Quest Resource Holding Corporation Reports Third Quarter 2024 Financial Results

November 07 2024 - 3:00PM

Quest Resource Holding Corporation (Nasdaq:

QRHC

) (“Quest” or the “Company”), a national

leader in environmental waste and recycling services, today

announced financial results for the third quarter ended September

30, 2024.

“We were very active during the third quarter: securing

significant new client wins, onboarding a record number of new

clients, and expanding engagements with existing ones. New client

onboarding, combined with strong demand from existing clients,

added approximately $16 million in revenue during the third

quarter. However, growth was partially offset by

weaker-than-expected conditions at certain clients in our

industrial end markets and isolated client attrition. In addition,

during the third quarter, we implemented our vendor management

system, which temporarily caused a significantly higher than

expected increase in cost of revenue and incremental SG&A in

support of the transition,” said S. Ray Hatch, President and Chief

Executive Officer of Quest.

“As a result of the hard work of our team, we have received high

marks from new clients, several of which have already been

reference clients, helping us to continue to grow our pipeline of

new business. In addition, we have made significant progress and

are in the final stages of selecting lenders to refinance our debt.

Based on initial proposals, the refinancing is on track to be

completed by the end of the year, and we expect both a significant

reduction in interest expense and improved terms. Based on the

continued ramp of new business and increasing efficiencies, we

expect to show year-over-year increases in revenue and

profitability during the fourth quarter. During 2025 and beyond, we

expect to continue to drive significant growth from new clients and

improve profitability from efficiency gains and earnings

leverage.”

Third Quarter 2024

Highlights

- Revenue was $72.8 million, a 3.3%

increase compared with the third quarter of 2023.

- Gross profit was $11.7 million, a

5.9% decrease compared with the third quarter of 2023.

- Gross margin was 16.1% of revenue

compared with 17.7% for the third quarter of 2023.

- GAAP net loss was $(3.4) million,

compared with GAAP net loss of $(2.1) million during the third

quarter of 2023.

- GAAP net loss per basic and diluted

share attributable to common stockholders was $(0.16), compared

with $(0.10) for the third quarter of 2023.

- Adjusted EBITDA was $2.5 million,

compared with $3.7 million during the third quarter of 2023.

- Adjusted net loss per diluted share

was $(0.06), compared with adjusted net income of $0.02 per diluted

share during the third quarter of 2023.

Year-to-Date 2024 Highlights

(September 30, 2024)

- Revenue was $218.6 million, a 0.2%

decrease compared with the same period of 2023.

- Gross profit was $39.3 million,

a 1.8% increase compared with the same period of 2023.

- Gross margin was 18.0% of revenue

compared with 17.6% during the same period of 2023.

- GAAP net loss was $(5.6) million,

compared with GAAP net loss of $(5.0) million during the same

period of 2023.

- GAAP net loss per basic and diluted

share attributable to common stockholders was $(0.27), compared

with $(0.25) during the same period of 2023.

- Year-to-date Adjusted EBITDA was

$12.8 million compared to $12.7 million during the same period of

2023.

- Adjusted net income per diluted

share was $0.05, compared with $0.12 per diluted share during the

same period of 2023.

Recent Highlights

- Secured a new client in the food

distribution business that is expected to produce seven figures of

annual revenue.

- Secured a new automotive service

client win that is expected to produce seven figures of annual

revenue.

- Completed the integration of

automated accounts payable processing system with solid waste

vendors, processing approximately 70% of invoices with zero human

interaction and 100% of invoices audited at the service line-item

level according to contractual terms.

- Progress in refinancing of existing

debt, on track for completion by the end of 2024 with significantly

better terms.

Third Quarter 2024 Earnings Conference

Call and Webcast

Quest will host a conference call on Thursday,

November 7, 2024, at 5:00 PM ET, to review the financial results

for the third quarter ended September 30, 2024. To participate,

dial 1-800-717-1738 or 1-646-307-1865. The conference call, which

may include forward-looking statements, is also being webcast and

is available via the investor relations section of Quest’s website

at https://investors.qrhc.com/investors. A replay of the webcast

will be archived on Quest’s investor relations website for 90

days.

About Quest Resource Holding

Corporation

Quest is a national provider of waste and

recycling services that enable larger businesses to excel in

achieving their environmental and sustainability goals and

responsibilities. Quest delivers focused expertise across multiple

industry sectors to build single-source, client-specific solutions

that generate quantifiable business and sustainability results.

Addressing a wide variety of waste streams and recyclables, Quest

provides information and data that tracks and reports the

environmental results of Quest’s services, gives actionable data to

improve business operations, and enables Quest’s clients to excel

in their business and sustainability responsibilities. For more

information, visit www.qrhc.com.

