August 29, 20240000918541falseCharlotteNorth Carolina00009185412024-08-292024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2024

NN, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39268 | 62-1096725 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| 6210 Ardrey Kell Road, Suite 120 | | |

Charlotte, North Carolina | | 28277 |

| (Address of principal executive offices) | | (Zip Code) |

(980) 264-4300

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 | | NNBR | | The Nasdaq Stock Market LLC |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company. | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

TLCA Amendment

On August 29, 2024, NN, Inc., a Delaware corporation (the “Company”), certain subsidiaries of the Company named therein, the lenders party thereto and Oaktree Fund Administration, LLC (“Oaktree”), as administrative agent, entered into that certain Amendment No. 4 to Term Loan Credit Agreement (the “TLCA Amendment”), which amended the Company’s existing Term Loan Credit Agreement, dated as of March 22, 2021 (as previously amended and as amended by the TLCA Amendment, the “Term Loan Credit Agreement”), by and among the Company, the lenders party thereto from time to time, and Oaktree, as administrative agent.

The TLCA Amendment, among other things, (i) requires the Company to use the net cash proceeds obtained in connection with any future sale and leaseback transactions to prepay any outstanding principal indebtedness under the Term Loan Credit Agreement; (ii) raises the amount of the Company’s allowable indebtedness – incurred in connection with the purchase or lease of fixed assets – from $20 million to $40 million, provided that no more than $26,950,000 is used with respect to any sale and leaseback transaction; (iii) makes certain modifications to the Domestic Liquidity (as defined in the Term Loan Credit Agreement) requirements; and (iv) amends certain definitions and other terms under the Term Loan Credit Agreement relating to sale and leaseback transactions.

ABL Amendment

Additionally, on August 29, 2024, the Company, certain subsidiaries of the Company named therein, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent, entered into that certain Amendment No. 3 to Credit Agreement (the “ABL Amendment” and together with the TLCA Amendment, the “Loan Amendments”), which amended the Company’s existing Credit Agreement, dated as of March 22, 2021 (as previously amended and as amended by the ABL Amendment, the “ABL Credit Agreement”), by and among the Company, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent.

The ABL Amendment, among other things, (i) raises the amount of the Company’s allowable indebtedness – incurred in connection with the financing of the acquisition, construction or improvement of any fixed or capital assets – from $20 million to $40 million, provided that no more than $26,950,000 is used with respect to any sale and leaseback transaction; (ii) makes certain modifications to the Domestic Liquidity (as defined in the Term Loan Credit Agreement) requirements; and (iii) amends certain definitions and other terms under the ABL Credit Agreement relating to any future sale and leaseback transactions by the Company.

The foregoing summaries of the TLCA Amendment and ABL Amendment are qualified in their entirety by reference to the full text of: (i) the TLCA Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K; and (ii) the ABL Amendment, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K, each of which is incorporated herein by reference.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

The information set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description of Exhibit |

| 10.1 | | |

| 10.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

| | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| |

| Date: | August 30, 2024 |

| | | | | | | | |

| NN, INC. |

| | |

| | |

| By: | /s/ Christopher H. Bohnert |

| Name: | Christopher H. Bohnert |

| Title: | Senior Vice President and Chief Financial Officer |

| | |

| | |

| | |

| | |

AMENDMENT NO. 4 TO TERM LOAN CREDIT AGREEMENT

This AMENDMENT NO. 4 TO TERM LOAN CREDIT AGREEMENT, dated as of August 29, 2024 (this “Amendment”), is entered into by and among NN, Inc., a Delaware corporation (the “Borrower”), each other Loan Party party hereto, each Lender (as defined below) party hereto, and Oaktree Fund Administration, LLC, as administrative agent and collateral agent (the “Administrative Agent”).

RECITALS

WHEREAS, the Borrower, the lenders party thereto from time to time (collectively, the “Lenders” and, individually, each a “Lender”) and the Administrative Agent are parties to that certain Term Loan Credit Agreement, dated as of March 22, 2021 and amended by that certain Amendment No. 1 to Term Loan Credit Agreement, dated as of March 3, 2022, by that certain Amendment No. 2 to Term Loan Credit Agreement, dated as of March 3, 2023, and by that certain Amendment No. 3 to Term Loan Credit Agreement dated as of March 15, 2024 (and as further amended, restated, amended and restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Credit Agreement” and the Credit Agreement, after giving effect to the effectiveness of this Amendment, the “Amended Credit Agreement”);

WHEREAS, the Borrower has requested that the Lenders agree to amend certain provisions of the Credit Agreement as provided for herein; and

WHEREAS, the Lenders are willing to agree to such amendment to the Credit Agreement.

