FALSE000087423800008742382024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2024

| | | | | | | | | | | | | | |

|

| STERLING INFRASTRUCTURE, INC. |

(Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 001-31993 | | 25-1655321 |

(State or other jurisdiction of incorporation

or organization) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

1800 Hughes Landing Blvd. The Woodlands, Texas | | | | 77380 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | |

Registrant’s telephone number, including area code: (281) 214-0777 |

| | | | |

|

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock, $0.01 par value per share | STRL | The NASDAQ Stock Market LLC |

| (Title of Class) | (Trading Symbol) | (Name of each exchange on which registered) |

| | |

|

| | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

| | | | | |

| |

| |

On August 5, 2024, Sterling Infrastructure, Inc. (the “Company”) issued a press release announcing financial results for the three and six months ended June 30, 2024 and providing an update on full year 2024 guidance. The press release is being furnished with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference. The information provided in this Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act, nor shall it be incorporated by reference in any filing made by the Company pursuant to the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), other than to the extent that such filing incorporates by reference any or all of such information by express reference thereto. |

Item 7.01 Regulation FD Disclosure.

| | | | | |

| |

| |

On August 6, 2024, the Company will host a conference call to discuss the second quarter 2024 results as well as corporate developments. The slides to be used during the conference call are being furnished with this Current Report on Form 8-K as Exhibit 99.2 and are incorporated herein by reference.

The information provided in this Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act, nor shall it be incorporated by reference in any filing made by the Company pursuant to the Exchange Act or the Securities Act, other than to the extent that such filing incorporates by reference any or all of such information by express reference thereto. |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| SIGNATURES |

|

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | | | | | | |

| | STERLING INFRASTRUCTURE, INC. |

| | | |

| Date: | August 5, 2024 | By: | /s/ Sharon R. Villaverde |

| | | Sharon R. Villaverde |

| | | Chief Financial Officer |

NEWS RELEASE

For Immediate Release:

August 5, 2024

Sterling Reports Record Second Quarter 2024 Results and Raises Full Year Guidance

THE WOODLANDS, TX – August 5, 2024 – Sterling Infrastructure, Inc. (NasdaqGS: STRL) (“Sterling” or the “Company”) today announced financial results for the second quarter 2024.

The financial comparisons herein are to the prior year quarter, unless otherwise noted.

Second Quarter 2024 Results

•Revenues of $582.8 million, an increase of 12%

•Gross margin of 19.3%, an increase from 17.7%

•Net Income of $51.9 million, or $1.67 per diluted share, an increase of 31% for both metrics.

•EBITDA(1) of $87.0 million, an increase of 18%

•Cash flows from operations totaled $170.6 million for the six months ended June 30, 2024

•Cash and Cash Equivalents totaled $540.0 million at June 30, 2024

•Backlog at June 30, 2024 was $2.10 billion

•Combined backlog(2) at June 30, 2024 was $2.45 billion

CEO Remarks and Outlook

“Our second quarter results reflect the strength of our diversified portfolio, which delivered 12% revenue growth and a remarkable 31% increase in diluted EPS. Our ongoing focus on margin expansion continues to drive profitability growth that significantly outpaces revenue. Gross profit margins of 19.3% marked a new record, and we see opportunity for further expansion,” stated Joe Cutillo, Sterling’s Chief Executive Officer. “We closed the second quarter with combined backlog of $2.45 billion, a 2.2% increase from the prior year. Additionally, as our business continues to move toward large, multi-phase projects, our pipeline of high probability work that is not captured in any backlog metrics has grown to over $500 million, providing multi-year visibility. Our operating cash flow generation in the quarter was again excellent at $121 million, driving our net cash position to $211 million, and supporting share repurchases of $30 million in the quarter. Our business is performing very well and we feel great about the opportunities ahead.”

Mr. Cutillo continued, “In E-Infrastructure Solutions, we achieved 20% operating income growth as operating margins expanded over 480 basis points to reach 21.4%. This excellent margin profile reflects our shift toward large mission-critical projects, including data centers and manufacturing, and away from small commercial and warehouse work. While this rotation is impacting top line for the segment, which declined 7%, we believe this is the best and most efficient use of our resources as we work to optimize returns. Notably, data center-related revenue increased more than 100% in the quarter and now represents over 40% of segment backlog. For the full year, we anticipate strong E-Infrastructure Solutions operating profit growth approaching 20%.

