As

filed with the U.S. Securities and Exchange Commission on October 15, 2024

Registration

Statement No.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

| SIDUS

SPACE, INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

4812 |

|

46-0628183 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

150

N. Sykes Creek Parkway, Suite 200

Merritt

Island, FL 32953

(321)

450-5633

(Address

and telephone number of registrant’s principal executive offices)

Carol

Craig

Chief

Executive Officer

Sidus

Space, Inc.

150

N. Sykes Creek Parkway, Suite 200

Merritt

Island, FL 32953

(321)

613-5620

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Jeffrey

J. Fessler, Esq.

Sean

F. Reid, Esq.

Sheppard, Mullin, Richter & Hampton LLP

30 Rockefeller Plaza

New York, NY 10112-0015

(212) 653-8700 |

|

Brad

L. Shiffman

Blank

Rome LLP

1271

Avenue of the Americas

New

York, NY 10020

Tel:

(212) 885-5000

|

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

|

Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

|

|

|

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities,

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

OCTOBER 15, 2024 |

Up to 3,745,318 Shares of

Class A Common Stock

Up

to 3,745,318 Pre-Funded Warrants to Purchase

up to 3,745,318 Shares of Class A Common Stock

Sidus

Space, Inc.

We

are offering up to 3,745,318 shares of our Class A common stock at an assumed public offering price of $2.67 (which is

the last sale price of our Class A common stock as reported by The Nasdaq Capital Market on October 10, 2024) on a firm commitment

basis. The actual public offering price per share of Class A common stock will be determined between us and the underwriters at the time

of pricing and may be at a discount to this assumed offering price. Therefore, the assumed public offering price used throughout this

prospectus may not be indicative of the final offering price of the shares of Class A common stock.

We

are also offering to each purchaser whose purchase of shares of our common stock in this offering would otherwise result in the purchaser,

together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the holder, 9.99%)

of our outstanding shares of Class A common stock immediately following the consummation of this offering, the opportunity to purchase,

if the purchaser so chooses, Pre-Funded Warrants to purchase shares of Class A common stock (“Pre-Funded Warrants”), in lieu

of shares of Class A common stock. The purchase price of each Pre-Funded Warrant is equal to the price per share of Class A common stock

being sold to the public in this offering, minus $0.001. The Pre-Funded Warrants will be immediately exercisable and may be exercised

at any time until all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Warrant we sell, the number of shares of

Class A common stock that we are offering will be decreased on a one-for-one basis.

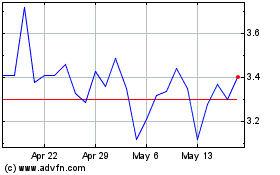

Our

Class A common stock is listed on The Nasdaq Capital Market under the symbol “SIDU”. On October 10, 2024, the

closing price as reported on The Nasdaq Capital Market was $2.67 per share. There is no

established trading market for the Pre-Funded Warrants and we do not intend to list the Pre-Funded Warrants on any securities

exchange or nationally recognized trading system.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have

elected to comply with certain reduced public company reporting requirements.

Investing

in our Class A common stock involves risks. See “Risk Factors” beginning on page 12.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share | |

Per

Pre-Funded

Warrant | |

Total |

| Price to the public | |

$ | | |

$ | | |

| |

| Underwriting discounts and

commissions(1) | |

$ | | |

$ | | |

| |

| Proceeds to us, before expenses | |

$ | | |

$ | | |

| |

| (1) |

Underwriting

discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the public offering price payable to

the underwriters. See “Underwriting” for a description of compensation payable to the underwriters. |

We

have granted a 45-day option to the representatives of the underwriter to purchase up to an additional 561,797 shares

of Class A common stock and/or Pre-Funded Warrants or any combination thereof, solely to cover over-allotments, if any.

The

underwriters expect to deliver the securities to purchasers on or about , 2024.

ThinkEquity

The date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Information Incorporated by Reference,” before deciding to invest in our

securities.

Neither

we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained

or incorporated by reference in this prospectus filed with the Securities and Exchange Commission (the “SEC”), and you should

rely only on the information contained in this prospectus or in any such free writing prospectus. We take no responsibility for and can

provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to

sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information contained

in this prospectus, or any document incorporated by reference in this prospectus, is accurate only as of the date of those respective

documents, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results

of operations and prospects may have changed since that date.

The

information incorporated by reference or provided in this prospectus contains estimates and other statistical data made by independent

parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this

prospectus from our own research as well as from industry and general publications, surveys and studies conducted by third parties. This

data involves several assumptions and limitations and contains projections and estimates of the future performance of the industries

in which we operate that are subject to a high degree of uncertainty, including those discussed in “Risk Factors.” We caution

you not to give undue weight to such projections, assumptions, and estimates. Further, industry and general publications, studies and

surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy

or completeness of such information. While we believe that these publications, studies, and surveys are reliable, we have not independently

verified the data contained in them. In addition, while we believe that the results and estimates from our internal research are reliable,

such results and estimates have not been verified by any independent source.

For

investors outside the United States (“U.S.”): We and the underwriters have not done anything that would permit this offering

or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the

U.S. Persons outside the U.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the securities and the distribution of this prospectus outside of the U.S. We

have not sought the consent of the sources to refer to their reports appearing or incorporated by reference in this prospectus.

The

Company’s brand and product names contained in this prospectus are trademarks, registered trademarks, or service marks of Sidus

Space, Inc. in the United States (“U.S.”) and certain other countries.

All

other trademarks, trade names and service marks appearing in this prospectus, or the documents incorporated by reference herein are the

property of their respective owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended

to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner. Solely for convenience,

trademarks, tradenames and service marks referred to in this prospectus appear without the ® and ™ symbols, but those references

are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the

applicable owner will not assert its rights, to these trademarks and trade names.

INFORMATION

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements that involve risks and uncertainties.