Reconciliation of U.S. GAAP to Non-GAAP

Financial Measures

In this press release, non-GAAP financial

measures, “Adjusted EBITDA” and “Adjusted Net Income (Loss)” are

presented. From time to time, Quest considers and uses these

supplemental measures of operating performance in order to provide

an improved understanding of underlying performance trends. Quest

believes it is useful to review, as applicable, both (1) GAAP

measures that include (i) depreciation and amortization, (ii)

interest expense, (iii) stock-based compensation expense, (iv)

income tax expense, and (v) certain other adjustments, and (2)

non-GAAP measures that exclude such items. Quest presents these

non-GAAP measures because it considers it an important supplemental

measure of Quest’s performance. Quest’s definition of these

adjusted financial measures may differ from similarly named

measures used by others. Quest believes these measures facilitate

operating performance comparisons from period to period by

eliminating potential differences caused by the existence and

timing of certain expense items that would not otherwise be

apparent on a GAAP basis. These non-GAAP measures have limitations

as an analytical tool and should not be considered in isolation or

as a substitute for the Company’s GAAP measures. (See attached

tables “Reconciliation of Net Loss to Adjusted EBITDA” and

“Adjusted Net Income Per Share”).

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, which provides a “safe harbor”

for such statements in certain circumstances. The forward-looking

statements include, but are not limited to, our expectation that we

will show year-over-year increases in revenue and profitability

during the fourth quarter, our expectation that we will continue to

drive significant growth from new clients and improving

profitability from efficiency gains and earnings leverage during

2025 and beyond, our expectation that our new client wins will

produce seven figures of annual revenue and our belief that we will

be able to refinance our existing debt by the end of 2024 on better

terms. Actual events or results could differ materially from those

discussed in the forward-looking statements as a result of various

factors, including, but not limited to, competition in the

environmental services industry, the impact of the current economic

environment, the spread of major epidemics (including Coronavirus)

and other related uncertainties such as government-imposed travel

restrictions, interruptions to supply chains, commodity price

fluctuations, extended shut down of businesses, and other factors

discussed in greater detail in our filings with the Securities and

Exchange Commission (“SEC”), including in our Annual Report on Form

10-K for the year ended December 31, 2023. You are cautioned not to

place undue reliance on such statements and to consult our SEC

filings for additional risks and uncertainties that may apply to

our business and the ownership of our securities. Our

forward-looking statements are presented as of the date made, and

we disclaim any duty to update such statements unless required by

law to do so.

Investor Relations Contact:

Three Part Advisors, LLCJoe Noyons

817.778.8424

Financial Tables Follow

|

Quest Resource Holding Corporation and

SubsidiariesSTATEMENTS OF OPERATIONS

(Unaudited)(In thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

72,766 |

|

|

$ |

70,425 |

|

|

$ |

218,562 |

|

|

$ |

219,036 |

|

| Cost of revenue |

|

|

61,066 |

|

|

|

57,995 |

|

|

|

179,294 |

|

|

|

180,471 |

|

| Gross profit |

|

|

11,700 |

|

|

|

12,430 |

|

|

|

39,268 |

|

|

|

38,565 |

|

|

Selling, general, and administrative |

|

|

10,273 |

|

|

|

9,620 |

|

|

|

29,457 |

|

|

|

28,250 |

|

|

Depreciation and amortization |

|

|

2,368 |

|

|

|

2,342 |

|

|

|

7,094 |

|

|

|

7,219 |

|

| Total operating expenses |

|

|

12,641 |

|

|

|

11,962 |

|

|

|

36,551 |

|

|

|

35,469 |

|

| Operating income (loss) |

|

|

(941 |

) |

|

|

468 |

|

|

|

2,717 |

|

|

|

3,096 |

|

|

Interest expense |

|

|

(2,723 |

) |

|

|

(2,408 |

) |

|

|

(7,807 |

) |

|

|

(7,407 |

) |

| Loss before taxes |

|

|

(3,664 |

) |

|

|

(1,940 |

) |

|

|

(5,090 |

) |

|

|

(4,311 |

) |

| Income tax expense

(benefit) |

|

|

(278 |

) |

|

|

111 |

|

|

|

465 |

|

|

|

650 |

|

| Net loss |

|

$ |

(3,386 |

) |

|

$ |

(2,051 |

) |

|

$ |

(5,555 |

) |

|

$ |

(4,961 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss applicable to common

stockholders |

|

$ |

(3,386 |

) |

|

$ |

(2,051 |

) |

|

$ |

(5,555 |

) |

|

$ |

(4,961 |

) |

| Net loss per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.16 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.25 |

) |

|

Diluted |

|

$ |

(0.16 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.25 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