Transportation Solutions had another excellent quarter, delivering 54% revenue growth and 57% operating profit growth. The transportation markets are the strongest that they have been in our company’s history, driving our expectation for very strong revenue and profitability growth in in 2024.

(1) See the “Non-GAAP Measures” and “EBITDA Reconciliation” sections below for more information.

(2) Combined Backlog includes Unsigned Awards of $347.2 million, $303.2 million and $657.2 million at June 30, 2024, December 31, 2023 and June 30, 2023, respectively.

In Building Solutions, revenue declined 2% while operating profit grew 2%. Our residential concrete slab business was impacted by the heavy rainfall in Texas during the quarter and the availability of developed land. Our commercial business decline in the quarter was in line with our expectations and our plumbing business is performing very well. We expect Building Solutions to deliver operating profit growth in excess of 20% in 2024 as our mix continues to shift toward higher-margin offerings.”

“We believe 2024 will be another excellent year for Sterling. Given our strong first half results and backlog position, we are raising our full year guidance. The midpoint of our 2024 guidance would represent 11% revenue growth, 28% net income growth and 18% EBITDA growth,” Mr. Cutillo concluded.

Full Year 2024 Guidance

•Revenue of $2.150 billion to $2.225 billion

•Net Income of $175 million to $180 million

•Diluted EPS of $5.60 to $5.75

•EBITDA(1) of $300 million to $310 million

Conference Call

Sterling’s management will hold a conference call to discuss these results and recent corporate developments on Tuesday, August 6, 2024 at 9:00 a.m. ET/8:00 a.m. CT. Interested parties may participate in the call by dialing (800) 836-8184. Please call in 10 minutes before the conference call is scheduled to begin and ask for the Sterling Infrastructure call. To coincide with the conference call, Sterling will post a slide presentation at www.strlco.com on the Events & Presentations section of the Investor Relations tab. Following management’s opening remarks, there will be a question and answer session.

To listen to a simultaneous webcast of the call, please go to the Company’s website at www.strlco.com at least 15 minutes early to download and install any necessary audio software. If you are unable to listen live, the conference call webcast will be archived on the Company’s website for 30 days.

About Sterling

Sterling operates through a variety of subsidiaries within three segments specializing in E-Infrastructure, Transportation and Building Solutions in the United States, primarily across the Southern, Northeastern, Mid-Atlantic and Rocky Mountain regions and the Pacific Islands. E-Infrastructure Solutions provides advanced, large-scale site development services for manufacturing, data centers, e-commerce distribution centers, warehousing, power generation and more. Transportation Solutions includes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, rail and storm drainage systems. Building Solutions includes residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs, other concrete work and plumbing services for new single-family residential builds. From strategy to operations, we are committed to sustainability by operating responsibly to safeguard and improve society’s quality of life. Caring for our people and our communities, our customers and our investors – that is The Sterling Way.

Joe Cutillo, CEO, “We build and service the infrastructure that enables our economy to run,

our people to move and our country to grow.”

(1) See the “Non-GAAP Measures” and “EBITDA Guidance Reconciliation” sections below for more information.

Important Information for Investors and Stockholders

Non-GAAP Measures

This press release contains “Non-GAAP” financial measures as defined under Regulation G of the amended U.S. Securities Exchange Act of 1934. The Company reports financial results in accordance with U.S. generally accepted accounting principles (“GAAP”), but the Company believes that certain Non-GAAP financial measures provide useful supplemental information to investors regarding the underlying business trends and performance of the Company’s ongoing operations and are useful for period-over-period comparisons of those operations.

Non-GAAP measures may include adjusted net income, adjusted EPS, EBITDA and adjusted EBITDA, in each case excluding the impacts of certain identified items. The excluded items represent items that the Company does not consider to be representative of its normal operations. The Company believes that these measures are useful for investors to review, because they provide a consistent measure of the underlying financial results of the Company’s ongoing business and, in the Company’s view, allow for a supplemental comparison against historical results and expectations for future performance. Furthermore, the Company uses each of these to measure the performance of the Company’s operations for budgeting and forecasting, as well as for determining employee incentive compensation. However, Non-GAAP measures should not be considered as substitutes for net income, EPS, or other data prepared and reported in accordance with GAAP and should be viewed in addition to the Company’s reported results prepared in accordance with GAAP.

