

with an increased backlog and expect strong sales growth to

continue into the fiscal second half.

“The grocery vertical generated sales growth over 50% in the

quarter driven by the resurgence in refrigerated and

non-refrigerated display case demand,” stated Clark. “Termination

of the proposed merger between two large grocery industry

participants was announced in December 2024. Uncertainty over the

proposed merger caused the industry to defer both maintenance and

key program investments over the last eighteen months. We began to

experience a resurgence in demand during the fiscal first quarter,

which accelerated in the second quarter, as expectations that a

judicial decision was imminent.

“In the fiscal second quarter, we successfully managed the

Department of Energy legislation requiring end of life production

for refrigerated display cases utilizing the current R448

technology at calendar year-end, with conversion to R290 and other

technologies effective January 1, 2025. We worked closely with our

customers to proactively plan and adopt the technology transition,

including the launch of our new R290 product line. We are well

positioned to capitalize on increased demand levels for display

case products throughout the calendar year.

“EMI delivered a solid performance in the second quarter,

contributing to the over 100% total sales growth for Display

Solutions. EMI sales were $23.4 million, substantially above what

is historically a softer period for store renovations as our

customers focus on the critical holiday shopping season. Sales were

driven by favorable performance in the QSR, refueling/c-store and

Grocery verticals.

“Within the Lighting segment, overall sales were lower

year-over-year against a challenging prior year comparison. Last

year, we had several large lighting projects, including a

multi-million-dollar installation at a new EV battery plant

complex, that did not recur in the current year. While small

project activity levels were healthy during the second quarter,

those projects were not sufficient to offset softness in large

project activity, resulting in a 10% year-over-year decline in

Lighting segment sales.

“Importantly, Lighting segment project quote activity remains

above prior-year levels, contributing to a segment book-to-bill of

1.1 exiting the second quarter which, on a historical basis, is

elevated entering a seasonally slower period for our construction

markets. While our Lighting segment backlog was 6% above the prior

year exiting the second quarter, we expect order rates to

accelerate as we enter the second half of our fiscal year.

“Innovation and new product vitality remains a central focus for

our business. Over the last four years, we’ve launched more than 30

new products each year. In fiscal 2025, we anticipate more than 40

new product launches and refreshes, consistent with an innovation

roadmap created to exceed specific customer requirements across

each vertical market. During the second quarter, we launched

multiple commercial programs designed to further accelerate

adoption of our recent product launches, including our V-LOCITY

series of outdoor area lights, new continuous indoor Linear

fixtures, and Zone High Bay for sports court applications. Enhanced

training and marketing programs for our sales force, agency

partners, and customers have led to accelerated adoption of new

products, consistent with our commercial strategy.”

Clark concluded, “LSI remains well positioned to drive

continued, profitable growth entering the second half of our fiscal

year 2025. Order rates and backlog remain strong; demand conditions

across most end-markets are robust; and we’re capitalizing on

favorable, multi-year secular opportunities where our vertically

integrated, solutions-based model is uniquely suited to support our

growing base of customers. We also continue to prioritize a

combination of organic and inorganic growth, as outlined within our

Fast Forward strategy, while maintaining our disciplined,

returns-driven approach toward capital deployment.”

FISCAL 2025 SECOND QUARTER CONFERENCE CALL

A conference call will be held today at 11:00 A.M. ET to review

the Company’s financial results and conduct a question-and-answer

session.

A webcast of the conference call and accompanying presentation

materials will be available in the Investor Relations section of

LSI Industries’ website at www.lsicorp.com. Individuals can also

participate by teleconference dial-in. To listen to a live

broadcast, go to the site at least 15 minutes prior to the

scheduled start time to register, download and install any

necessary audio software.

Domestic Live: 877-407-4018 International Live:

201-689-8471

To listen to a replay of the teleconference, which subsequently

will be available through February 6, 2025

Domestic Replay: 844-512-2921 International

Replay: 412-317-6671

Conference ID: 13751021

ABOUT LSI INDUSTRIES

Headquartered in Cincinnati, LSI Industries (NASDAQ: LYTS)

specializes in the creation of advanced lighting, graphics, and

display solutions. The Company’s American-made products, which

include lighting, print graphics, digital graphics, millwork, metal

and refrigerated products, and custom displays, are engineered to

elevate brands in competitive markets. With a workforce of

approximately 1,900 employees and 16 facilities throughout North

America, LSI is dedicated to providing top-quality solutions to its

clients. Additional information about LSI is available at

www.lsicorp.com.