You should not place undue reliance on these forward-looking statements. All statements other than statements of historical facts contained

in this prospectus and the documents incorporated by reference herein are forward-looking statements. The forward-looking statements

in this prospectus and the documents incorporated by reference herein are only predictions. We have based these forward-looking statements

largely on our current expectations and projections about future events and financial trends that we believe may affect our business,

financial condition, and results of operations. In some cases, you can identify these forward-looking statements by terms such as “anticipate,”

“believe,” “continue,” “could,” “depends,” “estimate,” “expects,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “possible,”

“predict,” “project,” “should,” “will,” “would” or the negative of those

terms or other similar expressions, although not all forward-looking statements contain those words. We have based these forward-looking

statements on our current expectations and projections about future events and trends that we believe may affect our financial condition,

results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking

statements include, but are not limited to, statements concerning the following:

| |

● |

our

projected financial position and estimated cash burn rate; |

| |

|

|

| |

● |

our

estimates regarding expenses, future revenues and capital requirements; |

| |

|

|

| |

● |

our

ability to continue as a going concern; |

| |

|

|

| |

● |

our

need to raise substantial additional capital to fund our operations; |

| |

|

|

| |

● |

our

ability to compete in the global space industry; |

| |

|

|

| |

● |

our

ability to obtain and maintain intellectual property protection for our current products and services; |

| |

|

|

| |

● |

our

ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce

or protect our intellectual property rights; |

| |

|

|

| |

● |

the

possibility that a third party may claim we have infringed, misappropriated or otherwise violated their intellectual property rights

and that we may incur substantial costs and be required to devote substantial time defending against these claims; |

| |

|

|

| |

● |

our

reliance on third-party suppliers and manufacturers; |

| |

|

|

| |

● |

the

success of competing products or services that are or become available; |

| |

|

|

| |

● |

our

ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; and |

| |

|

|

| |

● |

the

potential for us to incur substantial costs resulting from lawsuits against us and the potential for these lawsuits to cause us to

limit our commercialization of our products and services. |

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with that may cause our actual results to differ from those anticipated in our forward-looking statements.

Please see “Risk Factors” contained in this prospectus and in the documents incorporated herein, including our Annual Report

on Form 10-K for the year ended December 31, 2023, for additional risks that could adversely impact our business and financial performance.

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for

our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

Considering these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus and

the documents incorporated by reference herein may not occur and actual results could differ materially and adversely from those anticipated

or implied in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events

and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither

we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual

results or to changes in our expectations.

You

should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration

statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and

events and circumstances may be materially different from what we expect.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained elsewhere in this prospectus and the documents incorporated by reference

herein and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus.

It does not contain all the information that may be important to you and your investment decision. You should carefully read this entire

prospectus, including the matters set forth under “Risk Factors,” included elsewhere in this prospectus and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included

in our Annual Report on Form 10-K for the year ended December 31, 2023 incorporated by reference herein, unless context requires otherwise,

references to “we,” “us,” “our,” “Sidus Space” “Sidus,” or “the Company”

refer to Sidus Space, Inc.

Unless

otherwise indicated, all share information and per share information contained in this prospectus gives effect to a 1-for 100 share reverse

stock split of the Company’s Class A common stock and Class B common stock effected on December 19, 2023

Company

Overview

Founded

in 2012, we are a space mission enabler that provides flexible, cost-effective solutions including custom satellite design, payload hosting,

mission management, space manufacturing and AI enhanced space-based sensor data for government, defense, intelligence, and commercial

companies around the globe.

Our

adaptable solutions provide mission flexibility while reducing time to orbit. We are able to provide customers a variety of mission options

whether they require a custom satellite design, payload hosting, mission management, or space sensor data as a service. Our solutions

are also cost-effective while still preserving the ability to respond to customer needs.

Our

modular LizzieSat™ satellite platform, which is the first of its kind 3D printed, artificial intelligence (AI) enhanced multi-mission

satellite, can host new payloads. Its flexible and modular design also enables it to be customized or scaled to create a new satellite

design in a cost-effective manner to meet mission requirements.

LizzieSat™

is also able to operate as a data service platform and deliver situational awareness for a wide variety of missions including visual

spectrum, methane, and AIS data collection. And by incorporating FeatherEdge™ AI into our on-orbit processing, we are able to provide

more efficient and effective data processing and delivery.

We

have proven space heritage and expertise in multi-disciplinary engineering, mission-critical hardware manufacturing, satellite design,

production, launch planning, mission operations, and in-orbit support. We are strategically headquartered on Florida’s Space Coast,

which provides easy access to nearby launch facilities, and we operate a 35,000-square-foot manufacturing, assembly, integration, and

testing facility which is ISO 9001:2015, AS9100 Rev. D certified.

We

designed, launched, and manage our own satellite LizzieSat™, which achieved first launch mission success in March of 2024. The

success of our LizzieSat™ is built upon our work over the last decade, where we produced numerous flight-proven systems, platforms,

devices and hardware for other customers.

We

continue to focus on innovation and agility. We are leveraging the knowledge from our first satellite to continue to advance the capabilities

of our additional satellites currently in production. The satellites, which are of similar size and weight to the initial LizzieSat™,

are expected to include the following enhancements:

| |

●

|

VPX

open architecture with simplified assembly and integration, reduced mass, and better performance |

| |

|

|

| |

● |

Integration

of a processor capable of handling one hundred trillion or tera operations per second. Tera Operations Per Second (TOPS) |

| |

|

|

| |

● |

Upgraded

payload processor with Field Programmable Gate Array (FPGA) capable of handling payloads at high speed up to three Gb/s; also includes

five times more computing power and more speed with a 1.8 GHz dual core processor |

| |

|

|

| |

●

|

Two

times more memory storage. |

| |

|

|

| |

●

|

Upgraded

2nd generation FeatherEdge AI/ML product that includes an Iridium module to enable intersatellite communication for low-latency direct-to-satellite

phone message delivery. |

Our

products and services are offered through several business units: Space-as-a-Service, Space-Based Data Solutions, Artificial Intelligence/Machine

Learning (AI/ML) Products and Services, Mission Planning and Management Operations, 3D Printing Products and Services, Satellite Manufacturing

and Payload Integration, and Space and Defense Hardware Manufacturing.

Our

vertically integrated model is complementary across each line of business aiming to expand existing and unlock new potential revenue

generating opportunities while maintaining diversity of revenue. We are not dependent on a single line of business or customer, which

provides us the “optionality” to scale where market needs demand. This diversity mitigates risks associated with external

factors like macroeconomic shifts or technological disruptions. Our flexibility allows us to adapt swiftly to market changes, supporting

growth across all our business lines.