Reconciliations of Non-GAAP financial measures to the most comparable GAAP measures are provided in the tables included within this press release.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are considered forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our business strategy; our financial strategy; our industry outlook; our guidance; our expected margin growth; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this press release, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “guidance,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this press release are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this press release are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

| | | | | |

Company Contact: Sterling Infrastructure, Inc. Noelle Dilts, VP Investor Relations and Corporate Strategy 281-214-0795 |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenues | $ | 582,822 | | | $ | 522,325 | | | $ | 1,023,182 | | | $ | 925,904 | |

| Cost of revenues | (470,079) | | | (430,051) | | | (833,535) | | | (771,888) | |

| Gross profit | 112,743 | | | 92,274 | | | 189,647 | | | 154,016 | |

| General and administrative expense | (27,856) | | | (24,034) | | | (55,154) | | | (47,355) | |

| Intangible asset amortization | (4,280) | | | (3,737) | | | (8,577) | | | (7,473) | |

| Acquisition related costs | (101) | | | (59) | | | (137) | | | (249) | |

| Other operating expense, net | (7,772) | | | (4,181) | | | (10,920) | | | (6,049) | |

| Operating income | 72,734 | | | 60,263 | | | 114,859 | | | 92,890 | |

| Interest income | 6,305 | | | 2,203 | | | 12,207 | | | 4,177 | |

| Interest expense | (6,513) | | | (7,731) | | | (13,177) | | | (15,259) | |

| | | | | | | |

| Income before income taxes | 72,526 | | | 54,735 | | | 113,889 | | | 81,808 | |

| Income tax expense | (17,952) | | | (14,505) | | | (25,556) | | | (21,538) | |

| Net income, including noncontrolling interests | 54,574 | | | 40,230 | | | 88,333 | | | 60,270 | |

| Less: Net income attributable to noncontrolling interests | (2,695) | | | (750) | | | (5,406) | | | (1,141) | |

| Net income attributable to Sterling common stockholders | $ | 51,879 | | | $ | 39,480 | | | $ | 82,927 | | | $ | 59,129 | |

| | | | | | | |

| Net income per share attributable to Sterling common stockholders: | | | | | | | |

| Basic | $ | 1.68 | | | $ | 1.28 | | | $ | 2.68 | | | $ | 1.93 | |

| Diluted | $ | 1.67 | | | $ | 1.27 | | | $ | 2.66 | | | $ | 1.91 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 30,914 | | 30,780 | | 30,945 | | 30,699 |

| Diluted | 31,145 | | 31,000 | | 31,158 | | 30,886 |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

SEGMENT INFORMATION

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Revenues | 2024 | | % of Revenue | | 2023 | | % of Revenue | | 2024 | | % of Revenue | | 2023 | | % of Revenue |

| E-Infrastructure Solutions | $ | 241,312 | | | 41% | | $ | 260,148 | | | 50% | | $ | 425,788 | | | 42% | | $ | 465,988 | | | 50% |

| Transportation Solutions | 232,775 | | | 40% | | 151,088 | | | 29% | | 381,744 | | | 37% | | 262,227 | | | 29% |

| Building Solutions | 108,735 | | | 19% | | 111,089 | | | 21% | | 215,650 | | | 21% | | 197,689 | | | 21% |

| Total Revenues | $ | 582,822 | | | | | $ | 522,325 | | | | | $ | 1,023,182 | | | | | $ | 925,904 | | | |

| | | | | | | | | | | | | | | |

| Operating Income | | | | | | | | | | | | | | | |

| E-Infrastructure Solutions | $ | 51,677 | | | 21.4% | | $ | 43,167 | | | 16.6% | | $ | 78,846 | | | 18.5% | | $ | 67,436 | | | 14.5% |

| Transportation Solutions | 15,449 | | | 6.6% | | 9,856 | | | 6.5% | | 23,581 | | | 6.2% | | 15,162 | | | 5.8% |

| Building Solutions | 13,813 | | | 12.7% | | 13,480 | | | 12.1% | | 28,588 | | | 13.3% | | 22,181 | | | 11.2% |

| Segment Operating Income | 80,939 | | | 13.9% | | 66,503 | | | 12.7% | | 131,015 | | | 12.8% | | 104,779 | | | 11.3% |

| Corporate G&A Expense | (8,104) | | | | | (6,181) | | | | | (16,019) | | | | | (11,640) | | | |

