Universe Pharmaceuticals INC (the “Company”) (Nasdaq: UPC), a

pharmaceutical producer and distributor in China, today announced

its unaudited financial results for the first six months of fiscal

year 2021 ended March 31, 2021.

Mr. Gang Lai, Chairman and CEO of Universe

Pharmaceuticals INC, commented, “We are pleased to present our

financial results for the six months ended March 31, 2021, which

represent a strong start to our fiscal year 2021. In March 2021, we

also successfully completed our initial public offerings in the

United States. Despite the continued challenges and uncertainties

that we faced from the COVID-19 pandemic, our revenues grew by

48.2%, driven by increases in sales volumes fueled by our growing

customer base. Our focus has always been long-term growth as we

execute our business strategy, which calls for increasing market

share, expansion of our supply chain and sales network, and the

ability to secure high quality product at competitive prices. The

main catalysts for our long-term growth remain in place, giving us

confidence moving in to the second half of fiscal year 2021. Our

focus is to continue executing our business strategies as we

leverage our strong brand and supply channels to drive further

growth and improvement of our financial metrics.”

Financial Highlights for the Six Months Ended March 31,

2021

| |

|

For the Six Months Ended March 31, |

|

| ($ millions, except per share data) |

|

2021 |

|

|

2020 |

|

|

% Change |

|

| Revenues |

|

|

24.3 |

|

|

|

16.4 |

|

|

|

48.2 |

% |

| Income from operations |

|

|

9.6 |

|

|

|

6.6 |

|

|

|

45.6 |

% |

| Net income |

|

|

7.1 |

|

|

|

5.1 |

|

|

|

40.9 |

% |

| Earnings per share |

|

|

0.44 |

|

|

|

0.32 |

|

|

|

37.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

- Revenues

increased by 48.2% from $16.4 million in the six months ended March

31, 2020 to $24.3 million in the six months ended March 31, 2021,

primarily attributable to increased sales volume of our traditional

Chinese medicine derivatives (“TCMD”) products and third-party

products by 3,204,716 units or 29.2%, increased average selling

price of our TCMD products by $0.17 per unit or 12.8% and increased

average selling price of third-party products by $0.47 per unit or

26.9%, after we resumed business operations from the COVID-19

pandemic.

- Income from

operations was $9.6 million for the six months ended March 31,

2021, representing an increase of 45.6% from an income from

operations of $6.6 million for the six months ended March 31, 2020,

which was caused by a combined effect of increased revenues and

gross profit.

- Net income was

$7.1 million for the six months ended March 31, 2021, representing

an increase of 40.9% from a net income of $5.1 million for the

six months ended March 31, 2020.

- Earnings per

share was $0.44 for the six months ended March 31, 2021,

representing an increase of 37.5% from earnings per share of $0.32

for the six months ended March 31, 2020.

Financial Results for Six Months Ended March 31,

2021

Revenues

Total revenues increased by $7.9 million, or 48.2%, to $24.3

million for the six months ended March 31, 2021 from $16.4 million

for the six months ended March 31, 2020.

| |

|

For the Six Months Ended March 31, |

|

| |

|

2021 |

|

|

2020 |

|

|

($ millions) |

|

|

Revenue |

|

|

|

Cost of revenue |

|

|

|

Gross margin |

|

|

|

Revenue |

|

|

|

Cost of revenue |

|

|

|

Gross margin |

|

| TCMD products sales |

|

|

13.3 |

|

|

|

5.4 |

|

|

|

59.3 |

% |

|

|

7.4 |

|

|

|

3.1 |

|

|

|

57.9 |

% |

| Third-party products sales |

|

|

11.0 |

|

|

|

6.9 |

|

|

|

37.2 |

% |

|

|

9.0 |

|

|

|

4.7 |

|

|

|

47.0 |

% |

| Total |

|

|

24.3 |

|

|

|

12.3 |

|

|

|

49.3 |

% |

|

|

16.4 |

|

|

|

7.9 |

|

|

|

52.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales of TCMD products increased by $5.9

million, or 79.0%, from $7.4 million in the six months ended March

31, 2020 to $13.3 million in the six months ended March 31,2021,

because the sales volume of our TCMD products increased by 58.7%

from 5,760,229 units sold in the six months ended March 31, 2020 to

9,140,000 units sold in the six months ended March 31, 2021, and

the average selling price of our TCMD products increased by 12.8%

from $1.29 per unit in the six months ended March 31, 2020 to $1.46

per unit in the six months ended March 31, 2021.

Sales of third-party products increased by $2.0

million, or 22.6%, from $9.0 million in the six months ended March

31, 2020 to $11.0 million in the six months ended March 31, 2021.

