false

--02-28

0000788611

0000788611

2025-02-24

2025-02-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 24, 2025

NextTrip,

Inc.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-38015 |

|

27-1865814 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3900

Paseo del Sol

Santa Fe, New Mexico |

|

87507 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (505) 438-2576

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

NTRP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

On

February 24, 2025, the Company and Blue Fysh Holdings Inc. (“Blue Fysh”) entered into a share exchange agreement (the “Share

Exchange Agreement”) whereby Blue Fysh agreed to issue 117 restricted shares of its common stock to the Company, representing a

ten percent (10%) interest in Blue Fysh, in exchange for 483,000 restricted shares of Series N Nonvoting Convertible Preferred Stock

(the “Series N Preferred”) of the Company at an issuance price of $5.00 per share (the “Share Exchange”). The

Share Exchange is expected to close on or about February 27, 2025. The parties entered into the Share Exchange Agreement, creating minority

ownership positions between the entities, as part of their mutual efforts to work together to expand each company’s business opportunities.

Pursuant

to the Share Exchange Agreement, the Company agreed to use commercially reasonable efforts to register the shares of common stock (the

“Conversion Shares”) issuable upon conversion of the Series N Preferred for resale by Blue Fysh, and further agreed not to

file any other resale registration statement with the Securities and Exchange Commission after closing of the transaction unless such

registration statement includes all of Conversion Shares. Additionally, the Share Exchange Agreement and the Certificate of Designation

for the Series N Preferred provide that the Series N Preferred shall not be convertible into Conversion Shares unless and until the Company

elects to solicit stockholder approval of the issuance of common stock upon conversion of the Series N Preferred, which is has agreed

to use commercially reasonable efforts to do on a prompt basis, and the stockholders of the Company have in fact approved such issuance

in accordance with the applicable rules and regulations of the Nasdaq Capital Market.

The

foregoing summary of the Share Exchange Agreement does not purport to be complete and is subject to, and qualified in its entirety by,

the copy of the Share Exchange Agreement attached as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”),

which is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

information in Item 1.01 regarding the issuance of the Series N Preferred to Blue Fysh is hereby incorporated herein by reference.

The

shares of Series N Preferred issued by the Company (the “Shares”) have not been registered under the Securities Act of 1933,

as amended (the “Securities Act”), or any state securities laws, and were issued to the respective recipients in transactions

exempt from registration under the Securities Act in reliance upon the exemption from registration provided by Section 4(a)(2) under

the Securities Act and/or Regulation D promulgated thereunder. Accordingly, the Shares constitute “restricted securities”

within the meaning of Rule 144 under the Act.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

February 25, 2025, the Company withdrew the certificates of designation for its Series A Preferred Stock, Series B Convertible Preferred

Stock, Series C Convertible Preferred Stock, Series D Convertible Preferred Stock and Series G Convertible Preferred Stock (the “Withdrawn

Certificates”) by filing Certificates of Withdrawal with the Nevada Secretary of State. There were no shares of preferred stock

outstanding under the Withdrawn Certificates when filed. Copies of the Certificates of Withdrawal of the Withdrawn Certificates are attached

hereto as Exhibits 3.1, 3.2, 3.3, 3.4 and 3.5 to this Current Report, which are incorporated by reference herein.

Item

7.01 Regulation FD Disclosure.

On

February 27, 2025, the Company issued a press release announcing the execution of the Share Exchange Agreement with Blue Fysh. A copy

of the foregoing press release is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and

is incorporated by reference herein.

The

information in this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall it be deemed subject to the requirements of Item 10 of Regulation S-K, nor shall it be

deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether

made before or after the date hereof, regardless of any general incorporation language in such filing. The furnishing of this information

hereby shall not be deemed an admission as to the materiality of any such information.

Forward-Looking

Statements

This

Current Report, including Exhibit 99.1 attached hereto, contains certain forward-looking statements that involve substantial risks and

uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes,”

“will” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking

statements in this Current Report, including Exhibit 99.1 attached hereto, or hereafter, including in other publicly available documents

filed with the Securities and Exchange Commission (the “Commission”), reports to the stockholders of the Company and other

publicly available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause

our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or

operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s

best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to,

the risks set forth herein and in such other documents filed with the Commission, each of which could adversely affect the Company’s

business and the accuracy of the forward-looking statements contained herein. The Company’s actual results, performance or achievements

may differ materially from those expressed or implied by such forward-looking statements.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

NEXTTRIP,

INC. |

| |

|

|

|

|

| Date: |

February

27, 2025 |

|

By: |

/s/

William Kerby |

| |

|

|

Name: |

William

Kerby |

| |

|

|

Title: |

Chief

Executive Officer |

Exhibit 3.1

Exhibit 3.2

Exhibit

3.3

Exhibit 3.4

Exhibit

3.5

Exhibit

10.1

SHARE

EXCHANGE AGREEMENT

THIS

SHARE EXCHANGE AGREEMENT (this “Agreement”), dated as of February 24, 2025 (the “Effective Date”),

is entered into by and among i) NextTrip, Inc., a Nevada corporation (“Purchaser” or “Nexttrip”);

and ii) Blue Fysh Holdings Inc. a Florida corporation with headquarters located at12210 SW Main St Portland OR97223 (“Seller”

or BF” or “Blue Fysh”). Each of BF and Purchaser may be referred to herein as a “Party”

and collectively as the “Parties.”

