truefalse000136836512/312024Q1falseP1Yhttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:puremark:segmentmark:debenturemark:day00013683652024-01-012024-03-3100013683652024-05-1700013683652024-03-3100013683652023-12-310001368365us-gaap:NonrelatedPartyMember2024-03-310001368365us-gaap:NonrelatedPartyMember2023-12-310001368365us-gaap:RelatedPartyMember2024-03-310001368365us-gaap:RelatedPartyMember2023-12-3100013683652023-01-012023-03-310001368365us-gaap:CommonStockMember2023-12-310001368365us-gaap:AdditionalPaidInCapitalMember2023-12-310001368365us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001368365us-gaap:RetainedEarningsMember2023-12-310001368365us-gaap:RetainedEarningsMember2024-01-012024-03-310001368365us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001368365us-gaap:CommonStockMember2024-01-012024-03-310001368365us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001368365us-gaap:CommonStockMember2024-03-310001368365us-gaap:AdditionalPaidInCapitalMember2024-03-310001368365us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001368365us-gaap:RetainedEarningsMember2024-03-310001368365us-gaap:CommonStockMember2022-12-310001368365us-gaap:AdditionalPaidInCapitalMember2022-12-310001368365us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001368365us-gaap:RetainedEarningsMember2022-12-3100013683652022-12-310001368365us-gaap:RetainedEarningsMember2023-01-012023-03-310001368365us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001368365us-gaap:CommonStockMember2023-01-012023-03-310001368365us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001368365us-gaap:CommonStockMember2023-03-310001368365us-gaap:AdditionalPaidInCapitalMember2023-03-310001368365us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001368365us-gaap:RetainedEarningsMember2023-03-3100013683652023-03-310001368365currency:USD2024-03-310001368365currency:USD2023-12-310001368365currency:CNY2024-03-310001368365currency:CNY2023-12-310001368365currency:GBP2024-03-310001368365currency:GBP2023-12-310001368365currency:HKD2024-03-310001368365currency:HKD2023-12-310001368365currency:GBP2023-03-310001368365currency:CNY2023-03-310001368365currency:HKD2023-03-310001368365srt:WeightedAverageMembercurrency:CNY2024-03-310001368365srt:WeightedAverageMembercurrency:CNY2023-03-310001368365srt:WeightedAverageMembercurrency:GBP2024-03-310001368365srt:WeightedAverageMembercurrency:GBP2023-03-310001368365srt:MinimumMember2024-01-012024-03-310001368365srt:MaximumMember2024-01-012024-03-310001368365us-gaap:ProductAndServiceOtherMember2024-01-012024-03-310001368365us-gaap:ComputerSoftwareIntangibleAssetMember2024-03-310001368365us-gaap:EmployeeStockOptionMember2024-03-310001368365us-gaap:WarrantMember2024-03-310001368365mark:IonicVenturesLLCMember2024-03-310001368365mark:CustomerAMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310001368365mark:CustomerAMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001368365mark:CustomerBMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001368365mark:CustomerCMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001368365mark:CustomerAMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001368365mark:CustomerBMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001368365mark:CustomerCMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001368365mark:AIBasedProductsMember2024-01-012024-03-310001368365mark:AIBasedProductsMember2023-01-012023-03-310001368365us-gaap:ProductAndServiceOtherMember2023-01-012023-03-310001368365country:CN2024-01-012024-03-310001368365country:CN2023-01-012023-03-310001368365country:US2024-01-012024-03-310001368365country:US2023-01-012023-03-310001368365mark:AIBasedProductsMember2023-12-310001368365country:CNmark:AIBasedProductsMember2024-03-310001368365country:CNmark:AIBasedProductsMember2023-12-310001368365mark:ChinaBrandingGroupLimitedMember2024-01-012024-03-310001368365us-gaap:VehiclesMember2024-03-310001368365us-gaap:VehiclesMember2023-12-310001368365mark:ComputersandEquipmentMember2024-03-310001368365mark:ComputersandEquipmentMember2023-12-310001368365us-gaap:FurnitureAndFixturesMember2024-03-310001368365us-gaap:FurnitureAndFixturesMember2023-12-310001368365us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001368365us-gaap:LeaseholdImprovementsMember2024-03-310001368365us-gaap:LeaseholdImprovementsMember2023-12-310001368365mark:MudrickLoanAgreementsMemberus-gaap:NotesPayableOtherPayablesMember2024-03-310001368365mark:MudrickLoanAgreementsMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001368365mark:MudrickLoanAgreementsMemberus-gaap:LoansPayableMember2021-12-030001368365mark:MudrickLoanAgreementsMemberus-gaap:NotesPayableOtherPayablesMember2022-12-310001368365mark:MudrickLoanAgreementsMembermark:AccruedExpenseAndOtherCurrentLiabilitiesMemberus-gaap:NotesPayableOtherPayablesMember2022-12-310001368365mark:MudrickLoanAgreementsMemberus-gaap:NotesPayableOtherPayablesMember2023-03-310001368365mark:MudrickLoanAgreementsMemberus-gaap:NotesPayableOtherPayablesMember2023-01-012023-03-310001368365mark:NewMudrickNotePurchaseAgreementMembermark:MudrickLendersMember2023-03-140001368365mark:MudrickLoanAgreementsMemberus-gaap:NotesPayableOtherPayablesMember2023-03-140001368365mark:NewMudrickNotePurchaseAgreementMembermark:MudrickLendersMember2023-03-142023-03-140001368365mark:NewMudrickNotePurchaseAgreementMembermark:MudrickLendersMember2023-01-012023-03-310001368365mark:MudrickLoanAgreementsMemberus-gaap:LoansPayableMember2023-03-140001368365mark:MudrickLoanAgreementsMemberus-gaap:LoansPayableMember2023-03-142023-03-140001368365us-gaap:NotesPayableOtherPayablesMember2024-03-310001368365us-gaap:NotesPayableOtherPayablesMember2024-01-012024-03-310001368365us-gaap:ConvertibleSubordinatedDebtMembermark:IonicVenturesLLCMembermark:LetterAgreementMember2022-10-060001368365mark:IonicVenturesLLCMembermark:LetterAgreementMember2022-10-060001368365mark:Debenture2022Member2022-12-310001368365mark:IonicVenturesLLCMembermark:Debenture2022Member2022-12-310001368365mark:IonicVenturesLLCMember2022-10-062022-10-060001368365mark:IonicVenturesLLCMember2022-01-012022-12-310001368365mark:Debenture2022Member2023-12-310001368365us-gaap:ConvertibleSubordinatedDebtMembermark:IonicVenturesLLCMembermark:LetterAgreementMember2023-03-142023-03-140001368365us-gaap:ConvertibleSubordinatedDebtMembermark:IonicVenturesLLCMembermark:LetterAgreementMember2023-03-140001368365us-gaap:ConvertibleSubordinatedDebtMembermark:IonicVenturesLLCMembermark:FirstDebentureMembermark:FirstDebenturePurchaseAgreementMember2023-03-140001368365mark:SecondDebenturePurchaseAgreementMemberus-gaap:ConvertibleSubordinatedDebtMembermark:IonicVenturesLLCMembermark:SecondDebentureMember2023-03-140001368365mark:Debenture2023Membermark:IonicVenturesLLCMember2024-03-142024-03-140001368365mark:Debenture2023Membermark:IonicVenturesLLCMember2023-03-142023-03-140001368365mark:Debenture2023Membermark:IonicVenturesLLCMember2023-12-310001368365mark:IonicVenturesLLCMember2023-03-142023-03-140001368365mark:IonicVenturesLLCMember2023-01-012023-12-310001368365mark:Debenture2022Member2024-03-310001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMember2022-10-060001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMember2022-10-062022-10-060001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MaximumMember2022-10-062022-10-060001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MinimumMember2022-10-062022-10-060001368365mark:DebenturePurchaseAgreementAmendmentMemberus-gaap:ConvertibleSubordinatedDebtMembermark:IonicVenturesLLCMember2022-10-062022-10-060001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MinimumMember2022-10-060001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMembersrt:MaximumMember2023-01-050001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMember2023-01-052023-01-050001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMembersrt:MaximumMember2023-01-052023-01-050001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MinimumMembermark:LetterAgreementWithIonicMember2023-01-052023-01-050001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMember2023-01-050001368365mark:LetterAgreementMember2023-12-310001368365mark:LetterAgreementMember2023-06-302023-06-300001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMember2023-09-152023-09-150001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MinimumMembermark:LetterAgreementWithIonicMember2023-09-152023-09-150001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMembersrt:MaximumMember2023-09-152023-09-150001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMember2023-09-292023-09-290001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembermark:LetterAgreementWithIonicMembersrt:MaximumMember2024-01-090001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MaximumMember2024-01-092024-01-090001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MinimumMembermark:LetterAgreementWithIonicMember2024-01-082024-01-080001368365mark:ELOCPurchaseAgreementMembermark:IonicVenturesLLCMembersrt:MinimumMembermark:LetterAgreementWithIonicMember2024-01-092024-01-090001368365mark:ELOCAdvancesMembermark:IonicVenturesLLCMember2023-12-310001368365mark:ELOCAdvancesMembermark:IonicVenturesLLCMember2024-03-310001368365mark:ELOCAdvancesMembermark:IonicVenturesLLCMember2024-01-012024-03-310001368365mark:IonicVenturesLLCMember2023-12-310001368365mark:Debenture2023Membermark:IonicVenturesLLCMember2024-01-012024-03-310001368365mark:IonicVenturesLLCMember2024-01-012024-03-310001368365mark:Debenture2023Membermark:IonicVenturesLLCMember2024-03-310001368365mark:IonicVenturesLLCMembermark:Debenture2022Member2023-01-012023-03-310001368365mark:Debenture2023Membermark:IonicVenturesLLCMember2023-01-012023-03-310001368365mark:IonicVenturesLLCMembermark:LetterAgreementMember2023-01-012023-03-310001368365mark:ELOCAdvancesMembermark:IonicVenturesLLCMember2023-01-012023-03-310001368365mark:IonicVenturesLLCMember2023-01-012023-03-310001368365mark:PartialSettlementOfELOCAdvancesMembermark:IonicVenturesLLCMember2024-01-012024-03-310001368365us-gaap:WarrantMember2023-12-310001368365us-gaap:WarrantMember2023-01-012023-12-310001368365us-gaap:WarrantMember2024-01-012024-03-310001368365us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001368365us-gaap:EmployeeStockOptionMember2023-12-310001368365us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001368365mark:ChinaCashBonusAwardsMember2023-12-310001368365mark:ChinaCashBonusAwardsMember2023-01-012023-12-310001368365mark:ChinaCashBonusAwardsMember2024-01-012024-03-310001368365mark:ChinaCashBonusAwardsMember2024-03-310001368365mark:ChinaCashBonusAwardsMember2022-12-310001368365us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001368365mark:ChinaCashBonusAwardsMember2023-01-012023-03-310001368365srt:ManagementMembermark:AdvancesToSeniorManagementForOperatingExpensesMember2024-03-310001368365mark:ChinaBrandingGroupLimitedMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-03-310001368365mark:ChinaBrandingGroupLimitedMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001368365mark:ELOCAdvancesMemberus-gaap:SubsequentEventMembermark:IonicVenturesLLCMember2024-05-200001368365us-gaap:SubsequentEventMembermark:PartialSettlementOfELOCAdvancesMembermark:IonicVenturesLLCMember2024-04-012024-05-20

