false

0001000694

0001000694

2025-03-04

2025-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 4, 2025

NOVAVAX, INC.

(Exact name of registrant as specified

in charter)

| Delaware |

|

0-26770 |

|

22-2816046 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

700 Quince Orchard Road

Gaithersburg, Maryland 20878

(Address of Principal Executive Offices,

including Zip Code)

(240) 268-2000

(Registrant’s telephone number,

including area code)

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, Par Value $0.01 per share |

|

NVAX |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On March 4, 2025, Novavax, Inc. (the “Company”)

will provide an update for investors at the TD Cowen 45th Annual Health Care Conference, sharing information relating to certain strategic

and business updates (the “Investor Presentation”), which is attached as Exhibit 99.1 to this Current Report on Form 8-K and

incorporated into this Item 7.01 by reference. A copy of the Investor Presentation will also be accessible on the Company’s website

at www.novavax.com under “Latest Investor Presentation.”

Cautionary Note Regarding Forward-Looking Statements.

This Current Report on Form 8-K and the Investor

Presentation attached as Exhibit 99.1 include forward-looking statements including statements related to our corporate strategy and operating

plans, objectives and prospects; strategic priorities and impact; its partnerships, including expectations with respect to potential royalties,

milestones, and cost reimbursement, and plans for additional potential partnering activities; expectations regarding manufacturing capacity,

timing, production and delivery for its COVID-19 vaccine; the transition of the lead responsibility for commercialization of Novavax’s

COVID-19 vaccine to Sanofi beginning with the 2025-2026 vaccination season; the development of Novavax’s clinical and preclinical

product candidates and innovation expansion opportunities, including with respect to new Matrix formulations; the conduct, timing and

potential results from clinical trials and other preclinical studies; scope, timing and outcome of future and pending regulatory filings

and actions, including the potential BLA approval for Novavax’s COVID-19 vaccine; full year 2025 financial guidance and revenue

framework; expected combined annual R&D and SG&A expenses for 2025 and 2026; negotiations regarding Novavax’s existing advance

purchase agreements; and Novavax’s future financial or business performance. Generally, forward-looking statements can be identified

through the use of words or phrases such as “believe,” “may,” “could,” “will,” “would,”

“possible,” “can,” “estimate,” “continue,” “ongoing,” “consider,”

“anticipate,” “intend,” “seek,” “plan,” “project,” “expect,” “should,”

“would,” “aim,” or “assume,” the negative of these terms, or other comparable terminology, although

not all forward-looking statements contain these words.

Forward-looking statements are neither historical facts nor assurances

of future performance. Instead, they are based only on our current beliefs and expectations about the future of our business, future plans

and strategies, projections, anticipated events and trends, the economy, and other future conditions. Forward-looking statements involve

estimates, assumptions, risks, and uncertainties that could cause actual results or outcomes to differ materially from those expressed

or implied in any forward-looking statements, and, therefore, you should not place considerable reliance on any such forward-looking statements.

Such risks and uncertainties include, without limitation, challenges or delays in obtaining regulatory authorization for its COVID-19

vaccine, in particular with respect to its BLA submission to the FDA for approval of its COVID-19 vaccine, or its product candidates,

including for future COVID-19 variant strain changes, its CIC vaccine candidate, its stand-alone influenza vaccine candidate or other

product candidates; Novavax’s ability to successfully and timely manufacture, market, distribute, or deliver its updated 2024-2025

formula COVID-19 vaccine and the impact of its not having received a BLA from the FDA for the 2024-2025 vaccination season; challenges

related to Novavax’s partnership with Sanofi and in pursuing additional partnership opportunities; challenges satisfying, alone

or together with partners, various safety, efficacy, and product characterization requirements, including those related to process qualification,

assay validation and stability testing, necessary to satisfy applicable regulatory authorities; challenges or delays in conducting clinical

trials or studies for its product candidates; manufacturing, distribution or export delays or challenges; Novavax’s substantial

dependence on Serum Institute of India Pvt. Ltd. and Serum Life Sciences Limited for co-formulation and filling Novavax’s COVID-19

vaccine and the impact of any delays or disruptions in their operations; difficulty obtaining scarce raw materials and supplies including

for its proprietary adjuvant; resource constraints, including human capital and manufacturing capacity; constraints on Novavax’s

ability to pursue planned regulatory pathways, alone or with partners; challenges in implementing its global restructuring and cost reduction

plan; Novavax’s ability to timely deliver doses; challenges in obtaining commercial adoption and market acceptance of its updated

2024-2025 formula COVID-19 vaccine or any COVID-19 variant strain containing formulation, or for its CIC vaccine candidate and stand-alone

influenza vaccine candidate or other product candidates; challenges meeting contractual requirements under agreements with multiple commercial,

governmental, and other entities, including requirements to deliver doses that may require Novavax to refund portions of upfront and other

payments previously received or result in reduced future payments pursuant to such agreements and challenges in amending or terminating

such agreements; challenges related to the seasonality of vaccinations against COVID-19 or influenza; challenges related to the demand

for vaccinations against COVID-19 or influenza; challenges in identifying and successfully pursuing innovation expansion opportunities,

including with respect to Novavax’s Matrix-MTM adjuvant; Novavax’s expectations as to expenses and cash needs may

prove not to be correct for reasons such as changes in plans or actual events being different than its assumptions;; and other risks and

uncertainties identified in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31,

2024, filed with the Securities and Exchange Commission (“SEC”) on February 27, 2025, and in Part II, Item 1A “Risk

Factors”, which may be detailed and modified or updated in other documents filed with the SEC from time to time, and are available

at www.sec.gov and at www.novavax.com. You are encouraged to read these filings as they are made.

