0001850902false00018509022024-07-092024-07-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 9, 2024

ALPHA TEKNOVA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-40538 |

|

94-3368109 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

2451 Bert Drive

Hollister, CA 95023

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (831) 637-1100

N/A

(Former name, or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.00001 per share |

|

TKNO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On July 9, 2024, Alpha Teknova, Inc. (the “Company”) issued a press release providing a strategic business update and announcing preliminary financial results for the second quarter ended June 30, 2024 (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in this Item 2.02, including the Press Release, is intended to be furnished under Item 2.02 and Item 9.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

ALPHA TEKNOVA, INC. |

Date: July 9, 2024 |

By: |

/s/ Stephen Gunstream |

|

|

Stephen Gunstream |

|

|

President and Chief Executive Officer |

Exhibit 99.1

Teknova Provides Strategic Business Update and Announces Preliminary Second Quarter 2024 Results

Second quarter 2024 total revenue is in the range of $9.4 to $9.6 million

Company reaffirms 2024 revenue guidance of $35-38 million

HOLLISTER, Calif., July 9,2024 – Alpha Teknova, Inc. (“Teknova” or the “Company”) (Nasdaq: TKNO), a leading producer of critical reagents for the discovery, development, and commercialization of novel therapies, vaccines, and molecular diagnostics, today provided a business update including preliminary unaudited financial results for the second quarter ended June 30, 2024.

“I’m excited to share our sustained progress in executing against our strategy,” said Stephen Gunstream, President and Chief Executive Officer. “I’m increasingly confident that we will continue to deliver through the end of this year and beyond, in particular as market conditions appear likely to improve, notably with recent FDA approvals of novel gene therapies and with a recovery in biotech and cell and gene therapy funding more broadly.”

Business and Financial Updates

Financial Performance: Teknova reaffirms its fiscal 2024 revenue guidance of $35-38 million.

•Second quarter 2024 total revenue is in the range of $9.4 to $9.6 million, down 17% to 18% when compared to second quarter 2023. However, when adjusted to remove an unusually large Clinical Solutions order (as disclosed in the Company’s Quarterly Report on Form 10-Q for the second quarter of 2023), our second quarter 2024 revenue increased by 7% to 9%.

•Customer base remains diversified, with no single direct customer representing more than $1.0 million in revenue year-to-date.

•Teknova continues to anticipate Free Cash Outflow of less than $18 million for 2024 – with $3.0 to $3.4 million of total cash used in the second quarter of 2024.

•Company’s cost management efforts have been effective, led by a reduction in headcount of more than 40% compared to the peak in the second quarter of 2022, with 169 associates at the end of the second quarter 2024.

•Teknova expects to report its complete financial results for the second quarter of 2024 on August 13th, 2024, following the close of market.

Clinical Solutions: Teknova has seen an increase in the number of Clinical Solutions customers since fiscal 2023, from 34 to 43. While the Company’s overall revenue in fiscal 2024 is expected to be lower within the Clinical Solutions category compared to fiscal 2023, Teknova has successfully grown the number of its customers entering clinical trials and ordering its GMP-grade products, supporting the Company’s thesis that demand for its products has the potential to grow as novel therapies, especially cell and gene therapies, progress through development.

Lab Essentials: Customer experience metrics are on the rise as the Company continues to improve its manufacturing efficiency, with on-time delivery for made-to-stock and made-to-order products at an all-time high. Following a decrease in fiscal 2023 due to industry headwinds and product rationalization, the Company has seen an increase in the number of Lab Essentials customers from 2,829 to 2,913 since fiscal 2023.

The preliminary financial results presented above are based on currently available information and have been prepared by and are the responsibility of Teknova. Teknova has not fully completed its review of these preliminary financial results for the quarter ended June 30, 2024. Teknova’s independent auditor has not reviewed or audited these preliminary financial results. Teknova’s actual results may differ materially from these preliminary financial results and may be outside the estimated ranges.