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2024

Commission File Number 001-33720

Remark Holdings, Inc.

| | | | | | | | | | | | | | |

| Delaware | | 33-1135689 | |

| State of Incorporation | | IRS Employer Identification Number | |

800 S. Commerce St.

Las Vegas, NV 89106

Address, including zip code, of principal executive offices

702-701-9514

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: None

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| | | | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☑ | | Smaller reporting company | ☑ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of May 17, 2024, a total of 46,139,701 shares of the issuer’s common stock were outstanding.

TABLE OF CONTENTS

| | | | | | | | |

| PART I | | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The following information should be read in conjunction with our unaudited condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q (this “Form 10-Q”) and our audited consolidated financial statements and related notes included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on April 15, 2024, as amended on April 29, 2024, (the “2023 Form 10-K”).

In addition to historical information, this Form 10-Q includes “forward-looking statements” about the plans, strategies, objectives, goals or expectations of Remark Holdings, Inc. and subsidiaries (“Remark”, “we”, “us”, “our”). You will find forward-looking statements principally in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Such forward-looking statements are identifiable by words or phrases indicating that Remark or management “expects,” “anticipates,” “plans,” “believes,” or “estimates,” or that a particular occurrence or event “will,” “may,” “could,” “should,” or “will likely” result, occur or be pursued or “continue” in the future, that the “outlook” or “trend” is toward a particular result or occurrence, that a development is an “opportunity,” “priority,” “strategy,” “focus,” that we are “positioned” for a particular result, or similarly-stated expectations. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report or such other report, release, presentation, or statement. The forward-looking statements contained in this Form 10-Q are based on the expectations, estimates, projections, beliefs, and assumptions of our management based on information available to management as of the date on which this Form 10-Q was filed with the SEC, or as of the date on which the information incorporated by reference was filed with the SEC, as applicable, all of which are subject to change. Forward-looking statements are subject to risks, uncertainties, and other factors that are difficult to predict and could cause actual results to differ materially from those stated or implied by our forward-looking statements.

In addition to other risks and uncertainties described in connection with the forward-looking statements contained in this report and other periodic reports filed with the SEC, there are many important factors that could cause actual results to differ materially. Such risks and uncertainties include general business conditions, changes in overall economic conditions, our ability to integrate acquired assets, the impact of competition and other factors which are often beyond our control.

This should not be construed as a complete list of all of the economic, competitive, governmental, technological and other factors that could adversely affect our expected consolidated financial position, results of operations or liquidity. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial also may impair our business, operations, liquidity, financial condition and prospects. We undertake no obligation to update or revise our forward-looking statements to reflect developments that occur or information that we obtain after the date of this report.

PART I FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

REMARK HOLDINGS, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(dollars in thousands, except share and per share amounts)

| | | | | | | | | | | |

| |

| | | |

| March 31, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| Assets | | | |

| Cash | $ | 239 | | | $ | 145 | |

| Trade accounts receivable, net | 1,155 | | | 1,287 | |

| Inventory, net | 742 | | | 750 | |

| | | |

| Deferred cost of revenue | 6,178 | | | 6,644 | |

| Prepaid expense and other current assets | 840 | | | 614 | |

| Total current assets | 9,154 | | | 9,440 | |

| Property and equipment, net | 478 | | | 189 | |

| Operating lease assets | 432 | | | 517 | |

| Other long-term assets | 74 | | | 90 | |

| Total assets | $ | 10,138 | | | $ | 10,236 | |

| Liabilities | | | |

| Accounts payable | $ | 9,880 | | | $ | 9,348 | |

| Advances from related parties | 1,017 | | | 1,205 | |

| Obligations to issue common stock | 12,173 | | | 10,033 | |

Accrued expense and other current liabilities (including $1,031 and $495 of delinquent payroll taxes as of March 31, 2024 and December 31, 2023, respectively) | 12,235 | | | 11,921 | |

| Contract liability | 559 | | | 570 | |

Notes payable (including a past due amount of $16,307 as of each of March 31, 2024 and December 31, 2023) | 16,475 | | | 16,463 | |

| Total current liabilities | 52,339 | | | 49,540 | |

| | | |

| Operating lease liabilities, long-term | 235 | | | 286 | |

| | | |

| | | |

| Total liabilities | 52,574 | | | 49,826 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders’ Deficit | | | |