We cannot guarantee future results, events, level

of activity, performance, or achievement. Any or all of our forward-looking statements in this Current Report on Form 8-K and the Investor

Presentation may turn out to be inaccurate or materially different from actual results. Further, any forward-looking statement speaks

only as of the date when it is made, and we undertake no obligation to update or revise any forward-looking statements, whether as a result

of new information, future events, or otherwise, unless required by law. New factors emerge from time to time, and it is not possible

for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The information in Item 7.01, including Exhibit

99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended, or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any registration

statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended,

except as shall be expressly set forth by specific reference in such filing. In addition, the contents of the Company’s website

are not incorporated by reference into this Current Report on Form 8-K and you should not consider information provided on the Company’s

website to be part of this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Novavax, Inc. |

| |

|

|

| Date: March 4, 2025 |

By: |

/s/ Mark Casey |

| |

Name: |

Mark Casey |

| |

Title: |

Executive Vice President, Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

Novavax Corporate Presentation March 2025 © 2025 NOVAVAX. All rights reserved.

2 Cautionary Note Regarding Forward - Looking Statements © 2025 NOVAVAX. All rights reserved. This presentation includes forward - looking statements . These forward - looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning . These forward - looking statements address various matters including Novavax’s corporate strategy and operating plans, objectives and prospects ; its strategic priorities and near - term priorities ; its partnerships, including expectations with respect to potential royalties, milestones, and cost reimbursement, and plans for additional potential partnering activities ; its expectations regarding manufacturing capacity, timing, production and delivery for its COVID - 19 vaccine ; the transition of the lead responsibility for commercialization of Novavax’s COVID - 19 vaccine to Sanofi beginning with the 2025 - 2026 vaccination season ; the development of Novavax’s clinical and preclinical product candidates and innovation expansion opportunities, including with respect to new Matrix formulations ; the conduct, timing and potential results from clinical trials and other preclinical studies ; scope, timing and outcome of future and pending regulatory filings and actions, including the potential BLA approval for Novavax’s COVID - 19 vaccine ; full year 2025 financial guidance and revenue framework ; expected combined annual R&D and SG&A expenses for 2025 and 2026 ; negotiations regarding Novavax’s existing advance purchase agreements ; and Novavax’s future financial or business performance . Novavax cautions that these forward - looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements . These risks and uncertainties include, without limitation, challenges or delays in obtaining regulatory authorization for its COVID - 19 vaccine, in particular with respect to its BLA submission to the FDA for approval of its COVID - 19 vaccine, or its product candidates, including for future COVID - 19 variant strain changes, its CIC vaccine candidate, its stand - alone influenza vaccine candidate or other product candidates ; Novavax’s ability to successfully and timely manufacture, market, distribute, or deliver its updated 2024 - 2025 formula COVID - 19 vaccine and the impact of its not having received a BLA from the FDA for the 2024 - 2025 vaccination season ; challenges related to Novavax’s partnership with Sanofi and in pursuing additional partnership opportunities ; challenges satisfying, alone or together with partners, various safety, efficacy, and product characterization requirements, including those related to process qualification, assay validation and stability testing, necessary to satisfy applicable regulatory authorities ; challenges or delays in conducting clinical trials or studies for its product candidates ; manufacturing, distribution or export delays or challenges ; Novavax’s substantial dependence on Serum Institute of India Pvt . Ltd . and Serum Life Sciences Limited for co - formulation and filling Novavax’s COVID - 19 vaccine and the impact of any delays or disruptions in their operations ; difficulty obtaining scarce raw materials and supplies including for its proprietary adjuvant ; resource constraints, including human capital and manufacturing capacity ; constraints on Novavax’s ability to pursue planned regulatory pathways, alone or with partners ; challenges in implementing its global restructuring and cost reduction plan ; Novavax’s ability to timely deliver doses ; challenges in obtaining commercial adoption and market acceptance of its updated 2024 - 2025 formula COVID - 19 vaccine or any COVID - 19 variant strain containing formulation, or for its CIC vaccine candidate and stand - alone influenza vaccine candidate or other product candidates ; challenges meeting contractual requirements under agreements with multiple commercial, governmental, and other entities, including requirements to deliver doses that may require Novavax to refund portions of upfront and other payments previously received or result in reduced future payments pursuant to such agreements and challenges in amending or terminating such agreements ; challenges related to the seasonality of vaccinations against COVID - 19 or influenza ; challenges related to the demand for vaccinations against COVID - 19 or influenza ; challenges in identifying and successfully pursuing innovation expansion opportunities, including with respect to Novavax’s Matrix - M TM adjuvant ; Novavax’s expectations as to expenses and cash needs may prove not to be correct for reasons such as changes in plans or actual events being different than its assumptions ; and the risks identified under the heading “Risk Factors” in Novavax’s most recent Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q, as well as subsequent filings with the Securities and Exchange Commission . Novavax cautions investors not to place considerable reliance on the forward - looking statements contained in this presentation . Investors are encouraged to read Novavax’s filings with the Securities and Exchange Commission, available at www . sec . gov and on our website at www . novavax . com , for a discussion of these and other risks and uncertainties . The forward - looking statements in this presentation speak only as of the date of this presentation, and we undertake no obligation to update or revise any of these statements . Our business is subject to substantial risks and uncertainties, including those referenced above . Investors, potential investors, and others should give careful consideration to these risks and uncertainties . Novavax TM (and all associated logos) is a trademark of Novavax, Inc . Matrix - M TM is a trademark of Novavax AB .