RECITALS

WHEREAS,

Seller wishes to issue BF Voting Common Stock to purchaser which represents Ten Percent (10.00%) of the total issued and outstanding

BF Voting Common Stock (collectively the “BF Shares”);

WHEREAS,

Purchaser is a NASDAQ-listed company with approximately One Million Five Hundred Ninety Two Thousand and Seven Hundred Eighty Three (1,592,738)

common shares issued and outstanding at par value $0.001 per share and wishes to issue 483,000 Preferred Series N shares (“Seller

NTRP shares”) convertible to common stock (subject to blocker) at Five Dollars per share ($5.00) in exchange for a 10% ownership

of Blue Fysh.

WHEREAS

Purchaser and Seller are desirous of entering into a share exchange and believe there are significant commercial benefits in creating

minority ownership between the entities by way of a share exchange due to including but not limited to:

| |

i) |

Expanding

the audience reach of both companies by opening access to cross promote products and services of NextTrip’s FAST Channel (Compass.TV),

media platform (Travelmagazine.com) and Travel Products Platform (NextTrip.com) with Blue Fysh’s Point of Sale media screens

throughout North America. |

| |

|

|

| |

ii) |

Using

the expanded audience reach and platforms to increase advertising fees |

| |

|

|

| |

iii) |

Using

Blue Fysh’s sales force to assist with selling advertising on the NextTrip media platforms and/or on combined package sales

of NextTrip and Blue Fysh media platforms |

| |

|

|

| |

iv) |

By

way of using Blue Fysh media and outdoor billboard displays to create flash marketing to cause awareness of NextTrip as a public

entity, NextTrip’s travel products and services, as well as Compass.TV and Travel Magazine media properties. |

| |

|

|

| |

v) |

To

allow for the introduction of each Parties’ strategic partnerships and relationships, where the Parties mutually agree it would

be of benefit. |

| |

|

|

| |

vi) |

As

a means to assist in potential future funding of the respective businesses due to the synergies, joint ownership and expanded reach

in markets by way of the share exchange. |

WHEREAS,

the Seller and Purchaser desire to set forth in writing the terms and conditions of their agreement and understanding concerning the

exchange of the BF Shares for the Seller NTRP Shares.

WHEREAS,

Seller, subject to the terms and conditions herein, including without limitation compliance by Purchaser and BF of the covenants and

conditions set forth in Section 8 of this Agreement, desire to effect a tax-free exchange under Section 351 of the United States Internal

Revenue Code of 1986, as amended (the “Code”), or such other tax free reorganization or restructuring provisions as

may be available under the Code, of their BF Shares for the number of shares of restricted preferred stock in the Purchaser, par value

$0.001 per share (“NTRP Shares”), set forth opposite such Seller’s name on Exhibit A, (the “Seller

NTRP Preferred Series N Shares”, or “Seller NTRP Shares”), and the Purchaser desires to issue the Seller

NTRP Preferred Series N Shares to Sellers, in exchange for the BF Shares, subject to the terms and conditions hereof, including, without

limitation Section 5; and

NOW,

THEREFORE, in consideration of the premises and the mutual covenants, agreements, and considerations herein contained, and other

consideration, which consideration the Parties hereby acknowledge and confirm the sufficiency and receipt of, the Parties hereto agree

as follows:

AGREEMENT

1.

Recitals. The foregoing recitals are true, correct, and complete in all respects and are incorporated herein by this reference.

2.

Share Exchange. At the Closing (hereinafter defined), the Seller shall transfer, sell, convey, assign and deliver such Seller’s

BF Shares to Purchaser and Purchaser shall issue and deliver to the Seller NTRP Shares in exchange for such Seller’s BF Shares,

calculated in accordance with Section 3 below.

3.

Consideration. The exchange ratio for the BF Shares shall be 10% of the outstanding Common Stock Purchased Share in exchange for

483,000 shares of NTRP Preferred Series N shares.

4.

[Intentionally omitted.]

5.