Preferred stock, $0.001 par value; 1,000,000 shares authorized; zero issued | — | | | — | |

Common stock, $0.001 par value; 175,000,000 shares authorized; 41,153,044 and 22,038,855 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 41 | | | 22 | |

| Additional paid-in-capital | 390,247 | | | 379,244 | |

| Accumulated other comprehensive loss | (1,263) | | | (1,186) | |

| Accumulated deficit | (431,461) | | | (417,670) | |

| Total stockholders’ deficit | (42,436) | | | (39,590) | |

| Total liabilities and stockholders’ deficit | $ | 10,138 | | | $ | 10,236 | |

See Notes to Unaudited Condensed Consolidated Financial Statements

REMARK HOLDINGS, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

| Revenue | | | | | $ | 387 | | | $ | 826 | |

| Cost and expense | | | | | | | |

| Cost of revenue (excluding depreciation and amortization) | | | | | 350 | | | 455 | |

| Sales and marketing | | | | | 300 | | | 366 | |

| Technology and development | | | | | 346 | | | 169 | |

| General and administrative | | | | | 3,023 | | | 2,833 | |

| Depreciation and amortization | | | | | 64 | | | 46 | |

| | | | | | | |

| | | | | | | |

| Total cost and expense | | | | | 4,083 | | | 3,869 | |

| Operating loss | | | | | (3,696) | | | (3,043) | |

| Other income (expense) | | | | | | | |

| Interest expense | | | | | (943) | | | (1,544) | |

| Finance cost related to obligations to issue common stock | | | | | (9,147) | | | (3,576) | |

| | | | | | | |

| | | | | | | |

| Other gain, net | | | | | (5) | | | 1 | |

| Total other expense, net | | | | | (10,095) | | | (5,119) | |

| Loss before income taxes | | | | | (13,791) | | | (8,162) | |

| Provision for income taxes | | | | | — | | | — | |

| Net loss | | | | | $ | (13,791) | | | $ | (8,162) | |

| Other comprehensive income | | | | | | | |

| Foreign currency translation adjustments | | | | | (77) | | | (318) | |

| Comprehensive loss | | | | | $ | (13,868) | | | $ | (8,480) | |

| | | | | | | |

| Weighted-average shares outstanding, basic and diluted | | | | | 34,173,686 | | | 13,004,071 | |

| | | | | | | |

| | | | | | | |

| Net loss per share, basic and diluted | | | | | $ | (0.40) | | | $ | (0.63) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

See Notes to Unaudited Condensed Consolidated Financial Statements

REMARK HOLDINGS, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Stockholders’ Deficit

(in thousands, except number of shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Common Stock Shares | | Common Stock Par Value | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated Deficit | | Total |

Balance at December 31, 2023 | 22,038,855 | | | $ | 22 | | | $ | 379,244 | | | $ | (1,186) | | | $ | (417,670) | | | $ | (39,590) | |

| Net loss | — | | | — | | | — | | | — | | | (13,791) | | | (13,791) | |

| Share-based compensation | — | | | — | | | 15 | | | — | | | — | | | 15 | |

Common stock issued pursuant to agreements with Ionic (Note 11) | 19,114,189 | | | 19 | | | 10,988 | | | — | | | — | | | 11,007 | |

| | | | | | | | | | | |

| Foreign currency translation | — | | | — | | | — | | | (77) | | | — | | | (77) | |

Balance at March 31, 2024 | 41,153,044 | | | $ | 41 | | | $ | 390,247 | | | $ | (1,263) | | | $ | (431,461) | | | $ | (42,436) | |

| | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Common Stock Shares | | Common Stock Par Value | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated Deficit | | Total |

Balance at December 31, 2022 | 11,539,564 | | | $ | 12 | | | $ | 368,945 | | | $ | (859) | | | $ | (388,523) | | | $ | (20,425) | |

| Net loss | — | | | — | | | — | | | — | | | (8,162) | | | (8,162) | |

| Share-based compensation | — | | | — | | | 143 | | | — | | | — | | | 143 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Common stock issued pursuant to agreements with Ionic | 2,094,428 | | | 2 | | | 2,983 | | | — | | | — | | | 2,985 | |

| | | | | | | | | | | |

| Foreign currency translation | — | | | — | | | — | | | (318) | | | — | | | (318) | |

| | | | | | | | | | | |

Balance at March 31, 2023 | 13,633,992 | | | $ | 14 | | | $ | 372,071 | | | $ | (1,177) | | | $ | (396,685) | | | $ | (25,777) | |

See Notes to Unaudited Condensed Consolidated Financial Statements

REMARK HOLDINGS, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Cash Flows

(dollars in thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

Cash flows from operating activities: | | | |

Net loss | $ | (13,791) | | | $ | (8,162) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

Depreciation and amortization | 64 | | | 46 | |

Share-based compensation | 6 | | | 156 | |

| | | |

| Cost of extending note payable | — | | | 750 | |

| Finance cost related to obligations to issue common stock | 9,147 | | | 3,576 | |

| Accrued interest included in note payable | — | | | 1,139 | |

| | | |

| | | |

| | | |

| Provision for doubtful accounts | — | | | 6 | |

Other | 14 | | | (9) | |

Changes in operating assets and liabilities: | | | |

Accounts receivable | (120) | | | 84 | |

| Inventory | 3 | | | (1) | |

| Deferred cost of revenue | 467 | | | (22) | |

Prepaid expense and other assets | (179) | | | 176 | |

Operating lease assets | 85 | | | 47 | |

Accounts payable, accrued expense and other liabilities | 977 | | | (1) | |

Contract liability | — | | | 162 | |

Operating lease liabilities | (51) | | | (27) | |

Net cash used in operating activities | (3,378) | | | (2,080) | |

Cash flows from investing activities: | | | |

| | | |

Purchases of property, equipment and software | (332) | | | (4) | |

| | | |

Net cash used in investing activities | (332) | | | (4) | |

Cash flows from financing activities: | | | |

| | | |

| Proceeds from obligations to issue common stock - ELOC | 4,000 | | | 1,000 | |

| Proceeds from obligations to issue common stock - Debentures | — | | | 1,500 | |

| | | |

| Advances from related parties | 335 | | | 259 | |

| Repayments of advances from related parties | (522) | | | (355) | |

Repayments of debt | (9) | | | (8) | |

Net cash provided by financing activities | 3,804 | | | 2,396 | |

Net change in cash | 94 | | | 312 | |

Cash: | | | |

Beginning of period | 145 | | | 52 | |

End of period | $ | 239 | | | $ | 364 | |

| | | |

Supplemental cash flow information: | | | |

Cash paid for interest | $ | 150 | | | $ | 250 | |

| | | |

Supplemental schedule of non-cash investing and financing activities: | | | |

| | | |

Issuance of common stock - Ionic ELOC and Debentures (Note 11) | $ | 11,007 | | | $ | — | |

| | | |

| | | |

| | | |

| Purchase of property and equipment pursuant to notes payable | $ | 21 | | | $ | — | |

| | | |

See Notes to Unaudited Condensed Consolidated Financial Statements

REMARK HOLDINGS, INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

NOTE 1. ORGANIZATION AND BUSINESS

Organization and Business

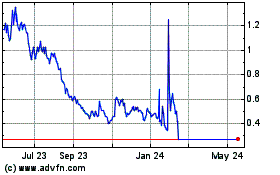

Remark Holdings, Inc. and its subsidiaries (“Remark”, “we”, “us”, or “our”) constitute a diversified global technology business with leading artificial intelligence (“AI”) and data-analytics solutions. The common stock of Remark Holdings, Inc. is traded in the OTCQX Best market under the ticker symbol MARK.

We primarily sell AI-based products and services. We currently recognize substantially all of our revenue from China, with additional revenue from sales in the U.S. and the U.K.

