Tiptree Inc. Announces Tax Treatment of 2024 Common Stock Distributions

January 07 2025 - 8:03AM

Business Wire

Tiptree Inc. (NASDAQ: TIPT) announced the income tax treatment

of its 2024 common stock distribution payments. Total 2024

distributions to common stockholders were $0.49 per share and are

considered return of capital, as set forth below.

CUSIP 88822Q103

FORM 1099-DIV

Box 1a

Box 1b

Box 2a

Box 2b

Box 3

Box 5

Record Date

Payment Date

Distribution Per Share

Ordinary Dividends

Qualified

Dividends

Capital Gain

Distributions

Unrecaptured Section 1250

Gain

Nondividend

Distributions

Section 199A Dividends

3/11/2024

3/18/2024

$0.06

-

-

-

-

$0.06

-

5/20/2024

5/28/2024

$0.06

-

-

-

-

$0.06

-

8/19/2024

8/26/2024

$0.06

-

-

-

-

$0.06

-

11/18/2024

11/25/2024

$0.06

-

-

-

-

$0.06

-

12/11/2024

12/19/2024

$0.25

$0.25

Total

$0.49

-

-

-

-

$0.49

-

Stockholders are encouraged to consult with their personal tax

advisors as to their specific tax treatment of Tiptree Inc.

distributions.

About Tiptree

Tiptree Inc. (NASDAQ: TIPT) allocates capital to select small

and middle market companies with the mission of building long-term

value. Established in 2007, Tiptree has a significant track record

investing across a variety of industries and asset types, including

the insurance, asset management, specialty finance, real estate and

shipping sectors. With proprietary access and a flexible capital

base, Tiptree seeks to uncover compelling investment opportunities

and support management teams in unlocking the full value potential

of their businesses. For more information, please visit

tiptreeinc.com and follow us on LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107757318/en/

Tiptree Inc. Investor Relations, 212-446-1400

ir@tiptreeinc.com

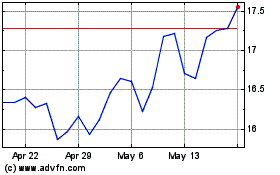

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

From Mar 2024 to Mar 2025