Representations and Warranties of Seller. Seller represents and warrants to Purchaser as of the Effective Date and the Closing Date,

that:

(a)

This Agreement has been duly executed and delivered by Seller and (assuming the due authorization, execution and delivery hereof by the

Purchaser) constitutes the valid and binding obligation of the respective Seller enforceable against each Seller in accordance with its

terms.

The

sale is being conducted in compliance with terms and conditions of a majority vote of the board of directors of BF to issue the BF Shares

and acknowledges that such issuance does not violate any previous agreements for its shareholder such as right of first refusal to purchase

the BF Shares. By its signature hereto, each Seller is waiving any such right of first refusal in the sale and exchange of BF Shares.

(b)

Seller has authority to issue BF shares with good and marketable title, free and clear of any liens, claims, charges, options, rights

of tenants or other encumbrances. The sale and delivery of the BF Shares held by each applicable Seller to the Purchaser pursuant to

this Agreement will vest in the Purchaser the legal and valid title to the BF Shares, free and clear of all liens, security interests,

adverse claims or other encumbrances of any character whatsoever, except for those associated with the restricted nature of the securities.

(c)

The BF Shares being exchanged hereunder are validly issued, fully paid and nonassessable.

(d)

Additional Representations:

| |

(i) |

Seller

can bear the economic risk of investment in the Seller NTRP Shares, has knowledge and experience in financial business matters, is

capable of bearing and managing the risk of investment in the Seller NTRP Shares. Seller recognizes that the Seller NTRP Shares have

not been registered under the Securities Act, nor under the securities laws of any state and, therefore, cannot be resold unless

the resale of the Seller NTRP Shares is registered under the Securities Act or unless an exemption from registration is available.

The Seller recognizes and understands that the ability to convert the Seller NTRP Shares are subject to the beneficial ownership

limitations as set forth in Section 7 of the Series N Convertible Preferred Certificate of Designation, a copy of which has been

furnished to Seller. The Seller is relying on its, his or her own investigation and evaluation of Purchaser and the Seller NTRP Shares

and not on any other information. |

| |

|

|

| |

(ii) |

The

Seller understands and acknowledges that each certificate or instrument representing the Seller NTRP Series N Preferred Shares will

be endorsed with the following legend (or a substantially similar legend), unless or until registered under the Securities Act, or

unless an exemption from registration exists in connection therewith: |

THE

SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE SOLD,

TRANSFERRED, ASSIGNED OR HYPOTHECATED UNLESS THERE IS AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT COVERING SUCH SECURITIES, THE

TRANSFER IS MADE IN COMPLIANCE WITH RULE 144 PROMULGATED UNDER SUCH ACT OR THE COMPANY RECEIVES AN OPINION OF COUNSEL FOR THE HOLDER

OF THESE SECURITIES WHICH IS REASONABLY SATISFACTORY TO THE COMPANY, STATING THAT SUCH SALE, TRANSFER, ASSIGNMENT OR HYPOTHECATION IS

EXEMPT FROM THE REGISTRATION AND PROSPECTUS DELIVERY REQUIREMENTS OF SUCH ACT.

| |

(iii) |

Prior

to Seller’s entry into this Agreement, Seller has had an opportunity to review, and has in fact reviewed, (i) Nexttrip’s

Annual Report on Form 10-K for the year ended February 28, 2024; and (ii) the Company’s current reports on Form 8-K and Form

10-Qs as filed with the SEC (which filings can be accessed by going to https://www.sec.gov/search/search.htm, typing “Nexttrip

Inc” in the “Company name” field, and clicking the “Search” button), from January 1, 2024, to the Effective

Date, in each case (i) including the audited and unaudited financial statements, description of business, risk factors, results of

operations, certain transactions and related business disclosures described therein (collectively the “Disclosure Documents”)

and an independent investigation made by it of Nexttrip. Seller acknowledges that due to its, his and her receipt of and review of

the information described above, such Seller has received similar information as would be included in a Registration Statement filed

under the Securities Act. |

| |

|

|

| |

(iv) |

Seller

acknowledges that it, is a sophisticated investor engaged in the business of assessing and assuming investment risks with respect

to securities, including securities such as the Seller NTRP Shares. |

6.

Representations and Warranties of Purchaser. Purchaser represents and warrants to Seller as of the Effective Date and the Closing

Date:

(a)

This Agreement has been duly executed and delivered by the Purchaser and (assuming the due authorization, execution and delivery hereof

by the Seller) constitutes the valid and binding obligation of the Purchaser enforceable against Purchaser in accordance with its terms.

The execution, delivery and performance by the Purchaser of this Agreement (i) does not contravene the terms of the Purchaser’s

organizational documents, (ii) does not violate, conflict with or result in any breach or contravention of, or the creation of any lien

or encumbrance under, any contractual obligation of the Purchaser or any law applicable to the Purchaser, and (iii) does not violate

any orders of any governmental authority against, or binding upon, the Purchaser.