Going Concern

During the three months ended March 31, 2024, and in each fiscal year since our inception, we have incurred operating losses which have resulted in a stockholders’ deficit of $42.4 million as of March 31, 2024. Additionally, our operations have historically used more cash than they have provided. Net cash used in operating activities was $3.4 million during the three months ended March 31, 2024. As of March 31, 2024, our cash balance was $0.2 million. Also, we did not make required repayments of the outstanding loans under the New Mudrick Loan Agreement when due (see Note 10 for more information) and we have accrued approximately $1.0 million of delinquent payroll taxes.

Our history of recurring operating losses, working capital deficiencies and negative cash flows from operating activities give rise to, and management has concluded that there is, substantial doubt regarding our ability to continue as a going concern. Our independent registered public accounting firm, in its report on our consolidated financial statements for the year ended December 31, 2023, has also expressed substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We intend to fund our future operations and meet our financial obligations through revenue growth from our AI and data analytics offerings. We cannot, however, provide assurance that revenue, income and cash flows generated from our businesses will be sufficient to sustain our operations in the twelve months following the filing of this Form 10-Q. As a result, we are actively evaluating strategic alternatives including debt and equity financings.

Conditions in the debt and equity markets, as well as the volatility of investor sentiment regarding macroeconomic and microeconomic conditions (in particular, as a result of the COVID-19 pandemic, global supply chain disruptions, inflation and other cost increases, and the geopolitical conflict in Ukraine), will play primary roles in determining whether we can successfully obtain additional capital. We cannot be certain that we will be successful at raising additional capital.

A variety of factors, many of which are outside of our control, may affect our cash flow; those factors include the lingering effects of the COVID-19 pandemic in China, regulatory issues, competition, financial markets and other general business conditions. Based on financial projections, we believe that we will be able to meet our ongoing requirements for at least the next 12 months with existing cash and based on the probable success of one or more of the following plans:

•develop and grow new product line(s)

•obtain additional capital through debt and/or equity issuances.

However, projections are inherently uncertain and the success of our plans is largely outside of our control. As a result, there is substantial doubt regarding our ability to continue as a going concern, and we may fully utilize our cash resources prior to September 30, 2024.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

We prepared the accompanying unaudited Condensed Consolidated Balance Sheet as of March 31, 2024, with the audited Consolidated Balance Sheet amounts as of December 31, 2023 presented for comparative purposes, and the related unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss, the Condensed Consolidated Statements of Cash Flows and the Condensed Consolidated Statements of Stockholders’ Deficit three months ended March 31, 2024 in accordance with the instructions for Form 10-Q. In compliance with those instructions, we have omitted certain information and footnote disclosures normally included in annual consolidated financial statements prepared in accordance with U.S. GAAP, though management believes the disclosures made herein are sufficient to ensure that the information presented is not misleading.

Our results of operations and our cash flows as of the end of the interim periods reported herein do not necessarily indicate the results we may experience for the remainder of the year or for any other future period.

Management believes that we have included all adjustments (including those of a normal, recurring nature) considered necessary to fairly present our unaudited Condensed Consolidated Balance Sheet and our unaudited Condensed Consolidated Statement of Stockholders’ Deficit, each as of March 31, 2024, as well as our unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss and Condensed Consolidated Statements of Cash Flows for all periods presented. You should read our unaudited condensed consolidated interim financial statements and footnotes in conjunction with our consolidated financial statements and footnotes included within the Annual Report on Form 10-K for the year ended December 31, 2022 (the “2023 Form 10-K”).

Consolidation

We include all of our subsidiaries in our condensed consolidated financial statements, eliminating all significant intercompany balances and transactions during consolidation.

Use of Estimates

We prepare our consolidated financial statements in conformity with GAAP. While preparing our financial statements, we make estimates and assumptions that affect amounts reported and disclosed in the consolidated financial statements and accompanying notes. Accordingly, actual results could differ from those estimates. On an ongoing basis, we evaluate our estimates, including those related to accounts receivable, deferred cost of revenue, share-based compensation, deferred income taxes, and inventory reserve, among other items.

The impact of the COVID-19 pandemic continues to unfold. As a result, many of our estimates and assumptions required increased judgment and carry a higher degree of variability and volatility. As events continue to evolve and additional information becomes available, our estimates may change materially in future periods.

Cash

Our cash consists of funds held in bank accounts.

We maintain cash balances in United States dollars (“USD”), British pounds (“GBP”), RMB and Hong Kong dollars (“HKD”). The following table, reported in USD, disaggregates our cash balances by currency denomination (in thousands):

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | March 31, 2024 | | December 31, 2023 |

| Cash denominated in: | | | | | | | | | | | |

| USD | | | | | | | | | $ | 177 | | | $ | 31 | |

| RMB | | | | | | | | | 16 | | | 109 | |

| GBP | | | | | | | | | 42 | | | 1 | |

| HKD | | | | | | | | | 4 | | | 4 | |

| Total cash | | | | | | | | | $ | 239 | | | $ | 145 | |

We maintain substantially all of our USD-denominated cash at a U.S. financial institution where the balances are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000. At times, however, our cash balances may exceed the FDIC-insured limit. As of March 31, 2024, we do not believe we have any significant concentrations of credit risk. Cash held by our non-U.S. subsidiaries is subject to foreign currency fluctuations against the USD, although such risk is somewhat mitigated because we transfer U.S. funds to China to fund local operations. If, however, the USD is devalued significantly against the RMB, our cost to further develop our business in China could exceed original estimates.

Fair Value of Financial Instruments

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants (an exit price). When reporting the fair values of our financial instruments, we prioritize those fair value measurements into one of three levels based on the nature of the inputs, as follows:

Level 1: Valuations based on quoted prices in active markets for identical assets and liabilities;

Level 2: Valuations based on observable inputs that do not meet the criteria for Level 1, including quoted prices in inactive markets and observable market data for similar, but not identical instruments; and

Level 3: Valuations based on unobservable inputs, which are based upon the best available information when external market data is limited or unavailable.

The fair value hierarchy requires us to use observable market data, when available, and to minimize the use of unobservable inputs when determining fair value. For some products or in certain market conditions, observable inputs may not be available.

We believe the reported carrying amounts for cash, marketable securities, receivables, prepaids and other current assets, accounts payable, accrued expense and other current liabilities, and short-term debt approximate their fair values because of the short-term nature of these financial instruments.

Foreign Currency Translation

We report all currency amounts in USD. Our overseas subsidiaries, however, maintain their books and records in their functional currencies, which are GBP in the United Kingdom (“U.K.”) and RMB in China.

In general, when consolidating our subsidiaries with non-USD functional currencies, we translate the amounts of assets and liabilities into USD using the exchange rate on the balance sheet date, and the amounts of revenue and expense are translated at the average exchange rate prevailing during the period. The gains and losses resulting from translation of financial statement amounts into USD are recorded as a separate component of accumulated other comprehensive loss within stockholders’ deficit.

We used the exchange rates in the following table to translate amounts denominated in non-USD currencies as of and for the periods noted:

| | | | | | | | | | | |

| 2024 | | 2023 |

Exchange rates at March 31st: | | | |

| GBP:USD | 1.262 | | | 1.237 | |

| RMB:USD | 0.138 | | | 0.146 | |

| HKD:USD | 0.128 | | | 0.127 | |

| | | |

Average exchange rate during the three months ended March 31st: | | | |

| RMB:USD | 0.139 | | | 0.146 | |

| GBP:USD | 1.270 | | | 1.214 | |

Revenue Recognition

AI-Based Products

We generate revenue by developing AI-based products, including fully-integrated AI solutions which combine our proprietary technology with third-party hardware and software products to meet end-user specifications. Under one type of contract for our AI-based products, we provide a single, continuous service to clients who control the assets as we create them. Accordingly, we recognize the revenue over the period of time during which we provide the service. Under another type of contract, we have performance obligations to provide fully-integrated AI solutions to our customer and we recognize revenue at the point in time when each performance obligation is completed and delivered to, tested by and accepted by our customer.