3 Non - GAAP Financial Measures © 2025 NOVAVAX. All rights reserved. The Company has used a non - GAAP financial measure in this presentation, which is Adjusted Licensing, Royalties and Other Revenue . Non - GAAP financial measures refer to financial information adjusted from financial measures prepared in accordance with accounting principles generally accepted in the United States (GAAP) . The Company believes that the presentation of this adjusted financial measure is useful to investors as it provides additional information on comparisons between periods by including certain items that affect overall comparability . The Company uses this non - GAAP financial measure for business planning purposes and to consider underlying trends of its business and believes presenting this measure also provides useful information to investors and others for understanding and evaluating trends in the Company’s expenses in the same manner as the Company’s management . Non - GAAP financial measures should be considered in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with GAAP . The use of this non - GAAP financial measure may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures . The Company is unable to reconcile this forward - looking non - GAAP financial measure to the most directly comparable GAAP measure without unreasonable effort because the Company is reliant on Sanofi sales forecasts for certain revenue categories, which are not available .

Table of Contents Corporate Overview and Growth Strategy • Corporate strategy • Novavax technology • Strategic priorities + impact • Pipeline Strategic Priorities • Executing on our Sanofi partnership • Leveraging our technology and pipeline to forge additional partnerships • Advancing our technology platform and early - stage pipeline Establishing a Lean Operating Model to Drive Shareholder Value • Lean and agile organization • Financial guidance and revenue framework 2025: Year Ahead • What to expect in 2025 and beyond 4 © 2025 NOVAVAX. All rights reserved.

Corporate Overview & Growth Strategy © 2025 NOVAVAX. All rights reserved. 5

Our strategy is focused on building a company based upon our scientific expertise in vaccines and our proven technology platform to achieve our ambition of tackling some of the world’s most pressing health challenges. Starting with our core expertise in infectious disease and expanding into other vaccine - preventable diseases and oncology, we will grow our own pipeline as well as collaborate to potentially improve or expand the portfolios of partners.” John C. Jacobs President and Chief Executive Officer Novavax is Focused on Harnessing the Promise of Vaccine Innovation to Help People Live Healthier Lives © 2025 NOVAVAX. All rights reserved. 6

Value - creating corporate growth strategy of research and development (R&D) plus business development supported by a lean operating model Phase 3 COVID - 19 - Influenza Combination (CIC) and stand - alone flu programs, plus disciplined approach to early - stage R&D as driver of innovative new assets Sanofi relationship serves as model for future strategic partnerships 7 Positioned for success Diversified & value - generating vaccine pipeline Differentiated & clinically proven technology Partner of choice Novavax is Driving Vaccine Innovation to Tackle Global Health Challenges and Create Value for Our Stakeholders Through R&D and Business Development Protein - based nanoparticle and Matrix - M have potential to generate best - in - class vaccines with reduced cost of goods © 2025 NOVAVAX. All rights reserved.

Technology Platform and Deep Vaccine Expertise Fuels Innovation and Partnerships 8 Matrix - M Adjuvant Our proprietary adjuvant can be added to vaccines to help induce a stronger, more potent and longer - lasting immune response . 2 Recombinant Protein - based Nanoparticle CLINICALLY PROVEN Our recombinant protein - based nanoparticle is highly immunogenetic and efficacious. 1 Excellent tolerability Favorable safety profile in clinical trials 2,3 Allow use of a lower dose of antigen that is still effective 2 Reduce the cost of production by using less antigen product when manufacturing 2 Potentially enable new vaccines to be developed for certain poorly immunogenic pathogens Helps immune system recognize a virus from different angles, improving immune response Reassuring safety profile 1 Refrigerator - stable Well - suited for development of combination vaccines Greater dose of antigen in a safe and targeted manner Disease - agnostic and adaptable CLINICALLY PROVEN 1.Dunkle LM, Kotloff KL, Gay CL et al. Efficacy and Safety of NVX - CoV2373 in Adults in the United States and Mexico. New England Journal of Medicine , 386(6), 531 - 543 (2022). 2.Heath PT, Galiza EP, Baxter DN et al. Safety and Efficacy of the NVX - CoV2373 COVID - 19 Vaccine at Completion of the Placebo - Controlled Phase of a Randomized Controlle d Trial. Clinical Infectious Diseases , (2022) 3.Áñez. Safety, Immunogenicity, and Efficacy of the NVX - CoV2373 COVID - 19 Vaccine in Adolescents. JAMA Netw Open. Published April 26, 2023. doi:10.1001/jamanetworkopen.2023.9135 4.Shinde V, Cai R, Plested J, Cho I, Fiske J, Pham X, Zhu M, Cloney - Clark S, Wang N, Zhou H, Zhou B, Patel N, Massare MJ, Fix A, Spindler M, Thomas DN, Smith G, Fries L, Glenn GM. Induction of Cross - Reactive Hemagglutination Inhibiting Antibody and Polyfunctional CD4+ T - Cell Responses by a Recombinant Matrix - M - Adjuvanted Hemagglutinin Nanoparticle Influenza Vaccine. Clin Infect Dis. 2021 Dec 6;73(11):e4278 - e4287. doi : 10.1093/ cid /ciaa1673. PMID: 33146720; PMCID: PMC8664440. 5.Shinde V, Cho I, Plested JS, Agrawal S, Fiske J, Cai R, Zhou H, Pham X, Zhu M, Cloney - Clark S, Wang N, Zhou B, Lewis M, Price - Abbott P, Patel N, Massare MJ, Smith G, Keech C, Fries L, Glenn GM. Comparison of the safety and immunogenicity of a novel Matrix - M - adjuvanted nanoparticl e influenza vaccine with a quadrivalent seasonal influenza vaccine in older adults: a phase 3 randomised controlled trial. Lancet Infect Dis. 2022 Jan;22(1):73 - 84. doi : 10.1016/S1473 - 3099(21)00192 - 4. Epub 2021 Sep 23. PMID: 34563277. 6.Linda Stertman , Anna - Karin E. Palm, Behdad Zarnegar , Berit Carow , Carolina Lunderius Andersson, Sofia E. Magnusson, Cecilia Carnrot , Vivek Shinde, Gale Smith, Gregory Glenn, Louis Fries & Karin Lövgren Bengtsson (2023) The Matrix - M adjuvant: A critical component of vaccines for the 21st century, Human Vaccines & Immunotherapeutics, 19:1, DOI: 10.1080/21645515.2023.2189885 7.Datoo MS, Natama HM, Somé A, Bellamy D, Traoré O, Rouamba T, Tahita MC, Ido NFA, Yameogo P, Valia D, Millogo A, Ouedraogo F, Soma R, Sawadogo S, Sorgho F, Derra K, Rouamba E, Ramos - Lopez F, Cairns M, Provstgaard - Morys S, Aboagye J, Lawrie A, Roberts R, Valéa I, Sorgho H, Williams N, Glenn G, Fries L, Reimer J, Ewer KJ, Shaligram U, Hill AVS, Tinto H. Efficacy and immunogenicity of R21/Matrix - M vaccine against clinical malaria after 2 years' follow - up in children in Bu rkina Faso: a phase 1/2b randomised controlled trial. Lancet Infect Dis. 2022 Dec;22(12):1728 - 1736. doi : 10.1016/S1473 - 3099(22)00442 - X. Epub 2022 Sep 7. PMID: 36087586. © 2025 NOVAVAX. All rights reserved.