Sales volume of third-party products slightly decreased by 3.4%,

from 5,219,039 units sold in the six months ended March 31, 2020 to

5,043,984 units sold in the six months ended March 31, 2021. In the

six months ended March 31, 2021, due to an overall increase in the

market prices of raw materials used in the manufacturing of

third-party products, we paid higher purchase prices for products

from third-party pharmaceutical companies and accordingly our

average selling price of third-party products in the six months

ended March 31, 2021 was higher than that in the six months ended

March 31, 2020. Our average selling price of third-party products

increased by 26.9%, from $1.71 per unit in the six months ended

March 31, 2020 to $2.18 per unit in the six months ended March 31,

2021.

Cost of revenues and Gross

profit

Cost of revenues increased by $4.4 million, or

56.4%, from $7.9 million in the six months ended March 31, 2020 to

$12.3 million in the six months ended March 31, 2021.

Gross profit increased by $3.5 million from $8.5

million in the six months ended March 31, 2020 to $12.0 million in

the six months ended March 31, 2021. Gross margin decreased by 2.7%

from 52.0% in the six months ended March 31, 2020 to 49.3% in the

six months ended March 31, 2021.

Operating expenses

Selling expenses increased by $463,046, or

71.7%, from $646,241 in the six months ended March 31, 2020 to

$1,109,287 in the six months ended March 31, 2021, primarily

attributable to (i) an increase in advertising expenses by $98,687,

or 58.7%, from $168,197 in the six months ended March 31, 2020 to

$266,884 in the six months ended March 31, 2021. We use outdoor

billboard, magazine and social media such as WeChat and Weibo to

advertise our brand and products in order to increase customer

awareness. In the six months ended March 31,2021, in connection

with our sales promotion of our TCMD products to targeted

customers, we spent more on advertising than we did in the six

months ended March 31, 2020, which led to higher advertising

expenses in the six months ended March 31, 2021; (ii) an increase

in our salary and benefit expenses paid to our sales employees by

$193,871, or 89.2%, from $217,439 in the six months ended March 31,

2020 to $411,310 in the six months ended March 31,2021, and an

increase in business travel and meals expense by $18,799 or 225.2%,

from $8,346 in the six months ended March 31, 2020 to $27,145 in

the six months ended March 31, 2021, primarily due to our increased

sales activities during the six months ended March 31, 2021. For

the same period of 2020, from early February to early March 2020,

we temporarily suspended our business as affected by the COVID-19

pandemic. During the one-month temporary closure of our facilities

in response to COVID-19, we reduced business travels and we only

paid basic salary to our sales personnel during this period of

time, which led to lower amount of salary expenses and business

travel expenses in the six months ended March 31, 2020 as compared

to the six months ended March 31, 2021; (iii) an increase in

shipping and delivery expenses by $151,620, or 62.7%, from $241,826

in the six months ended March 31, 2020 to $393,446 in the six

months ended March 31, 2021, due to our increased sales volume and

sales orders fulfillment during the six months ended March 31,

2021.

General and administrative expenses increased by

$241,685 or 32.5% from $743,813 in the six months ended March 31,

2020 to $985,498 in the six months ended March 31, 2021, primarily

attributable to (i) our professional service fees increased by

$290,805 in the six months ended March 31, 2021 as compared to the

six months ended March 31, 2020, primarily due to increased audit

fee and business consulting fees in connection with our intended

public offering, (ii) an increase in our office supply and utility

expenses by $86,842, or 135.7%, to support our administration

activities; (iii) an increase in our salaries, welfare expenses and

insurance expenses paid to administration employees by $74,411, or

31.9%, because of higher amount of annual bonus was distributed to

administrative staffs in the six months ended March 31, 2021 as

compared to the six months ended March 31,2020, and offset by a

decrease in bad debt expense by $212,291 because we accrued more

bad debt expenses in period periods based on estimated accounts

receivable collection trend and approximately $0.2 million bad debt

accrual in prior periods has been collected in the six months ended

March 31, 2021.

Research and development expenses decreased by

$236,959, or 43.3%, from $547,627 for the six months ended March

31, 2020 to $310,668 for the six months ended March 31, 2021,

primarily attributable to a decrease in the materials used in the

R&D activities by $269,185. In the six months ended March 31,

2020, in order to develop new products and improve the formulation

of several existing products, we conducted more testing on product

stability and safety, and as a result, more materials were used in

our R&D activities in the six months ended March 31, 2020 than

in the six months ended March 31, 2021.

Other income (expenses),

net

Total other expenses, net, decreased by $18,306

or 43.0%, from $42,578 in the six months ended March 31, 2020 to

$24,272 in the six months ended March 31, 2021.

Provision for Income Taxes

Provision for income taxes was $2.4 million in

the six months ended March 31, 2021, an increase of $0.9 million,

or 64.5% from $1.5 million in the six months ended March 31, 2020

due to our increased taxable income.

Net income

Net income was $7.1 million for the six months

ended March 31, 2021, representing a $2.0 million increase from a

net income of $5.1 million for the six months ended March 31,

2020.

Basic and diluted earnings per share were $0.44

for the six months ended March 31, 2021, representing a change of

37.5% from basic and diluted earnings per share of $0.32 for

the six months ended March 31, 2020.