| Acquisition Related Costs | (101) | | | | | (59) | | | | | (137) | | | | | (249) | | | |

| Total Operating Income | $ | 72,734 | | | 12.5% | | $ | 60,263 | | | 11.5% | | $ | 114,859 | | | 11.2% | | $ | 92,890 | | | 10.0% |

|

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 539,985 | | | $ | 471,563 | |

| Accounts receivable | 374,771 | | | 252,435 | |

| Contract assets | 77,034 | | | 88,600 | |

| Receivables from and equity in construction joint ventures | 5,467 | | | 17,506 | |

| Other current assets | 19,511 | | | 17,875 | |

| Total current assets | 1,016,768 | | | 847,979 | |

| Property and equipment, net | 268,185 | | | 243,648 | |

| Operating lease right-of-use assets, net | 58,970 | | | 57,235 | |

| Goodwill | 281,363 | | | 281,117 | |

| Other intangibles, net | 319,820 | | | 328,397 | |

| | | |

| Other non-current assets, net | 19,444 | | | 18,808 | |

| Total assets | $ | 1,964,550 | | | $ | 1,777,184 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 163,841 | | | $ | 145,968 | |

| Contract liabilities | 556,134 | | | 444,160 | |

| Current maturities of long-term debt | 26,428 | | | 26,520 | |

| Current portion of long-term lease obligations | 19,831 | | | 19,641 | |

| Accrued compensation | 29,768 | | | 27,758 | |

| Other current liabilities | 24,854 | | | 14,121 | |

| Total current liabilities | 820,856 | | | 678,168 | |

| Long-term debt | 302,459 | | | 314,996 | |

| Long-term lease obligations | 39,180 | | | 37,722 | |

| Members’ interest subject to mandatory redemption and undistributed earnings | 23,811 | | | 29,108 | |

| Deferred tax liability, net | 80,304 | | | 76,764 | |

| Other long-term liabilities | 16,926 | | | 16,573 | |

| Total liabilities | 1,283,536 | | | 1,153,331 | |

| Stockholders’ equity: | | | |

| Common stock | 312 | | | 309 | |

| Additional paid in capital | 291,401 | | | 293,570 | |

| Treasury stock | (29,006) | | | — | |

| Retained earnings | 407,961 | | | 325,034 | |

| | | |

| Total Sterling stockholders’ equity | 670,668 | | | 618,913 | |

| Noncontrolling interests | 10,346 | | | 4,940 | |

| Total stockholders’ equity | 681,014 | | | 623,853 | |

| Total liabilities and stockholders’ equity | $ | 1,964,550 | | | $ | 1,777,184 | |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 88,333 | | | $ | 60,270 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 33,183 | | | 27,672 | |

| Amortization of debt issuance costs and non-cash interest | 597 | | | 877 | |

| Gain on disposal of property and equipment | (2,964) | | | (2,631) | |

| | | |

| | | |

| Deferred taxes | 3,517 | | | 6,790 | |

| Stock-based compensation | 9,382 | | | 7,003 | |

| | | |

| Changes in operating assets and liabilities | 38,513 | | | 81,126 | |

| Net cash provided by operating activities | 170,561 | | | 181,107 | |

| Cash flows from investing activities: | | | |

| Acquisitions, net of cash acquired | (1,016) | | | — | |

| Disposition proceeds | — | | | 14,000 | |

| Capital expenditures | (51,309) | | | (38,859) | |

| Proceeds from sale of property and equipment | 6,944 | | | 8,525 | |

| Net cash used in investing activities | (45,381) | | | (16,334) | |

| Cash flows from financing activities: | | | |

| | | |

| Repayments of debt | (13,324) | | | (67,589) | |

| Repurchase of common stock | (30,142) | | | — | |

| | | |

| Withholding taxes paid on net share settlement of equity awards | (13,264) | | | (4,328) | |

| | | |

| Other | (28) | | | — | |

| Net cash used in financing activities | (56,758) | | | (71,917) | |

| Net change in cash, cash equivalents, and restricted cash | 68,422 | | | 92,856 | |

| Cash, cash equivalents and restricted cash at beginning of period | 471,563 | | | 185,265 | |

| Cash, cash equivalents and restricted cash at end of period | 539,985 | | | 278,121 | |

| Less: restricted cash | — | | | — | |

| | | |

| Cash and cash equivalents at end of period | $ | 539,985 | | | $ | 278,121 | |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