FORWARD-LOOKING STATEMENTS

For details on the uncertainties that may cause our actual

results to be materially different than those expressed in our

forward-looking statements, visit https://investors.lsicorp.com as

well as our Annual Reports on Form 10-K and Quarterly Reports on

Form 10-Q which contain risk factors.

Three Months Ended December

31

Six Months Ended

(Unaudited)

December 31

2024

2023

(In thousands, except per

share data)

2024

2023

$

147,734

$

109,005

Net sales

$

285,829

$

232,446

112,804

77,438

Cost of products sold

217,147

163,943

69

-

Expense on step-up basis of

acquired lease

136

-

-

31

Severance costs and

restructuring costs

38

378

34,861

31,536

Gross profit

68,508

68,125

1,669

849

Long-term performance based

compensation

2,853

2,174

-

4

Severance costs and

restructuring costs

22

10

1,408

1,190

Amortization expense of

acquired intangible assets

2,816

2,380

-

-

Acquisition costs

48

-

81

-

Consulting expense: commercial

growth initiatives

81

19

23,244

21,674

Selling and administrative

costs

45,098

44,695

8,459

7,819

Operating Income

17,590

18,847

382

(29

)

Other (income) expense

322

67

728

453

Interest expense, net

1,603

1,019

7,349

7,395

Income before taxes

15,665

17,761

1,702

1,489

Income tax

3,336

3,827

$

5,647

$

5,906

Net income

$

12,329

$

13,934

Weighted

Average Common Shares Outstanding

29,930

29,024

Basic

29,761

28,890

30,876

30,043

Diluted

30,709

29,949

Earnings

Per Share

$

0.19

$

0.20

Basic

$

0.41

$

0.48

$

0.18

$

0.20

Diluted

$

0.40

$

0.47

(amounts in thousands) December 31 June 30,

2024

2024

Current assets

$

163,405

$

162,499

Property, plant and equipment, net

31,534

32,959

Other assets

149,606

153,342

Total assets

$

344,545

$

348,800

Current maturities of long-term debt

$

3,571

$

3,571

Other current liabilities

74,977

75,636

Long-term debt

34,615

50,658

Other long-term liabilities

14,267

14,580

Shareholders' equity

217,115

204,355

$

344,545

$

348,800

Three Months Ended December 31, 2024

Results

Net sales for the three months ended December 31, 2024, were

$147.7 million representing an increase of 36% compared to the

three months ended December 31, 2023, net sales of $109.0 million.

Lighting Segment net sales of $58.2 million decreased 10% and

Display Solutions Segment net sales of $89.5 million increased 103%

from last year’s second quarter net sales. Net income for the three

months ended December 31, 2024, was $5.6 million, or $0.18 per

share, compared to $5.9 million or $0.20 per share for the three

months ended December 31, 2023. Earnings per share represents

diluted earnings per share.

Six Months Ended December 31, 2024

Results

Net sales for the six months ended December 31, 2024, were

$285.8 million representing a 23% increase from the six months

ended December 31, 2023, net sales of $232.4 million. Lighting

Segment net sales of $116.6 million decreased 12% and Display

Solutions Segment net sales of $169.2 million increased 69% from

last year’s net sales. Net income for the six months ended December

31, 2024, was $12.3 million, or $0.40 per share, compared to $13.9

million or $0.47 per share for the six months ended December 31,

2023. Earnings per share represents diluted earnings per share.

Balance Sheet

The balance sheet at December 31, 2024, included current assets

of $163.4 million, current liabilities of $78.5 million and working

capital of $84.9 million, which includes cash of $4.7 million. The

current ratio was 2.1 to 1. The balance sheet also included

shareholders’ equity of $217.1 million and long-term debt of $34.6

million. It is the Company’s priority to continuously generate

sufficient cash flow, coupled with an approved credit facility, to

adequately fund operations.

Cash Dividend Actions

The Board of Directors declared a regular quarterly cash

dividend of $0.05 per share in connection with the second quarter

of fiscal 2025, payable February 11, 2025, to shareholders of

record as of the close of business on February 3, 2025. The

indicated annual cash dividend rate is $0.20 per share. The Board

of Directors has adopted a policy regarding dividends which

provides that dividends will be determined by the Board of

Directors in its discretion based upon its evaluation of earnings

both on a GAAP and non-GAAP basis, cash flow requirements,

financial condition, debt levels, stock repurchases, future

business developments and opportunities, and other factors deemed

relevant by the Board.