9 1st product launch in 2022 WHO authorization of R21/Matrix - M malaria vaccine with Oxford University and Serum Institute of India New corporate growth strategy unveiled 2024 Evolution of Business Model to Focus on R&D and Diversified Partnerships COVID - 19 vaccine launched in multiple markets New leadership in 2023 New CEO and executive team restructure 2nd product launch in 2023 Sanofi partnership announced May 2024 Collaboration and licensing agreement with multiple potential revenue streams Focus on driving value through R&D and partnerships/collaborations Strong Foundation with Future Focus on Innovating and Partnering Our Technology Platform Foundational Technology Innovation to Vertically Integrated Commercial Company with Singular Focus on COVID - 19 © 2025 NOVAVAX. All rights reserved.

Corporate Growth Strategy New Corporate Strategy Delivers Value Through R&D and Partnerships In - house early - stage R&D to build a pipeline of high - value assets using our proven technology Partnerships to drive value creation for our R&D assets earlier in the development process, and for Matrix - M alone Three Priorities One Operating Model 1 2 1 2 3 Sanofi partnership Leverage our proven technology platform and pipeline to drive additional partnerships Lean and focused R&D and business development operating model 10 © 2025 NOVAVAX. All rights reserved. Advance technology platform and early - stage pipeline

Partner Authorized Use Phase 3 Phase 2 Phase 1 Preclinical Candidate Therapeutic Area Novavax Novavax COVID - 19 Vaccine 1 Respiratory diseases COVID - 19 COVID - influenza combination (CIC) vaccine Respiratory diseases COVID - 19 + seasonal influenza Influenza vaccine (older adults) Respiratory diseases Seasonal influenza RSV combinations (RSV, hMPV, other respiratory) Respiratory diseases Respiratory syncytial virus (RSV) Highly pathogenic H5N1 avian pandemic influenza vaccine Respiratory diseases H5N1 avian pandemic influenza Shingles vaccine Viral infection Varicella - zoster virus (shingles) C. diff vaccine Bacterial disease Clostridioides difficile (C. diff) colitis Matrix - M Matrix - M Matrix - M Matrix - M Matrix - M Matrix - M Matrix - M 1. Authorized in select geographies under trade names Novavax COVID - 19 Vaccine, Adjuvanted; Covovax ; and Nuvaxovid . In - House R&D Pipeline Diversification 11 © 2025 NOVAVAX. All rights reserved.

Partner Authorized Use Phase 3 Phase 2 Phase 1 Preclinical Candidate Therapeutic Area Developed by partners leveraging Novavax technology R21/Matrix - M adjuvant 1 Parasitic diseases Malaria RIV3 (FLUBLOK) - NCT06695130 2 Respiratory diseases COVID - 19 + seasonal influenza TIV - HD (FLUZONE High - Dose) NCT06695117 2 Respiratory diseases COVID - 19 + seasonal influenza Licensed rights to develop additional combination vaccines using our COVID - 19 vaccine Respiratory diseases Additional Vaccines Licensed rights to develop vaccines using our Matrix - M adjuvant Vaccines using our Matrix - M adjuvant Matrix - M 1. Commercialized by Serum Institute of India; Granted prequalification by the WHO and distributed by UNICEF to endemic countrie s i n Africa. 2. Granted Fast Track designation in the U.S. Phase 1/2 Matrix - M Phase 1/2 Matrix - M Additional Value Generation through Partnerships 12 © 2025 NOVAVAX. All rights reserved.

STRATEGIC PRIORITY 1 Sanofi Partnership © 2025 NOVAVAX. All rights reserved. 13

Our partnership with Sanofi sets the bar for what is possible when our novel technology platform is combined with others’ world - class commercialization capabilities. This collaboration with Sanofi is just the beginning. By leveraging our people, our science and our technology we aim to improve existing or create new products and, in the process, deliver outstanding value for all our stakeholders.” Elaine O’Hara Executive Vice President and Chief Strategy Officer Existing and Future Partnerships Promise to Increase Access to Our Technology and Fuel Value to Stakeholders © 2025 NOVAVAX. All rights reserved. 14

Sanofi P artnership has the Potential to Drive Business Through Multiple Revenue Streams 15 Co - exclusive license to co - commercialize Novavax’s current stand - alone adjuvanted COVID - 19 vaccine worldwide* Sole license to Novavax’s adjuvanted COVID - 19 vaccine for use in combination with Sanofi’s flu and other vaccines Non - exclusive license to use the Matrix - M adjuvant in vaccine products Sanofi took a minority (<5%) equity investment in Novavax * Except in countries with existing Advance Purchase Agreements and in India, Japan, and South Korea where Novavax has existi ng partnership agreements Future partnerships further validate our technology platform and have the potential to provide significant opportunity to drive value creation, increase access to our technology and benefit global health © 2025 NOVAVAX. All rights reserved.

