Summit Therapeutics plc (NASDAQ:SMMT) (AIM:SUMM) today reports its

financial results for the fourth quarter and fiscal year ended 31

January 2018 and provides an update on operational progress.

Mr Glyn Edwards, Chief Executive Officer

of Summit, commented: “This was a landmark year for

Summit’s Duchenne muscular dystrophy programme where we saw a

statistically significant reduction in muscle damage and

inflammation in patients after just 24-weeks of ezutromid

treatment. This provides evidence that ezutromid is reducing the

severity of the disease for these patients.

“Strongly encouraged by these findings, we are

accelerating preparatory activities for a placebo controlled trial

of ezutromid and also preparing for a potential regulatory filing

of ezutromid based on top-line data from the full 48-week results,

which are expected in the third quarter of 2018.

“Our infectious disease business has also made

major strides over the past year. With funding support from BARDA,

we are preparing to initiate our Phase 3 trials for ridinilazole, a

precision antibiotic for the treatment of C. difficile infections.

Based on the discovery and development platform we acquired in

2017, we are also building a pipeline of new mechanism antibiotics

as we position ourselves as leaders in the field of

antibacterials.

“With two lead clinical programmes in DMD and

CDI, and a growing pipeline of early-stage compounds, we are

building a fully-integrated company focused on advancing novel

mechanism drugs as new standards of care.”

Rare Diseases

Highlights

- Announced positive 24-week interim data from PhaseOut DMD, a

Phase 2 proof of concept trial of ezutromid in patients with DMD,

which showed evidence of activity across three different measures.

Specifically, ezutromid:

- Maintained the production of utrophin, a naturally occurring

protein that can potentially substitute for dystrophin.

- Significantly and meaningfully reduced muscle damage.

- Significantly reduced muscle inflammation.

- Accelerating preparatory activities for a placebo controlled

clinical trial for ezutromid, and for a potential regulatory filing

of ezutromid based on the 48-week results from PhaseOut DMD.

- Received a $22 million milestone payment from our strategic

partner, Sarepta Therapeutics, for the completion of enrolment in

PhaseOut DMD.

- Maintaining leadership in utrophin modulation through our

strategic alliance with the University of Oxford to identify

utrophin modulator candidates.

Infectious Diseases

Highlights

- Awarded a contract worth up to $62 million from Biomedical

Advanced Research and Development Authority (‘BARDA’) to support

the clinical and regulatory development of ridinilazole for the

treatment of CDI.

- Outlined ridinilazole Phase 3 clinical programme following

input from the US Food and Drug Administration and European

Medicines Agency. The trials are expected to start in Q1 2019.

- Obtained a proprietary infectious disease discovery and

development platform through the acquisition of Discuva Limited in

December 2017, positioning Summit as a leader in the research and

development of new classes of antibiotics; in March 2018, announced

identification of novel mechanism antibiotic compounds for the

treatment of gonorrhoea using this platform.

Financial Highlights

- Cash and cash equivalents at 31 January 2018 of £20.1 million

compared to £28.1 million at 31 January 2017.

- In March 2018 (post fiscal year end), raised gross proceeds of

£15.0 million ($21.2 million*) through a placing of new ordinary

shares to investors in Europe.

- Loss for the year ended 31 January 2018 of £7.1 million

compared to a loss of £21.4 million for the year ended 31 January

2017.

Conference Call and Webcast

InformationSummit will host a conference call and webcast

to review the financial results for the fiscal year ended 31

January 2018 today at 1:00pm BST / 8:00am EDT. To participate in

the conference call, please dial +44 (0)330 336 9411 (UK and

international participants) or +1 646 828 8156 (US local number)

and use the conference confirmation code 1980085. Investors may

also access a live audio webcast of the call via the investors

section of the Company’s website, www.summitplc.com. A replay of

the webcast will be available shortly after the presentation

finishes.

About Summit TherapeuticsSummit

is a biopharmaceutical company focused on the discovery,

development and commercialisation of novel medicines for

indications for which there are no existing or only inadequate

therapies. Summit is conducting clinical programmes focused on the

genetic disease Duchenne muscular dystrophy and the infectious

disease C. difficile infection. Further information is available at

www.summitplc.com and Summit can be followed on Twitter

(@summitplc).

*Based on a conversion rate of US$1.4135 to

£1.00

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (MAR).

For more information, please

contact:

|

Summit |

|

|

| Glyn

Edwards / Richard Pye (UK office) |

Tel: |

44

(0)1235 443 951 |

| Erik

Ostrowski / Michelle Avery (US office) |

|

+1

617 225 4455 |

|

|

|

|

|

Cairn Financial Advisers LLP (Nominated

Adviser) |

Tel: |

+44

(0)20 7213 0880 |

| Liam

Murray / Tony Rawlinson |

|

|

|

|

|

|

|

N+1 Singer (Joint Broker) |

Tel: |

+44

(0)20 7496 3000 |

|

Aubrey Powell / Jen Boorer |

|

|

|

|

|

|

|

Panmure Gordon (Joint Broker) |

Tel: |

+44

(0)20 7886 2500 |

|

Freddy Crossley, Corporate Finance |

|

|

| Tom

Salvesen, Corporate Broking |

|

|

|

|

|

|

|

MacDougall Biomedical Communications (US) |

Tel: |

+1

781 235 3060 |

| Karen

Sharma |

|

ksharma@macbiocom.com |

|

|

|

|

|

Consilium Strategic Communications (UK) |

Tel: |

+44

(0)20 3709 5700 |

|

Mary-Jane Elliott / Jessica Hodgson / |

|

summit@consilium-comms.com |

|

Philippa Gardner |

|

|

Forward Looking StatementsAny

statements in this press release about Summit’s future

expectations, plans and prospects, including but not limited to,

statements about the clinical and preclinical development of

Summit’s product candidates, the therapeutic potential of Summit’s

product candidates, the timing of initiation, completion and

availability of data from clinical trials, the potential submission

of applications for regulatory approvals, the sufficiency of

Summit’s cash resources, and other statements containing the words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “would,” and similar expressions, constitute

forward looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995. Actual results may differ

materially from those indicated by such forward-looking statements

as a result of various important factors, including: the

uncertainties inherent in the initiation of future clinical trials,

availability and timing of data from ongoing and future clinical

trials and the results of such trials, whether preliminary results

from a clinical trial will be predictive of the final results of

that trial or whether results of early clinical trials or

preclinical studies will be indicative of the results of later

clinical trials, expectations for regulatory approvals,

availability of funding sufficient for Summit’s foreseeable and

unforeseeable operating expenses and capital expenditure

requirements and other factors discussed in the “Risk Factors”

section of filings that Summit makes with the Securities and

Exchange Commission including Summit’s Annual Report on Form 20-F

for the fiscal year ended January 31, 2017. Accordingly,

readers should not place undue reliance on forward looking

statements or information. In addition, any forward-looking

statements included in this press release represent Summit’s views

only as of the date of this release and should not be relied upon

as representing Summit’s views as of any subsequent date. Summit

specifically disclaims any obligation to update any forward-looking

statements included in this press release.