20,666 |

|

|

|

20,060 |

|

|

|

20,542 |

|

|

|

19,985 |

|

|

Diluted |

|

|

20,666 |

|

|

|

20,060 |

|

|

|

20,542 |

|

|

|

19,985 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NET LOSS TO ADJUSTED

EBITDA(Unaudited)(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

September 30, |

|

|

September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net loss |

$ |

(3,386 |

) |

|

$ |

(2,051 |

) |

|

$ |

(5,555 |

) |

|

$ |

(4,961 |

) |

| Depreciation and

amortization |

|

2,613 |

|

|

|

2,438 |

|

|

|

7,714 |

|

|

|

7,486 |

|

| Interest expense |

|

2,723 |

|

|

|

2,408 |

|

|

|

7,807 |

|

|

|

7,407 |

|

| Stock-based compensation

expense |

|

571 |

|

|

|

289 |

|

|

|

1,291 |

|

|

|

950 |

|

| Acquisition, integration, and

related costs |

|

30 |

|

|

|

374 |

|

|

|

91 |

|

|

|

1,026 |

|

| Other adjustments |

|

261 |

|

|

|

141 |

|

|

|

980 |

|

|

|

172 |

|

| Income tax expense

(benefit) |

|

(278 |

) |

|

|

111 |

|

|

|

465 |

|

|

|

650 |

|

| Adjusted EBITDA |

$ |

2,534 |

|

|

$ |

3,710 |

|

|

$ |

12,793 |

|

|

$ |

12,730 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED NET INCOME (LOSS) PER SHARE(Unaudited)(In

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Reported net loss (1) |

$ |

(3,386 |

) |

|

$ |

|

(2,051 |

) |

|

$ |

(5,555 |

) |

|

$ |

(4,961 |

) |

| Amortization of intangibles

(2) |

|

2,209 |

|

|

|

|

2,224 |

|

|

|

6,650 |

|

|

|

6,668 |

|

| Acquisition, integration, and

related costs (3) |

|

30 |

|

|

|

|

374 |

|

|

|

91 |

|

|

|

1,026 |

|

| Other adjustments (4) |

|

— |

|

|

|

|

2 |

|

|

|

— |

|

|

|

(75 |

) |

| Adjusted net income

(loss) |

$ |

(1,147 |

) |

|

$ |

|

549 |

|

|

$ |

1,186 |

|

|

$ |

2,658 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

(loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reported net loss |

$ |

(0.16 |

) |

|

$ |

|

(0.10 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.25 |

) |

| Adjusted net income

(loss) |

$ |

(0.06 |

) |

|

$ |

|

0.02 |

|

|

$ |

0.05 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: Diluted (5) |

|

20,666 |

|

|

|

|

22,425 |

|

|

|

22,873 |

|

|

|

22,218 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Applicable

to common

stockholders (2)

Reflects the elimination of non-cash amortization of

acquisition-related intangible

assets (3) Reflects

the add back of acquisition/integration related transaction

costs (4) Reflects

adjustments to earn-out fair

value (5) Reflects

adjustment for dilution when adjusted net income is positive

|

BALANCE SHEETS(In thousands, except per share

amounts) |

| |

|

|

|

|

| |

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

| |

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,133 |

|

|

$ |

324 |

|

| Accounts receivable, less

allowance for doubtful accounts of $1,990and $1,582 as of September

30, 2024 and December 31, 2023, respectively |

|

|

60,125 |

|

|

|

58,147 |

|

| Prepaid expenses and other

current assets |

|

|

3,310 |

|

|

|

2,142 |

|

|

Total current assets |

|

|

64,568 |

|

|

|

60,613 |

|

| |

|

|

|

|

|

|

| Goodwill |

|

|

85,828 |

|

|

|

85,828 |

|

| Intangible assets, net |

|

|

20,006 |

|

|

|

26,052 |

|

| Property and equipment, net,

and other assets |

|

|

7,753 |

|

|

|

4,626 |

|

|

Total assets |

|

$ |

178,155 |

|

|

$ |

177,119 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

|

$ |

39,947 |

|

|

$ |

41,296 |

|

| Other current liabilities |

|

|

1,434 |

|

|

|

2,470 |

|

| Current portion of notes

payable |

|

|

1,159 |

|

|

|

1,159 |

|

|

Total current liabilities |

|

|

42,540 |

|

|

|

44,925 |

|

| |

|

|

|

|

|

|

| Notes payable, net |

|

|

71,901 |

|

|

|

64,638 |

|

| Other long-term

liabilities |

|

|

946 |

|

|

|

1,275 |

|

|

Total liabilities |

|

|

115,387 |

|

|

|

110,838 |

|

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

| Preferred stock, $0.001 par

value, 10,000 shares authorized, noshares issued and outstanding as

of September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value, 200,000 shares authorized,20,464 and 20,161 shares issued

and outstanding asof September 30, 2024 and December 31, 2023,

respectively |

|

|

20 |

|

|

|

20 |

|

| Additional paid-in

capital |

|

|

178,351 |

|

|

|

176,309 |

|

| Accumulated deficit |

|

|

(115,603 |

) |

|

|

(110,048 |

) |

|

Total stockholders’ equity |

|

|

62,768 |

|

|

|

66,281 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

178,155 |

|

|

$ |

177,119 |

|

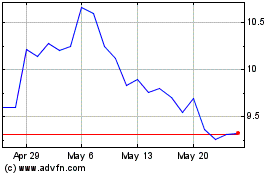

Quest Resource (NASDAQ:QRHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quest Resource (NASDAQ:QRHC)

Historical Stock Chart

From Nov 2023 to Nov 2024