(b)

Purchaser is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Nevada and all jurisdictions

where the nature of its business requires such licensing or qualifications. Purchaser has all necessary corporate power and authority

to conduct its business in the manner which its business is currently being conducted and to enter into this Agreement and perform its

obligations hereunder.

(c)

Except as set forth in this Agreement or otherwise obtained and delivered to Seller prior to the Closing, no approval, consent, compliance,

exemption, authorization or other action by, or notice to, or filing with, any or any entity, governmental agency, other person or individual,

and no lapse of a waiting period under any applicable law, is required to be obtained by the Purchaser in connection with the execution,

delivery, or performance by the Purchaser, of this Agreement.

(d)

All of the issued and outstanding Seller NTRP Preferred Series N Shares at the Closing (i) will have been duly authorized, validly issued,

fully paid and are non-assessable, (ii) will have been issued in compliance with all applicable federal and state securities laws, and

iii) will not have been issued in violation of any agreement, arrangement or commitment to which Company or any of its affiliates is

a party or is subject to or in violation of any preemptive or similar rights of any person.

(e)

Since February 28, 2024, there has been no material adverse change in the financial or other condition, properties or business operations

of Purchaser which has not been disclosed in a report filed with the Securities and Exchange Commission.

(f)

Purchaser has conducted its own independent investigation, review and analysis of the BF Shares and the business and assets of BF, together

with the results of operations, prospects, conditions (financial or otherwise) of the same and acknowledges that it has been provided

adequate access to the personnel, assets, properties, premises, books and records and other documents and data of Company for such purpose.

Purchaser acknowledges and agrees that in making its decision to enter into this Agreement and to consummate the transactions contemplated

hereby, Purchaser has relied on its own independent investigation and due diligence and on the representations and warranties of Seller

set forth in Section 5 of this Agreement. Purchaser has not relied on any representations and warranties, express or implied, other than

the representations and warranties of Seller set forth in Section 5 of this Agreement. The Purchaser acknowledges that it is purchasing

the BF Shares on an “As Is” basis, with no representations or warranties by the Seller, whether express or implied with respect

to the BF Shares or the Company other than the representations and warranties set forth in Section 5.

(g)

Purchaser understands that the BF Shares have not been registered under the Securities Act of 1933,

as amended (the “Securities Act”) or any other applicable state securities laws. Purchaser is an “accredited

investor”, as such term is defined in Regulation D of the Securities Act, and is purchasing the BF Shares for investment, for its

own account and not with a view to distribution thereof. The Preferred Series N Shares will be economically equivalent to NT Common Stock,

and upon stockholder approval, will automatically convert, for no additional value, into shares of NextTrip’s Common Stock, par

value $0.001 per share (the “NT Common Stock”) on a one-to-one basis, and have the rights and preferences set forth

in the draft Certificate of Designation attached hereto. It is the intent of the parties that, for purposes of Rule 144, Blue Fysh holding

period with regard to the NT Common Stock will commence at the Closing (i.e., it will get to tag onto the holding period for the

Series N Stock).

(h)

Next Trip will undertake all actions reasonably necessary to enable Blue Fysh to available itself of Rule 144 for purposes of selling

its NT Common Stock, including timely filing all of Next Trip’s Securities Act filings and delivering customary legal opinions

to Next Trip’s transfer agent.

(i)

Next Trip will use commercially reasonable efforts to register the resale of the shares of NT Common Stock issued upon conversion of

Blue Fysh’s Series N Stock and will file such registration after Closing and use commercially reasonable efforts to have such Registration

Statement declared effective by the SEC after the filing of the Registration Statement.

(j)

Additionally, Next Trip will grant to Blue Fysh customary piggyback registration rights. Next Trip will not file any resale registration

statement after the Closing unless such registration statement includes all of Blue Fysh’s NT Common Stock.

(k)

Blue Fysh will not be required to enter into any additional lock up agreements.

(l)

In accordance with the stockholder approval requirements of the NASDAQ, NextTrip will use its commercially reasonable efforts to promptly

seek to obtain stockholder approval of the conversion of the Preferred Series N Shares into NT Common Stock.

(m)

Intentionally Deleted.

(n)

The BF Shares do not trade publicly. Purchaser agrees, based on its due diligence, that the price set forth in Section 3 above is fair

and reasonable for the BF Shares.

7.

Representations and Warranties of Company.

(a)

BF represents and warrants to Purchaser as of the Effective Date, which representations and warranties shall also be true as of the Closing

Date, as follows:

(i)

BF is a corporation duly incorporated, validly existing and in good standing under the laws of Florida and has all necessary power and

authority to conduct its business and own its properties as now conducted and owned.

