MicroStrategy® Incorporated (Nasdaq: MSTR) (the “Company”), the

largest corporate holder of bitcoin and the world’s first Bitcoin

Treasury Company, today announced updates with respect to its

bitcoin activity and holdings, capital markets activity, and BTC

Yield, a key performance indicator.

BTC Update

The Company today announced that, during the period between

October 31, 2024 and November 10, 2024, the Company acquired

approximately 27,200 bitcoins for approximately $2.03 billion in

cash, at an average price of approximately $74,463 per bitcoin,

inclusive of fees and expenses. The bitcoin purchases were made

using proceeds from the issuance and sale of Shares (defined below)

under the Sales Agreements (defined below).

As of November 10, 2024, the Company, together with its

subsidiaries, held an aggregate of approximately 279,420 bitcoins,

which were acquired at an aggregate purchase price of approximately

$11.9 billion and an average purchase price of approximately

$42,692 per bitcoin, inclusive of fees and expenses.

ATM Update

As previously disclosed, on August 1, 2024, the Company entered

into a Sales Agreement (the “August Sales Agreement”) with TD

Securities (USA) LLC, The Benchmark Company, LLC, BTIG, LLC,

Canaccord Genuity LLC, Maxim Group LLC and SG Americas Securities,

LLC, as sales agents (the “August Sales Agents”), pursuant to which

the Company may issue and sell shares of its class A common stock,

par value $0.001 per share (“Shares”), having an aggregate offering

price of up to $2.0 billion from time to time through the Sales

Agents.

Additionally, on October 30, 2024, the Company entered into a

Sales Agreement (the “October Sales Agreement” and, together with

the August Sales Agreement, the “Sales Agreements”) with TD

Securities (USA) LLC, Barclays Capital Inc., The Benchmark Company,

LLC, BTIG, LLC, Canaccord Genuity LLC, Cantor Fitzgerald & Co.,

Maxim Group LLC, Mizuho Securities USA LLC, and SG Americas

Securities, LLC, as agents (the “October Sales Agents”), pursuant

to which the Company may issue and sell Shares having an aggregate

offering price of up to $21 billion from time to time through the

October Sales Agents.

The Company today announced that, as of November 10, 2024, the

Company had sold an aggregate of 7,854,647 Shares under the Sales

Agreements for aggregate net proceeds to the Company (less sales

commissions) of approximately $2.03 billion. As a result of these

sales, the August Sales Agreement has been substantially depleted

and further at-the-market sales of Shares will be made under the

October Sales Agreement.

BTC Yield KPI

From October 1, 2024 to November 10, 2024, the Company’s BTC

Yield was 7.3%. From January 1, 2024 to November 10, 2024, the

Company’s BTC Yield was 26.4%.

BTC Yield is a key performance indicator (“KPI”) that represents

the percentage change period-to-period of the ratio between the

Company’s bitcoin holdings and its Assumed Diluted Shares

Outstanding. Assumed Diluted Shares Outstanding refers to the

aggregate of the Company’s actual shares of common stock

outstanding as of the end of the applicable period plus all

additional shares that would result from the assumed conversion of

all outstanding convertible notes, exercise of all outstanding

stock option awards, and settlement of all outstanding restricted

stock units and performance stock units. The Company uses BTC Yield

as a KPI to help assess the performance of its strategy of

acquiring bitcoin in a manner the Company believes is accretive to

shareholders. The Company believes this KPI can be used to

supplement an investor’s understanding of the Company’s decision to

fund the purchase of bitcoin by issuing additional shares of its

common stock or instruments convertible to common stock.