Products

and Services

| |

● |

Space-as-a-Service capabilities: We replace traditional, product-centric Space business models and transform them into “-as-a-Service” models. For our customers, their capital expenditures are drastically reduced as design, development, and manufacturing of the satellite is no longer necessary. These resources can be redirected towards operations, and operating margins are higher as a result due to a more efficient approach to providing the service and taking advantage of lessons learned and economies of scale. |

| |

|

|

|

|

| |

|

|

● |

Satellite-as-a-Service

(SataaS): We offer integration of a customer payload or technology and handle the remaining services required including bus

development, launch, and ongoing mission operations, and provide data validation for success criteria. We consider the continued

operation of payloads as Constellation-as-a-Service. |

| |

|

|

|

|

| |

|

|

● |

Space

Platform-as-a-Service (SPaaS): We provide the ability for customers to build applications as a layer on our space platform.

Our architecture is flexible enough to support new customer missions post-launch (through software and algorithm updates), which

allows Sidus to generate additional revenue on LizzieSats that have already launched, these services allow software application developers

to use our network of sensors, software-defined radio and high-performance computer for their business cases. We

offer the ability to run a customer’s AI/ML software models on earth observation satellites without the customer having to

launch their own hardware. We consider extended operations of SPaaS as Space Based Data Solutions. |

| |

|

|

|

|

| |

|

|

● |

Constellation-as-a-Service

(CaaS): We offer satellites as a platform on which customer sensors and instruments can be flown as a service to collect

data from a specific geographic location to provide data to the customer on a monthly subscription basis. Our Constellation-as-a-Service

model shares our satellite and constellation with multiple customers and therefore offers CaaS customers more sensor data and capacity

for a fraction of traditional Earth Observation (EO) and Non-Earth Imaging (NEI) satellite costs. It also allows for rapid program

activation and increased resiliency for mission failures. |

| |

|

|

|

|

| |

● |

Space Based Data Solutions (SBDaaS): We offer several space-based platform missions depending on needs, budget, and timeframe. Our performance-based LizzieSat constellation provides data and results for commercial, and government demands of our interconnected, cloud-based, and data-driven world predicated on the specific sensors and technologies requested. Integrated AI provides fast pattern recognition with AI edge processing for identifying emerging issues and anomalies related to the data collection. Our LizzieSat design allows for simultaneous on-orbit data collection from multiple sensors with the flexibility to integrate new technologies during the production cycle. |

| |

● |

AI/ML Products and Services: We offer both software and hardware AI solutions for space. Our FeatherEdge solution, a compact data processing unit tailored for AI applications in orbit, redefines space efficiency. Its small size and low power design ensure seamless compatibility with diverse satellite platforms. By processing onboard sensor data directly and transmitting only crucial information, FeatherEdge reduces downlink costs and significantly bolsters response times for critical events in orbit. Additionally, it combines cutting-edge computing prowess with space grade reliability, delivering a complete AI payload in tandem with FeatherEdge software for unparalleled on-orbit edge computing capabilities. Our AI/ML products are integrated into each Sidus Space satellite but also available for integration into customer satellites. With FeatherEdge, customers can:

|

| |

|

|

| |

|

|

● |

Enhance

image processing capabilities for detailed EO and NEI applications |

| |

|

|

● |

Enable

Satellites to operate autonomously, streamlining mission tasks |

| |

|

|

● |

Facilitate

cloud-based data processing for space applications |

| |

|

|

● |

Contribute

to enhanced space surveillance and awareness |

| |

|

|

● |

Store

and compress data on-orbit efficiently |

| |

|

|

● |

Improve

radar capabilities for high-resolution imaging in space |

| |

|

|

|

|

| |

● |

Mission Planning and Management Operations: We provide 24/7/365 real-time routine and non-real-time mission operations for satellites and payload missions. This service supports end-to-end mission operations for small and medium-sized satellite operators, including satellite monitoring, control, and data management. We provide innovative mission operations solutions tailored to meet mission critical requirements including planning and validation, software suite operations and mission execution. |

| |

|

|

|

|

| |

|

|

● |

24/7/365

Operations for Low Earth Orbit (LEO) or cis-lunar missions |

| |

|

|

● |

Amazon

Web Services cloud-based servers for secure data transfer and archival |

| |

|

|

● |

Backup

control center capability allows around-the-clock operations if Sidus Mission Control Center (MCC) is unavailable. |

| |

|

|

● |

In-house

designed C2 routing, encryption, and customer API integration |

| |

|

|

● |

Multiple

ground station providers available for use to meet customer needs |

| |

|

|

● |

Physical and cyber security to ensure satellite and onboard payloads are protected |

| |

|

|

| |

● |

Mission Driven Satellite Solutions: We design and manufacture small satellites, leveraging advanced in-house and outsourced technologies. Our satellites are designed to provide improved and highly effective payload capacity and mission flexibility, offering cost-effective and reliable satellite options for customers. We also provide services including compliance assessment with government regulations, insurance, licensing, launch integration and space data delivery. |

| |

|

|

|

|

| |

● |

Space and Defense Hardware Manufacturing: Our manufacturing business operates within a 35,000 square foot facility in Cape Canaveral, Florida and is adjacent to our cleanroom. We blend the expertise of skilled engineers, expert technicians, and state-of-the-art equipment to meet the demanding needs of the space and defense market. From crafting prototypes and managing low-rate initial production to executing high-volume Swiss screw machining, we have over a decade of proven space flight heritage and space qualification experience in design, development, test and certification of space hardware, software, and manufacturing. We are experienced in mechanical and electrical flight hardware for satellites, the International Space Station, and other space assets. Manufacturing services include: |

| |

|

|

|

|

| |

|

|

● |

Precision

Machining |

| |

|

|

● |

Assembly

and Test |

| |

|

|

● |

Program

Management including supply chain management |

| |

|

|

|

|

| |

|

We have an approximately 10,000 square-foot reconfigurable avionics lab that produces a wide range of space system flight and ground cables, medical and mission critical wire harnesses, military harness assemblies, electronic chassis, and electro-mechanical assemblies. We hold an AS9100DAerospace certification, and we are International Traffic In Arms Regulations registered thereby positioning us, in combination with our existing tooling and capability, to address unique high-precision aerospace manufacturing requirements. |

| |

|

|

|

|

| |

|

We have supported multiple major government and commercial space programs that include Blue Origin, SpaceX, NASA’s Artemis / SLS, Collins Aerospace Spacesuits, Sierra Space’s Dream Chaser, Eutelasat Oneweb Satellites and the International Space Station and continue to provide manufacturing of space hardware for many of the programs |