NOW, THEREFORE, in consideration of the covenants and agreements contained herein, as well as other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

SECTION 1. Defined Terms. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Credit Agreement.

SECTION 2. Amendments.

(a) Section 1.01 of the Credit Agreement is hereby amended by inserting the following definitions in the appropriate alphabetical order:

“Amendment No. 4” means that certain Amendment No. 4 to Term Loan Credit Agreement, dated as of August 29, 2024, among the Borrower, each other Loan Party thereto, each Lender party thereto and Oaktree Fund Administration, LLC, as administrative agent and collateral agent.

“Amendment No. 4 Effective Date” means August 29, 2024.

(b) The final proviso of clause (a) of the definition of “Net Cash Proceeds” is hereby amended and restated in its entirety as follows:

; provided, further, that such cash or Cash Equivalents received in connection with any Disposition (other than (x) the 2024 Sale and Leaseback Transaction, (y) any other Disposition in the form of a sale

and leaseback transaction of assets owned by the Loan Parties or any of their respective Subsidiaries prior to the date such transaction is consummated and not acquired in contemplation thereof (and not, for the avoidance of doubt, in connection with any purchase money financing in connection with the acquisition of any assets), and (z) any other Disposition consummated after the Amendment No. 3 Effective Date and before June 30, 2024, the proceeds of which are greater than $5,000,000) or Extraordinary Receipt shall only constitute Net Cash Proceeds under this clause (a) in any fiscal year to the extent that the aggregate amount of such cash and Cash Equivalents received in such fiscal year exceeds $5,000,000; and

(c) The final sentence of Section 2.05(b)(ii) is hereby amended and restated in its entirety as follows:

Notwithstanding anything in this Section 2.05(b) to the contrary, the Borrower shall prepay an aggregate principal amount of Term Loans equal to 100% of the Net Cash Proceeds received in connection with (x) the 2024 Sale and Leaseback Transaction, (y) any other Disposition in the form of a sale and leaseback transaction of assets owned by the Loan Parties or any of their respective Subsidiaries prior to the date such transaction is consummated and not acquired in contemplation thereof (and not, for the avoidance of doubt, in connection with any purchase money financing in connection with the acquisition of any assets), or (z) or any other Disposition consummated after the Amendment No. 3 Effective Date and before June 30, 2024, the proceeds of which are greater than $5,000,000, in each case, within ten (10) Business Days of receipt thereof by the Borrower (such prepayments to be applied as set forth in clause (v) below) without regard to any reinvestment rights with respect to such Net Cash Proceeds.

(d) The first sentence of Section 2.05(c) is hereby amended and restated in its entirety as follows:

In the event that all or any portion of the Term Loans is repaid or prepaid as a result of any voluntary prepayment or mandatory prepayment, but excluding any prepayment made pursuant to Sections 2.05(b)(i), (b)(ii) (including, for the avoidance of doubt, prepayments made in connection with (x) the 2024 Sale and Leaseback Transaction, (y) any other Disposition in the form of a sale and leaseback transaction of assets owned by the Loan Parties or any of their respective Subsidiaries prior to the date such transaction is consummated and not acquired in contemplation thereof (and not, for the avoidance of doubt, in connection with any purchase money financing in connection with the acquisition of any assets), and (z) any other Disposition consummated after the Amendment No. 3 Effective Date and before June 30, 2024, the proceeds of which are greater than $5,000,000) and (b)(iv), on or prior to the third anniversary of the Closing Date, such repayments, prepayments or required assignments shall be made at (A) an amount equal to the Make-Whole Amount, if such repayment, prepayment or required assignment

occurs on or prior to the first anniversary of the Closing Date, (B) 2.0% of the amount repaid or prepaid as of the date of such repayment, prepayment or required assignment, if such repayment, prepayment or required assignment occurs after the first anniversary of the Closing Date but on or prior to the second anniversary of the Closing Date and (C) 1.0% of the amount repaid or prepaid, if such repayment, prepayment or required assignment occurs after the second anniversary of the Closing Date but on or prior to the third anniversary of the Closing Date (the foregoing premiums (including the Make-Whole Amount), the “Prepayment Premium”).