EBITDA RECONCILIATION

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income attributable to Sterling common stockholders | $ | 51,879 | | | $ | 39,480 | | | $ | 82,927 | | | $ | 59,129 | |

| Depreciation and amortization | 16,925 | | | 13,980 | | | 33,183 | | | 27,672 | |

| Interest expense, net of interest income | 208 | | | 5,528 | | | 970 | | | 11,082 | |

| Income tax expense | 17,952 | | | 14,505 | | | 25,556 | | | 21,538 | |

EBITDA(1) | 86,964 | | | 73,493 | | | 142,636 | | | 119,421 | |

| | | | | | | |

| Acquisition related costs | 101 | | | 59 | | | 137 | | | 249 | |

Adjusted EBITDA(2) | $ | 87,065 | | | $ | 73,552 | | | $ | 142,773 | | | $ | 119,670 | |

| | | | | | | |

(1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. |

| | | | | | | |

(2) The Company defines adjusted EBITDA as EBITDA excluding the impact of acquisition related costs. |

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

EBITDA GUIDANCE RECONCILIATION

(In millions)

(Unaudited)

| | | | | | | | | | | |

| | Full Year 2024 Guidance |

| | Low | | High |

| Net income attributable to Sterling common stockholders | $ | 175 | | | $ | 180 | |

| Depreciation and amortization | 66 | | | 67 | |

| Interest expense, net of interest income | 2 | | | 2 | |

| Income tax expense | 57 | | | 61 | |

EBITDA (1) | $ | 300 | | | $ | 310 | |

| | | |

(1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense, and taxes. |

We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow. Q2 2024 Earnings Call August 6, 2024

2Sterling | STRL: Second Quarter 2024 DISCLOSURE: Forward-Looking Statements This presentation contains, and the officers and directors of the Company may from time to time make, statements that are considered forward- looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about: our business strategy; our financial strategy; our industry outlook; our guidance; our expected margin growth; and our plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this presentation, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” "would," “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” "guidance," “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this presentation are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this presentation are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward- looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission and elsewhere in those filings. Additional factors or risks that we currently deem immaterial, that are not presently known to us or that arise in the future could also cause our actual results to differ materially from our expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which our forward-looking statements are based are likely to change after the date the forward-looking statements are made. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward- looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. This presentation may contain the financial measures: adjusted net income, EBITDA, adjusted EBITDA, and adjusted EPS, which are not calculated in accordance with U.S. GAAP. When presented, a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measure will be provided in the Appendix to this presentation.

E-Infrastructure Solutions + Fastest growing segment in revenue growth + Provides value-added solutions to blue-chip customers in all major East Coast markets + Develops advanced, large-scale site development services for manufacturing, data centers, e-commerce distribution centers, warehousing, power generation and more Building Solutions + Serves the Nation's Top Builders in the Nation's Top Housing Markets: Texas & Arizona + Residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs, other concrete work and plumbing services for new single- family residential builds Transportation Solutions + Enhanced business mix + Provides infrastructure solutions in the Rocky Mountain States and Texas + Infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, rail and storm drainage systems Sterling | STRL: Second Quarter 2024 3 WHO is Sterling? NASDAQ STRL Shares outstanding(2) 30.7M HQ The Woodlands, TX Market cap(2) $3.22B Employees ~3,000(1) Revenue(3) $2.19B Segments E-Infrastructure Solutions Building Solutions Transportation Solutions EBITDA(3) $305M Projects underway ~220(1) Total Backlog(1) $2.10B A market-leading infrastructure service provider of e-infrastructure, building and transportation solutions. A story of successful execution of a multi-year strategic business transformation; born of a vision that levers our entrepreneurial spirit. We offer a customer-centric, market-focused portfolio of goods and services geographically positioned in the right markets. (1) At June 30, 2024. (2) Shares outstanding and Market Cap as of August 2, 2024. (3) Full Year 2024 Revenue and EBITDA Mid-Point Guidance. *See EBITDA Reconciliation in the Appendix page 16.