BTC Yield and Basic and Assumed Diluted Shares Outstanding

12/31/2023

9/30/2024

11/10/2024

Total Bitcoin Holdings

189,150

252,220

279,420

Shares Outstanding (in ‘000s)

(1)

Class A

149,041

182,995

191,154

Class B

19,640

19,640

19,640

Basic Shares Outstanding (2)

168,681

202,635

210,794

2025 Convertible Shares @$39.80

16,330

-

-

2027 Convertible Shares @$143.25

7,330

7,330

7,330

2028 Convertible Shares @$183.19

-

5,513

5,513

2030 Convertible Shares @$149.77

-

5,342

5,342

2031 Convertible Shares @$232.72

-

2,594

2,594

2032 Convertible Shares @$204.33

-

3,915

3,915

Options Outstanding

12,936

5,678

5,256

RSU/PSU Unvested

2,359

2,034

2,013

Assumed Diluted Shares Outstanding

(3)

207,636

235,042

242,758

BTC Yield % (Quarter to Date)

7.3%

BTC Yield % (Year to Date)

26.4%

(1)

On July 11, 2024, the Company announced a

10-for-1 stock split of the Company’s class A common stock and

class B common stock. The stock split was effected by means of a

stock dividend to the holders of record of the Company’s class A

common stock and class B common stock as of the close of business

on August 1, 2024, the record date for the dividend. The dividend

was distributed after the close of trading on August 7, 2024 and

trading commenced on a split-adjusted basis at market open on

August 8, 2024. As a result of the stock split, all applicable

share and equity award information has been retroactively adjusted

to reflect the stock split for all periods presented.

(2)

Basic Shares Outstanding as of 12/31/2023

and 9/30/2024 reflects the actual Class A and Class B common stock

outstanding as of the dates presented. Basic Shares

Outstanding as of 11/10/2024 reflects the sum of (i) the actual

Class A and Class B common stock outstanding as of the date

presented and (ii) shares of Class A common stock sold under

at-the-market equity offering programs and/or exercised pursuant to

stock options as of the date presented and pending issuance upon

settlement.

(3)

Assumed Diluted Shares Outstanding refers

to the aggregate of our Basic Shares outstanding as of the end of

each period plus all additional shares that would result from the

assumed conversion of all outstanding convertible notes, exercise

of all outstanding stock option awards, and settlement of all

outstanding restricted stock units and performance stock

units. Assumed Diluted Shares Outstanding is not calculated

using the treasury method and does not take into account any

vesting conditions (in the case of equity awards), the exercise

price of any stock option awards or any contractual conditions

limiting convertibility of convertible debt instruments.

Important Information about BTC Yield KPI

BTC Yield is a KPI that represents the percentage change

period-to-period of the ratio between the Company’s bitcoin

holdings and its Assumed Diluted Shares Outstanding. Assumed

Diluted Shares Outstanding refers to the aggregate of the Company’s

actual shares of common stock outstanding as of the end of each

period plus all additional shares that would result from the

assumed conversion of all outstanding convertible notes, exercise

of all outstanding stock option awards, and settlement of all

outstanding restricted stock units and performance stock units.

Assumed Diluted Shares Outstanding is not calculated using the

treasury method and does not take into account any vesting

conditions (in the case of equity awards), the exercise price of

any stock option awards or any contractual conditions limiting

convertibility of convertible debt instruments.

The Company uses BTC Yield as a KPI to help assess the

performance of its strategy of acquiring bitcoin in a manner the

Company believes is accretive to shareholders. The Company believes

this KPI can be used to supplement an investor’s understanding of

its decision to fund the purchase of bitcoin by issuing additional

shares of its common stock or instruments convertible to common

stock. When the Company uses this KPI, management also takes into

account the various limitations of this metric, including that it

does not take into account debt and other liabilities and claims on

company assets that would be senior to common equity and that it

assumes that all indebtedness will be refinanced or, in the case of

the Company’s senior convertible debt instruments, converted into

shares of common stock in accordance with their respective

terms.

Additionally, this KPI is not, and should not be understood as,

an operating performance measure or a financial or liquidity

measure. In particular, BTC Yield is not equivalent to “yield” in

the traditional financial context. It is not a measure of the

return on investment the Company’s shareholders may have achieved

historically or can achieve in the future by purchasing stock of

the Company, or a measure of income generated by the Company’s

operations or its bitcoin holdings, return on investment on its

bitcoin holdings, or any other similar financial measure of the

performance of its business or assets.

The trading price of the Company’s class A common stock is

informed by numerous factors in addition to the amount of bitcoins

the Company holds and number of actual or potential shares of its

stock outstanding, and as a result, the market value of the

Company’s shares may trade at a discount or a premium relative to

the market value of the bitcoin the Company holds, and BTC Yield is

not indicative nor predictive of the trading price of the Company’s

shares of class A common stock.