(e) Section 7.02(b) of the Credit Agreement is hereby amended and restated in its entirety as follows:

(b) any loans granted to or Indebtedness under Financing Lease Obligations entered into by the Borrower or any of its Subsidiaries for the purchase or lease of fixed assets and any Refinance Indebtedness in respect thereof permitted by clause (g) below, which loans and Indebtedness under Financing Lease Obligations shall only be secured by the fixed assets being purchased or leased, so long as the aggregate principal amount of all such loans and Indebtedness under Financing Lease Obligations (other than with respect to the 2024 Sale and Leaseback Transaction) for the Borrower and all of its Subsidiaries shall not exceed $40,000,000 at any time outstanding, of which no more than $26,950,000 shall be used with respect to any sale and leaseback transaction of assets not owned by the Loan Parties or any of their respective Subsidiaries prior to the date such transaction is consummated;

(f) Section 7.14(b) of the Credit Agreement is hereby amended and restated in its entirety as follows:

(b) Liquidity. (i) Permit Domestic Liquidity as of the last day of any fiscal quarter to be less than $10,000,000 and (ii) within five (5) Business Days following the last day of each fiscal quarter in which (A) the Consolidated Net Leverage Ratio of the Borrower and its Subsidiaries is equal to or greater than 3:00:1.00 or (B) Domestic Liquidity of the Borrower and its Subsidiaries is equal to or less than $35,000,000, the Borrower shall deliver to the Administrative Agent and each Lender a weekly projected cash flow statement of the Borrower and its Subsidiaries for the succeeding thirteen (13) weeks (clauses (i) and (ii) collectively, the “Minimum Liquidity Covenant”, and together with the Consolidated Net Leverage Ratio Covenant, the “Financial Covenants” and each, a “Financial Covenant”).

(g) The Credit Agreement, as amended pursuant to this Section 2, is hereby ratified, approved and confirmed in each and every respect by all parties hereto. The rights and obligations of the parties to the Credit Agreement with respect to the period prior to the Amendment No. 4 Effective Date shall not be affected by such amendment.

SECTION 3. Conditions to Effectiveness. This Amendment shall become effective upon satisfaction (or effective waiver) of the following conditions precedent (such date, the “Amendment No. 4 Effective Date”):

(a) The Administrative Agent (or its counsel) shall have received from the Borrower, each other Loan Party, and each Lender an executed counterpart of this Amendment (or photocopies thereof sent by fax, .pdf or other electronic means, each of which shall be enforceable with the same effect as a signed original).

(b) The Administrative Agent (or its counsel) shall have received from the Borrower an executed copy of that certain Amendment No. 3 to Credit Agreement, dated as of the date hereof (the “ABL Amendment”), duly executed by the Borrower, each other loan party thereto, and the ABL Administrative Agent, which such ABL Amendment shall be in form and substance reasonably satisfactory to the Administrative Agent.

(c) After giving effect to this Amendment, the representations and warranties contained in each of the Loan Documents are true and correct in all material respects on and as of the Amendment No. 4 Effective Date (or to the extent such representations and warranties specifically relate to an earlier date, on and as of such earlier date).

(d) No Default or Event of Default shall have occurred and be continuing after giving effect to this Amendment.

(e) The Administrative Agent shall have received reimbursement or payment of all fees and expenses required to be reimbursed or paid hereunder or under any other Loan Document or otherwise agreed to in writing to be paid (including the reasonable and documented fees, charges and disbursements of Proskauer Rose LLP, as counsel to the Administrative Agent), in each case, on or prior to the Amendment No. 4 Effective Date, in the case of reimbursement of expenses, to the extent invoiced at least three (3) Business Days prior to the Amendment No. 4 Effective Date (or such later date as the Borrower may agree).

SECTION 4. Consent to ABL Amendment. Notwithstanding anything in the Amended Credit Agreement or the ABL Intercreditor Agreement to the contrary, the Administrative Agent hereby consents to the amendment, supplementation, and modification of the ABL Credit Agreement pursuant to the ABL Amendment.

