false

--12-31

0001429560

0001429560

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2024

TREVENA, INC.

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-36193 |

|

26-1469215 |

(Commission

File No.) |

|

(IRS Employer

Identification No.) |

955 Chesterbrook Boulevard, Suite 110

Chesterbrook, PA 19087

(Address of principal executive offices and zip

code)

Registrant’s telephone number, including

area code: (610) 354-8840

Not applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class | |

Trading Symbol(s) | |

Name of each exchange on which registered |

| Common Stock, $0.001 par value | |

TRVN | |

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 3.03. |

Material Modification to Rights of Security Holders. |

The information set forth in Item 5.03 is

incorporated herein by reference.

|

Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On August 8, 2024, Trevena, Inc. (the

“Company”) filed a Certificate of Amendment (the “Amendment”) to the Company’s Amended and Restated Certificate

of Incorporation (as amended, the “Certificate of Incorporation”) with the Secretary of State of the State of Delaware to

effect a 1-for-25 reverse stock split of its issued and outstanding common stock, effective as of 12:01 a.m. on August 13, 2024

(the “Reverse Stock Split”).

At the Annual General Meeting of stockholders

held on June 13, 2024, Trevena’s stockholders approved a reverse stock split of Trevena’s common stock at a ratio

of not less than 1-for-2 and not more than 1-for-25, with such ratio to be determined by the Board of Directors at any time prior to August 28,

2024. Additional information regarding the reverse stock split approved by stockholders can be found in Trevena’s definitive proxy

statement that was filed with the Securities and Exchange Commission on April 29, 2024. On July 31, 2024, the

Board approved the Reverse Stock Split at a ratio of 1-for-25.

The Amendment provides that at the effective time of the reverse stock

split, each 25 shares of the Company’s issued and outstanding common stock will be automatically combined into one validly issued,

fully paid and non-assessable share of common stock, without effecting a change to the par value per share. The reverse stock split will

affect all shares of the Company’s common stock outstanding immediately prior to the effective time of the reverse stock split,

as well as the number of shares of common stock available for issuance under the Company’s equity incentive plans. In addition,

the reverse stock split will effect a reduction in the number of shares of common stock issuable upon the exercise of stock options and

warrants outstanding immediately prior to the effectiveness of the reverse stock split with a corresponding increase in exercise price

per share.

No fractional shares will be issued in connection

with the reverse stock split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the reverse stock

split will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be

entitled multiplied by the closing trading price per share of the common stock (as adjusted for the reverse stock split) as reported on

The Nasdaq Capital Market on the trading day immediately preceding the effective time of the reverse stock split.

The Company’s common stock will continue

to be traded on the Nasdaq Capital Market under the symbol “TRVN” and will begin trading on a split-adjusted basis when the

market opens on Tuesday, August 13, 2024. The reverse stock split is intended to enable Trevena to regain compliance with the $1.00 minimum

bid price required for continued listing on the Nasdaq Capital Market. The new CUSIP number for Trevena’s common stock following

the reverse stock split will be 89532E 307.

The foregoing description of the Amendment

is qualified in its entirety by reference to the Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on

Form 8-K and is incorporated herein by reference.

On August 8, 2024, the Company issued

a press release announcing the Reverse Stock Split. A copy of the press release is filed as Exhibit 99.1 to this Current Report on

Form 8-K and is incorporated herein by reference.

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

TREVENA, INC. |

| |

|

|

| Date: August 8, 2024 |

By: |

/s/ Barry Shin |

| |

|

Barry Shin |

| |

|

Executive Vice President, Chief Operating Officer & Chief Financial Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF

AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION

OF

TREVENA, INC.

* * * * *

Trevena, Inc., a corporation organized and existing

under and by virtue of the General Corporation Law of the State of Delaware, DOES HEREBY CERTIFY:

FIRST: The Amended and Restated Certificate of

Incorporation, as amended on May 17, 2018 and November 9, 2022, and as currently in effect, is hereby amended by deleting Article IV.

A. and inserting the following in lieu thereof such that Article IV. A. shall read in its entirety as follows:

A. The Company is authorized to issue two classes of stock

to be designated, respectively, "Common Stock" and "Preferred Stock." The total number of shares of all classes of

capital stock which the Company shall have authority to issue is two hundred five million (205,000,000) shares, of which two hundred million

(200,000,000) shares shall be Common Stock (the "Common Stock"), each having a par value of one-tenth of one cent ($0.001),

and five million (5,000,000) shares shall be Preferred Stock (the "Preferred Stock"), each having a par value of one-tenth of

one cent ($0.001). Effective at 12:01 a.m. Eastern Time, on August 13, 2024 (the "Effective Time"), each 25 shares of Common

Stock issued and outstanding at such time shall, automatically and without any further action on the part of the Company or the holder

thereof, be combined into one (1) validly issued, fully paid and non-assessable share of Common Stock, without effecting a change to the

par value per share of Common Stock, subject to the treatment of fractional interests as described below (the "Reverse Stock Split").