CHAIRMAN’S STATEMENT

This past year has been marked by success and

progress across the business. Summit now has two clinical

programmes with positive clinical data in patients, external

validation for both our C. difficile infection (‘CDI’) and Duchenne

muscular dystrophy (‘DMD’) programmes, a strengthened pipeline for

a sustainable future and a strengthened team to guide the

development of novel drugs for serious illnesses.

Clinical SuccessWe delivered

the first clinical evidence of ezutromid activity in patients with

DMD. Ezutromid has the potential to profoundly improve the lives of

all patients living with DMD. The evidence we have seen after just

24 weeks of treatment indicates ezutromid is potentially reducing

the severity of the disease. To put the typical severity of the

disease in perspective, patients with DMD progressively lose muscle

function throughout their lives, ultimately resulting in premature

death in their late twenties. Changes to the inexorable disease

progression could provide meaningful benefit for patients. We

anticipate that the 48-week data has the potential to provide

continued evidence of improved disease progression through

measurements of muscle health, and we expect to report those data

in the third quarter of 2018.

The 24-week data have bolstered our confidence

that ezutromid could become the standard of care for all patients

with DMD. We are preparing ourselves to rapidly advance ezutromid

towards the market after receipt of the 48-week data. We see two

potential paths to get to market with positive 48-week data. In one

scenario, we could potentially pursue accelerated approval in the

US based on the 48-week data. In another scenario, we conduct a

pivotal, placebo controlled trial that would be the basis of

regulatory filings for approvals in the US and EU. Our recent

fundraise in Europe allows us to maintain clinical and regulatory

flexibility for both of these options. We remain committed to

independently commercialising ezutromid in the United States, one

the world’s most important pharmaceutical markets, while our

partner, Sarepta Therapeutics, has commercialisation rights in

Europe.

External ValidationOur

precision antibiotic for CDI garnered third-party US Government

support with a $62 million BARDA award. This is a major endorsement

for ridinilazole. These funds are helping to support the Phase 3

clinical and regulatory development of ridinilazole.

Ridinilazole’s potential to treat CDI and reduce

recurrent disease make it an attractive potential option for

front-line treatment. To support this positioning, we carefully

designed our Phase 3 programme to provide evidence of value for

patients, payors and healthcare providers. There is an urgent need

for new treatment options in CDI with over one million cases a year

in the US and Europe and we believe ridinilazole is the answer.

The external validation our CDI programme

received this year from BARDA complements the validation we

received of our DMD programme through our strategic partnership

with Sarepta. This partnership continues to provide us with

intangible benefits, such as access to Sarepta’s knowledge and

expertise in DMD drug development, as well as financial support.

This past year, we received a $22 million milestone payment from

Sarepta upon the completion of enrolment in our PhaseOut DMD

clinical trial, and as of January 2018, Sarepta is contributing a

45% share of our global DMD programme development costs.

A Sustainable Pipeline

Antibiotic resistance is an emerging global health and political

issue. We believe that our investments in antibiotic research and

development provide an opportunity for Summit to assume a

leadership role in this field. Our strategy is to develop new

mechanism antibiotics designed to treat specific diseases where we

can demonstrate clear advantages over existing standards of care

and have clear commercial value. We will pursue this strategy with

our recently acquired discovery and development platform.

Separately, we continue to secure our leadership

in utrophin modulation through our ongoing collaboration with the

University of Oxford. We intend to have the first- and

best-in-class molecules with the goal of one day being able to stop

DMD disease progression for all patients living with this

disorder.

A Bright FutureWe enter this

next year in a position of strength with great opportunities for

our products. Our progress brought us one step closer to realising

the significant value of ezutromid and ridinilazole for the

Company, shareholders and most importantly, patients. Our growth

over the past year ensures we have a strong team and a pipeline for

the future. We now look to an exciting year ahead with the full

results from PhaseOut DMD expected in the third quarter of this

year.

Having two clinical stage assets with compelling

patient data is a tremendous achievement and one that would not

have happened without the continued support from our shareholders

and dedication and professionalism from our employees. Finally, I’d

like to thank the patients, families and clinical sites involved in

our clinical trials. Without them, we would not be able to make

such progress in advancing our promising product candidates.

Frank Armstrong, FRCPE,

FFPMNon-Executive Chairman

OPERATIONAL REVIEW

Summit is a biopharmaceutical company focused on

the discovery, development and commercialisation of novel medicines

for indications in rare diseases and infectious diseases for which

there are no existing or only inadequate therapies. In rare

diseases, Summit is pioneering utrophin modulation as a potential

disease modifying treatment for all patients affected by the fatal

disorder DMD. In infectious diseases, Summit’s clinical focus is on

advancing the development of the precision antibiotic ridinilazole

that has the potential to not only treat the initial CDI infection,

but importantly to reduce rates of recurrent disease. In the

broader infectious disease area, Summit is developing new mechanism

antibiotics against pathogens where an urgent unmet need exists,

and where the Company can demonstrate advantages over current

treatments.

Rare Diseases: Duchenne Muscular

Dystrophy

Utrophin Modulation

Programme

DMD is the most common and severe form of

muscular dystrophy, impacting 50,000 patients in the developed

world alone. DMD is caused by the lack of dystrophin, a protein

that maintains healthy muscle function. The absence of dystrophin

results in a catastrophic cycle of muscle damage and repair that

leads to progressive loss of functional ability and ultimately in

premature death.