SECTION 5. Effects on Loan Documents.

(a) From and after the Amendment No. 4 Effective Date, each reference in the Amended Credit Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import shall, unless expressly provided otherwise, mean and be a reference to the Amended Credit Agreement and each reference in each other Loan Document to the Credit Agreement (including by means of words like “thereunder,” “thereof” and words of like import) shall, unless expressly provided otherwise, mean and be a reference to the Amended Credit Agreement.

(b) Except as expressly set forth herein, each and every term, condition, obligation, covenant and agreement contained in the Credit Agreement or any other provision of either such agreement or any other Loan Document is hereby ratified and re-affirmed in all respects and shall continue in full force and effect and each Loan Party reaffirms its obligations under each of the Loan Documents to which it is party (including, for the avoidance of doubt, the Guaranty Agreement), and confirms that all obligations of such Loan Party under the Loan Documents to which such Loan Party is a party shall continue to apply to the Amended Credit Agreement.

(c) Except as expressly amended hereby, all Loan Documents shall continue to be in full force and effect and are hereby in all respects ratified and confirmed.

(d) The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of any Lender, the Administrative Agent or any other Secured Party under any of the Loan Documents, nor constitute a waiver of any provision of the Loan Documents or in any way limit, impair or otherwise affect the rights and remedies of the Administrative Agent, the Lenders or any of the other Secured Parties under the Loan Documents.

(e) The other parties hereto hereby acknowledge and agree that, from and after the Amendment No. 4 Effective Date, this Amendment shall constitute a Loan Document for all purposes of the Amended Credit Agreement.

SECTION 6. Miscellaneous.

(a) This Amendment is binding and enforceable as of the date hereof against each party hereto and its successors and permitted assigns.

(b) This Amendment may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Delivery of an executed signature page of this Amendment by facsimile or other electronic mail transmission shall be effective as delivery of a manually executed counterpart hereof. A set of the copies of this Amendment signed by all the parties shall be lodged with the Administrative Agent. Each party hereto agrees that the words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Amendment shall be deemed to include electronic signatures or the keeping of electronic records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

(c) If any provision of this Amendment is held to be illegal, invalid or unenforceable, (x) the legality, validity and enforceability of the remaining provisions of this Amendment shall not be affected or impaired thereby and (y) the parties shall endeavor in good faith negotiations to replace the illegal, invalid or unenforceable provisions with valid provisions the economic effect of which comes as close as possible to that of the illegal, invalid or unenforceable provisions. The invalidity of a provision in a particular jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

(d) Each of the parties hereto hereby agrees that Sections 10.14 and 10.15 of the Credit Agreement are incorporated by reference herein, mutatis mutandis, and shall have the same force and effect with respect to this Amendment as if originally set forth herein.

(e) Section headings herein are included herein for convenience of reference only and shall not constitute a part hereof for any other purpose or be given any substantive effect.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered by their respective proper and duly authorized officers as of the day and year first above written.

NN, INC., as the Borrower

| | | | | |

| By: | /s/ Chris Bohnert |

| Name: | Chris Bohnert |

| Title: | Senior Vice President, Cheif Financial Officer |

[Amendment No. 4 to Term Loan Credit Agreement]

The following other Loan Parties:

Whirlaway Corporation

PNC Acquisition Company, Inc.

PMC USA Acquisition Company, Inc.

PMC Acquisition Company, Inc.

NN Precision Plastics, Inc.

Caprock Manufacturing, Inc.

Caprock Enclosures, LLC

Brainin-Advance Industries LLC

Wauconda Tool & Engineering LLC

General Metal Finishing LLC

Advanced Precision Products, Inc.

HowesTemco, LLC

Premco, Inc.

Profiles, Incorporated

Holmed, LLC

Southern California Technical Arts, Inc.

Autocam Corporation

Autocam-Pax, Inc.