| |

● |

3D

Printing Products and Services: Recently unveiled, our multi-material 3D printing services and printers enable the fabrication

of a complex satellite bus with unprecedented precision, efficiency and modularity. This technology revolutionizes the manufacturing

process, reducing production costs and lead times while reducing the weight of the satellite bus without

sacrificing its structural integrity. This 3D material has been used on-orbit and carries

a Technology Readiness Level (TRL) of TRL-9 for space applications. TRL-9 describes the maturity of a technology that has been proven

to work during a flight mission in space. |

| |

|

|

| As of September 2024, key achievements and successes include: |

| |

|

|

| |

● |

Launched

the first of several planned hybrid additive in-house manufactured (3D printed) satellites (“LizzieSats”) engineered

to have the capacity and adaptability to simultaneously host payloads for Sidusdriven data-as-a-service purposes and/or offer ‘ride-share’

opportunities for technology customers to deliver data to their end users. |

| |

|

|

| |

● |

Established

on-orbit data operations by completing the commissioning phase and activating payloads. The Sidus team has already achieved several

primary mission objectives and continues to work through the remaining tasks in a deliberate and systematic approach. Many competitors

launch a prototype satellite for the first launch, but LizzieSat-1 is a functional satellite with both customer and Sidus-owned

technology onboard. The NASA Stennis Space Center ASTRA team and Sidus Space successfully completed all ASTRA primary mission objectives

on LizzieSat-1. Once the ASTRA primary mission objectives were completed, NASA awarded Sidus Space with additional funding to complete

new critical mission objectives over the course of the next 12 months. |

| |

|

|

| |

● |

Signed

a multi-year and multi-launch agreement with Space-X thereby offering customers by extension a reliable, cost-effective launch service

with a steady cadence of launches. |

| |

|

|

| |

● |

Completed

build of the second LizzieSat (LizzieSat-2) planned to launch in the fourth quarter of 2024 with Sidus and customer payloads

installed. Sidus space is nearly complete with building and testing of the third commercial LizzieSat (LizzieSat-3)

with Sidus and customer hosted payloads installed. LizzieSat-3 launch is planned for Q1 2025. |

| |

|

|

| |

● |

Integrated

Edge Artificial Intelligence (AI) software into LizzieSat-1 satellite and demonstrated successful operations to offer on-orbit tailored

solutions to customers enabling geospatial data to be processed more effectively. LizzieSat-3 is expected to fly the next generation

version of the integrated Edge AI software which includes multiple enhancements in technology and rapid data transfer. |

| |

|

|

| |

● |

Established

a fully operational mission control center to manage satellite operations, orchestrate collection management tasks and satisfy data

distribution requests for our own constellations and others. |

| |

|

|

| |

● |

Achieved

flight heritage, which is the history of successful operation of a particular component, subsystem, or system in a space environment,

for our FeatherEdge edge computing hardware and software solutions. |

| |

|

|

| |

● |

Expanded

our capabilities and opportunities related to geospatial intelligence following the National Geospatial-Intelligence Agency’s

(NGA) award to provide research and development services to NGA’s Research and Development directorate as a subcontractor to

Solis Science. |

| |

|

|

| |

● |

Expanded

our capabilities related to Lunar following award of the NASA Lunar Terrain Vehicle Services Contract as a member of the Intuitive

Machines-led Moon Reusable Autonomous Crewed Exploration Rover team. |

We

plan to be a global provider of space-based data and insights by collecting data from space with no equivalent terrestrial alternatives.

We plan to initially focus on creating offerings in earth-based observations and Space situational awareness. These decisions are reinforced

by the growing and large addressable markets they represent.

Our

LizzieSat satellite platform has been designed to provide differentiated data collection when compared to industry alternatives. We plan

to lead the next generation of earth and space data collection by:

| |

● |

Collecting

on-orbit coincident data: LizzieSat is capable of hosting multiple-sensors on the same satellite to collect varying data types at

the same time and with the same collection geometry. On-orbit coincident collection benefits users by decreasing false positives

with complementary datasets that reinforce one another. |

| |

|

|

| |

● |

Analyzing

data on the satellite on-orbit: To maximize value and speed in data processing, we invested

resources into Artificial Intelligence (AI) and Machine Learning (ML) on-board the satellite through hardware and software development.

Our plans include integrating radiation hardened AI/ML capabilities alongside our on-orbit coincident data collection. |

| |

|

|

| |

● |

Reducing

data size: By processing data at the edge on-board LizzieSat, we reduce the file size by transmitting only the processed solution,

not the entire raw dataset. This enables us to move data from low-earth orbit to higher orbit data relay services (such as Iridium)

for a lower-cost and more continual data transmission option to our customers. |

| |

● |

Providing

a system flexible enough to support new customer missions post-launch (through software and algorithm updates) which allows Sidus

to generate additional revenue on LizzieSats that have already launched |

The

net value of data collected from our planned LizzieSat constellation is expected to allow organizations to make better decisions with

higher confidence, and increased accuracy and speed. We expect to enrich this processed data with customizable analytics users control

for their own use case, and in turn provide data as a subscription across industries to organizations so they can improve decision-making

and mitigate risk.

We

support a broad range of international and domestic governments and commercial companies including the Netherlands Organization, U.S.

Department of State, the U.S. Department of Defense, NASA, Collins Aerospace, Lockheed Martin, Teledyne Marine, Bechtel, OneWeb Satellites,

Parsons Corporation, and L3Harris in areas that include launch vehicles, satellite hardware, and autonomous underwater vehicles. Planned

services that benefit current and future customers include delivering space-based data that can provide critical insight for agriculture,

commodities tracking, disaster assessment, illegal trafficking monitoring, energy, mining, oil and gas, fire monitoring, classification

of vegetation, soil moisture, carbon mass, Maritime Automatic Identification System (AIS), Air Traffic Control Automatic Dependent Surveillance, and weather monitoring; providing the ability for customers to demonstrate that a technology (hardware or software) performs successfully

in the harsh environment of space and delivering space services. We plan to own and operate one of the industry’s leading U.S.

based low earth orbit small satellite (“smallsat” or “smallsats”) constellations focused on earth observation

and remote sensing. Our operating strategy is to continue to enhance the capabilities of our satellite constellation, to increase our

international and domestic partnerships and to expand our co-incident data analytics offerings in order to increase the value we deliver

to our customers. Our two operating assets—our satellite constellation and hardware manufacturing capability, complement each other

and stem from years of experience and innovation.