Utrophin and dystrophin play a similar role in

maintaining muscle function, but do so at different times. Utrophin

plays this role when new muscle fibres are being formed, or when

damaged fibres are being repaired, but then switches off to make

way for dystrophin to perform this role in mature muscle fibres.

Since patients with DMD are not able to produce dystrophin, a cycle

of muscle damage and repair occurs, which eventually leads to

muscle fibre failure. Utrophin modulation aims to address the root

cause of DMD by maintaining the production of utrophin to

substitute for the missing dystrophin. The presence of utrophin in

mature muscle fibres could break the cycle of damage and repair and

ultimately slow, or even stop, disease progression. Importantly,

this approach has the potential to treat all patients with DMD

regardless of their underlying dystrophin gene mutation.

Summit has established a leadership position in

the field of utrophin modulation with a pipeline of small molecule

utrophin modulator therapies. The Company’s lead utrophin

modulator, ezutromid, has shown evidence of reducing DMD disease

severity in patients in a Phase 2 clinical trial.

Ezutromid Clinical

Development

Ezutromid: PhaseOut DMD, a Phase 2 Proof of

Concept TrialPhaseOut DMD is a 48-week, open-label Phase 2 clinical

trial evaluating ezutromid in patients with DMD. The clinical trial

completed enrolment of 40 patients aged between their fifth and

tenth birthdays at multiple sites in the US and UK in May 2017. At

the end of 48 weeks of dosing, patients have the option of

continuing to be dosed with ezutromid in an extension phase.

Results from a planned 24-week interim analysis were announced in

January and February 2018. Top-line results from the full 48-week

trial are expected in the third quarter of 2018.

PhaseOut DMD aims to establish proof of concept

for ezutromid through the evaluation of muscle health and function.

Primary and secondary endpoints are focused on muscle health and

exploratory measures assess muscle function. With respect to muscle

health, PhaseOut DMD measures the change from baseline in magnetic

resonance parameters of the leg after 48 weeks of treatment as the

primary endpoint. Biopsy measures evaluating utrophin and muscle

damage are assessed as secondary muscle health endpoints. For

muscle function, PhaseOut DMD measures the North Star Ambulatory

Assessment and six-minute walk distance.

DMD progresses over many years, beginning with

instability of the muscle membrane that leads to a relentless cycle

of muscle damage and repair. The first anticipated evidence of drug

effect of ezutromid would therefore be related to utrophin protein

expression and reduced muscle fibre damage and inflammation.

Further downstream effects related to muscle health and function

are expected to be seen with longer dosing.

The PhaseOut DMD 24-week interim data show

ezutromid stabilised muscle fibre membranes as measured by a mean

increase in levels of utrophin protein. This led to a statistically

significant and meaningful decrease in muscle damage, as measured

by levels of the biomarker developmental myosin in muscle biopsies,

and a significant decrease in muscle inflammation as measured by

magnetic resonance spectroscopy.

The combination of these findings supports

ezutromid target engagement, and provides evidence of ezutromid’s

early impact on downstream muscle health. Importantly, ezutromid

was shown to be well tolerated.

Future Clinical and Regulatory Development Plans

The Company’s objective is to rapidly advance ezutromid’s

development. Summit will evaluate its clinical and regulatory

options after receipt of the PhaseOut DMD 48-week top-line data. To

maintain clinical and regulatory flexibility, the Company is

accelerating plans for a randomised, placebo-controlled clinical

trial for ezutromid alongside preparatory activities to support a

potential regulatory filing of ezutromid based on the 48-week

PhaseOut DMD clinical trial results if they are positive.

Pipeline Activities

As part of the Company’s strategy to maintain

its leadership position in the field of utrophin modulation, Summit

is developing a pipeline of future generation utrophin modulators.

This research, conducted as part of the strategic alliance with the

University of Oxford, is building on the promise of ezutromid to

identify new, structurally distinct molecules.

Sarepta Therapeutics Licence and

Collaboration Agreement

The clinical progress made with ezutromid

triggered a $22 million milestone payment from Sarepta as part of

the exclusive European licence and collaboration agreement that was

signed in October 2016. Starting 1 January 2018, Summit and Sarepta

share specified global research and development costs related to

Summit’s utrophin modulator pipeline at a 55%/45% split,

respectively.

Summit retains commercialisation rights in all

other countries, including the United States and Japan.

Other Activities

In September 2017, Summit joined the

Collaborative Trajectory Analysis Project (‘cTAP’) to support

cTAP’s mission of accelerating the development of drugs to treat

DMD through a coalition of Duchenne clinical experts, patient

advocates and biopharmaceutical companies. Summit believes cTAP’s

predictive models of disease progression could benefit the

development of its utrophin modulator pipeline.

Infectious Diseases

C. difficile InfectionCDI is a major healthcare

threat. There are over one million estimated cases of CDI

annually between the United States and Europe alone. Mainstay CDI

treatments are dominated by broad spectrum antibiotics that cause

substantial disruption to the collection of bacteria in the gut

flora, which leads to high rates of recurrent disease. Each

recurrent episode of CDI is typically more severe than the prior

episode, and carries an increased risk of mortality. As such,

disease recurrence is the key clinical issue facing CDI.

Ridinilazole is a novel class, precision

antibiotic designed to selectively target C. difficile bacteria

without causing collateral damage to the gut flora. Therefore, it

has the potential to be a front-line therapy that treats not only

the initial CDI infection, but importantly reduces the rate of CDI

recurrence. Ridinilazole has received Qualified Infectious Disease

Product designation and has been granted Fast Track designation in

the US.

Phase 2 Clinical ProgrammeSummit has generated a

comprehensive preclinical and clinical data package supporting

ridinilazole as a potential new front-line treatment for CDI. In a

Phase 2 proof of concept clinical trial called CoDIFy, ridinilazole

was shown to be highly preserving of the microbiome of patients

compared with the standard of care, vancomycin, and achieved a

substantial reduction in rates of recurrent disease. Ridinilazole

notably demonstrated statistical superiority over vancomycin in the

primary endpoint of the trial called sustained clinical response

(‘SCR’), an endpoint that combines cure at the end of treatment and

the number of recurrences in the subsequent 30-days. Results from

this 100-patient, double-blind clinical trial were published in The

Lancet Infectious Diseases in April 2017. Building on the CoDIFy

data, top-line data were reported from an exploratory Phase 2

clinical trial in September 2017 that showed ridinilazole preserved

the gut microbiomes of patients with CDI better than the marketed

narrow-spectrum antibiotic fidaxomicin.