Polymetallurgical LLC

NN Power Solutions Holdings, LLC

NN Power Solutions, LLC

| | | | | |

| By: | /s/ Chris Bohnert |

| Name: | Chris Bohnert |

| Title: | Authorized Signatory |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE FUND ADMINISTRATION, LLC,

as the Administrative Agent

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Managing Member |

| |

| By: | /s/ Mary Gallegly |

| Name: Mary Gallegly |

| Title: Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: Jessica Dombroff |

| Title: Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE GILEAD INVESTMENT FUND AIF (DELAWARE), L.P.

| | | | | |

| By: | Oaktree Fund AIF Series, L.P. – Series T |

| Its: | General Partner |

| |

| By: | Oaktree Fund GP AIF, LLC |

| Its: | Managing Member |

| |

| By: | Oaktree Fund GP III, L.P. |

| Its: | Managing Member |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Authorized Signatory |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Authorized Signatory |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE GCP FUND DELAWARE HOLDINGS, L.P.

| | | | | |

| By: | Oaktree Global Credit Plus Fund GP, L.P. |

| Its: | General Partner |

| |

| By: | Oaktree Global Credit Plus Fund GP Ltd. |

| Its: | General Partner |

| |

| By: | Oaktree Capital Management, L.P. |

| Its: | Director |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE HUNTINGTON-GCF INVESTMENT FUND (DIRECT LENDING AIF), L.P.

| | | | | |

| By: | Oaktree Huntington-GCF Investment Fund |

| (Direct Lending AIF) GP, L.P. |

| Its: | General Partner |

| |

| By: | Oaktree Huntington-GCF Investment Fund |

| (Direct Lending AIF) GP, LLC |

| Its: | General Partner |

| |

| By: | Oaktree Fund GP III, L.P. |

| Its: | Managing Member |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Authorized Signatory |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Authorized Signatory |

[Amendment No. 4 to Term Loan Credit Agreement]

OSI 2 SENIOR LENDING SPV, LLC

| | | | | |

| By: | Oaktree Specialty Lending Corporation |

| Its: | Managing Member |

| |

| By: | Oaktree Fund Advisors, LLC |

| Its: | Investment Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

EXELON STRATEGIC CREDIT HOLDINGS, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President r |

OAKTREE-NGP STRATEGIC CREDIT, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

OAKTREE-FORREST MULTI-STRATEGY, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE-TBMR STRATEGIC CREDIT FUND C, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

OAKTREE-TBMR STRATEGIC CREDIT FUND F, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

OAKTREE-TBMR STRATEGIC CREDIT FUND G, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE-MINN STRATEGIC CREDIT, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

INPRS STRATEGIC CREDIT HOLDINGS, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

OAKTREE-TCDRS STRATEGIC CREDIT, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE-TSE 16 STRATEGIC CREDIT, LLC

| | | | | |

| By: | Oaktree Capital Management, L.P. |

| Its: | Manager |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

OAKTREE SPECIALTY LENDING CORPORATION

| | | | | |

| By: | Oaktree Fund Advisors, LLC |

| Its: | Investment Advisor |

| |

| |

| By: | /s/ Mary Gallegly |

| Name: | Mary Gallegly |

| Title: | Managing Director |

| |

| By: | /s/ Jessica Dombroff |

| Name: | Jessica Dombroff |

| Title: | Senior Vice President |

[Amendment No. 4 to Term Loan Credit Agreement]

AMENDMENT NO. 3 TO CREDIT AGREEMENT

Dated as of August 29, 2024

THIS AMENDMENT NO. 3 TO CREDIT AGREEMENT (this “Amendment”) is made as of August 29, 2024 by and among NN, INC., a Delaware corporation (the “Borrower”), the Lenders party hereto and JPMorgan Chase Bank, N.A., as Administrative Agent (the “Administrative Agent’), under that certain Credit Agreement, dated as of March 22, 2021, by and among the Borrower, the subsidiaries of the Borrower from time to time party thereto as Loan Parties, the Lenders party thereto and the Administrative Agent (as amended by that certain Amendment No. 1 to Credit Agreement, dated as of March 3, 2023, by that certain Amendment No. 2 to Credit Agreement, dated as of March 15, 2024, and as further amended, restated, supplemented or otherwise modified prior to the date hereof, the “Existing Credit Agreement”, and as amended by this Amendment, the “Amended Credit Agreement”). Capitalized terms used herein and not otherwise defined herein shall have the respective meanings given to them in the Amended Credit Agreement.