Non-GAAP Financial

Measures

This press release includes adjustments to GAAP operating

income, net income, and earnings per share for the three and six

months ended December 31, 2024, and 2023. Operating income, net

income, and earnings per share, which exclude the impact of

long-term performance based compensation expense, the amortization

expense of acquired intangible assets, commercial growth

opportunity expense, acquisition costs, the lease expense on the

step-up basis of acquired leases, and restructuring and severance

costs, are non-GAAP financial measures. We further note that while

the amortization expense of acquired intangible assets is excluded

from the measures, the revenue of the acquired companies is

reflected in the measures and the acquired assets contribute to

revenue generation. We exclude these items because we believe they

are not representative of the ongoing results of the operations of

the business. Also included in this press release are non-GAAP

financial measures, including Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA and Adjusted EBITDA), Net

Debt to Adjusted EBITDA, Free Cash Flow, and organic sales growth.

We believe that these are useful as supplemental measures in

assessing the operating performance of our business. These measures

are used by our management, including our chief operating decision

maker, to evaluate business results, and are frequently referenced

by those who follow the Company. These non-GAAP measures may be

different from non-GAAP measures used by other companies. In

addition, the non-GAAP measures are not based on any comprehensive

set of accounting rules or principles. Non-GAAP measures have

limitations, in that they do not reflect all amounts associated

with our results as determined in accordance with U.S. GAAP.

Therefore, these measures should be used only to evaluate our

results in conjunction with corresponding GAAP measures. Below is a

reconciliation of these non-GAAP measures to net income and

earnings per share reported for the periods indicated along with

the calculation of EBITDA, Adjusted EBITDA, Free Cash Flow, Net

Debt to Adjusted EBITDA, and organic sales growth.

Three Months EndedDecember 31 Six Months EndedDecember

31 (Unaudited)

2024

2023

% Change (In thousands, except per share data)

2024

2023

% Change

$

147,734

$

109,005

36

%

Net sales

$

285,829

$

232,446

23

%

8,459

7,819

8

%

Operating income as reported

17,590

18,847

-7

%

1,669

849

Long-term performance based compensation

2,853

2,174

81

-

Consulting expense: commercial growth initiatives

81

19

-

-

Acquisition costs

48

-

1,408

1,190

Amortization expense of acquired intangible assets

2,816

2,380

69

-

Expense on step-up basis of acquired lease

136

-

-

35

Severance costs and Restructuring costs

60

388

$

11,686

$

9,893

18

%

Operating income as adjusted

$

23,584

$

23,808

-1

%

$

5,647

$

5,906

-4

%

Net income as reported

$

12,329

$

13,934

-12

%

$

7,996

$

7,249

10

%

Net income as adjusted

$

15,977

$

16,859

-5

%

$

0.18

$

0.20

-7

%

Earnings per share (diluted) as reported

$

0.40

$

0.47

-14

%

$

0.26

$

0.24

7

%

Earnings per share (diluted) as adjusted

$

0.52

$

0.56

-8

%

Three Months Ended Six Months Ended December

31 December 31

2024

2023

(In thousands, except per share data)

2024

2023

DilutedEPS DilutedEPS DilutedEPS

DilutedEPS Reconciliation of net income to adjusted net

income

$

5,647

$

0.18

$

5,906

$

0.20

Net income as reported

$

12,329

$

0.40

$

13,934

$

0.47

1,294

0.04

625

0.02

Long-term performance based compensation

2,161

$

0.07

1,599

0.05

1,090

0.04

885

0.03

Amortization expense of acquired intangible assets

2,132

$

0.07

1,755

0.06

62

-

-

-

Consulting expense: commercial growth initiatives

62

$

-

13

-

-

-

34

-

Severance costs and Restructuring costs

45

$

-

290

0.01

-

-

-

-

Acquisition costs

50

-

-

53

-

-

-

Expense on step-up basis of acquired lease

103

$

0.01

-

-

(150

)

-

(201

)

(0.01

)

Tax rate difference between reported and adjustednet income

(905

)

$

(0.03

)

(732

)

(0.03

)

$

7,996

$

0.26

$

7,249

$

0.24

Net income adjusted

$

15,977

$

0.52

$

16,859

$

0.56

Three Months EndedDecember 31 (Unaudited; In

thousands)

Six Months EndedDecember 31 Net Income to Adjusted

EBITDA

2024

2023

% Change

2024

2023

% Change

$

5,647

$

5,906

Net income as reported

$

12,329

$

13,934

1,702

1,489

Income tax

3,336

3,827

728

453

Interest expense, net

1,603

1,019

382

(29

)