Regulatory Update and Planned Phase 3 Clinical

ProgrammeIn February 2017, Summit outlined its Phase 3 development

programme for ridinilazole following input from the FDA and

European Medicines Agency. The Phase 3 programme aims to

differentiate this novel antibiotic from the current standard of

care treatment for CDI and help position the drug for commercial

success.

The two planned Phase 3 clinical trials are

expected to enrol approximately 700 patients each. The primary

endpoint is expected to be superiority in SCR, which was the

primary endpoint used in Summit’s Phase 2 proof of concept trial of

ridinilazole. Other planned endpoints will include health economic

outcome measures to support the commercial positioning of

ridinilazole as a front-line treatment for CDI. The Company expects

to initiate these clinical trials in the first quarter of 2019.

Funding and Licensing AgreementsIn September

2017, Summit was awarded a contract worth up to $62 million from

the US Biomedical Advanced Research and Development Authority

(‘BARDA’) to fund, in part, the clinical and regulatory development

of ridinilazole.

In December 2017, Summit entered into a licence

and commercialisation agreement to grant the Brazilian based

company Eurofarma Laboratórios (‘Eurofarma’) exclusive rights to

commercialise ridinilazole for CDI in certain countries in South

America, Central America and the Caribbean. Summit retains

commercial rights in the rest of the world including the United

States and Europe.

The Company believes these agreements are a

testament to the strength of ridinilazole’s clinical and

preclinical data.

Novel Antibiotic Discovery and Development

PlatformIn December 2017, Summit acquired an innovative bacterial

genetics-based platform to generate new mechanism antibiotics.

Summit intends to use the platform to develop compounds that target

pathogens where there is a serious unmet need and where the Company

can demonstrate advantages over the current standard of treatment.

This platform combines transposon technology with bioinformatics to

create a powerful tool to identify new antibacterial drug targets,

elucidate antibiotic mechanisms of action and optimise against

bacterial resistance.

In March 2018, the Company unveiled a series of

new mechanism antibiotics identified using this platform that

target gonorrhoea. In early testing, these compounds have been

shown to have high potency against strains of gonorrhoea with no

development of resistance to date. The Company expects to select a

candidate to advance into IND enabling studies in the second half

of 2018.

Operational Update

In January 2017, Dr David Roblin was appointed

as Chief Operating Officer (‘COO’) and President of Research &

Development and his role was expanded to include Chief Medical

Officer in May 2017. Dr Roblin has had a highly successful career

in the pharmaceutical industry, including senior leadership roles

at Pfizer and Bayer, which involved overseeing the research,

development and commercial launch of drugs across several therapy

areas including infectious diseases. His depth of knowledge and

expertise will help to ensure Summit is at the forefront of

utrophin modulation in DMD and innovative antibiotic

development.

FINANCIAL REVIEW

Revenue

Revenue increased by £23.1 million to £25.4

million for the year ended 31 January 2018 from £2.3 million for

the year ended 31 January 2017. The increase was due to income

recognised following the exclusive licence and collaboration

agreement entered into with Sarepta in October 2016. During the

year ended 31 January 2018, £6.9 million relating to the upfront

payment of $40.0 million (£32.8 million) received from Sarepta in

October 2016 was recognised compared to £2.3 million for the year

ended 31 January 2017. To date, an aggregate of £9.2 million of the

upfront payment has been recognised while the remaining £23.6

million is classified as deferred revenue and will continue to be

recognised as revenue over the development period. Revenue

recognised during the year ended 31 January 2018 also reflects the

receipt of a development milestone of £17.2 million ($22.0 million)

paid by Sarepta which was recognised in full and £0.9 million of

revenue in respect of specified research and development costs

funded by Sarepta. The Group also recognised £0.1 million of

revenue following receipt of a $2.5 million upfront payment in

respect of the licence and commercialisation agreement signed with

Eurofarma in December 2017, and £0.3 million of revenue pursuant to

a research collaboration agreement between the Group’s acquired

subsidiary Discuva Limited and F. Hoffmann - La Roche Limited.

Other Operating Income

Other operating income increased by

£2.6 million to £2.7 million during the year ended 31

January 2018 from £0.1 million during the year ended 31

January 2017. This increase resulted primarily from the recognition

of £1.8 million pursuant to Summit’s funding contract with BARDA

that was awarded to the Group in September 2017 and £0.9 million

resulting from the derecognition of a part of Summit’s financial

liabilities on funding arrangements.

Operating Expenses

Research and Development ExpensesResearch and

development expenses increased by £10.0 million, or 52.9 %, to

£29.0 million for the year ended 31 January 2018 from £19.0 million

for the year ended 31 January 2017. This was due to increased

spending related to both the DMD and CDI programmes. Investment in

the DMD programme increased by £6.5 million to £16.0 million from

£9.5 million for the year ended 31 January 2017. Costs associated

with the CDI programme increased by £1.5 million to £5.6 million

for the year ended 31 January 2018 from £4.1 million for the year

ended 31 January 2017. Other research and development expenses

increased by £2.0 million during the period which was primarily

attributable to an increase in headcount within the DMD and CDI

project teams.

General and Administration ExpensesGeneral and

administration expenses increased by £3.7 million, or 45.0 %, to

£12.0 million for the year ended 31 January 2018 from £8.3 million

for the year ended 31 January 2017. This increase was due to a net

negative movement in exchange rate variances of £1.5 million, an

increase of £1.3 million in staff related costs, an increase of

£0.6 million in overhead and facility related costs and an increase

of £0.3 million in share-based payment expense.

Finance Income

Finance income was £3.1 million for the year

ended 31 January 2018 and related primarily to the de-recognition

of part of the Group’s financial liabilities on funding

arrangements, specifically the remeasurements and discounts

associated with those liabilities since initial recognition.

Finance income recognised in comparative periods relates to

interest

received.

Finance Costs

Finance costs increased by £0.3 million, or

35.0%, to £1.2 million for the year ended 31 January 2018 from £0.9

million for the year ended 31 January 2017 and related to the

unwinding of the discount and remeasurements on financial

liabilities on funding arrangements.