WHEREAS, the Borrower, the Lenders party hereto and the Administrative Agent have agreed to make certain modifications to the Existing Credit Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the premises set forth above, the terms and conditions contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Borrower, the Lenders party hereto and the Administrative Agent hereby agree to enter into this Amendment.

1. Amendments to the Existing Credit Agreement. Effective as of the Amendment No. 3 Effective Date (as defined below), the parties hereto agree that the Existing Credit Agreement is hereby amended as follows:

(a) Section 1.01 of the Existing Credit Agreement is hereby amended by adding the following new defined terms in the appropriate alphabetical order:

“Amendment No. 3” means that certain Amendment No. 3 to Credit Agreement, dated as of the Amendment No. 3 Effective Date, by and between the Borrower, the Administrative Agent, and the Lenders party thereto.

“Amendment No. 3 Effective Date” means August 29, 2024.

(b) Section 1.01 of the Existing Credit Agreement is hereby amended by deleting the term “Junior Capital Condition” in its entirety.

(c) The definition of “Net Proceeds” set forth in Section 1.01 of the Existing Credit Agreement is hereby amended and restated in its entirety with the following:

“Net Proceeds” means, with respect to any event, (a) the cash proceeds received in respect of such event including (i) any cash received in respect of any non-cash proceeds (including any cash payments received by way of deferred payment of principal pursuant to a note or installment receivable or purchase price adjustment receivable or otherwise, but excluding any interest payments), but only as and when received, (ii) in the case of a casualty, insurance proceeds

and (iii) in the case of a condemnation or similar event, condemnation awards and similar payments, minus (b) the sum of (i) all reasonable fees and out-of-pocket expenses paid to third parties (other than Affiliates) in connection with such event, (ii) in the case of a Disposition of an asset (including pursuant to a sale and leaseback transaction or a casualty or a condemnation or similar proceeding), the amount of all payments required to be made as a result of such event to repay Indebtedness (other than Loans) secured by such asset or otherwise subject to mandatory prepayment as a result of such event and (iii) the amount of all taxes paid (or reasonably estimated to be payable) and the amount of any reserves established to fund contingent liabilities reasonably estimated to be payable (provided that (1) such amounts held in such reserves shall not exceed 10% of the gross cash proceeds received with respect to a Disposition or other event and (2) such amounts held in such reserves shall constitute Net Proceeds upon release to, or receipt by, the Borrower or any of its Subsidiaries), in each case during the year that such event occurred or the next succeeding year and that are directly attributable to such event (as determined reasonably and in good faith by a Financial Officer of the Borrower); provided, that the cash proceeds received in connection with any Disposition (other than (x) the 2024 Sale and Leaseback Transaction, (y) any other Disposition of assets solely constituting Term Loan Priority Collateral in the form of a sale and leaseback transaction of assets owned by the Loan Parties or any of their respective Subsidiaries prior to the date such transaction is consummated and not acquired in contemplation thereof (and not, for the avoidance of doubt, in connection with any purchase money financing in connection with the acquisition of any assets) and (z) any other Disposition of assets solely constituting Term Loan Priority Collateral consummated after the Amendment No. 2 Effective Date and before June 30, 2024, the proceeds of which are greater than $5,000,000) or Extraordinary Receipt shall only constitute Net Proceeds under this definition in any fiscal year to the extent that the aggregate amount of such cash proceeds received in such fiscal year exceeds $5,000,000.

(d) Clause (a) of the definition of “Prepayment Event” set forth in Section 1.01 of the Existing Credit Agreement is hereby amended and restated in its entirety with the following:

(a) any Disposition (including pursuant to a sale and leaseback transaction but excluding for the avoidance of doubt, (x) the 2024 Sale and Leaseback Transaction, (y) any other Disposition of assets solely constituting Term Loan Priority Collateral in the form of a sale and leaseback transaction of assets owned by the Loan Parties or any of their respective Subsidiaries prior to the date such transaction is consummated and not acquired in contemplation thereof (and not, for the avoidance of doubt, in connection with any purchase money financing in connection with the acquisition of any assets) and (z) any other Disposition of assets solely constituting Term Loan Priority Collateral consummated after the Amendment No. 2 Effective Date and before June 30, 2024, the proceeds of which are greater than $5,000,000) of any property or asset of any Loan Party or any Subsidiary that is made pursuant to Section 6.05(g); or