(ii)

For all periods ended on or prior to the Effective Date, BF has accurately completed, in all material respects, and has filed or will

file within the time prescribed by law (including extensions of time approved by the appropriate taxing authority) all tax returns and

reports required to be filed with the Internal Revenue Service, the Canadian Revenue Agency, any other states, province or governmental

subdivisions and all foreign countries and has paid, or made adequate provision for the payment of, all taxes, interest, penalties, assessments

or deficiencies known to be due.

(iii)

BF has a subsidiary, Blue Fysh LLC.

(iv)

No annual financial statement have been issued as of this date and there has been no material adverse change in the financial or other

condition, properties or business operations of BF.

(v)

There are no suits, proceedings or investigations pending or, to BF’s knowledge, threatened against or affecting BF or an officer

of BF which is reasonably likely to have a material adverse effect on the business, assets, or financial condition of BF.

(vi)

BF is in material compliance with its corporate governing documents and all applicable laws and regulations related to its business.

(vii)

All of the issued and outstanding BF Shares (i) have been duly authorized, validly issued, fully paid and are non-assessable, (ii) subject

to Section 5(e) above, have been issued in compliance with all applicable federal and state or provincial securities laws, (iii) will

not have been issued in violation of any agreement, arrangement or commitment to which Company or any of its affiliates is a party or

is subject to or in violation of any preemptive or similar rights of any person, and (iv) will have the rights, preferences, powers,

restrictions and limitations of BF’s voting common stock.

(viii)

BF is not subject to any formal order with any federal or state agency.

Prior

to the Closing, Company will not issue any stock or other equity to any party, and the percentage of issued and outstanding Class A common

stock of the Company being purchased by Purchaser shall be as set forth in the Recitals

8.

Covenants of Purchaser and BF. As condition to the closing on the sale of the BF Shares to Purchaser, Purchaser do hereby covenant

and agree:

(a)

No Board appointments are contemplated as a result of this transaction, however since Blue Fysh is a private entity, NextTrip will have

the right to appoint a representative to the Advisory Committee to convene with management for purposes of financial updates as may be

needed for reporting purposes with NextTrip Board and/or financial filings, new strategic initiatives, fundings and other financial events

that would significantly alter or affect NextTrip’s ownership position such that they may cause a revaluation of the asset. The

parties will enter into a customary Stockholder’s Agreement with regard to the BF Common Stock, including customary transfer restrictions

and tag- and drag-along provisions (the “Stockholder Agreement”).

The

transaction Closing documents will consist of (i) a Certificate of Designation of Series N Stock, (ii) the Stockholder Agreement to be

completed with thirty (30) days subsequent to Closing, (iii a Registration Rights Agreement, and (v) such other documents as customarily

required. The parties acknowledge the confidentiality of this Agreement and agree not to disclose, distribute or discuss the contents

contained herein with any third party other than their accountants and attorneys.

(b)

NextTrip agrees that it will not disclose, and will not include in any public announcement, the name of Blue Fysh, unless expressly agreed

to by Blue Fysh or unless and until such disclosure is required by law or applicable regulation, and then only to the extent of such

requirement. In the event that such disclosure is required by law or applicable regulation, NextTrip will provide notice of such disclosure

to Blue Fysh.

9.

The purchase and sale of the BF Shares shall take place at a closing to be held at such time, place and manner as shall be agreed

upon by the Parties (the “Closing” and the date on which the Closing occurs, the “Closing Date”).

The Closing shall occur on or before February 27, 2025, subject to the conditions to closing occurring as discussed below. As a condition

to Closing:

(c)

Each of the representations and warranties of Purchaser hereunder shall be true and correct at the Closing as though made at the Closing

Date and Purchaser shall have performed all covenants which by their terms are required to have been performed prior to Closing. Without

limiting the foregoing, Purchaser shall have fulfilled, to the reasonable satisfaction of the Seller, all of its obligations pursuant

to Section 8 of this Agreement (to the extent to be performed on or prior to the Closing Date).

(d)

Each of the representations and warranties of Seller and the Company hereunder shall be true and correct at the Closing as though made

at the Closing Date and Seller shall have performed any covenants which by their terms are required to have been performed prior to Closing.

(e)

Seller shall have delivered to Purchaser stock certificates, stock powers or such other instruments as necessary to evidence the transfer

of the BF Shares and a signed and completed Certificate of Accredited Investor Status.

(f)

Purchaser shall have delivered to the Seller such stock certificates or other instruments as necessary to evidence the issuance of the

Seller NTRP Shares to the Seller in the amounts as set forth in Exhibit A of this Agreement.

(g)

Purchaser shall have obtained all consents, orders, approvals, and/or waivers required to consummate the transactions contemplated herein,

including without limitation the approval of its board of directors and shareholders in accordance with applicable law, and shall have

delivered to Seller evidence of the same in form and substance reasonably satisfactory to Seller.