Taxation

Our income tax credit decreased by £0.5 million,

or 13.2%, to £3.8 million for the year ended 31 January 2018 from

£4.3 million for the year ended 31 January 2017. This was driven by

our lower level of net loss during the year ended 31 January 2018

as compared to the year ended 31 January 2017, which impacts the

level of income tax credit receivable.

Losses

Loss before income tax was £10.9 million for the

year ended 31 January 2018 compared to £25.7 million for the year

ended 31 January 2017. Net loss for the year ended 31 January 2018

was £7.1 million with a net loss per share of 11 pence compared to

a net loss of £21.4 million for the year ended 31 January 2017 and

a net loss per share of 35 pence.

Cash Flows

The Group had a net cash outflow of £6.0 million

for the year ended 31 January 2018 as compared to a net cash inflow

of £12.5 million for the previous year.

For the year ended 31 January 2018 net cash used

by operating activities was of £14.7 million as compared to net

cash generated from operating activities of £12.1 million for the

year ended 31 January 2017. This net movement of £26.8 million was

driven by an increase in research and development costs during the

year ended 31 January 2018, and the receipt, during the year ended

31 January 2017, of a £32.8 million upfront payment as part of the

Sarepta agreement entered into in October 2016 which was partially

offset by the receipt of the development milestone from Sarepta of

£17.2 million during the year ended 31 January 2018, as well as the

funding received from BARDA and the upfront payment received from

Eurofarma during the year ended 31 January 2018.

Net cash outflows from investing activities for

the year ended 31 January 2018 of £5.2 million includes £4.8

million used in the acquisition of Discuva Limited in December

2017, net of cash acquired as part of the transaction, and a

further £0.5 million used to acquire property, plant and equipment

and intangible assets mainly in relation to the relocation of

Summit’s UK office in Oxford.

Net cash generated from financing activities for

the year ended 31 January 2018 of £13.9 million includes £13.5

million of proceeds, net of transaction costs, received following

the Company’s underwritten public equity offering in September 2017

and £0.4 million received following the exercise of warrants and

share options. During the year ended 31 January 2017 the Group

received proceeds of £0.4 million following the exercise of

warrants and share options.

Financial position

As at 31 January 2018, total cash and cash

equivalents held were £20.1 million (31 January 2017: £28.1

million).

In March 2018, post the period under review,

total gross proceeds of £15.0 million ($21.2 million) were raised

through a placing of new ordinary shares.

Headcount

Average headcount of the Group for the year was

60 (2017: 44).

Share Capital

In September 2017, the Group completed an

underwritten public offering on the NASDAQ Global Market issuing

1,677,850 American Depositary Shares (‘ADS’) at a price of $12.00

per ADS. Each ADS represents five ordinary shares of one penny

nominal value each in the capital of the Company, meaning 8,389,250

new ordinary shares were issued. Total gross proceeds of $20.1

million (£14.9 million) were raised and directly attributable

transaction costs of £1.4 million were incurred.

In December 2017, the Group acquired 100% of the

share capital of Discuva Limited. As part of the consideration the

Group issued £5.0 million in new ordinary shares to the former

Discuva shareholders at a price of 170.4 pence per share, meaning

2,934,272 ordinary shares were issued.

In February 2017, warrants over 50,000 ordinary

shares were exercised raising net proceeds of £0.01 million.

During the year 348,536 share options were

exercised raising net proceeds of £0.39 million.

Glyn Edwards

Erik Ostrowski Chief Executive Officer Chief Financial Officer

11 April 2018

FINANCIAL STATEMENTS

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(audited) For the year ended 31 January 2018

| |

|

Twelvemonths ended 31 January 2018 |

|

Twelve months ended 31 January

2018 |

|

Twelve

months ended 31 January 2017 |

|

|

|

Note |

$000s |

|

£000s |

|

£000s |

|

|

|

|

|

|

|

|

Revenue |

|

36,070 |

|

25,419 |

|

2,304 |

|

|

|

|

|

|

|

| Other operating

income |

|

3,867 |

|

2,725 |

|

72 |

|

| |

|

|

|

|

| Operating

expenses |

|

|

|

|

| Research and

development |

|

(41,108 |

) |

(28,970 |

) |

(18,952 |

) |

|

General and administration |

|

(17,027 |

) |

(11,999 |

) |

(8,277 |

) |

| Total operating

expenses |

|

(58,135 |

) |

(40,969 |

) |

(27,229 |

) |

|

|

|

|

|

|

| Operating

loss |

|

(18,198 |

) |

(12,825 |

) |

(24,853 |

) |

|

|

|

|

|

|

| Finance

income |

|

4,393 |

|

3,096 |

|

8 |

|

| Finance

cost |

|

(1,652 |

) |

(1,164 |

) |

(862 |

) |

|

|

|

|

|

|

| Loss before

income tax |

|

(15,457 |

) |

(10,893 |

) |

(25,707 |

) |

|

|

|

|

|

|

| Income

tax |

|

5,338 |

|

3,762 |

|

4,336 |

|

|

|

|

|

|

|

|

Loss for the year |

|

(10,119 |

) |

(7,131 |

) |

(21,371 |

) |

|

|

|

|

|

|

| Other

comprehensive (losses) / income |

|

|

|

|

| Items that may be

reclassified subsequently to profit or loss |

|

|

|

|

| Exchange

differences on translating foreign operations |

|

(18 |

) |

(13 |

) |

29 |

|

|

Total comprehensive loss for the year |

|

(10,137 |

) |

(7,144 |

) |

(21,342 |

) |

|

Basic and diluted loss per ordinary share from

operations |

2 |

(15)cents |

(11)pence |

(35)pence |

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(unaudited) For the three months ended 31 January 2018