(e) Section 6.01(e) of the Existing Credit Agreement is hereby amended and restated in its entirety with the following:

(e) Indebtedness of the Borrower or any Subsidiary incurred to finance the acquisition, construction or improvement of any fixed or capital assets (whether or not constituting purchase money Indebtedness), including Financing Lease Obligations and any Indebtedness assumed in connection with the acquisition of any such assets or secured by a Lien on any such assets prior to the acquisition thereof, and extensions, renewals and replacements of any such Indebtedness in accordance with clause (f) below; provided that (i) such Indebtedness is incurred prior to or within 90 days after such acquisition or the completion of such construction or improvement and (ii) the aggregate principal amount of Indebtedness permitted by this clause (e) (other than with respect to the 2024 Sale and Leaseback Transaction) together with any Refinance Indebtedness in respect thereof permitted by clause (f) below, shall not exceed $40,000,000 at any time outstanding, of which no more than $26,950,000 shall be used with respect to any sale and leaseback transaction of assets not owned by the Loan Parties or any of their respective Subsidiaries prior to the date such transaction is consummated;

(f) Section 6.13(b) of the Existing Credit Agreement is hereby amended and restated in its entirety with the following:

(b) Liquidity. (i) The Borrower will not permit Domestic Liquidity as of the last day of any fiscal quarter to be less than (x) from the Amendment No. 3 Effective Date through and including the date that is ninety (90) days after the Amendment No. 3 Effective Date, $10,000,000, and (y) thereafter, $20,000,000 and (ii) within five (5) Business Days following the last day of each fiscal quarter in which (A) the Consolidated Net Leverage Ratio of the Borrower and its Subsidiaries is equal to or greater than 3:00:1.00 or (B) Domestic Liquidity of the Borrower and its Subsidiaries is equal to or less than $35,000,000, the Borrower shall deliver to the Administrative Agent and each Lender a weekly projected cash flow statement of the Borrower and its Subsidiaries for the succeeding thirteen (13) weeks.

2. Conditions of Effectiveness. The effectiveness of this Amendment (the “Amendment No. 3 Effective Date”) is subject to the satisfaction (or effective waiver) of the following conditions precedent:

(a) The Administrative Agent (or its counsel) shall have received counterparts of this Amendment duly executed by the Borrower, the Lenders and the Administrative Agent (or photocopies thereof sent by fax, pdf or other electronic means, each of which shall be enforceable with the same effect as a signed original).

(b) The Administrative Agent shall have received payment of the Administrative Agent’s and its affiliates’ reasonable and documented out-of-pocket expenses (including reasonable and documented out-of-pocket fees and expenses of counsel for the Administrative Agent) in connection with this Amendment.

(c) The Administrative Agent (or its counsel) shall have received a duly executed copy of that certain Amendment No. 4 to Term Loan Credit Agreement, dated as of the date hereof (the “Term Loan Amendment”), duly executed by the Borrower, each other loan party thereto, and the Term Loan Agent, which such amendment shall be in form and substance reasonably satisfactory to the Administrative Agent.

3. Consent to Term Loan Amendment. Notwithstanding anything in the Amended Credit Agreement or the Intercreditor Agreement to the contrary, the Administrative Agent hereby consents to the amendment, supplementation, and modification of the Term Loan Credit Agreement pursuant to the Term Loan Amendment.

4. Representations and Warranties of the Borrower. The Borrower hereby represents and warrants as follows:

(a) This Amendment and the Amended Credit Agreement constitute legal, valid and binding obligations of the Borrower, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

(b) As of the date hereof and after giving effect to the terms of this Amendment, (i) no Default or Event of Default has occurred and is continuing or would result therefrom and (ii) the representations and warranties of the Loan Parties set forth in the Amended Credit Agreement and the other Loan Documents are true and correct in all respects with the same effect as though made on and as of the date hereof (it being understood and agreed that any representation or warranty which by its terms is made as of a specified date is true and correct only as of such specified date).

5. Reference to and Effect on the Existing Credit Agreement.

(a) Upon the effectiveness hereof, each reference to the Existing Credit Agreement in the Amended Credit Agreement or any other Loan Document shall mean and be a reference to the Amended Credit Agreement.