(h)

The Company shall have obtained any corporate consents or approvals in accordance with applicable law and delivered to Purchaser evidence

of the same in form and substance reasonably satisfactory to Purchaser.

10.

Restrictions on Transfer. Each certificate of BF Shares shall bear the following legend:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE BEEN ACQUIRED FOR INVESTMENT AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF

1933, AS AMENDED, OR ANY STATE SECURITIES OR BLUE SKY LAWS. THESE SECURITIES MAY NOT BE SOLD OR TRANSFERRED IN THE ABSENCE OF SUCH REGISTRATION

OR AN EXEMPTION THEREFROM UNDER SAID ACT OR LAWS. THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE ALSO SUBJECT TO A SHAREHOLDERS’

AGREEMENT DATED AS OF MARCH 14, 2018 BETWEEN BF AND THE OTHER PARTIES NAMED THEREIN. THE TERMS OF SUCH SHAREHOLDERS’ AGREEMENT

INCLUDE, AMONG OTHER THINGS, RESTRICTIONS ON TRANSFER. A COPY OF SUCH AGREEMENT MAY BE OBTAINED AT NO COST BY WRITTEN REQUEST MADE BY

THE HOLDER OF RECORD OF THIS CERTIFICATE TO THE SECRETARY OF BF.”

11.

Termination.

(a) This Agreement may be terminated prior to the Closing as follows:

(i) By the mutual written agreement of the Parties;

(ii)

By either Purchaser or Seller by written notice to the other party hereto if the Closing shall not have occurred by February 27th

2025, unless such date is extended by the mutual written consent of the Seller and the Purchaser; provided, however, that such

right shall not be available to any party whose breach of any representation, warranty, covenant or agreement under this Agreement has

been the cause of, or resulted in, the failure of the Closing to occur on or before such date.

(iii)

By either party by written notice to the other party, if such other party is in material breach of, or noncompliance with, any of its

representations, warranties, covenants, agreements or Closing conditions hereunder, and such material breach, if cureable, is not cured

within [10] business days of delivery of written notice of such breach.

(b)

If this Agreement terminates in accordance with this Section 11, it shall become null and void and have no further force or effect.

12.

Notices. All notices, demands and other communications provided for or permitted hereunder shall be made in writing and shall be

by registered or certified first-class mail, return receipt requested, telecopier, e-mail, courier service or personal delivery and shall

be deemed to have been duly given (i) when delivered by hand, if personally delivered; (ii) one business day after being sent, if sent

via a reputable overnight courier service guaranteeing next business day delivery; (iii) five (5) business days after being sent, if

sent by registered or certified mail, return receipt requested, postage prepaid; and (iv) when receipt is mechanically acknowledged,

if telecopied or e-mailed, in each case to the following addresses:

| |

(i)

|

if

to the Seller: |

| |

|

Blue

Fysh Holdings Inc. |

Registered

agent and Registered address is:

Michael

H Robbins Esq.

Shumaker

Loop & Kendrick LLP

101

East Kennedy Boulevard

Suite

2800

Tampa,

Florida, 33602

| |

(ii) |

if

to the Purchaser: |

| |

|

|

| |

|

William

Kerby |

| |

|

1560

Sawgrass Corporate Parkway |

| |

|

Suite

400 |

| |

|

Sunrise,

FL 33323 |

13.

Miscellaneous.

(a)

Further Assurances. Each party shall do and perform, or cause to be done and performed,

all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as

the other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation

of the transactions contemplated hereby.

(b)

Attorney’s Fees. BF shall pay the respective reasonable legal fees and expenses in connection with the preparation of this

Agreement and the subsequent Closing.

(c)

Severability. Whenever possible, each provision of this Agreement shall be interpreted in such a manner as to be effective and

valid under applicable law, but if any provision of this Agreement shall be prohibited by or invalid under applicable law, such provision

shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining

provisions of this Agreement.

(d)

Brokers. Each Party represents that is has not dealt with any broker, finder, commission agent, or other similar person in connection

with the offer or sale of the BF Shares and the transaction contemplated by this Agreement and is under no obligation to pay any broker’s

fee, finder’s fee, or commission in connection with such transaction.

(e)

Headings. The headings of sections contained in this Agreement are for convenience only and shall not be deemed to control or

affect the meaning or construction of any provision of this Agreement.

(f)

GOVERNING LAW. THIS AGREEMENT SHALL BE GOVERNED BY AND

CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF FLORIDA WITHOUT GIVING EFFECT TO THE CONFLICT OF LAWS RULES OR CHOICE OF LAWS RULES

THEREOF OR OF ANY STATE.

