Form 8-K - Current report

October 17 2023 - 8:00AM

Edgar (US Regulatory)

false

0001659617

0001659617

2023-10-17

2023-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): October 17, 2023

MOLECULIN BIOTECH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37758

|

47-4671997

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification

No.)

|

5300 Memorial Drive, Suite 950, Houston, TX 77007

(Address of principal executive offices and zip code)

(713) 300-5160

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

MBRX

|

The NASDAQ Stock Market LLC

|

|

Item 7.01

|

Regulation FD Disclosure

|

On October 17, 2023, Moleculin Biotech, Inc. (the “Company”), held a virtual investor call with the Company’s Chairman and Chief Executive Officer, Walter Klemp, discussing the first patient in the Phase 2 study for AML.

A copy of the script is attached to this report as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be “filed” for the purpose of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (“Securities Act”), unless specifically identified therein as being incorporated by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

104

|

Cover page Interactive Data File (formatted as Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MOLECULIN BIOTECH, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

Date:

|

October 17, 2023

|

|

| |

|

|

|

| |

By:

|

/s/ Jonathan P. Foster

|

|

| |

|

Jonathan P. Foster

|

|

Exhibit 99.1

Planned Video Script

Virtual Investor: Moleculin Doses First Patient in Phase 2 Study for AML

Participants:

| |

●

|

Jenene Thomas, CEO of JTC IR - Moderator

|

| |

●

|

Wally Klemp, Chairman and Chief Executive Officer of Moleculin Biotech

|

Moleculin Bio (Nasdaq: MBRX)

Jenene Introduction:

| |

●

|

Hello and thank you for joining us today for another Virtual Investor – What This Means Segment. My name is Jenene Thomas, CEO of JTC IR, and I will be the moderator for the event.

|

| |

|

I am pleased to be joined by Walter Klemp, Chairman and Chief Executive of Moleculin Bio.

|

| |

|

Before we get started, I just want to inform our audience that Moleculin Bio is listed on the Nasdaq and trades under the ticker M B R X. During today’s discussion, the Company will be making forward-looking statements and actual results could differ materially from these forward-looking statements. Some of the factors that could cause actual results to differ materially from these contemplated by such forward-looking statements are discussed in the periodic reports Moleculin files with the Securities and Exchange Commission. These documents are available in the Investors section of the Company's website and on the Securities and Exchange Commission's website. We encourage you to review these documents carefully.

|

Moderated questions

|

1)

|

Jenene Question: Wally, last time we spoke you announced publicly that you are gearing up for a year of data and it seems the first of many milestones has been achieved. Focusing on your AML program for this segment can you discuss the status of your ongoing clinical study of annamycin for AML?

|

| |

a)

|

Wally Response: Well, as a quick review, the AML space is dominated by combination therapies – that’s true for chemotherapy drugs such as anthracyclines and for other drug therapies – like venetoclax. In fact, it’s very difficult to get investigators to treat patients with a single agent or monotherapy, especially when those patients have a reasonable chance of achieving lasting remission. Unfortunately, the regulatory authorities require that you demonstrate safety and efficacy as a monotherapy before being allowed to go into combination with other drugs.

|

| |

|

That’s what the last 5 plus years has been all about for us. We had to validate in monotherapy human trials the safety, including the absence of cardiotoxicity, and efficacy that had been shown previously in animal studies. As you know, all currently prescribed anthracyclines are significantly cardiotoxic, so a truly noncardiotoxic anthracycline would be considered a major breakthrough.

|

It’s been a long hard road to get here, but we are finally at what I call the “starting line” with Annamycin in AML. Specifically, we are finally in a Phase 2 combination trial where every patient adds to the body of evidence that supports an approval pathway for our drug.

That said, what we’ve seen along the way is pretty impressive.

We’ve now treated 36 patients across three AML trials in the US and Europe. The patients in our most recent trials have mostly been in excess of 60 years of age and heavily pre-treated with other therapies. As we have previously reported, we saw 3 CRi’s in the 5 patients treated in the last cohort of our monotherapy trial. And now we’ve seen 2 CR’s (and I should add, durable CR’s) from the first 6 patients in the lead-in cohorts of our combination trial. So, our complete response rate has ranged from 33% to 60%. Importantly, though, the patients we are now treating are in the phase 2 portion of the combination trial. And, this is where our efficacy data really starts to matter and where we think it will truly shine.