Sterling | STRL: Second Quarter 2024 4 Strategic Transformation at a Glance

+ Second Quarter 2024 Results Sterling | STRL: Second Quarter 2024 5

Second Quarter 2024 Results Highlights + Revenues: $582.8 million + Net Income: $51.9 million + Diluted EPS: $1.67 + EBITDA(1): $87.0 million + Cash Flow from Operations(2): $170.6 million + Cash & Cash Equivalents(3): $540.0 million + Backlog(3): $2.10 billion with 16.0% margin + Combined Backlog(4): $2.45 billion Sterling | STRL: Second Quarter 2024 6 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. See EBITDA reconciliation on page 15. (2) Cash flow from operations for the six months ended June 30, 2024. (3) Cash & Cash Equivalents and Backlog at June 30, 2024. (4) Combined Backlog includes Unsigned Awards of $347.2 million at June 30, 2024.

Sterling | STRL: Second Quarter 2024 7 Quarterly Consolidated and Segment Results ($ in millions, except per share data) Q2 2024 Q2 2023 Revenues $ 582.8 $ 522.3 Gross Profit 112.7 92.3 G&A Expense (27.9) (24.0) Intangible Amortization (4.3) (3.7) Acquisition Related Costs (0.1) (0.1) Other Operating Expense, Net (7.8) (4.2) Operating Income 72.7 60.3 Interest, Net (0.2) (5.5) Income Tax Expense (18.0) (14.5) Less: Net Income Attributable to NCI (2.7) (0.8) Net income $ 51.9 $ 39.5 Diluted EPS $ 1.67 $ 1.27 EBITDA (1) $ 87.0 $ 73.5 ($ in millions) Q2 2024 Q2 2023 E-Infrastructure Solutions Revenue $ 241.3 $ 260.1 Operating Income $ 51.7 $ 43.2 Operating Margin 21.4 % 16.6 % Transportation Solutions Revenue $ 232.8 $ 151.1 Operating Income $ 15.4 $ 9.9 Operating Margin 6.6 % 6.5 % Building Solutions Revenue $ 108.7 $ 111.1 Operating Income $ 13.8 $ 13.5 Operating Margin 12.7 % 12.1 % (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. See EBITDA reconciliation on page 15.

Sterling | STRL: Second Quarter 2024 8 Remaining Performance Obligations (RPOs)(1) ($ in millions) June 30, 2024 December 31, 2023 June 30, 2023 E-Infrastructure Solutions RPOs $ 868.2 $ 813.7 $ 886.6 Transportation Solutions RPOs 1,160.5 1,184.5 743.6 Building Solutions RPOs - Commercial 70.1 68.8 105.4 Total RPOs $ 2,098.8 $ 2,067.0 $ 1,735.6 (1) Our remaining performance obligations do not differ from what we refer to as “Backlog,” and represent the amount of revenues we expect to recognize in the future from our contract commitments on projects.

Sterling | STRL: Second Quarter 2024 9 Increased EBITDA and Cash Flow Drives Liquidity Strategy Foward Looking EBITDA Debt Coverage Ratio 1.2X 1.1X 12/31/23 6/30/24 0.0X 0.3X 0.5X 0.8X 1.0X 1.3X We expect to pursue strategic uses of our liquidity, such as strategic acquisitions, investing in capital equipment and managing leverage. Capital allocation focus • Long-term shareholder value • Complementing organic growth in existing and new markets • Strong cash flow profile provides flexibility and drives liquidity strategy Sterling is comfortable with a forward looking debt/ EBITDA coverage ratio of +/-2.5X. 5-Year Credit Facility $330M Term Loan Borrowings $75M Revolving Credit Facility (Undrawn) Key Cash Flow Considerations Q2 YTD 2024 Q2 YTD 2023 Cash flows from Operations $170.6M $181.1M Net CAPEX $44.4M $30.3M • Cash & Cash Equivalents at June 30, 2024 was $540.0 million • 2024 EBITDA guidance(1): $300M to $310M • Expected 2024 noncash expenses: $25M to $30M (Stock-based compensation, noncash interest expense, deferred taxes, etc.) • Scheduled term loan debt payments total $26,300, $26,300 and $6,600 for 2024, 2025, and 2026, respectively (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense and taxes. See EBITDA guidance reconciliation on page 16.