As noted above, this KPI is narrow in its purpose and is used by

management to assist it in assessing whether the Company is using

equity capital in a manner accretive to shareholders solely as it

pertains to its bitcoin holdings.

In calculating this KPI, the Company does not take into account

the source of capital used for the acquisition of its bitcoin. The

Company notes in particular, it has acquired bitcoin using proceeds

from the offerings of its 6.125% Senior Secured Notes due 2028

Secured Notes (which the Company has since redeemed), which were

not convertible to shares of the Company’s common stock, as well as

convertible senior notes, which at the time of issuance had, and

may from time-to-time thereafter have, conversion prices above the

current trading prices of the Company’s common stock, or as to

which the holders of such convertible notes may not then be

entitled to exercise the conversion rights of the notes. Such

offerings have had the effect of increasing the BTC Yield without

taking into account the corresponding debt. Conversely, if any of

the Company’s convertible senior notes mature or are redeemed

without being converted into common stock, the Company may be

required to sell shares in quantities greater than the shares such

notes are convertible into or generate cash proceeds from the sale

of bitcoin, either of which would have the effect of decreasing the

BTC Yield due to changes in the Company’s bitcoin holdings and

shares in ways that were not contemplated by the assumptions in

calculating BTC Yield. Accordingly, this metric might overstate or

understate the accretive nature of the Company’s use of equity

capital to buy bitcoin because not all bitcoin may be acquired

using proceeds of equity offerings and not all issuances of equity

may involve the acquisition of bitcoin.

The Company determines its KPI targets based on its history and

future goals. The Company’s ability to achieve positive BTC Yield

may depend on a variety of factors, including its ability to

generate cash from operations in excess of its fixed charges and

other expenses, as well as factors outside of its control, such as

the availability of debt and equity financing on favorable terms.

Past performance is not indicative of future results.

The Company has historically not paid any dividends on its

shares of common stock, and by presenting this KPI the Company

makes no suggestion that it intends to do so in the future.

Ownership of common stock does not represent an ownership interest

in the bitcoin the Company holds.

Investors should rely on the financial statements and other

disclosures contained in the Company’s SEC filings. This KPI is

merely a supplement, not a substitute. It should be used only by

sophisticated investors who understand its limited purpose and many

limitations.

About MicroStrategy Incorporated

MicroStrategy (Nasdaq: MSTR) is the world's first and largest

Bitcoin Treasury Company. We are a publicly traded company that has

adopted Bitcoin as our primary treasury reserve asset. By using

proceeds from equity and debt financings, as well as cash flows

from our operations, we strategically accumulate Bitcoin and

advocate for its role as digital capital. Our treasury strategy is

designed to provide investors varying degrees of economic exposure

to Bitcoin by offering a range of securities, including equity and

fixed-income instruments. In addition, we provide industry-leading

AI-powered enterprise analytics software, advancing our vision of

Intelligence Everywhere. We leverage our development capabilities

to explore innovation in Bitcoin applications, integrating

analytics expertise with our commitment to digital asset growth. We

believe our combination of operational excellence, strategic

Bitcoin reserve, and focus on technological innovation positions us

as a leader in both the digital asset and enterprise analytics

sectors, offering a unique opportunity for long-term value

creation.

MicroStrategy, MicroStrategy AI, Intelligence Everywhere,

Intelligent Enterprise, and MicroStrategy Library are either

trademarks or registered trademarks of MicroStrategy Incorporated

in the United States and certain other countries. Other product and

company names mentioned herein may be the trademarks of their

respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111351255/en/

MicroStrategy Incorporated Shirish Jajodia Corporate Treasurer

ir@microstrategy.com

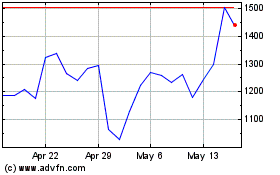

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

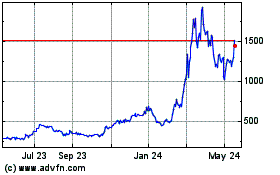

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Nov 2023 to Nov 2024