So, I am looking forward to beginning to report preliminary Phase 2 data when we report our Q3 earnings in the first part of November.

One thing I have to stress, though, is why we refer to Annamycin as a “next generation anthracycline or a next generation chemotherapy”. We have shown Annamycin to have effectively no cardiotoxicity in preclinical studies. Now, we’ve treated 66 patients across two indications (AML and Soft Tissue Sarcomas) and have yet to see a single instance of cardiotoxicity. This is critically important as the first black box warning for all currently prescribed anthracyclines like doxorubicin is literally “cardiomyopathy” or heart damage. So, we believe - not seeing any cardiotoxicity in the first 66 patients treated, most of whom we’ve taken well over the FDA’s lifetime maximum limit for anthracycline therapy - is remarkable.

|

2)

|

Jenene Question: You recently announced the first patients dosed in the Phase 2 portion of your study. Can you discuss what this means for the AML program?

|

| |

a)

|

Wally Response: We had several expectations once we were able to begin recruiting Phase 2 patients. One was that we would start seeing healthier patients who would have a better chance of responding to Annamycin than the heavily pretreated patients we’ve seen to date. We also expected the pace of recruitment to accelerate since the combination is positioned to help an important segment of the AML population that is currently under served. Both of those things are playing the way we hoped. And I hope to be announcing significant additional recruitment in this trial come November.

|

| |

|

Now, the reason this is so important is that the Phase 2 data we expect to be announcing should form the basis for positioning Annamycin for an approval pathway and attracting the kind of partnering activities that can lead to exit opportunities for our investors.

|

| |

|

Clearly, when you look at the pharma transactions that are getting done today, they are largely being driven by Phase 2 and Phase 3 data. That’s the kind of data we can now finally start delivering.

|

|

3)

|

Jenene Question: What are the next steps for your program and what this means for your overall development strategy for annamycin in AML?

|

| |

a)

|

Wally Response: Based on the patients we now have in screening, we expect that the pace of recruitment will be increasing. Our priority is to fill out this Phase2, which we now think we can do within a matter of months. That should put us in a position to meet with the FDA and the EMA early next year to negotiate the structure of a pivotal approval trial. In fact, we are already in discussions with our investigators about what that trial design will be.

|

|

4)

|

Jenene Question: What should investor expectations be for Annamycin in AML, both broadly and for the remainder of the year for Moleculin?

|

| |

a)

|

Wally Response: Broadly speaking, we think Annamycin is well positioned to become the next Venetoclax in AML and, frankly, I think that’s grossly understating our potential. As it relates to the rest of this year, by the time we are announcing third quarter results, we should be able to comment on Phase 2 patient progress - recruitment and efficacy - and we expect by year end, we should be in a position to give a pretty good efficacy readout on a significant number of patients.

|

| |

|

But it’s really important for investors to focus on and understand this…we have already shown a level of patient response that is greater than the CR rates or efficacy shown in some recent approvals, including for example Venetoclax…and that drug is already generating a half a billion dollars a year in revenue. All we need to do now is continue to deliver similar results in Phase 2, and that should drive licensing opportunities and other support for pivotal approval trials.

|

| |

|

Bottom line: I think investors will have an opportunity to get a pretty good read on our Phase 2 progress yet this year.

|

Jenene Closing:

| |

●

|

With that, this concludes the Virtual Investor What this Means segment with Moleculin. I would like to thank Wally Klemp, Chairman and CEO of Moleculin for joining us today.

|

| |

●

|

I would also like to thank our viewers for your time and attention. As a reminder, you can access the webcast replay from today’s event at: www.virtualinvestorco.com.

|

https://www.virtualinvestorco.com/whatthismeans

Video will be available approx. 60 days

v3.23.3

Document And Entity Information

|

Oct. 17, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLECULIN BIOTECH, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 17, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37758

|

| Entity, Tax Identification Number |

47-4671997

|

| Entity, Address, Address Line One |

5300 Memorial Drive, Suite 950

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77007

|

| City Area Code |

713

|

| Local Phone Number |

300-5160

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MBRX

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001659617

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

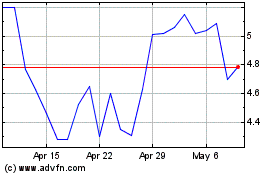

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2024 to May 2024

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From May 2023 to May 2024