16 Sanofi Partnership Has the Potential to Provide Durable Cash Flows Over Time $500M upfront payment received in Q2 2024 o $424M recognized in 2024 o $76M amortized over the performance period through 2026 $500 License, Royalties & Other Q2 2024 Upfront Payment and Equity Investment (~$570 Million) Equity investment ~$70 Balance Sheet Q2 2024 Pediatric database lock – revenue recognition amortized over performance period through 2026 $50 License, Royalties & Other Q4 2024 Milestones ($700 Million) BLA Approval – PDUFA date in April 2025 $175 Q2 2025 Transfer of U.S. market authorization $25 2025 Transfer of EU market authorization $25 2025 Technology transfer completed $75 Late 2026 Initiation of Phase 3 trial of Sanofi influenza - COVID - 19 program $125 Per Sanofi development plan First commercial sale of Sanofi combination product $225 Nuvaxovid tiered net product sales royalty High Teens to low Twenties % License, Royalties & Other 2025 & forward Royalties Sanofi influenza - COVID - 19 & other combination products tiered net product sales royalty Mid - single digits to sub teens % License, Royalties & Other Per Sanofi development plan Product supply, select R&D activities and technology transfer during the performance period through 2026 Variable License, Royalties & Other 2025 - 2026 Cost Reimbursement Payment Type Expected Event Timing* Line Item Amount ($M) Related To In addition, Novavax is eligible to receive economics under the Matrix - M license agreement New vaccines using Matrix - M: Launch and sales milestones of up to $200M plus mid - single digits royalties *Company estimate of when event may occur rather than when payment becomes due 1. Sanofi may select the first four of such products without having to pay these milestones © 2025 NOVAVAX. All rights reserved.

Significant Interest in Both Matrix - M and R&D Assets in Development Partnership potential in exploration phase • M aterial transfer agreement with a leading pharma company in Q4 2024 • Partnership interest in H5N1 avian pandemic influenza assets • Significant interest in partnering / out - licensing Matrix - M adjuvant CURRENT PARTNERSHIPS © 2025 NOVAVAX. All rights reserved. 17

STRATEGIC PRIORITY 2 Leveraging our Technology and Pipeline to Forge Additional Partnerships © 2025 NOVAVAX. All rights reserved. 18

Matrix - M Holds Incredible Promise for Our Own Vaccines and to Improve Other Companies’ Existing or New Vaccines R21/Matrix - M Malaria Vaccine: The Power of Matrix - M Partnership • Partnership with University of Oxford and Serum Institute of India • Used in multiple African countries to prevent malaria in children aged 5 months to 3 years, with 15+ countries to offer the vaccine by 2025 • One of only two malaria vaccines recommended for use in malaria endemic areas • Expected to save 10,000s of young lives every year 19 • Used in our COVID - 19 vaccine and to expand our pipeline • Exploring development of new Matrix - M formulations for new applications • Potential to enhance other companies’ existing and new vaccines • Executed multiple Material Transfer Agreements for Matrix - M with leading pharmaceutical companies © 2025 NOVAVAX. All rights reserved.

Value Proposition and Proof Points Matrix - M Can be Added to Vaccines to Induce Stronger and Longer - lasting Immune Response 20 © 2025 NOVAVAX. All rights reserved. 1. Stertman , L et al., 2023 2. Kalkeri , R et al., 2024 3. Datoo , MS et al., 2022 • Improve upon existing viral vaccines Example: Inactivated egg - based influenza • Improve immune response, antigen - sparing, reduce COGs Example: Pneumococcal polysaccharide • Explore opportunities and potential partnerships in oncology • Enable new vaccine development for poorly immunogenic pathogens • Explore development of new Matrix - M formulations for new applications • Increased magnitude and breadth of antibody response • Induces polyfunctional T - cells • Supports FcR - mediated responses • Antigen - sparing • Favorable safety and reactogenicity profile Actively partnering Matrix - M with vaccine companies to improve existing portfolios and bring new vaccines to market Matrix - M Adjuvant A ttributes 1,2,3

1 2 4 8 16 32 64 128 256 512 C o m p e t i n g A n t i b o d y E q u i v a l e n t ( C A E , μ g / m l ) HA (1.5 g/Strain) + Matrix-M (5 g) LOD Competition binning : A/Darwin/6/21 HA ✱✱✱✱ (p= <0.0001) ✱✱✱✱ (p= <0.0001) ✱ (p= 0.0299) Licensed IIV Licensed IIV + Matrix-M 21 Mice vaccinated on days 0 and 21, HAI measured at day 35 1 8 16 32 64 128 256 512 1024 2048 4096 H A I T i t e r ( G M T , 9 5 % C I ) Licensed IIV Licensed IIV + Matrix-M HA (0.5 g/Strain) + Matrix-M (5 g) A/Victoria/4897/22 B/Austria/1359417/21 A/Darwin/9/21 B/Phuket/3073/13 ✱✱ (p= 0092) ✱ (p =<0.0001) Competition binning: A/Darwin/6/21 HA 1 Matrix - M is Backed By Clinical Results That Show its Benefits When Added to Vaccines CASE STUDY Matrix - M has the potential to produce a more potent, highly protective vaccine by increasing the magnitude and breadth of response 1 © 2025 NOVAVAX. All rights reserved. 1. Portno A. et al.; Influenza hemagglutinin nanoparticle vaccine elicits broadly neutralizing antibodies against structurally distinct domains of H3N2 HA. Vaccines. 2020 Feb 22; 8, 99; doi:10.3390/vaccines8010099. HA (0.5µg/µ gStrain ) + Matrix - M (5µg) HA (1.5µg/µ gStrain ) + Matrix - M (5µg) HAI responses increased when Matrix - M given with licensed egg - derived inactivated influenza vaccine (IIV)