About Teknova

Teknova makes solutions possible. Since 1996, Teknova has been innovating the manufacture of critical reagents for the life sciences industry to accelerate the discovery and development of novel therapies that will help people live longer, healthier lives. We offer fully customizable solutions for every stage of the workflow, supporting industry leaders in cell and gene therapy, molecular diagnostics, and synthetic biology. Our fast turnaround of high-quality agar plates, microbial culture media, buffers, reagents, and water helps our customers scale seamlessly from RUO to GMP. Headquartered in Hollister, California, with over 200,000 square feet of state-of-the-art facilities, Teknova’s modular manufacturing platform was designed by our team of scientists, engineers, and quality control experts to efficiently produce the foundational ingredients for the discovery and commercialization of novel therapies.

Non-GAAP Financial Measures

This press release contains a financial measure that has not been calculated in accordance with U.S. generally accepted accounting principles (GAAP). Teknova uses the following non-GAAP financial measure in assessing the performance of its business and the effectiveness of its business strategies: Free Cash Flow. Teknova defines Free Cash Flow as cash used in operating activities plus purchases of property, plant, and equipment.

Teknova provides Free Cash Flow in this press release because Teknova believes that analysts, investors, and other interested parties frequently use this measure to evaluate companies in Teknova’s industry and that such measure facilitates comparisons on a consistent basis across

reporting periods. Teknova also believes such measure is helpful in highlighting trends in Teknova’s operating results because such measure excludes items that are not indicative of Teknova’s core operating performance. Investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measure presented by Teknova may be different from the non-GAAP financial measure used by other companies.

We have not reconciled forward-looking Free Cash Flow to its most directly comparable GAAP measure in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. We cannot predict with reasonable certainty the ultimate outcome of certain components of such reconciliation, including timing of customer payments for account receivables and payment terms for operating expenses, or others that may arise, without unreasonable effort. For these reasons, we are unable to assess the probable significance of the unavailable information, which could materially impact the amount of future free cash outflow.

Forward-Looking Statements

Statements in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical facts, may constitute “forward-looking statements.” These statements include, but are not limited to, statements relating to Teknova’s preliminary unaudited financial results for the quarter ended June 30, 2024, including anticipated total revenue, cash used, including our expectations for 2024 revenue and free cash outflow guidance, expected growth in Lab Essentials and Clinical Solutions, and other statements about Teknova’s business prospects, including about the Company’s profitability, strategy of managing operating expenses, and long-term growth strategy. The words, without limitation, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these or similar identifying words. These forward-looking statements are based on management’s current expectations and beliefs and are subject to risks and uncertainties, all of which are difficult to predict and many of which are beyond Teknova’s control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks and uncertainties include, but are not limited to, demand for Teknova’s products (including the potential delay to or pausing of customer orders); Teknova’s assessment of fundamental indicators of future demand across its target customer base; Teknova’s cash flows and revenue growth rate; Teknova’s supply chain, sourcing, manufacturing, and warehousing; inventory management; risks related to global economic and marketplace uncertainties, including those related to the conflicts in Ukraine and the Middle East; reliance on a limited number of customers for a high percentage of Teknova’s revenue; potential acquisitions and integration of other companies; and other factors discussed in the “Risk Factors” section of Teknova’s most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including in Teknova’s Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent Quarterly Reports on Form 10-Q filed with the SEC, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although Teknova believes that the expectations reflected in its forward-looking statements are reasonable,

Teknova does not know whether its expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by Teknova on its website or otherwise. Teknova does not undertake any obligation to update, amend, or clarify these forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

Investor Contact Media Contact

Matt Lowell Jennifer Henry

Chief Financial Officer Senior Vice President, Marketing

matt.lowell@teknova.com jenn.henry@teknova.com

+1 831-637-1100 +1 831-313-1259

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

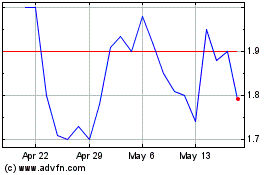

Alpha Teknova (NASDAQ:TKNO)

Historical Stock Chart

From Jun 2024 to Jul 2024

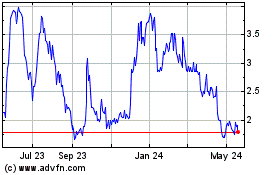

Alpha Teknova (NASDAQ:TKNO)

Historical Stock Chart

From Jul 2023 to Jul 2024