Sterling | STRL: Second Quarter 2024 10 Contact Us Sterling Infrastructure, Inc. Noelle Dilts, VP IR and Corporate Strategy Tel: (281) 214-0795 noelle.dilts@strlco.com

+ Appendix Sterling | STRL: Second Quarter 2024 11

Sterling | STRL: Second Quarter 2024 12 2024 Modeling Considerations(1) (1) In millions except for EPS and percentages. (2) See EBITDA guidance reconciliation on page 16. Revenue $2,150 to $2,225 Gross Margin 18.5% to 19.0% G&A Expense as % of Revenue (Excluding Intangible Amortization) ~5% Intangible Amortization $17 Other Operating Expense Net $23 to $25 JV Non-Controlling Interest Expense ~$10 Effective Income Tax Rate ~25% Net Income $175 to $180 Diluted EPS $5.60 to $5.75 Expected Dilutive Shares Outstanding 31.3 EBITDA(2) $300 to $310

2024 Modeling Considerations Continued* Sterling | STRL: Second Quarter 2024 13 * In Millions. Non-Cash Items FY 2024 Expectations FY 2023 Depreciation $49 to $50 $42.2 Intangible Amortization $17 $15.2 Debt Issuance Cost Amortization $1 to $2 $1.7 Stock-based Compensation $18 to $20 $14.6 Deferred Taxes $6 to $8 $14.7 Other Cash Flow Items FY 2024 Expectations FY 2023 Interest expense, net of interest income $2 $15.2 CAPEX, net of disposals $60 to $65 $50.6

Sterling | STRL: Second Quarter 2024 14 (1) The Company defines adjusted net income attributable to Sterling common stockholders as GAAP net income attributable to Sterling common stockholders excluding the impact of acquisition related costs. Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net income attributable to Sterling common stockholders $ 51,879 $ 39,480 $ 82,927 $ 59,129 Acquisition related costs 101 59 137 249 Adjusted net income attributable to Sterling common stockholders (1) $ 51,980 $ 39,539 $ 83,064 $ 59,378 Net income per share attributable to Sterling common stockholders: Basic $ 1.68 $ 1.28 $ 2.68 $ 1.93 Diluted $ 1.67 $ 1.27 $ 2.66 $ 1.91 Adjusted net income per share attributable to Sterling common stockholders: Basic $ 1.68 $ 1.28 $ 2.68 $ 1.93 Diluted $ 1.67 $ 1.28 $ 2.67 $ 1.92 Weighted average common shares outstanding: Basic 30,914 30,780 30,945 30,699 Diluted 31,145 31,000 31,158 30,886 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES ADJUSTED NET INCOME RECONCILIATION (In thousands) (Unaudited)

Sterling | STRL: Second Quarter 2024 15 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders adjusted for depreciation and amortization, net interest expense and taxes. (2) The Company defines adjusted EBITDA as EBITDA excluding the impact of acquisition related costs. Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net income attributable to Sterling common stockholders $ 51,879 $ 39,480 $ 82,927 $ 59,129 Depreciation and amortization 16,925 13,980 33,183 27,672 Interest expense, net of interest income 208 5,528 970 11,082 Income tax expense 17,952 14,505 25,556 21,538 EBITDA (1) 86,964 73,493 142,636 119,421 Acquisition related costs 101 59 137 249 Adjusted EBITDA (2) $ 87,065 $ 73,552 $ 142,773 $ 119,670 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES EBITDA RECONCILIATION (In thousands) (Unaudited)

Sterling | STRL: Second Quarter 2024 16 (1) The Company defines EBITDA as GAAP net income attributable to Sterling common stockholders, adjusted for depreciation and amortization, net interest expense and taxes. Full Year 2024 Guidance Low High Net income attributable to Sterling common stockholders $ 175 $ 180 Depreciation and amortization 66 67 Interest expense, net of interest income 2 2 Income tax expense 57 61 EBITDA (1) $ 300 $ 310 STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES EBITDA GUIDANCE RECONCILIATION (In millions) (Unaudited)

THANK YOU We build and service the infrastructure that enables our economy to run, our people to move, and our country to grow.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

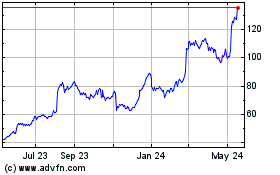

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Oct 2024 to Nov 2024

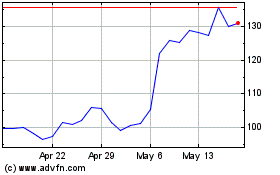

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Nov 2023 to Nov 2024