(b) The Amended Credit Agreement and all other documents, instruments and agreements executed and/or delivered in connection with the Existing Credit Agreement shall remain in full force and effect and are hereby ratified and confirmed.

(c) The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Administrative Agent or the Lenders, nor constitute a waiver of any provision of the Existing Credit Agreement or any other documents, instruments and agreements executed and/or delivered in connection therewith.

(d) This Amendment is a Loan Document.

6. Governing Law. This Amendment shall be construed in accordance with and governed by the law of the State of New York.

7. Headings. Section headings in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for any other purpose.

8. Counterparts. This Amendment may be executed by one or more of the parties hereto on any number of separate counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment that is an Electronic Signature transmitted by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page shall be effective as delivery of a

manually executed counterpart of this Amendment. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Amendment shall be deemed to include Electronic Signatures, deliveries or the keeping of records in any electronic form (including deliveries by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page), each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be; provided, that, without limiting the foregoing, (i) to the extent the Administrative Agent has agreed to accept any Electronic Signature, the Administrative Agent and each of the Lenders shall be entitled to rely on such Electronic Signature purportedly given by or on behalf of the Borrower or any other Loan Party without further verification thereof and without any obligation to review the appearance or form of any such Electronic Signature, and (ii) upon the request of the Administrative Agent or any Lender, any Electronic Signature shall be promptly followed by a manually executed counterpart. As used herein, “Electronic Signature” means an electronic sound, symbol, or process attached to, or associated with, a contract or other record and adopted by a Person with the intent to sign, authenticate or accept such contract or record.

[Signature Pages Follow]

IN WITNESS WHEREOF, this Amendment has been duly executed as of the day and year first above written.

NN, INC.,

as the Borrower

| | | | | |

| By: | /s/ Chris Bohnert |

| Name: | Chris Bohnert |

| Title: | Senior Vice President, Cheif Financial Officer |

NN POWER SOLUTIONS HOLDINGS, LLC, AUTOCAM CORPORATION,

NN PRECISION PLASTICS, INC.,

WHIRLAWAY CORPORATION,

CAPROCK MANUFACTURING, INC.,

CAPROCK ENCLOSURES, LLC,

PMC USA ACQUISITION COMPANY, INC.,

AUTOCAM-PAX, INC.,

BRAININ-ADVANCE INDUSTRIES LLC,

POLYMETALLURGICAL LLC,

SOUTHERN CALIFORNIA TECHNICAL ARTS, INC.,

GENERAL METAL FINISHING LLC,

WAUCONDA TOOL & ENGINEERING LLC,

ADVANCED PRECISION PRODUCTS, INC.,

HOLMED LLC,

HOWESTEMCO LLC,

PREMCO, INC.,

NN POWER SOLUTIONS, LLC,

PNC ACQUISITION COMPANY, INC.,

PMC ACQUISITION COMPANY, INC.,

PROFILES, INCORPORATED, as Loan Parties

| | | | | |

| By: | /s/ Chris Bohnert |

| Name: | Chris Bohnert |

| Title: | Authorized Signatory |

Signature Page to Amendment No. 3 to

Credit Agreement

JPMORGAN CHASE BANK, N.A.,

as Administrative Agent and as a Lender

| | | | | |

| By: | /s/ Andrew Rossman |

| Name: | Andrew Rossman |

| Title: | Executive Director |

Signature Page to Amendment No. 3 to

Credit Agreement

Cover Page

|

Aug. 29, 2024 |

| Cover [Abstract] |

|

| Entity Registrant Name |

NN, Inc.

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 29, 2024

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000918541

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39268

|

| Entity Tax Identification Number |

62-1096725

|

| Entity Address, Address Line One |

6210 Ardrey Kell Road, Suite 120

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28277

|

| City Area Code |

980

|

| Local Phone Number |

264-4300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

NNBR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

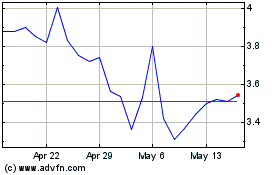

NN (NASDAQ:NNBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

NN (NASDAQ:NNBR)

Historical Stock Chart

From Jan 2024 to Jan 2025