CASE STUDY Vaccine Vaccine + Matrix-M 10 1 10 2 10 3 10 4 10 5 Pneumococcal Vaccine (~3μg) I g G T i t e r ( E C 5 0 ) LOD 8.3 Fold- Rise Anti- Pneumococal Vaccine IgG Matrix - M Increases Antibody Detection Anti - Pneumococcal IgG Matrix - M Increases Antibody Activity Opsonophagocytic Killing (OPK) Mice vaccinated on days 0, 14, and 28. Antibody testing at day 42. Early Novavax research demonstrated that Matrix - M could produce a more potent bacterial vaccine, reducing the amount of antigen needed per dose and reducing manufacturing costs. 22 Early Research Shows Existing Pneumococcal Vaccines Could Benefit from Matrix - M © 2025 NOVAVAX. All rights reserved.

Novavax Combination and Stand - alone Flu Phase 3 Clinical Trial Initiated in December 2024 23 • Initiated Phase 3 trial in December 2024 • Initial cohort of ~2,000 participants • Immunogenicity comparisons to standalone COVID - 19 and commercial trivalent influenza vaccine • A dults age 65+ • Working with U.S. FDA to assess the potential feasibility accelerated approval for CIC • Continued market need: >60% consumer preference for all - in - one option 1 Commercial Flu Vaccine CIC Novavax's COVID - 19 Vaccine Novavax's Flu Vaccine Participants to be randomized to one of four arms: Immunogenicity comparisons Immunogenicity comparisons Intend to partner to advance to filing and commercialization © 2025 NOVAVAX. All rights reserved. 1. Source: Poulos, C., Buck, P. O., Ghaswalla , P., Rudin, D., Kent, C., & Mehta, D. (2025). US consumer and healthcare professional preferences for combination COVID - 19 and influenza vaccines. Journal of Medical Economics, 28(1), 279 – 290. https:// doi.org /10.1080/13696998.2025.2462412

Pursuing Partnership for our Differentiated Combination and Stand - alone Flu Vaccine Candidates Leverage Proven Technology Platform Commercialized COVID - 19 vaccine with demonstrated efficacy and tolerability profile Matrix - M induces broad antibody response and long - lived cellular response Trivalent influenza vaccine candidate with positive Phase 3 results generated Favorable side effect profile compared to mRNA offerings Broader protection against forward drifted strains Expected to be first available non - mRNA option Attractive TPP with prefilled syringe and refrigeration - stable storage 24 Influenza (65+) Influenza + COVID - 19 (65+) Anticipated Profile Advantages Anticipated Profile Advantages Robust immune responses that likely improve upon existing vaccines Broader protection against forward drifted strains Attractive target product profile (TPP) with potential for superiority versus current enhanced vaccines, with prefilled syringe and refrigeration - stable storage © 2025 NOVAVAX. All rights reserved.

Phase 2: Influenza + COVID - 19 (65+) Clinical Outcomes Highlight the Partnership Opportunity for our Programs in High - value Markets 25 CIC wild - type HAI* responses generally consistent with Fluzone ® HD and FLUAD ® Strong immune response with SARS - CoV - 2 anti - S IgG and neutralization responses achieved levels seen in Nuvaxovid TM Phase 3 trial Comparable reactogenicity to Fluzone ® HD and FLUAD ® *Baseline - adjusted wild - type HAI or MN or CD4+. FLUAD® is a registered trademark of Seqirus UK Limited; Fluzone ® High - Dose Quadrivalent® is a registered trademark of Sanofi Pasteur Inc. Influenza (65+) 44 – 89% higher HAI* responses for A strains compared to Fluzone ® HD; non - inferior B - strains 31 – 56% higher for all four strains compared to FLUAD ® 105 - 113% higher MN response to Fluzone ® HD and 67 – 86% higher than FLUAD ® for A strains Substantially higher polyfunctional* CD4+ to Fluzone ® HD or FLUAD ® Comparable reactogenicity to Fluzone ® HD and FLUAD ® Phase 2 Data Phase 2 Data © 2025 NOVAVAX. All rights reserved.

Solid Foundation to Advance Our Differentiated H5N1 Avian Pandemic Influenza Program Leveraging Our Infectious Disease Expertise to Address Potential Pandemics • H5N1 vaccine candidate currently undergoing preclinical evaluation • Evaluating multiple highly pathogenic avian influenza strains • Ability to quickly pivot to evaluate new strains as they emerge 26 Exploring Partnerships • Ready to join preparedness efforts and pursue funding opportunities • Currently available vaccines produce relatively low neutralization responses and seroconversion rates, so improved options are needed © 2025 NOVAVAX. All rights reserved.

STRATEGIC PRIORITY 3 Advancing our Technology and Early - stage Pipeline 27 © 2025 NOVAVAX. All rights reserved.