(g)

Assignability and Binding Effect. This Agreement shall inure to the benefit of and be binding upon the Parties and their respective

successors, heirs, and permitted assigns. This Agreement is personal to the Parties and the rights and obligations hereunder shall not

be assignable without the express written consent of all Parties.

(h)

Third Parties. Nothing herein expressed or implied is intended or shall be construed to confer upon or give to any Person other

than the Parties and their successors, heirs, or permitted assigns, any rights or remedies under or by reason of this Agreement.

(i)

Multiple Counterparts. This Agreement may be executed in multiple counterparts, including by facsimile signature, each of which

shall be deemed to be an original, but all of which together shall constitute one and the same instrument.

(j)

Amendment. This Agreement may not be modified, amended, or supplemented except by an agreement in writing signed by all of the

Parties.

(k)

Entire Agreement. This Agreement constitutes the entire understanding between the parties hereto and supersedes all prior agreements

regarding the subject matter hereof, including, but not limited to the Prior Purchase Agreements which have been rescinded.

(l)

Review and Construction of Documents. Each Party represents to the others that (a) before executing this Agreement, said Party

has fully informed itself of the terms, contents, conditions and effects of this Agreement; (b) said Party has relied solely and completely

upon its own judgment in executing this Agreement; (c) said Party has had the opportunity to seek and has obtained the advice of its

own legal, tax and business advisors before executing this Agreement; (d) said Party has acted voluntarily and of its own free will in

executing this Agreement; and (e) this Agreement is the result of arm’s length negotiations conducted by and among the Parties

and their respective counsel.

[Signature

Page to Share Exchange Agreement Follows]

IN

WITNESS WHEREOF, the parties have executed this Agreement as of the date first set forth above to be effective as of the Effective

Date.

| PURCHASER: |

|

| NextTrip,

Inc. |

|

| |

|

|

| By:

|

/s/

Wiliam Kerby |

|

| Name: |

William

Kerby |

|

| Title: |

CEO |

|

| |

|

|

| COMPANY: |

|

| Blue

Fysh Holdings, Inc. |

|

| |

|

|

| By: |

/s/

Jacquie Boddaert |

|

| Name: |

Jacquie

Boddaert |

|

| Title: |

|

|

EXHIBIT

A

SELLER

AND EXCHANGE OF SHARES

| Name

of Seller |

|

BF

Shares |

|

Seller

NTRP Shares |

| Blue

Fysh Holdings Inc. |

|

117

Common Shares |

|

483,000

Preferred Series N Shares |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

EXHIBIT

B

Intentionally

Blank

EXHIBIT

C

CERTIFICATE

OF ACCREDITED INVESTOR STATUS

Exhibit

99.1

NextTrip

and Blue Fysh Announce Strategic Partnership and Share Exchange Agreement to Drive Mutual Growth

Enables

Expanded Audience Reach, Increased Advertising Revenue, Enhanced Sales Efforts, Increased Brand Awareness and Other Strategic Partnership

Opportunities

SUNRISE,

FL — February 27, 2025 – NextTrip, Inc. (NASDAQ: NTRP) (“NextTrip,” “we,” “our,” or the

“Company”), a leading travel technology company, and Blue Fysh Holdings Inc. (Blue Fysh), a premier provider of

digital out-of-home (“OOH”) media solutions, announced today that they have entered into a strategic partnership and share

exchange agreement. This collaboration is designed to unlock significant commercial benefits for both companies by creating minority

ownership between the entities.

The

share exchange agreement is expected to drive mutual growth through multiple strategic initiatives, including but not limited to:

Expanded

Audience Reach: The partnership will allow both companies to cross-promote their products and services, integrating NextTrip’s

FAST Channel (Compass.TV), media platform (TravelMagazine.com), and travel products platform (NextTrip.com) with

Blue Fysh’s expertise in digital OOH solutions throughout North America. This integration will significantly broaden their respective

customer bases.

Increased

Advertising Revenue: By leveraging the combined media assets, NextTrip and Blue Fysh will enhance their ability to broaden reach,

deployment, and expect to generate higher advertising fees, providing greater value to advertisers and stakeholders.

Enhanced

Sales Efforts: Blue Fysh’s strategic sales relationships will contribute to advertising sales across NextTrip’s media

platforms. This includes maximizing the monetization potential of both companies’ digital and physical advertising assets.

Increased

Brand Awareness: Blue Fysh’s media relationships and digital displays are anticipated to be utilized to create flash marketing

campaigns to raise awareness of NextTrip. These campaigns will highlight NextTrip’s travel products and services as well as its

media properties, Compass.TV and Travel Magazine.

Strategic

Partnership Opportunities: The agreement facilitates the introduction of each party’s strategic partnerships and relationships,

enabling mutually beneficial collaborations that align with both companies’ long-term business objectives.

