Goal Acquisitions Corp. (Nasdaq: PUCK) (“Goal”), a publicly traded

special purpose acquisition company, announced that on February 7,

2023 its shareholders approved an extension to extend the period of

time to consummate an initial business combination to March 18,

2023, subject to extension by the Board of Directors for up to five

additional thirty-day periods. More than 89% of shareholders voted

in favor of the extension, 9,546,357 public shares remain

outstanding, and Goal expects to have approximately $97,029,243

remaining in the trust account.

As previously announced on November 17, 2022 and described in

greater detail in a Current Report on Form 8-K filed by Goal with

the Securities and Exchange Commission (the “SEC”) on November 17,

2022, Goal and Digital Virgo Group (“Digital Virgo”), a global

leader providing access to mobile content, entertainment, and

commerce payable on a phone bill, that is building a one

destination hub enabling users to access the services and products

they want with just a mobile device—no credit card or bank account

needed, using carrier billing solutions or alternative payment

methods, entered into a business combination agreement. The

business combination agreement was amended and restated as of

February 8, 2023 (the “Amended and Restated Business Combination

Agreement”) as described in greater detail in a Current Report on

Form 8-K filed with the SEC on February 10, 2023.

Upon closing of the business combination, Digital Virgo is

expected to be the publicly traded entity for the combined company.

Closing is conditioned upon, among other things, regulatory and

shareholder approval.

About Digital Virgo

Digital Virgo enables worldwide access to mobile content,

entertainment, and commerce—all payable on a phone bill using

carrier billing solutions, or alternative payment methods. Offering

a global hub that connects merchants with telecom operators,

Digital Virgo facilitates the deployment, integration, and

optimization of mobile payment and distribution solutions to give

end users a secure and frictionless experience. Operating in 40+

countries and with more than 2 billion connected users, Digital

Virgo’s global network of local offices allows the company to roll

out scalable and sustainable mobile experiences worldwide. For more

information, visit digitalvirgo.com.

About Goal Acquisitions

Goal Acquisitions Corp. is a blank check company formed for the

purpose of effecting a merger, share exchange, asset acquisition,

stock purchase, recapitalization, reorganization, or other similar

business combination with one or more business entities. For more

information visit www.goalacquisitions.com.

No Offer or Solicitation

This press release is for informational purposes only and does

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which the offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

No Assurances

There can be no assurance that the proposed business combination

will be completed, nor can there be any assurance, if the business

combination is completed, that the potential benefits of combining

the companies will be realized. The description of the business

combination contained herein is qualified in its entirety by

reference to the definitive agreements relating to the business

combination, copies of which have been filed by Goal with the SEC

as an exhibit to a Current Report on Form 8-K on November 17, 2022

and, with respect to the Amended and Restated Combination Agreement

on Form 8-K filed with the SEC on February 10, 2023.

Participants in the Solicitation

Goal and Digital Virgo and their respective directors and

executive officers may be considered participants in the

solicitation of proxies from Goal’s stockholders with respect to

the potential transaction described in this press release under the

rules of the SEC. Information about the directors and executive

officers of Goal and their ownership of Goal’s securities is set

forth in Goal’s Final Prospectus filed with the SEC on February 16,

2021. Additional information regarding the persons who may, under

the rules of the SEC, be deemed participants in the solicitation of

Goal’s stockholders in connection with the potential transaction

will be set forth in the preliminary and definitive proxy

statements when those are filed with the SEC. These documents are

available free of charge at the SEC’s website at www.sec.gov or by

directing a request to Goal Acquisitions Corp., Attention: William

T. Duffy, telephone: (888) 717-7678.

Additional Information about the Proposed Business

Combination and Where to Find It

Digital Virgo has submitted with the SEC a Registration

Statement on Form F-4 (as may be amended, the “Registration

Statement”), which includes a preliminary proxy statement of Goal

and a prospectus in connection with the proposed business

combination involving Goal, Goal Acquisitions Nevada Corp. and

Digital Virgo pursuant to the business combination agreement by and

among the parties. STOCKHOLDERS OF GOAL AND OTHER INTERESTED

PERSONS ARE ADVISED TO READ, WHEN AVAILABLE, THE PRELIMINARY AND

DEFINITIVE PROXY STATEMENT/PROSPECTUS, ANY AMENDMENTS THERETO AS

WELL AS ANY OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED

WITH THE SEC IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION

BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT

GOAL, DIGITAL VIRGO AND THE BUSINESS COMBINATION. THE DEFINITIVE

PROXY STATEMENT/PROSPECTUS WILL BE MAILED TO STOCKHOLDERS OF GOAL

AS OF A RECORD DATE TO BE ESTABLISHED FOR VOTING ON THE BUSINESS

COMBINATION. ONCE AVAILABLE, STOCKHOLDERS OF GOAL WILL ALSO BE ABLE

TO OBTAIN A COPY OF THE PROXY STATEMENT/PROSPECTUS AND OTHER

DOCUMENTS FILED WITH THE SEC WITHOUT CHARGE, BY DIRECTING A REQUEST

TO: GOAL ACQUISITIONS CORP., ATTENTION: WILLIAM T. DUFFY,

TELEPHONE: (888) 717-7678. THE PRELIMINARY AND DEFINITIVE PROXY

STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS, ONCE

AVAILABLE, CAN ALSO BE OBTAINED, WITHOUT CHARGE, AT THE SEC’S

WEBSITE (WWW.SEC.GOV).