We recognize revenue when we transfer control of the promised goods or services to our customers, and we recognize an amount that reflects the consideration to which we expect to be entitled in exchange for those goods or services. If there is uncertainty related to the timing of collections from our customer, which may be the case if our customer is not the ultimate end user of our goods, we consider this to be uncertainty of the customer’s ability and intention to pay us when consideration is due. Accordingly, we recognize revenue only when we have transferred control of the goods or services and collectability of consideration from the customer is probable.

When customers pay us prior to when we satisfy our obligation to transfer control of promised goods or services, we record the amount that reflects the consideration to which we expect to be entitled as a contract liability until such time as we satisfy our performance obligation.

For contracts under which we have not yet completed the performance obligation, deferred costs are recorded for any amounts incurred in advance of the performance obligation.

For our contracts with customers, we generally extend short-term credit policies to our customers, typically up to one year for large-scale projects.

We record the incremental costs of obtaining contracts as an expense when incurred.

We offer extended warranties on our products for periods of one to three years. Revenue from these extended warranties is recognized on a straight-line basis over the warranty contract term.

Other

We generate revenue from other sources, such as from advertising and marketing services. We recognize the revenue from these contracts at the point in time when we transfer control of the good sold to the customer or when we deliver the promised

promotional materials or media content. Substantially all of our contracts with customers that generate Other revenue are completed within one year or less.

Inventory

We use the first-in first-out method to determine the cost of our inventory, then we report inventory at the lower of cost or net realizable value. We regularly review our inventory quantities on hand and record a provision for excess and obsolete inventory based primarily on our estimated sales forecasts. At March 31, 2024 and December 31, 2023, reserve for inventory was $2.2 million and $2.2 million, respectively.

Internal Use Software

We acquire or develop applications and other software that help us meet our internal needs with respect to operating our business. For such projects, planning cost and other costs related to the preliminary project stage, as well as costs incurred for post-implementation activities, are expensed as incurred. We capitalize costs incurred during the application development phase only when we believe it is probable the development will result in new or additional functionality. The types of costs capitalized during the application development phase include fees incurred with third parties for consulting, programming and other development activities performed to complete the software. We amortize our internal use software on a straight-line basis over an estimated useful life of three years. If we identify any internal use software to be abandoned, the cost less the accumulated amortization, if any, is recorded as amortization expense. Once we have fully amortized internal use software costs that we capitalized, we remove such amounts from their respective accounts.

Net Income (Loss) per Share

We calculate basic net income (loss) per share using the weighted-average number of common stock shares outstanding during the period. For the calculation of diluted net income (loss) per share, we give effect to all the shares of common stock that were outstanding during the period plus the number of additional common shares that would have been outstanding if all dilutive potential common shares had been issued, using the treasury stock method. Potential common shares are excluded from the computation when their effect is anti-dilutive. Dilutive potential shares of common stock consist of incremental shares of common stock issuable upon exercise of stock options and warrants.

For the three months ended March 31, 2024 and 2023, there were no reconciling items related to either the numerator or denominator of the loss per share calculation, as their effect would have been anti-dilutive.

Securities which may have affected the calculation of diluted earnings per share for the three and three months ended March 31, 2024 if their effect had been dilutive include 1,537,961 total outstanding options to purchase our common stock, 1,007,441 outstanding warrants to purchase our common stock, as well as an estimated 57,994,858 shares of our common stock issuable to Ionic Ventures, LLC (“Ionic”) in relation to our transactions with Ionic (see Note 11).

Segments

Existing GAAP, which establishes a management approach to segment reporting, defines operating segments as components of an entity about which separate, discrete financial information is available for evaluation by the chief operating decision maker. We have identified our Chief Executive Officer as our chief operating decision maker, who reviews operating results to make decisions about allocating resources and assessing performance based upon only one operating segment.

Recently Issued Accounting Pronouncements

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosure, which is intended to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expense categories that are regularly provided to the chief operating decision maker and included in each reported measure of a segment’s profit or loss. The update also requires all annual disclosures about a reportable segment’s profit or loss and assets to be provided in interim periods and for entities with a single reportable segment to provide all the disclosures required by ASC 280, Segment Reporting, including the significant segment expense disclosures. For us, ASU 2023-07 will be effective on January 1, 2024 and interim periods beginning in fiscal year 2025, with early adoption permitted. The updates required by ASU 2023-07 should be applied retrospectively to all periods presented in the financial statements. We do not expect this standard to have a material impact on our results of operations, financial position or cash flows.

We have reviewed all accounting pronouncements recently issued by the FASB and the SEC. The authoritative pronouncements that we have already adopted did not have a material effect on our financial condition, results of operations, cash flows or reporting thereof, and except as otherwise noted above, we do not believe that any of the authoritative pronouncements that we have not yet adopted will have a material effect upon our financial condition, results of operations, cash flows or reporting thereof.

NOTE 3. CONCENTRATION OF RISK

Revenue and Accounts Receivable

The disaggregation of revenue tables in Note 4 demonstrate the concentration in our revenue from certain products and the geographic concentration of our business. We also have a concentration in the volume of business we transacted with customers, as during the three months ended March 31, 2024, apart from a de minimis amount, essentially all of our revenue resulted from one customer, while during three months ended March 31, 2023, one customer represented about 50% of our revenue. At March 31, 2024, net accounts receivable from three of our customers represented about 35%, 33% and 11%, respectively, of our net accounts receivable, while at December 31, 2023, net accounts receivable from three of our customers represented about 39%, 37% and 13%, respectively, of our net accounts receivable.

Deferred Cost of Revenue

See Note 6 for a discussion of a risk concentration regarding our deferred cost of revenue.

Cost of Sales and Accounts Payable

The various hardware we purchase to fulfill our contracts with customers is not especially unique in nature. Based on our analysis, we believe that should any disruption in our current supply chain occur, a sufficient number of alternative vendors is available to us, at reasonably comparable specifications and price, such that we would not experience a material negative impact on our ability to procure the hardware we need to operate our business.

NOTE 4. REVENUE

We primarily sell AI-based products and services based upon computer vision and other technologies.

We do not include disclosures related to remaining performance obligations because substantially all our contracts with customers have an original expected duration of one year or less or, with regard to our stand-ready obligations, the amounts involved are not material.

Disaggregation of Revenue

The following table presents a disaggregation of our revenue by category of products and services (in thousands):

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

AI-based products and services, including amounts from China Business Partner in 2023 (See Note 15) | | | | | $ | 387 | | | $ | 721 | |

| Other | | | | | — | | | 105 | |

| Revenue | | | | | $ | 387 | | | $ | 826 | |

The following table presents a disaggregation of our revenue by country (in thousands):

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

| China | | | | | $ | 387 | | | $ | 743 | |

| United States and United Kingdom | | | | | — | | | 83 | |

| | | | | | | |

| Revenue | | | | | $ | 387 | | | $ | 826 | |

Significant Judgments

When accounting for revenue we make certain judgments, such as whether we act as a principal or as an agent in transactions or whether our contracts with customers fall within the scope of current GAAP regarding revenue, that affect the determination of the amount and timing of our revenue from contracts with customers. Based on the current facts and circumstances related to our contracts with customers, none of the judgments we make involve an elevated degree of qualitative significance or complexity such that further disclosure is warranted in terms of their potential impact on the amount and timing of our revenue.

Contract Assets and Contract Liabilities

We do not currently generate material contract assets. During the three months ended March 31, 2024, our contract liability changed only as a result of routine business activity.

During the three months ended March 31, 2024 and 2023, the amount of revenue we recognized that was included in the beginning balance of Contract liability was not material.

During the three months ended March 31, 2024 and 2023, we did not recognize revenue from performance obligations that were satisfied in previous periods.