Novavax’s R&D expertise, paired with our transformative technology, should allow us to expand our pipeline with high - value programs.” Ruxandra Draghia - Akli, MD, PhD Executive Vice President and Head of R&D Novavax's Technology Creates Opportunities to Strategically Diversify Our Pipeline © 2025 NOVAVAX. All rights reserved. 28

We are Identifying Early - stage Pipeline and Innovation Expansion Opportunities as Part of Our R&D Strategy to Support Long - term Growth Core Expertise COVID - 19 - Influenza Combination (CIC), stand - alone seasonal influenza vaccine candidates COVID - 19 CIC Flu New Opportunities in Infectious Disease Therapeutic Area Expansion RSV Comb./ Avian Pandemic Flu Potential Expansion Beyond Infectious Diseases Oncology New Opportunities in Infectious Disease Varicella - Zoster (shingles), Clostridioides difficile (C. diff) colitis Experience in Infectious Disease RSV combinations and H5N1 avian pandemic influenza vaccine candidates 29 © 2025 NOVAVAX. All rights reserved.

Partner Authorized Use Phase 3 Phase 2 Phase 1 Preclinical Candidate Therapeutic Area Novavax Novavax COVID - 19 Vaccine 1 Respiratory diseases COVID - 19 COVID - influenza combination (CIC) vaccine Respiratory diseases COVID - 19 + seasonal influenza Influenza vaccine (older adults) Respiratory diseases Seasonal influenza RSV combinations (RSV, hMPV, other respiratory) Respiratory diseases Respiratory syncytial virus (RSV) Highly pathogenic H5N1 avian pandemic influenza vaccine Respiratory diseases H5N1 avian pandemic influenza Shingles vaccine Viral infection Varicella - zoster virus (shingles) C. diff vaccine Bacterial disease Clostridioides difficile (C. diff) colitis Matrix - M Matrix - M Matrix - M Matrix - M Matrix - M Matrix - M Matrix - M 1. Authorized in select geographies under trade names Novavax COVID - 19 Vaccine, Adjuvanted; Covovax ; and Nuvaxovid . In - House R&D Pipeline Diversification 30 © 2025 NOVAVAX. All rights reserved.

© 2025 NOVAVAX. All rights reserved. Advancing Early - Stage and Preclinical Programs in High - Value Vaccine - Preventable Diseases H5N1 Avian Flu RSV Combinations Varicella - zoster virus (Shingles) C. difficile • Non - human primate studies have shown our vaccine candidate can produce protective levels of immunity after a single dose • We stand ready to join pandemic preparedness efforts and are currently pursuing funding and partnership opportunities. • No RSV combinations available ; opportunity to develop differentiated combination with broader coverage • Building on our expertise and extensive history in this area • Our technology has the potential to improve on the current standard of care by enabling a more tolerable, less reactogenic, equally efficacious vaccine • Significant market opportunity • Significant unmet need, with no approved vaccine • Our technology has the potential to facilitate the development of a multivalent adjuvanted vaccine with enhanced activity ~$1B in H5N1 government contracts awarded since 2024 1 $1.5B+ U.S. market with ~ 400K hospitalizations annually for respiratory illness (excluding flu + COVID) 2 More tolerable entrant could substantially grow current ~$2B U.S. market and ~ $4.5B global market 3 $5B - $6B U.S. healthcare costs and ~500K hospitalizations annually; multi - billion market opportunity 4 Market Opportunity 1. Source: USASpending.gov ; CDC; Company Websites and Press Releases. 2. Source: Bhasin. J Hosp Med. 2024; Falsey . Open Forum ID. 2021; Philippot . Heliyon . 2024; Company Financial Reports. 3. Source: Company Financial Reports; GlobalData ; Evaluate Pharma. 4. Source: Feurerstadt . JAMDA. 2022; Guh . N Engl J Med. 2020; Song; GlobalData ; Evaluate Pharma. 31

Establishing a Lean Operating Model to Drive Shareholder Value © 2025 NOVAVAX. All rights reserved. 32

33 We remain focused on improving the financial strength and performance of Novavax to drive shareholder value. Through a diligent approach to our cost structure, we are creating an agile and lean organization that is positioned to deliver on our strategy.” Jim Kelly Executive Vice President, Chief Financial Officer and Treasurer Driving Shareholder Value While Remaining Agile © 2025 NOVAVAX. All rights reserved.

New Growth Strategy for Novavax Has Potential for Multiple Revenue Streams Areas of Potential Revenue Generation in 2025 and Beyond Are Not Included in 2025 Guidance 2025 Revenue Framework New Strategy Drives Revenue Growth via Partnering and Innovative R&D Core Spend Profile Focus on Lean and Efficient M odel Reduces C ost Structure 2025 R&D + SG&A Guidance Full Value Potential Revenue Cost Structure © 2025 NOVAVAX. All rights reserved. Long - term core spend profile of $250 million when adjusted to remove o CIC investment o Sanofi support Business plan 1 drives towards profitability 2 supported by a potential Sanofi CIC launch as early as 2027 A Revenues from existing Sanofi agreement (COVID, CIC & Matrix) plus new business development deals & partnerships to drive cash flow B Results in long term value creation by monetizing our innovative technology platform 1. Timing of the Sanofi CIC launch is a primary contributor to the timing of future Novavax profitability 2. Profitability defined as GAAP operating profit less SBC and depreciation C D 34

2025 is an Important Transition Year for Novavax Change to How Our Financials Will Look What Investors Should Expect During 2025 Revenue changes as we Track our progress on…. Focus on key value producing R&D programs and Eliminate the cost and complexity associated with commercialization activities Increase emphasis on licensing and royalty revenue from partners and pursue grant revenue opportunities and Decrease emphasis on product sales Operating expenses are expected to decrease significantly in 2025 & 2026 as we o Sanofi commercialization, U.S. BLA action & CIC development o $225 million in anticipated Sanofi milestones o Novavax CIC/Flu initial study cohort results by mid year o Additional BD announcements o Investor day in 2H 2025 35 © 2025 NOVAVAX. All rights reserved.