Key

Factors Affecting Our Results and Prospects

We

believe that our performance and future success depend on several factors that present significant opportunities but also pose risks

and challenges, including competition from better known and well-capitalized companies, the risk of actual or perceived safety issues

and their consequences for our reputation and the other factors discussed under “Risk Factors.” We believe the factors discussed

below are key to our success.

Expanding

Commercial Satellite Operations

Our

goal is to help customers understand how space-based data can be impactful to day-to-day business. Our strategy includes increasing the

demand downstream by starting out as end user focused. While others are focused on a data verticalization strategy specializing on key

sectors or a problem set, we believe that flexibility in production, low-cost bespoke design and ‘Bringing Space Down to Earth’

for consumers will provide a scalable model for growth. In Q1 2024, we successfully launched and began operations with our LizzieSat

multi-mission satellite.

In

Q2 2024, we announced the successful on-orbit activation of the FeatherEdge AI platform which enables us to deliver near real-time intelligence

derived from earth observation data. Further expanding the capabilities of our constellation, we implemented the SatLab A/S second-generation

automated identification system (AIS) technology into the LizzieSat satellite constellation. AIS technology uses sophisticated systems

on board marine vessels to identify and track ships to prevent collisions and protect life at sea. The integration of this technology,

combined with data from optical sensors on board LizzieSat enables unique vessel tracking and monitoring solutions while providing valuable

information about ship movements in real time.

We

have previously been approved for our X-band and S-band radio frequencies licensing through a published filing by the ITU on April 6,

2021. Such licenses are held through Aurea Alas, Ltd., an Isle of Man company, which is a Variable interest entity to us. The ITU filing

contains approved spectrum use for multiple X-Band and S-Band frequencies and seven different orbital planes, including 45 degrees. In

August 2023, the FCC granted Sidus a LizzieSat experimental launch and operating license for launch and deploy on a SpaceX Falcon 9 Transporter

10 mission. This license includes approval for orbital operations utilizing the previously approved ITU S-band and X-band frequencies

and ground station coverage. We have also filed an FCC Part 25 license request for the LizzieSat satellite constellation missions two

through five. The FCC Part 25 license request is near completion and is planned to be approved by the end of October 2024. The

National Oceanic and Atmospheric Administration (NOAA), an agency of the U.S. Department of Commerce, granted a Tier 1 license authorizing

Sidus to operate LizzieSat1-3, a private remote-sensing space system comprised of three satellites (LizzieSat-1 through LizzieSat-3 or

LS-1 through LS-3) in 2024. This license was updated and approved by NOAA after LizzieSat -1 launch to reflect the actual orbital

data and planned altitudes for imager operations.

The

imagery from Near-infrared and Short-wave infrared imagers will be integrated into our FeatherBox AI onboard processor and combined with

AIS data to detect marine traffic migration and illegal fishing activities, detect methane emissions and detect vegetative stress in

various agricultural areas. Any delays in commencing our commercial launch operations, including delays or cost overruns in obtaining

NOAA licenses or other regulatory approvals for future operations or frequency requirements, could adversely impact our results and growth

plans.

The

exact timing of launches is contingent on several factors, including satisfactory and timely completion of assembly, integrating and

testing of the satellites, regulatory approvals, confirmation of the launch slot timing by the launch provider, logistics, weather conditions,

and other factors, many of which are beyond our control.

Growing

and expanding our experienced space hardware operations

We

are seeking to grow our space and defense hardware operations, with a goal of expanding from one shift to two and a half shifts with

an increased customer base in the future. With current customers in the space, marine, and defense industries, our contract revenue is

growing, and we are in active discussions with numerous potential customers, including government agencies, large defense contractors

and private companies, to add to our contracted revenue. In the past decade, we have fabricated ground and flight products for the NASA

SLS Rocket and Mobile Launcher as well as other commercial space and satellite companies. We have supported customers such as Boeing,

Lockheed Martin, Northrop Grumman, Dynetics/Leidos, Blue Origin, United Launch Alliance, Collins Aerospace, L3Harris, OneWeb and Space

Systems Loral/Maxar. We have manufactured various products including fluid, hydraulic and pneumatic systems, electrical control systems,

cable harnesses, hardware lifting frames, umbilical plates, purge and hazardous gas disconnects, frangible bolts, reef cutters, wave

guides, customized platforms, and other precision machined and electrical component parts for all types of rockets, ground, flight and

satellite systems.

Vertically

Integrated Space Infrastructure Manufacturing

We

are designing, developing, manufacturing, and operating a constellation of proprietary smallsats. These satellites are designed for multiple

missions and customers and form the foundation of our satellite platform. Weighing approximately 100 kilograms each, these hybrid 3D

printed, modular satellites are being designed to be more functional than cubesats and nanosatellites and less expensive to manufacture

than the larger satellites in the 200-600kg range. In addition to our own satellites, we are expecting to design and manufacture customized

satellites for LEO and lunar applications for customers that include government and commercial entities.

Our

cost-efficient smallsats are being designed from the ground-up to optimize performance per unit cost. Our model is a movement from highly

bespoke, costly satellite manufacturing techniques to standardized bus with integration of customer needs at lower costs. We can integrate

technologies and deliver data on demand at lower costs than legacy providers due to our vertical integration, use of commercial off the

shelf (COTS) proven systems, cost-efficiencies, capital efficient constellation design, and adaptable pricing models.

We

design and manufacture our satellites at our Cape Canaveral facility. Our current configuration and facility are designed to manufacture

multiple satellites per month. Our vertical integration enables us to control our satellites through the entire design, manufacturing,

and operation process. Our years of experience manufacturing space hardware means we can leverage our manufacturing expertise and commercial

best practices for satellite production. Additionally, leveraging both in-house and partner-provided subsystem components and in-house

design and integration services, as well as operational support of satellites on orbit, to provide turn-key delivery of entire constellations

offer “concept to constellation” in months instead of years. Specifically, our offerings are expected to encompass all aspects

of hosted satellite and constellation services, including hosting customer payloads onto our satellites, and delivering data and constellation

services to customers from our space platform. These services are expected to allow customers to focus on developing innovative payloads

rather than having to design or develop complete satellite buses or satellites or constellations, which we will provide, along with ancillary

services that are likely to include telemetry, tracking and control, communications, processing, as well as software development and

maintenance. Our patented space-related technologies include a print head for regolith-polymer mixture and associated feedstock; a heat

transfer system for regolith; a method for establishing a wastewater bioreactor environment; vertical takeoff and landing pad and interlocking

pavers to construct same; and high-load vacuum chamber motion feedthrough systems and methods. Regolith is a blanket of unconsolidated,

loose, heterogeneous superficial deposits covering solid rock. It includes dust, broken rocks, and other related materials and is present

on earth, the moon, Mars, some asteroids, and other terrestrial planets and moons. We continue to patent our products including our satellites,

external platforms and other innovations.