“This

share exchange represents an exciting opportunity for NextTrip and Blue Fysh to leverage each other’s strengths, expand market

reach, and create new revenue streams,” said Bill Kerby, chief executive officer of NextTrip. “We believe that this collaboration

will drive significant value for both companies and our stakeholders.”

Ron

Hrynyk, Chairman of Blue Fysh, added, “By joining forces with NextTrip, we are enhancing our collective ability to deliver impactful

advertising and marketing solutions. Our proven success with other media providers has demonstrated the power of strategic media partnerships,

and we are excited to bring that expertise and momentum to NextTrip’s Compass TV. We believe this collaboration will unlock new

business opportunities, drive audience engagement, and offer innovative media solutions tailored to the evolving needs of our clients.”

The

companies anticipate that this strategic alignment will foster innovation, increase revenue potential, and enhance shareholder value

for both entities.

Additional

information regarding the share exchange and partnership is available in today’s Form 8-K filing available at sec.gov.

About

Blue Fysh

Blue

Fysh is focused on creating and implementing digital and network solutions that connect people to brands in the places they live, love

and work. Blue Fysh has implemented thousands of digital installations in diverse environments enabling media content clients to deliver

compelling marketing solutions that connect brands with consumers in high traffic environments. For more information, visit bluefysh.com.

About

NextTrip

NextTrip

(NASDAQ: NTRP) is a technology-driven platform delivering innovative travel booking and travel media solutions. NextTrip Leisure offers

individual and group travelers’ vacations to the most popular and sought-after destinations in Mexico, the Caribbean, and around

the world. The NextTrip Media platform – Travel Magazine – provides a social media space for viewers to explore, educate,

and share their “bucket list” travel experiences with friends. Additionally, NextTrip is launching an end-to-end content

ecosystem that utilizes AI-assisted travel planning to capture advertising, build brand awareness, reward loyalty, and drive bookings.

For more information and to book a trip, visit www.nexttrip.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended (which Sections were adopted as part of the Private Securities Litigation

Reform Act of 1995). Statements preceded by, followed by or that otherwise include the words “believe,” “anticipate,”

“estimate,” “expect,” “intend,” “plan,” “project,” “prospects,”

“outlook,” and similar words or expressions, or future or conditional verbs such as “will,” “should,”

“would,” “may,” and “could” are generally forward-looking in nature and not historical facts. These

forward-looking statements involve known and unknown risks, uncertainties and other factors. Among the important factors that could cause

actual results to differ materially from those indicated by such forward-looking statements are risks relating to, among other things,

continued development efforts for Compass.TV and the company’s other platforms; market acceptance and use of Compass.TV and NextTrip’s

other platforms; NextTrip’s ability to engage influencers to help expand its Compass.TV content and gain additional viewers; changes

to NextTrip’s relationship with Dooya; changes in travel, and in particular group travel, trends; changes in domestic and foreign

business, market, financial, political and legal conditions; unanticipated conditions that could adversely affect the company; the overall

level of consumer demand for NextTrip’s products/services; general economic conditions and other factors affecting consumer confidence,

preferences, and behavior in the travel industry; disruption and volatility in the global currency, capital, and credit markets; the

financial strength of NextTrip’s customers; NextTrip’s ability to raise additional capital to fund its operations; NextTrip’s

ability to implement its business strategy; changes in governmental regulation; NextTrip’s exposure to litigation claims and other

loss contingencies; stability of consumer demand for NextTrip’s products; any breaches of, or interruptions in, NextTrip’s

information systems; fluctuations in the price, availability and quality of products as well as foreign currency fluctuations; NextTrip’s

ability to maintain its Nasdaq listing; and changes in tax laws and liabilities, tariffs, legal, regulatory, political and economic risks.

NextTrip disclaims any intention to, and undertakes no obligation to, revise any forward-looking statements, whether as a result of new

information, a future event, or otherwise, except as required by applicable law. For additional information regarding risks and uncertainties

that could impact NextTrip’s forward-looking statements, please see disclosures contained in the company’s Annual Report

on Form 10-K for the fiscal year ended February 29, 2024 filed with the SEC on September 4, 2024 and our other filings with the SEC which

may be viewed at www.sec.gov.

Contacts

Chris

Tyson

Executive Vice President

MZ Group - MZ North America

949-491-8235

NTRP@mzgroup.us

www.mzgroup.us

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

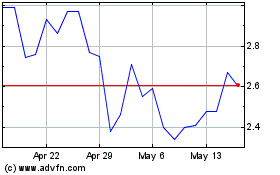

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Jan 2025 to Feb 2025

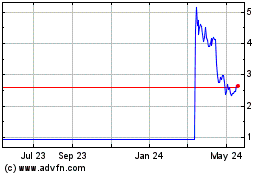

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Feb 2024 to Feb 2025