| |

|

Threemonths ended 31 January2018 |

|

Threemonths ended 31 January2018 |

|

Threemonths ended 31 January2017 |

|

|

|

Note |

$000s |

|

£000s |

|

£000s |

|

|

|

|

|

|

|

|

Revenue |

|

4,274 |

|

3,012 |

|

1,728 |

|

|

|

|

|

|

|

| Other operating

income |

|

1,633 |

|

1,151 |

|

- |

|

| |

|

|

|

|

| Operating

expenses |

|

|

|

|

| Research and

development |

|

(14,051 |

) |

(9,902 |

) |

(4,792 |

) |

|

General and administration |

|

(7,231 |

) |

(5,096 |

) |

(3,027 |

) |

| Total operating

expenses |

|

(21,282 |

) |

(14,998 |

) |

(7,819 |

) |

|

|

|

|

|

|

| Operating

loss |

|

(15,375 |

) |

(10,835 |

) |

(6,091 |

) |

|

|

|

|

|

|

| Finance

income |

|

13 |

|

9 |

|

1 |

|

| Finance

cost |

|

(702 |

) |

(495 |

) |

(215 |

) |

|

|

|

|

|

|

| Loss before

income tax |

|

(16,064 |

) |

(11,321 |

) |

(6,305 |

) |

|

|

|

|

|

|

| Income

tax |

|

(280 |

) |

(197 |

) |

1,380 |

|

|

|

|

|

|

|

|

Loss for the period |

|

(16,344 |

) |

(11,518 |

) |

(4,925 |

) |

|

|

|

|

|

|

| Other

comprehensive losses |

|

|

|

|

| Items that may be

reclassified subsequently to profit or loss |

|

|

|

|

| Exchange

differences on translating foreign operations |

|

(11 |

) |

(8 |

) |

(14 |

) |

|

Total comprehensive loss for the period |

|

(16,355 |

) |

(11,526 |

) |

(4,939 |

) |

|

Basic and diluted loss per ordinary share from

operations |

2 |

(23)cents |

(16)pence |

(8)pence |

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(audited)As at 31 January 2018

|

|

|

31 January2018 |

|

31 January2018 |

|

31

January2017 |

|

|

|

|

$000s |

|

£000s |

|

£000s |

|

|

ASSETS |

|

|

|

|

| Non-current

assets |

|

|

|

|

| Goodwill |

|

3,516 |

|

2,478 |

|

664 |

|

| Intangible assets |

|

20,980 |

|

14,785 |

|

3,470 |

|

| Property,

plant and equipment |

|

1,148 |

|

809 |

|

116 |

|

| |

|

25,644 |

|

18,072 |

|

4,250 |

|

| Current

assets |

|

|

|

|

| Prepayments and other

receivables |

|

15,799 |

|

11,134 |

|

1,027 |

|

| Current tax

receivable |

|

6,605 |

|

4,654 |

|

4,248 |

|

| Cash and

cash equivalents |

|

28,525 |

|

20,102 |

|

28,062 |

|

| |

|

50,929 |

|

35,890 |

|

33,337 |

|

|

|

|

|

|

|

|

Total assets |

|

76,573 |

|

53,962 |

|

37,587 |

|

| |

|

|

|

|

|

LIABILITIES |

|

|

|

|

| Non-current

liabilities |

|

|

|

|

| Deferred revenue |

|

(25,589 |

) |

(18,033 |

) |

(23,615 |

) |

| Financial liabilities

on funding arrangements |

|

(4,385 |

) |

(3,090 |

) |

(5,919 |

) |

| Provisions for other

liabilities and charges |

|

(2,329 |

) |

(1,641 |

) |

(85 |

) |

| Deferred tax

liability |

|

(3,376 |

) |

(2,379 |

) |

(565 |

) |

|

|

|

(35,679 |

) |

(25,143 |

) |

(30,184 |

) |

| Current

liabilities |

|

|

|

|

| Trade and other

payables |

|

(12,675 |

) |

(8,932 |

) |

(3,984 |

) |

| Deferred revenue |

|

(14,207 |

) |

(10,012 |

) |

(6,912 |

) |

|

|

|

(26,882 |

) |

(18,944 |

) |

(10,896 |

) |

|

|

|

|

|

|

|

Total liabilities |

|

(62,561 |

) |

(44,087 |

) |

(41,080 |

) |

|

|

|

|

|

|

|

Net assets / (liabilities) |

|

14,012 |

|

9,875 |

|

(3,493 |

) |

| |

|

|

|

|

|

EQUITY |

|

|

|

|

| Share capital |

|

1,044 |

|

736 |

|

618 |

|

| Share premium

account |

|

85,476 |

|

60,237 |

|

46,420 |

|

| Share-based payment

reserve |

|

9,568 |

|

6,743 |

|

5,136 |

|

| Merger reserve |

|

4,295 |

|

3,027 |

|

(1,943 |

) |

| Special reserve |

|

28,370 |

|

19,993 |

|

19,993 |

|

| Currency translation

reserve |

|

53 |

|

37 |

|

50 |

|

|

Accumulated losses reserve |

|

(114,794 |

) |

(80,898 |

) |

(73,767 |

) |

|

Total equity /

(deficit) |

|

14,012 |

|

9,875 |

|

(3,493 |

) |

CONSOLIDATED STATEMENT OF CASH FLOWS (audited)