Revenue

Generation

We

generate revenue by selling payload space on our satellite platform, providing engineering and systems integration services to strategic

customers on a project-by-project basis, and manufacturing space hardware to include satellites. Additionally, we intend to add to our

revenue by selling geospatial data and actionable intelligence captured through our constellation. This support is typically contracted

to both commercial and government customers under fixed price contracts and often includes other services. Due to the size and capacity

of our satellite, we plan to host a diverse array of sensors such as Multispectral and Hyperspectral Earth Observing Imagers, Maritime

Vessel RF Tracking receivers, UHF IoT Transceivers, Optical Communications systems, and others on a single platform that can simultaneously

address the needs of many customer requirements.

Lowering

Manufacturing Cost and Schedule

We

have developed a manufacturing model that provides rapid response to customer requirements including integration of customers technologies

and space-based data delivery. Our planned satellites are being designed to integrate COTS subsystems that are space-proven, can be rapidly

integrated into the satellite and replaced rapidly when customer needs change or evolve. Our vertically integrated manufacturing processes

give us the flexibility to make changes during the production cycle without impacting launch or costs.

Recent

Developments

Launch

and Deployment of First Satellite

On

March 4, 2024, we successfully launched and deployed our first LizzieSat satellite to low Earth orbit as part of SpaceX’s Transporter-10

Rideshare mission and are managing mission operations with the satellite from our operations center in Merritt Island, Florida. Our Mission

Control Center (MCC) team provides 24/7/365 coverage to monitor every aspect of a mission, from the health and status of the satellite

or spacecraft while in orbit, to performing operational tests throughout mission lifecycle. The MCC monitors propulsion, temperature,

on-board computers, and payload status and has the capability to identify potential risks, helping ensure the success of each mission.

Additionally, our MCC establishes and maintains bidirectional communication with satellites via a network of ground stations, allowing

for the transmittal of data and imagery while on-orbit back to Earth. Our MCC is scalable to support from one spacecraft to a full constellation

of many satellites and can support customers that do not have their own mission control capabilities.

As

part of LizzieSat operations we successfully completed an on-orbit autonomous systems demonstration mission for NASA Stennis. This marks

the first time NASA Stennis has ever flown a payload into space, recognized as a historic milestone by the NASA Stennis Center Director.

We were contracted by NASA to not only integrate and fly the technology but to handle launch and satellite activation and on-board data

collection. Once the primary mission objectives were completed, NASA provided Sidus Space with additional funding to complete new critical

objectives over the course of the next 12 months.

During

this mission we also demonstrated FeatherEdge’s ability to upload new algorithms post-launch, run a machine vision algorithm on

the hardware accelerator capable of processing data 300 times faster than a standard CPU, and to downlink health and status data to our

Sidus Mission Control Center in Merritt Island, FL. Our Google-powered AI processor sets the groundwork for substantial upgrades on future

launches, which is expected to include NVIDIA-powered AI accelerators with 25x more computing power than our previous version of FeatherEdge,

resulting in what we believe will be the highest performance edge computing capability on orbit.

March

2024 Public Offering

On

March 5, 2024, we completed an underwritten public offering of 1,321,000 shares of our Class A common stock at a public offering price

of $6.00 per share, for which we received approximately $7,100,000.00 of net proceeds. ThinkEquity served as sole underwriter for the

offering.

January

2024 Public Offering

On

January 29, 2024, we completed a public offering of 1,181,800 shares of our Class A common stock at a public offering price of $4.50

per share, and Pre-Funded Warrants to purchase up to 69,900 shares of Class A common stock at a public offering price of $4.499 per Pre-Funded

Warrant. ThinkEquity served as sole underwriter for the offering.

October

2023 Registered Direct Offering

On

October 11, 2023, we entered into a securities purchase agreement (the “Purchase Agreement”) with certain institutional investors,

pursuant to which we agreed to issue and sell to such investors, in a registered direct offering (the “October Offering”),

an aggregate of 2,000 shares of the Company’s Series A convertible preferred stock, par value $0.0001 per share and stated value

of $1,000 per share (the “Series A preferred stock”) at an offering price of $1,000 per share. Each share of Series A preferred

stock is convertible into shares of the Company’s Class A common stock at an initial conversion price of $10.152 per share (the

“Conversion Price”). The Conversion Price is subject to customary adjustments for stock dividends, stock splits, reclassifications

and the like, and subject to price-based adjustment, on a “full ratchet” basis, in the event of any issuances of common stock,

or securities convertible, exercisable or exchangeable for common stock, at a price below the then-applicable Conversion Price (subject

to certain exceptions). On January 5, 2024, pursuant

to Section 8(g) of the Certificate of Designation of Preferences and Rights of the Series A preferred stock (“COD”), our

board approved a reduction in the Conversion Price to $3.89642 per share, which is the Conversion Price the Series A preferred stock

would have adjusted to pursuant to Section 8(d) of the COD on January 15, 2024. In addition, the Purchase Agreement provides that until

October 13, 2024, the investors in the October Offering have a right to participate in a subsequent placement of our equity securities

(including this offering) of up to 50% of such subsequent placement.

Concurrently

with the sale of the Series A preferred stock, pursuant to the Purchase Agreement in a concurrent private placement, for each share of

Class A common stock issuable upon conversion of the Series A preferred stock purchased by the investor, such investor received an unregistered

warrant (the “Warrant”) to purchase one share of Class A common stock. An aggregate of 197,006 Warrants were issued in the

private placement, and each Warrant is exercisable for one share of the Company’s Class A common stock at an exercise price of

$10.152 per share, will be exercisable immediately upon issuance, and will have a term of five years from the date of issuance. The exercise

price is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based

adjustment, on a “full ratchet” basis, in the event of any issuances of Class A common stock, or securities convertible,

exercisable or exchangeable for Class A common stock, at a price below the then-applicable exercise price (subject to certain exceptions).

