MIND C.T.I. LTD. – (NasdaqGM: MNDO), a leading provider of

convergent end-to-end prepaid/postpaid billing and customer care

product based solutions for service providers, unified

communications analytics and call accounting solutions for

enterprises as well as enterprise messaging solutions, today

announced results for its fourth quarter of 2021 and its full year

ended December 31, 2021.

The following will summarize our business in the

fourth quarter of 2021 and provide a more detailed review of the

financial results for the quarter and for the full year. Full

financial results can be found in the Company News section of our

website at http://www.mindcti.com/company/news/ and in our Form

6-K.

Financial Highlights of Q4

2021

- Revenues of $6.0 million, compared to $5.8 million in the

fourth quarter of 2020.

- Operating income of $1.6 million, or 27% of total revenue,

compared to $1.3 million, or 23% of revenue in the fourth quarter

of 2020.

- Net income of $1.5 million or $0.08 per share, compared to $1.4

million or $0.07 per share in the fourth quarter of 2020.

- Cash flow from operating activities of $2.5 million, compared

to $2.3 million in the fourth quarter of 2020.

Financial Highlights of Full Year

2021

- Revenues of $26.3 million, compared to $23.4 million in 2020,

with the increase attributed to the messaging segment.

- Operating income of $6.8 million, or 25.9% of total revenue,

compared to $5.5 million, or 23.0% of total revenue in 2020.

- Net income of $5.9 million, or $0.30 per share, compared to

$5.4 million, or $0.27 per share in 2020.

- Cash flow from operating activities of $6.9 million, compared

to $6.5 million in 2020.

- Cash position of approximately $18.5 million as of December 31,

2021.

Monica Iancu, MIND CTI’s Chief Executive

Officer, commented: “2021 was a record year for MIND’s revenue. As

previously announced, our messaging segment was favorably impacted

by campaigns carried out by a few customers. The unprecedented

growth we encountered in Q2 and Q3, in our messaging segment, was

temporary in nature. The messaging markets, unlike our traditional

ones, are difficult to predict, as external factors have a strong

impact on both revenues and margins. As the proportion of our

messaging business, out of our total revenue, increases, we expect

our business results to present higher volatility in revenues,

margins, and cash flows compared to past years. Our telecom markets

continue to be challenging, with low demand and strong competition,

and we expect to eventually experience negative business impact

from these continuous trends.

“The political situation in Eastern Europe

(Ukraine) is very sad but has no immediate direct effect on our

business, as we have no operations and no customers in Russia or

Ukraine.

“It is our strategy to pursue acquisitions that

could be a source of growth, as well as to continue with our

dividend policy, and at the same time invest in new technologies to

enhance our offering.”

Revenue Distribution for Q4

2021 Revenues in Europe represented 53% (including the

Message Mobile and GTX revenues in Germany that represented 42%),

revenues in the Americas represented 38%, and revenues in the rest

of the world represented 9% of our total revenues.

Revenues from our customer care and billing

software were $2.9 million, or 48% of total revenues, revenues from

enterprise messaging and payment solutions were $2.5 million, or

42% of total revenues, and revenues from our enterprise call

accounting software were $0.6 million, or 10% of total

revenues.

Revenues from maintenance and additional

services were $5.6 million, or 93% of total revenues, while

revenues from licenses were $0.4 million, or 7% of total

revenues.

Revenue Distribution for Full Year

2021 Revenues in Europe represented 56% (including the

Message Mobile and GTX revenues in Germany that represented 45%),

revenues in the Americas represented 36%, and revenues in the rest

of the world represented 8% of our total revenues.

Revenues from our customer care and billing

software were $12.1 million, or 46% of total revenues, revenues

from enterprise messaging and payment solutions were $12.0 million,

or 46% of total revenues, and revenues from enterprise call

accounting software were $2.2 million, or 8% of our total

revenues.

Revenues from maintenance and additional

services were $24.8 million, or 94%, compared to $22 million or 94%

of total revenues in 2020, while revenues from licenses were $1.5

million, or 6% of total revenues, compared to $1.4 million, or 6%

of total revenues in 2020.

Dividend Distribution Since

July 2003, when we first adopted a dividend policy, we performed 19

distributions, including one special dividend. We continue to

believe that our annual dividends enhance shareholder value.

Taking into consideration our dividend policy

and the remaining cash after the distribution, our Board of

Directors declared on March 10, 2022, a gross dividend of $0.26 per

share. The record date for the dividend will be March 24, 2022 and

the payment date will be April 6, 2022. Tax will be withheld at a

rate of 22%.

Changes in Management Team

During 2021, Ran Mendelaw, (45), re-joined us as Chief Financial

Officer, bringing over 18 years of experience in accounting,

financial management and public companies. Ran served as MIND’s CFO

from May 2018 until June 2019. Prior to that, he served as a group

controller in a public industrial company and for ten years as

senior manager at PwC Israel. Mr. Mendelaw holds a B.A. degree in

Accounting and Economics from Haifa University and he is a

Certified Public Accountant in Israel.

About MIND MIND CTI Ltd. is a

leading provider of convergent end-to-end billing and customer care

product-based solutions for service providers, unified

communications analytics and call accounting solutions for

enterprises as well as enterprise messaging solutions. MIND

provides a complete range of billing applications for any business

model (license, SaaS, managed service or complete outsourced

billing service) for Wireless, Wireline, Cable, IP Services and

Quad-play carriers. A global company, with over twenty years of

experience in providing solutions to carriers and enterprises, MIND

operates from offices in the United States, Romania, Germany, and

Israel.

Cautionary Statement for Purposes of the "Safe

Harbor" Provisions of the Private Securities Litigation Reform Act

of 1995: All statements other than historical facts included in the

foregoing press release regarding the Company's business strategy

are "forward-looking statements", including estimations relating to

the impact of the recent political situation in Ukraine, the impact

of the COVID-19 pandemic and mitigation measures in connection

thereto, expectations of the results of the Company’s business

optimization initiative, integration of the company’s acquisitions

and its projected outlook and results of operations. These

statements are based on management's beliefs and assumptions and on

information currently available to management. Forward-looking

statements are not guarantees of future performance, and actual

results may materially differ. The forward-looking statements

involve risks, uncertainties, and assumptions, including, but not

limited to, the impact of the COVID-19 pandemic on our customers

and economic conditions in our key markets, as well as the risks

discussed in the Company's annual report and other filings with the

United States Securities Exchange Commission. The Company does not

undertake to update any forward-looking information.

For more information please

contact:Andrea DrayMIND C.T.I. Ltd.Tel:

+972-4-993-6666investor@mindcti.com

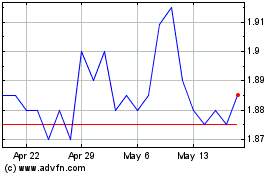

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Jan 2025 to Feb 2025

MIND C T I (NASDAQ:MNDO)

Historical Stock Chart

From Feb 2024 to Feb 2025