Certain Agreements Related to AI-Based Product Sales in China

We completed certain projects in China during the year ended December 31, 2023 worth approximately $1.4 million, but the agreement did not meet the criteria for revenue recognition on an accrual basis. We will recognize the revenue from such agreement as we receive the cash. We recognized approximately $0.4 million of such amount during the three months ended March 31, 2024.

NOTE 5. TRADE ACCOUNTS RECEIVABLE

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | March 31, 2024 | | December 31, 2023 |

| Gross accounts receivable balance | | | | | | | | | $ | 6,823 | | | $ | 7,063 | |

| Allowance for bad debt | | | | | | | | | (5,668) | | | (5,776) | |

| Accounts receivable, net | | | | | | | | | $ | 1,155 | | | $ | 1,287 | |

Generally, it is not unusual for Chinese entities to pay their vendors on longer timelines than the timelines typically observed in U.S. commerce. Trade receivables related to our China AI projects at March 31, 2024 and December 31, 2023; including approximately $0.7 million and $0.7 million, respectively, of trade receivables from projects related to work with our China Business Partner (see Note 15 for more information regarding our China Business Partner and related accounting); represented essentially all our gross trade receivables in each such period. When evaluating for current expected credit losses during 2023, we took into account our historical experience as well as our expectations based upon how we believe the COVID-19 pandemic has caused lingering effects on us and our customers.

NOTE 6. DEFERRED COST OF REVENUE

Deferred cost of revenue as of March 31, 2024 and December 31, 2023 of $6.2 million and $6.6 million, respectively, represent amounts we have paid in advance to vendors who provide services to us in relation to various projects in China. Specifically, the deferred cost of revenue balance as of March 31, 2024, a large percentage of which was paid to a single vendor in 2022 for project installations we expect will be provided to us through our China Business Partner (described in more detail in Note 15), will be utilized as the vendors install our software solutions and/or hardware at numerous sites across various regions of China for our customers and as the vendors perform other services for us pursuant to customer requirements. Because most of the projects for which we have engaged the vendors require purchases of hardware, equipment and/or supplies in advance of site visits, we made the prepayments in anticipation of several large batches of project installations. We did not make any additional advance payments to vendors in 2024 related to projects, and we were able to complete installations of projects that reduced by $0.4 million the deferred cost of revenue balance associated with the vendor which performs the project installations provided to us through our China Business Partner.

Lengthy COVID-19 related lockdowns that occurred in various regions in China during 2022 were the initial cause of delays in completing projects for which we had paid in advance. A slow recovery from such lockdowns in addition to increased political tensions between the U.S. and China led to our decision to reduce staff in China, all of which has made progress in completing projects slow. Given that the delays were not a result of the vendor’s inability to either perform the services or refund the amounts we advanced, and also because we continue to complete some of the installations, we believe the balance as of March 31, 2024 will be fully recovered.

NOTE 7. PREPAID EXPENSE AND OTHER CURRENT ASSETS

The following table presents the components of prepaid expense and other current assets (in thousands):

| | | | | | | | | | | |

| |

| | | |

| March 31, 2024 | | December 31, 2023 |

| | | |

| | | |

Other receivables | 157 | | | 147 | |

Prepaid expense | 555 | | | 339 | |

Deposits | 128 | | | 128 | |

| | | |

| | | |

Total | $ | 840 | | | $ | 614 | |

| | | |

NOTE 8. PROPERTY AND EQUIPMENT

Property and equipment consist of the following (in thousands, except estimated lives):

| | | | | | | | | | | | | | | | | |

| | | |

| | | | | |

| Estimated Life

(Years) | | March 31, 2024 | | December 31, 2023 |

| Vehicles | 3 | | $ | 153 | | | 153 | |

| Computers and equipment | 3 | | 1,219 | | | $ | 1,217 | |

| Furniture and fixtures | 3 | | 42 | | | 42 | |

| Software | 3 | | 4,413 | | | 4,082 | |

| Leasehold improvements | 3 | | 206 | | | 204 | |

| | | | | |

| Total property, equipment and software | | | $ | 6,033 | | | $ | 5,698 | |

| Less accumulated depreciation | | | (5,555) | | | (5,509) | |

| Total property, equipment and software, net | | | $ | 478 | | | $ | 189 | |

For the three months ended March 31, 2024 and 2023, depreciation (and amortization of software) expense was not material.

NOTE 9. ACCRUED EXPENSE AND OTHER CURRENT LIABILITIES

The following table presents the components of Accrued expense and other current liabilities (in thousands):

| | | | | | | | | | | |

| |

| | | |

| March 31, 2024 | | December 31, 2023 |

| Accrued compensation and benefit-related expense | $ | 2,303 | | | $ | 3,221 | |

| Accrued delinquent payroll taxes | 1,031 | | | 495 | |

| Accrued interest | 2,348 | | | 1,570 | |

| Other accrued expense | 3,290 | | | 3,577 | |

| Other payables | 2,099 | | | 2,138 | |

| Operating lease liability - current | 254 | | | 288 | |

| | | |

| Other current liabilities | 910 | | | 632 | |

Total | $ | 12,235 | | | $ | 11,921 | |

| | | |

Other current liabilities at March 31, 2024 includes $0.5 million that we received during the three months ended March 31, 2024 from a potential investor in relation to a proposed private stock sale for which an agreement has not yet been finalized.

NOTE 10. NOTES PAYABLE

The following table presents our notes payable (in thousands) as of:

| | | | | | | | | | | |

| |

| | | |

| March 31, 2024 | | December 31, 2023 |

| New Mudrick Notes (Past Due) | $ | 16,307 | | | $ | 16,307 | |

| Other notes payable | 168 | | | 156 | |

| Notes payable, net of unamortized discount and debt issuance cost | $ | 16,475 | | | $ | 16,463 | |

| | | |

On December 3, 2021, we entered into senior secured loan agreements (the “Original Mudrick Loan Agreements”) with certain of our subsidiaries as guarantors (the “Guarantors”) and certain institutional lenders affiliated with Mudrick Capital Management, LP (collectively, “Mudrick”), pursuant to which Mudrick extended credit to us consisting of term loans in the aggregate principal amount of $30.0 million (the “Original Mudrick Loans”). The Original Mudrick Loans bore interest at 16.5% per annum with an original maturity date of July 31, 2022.

As of December 31, 2022, the outstanding balance of the Original Mudrick Loans was $14.4 million, and approximately $0.8 million of accrued interest was included in Accrued expense and other current liabilities. During the three months ended March 31, 2023, prior to the New Mudrick Loan Agreement (defined below) canceling the Original Mudrick Loans, we accrued approximately $0.6 million additional interest expense on the Original Mudrick Loans, of which $0.3 million was paid during such period.

On March 14, 2023, we entered into a Note Purchase Agreement (the “New Mudrick Loan Agreement”) with Mudrick, pursuant to which all of the Original Mudrick Loans were cancelled in exchange for new notes payable to Mudrick (the “New Mudrick Notes”) in the aggregate principal amount of approximately $16.3 million. The principal balance of the New Mudrick Notes included the $14.4 million outstanding balance of the Original Mudrick Loans, plus $1.1 million of accrued interest on the Original Mudrick Loans, plus a fee of approximately $0.8 million payable to Mudrick as consideration for cancelling the Original Mudrick Loans and converting all amounts outstanding thereunder into the New Mudrick Notes. We recorded the $0.8 million as interest expense during the three months ended March 31, 2023.

The New Mudrick Notes bear interest at a rate of 20.5% per annum, which is payable on the last business day of each month commencing on May 31, 2023. The interest rate will increase by 2% and the principal amount outstanding under the New Mudrick Notes and any unpaid interest thereon may become immediately due and payable upon the occurrence of any event of default under the New Mudrick Loan Agreement. All amounts outstanding under the New Mudrick Notes, including all accrued and unpaid interest, became due and payable in full on October 31, 2023.