For the year ended 31 January 2018

| |

Twelvemonthsended31

January2018 |

|

Twelvemonthsended31

January2018 |

|

Twelvemonthsended31 January2017 |

|

|

|

$000s |

|

£000s |

|

£000s |

|

| Cash flows from

operating activities |

|

|

|

| Loss before income

tax |

(15,457 |

) |

(10,893 |

) |

(25,707 |

) |

|

|

|

|

|

| Adjusted for: |

|

|

|

| Other operating income

on derecognition of financial liabilities on funding

arrangements |

(1,288 |

) |

(908 |

) |

- |

|

| Finance income |

(4,393 |

) |

(3,096 |

) |

(8 |

) |

| Finance cost |

1,652 |

|

1,164 |

|

862 |

|

| Foreign exchange

loss |

2,781 |

|

1,960 |

|

711 |

|

| Depreciation |

199 |

|

140 |

|

48 |

|

| Amortisation of

intangible fixed assets |

150 |

|

106 |

|

10 |

|

| Loss on disposal of

assets |

57 |

|

40 |

|

- |

|

| Movement in

provisions |

(85 |

) |

(60 |

) |

12 |

|

| Research and

development expenditure credit |

(33 |

) |

(23 |

) |

(3 |

) |

|

Share-based payment |

2,280 |

|

1,607 |

|

1,379 |

|

| Adjusted loss from

operations before changes in working capital |

(14,137 |

) |

(9,963 |

) |

(22,696 |

) |

| |

|

|

|

| (Increase) / decrease

in prepayments and other receivables |

(12,761 |

) |

(8,993 |

) |

492 |

|

| (Decrease) / increase

in deferred revenue |

(3,522 |

) |

(2,482 |

) |

30,527 |

|

| Increase

in trade and other payables |

4,789 |

|

3,375 |

|

813 |

|

| Cash (used by) /

generated from operations |

(25,631 |

) |

(18,063 |

) |

9,136 |

|

| Taxation

received |

4,788 |

|

3,374 |

|

3,005 |

|

|

Net cash (used by) / generated from operating

activities |

(20,843 |

) |

(14,689 |

) |

12,141 |

|

| |

|

|

|

| Investing

activities |

|

|

|

| Acquisition of

subsidiaries net of cash acquired |

(6,776 |

) |

(4,775 |

) |

- |

|

| Purchase of property,

plant and equipment |

(511 |

) |

(360 |

) |

(81 |

) |

| Purchase of intangible

assets |

(169 |

) |

(119 |

) |

(7 |

) |

| Interest

received |

17 |

|

12 |

|

8 |

|

|

Net cash used in investing activities |

(7,439 |

) |

(5,242 |

) |

(80 |

) |

|

|

|

|

|

| Financing

activities |

|

|

|

| Proceeds from issue of

share capital |

21,187 |

|

14,931 |

|

- |

|

| Transaction costs on

share capital issued |

(2,026 |

) |

(1,428 |

) |

- |

|

| Proceeds from exercise

of warrants |

14 |

|

10 |

|

107 |

|

| Proceeds from exercise

of share options |

556 |

|

392 |

|

283 |

|

| Cash received from

funding arrangements accounted for as financial liabilities |

- |

|

- |

|

23 |

|

|

Net cash generated from financing activities |

19,731 |

|

13,905 |

|

413 |

|

|

|

|

|

|

| (Decrease) /

Increase in cash and cash equivalents |

(8,551 |

) |

(6,026 |

) |

12,474 |

|

|

|

|

|

|

| Effect of

exchange rates on cash and cash equivalents |

(2,744 |

) |

(1,934 |

) |

(716 |

) |

|

|

|

|

|

| Cash and cash

equivalents at beginning of the year |

39,820 |

|

28,062 |

|

16,304 |

|

|

|

|

|

|

|

Cash and cash equivalents at end of the year |

28,525 |

|

20,102 |

|

28,062 |

|

CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY (audited)

Year ended 31 January 2018

|

Group |

|

Sharecapital£000s |

Sharepremiumaccount£000s |

|

Share-basedpaymentreserve£000s |

Mergerreserve£000s |

|

Specialreserve£000s |

Currencytranslationreserve£000s |

|

Accumulatedlossesreserve£000s |

|

Total £000s |

|

| At 1

February 2017 |

|

618 |

46,420 |

|

5,136 |

(1,943 |

) |

19,993 |

50 |

|

(73,767 |

) |

(3,493 |

) |

| Loss

for the year |

|

- |

- |

|

- |

- |

|

- |

- |

|

(7,131 |

) |

(7,131 |

) |

|

Currency translation adjustment |

|

- |

- |

|

- |

- |

|

- |

(13 |

) |

- |

|

(13 |

) |

| Total

comprehensive loss for the year |

|

- |

- |

|

- |

- |

|

- |

(13 |

) |

(7,131 |

) |

(7,144 |

) |

| New

share capital issued |

|

84 |

14,847 |

|

- |

- |

|

- |

- |

|

- |

|

14,931 |

|

|

Transaction costs on share capital issued |

|

- |

(1,428 |

) |

- |

- |

|

- |

- |

|

- |

|

(1,428 |

) |

| Issue

of ordinary shares as consideration for a business combination |

|

30 |

- |

|

- |

4,970 |

|

- |

- |

|

- |

|

5,000 |

|

| New

share capital issued from exercise of warrants |

|

1 |

9 |

|

- |

- |

|

- |

- |

|

- |

|

10 |

|

| Share

options exercised |

|

3 |

389 |

|

- |

- |

|

- |

- |

|

- |

|

392 |

|

|

Share-based payment |

|

- |

- |

|

1,607 |

- |

|

- |

- |

|

- |

|

1,607 |

|

|

At 31 January 2018 |

|

736 |

60,237 |

|

6,743 |

3,027 |

|

19,993 |

37 |

|

(80,898 |

) |

9,875 |

|

Year ended 31 January 2017

|

Group |

|

Share capital£000s |

Sharepremiumaccount£000s |

Share-basedpaymentreserve£000s |

Mergerreserve£000s |

|

Specialreserve£000s |

Currencytranslationreserve£000s |

Accumulatedlossesreserve£000s |

|

Total £000s |

|

| At 1 February 2016 |

|

613 |

46,035 |

3,757 |

(1,943 |

) |

19,993 |

21 |

(52,396 |

) |

16,080 |

|

| Loss for the year |

|

- |

- |

- |

- |

|

- |

- |

(21,371 |

) |

(21,371 |

) |

| Currency

translation adjustment |

|

- |

- |

- |

- |

|

- |

29 |

- |

|

29 |

|

| Total comprehensive

loss for the year |

|

- |

- |

- |

- |

|

- |

29 |

(21,371 |

) |

(21,342 |

) |

| New share capital

issued from exercise of warrants |

|

2 |

105 |

- |

- |

|

- |

- |

- |

|

107 |

|

| Share options

exercised |

|

3 |

280 |

- |

- |

|

- |

- |

- |

|

283 |

|

|

Share-based payment |

|

- |

- |

1,379 |

- |

|

- |

- |

- |

|

1,379 |

|

| At 31

January 2017 |

|

618 |

46,420 |

5,136 |

(1,943 |

) |

19,993 |

50 |

(73,767 |

) |

(3,493 |

) |

NOTES TO THE FINANCIAL STATEMENTSFor the year

ended 31 January 2018

1. Basis of Accounting

This financial information for the years ended

31 January 2018 and 31 January 2017 does not constitute the

statutory financial statements for the respective years within the

meaning of Sections 434-436 of the Companies Act 2006 and is an

extract from the financial statements. It is based on, and is

consistent with, the Group’s statutory accounts for the year ended

31 January 2018 and those financial statements will be delivered to

the Registrar of Companies following the Company’s 2018 Annual

General Meeting. Financial statements for the year ended 31

January 2017 have been delivered to the Registrar of Companies. The

financial statements for the years ended 31 January 2018 and 2017

contain an unqualified report from the Group’s auditors.