On January 9, 2024, pursuant to Section 2(h) of the Warrant, our board approved a reduction in

the exercise price of the Warrant to $3.89642 per share, which is the exercise price the Warrant would have adjusted to pursuant to Section

2(c) of the Warrant on January 15, 2024. As a result of the reduction of the exercise price, pursuant to Section (c) of the Warrant,

the number of shares underlying the Warrants increased to 513,292. As a result of this offering, the exercise price of the Warrant will

be reduced to $ per share and the aggregate number of shares of Class A common stock issuable upon exercise of the Warrant will be .

Corporate

Information

We

were formed as a limited liability company under the name Craig Technologies Aerospace Solutions, LLC on July 17, 2012. On April 15,

2021, we converted into a Delaware corporation, and on August 13, 2021 changed our name to Sidus Space, Inc. Our principal executive

offices are located at 150 N. Sykes Creek Parkway, Suite 200, Merritt Island, FL 32953 and our telephone number is (321) 450-5633. Our

website address is www.sidusspace.com. The information contained on our website is not incorporated by reference into this prospectus,

and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or

in deciding whether to purchase our Class A common stock.

Implications

of Being an Emerging Growth Company

As

a company with less than $1.235 billion in revenues during our last fiscal year, we qualify as an emerging growth company as defined

in the Jumpstart Our Business Startups Act (“JOBS Act”) enacted in 2012. As an emerging growth company, we expect to take

advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not

limited to:

| |

● |

being

permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure in this prospectus; |

| |

|

|

| |

● |

not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley

Act”); |

| |

|

|

| |

● |

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

|

| |

|

|

| |

● |

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved. |

We

may use these provisions until the last day of our fiscal year following the fifth anniversary of the completion of our initial public

offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated

filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.0 billion of non-convertible debt in any three-year

period, we will cease to be an emerging growth company prior to the end of such five-year period.

The

JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised

accounting standards. As an emerging growth company, we intend to take advantage of an extended transition period for complying with

new or revised accounting standards as permitted by The JOBS Act.

To

the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the

Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as

an emerging growth company may continue to be available to us as a smaller reporting company, including: (i) not being required to comply

with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (ii) scaled executive compensation disclosures;

and (iii) the requirement to provide only two years of audited financial statements, instead of three years.

THE

OFFERING

| Class

A common stock offered by us |

|

3,745,318

Shares, based on the sale of our common stock

at an assumed public offering price of $2.67 per share of Class A common stock, which is the last reported sale price of our

Class A common stock on The Nasdaq Capital Market on October 10, 2024, and no sale of any Pre-Funded Warrants |

| |

|

|

| Pre-Funded

Warrants offered by us |

|

We

are also offering to those purchasers, if any, whose purchase of the Class A common stock

in this offering would result in the purchaser, together with its affiliates and certain

related parties, beneficially owning more than 4.99% (or at the election of the purchaser,

9.99%) of our outstanding Class A common stock immediately following the consummation of

this offering, the opportunity to purchase, if they so choose, up to Pre-Funded Warrants,

in lieu of the common stock that would otherwise result in ownership in excess of 4.99% (or

9.99%, as applicable) of our outstanding Class A common stock.

The

purchase price of each Pre-Funded Warrant is equal to the price per share of Class A common stock being sold to the public in this

offering minus $0.001. The Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until exercised in

full.

This

prospectus also relates to the offering of Class A common stock issuable upon exercise of the Pre-Funded Warrants.

For

each Pre-Funded Warrant we sell, the number of shares of Class A common stock that we are offering will be decreased on a one-for-one

basis.

For

additional information regarding the terms of the Pre-Funded Warrants, see “Description of Securities We Are Offering.” |

| |

|

|

| Class

A common stock outstanding immediately prior to this offering(1) |

|

4,081,344

shares |

| |

|

|

| Class

A common stock outstanding immediately after this offering(1) |

|

7,826,662 shares

(assuming no exercise of the over-allotment option and no exercise of the Pre-Funded Warrants issued in connection with this

offering). |

| |

|

|

| Option

to purchase additional securities |

|

We

have granted the underwriters a 45-day option from the date of this prospectus, exercisable one or more times in whole or in part,

to purchase up to an additional 561,797 shares of Class A common stock and/or Pre-Funded Warrants ,based on the sale of our

common stock at an assumed public offering price of $2.67 per share of Class A common stock, which is the last reported sale

price of our Class A common stock on The Nasdaq Capital Market on October 10, 2024, or any combination thereof (15%

of the total number of shares of Class A common stock and/or Pre-Funded Warrants to be offered by us in the offering), solely to

cover over-allotments, if any. |

| |

|

|

| Use

of proceeds |

|

We

estimate that the net proceeds from this offering will be approximately $8.9 million (or approximately $10.2 million

if the underwriters exercise their option to purchase additional shares of Class A common stock in full), at an assumed public offering

price of $2.67 per share, which was the closing price of our Class A common stock on The Nasdaq Capital Market on October

10, 2024, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend

to use the net proceeds from this offering for (i) sales and marketing, (ii) operational costs, (iii) product development, (iv) manufacturing

expansion and (v) working capital and other general corporate purposes. We may also use a portion of the net proceeds to in-license,

acquire or invest in complementary businesses or products, however, we have no current commitments or obligations to do so. See “Use

of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| |

|

|

| Voting

rights |

|

We

have two classes of common stock: Class A common stock and Class B common stock. The rights of the holders of Class A common stock

and Class B common stock are identical, except with respect to voting rights. Each share of Class A common stock is entitled to one

vote. Each share of Class B common stock is entitled to ten votes and is convertible at any time into one share of Class A common

stock. The holders of our outstanding Class B common stock will hold approximately 11% of the voting power of our outstanding

capital stock following this offering. |

| |

|

|

| Risk

factors |

|

See

“Risk Factors” on page 12 and other information included in this prospectus for a discussion of factors to consider

carefully before deciding to invest in shares of our Class A Common Stock. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