To secure the payment and performance of the obligations under the Original Mudrick Loan Agreements and the New Mudrick Loan Agreement, we, together with certain of our subsidiaries (the “Guarantors”), have granted to TMI Trust Company, as the collateral agent for the benefit of Mudrick, a first priority lien on, and security interest in, all assets of Remark and the Guarantors, subject to certain customary exceptions.

We did not make required repayments of the outstanding loans under the New Mudrick Loan Agreement that were due beginning on June 30, 2023, which constitute events of default for which we have not received a waiver as of the date of this Form 10-Q. While we are actively engaged in discussions with Mudrick regarding a resolution of the events of default and have made progress in such discussions, we cannot provide any assurance that we will be successful in obtaining a waiver or that Mudrick will continue to forebear from taking any enforcement actions against us.

Other Notes Payable

The Other notes payable in the table above represent individually immaterial notes payable issued for the purchase of operating assets. Such notes payable bear interest at a weighted-average interest rate of approximately 7.1% and have a weighted-average remaining term of approximately 4.3 years.

NOTE 11. OBLIGATIONS TO ISSUE COMMON STOCK (TRANSACTIONS WITH IONIC)

Convertible Debentures

On October 6, 2022, we entered into a debenture purchase agreement (the “2022 Debenture Purchase Agreement”) and a purchase agreement (the “Original ELOC Purchase Agreement”) with Ionic. Pursuant to the 2022 Debenture Purchase Agreement, we issued a convertible subordinated debenture in the original principal amount of approximately $2.8 million (the “2022 Debenture”) to Ionic for a purchase price of $2.5 million. The 2022 Debenture automatically converted into shares of our common stock (the “2022 Debenture Settlement Shares”) on November 17, 2022 upon the effectiveness of a registration statement we filed pursuant to a registration rights agreement we entered into with Ionic. Upon issuance of the 2022 Debenture, we initially estimated the obligation to issue common stock at approximately $3.6 million. As of December 31, 2022, we estimated such obligation to have a fair value of $1.9 million, representing an additional 1,720,349 shares to be issued pursuant to the 2022 Debenture. When the measurement period for determining the conversion price of the 2022 Debenture was completed, we determined that the final number of 2022 Debenture Settlement Shares would be 3,129,668 (inclusive of 898,854 shares that were issued during 2022), resulting in the issuance of an additional 2,230,814 shares during 2023 with a fair value of $3.1 million.

On March 14, 2023, we entered into a new debenture purchase agreement (the “2023 Debenture Purchase Agreement”) with Ionic pursuant to which we authorized the issuance and sale of two convertible subordinated debentures in the aggregate principal amount of approximately $2.8 million for an aggregate purchase price of $2.5 million. The first debenture is in the original principal amount of approximately $1.7 million for a purchase price of $1.5 million (the “First 2023 Debenture”), which was issued on March 14, 2023, and the second debenture is in the original principal amount of approximately $1.1 million for a purchase price of $1.0 million (the “Second 2023 Debenture” and collectively with the First Debenture, the “2023 Debentures”), which was issued on April 12, 2023. The 2023 Debenture automatically converted into shares of our common stock (the “2023 Debenture Settlement Shares”) on June 26, 2023 upon the effectiveness of a registration statement we filed pursuant to a registration rights agreement we entered into with Ionic. Upon issuance of the First 2023 Debenture and the Second 2023 Debenture, we initially estimated the obligations to issue common stock at an aggregate of approximately $4.1 million, or equivalent estimated issuable shares of 3,669,228. As of December 31, 2023, we estimated that an aggregate total of 9,383,966 shares remained to be issued upon conversion in full of the 2023 Debentures, representing obligations with an aggregate fair value of $4.6 million. When the measurement period for determining the conversion price of the 2023 Debentures was completed, we determined that the final number of 2023 Debentures Settlement Shares would be 16,928,989 (inclusive of 657,000 shares that were issued during 2023), resulting in the issuance during the three months ended March 31, 2024 of an additional 16,271,989 shares with a fair value of $10.3 million in final settlement of the 2023 Debentures.

Equity Line of Credit

The Original ELOC Purchase Agreement, as amended by those certain letter agreements by and between Remark and Ionic, dated as of January 5, 2023; July 12, 2023; August 10, 2023 and September 15, 2023; as well as the first amendment on January 9, 2024, and subsequent letter agreement on February 14, 2024 (as amended, the “Amended ELOC Purchase Agreement”), provides that, upon the terms and subject to the conditions and limitations set forth therein, we have the right to direct Ionic to purchase up to an aggregate of $50.0 million of shares of our common stock over the 36-month term of the Amended ELOC Purchase Agreement. Under the Amended ELOC Purchase Agreement, after the satisfaction of certain commencement conditions, including, without limitation, the effectiveness of a resale registration statement filed with the SEC registering such shares and that the 2022 Debenture shall have been fully converted into shares of common stock or shall otherwise have been fully redeemed and settled in all respects in accordance with the terms of the 2022 Debenture, we have the right to present Ionic with a purchase notice (each, a “Purchase Notice”) directing Ionic to purchase any amount up to $3.0 million of our common stock per trading day, at a per share price equal to 80% (or 70% if our common stock is not then trading on Nasdaq) of the average of the two lowest volume-weighted average prices (“VWAPs”) over a specified measurement period. With each purchase under the Amended ELOC Purchase Agreement, we are required to deliver to Ionic an additional number of shares equal to 2.5% of the number of shares of common stock deliverable upon such purchase. The number of shares that we can issue to Ionic from time to time under the Amended ELOC Purchase Agreement shall be subject to the condition that we will not sell shares to Ionic to the extent that Ionic, together with its affiliates, would beneficially own more than 4.99% of the outstanding shares of our common stock immediately after giving effect to such sale (the “Beneficial Ownership Limitation”).

In addition, Ionic will not be required to buy any shares of our common stock pursuant to a Purchase Notice on any trading day on which the closing trade price of our common stock is below $0.20 (as amended by the January 2023 Letter Agreement, as defined below). We will control the timing and amount of sales of our common stock to Ionic. Ionic has no right to require any sales by us, and is obligated to make purchases from us as directed solely by us in accordance with the Amended ELOC

Purchase Agreement. The Amended ELOC Purchase Agreement provides that we will not be required or permitted to issue, and Ionic will not be required to purchase, any shares under the Amended ELOC Purchase Agreement if such issuance would violate Nasdaq rules, and we may, in our sole discretion, determine whether to obtain stockholder approval to issue shares in excess of 19.99% of our outstanding shares of common stock if such issuance would require stockholder approval under Nasdaq rules. Ionic has agreed that neither it nor any of its agents, representatives and affiliates will engage in any direct or indirect short-selling or hedging our common stock during any time prior to the termination of the Amended ELOC Purchase Agreement.

The Amended ELOC Purchase Agreement may be terminated by us at any time after commencement, at our discretion; provided, however, that if we sold less than $25.0 million to Ionic (other than as a result of our inability to sell shares to Ionic as a result of the Beneficial Ownership Limitation, our failure to have sufficient shares authorized or our failure to obtain stockholder approval to issue more than 19.99% of our outstanding shares), we will pay to Ionic a termination fee of $0.5 million, which is payable, at our option, in cash or in shares of common stock at a price equal to the closing price on the day immediately preceding the date of receipt of the termination notice. Further, the Amended ELOC Purchase Agreement will automatically terminate on the date that we sell, and Ionic purchases, the full $50.0 million amount under the agreement or, if the full amount has not been purchased, on the expiration of the 36-month term of the Amended ELOC Purchase Agreement.