The par value of the Common Stock following the Reverse Stock Split shall remain $0.001 per share. No fractional shares shall be issued,

in connection with the Reverse Stock Split, and, in lieu thereof, the Corporation shall pay each stockholder of record at the time of

effectiveness of the Reverse Stock Split who otherwise would be entitled to receive fractional shares because they hold a number of pre-Reverse

Stock Split shares not evenly divisible by the number of pre-Reverse Stock Split shares for which each post-Reverse Stock Split share

is to be exchanged an amount in cash equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing

sales price of our Common Stock as reported on The Nasdaq Capital Market on the date on which the Effective Time occurs. Each certificate

that immediately prior to the Effective Time represented shares of Common Stock (an "Old Certificate") shall thereafter represent

that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined,

subject to the elimination of fractional share interests as described above. The Reverse Split shall also apply to any outstanding securities

or rights convertible into, or exchangeable or exercisable for, Common Stock and all references to such Common Stock in agreements, arrangements,

documents and plans relating thereto or any option or right to purchase or acquire shares of Common Stock shall be deemed to be references

to the Common Stock or options or rights to purchase or acquire shares of Common Stock, as the case may be, after giving effect to the

Reverse Split.

SECOND: This Certificate of Amendment was

duly adopted and approved in accordance with the provisions of Sections 141 and 242 of the General Corporation Law of the State of Delaware

by the directors and stockholders of the corporation.

THIRD: This Certificate of Amendment shall

become effective at 12:01 a.m., Eastern Time, on August 13, 2024.

IN WITNESS WHEREOF, Trevena, Inc. has

caused this Certificate of Amendment to be signed by Joel Solomon, its Corporate Secretary, this 8th day of August 2024.

| |

TREVENA, INC. |

| |

|

| |

|

| |

By: Joel Solomon, Corporate Secretary |

Exhibit 99.1

Trevena Announces Reverse Stock Split

--

CHESTERBROOK,

Pa., August 8, 2024 (GLOBE NEWSWIRE) -- Trevena, Inc. (Nasdaq: TRVN), a biopharmaceutical company focused on the development

and commercialization of novel medicines for patients with central nervous system (CNS) disorders, today announced that it has

filed a Certificate of Amendment to its Certificate of Incorporation (the “Amendment”) to effect a reverse stock split of

its common stock at a ratio of 1-for-25. The reverse stock split will become effective at 12:01 a.m. ET on Tuesday,

August 13, 2024. Trevena’s common stock will continue to be traded on the Nasdaq Capital Market under the symbol “TRVN”

and will begin trading on a split-adjusted basis when the market opens on Tuesday, August 13, 2024. The reverse stock split

is intended to enable Trevena to regain compliance with the $1.00 minimum bid price required for continued listing on the Nasdaq

Capital Market. The new CUSIP number for Trevena’s common stock following the reverse stock split will be 89532E 307.

At the Annual General Meeting of stockholders

held on June 13, 2024, Trevena’s stockholders approved a reverse stock split of Trevena’s common stock at a ratio

of not less than 1-for-2 and not more than 1-for-25, with such ratio to be determined by the Board of Directors. Additional information

regarding the reverse stock split approved by stockholders can be found in Trevena’s definitive proxy statement that was filed with

the Securities and Exchange Commission on April 29, 2024.

The Amendment provides that at the effective time of the reverse stock

split, each 25 shares of the Company’s issued and outstanding common stock will be automatically combined into one validly issued,

fully paid and non-assessable share of common stock, without effecting a change to the par value per share. The reverse stock split will

affect all shares of the Company’s common stock outstanding immediately prior to the effective time of the reverse stock split,

as well as the number of shares of common stock available for issuance under the Company’s equity incentive plans. In addition,

the reverse stock split will effect a reduction in the number of shares of common stock issuable upon the exercise of stock options and

warrants outstanding immediately prior to the effectiveness of the reverse stock split with a corresponding increase in exercise price

per share.

No fractional shares will be issued in connection

with the reverse stock split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the reverse stock

split will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be

entitled multiplied by the closing trading price per share of the common stock (as adjusted for the reverse stock split) as reported

on The Nasdaq Capital Market on the trading day immediately preceding the effective time of the reverse stock split. Stockholders with

shares in brokerage accounts should direct any questions concerning the reverse stock split to their broker; all other stockholders may

direct questions to the Company's transfer agent, Continental Stock Transfer & Trust Company at (800) 509-5586.

About Trevena

Trevena, Inc. is a biopharmaceutical company focused on the development

and commercialization of innovative medicines for patients with CNS disorders. The Company has one approved product in the United States,

OLINVYK® (oliceridine) injection, indicated in adults for the management of acute pain severe enough to require an

intravenous opioid analgesic and for whom alternative treatments are inadequate. The Company’s novel pipeline is based on Nobel

Prize winning research and includes three differentiated investigational drug candidates: TRV045 for diabetic neuropathic pain and epilepsy,

TRV250 for the acute treatment of migraine and TRV734 for maintenance treatment of opioid use disorder.

For more information, please visit www.Trevena.com

For more information, please contact:

Company Contact:

Bob Yoder

SVP and Chief Business Officer

Trevena, Inc.

(610) 354-8840

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-36193

|

| Entity Registrant Name |

TREVENA, INC.

|

| Entity Central Index Key |

0001429560

|

| Entity Tax Identification Number |

26-1469215

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

955 Chesterbrook Boulevard

|

| Entity Address, Address Line Two |

Suite 110

|

| Entity Address, City or Town |

Chesterbrook

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

610

|

| Local Phone Number |

354-8840

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

TRVN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

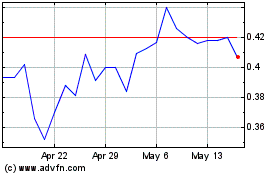

Trevena (NASDAQ:TRVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Trevena (NASDAQ:TRVN)

Historical Stock Chart

From Dec 2023 to Dec 2024