Shares

of our Class A Common Stock are listed on The Nasdaq Capital Market under the symbol “SIDU.” There is no established

trading market for the Pre-Funded Warrants, and we do not expect a trading market to develop. We do not intend to list the Pre-Funded

Warrants on any securities exchange or nationally recognized trading system. |

(1)

The number of shares of Class A common stock that will be outstanding after this offering is based on 4,081,344 shares of Class A common

stock and 100,000 shares of Class B common stock outstanding as of October 10, 2024, and excludes:

| |

|

● |

100,000

shares of Class A common stock issuable upon conversion of our Class B Common Stock; |

| |

|

|

|

| |

|

● |

64,552

shares of Class A common stock issuable upon exercise of non-qualified stock options at a weighted average exercise price of $11.58

per share; |

| |

|

|

|

| |

|

● |

94,568

shares of Class A common stock issuable upon

exercise of warrants at an exercise price of $3.89 per share (which will increase to 137,779 shares after giving

effect to an anti-dilution adjustment to the warrants based on the assumed public offering price of $2.67 share in this offering); |

| |

|

|

|

| |

|

● |

8,061 shares of

Class A common stock issuable upon exercise of warrants at a weighted average exercise price of $34.66 per share; |

| |

|

|

|

| |

|

● |

157,585

shares of Class A common stock

issuable upon exercise of representative’s warrants at a weighted average exercise price of $10.65 per share; and |

| |

|

|

|

| |

|

● |

800,000

shares of Class A common stock reserved for future issuance under our 2021 Omnibus Equity Incentive Plan. |

Unless

otherwise indicated, this prospectus reflects and assumes the following:

| |

● |

no

exercise of outstanding options or warrants; |

| |

|

|

| |

● |

no

sale of any Pre-Funded Warrants in this proposed offering; |

| |

|

|

| |

● |

no

exercise of the representative’s warrants to be issued upon consummation of this offering at an exercise price equal to

125% of the offering price of the Class A Common stock; and |

| |

|

|

| |

● |

no

exercise by the underwriters of their option to purchase up to 561,797 additional shares

of our Class A common stock and/or Pre-Funded Warrants from us to cover over-allotments,

if any. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. This prospectus and the documents incorporated by reference herein contain

a discussion of the risks applicable to an investment in our securities. Prior to making a decision about investing in our securities,

you should carefully consider the specific factors discussed within this prospectus. and the risk factors discussed in the section entitled

“Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2023 and incorporated herein by

reference. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently

known to us or that we currently deem immaterial may also affect our operations. If any of the risks or uncertainties described in our

SEC filings or this prospectus or any additional risks and uncertainties actually occur, our business, financial condition and results

of operations could be materially and adversely affected. In that case, the trading price of our Class A common stock could decline and

you might lose all or part of your investment.

Risks

Related to this Offering

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds,

and the proceeds may not be invested successfully.

Our

management will have broad discretion as to the use of the net proceeds from any offering by us and could use them for purposes other

than those contemplated at the time of this offering. Accordingly, you will be relying on the judgment of our management with regard

to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used appropriately. It is possible that the proceeds will be invested in a way that does not yield a favorable, or any, return

for us.

You

may experience future dilution as a result of future equity offerings.

In

order to raise additional capital, we may in the future offer additional shares of our Class A common stock or other securities convertible

into or exchangeable for our Class A common stock at prices that may not be the same as the price per share in this offering. We may

sell shares or other securities in any other offering at a price per share that is less than the price per share paid by any investors

in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

The price per share at which we sell additional shares of our Class A common stock, or securities convertible or exchangeable into Class

A common stock, in future transactions may be higher or lower than the price per share paid by any investors in this offering.

We

are selling a substantial number of shares of our Class A common stock in this offering, which could cause the price of our Class A common

stock to decline.

In

this offering, we are offering shares of Class A common stock. The existence of the potential additional shares of our Class A common

stock in the public market, or the perception that such additional shares may be in the market, could adversely affect the price of our

Class A common stock. We cannot predict the effect, if any, that market sales of those shares of Class A common stock or the availability

of those shares of Class A common stock for sale will have on the market price of our Class A common stock.

The

Nasdaq Capital Market may seek to delist our Class A common stock if it concludes this offering does not qualify as a Public Offering

as defined under Nasdaq’s stockholder approval rule.

The

continued listing of our Class A common stock on The Nasdaq Capital Market depends on our compliance with the requirements for continued

listing under the Nasdaq Marketplace Rules, including but not limited to Market Place Rule 5635, or the stockholder approval rule. The

stockholder approval rule prohibits the issuance of shares of common stock (or derivatives) in excess of 20% of our outstanding shares

of common stock without stockholder approval, unless those shares are sold at a price that equals or exceeds the Minimum Price, as defined

in the stockholder approval rule, or in what Nasdaq deems a Public Offering, as defined in the stockholder approval rule. The securities

sold in this offering may be sold at a significant discount to the Minimum Price as defined in the stockholder approval rule, and we

do not intend to obtain the approval of our stockholders for the issuance of the securities in this offering. Accordingly, we have sought

to conduct, and plan to continue to conduct, this offering as a Public Offering as defined in the stockholder approval rule, which is

a qualitative analysis based on several factors as determined by Nasdaq, including by broadly marketing and offering these securities

in a firm commitment underwritten offering registered under the Securities Act. Demand for the securities sold by us in this offering,

and the final offering price for these securities, will be determined following a broad public marketing effort over several trading

days, and final distribution of these securities will ultimately be determined by the underwriter. Nasdaq has also published guidance

that an offering of securities that are “deeply discounted” to the Minimum Price (for example a discount of 50% or more)

will typically preclude a determination that the offering qualifies as Public Offering for purposes of the stockholder approval rule.

We cannot assure you that Nasdaq will determine that this offering will be deemed a Public Offering under the stockholder approval rule.

If Nasdaq determines that this offering was not conducted in compliance with the stockholder approval rule, Nasdaq may cite a deficiency

and move to delist our Class A common stock from The Nasdaq Capital Market. Upon a delisting from The Nasdaq Capital Market, our stock

would likely be traded in the over-the-counter inter-dealer quotation system, more commonly known as the OTC. OTC transactions involve

risks in addition to those associated with transactions in securities traded on the securities exchanges, such as The Nasdaq Capital

Market, or, together, Exchange-listed stocks. Many OTC stocks trade less frequently and in smaller volumes than Exchange-listed stocks.