Other (income) expense

322

67

$

8,459

$

7,819

8

%

Operating Income as reported

$

17,590

$

18,847

-7

%

3,018

2,357

Depreciation and amortization

5,958

4,728

$

11,477

$

10,176

13

%

EBITDA

$

23,548

$

23,575

0

%

1,669

849

Long-term performance based compensation

2,853

2,174

81

-

Consulting expense: commercial growth initiatives

81

19

-

-

Acquisition costs

48

-

69

-

Expense on step-up basis of acquired lease

136

-

-

35

Severance costs and Restructuring costs

60

388

$

13,296

$

11,060

20

%

Adjusted EBITDA

$

26,726

$

26,156

2

%

9.0

%

10.1

%

Adjusted EBITDA as a percentage of sales

9.4

%

11.3

%

Three Months EndedDecember 31 (Unaudited; In

thousands)

Six Months EndedDecember 31 Free Cash Flow

2024

2023

% Change

2024

2023

% Change

$

9,891

$

9,276

7

%

Cash flow from operations

$

21,737

$

19,868

9

%

(1,066

)

(1,956

)

Capital expenditures

(1,825

)

(3,349

)

$

8,825

$

7,320

21

%

Free cash flow

$

19,912

$

16,519

21

%

Net Debt to Adjusted EBITDA Ratio December 31

June 30 (amounts in thousands)

2024

2024

Current maturity of debt

$

3,571

$

3,571

Long-term debt

34,615

50,658

Total debt

$

38,186

$

54,229

Less: cash

(4,712

)

(4,110

)

Net debt

$

33,474

$

50,119

Adjusted EBITDA - trailing twelve months

$

52,006

$

51,436

Net debt to adjusted EBITDA ratio

0.6

1.0

Organic compared to Inorganic Sales Q2 2024

Q2 2025 % Variance

Lighting Segment

$

64,796

$

58,210

-10

%

Display Solutions Segment -

Comparable Display Solutions Sales

$

44,209

$

66,133

50

%

- EMI

$

-

$

23,391

Total Display Solutions Sales

$

44,209

$

89,524

103

%

Total net sales

$

109,005

$

147,734

36

%

Less: EMI

-

23,391

Total organic net sales

$

109,005

$

124,343

14

%

Reconciliation of net income to adjusted net income - Six

quarter view FY 2024 DilutedEPS

DilutedEPS Q1 2024 Q2 2024 Net income

reported

$

8,028

$

0.27

$

5,906

$

0.20

Consulting expense: commercial growth initiatives

13

-

-

-

Amortization expense of acquired intangible assets

870

0.03

885

0.03

Severance costs/Restructuring costs

256

0.01

34

-

Long-term performance based compensation

974

0.03

625

0.02

Tax rate difference between reported and adjusted net income

(531

)

(0.02

)

(201

)

(0.01

)

Net income adjusted

$

9,610

$

0.32

$

7,249

$

0.24

Adjusted net income %

7.8

%

6.7

%

FY 2024 DilutedEPS DilutedEPS Q3

2024 Q4 2024 Net income reported

$

5,375

$

0.18

$

5,668

$

0.19

Acquisition costs

-

-

722

0.02

Amortization expense of acquired intangible assets

888

0.03

1,028

0.04

Severance costs/Restructuring costs

101

-

5

-

Long-term performance based compensation

767

0.03

906

0.03

Tax rate difference between reported and adjusted net income

-

(25

)

-

Net income adjusted

$

7,131

$

0.24

$

8,304

$

0.28

Adjusted net income %

6.6

%

6.4

%

FY 2025 DilutedEPS DilutedEPS Q1

2025 Q2 2025 Net income reported

$

6,682

$

0.22

$

5,647

$

0.18

Acquisition costs

36

-

-

-

Consulting expense: commercial growth initiatives

-

-

62

-

Amortization expense of acquired intangible assets

1,042

0.03

1,090

0.04

Lease expense on the step-up basis of acquired leases

50

-

53

-

Severance costs/Restructuring costs

45

-

-

-

Long-term performance based compensation

881

0.03

1,294

0.04

Tax rate difference between reported and adjusted net income

(755

)

(0.02

)

(150

)

-

Net income adjusted

$

7,981

$

0.26

$

7,996

$

0.26

Adjusted net income %

5.8

%

5.4

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123811047/en/

INVESTOR & MEDIA CONTACT Noel Ryan, IRC 720.778.2415

LYTS@vallumadvisors.com

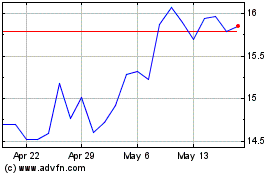

LSI Industries (NASDAQ:LYTS)

Historical Stock Chart

From Jan 2025 to Feb 2025

LSI Industries (NASDAQ:LYTS)

Historical Stock Chart

From Feb 2024 to Feb 2025