FY 2022 Actual FY 2023 Actual FY 2024 Actual FY 2025 Expected FY 2026 Expected FY 2027 Expected Reducing Operating Expenses to Enable Value Creation FY 2025 guidance for combined R&D and SG&A expenses of $475 - $525 million o Targeting ~70% of spend in R&D for 2025 o Majority of R&D spend relates to completion of our CIC/Flu program and support of Sanofi related activities Expect greater than $250 million in operating cost savings beginning in 2025 o End to lead commercialization role r educes annual operating costs by over $170 million o Sale of Czech Republic manufacturing facility r educes annual operating costs by ~$80 million (impacts both COGS & R&D expenses) $1.7B Combined Annual R&D and SG&A Expense $1.2B ~$1.5B & 85% reduction compared to FY 2022 $728M $475 - $525M ~$350M Expect a portion of 2025 & 2026 costs to be reimbursed by Sanofi under the agreement 36 © 2025 NOVAVAX. All rights reserved. ~$250M

2025 Revenue Framework 37 © 2025 NOVAVAX. All rights reserved. Full Year 2025 (as of February 27, 2025) $ in millions No guidance at this time Sanofi Royalties No guidance at this time Sanofi CIC and Matrix - M Milestones No guidance at this time Product Sales $300 - $350 Adjusted Licensing, Royalties and Other Revenue 1,2,3,4,5 1. $ 225 M in BLA & MAH Milestones . Novavax is eligible to receive from Sanofi a $ 175 million milestone payment upon the approval of the COVID - 19 U . S . BLA and inclusive of JN 1 and pre - filled syringe presentation, and two separate $ 25 million milestone payments upon the transfer to Sanofi of the Market Authorization for the U . S . and EU markets, respectively . 2. $ 15 M Database Lock Milestone Amortization . In December 2024 , Novavax triggered the payment for a $ 50 million milestone from Sanofi related to the COVID - 19 pediatric database lock and payment is expected in Q 1 2025 . Revenue recognition will occur over the performance period through 2026 . During 2024 , $ 16 million was recorded, and $ 15 million and $ 19 million are expected for 2025 and 2026 , respectively . 3. $ 35 M Upfront Payment Amortization . In 2024 , Novavax received a $ 500 million upfront payment upon signing of the Sanofi CLA . Revenue recognition will occur over the performance period through 2026 . During 2024 , $ 424 million was recorded , and $ 35 million and $ 41 million are expected for 2025 and 2026 , respectively . 4. $ 25 M to $ 50 M R&D Reimbursement . Under the Sanofi CLA, Novavax is eligible to receive reimbursement for costs incurred related to select R&D and technology transfer activities during the transition performance period that is expected to run through the end of 2026 . 5. $ 0 M to $ 25 M in Other partner revenue . Royalties and adjuvant reimbursement associated with collaborations with the Serum Institute on R 21 and collaboration partners for COVID - 19 vaccine including Serum, SK Bio and Takeda . Contribution to 2025 Adjusted Licensing, Royalties and Other Revenue Components of Total Revenue

Significant Value Creation Potential from Sanofi Related Revenue 38 © 2025 NOVAVAX. All rights reserved. Components of r evenue excluded from the 2025 Revenue Framework o Sanofi Royalties 1 o Sanofi CIC and Matrix M related M ilestones 2 o Nuvaxovid Product Sales 3 1. Sanofi Royalties . Sanofi will initiate lead commercial responsibility for the 2025 - 2026 vaccination season in select markets including the U . S . Novavax is eligible to receive royalties in the high teens to low twenties percent on Sanofi sales . Novavax is reliant on Sanofi’s sales forecast to estimate royalties and therefore these will not be included in full year 2025 guidance at this time . 2. Sanofi CIC and Matrix - M related milestones . Novavax is eligible to receive up to $ 350 million in Phase 3 development and commercial launch milestone payments associated with Sanofi influenza - COVID - 19 combination products . For each n ew vaccine using Matrix - M, Novavax is eligible to receive up to $ 200 million in launch and sales milestones and mid - single digit royalties for 20 years . 3. Nuvaxovid Product Sales . During the first half of 2025 , Novavax will continue to sell Nuvaxovid in the U . S . as it transitions the market to Sanofi beginning with the 2025 - 2026 vaccination season . These sales are expected to be immaterial . Novavax will sell Nuvaxovid commercial supply to Sanofi for the 2025 and 2026 seasons and the reimbursement for this supply will be recorded as product sales . For APA agreements, Novavax is working to amicably negotiate or deliver doses or when appropriate exit agreements with the goal of these activities to be cash flow neutral or favorable on a go forward basis . Expect significant future cash flows and value creation Components of Revenue Descriptions

2025: Year Ahead © 2025 NOVAVAX. All rights reserved. 39

40 © 2025 NOVAVAX. All rights reserved. 2025 and Beyond Additional Sanofi - related milestones Data from late - stage assets Additional and enhanced partnerships Advancement of early - stage pipeline WHAT TO EXPECT KEY MILESTONES U.S. COVID - 19 BLA PDUFA date of April 2025 Sanofi CIC Phase 3 trial initiation Sanofi royalty opportunities from fall 2025 COVID - 19 commercial performance Transition U.S. + EU markets to Sanofi Data from initial cohort in CIC and stand - alone influenza Phase 3 trial by mid 2025

Thank you 41 © 2025 NOVAVAX. All rights reserved.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

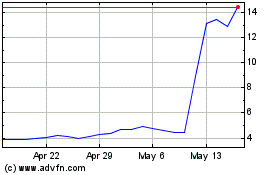

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Mar 2024 to Mar 2025