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards and

IFRS Interpretations Committee interpretations ('IFRS') as adopted

by the European Union and the Companies Act 2006 applicable to

companies reporting under IFRS. The Consolidated Financial

Statements have been prepared on a going concern basis and under

the historical cost convention.

Whilst the financial information included in

this preliminary announcement has been prepared in accordance with

IFRSs adopted for use in the European Union and as issued by the

International Accounting Standards Board, this announcement does

not itself contain sufficient information to comply with IFRSs.

This announcement is available from the Company

Secretary and is on the Company’s website.

The financial information for the three-month

periods ended 31 January 2018 and 2017 is unaudited.

Solely for the convenience of the reader, unless

otherwise indicated, all pound sterling amounts stated in the

Consolidated Statement of Financial Position as at 31 January 2018

and in the Consolidated Statement of Comprehensive Income and

Consolidated Statement of Cash Flows for the year and three months

ended 31 January 2018 have been translated into US dollars at the

rate on 31 January 2018 of $1.4190 to £1.00. These translations

should not be considered representations that any such amounts have

been, could have been or could be converted into US dollars at that

or any other exchange rate as at that or any other date.

The Board of Directors of the Company approved

this statement on 11 April 2018.

Adoption of IFRS 15 Revenue from

contracts with customers

IFRS 15 establishes comprehensive guidelines for determining

when to recognise revenue and how much revenue to recognise. The

core principle in that framework is that a company should recognise

revenue to depict the transfer of control of promised goods or

services to the customer in an amount that reflects the

consideration to which the company expects to be entitled in

exchange for those goods or services. The standard is

effective for reporting periods beginning on or after 1 January

2018 and replaces the accounting standard IAS 18 Revenue. The Group

will adopt this new standard effective 1 February 2018 as

required.

The Group has assessed the effect of adoption of this standard

as it relates to the licence and collaboration agreement with

Sarepta Therapeutics Inc. (‘Sarepta’), licence and

commercialisation agreement with Eurofarma Laboratórios SA

('Eurofarma') and the research collaboration agreement with F.

Hoffmann - La Roche Limited ('Roche'). Currently, the Group

anticipates the accounting for contingent milestone payments and

development cost share income to be the most significant change in

the accounting for its license and collaboration agreements. The

impact of the Group’s assessment would result in the contingent

milestone payments and development cost share income being

recognised over the estimated development services period, with

initial recognition when it becomes highly probable that a

significant reversal in the amount of cumulative revenue recognised

will not occur.

2. Loss per Share

Calculation

The loss per share has been calculated using the

loss for the period and dividing this by the weighted average

number of ordinary shares in issue during the twelve months ended

31 January 2018: 65,434,294 and during the three months ended 31

January 2018: 71,886,897 (for the twelve months ended 31 January

2017: 61,548,557 and for the three months ended 31 January 2017:

61,819,596).

Since the Group has reported a net loss, diluted

loss per share is equal to basic loss per share.

3. Issue of Share Capital

On 22 February 2017, warrants over 50,000 ordinary shares were

exercised at a price of 20 pence per share. The issue of

shares raised net proceeds of £10,000.

On 18 September 2017, the Group completed an underwritten public

offering on the Nasdaq Global Market issuing 1,459,000 American

Depositary Shares (‘ADS’) at a price of $12.00 per ADS. The

underwriters also exercised in full their over-allotment option to

purchase an additional 218,850 ADSs on the same terms which was

also completed on 18 September 2017. Each ADS represents five

ordinary shares of one penny nominal value each in the capital of

the Company, meaning 8,389,250 new ordinary shares were issued.

Total gross proceeds of $20.1 million (£14.9 million) were raised

and directly attributable transaction costs of £1.4 million were

incurred.

On 23 December 2017, the Group acquired 100% of the share

capital of Discuva Limited, a privately held UK-based company. As

part of the consideration the Group issued £5.0 million in new

ordinary shares of Summit of one penny nominal value to Discuva

shareholders at a price of 170.4 pence per share, meaning 2,934,272

ordinary shares were issued.

During the year to 31 January 2018 the following exercises of

share options took place:

|

Date |

Number of options exercised |

| 10 April 2017 |

16,667 |

| 27 June 2017 |

19,425 |

| 28 September 2017 |

32,500 |

| 29 September 2017 |

94,425 |

| 2 October 2017 |

97,199 |

| 4 October

2017 |

88,320 |

| |

348,536 |

The total net proceeds from exercised share

options during the year was £0.39 million.

All new ordinary shares rank pari passu with

existing ordinary shares.

Following the public offering and exercise of

the over-allotment option, the issuance of shares as consideration

for the acquisition of Discuva Limited and the exercise of the

above share options and warrants, the number of ordinary shares in

issue was 73,563,624 at the end of 31 January 2018.

4. Business Combinations

On 23 December 2017, the Group acquired 100% of the share

capital of Discuva Limited ('Discuva'), a privately held UK-based

company. As part of the acquisition the Group has obtained a

bacterial genetics-based platform for the discovery and development

of new mechanism antibiotic compounds.

Under the terms of the acquisition, the consideration to Discuva

shareholders comprised of £6.1 million in cash (being £5.0 million

plus the value of net cash acquired by the Group as part of the

acquisition) and £5.0 million in new ordinary shares of Summit of

one penny nominal value issued to Discuva shareholders at a price

of 170.4 pence per share, representing 2,934,272 ordinary

shares.

5. Subsequent Event

Post year end on 29 March 2018, the Group completed a placing on

the AIM market of the London Stock Exchange, issuing 8,333,333 new

ordinary shares at a price of 180 pence per share. Total gross

proceeds of £15.0 million were raised (before expenses).

Following the placing the number of ordinary shares in issue was

81,901,173.

-END-

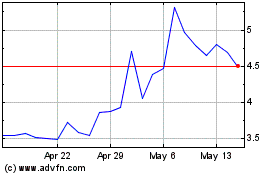

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Jul 2023 to Jul 2024