On January 5, 2023, we and Ionic entered into a letter agreement (the “January 2023 Letter Agreement”) which amended the Original ELOC Purchase Agreement. Under the Letter Agreement, the parties agreed, among other things, to (i) amend the floor price below which Ionic will not be required to buy any shares of our common stock under the Amended ELOC Purchase Agreement from $0.25 to $0.20, determined on a post-reverse split basis, (ii) amend the per share purchase price for purchases under the Amended ELOC Purchase Agreement to 80% of the average of the two lowest daily VWAPs over a specified measurement period, which will commence at the conclusion of the applicable measurement period related to the 2022 Debenture and (iii) waive certain requirements in the Amended ELOC Purchase Agreement to allow for a one-time $0.5 million purchase under the Amended ELOC Purchase Agreement.

As partial consideration for the waiver to allow for the $0.5 million purchase by Ionic, we agreed to issue to Ionic that number of shares (the “Letter Agreement Shares”) equal to the difference between (x) the variable conversion price in the 2022 Debenture, and (y) the calculation achieved as a result of the following formula: 80% (or 70% if our common stock is not then trading on Nasdaq) of the lowest VWAP starting on the trading day immediately following the receipt of pre-settlement conversion shares following the date on which the 2022 Debenture automatically converts or other relevant date of determination and ending the later of (a) 10 consecutive trading days after (and not including) the Automatic Conversion Date (as defined in the Amended ELOC Purchase Agreement) or such other relevant date of determination and (b) the trading day immediately after shares of our common stock in the aggregate amount of at least $13.9 million shall have traded on Nasdaq. As of March 31, 2023, we estimated the obligation to issue the Letter Agreement Shares at approximately $0.2 million. As of June 30, 2023, we had issued all of the 200,715 Letter Agreement Shares.

On September 15, 2023, we and Ionic entered into a letter agreement (the “September 2023 Letter Agreement”) which amends the Amended ELOC Purchase Agreement, as previously amended on January 5, 2023. Under the September 2023 Letter Agreement, which repeated changes made in earlier letter agreements between Remark and Ionic dated July 12, 2023 and August 10, 2023, the parties agreed, among other things, to (i) allow Remark to deliver one or more irrevocable written notices (“Exemption Purchase Notices”) to Ionic in a total aggregate amount not to exceed $20.0 million, which total aggregate amount shall be reduced by the aggregate amount of previous Exemption Purchase Notices, (ii) amend the per share purchase price for purchases under an Exemption Purchase Notice to 80% of the average of the two lowest daily volume-weighted average prices (“VWAPs”) over a specified measurement period, (iii) amend the definition of the specified measurement period to stipulate that, for purposes of calculating the final purchase price, such measurement period begins the trading day after Ionic pays Remark the amount requested in the purchase notice, while the calculation of the dollar volume of Remark common stock traded on the principal market to determine the length of the measurement period shall begin on the trading day after the previous measurement period ends, iv) that any additional Exemption Purchase Notices that are not in accordance with the terms and provisions of the Purchase Agreement shall be subject to Ionic’s approval, v) to amend section 11(c) of the Amended ELOC Purchase Agreement to increase the Additional Commitment Fee from $0.5 million to $3.0 million and vi) that by September 29, 2023, the parties will amend the Debenture Transaction Documents to include a so-called Most Favored Nation provision that will provide Ionic with necessary protection against any future financing, settlement, exchange or other transaction whether with an existing or new lender, investor or counterparty, and that, if such amendment is not made by September 29, 2023, the Additional Commitment Fee shall be further increased to approximately $3.8 million.

On January 9, 2024, we and Ionic entered into an amendment (the “First Amendment”) to the Amended ELOC Purchase Agreement. Under the First Amendment, the parties agreed, among other things, (i) to clarify that the Floor Price per the agreement is $0.25, (ii) to amend the per share purchase price for purchases under a Regular Purchase Notice to 80% of the average of the two lowest daily volume-weighted average prices (“VWAPs”) over a specified measurement period, (iii) to increase the frequency at which we can submit purchase notices, within limits, and (iv) to amend section 11(c) of the ELOC Purchase Agreement to increase the Additional Commitment Fee from $500,000 to approximately $3.8 million.

On February 14, 2024, we and Ionic entered into a letter agreement (the “February 2024 Letter Agreement”) which amends the Amended ELOC Purchase Agreement. Under the February 2024 Letter Agreement, the parties agreed, among other things, (i) to redefine the definition of Principal Market to include markets in addition to the Nasdaq Capital Market and the OTC Bulletin Board, (ii) that Ionic will forbear from enforcing any noncompliance with the covenants in the Amended ELOC Purchase Agreement as a result of Remark’s delisting from Nasdaq and any related suspension of trading on Nasdaq, and (iii) to clarify that we can still issue Regular Purchase Notices despite the delisting from Nasdaq and any related suspension of trading on Nasdaq so long as the Principal Market is either the OTCQX, OTCQB, or OTCBB and each Regular Purchase does not exceed $500,000.

As of December 31, 2023, we estimated that an additional 10,876,635 shares would be issued in settlement of our obligation to issue common stock under the ELOC Advances, representing an obligation with an aggregate fair value of $5.4 million. During the three months ended March 31, 2024, Ionic advanced to us a total of $4.0 million pursuant to the Amended ELOC Purchase Agreement. Upon issuance of the ELOC Advances during the three months ended March 31, 2024, we initially estimated the obligations to issue common stock at approximately $6.6 million (resulting in a finance cost of $2.6 million in excess of the $4.0 million advance), or equivalent estimated issuable shares of 15,356,612. During the three months ended March 31, 2024, we issued 2,842,200 shares with a fair value of $0.7 million in partial settlement of ELOC Advances. As of March 31, 2024, we estimated that an additional 57,994,858 shares with a fair value of $12.2 million would be issued in settlement of our obligation to issue common stock under the ELOC Advances.

Accounting for the Debentures and the ELOC

Using the guidance in ASC Topic 480, Distinguishing Liabilities from Equity, we evaluated the 2023 Debenture Purchase Agreement and its associated First 2023 Debenture, and the Amended ELOC Purchase Agreement and its associated ELOC Advances, and determined that all represented obligations that must or may be settled with a variable number of shares, the monetary value of which was based solely or predominantly on a fixed monetary amount known at inception. Using a Level 3 input, we estimated the number of shares of our common stock that we would have to issue for each obligation and multiplied the estimated number of shares by the closing market price of our common stock on the measurement date to determine the fair value of the obligation. We then recorded the amount of the initial obligation in excess of the purchase price as finance cost. We remeasure each obligation at every balance sheet date until all shares representing the obligation have been issued, with the change in the amount of the obligation being recorded as finance cost. The following table shows the changes in our obligations to issue common stock (dollars in thousands):

| | | | | | | | | | | | | | | | | |

| 2023 Debentures | | ELOC Advances | | Total |

| Obligations to Issue Common Stock | | | | | |

Balance at December 31, 2023 | $ | 4,647 | | | $ | 5,386 | | | $ | 10,033 | |

| Establishment of new obligation to issue shares | — | | | 6,619 | | | 6,619 | |

| Issuance of Shares | (10,321) | | | (686) | | | (11,007) | |

| Change in measurement of liability | 5,674 | | | 854 | | | 6,528 | |

Balance at March 31, 2024 | $ | — | | | $ | 12,173 | | | $ | 12,173 | |

| | | | | |

| Estimated Number of Shares Issuable | | | | | |

Balance at December 31, 2023 | 9,383,966 | | | 10,876,635 | | | 20,260,601 | |

| Establishment of new obligation to issue shares | — | | | 15,356,612 | | | 15,356,612 | |

| Issuance of Shares | (16,271,989) | | | (2,842,200) | | | (19,114,189) | |

| Change in estimated number of shares issuable | 6,888,023 | | | 34,603,811 | | | 41,491,834 | |

Balance at March 31, 2024 | — | | | 57,994,858 | | | 57,994,858 | |

The following table shows the composition of finance cost associated with our obligations to issue common stock (dollars in thousands) for the three months ended March 31, 2024:

| | | | | | | | | | | | | | | | | |

| 2023 Debentures | | ELOC Advances | | Total |