Forward-Looking Statements

The information in this press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words

such as “estimate,” “plan,” “project,” “forecast,” “intend,” “may,”

“will,” “expect,” “continue,” “should,” “would,” “anticipate,”

“believe,” “seek,” “target,” “predict,” “potential,” “seem,”

“future,” “outlook” or other similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters, but the absence of these words does not mean

that a statement is not forward-looking. These forward-looking

statements include, but are not limited to, (1) statements

regarding estimates and forecasts of financial and performance

metrics and projections of market opportunity and market share; (2)

references with respect to the anticipated benefits of the proposed

business combination and the projected future financial performance

of Goal and Digital Virgo’s operating companies following the

proposed business combination; (3) changes in the market for

Digital Virgo’s products and services and expansion plans and

opportunities; (4) Digital Virgo’s unit economics; (5) the sources

and uses of cash of the proposed business combination; (6) the

anticipated capitalization and enterprise value of the combined

company following the consummation of the proposed business

combination; (7) the projected technological developments of

Digital Virgo and its competitors; (8) anticipated short- and

long-term customer benefits; (9) current and future potential

commercial and customer relationships; (10) the ability to

manufacture efficiently at scale; (11) anticipated investments in

research and development and the effect of these investments and

timing related to commercial product launches; and (12)

expectations related to the terms and timing of the proposed

business combination. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of Digital Virgo’s and Goal’s

management and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by

any investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions. Many actual events and circumstances are

beyond the control of Digital Virgo and Goal. These forward-looking

statements are subject to a number of risks and uncertainties,

including the occurrence of any event, change or other

circumstances that could give rise to the termination of the

business combination agreement; the risk that the business

combination disrupts current plans and operations as a result of

the announcement and consummation of the transactions described

herein; the inability to recognize the anticipated benefits of the

business combination; the lack of a third-party fairness opinion in

determining whether or not to pursue the proposed business

combination; the ability to obtain or maintain the listing of

Digital Virgo on The Nasdaq Stock Market, following the business

combination, including having the requisite number of shareholders;

costs related to the business combination; changes in domestic and

foreign business, market, financial, political and legal

conditions; risks relating to the uncertainty of certain projected

financial information with respect to Digital Virgo; Digital

Virgo’s ability to successfully and timely develop, manufacture,

sell and expand its technology and products, including implement

its growth strategy; Digital Virgo’s ability to adequately manage

any supply chain risks, including the purchase of a sufficient

supply of critical components incorporated into its product

offerings; risks relating to Digital Virgo’s operations and

business, including information technology and cybersecurity risks,

failure to adequately forecast supply and demand, loss of key

customers and deterioration in relationships between Digital Virgo

and its employees; Digital Virgo’s ability to successfully

collaborate with business partners; demand for Digital Virgo’s

current and future offerings; risks that orders that have been

placed for Digital Virgo’s products are cancelled or modified;

risks related to increased competition; risks relating to potential

disruption in the transportation and shipping infrastructure,

including trade policies and export controls; risks that Digital

Virgo is unable to secure or protect its intellectual property;

risks of product liability or regulatory lawsuits relating to

Digital Virgo’s products and services; risks that the

post-combination company experiences difficulties managing its

growth and expanding operations; the uncertain effects of the

COVID-19 pandemic and certain geopolitical developments; the

inability of the parties to successfully or timely consummate the

proposed business combination, including the risk that any required

shareholder or regulatory approvals are not obtained, are delayed

or are subject to unanticipated conditions that could adversely

affect the combined company or the expected benefits of the

proposed business combination; the outcome of any legal proceedings

that may be instituted against Digital Virgo or Goal or other

following announcement of the proposed business combination and

transactions contemplated thereby; the ability of Digital Virgo to

execute its business model, including market acceptance of its

planned products and services and achieving sufficient production

volumes at acceptable quality levels and prices; technological

improvements by Digital Virgo’s peers and competitors; and those

risk factors discussed in documents of Goal and Digital Virgo which

were filed, or are to be filed, with the SEC. If any of these risks

materialize or our assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. There may be additional risks that

neither Goal nor Digital Virgo presently know or that Goal and

Digital Virgo currently believe are immaterial that could also

cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect Goal’s and Digital Virgo’s expectations, plans or forecasts

of future events and views as of the date of this press release.

Goal and Digital Virgo anticipate that subsequent events and

developments will cause Goal’s and Digital Virgo’s assessments to

change. However, while Goal and Digital Virgo may elect to update

these forward-looking statements at some point in the future, Goal

and Digital Virgo specifically disclaim any obligation to do so.

Readers are referred to the most recent reports filed with the SEC

by Goal. Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made,

and we undertake no obligation to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts

For inquiries regarding Digital Virgo, please contact: www.digitalvirgo.com/contact.

Media

For Digital Virgo media inquiries, please contact Communications Director Émilie Roussel:

press@digitalvirgo.com

For Goal Acquisitions media inquiries, please contact:

press@goalacquisitions.com

Investors

For investor inquiries at Digital Virgo, please contact:

ir@digitalvirgo.com

For investor inquiries at Goal Acquisitions, please contact:

info@goalacquisitions.com

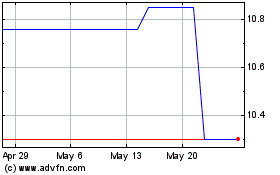

Goal Acquisition (NASDAQ:PUCK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Goal Acquisition (NASDAQ:PUCK)

Historical Stock Chart

From Dec 2023 to Dec 2024