Balance Sheet

As of March 31, 2021, the Company had cash of

$36.0 million as compared to $10.1 million as of September 30,

2020.

Cash Flow

Net cash provided by operating activities

was $1.1 million in the six months ended March 31, 2021,

compared with $8.4 million in the six months ended March

31, 2020.

Net cash used in investing activities was

$50,875 in the six months ended March 31, 2021, compared

with $47,512 in the six months ended March 31, 2020.

Net cash used provided by financing activities

was $24.1 million in the six months ended March 31, 2021, compared

with $0.4 million in the six months ended March 31,

2020.

About Universe Pharmaceuticals INC

Universe Pharmaceuticals INC, headquartered in

Ji’an, Jiangxi, China, is a pharmaceutical producer and distributor

in China. The Company specializes in the manufacturing, marketing,

sales and distribution of traditional Chinese medicine derivatives

products targeting the elderly with the goal of addressing their

physical conditions in the aging process and to promote their

general well-being. The Company also distributes and sells

biomedical drugs, medical instruments, Traditional Chinese Medicine

Pieces, and dietary supplements manufactured by third-party

pharmaceutical companies. Currently, the Company’s products are

sold in 30 provinces of China. For more information, visit the

company’s website at http://www.universe-pharmacy.com/.

Forward-Looking Statements

All statements other than statements of

historical fact in this announcement are forward-looking

statements. These forward-looking statements involve known and

unknown risks and uncertainties and are based on current

expectations and projections about future events and financial

trends that the Company believes may affect its financial

condition, results of operations, business strategy and financial

needs. Investors can identify these forward-looking statements by

words or phrases such as "may," "will," "expect," "anticipate,"

"aim," "estimate," "intend," "plan," "believe," "potential,"

"continue," "is/are likely to" or other similar expressions. The

Company undertakes no obligation to update forward-looking

statements to reflect subsequent occurring events or circumstances,

or changes in its expectations, except as may be required by law.

Although the Company believes that the expectations expressed in

these forward-looking statements are reasonable, it cannot assure

you that such expectations will turn out to be correct, and the

Company cautions investors that actual results may differ

materially from the anticipated results and encourages investors to

review other factors that may affect its future results in the

Company’s registration statement and in its other filings with the

SEC.

For more information, please contact:

Ascent Investors Relations LLCTina

XiaoPresidentPhone:

917-609-0333Email: tina.xiao@ascent-ir.com

UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL DATA

UNIVERSE PHARMACEUTICALS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED)

|

|

|

As of |

|

|

|

|

March 31, 2021 |

|

|

September 30, 2020 |

|

|

ASSETS |

|

CURRENT ASSETS |

|

|

|

|

|

|

|

Cash |

|

$ |

35,999,129 |

|

|

|

$ |

10,058,202 |

|

|

Accounts receivable, net |

|

|

17,799,597 |

|

|

|

|

10,871,778 |

|

|

Inventories, net |

|

|

4,917,271 |

|

|

|

|

1,906,232 |

|

|

Deferred initial public offering costs |

|

|

- |

|

|

|

|

443,709 |

|

|

Prepaid expenses and other current assets |

|

|

3,089,459 |

|

|

|

|

- |

|

|

TOTAL CURRENT ASSETS |

|

|

61,805,456 |

|

|

|

|

23,279,921 |

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

4,404,018 |

|

|

|

|

4,428,064 |

|

|

Intangible assets, net |

|

|

178,573 |

|

|

|

|

174,776 |

|

|

Investment in equity securities |

|

|

762,500 |

|

|

|

|

735,000 |

|

|

Deferred tax assets |

|

|

122,342 |

|

|

|

|

186,537 |

|

|

TOTAL NONCURRENT ASSETS |

|

|

5,467,433 |

|

|

|

|

5,524,377 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

67,272,889 |

|

|

|

$ |

28,804,298 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Short-term bank loans |

|

$ |

2,745,000 |

|

|

|

$ |

2,646,000 |

|

|

Accounts payable |

|

|

8,589,492 |

|

|

|

|

2,691,193 |

|

|

Taxes payable |

|

|

1,436,645 |

|

|

|

|

1,331,749 |

|

|

Due to related party |

|

|

3,117,081 |

|

|

|

|

956,492 |

|

|

Accrued expenses and other current liabilities |

|

|

694,410 |

|

|

|

|

375,960 |

|

|

TOTAL CURRENT LIABILITIES |

|

|

16,582,628 |

|

|

|

|

8,001,394 |

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Ordinary shares, $0.003125 par value, 100,000,000 shares

authorized, 21,750,000 shares and 16,000,000 shares issued and

outstanding as of March 31, 2021 and September 30, 2020,

respectively |

|

|

67,969 |

|

|

|

|

50,000 |

|

|

Additional paid in capital |

|

|

29,174,188 |

|

|

|

|

3,679,000 |

|

|

Share subscription receivable |

|

|

(3,571,241 |

) |

|

|

|

- |

|

|

Statutory reserve |

|

|

2,439,535 |

|

|

|

|

2,439,535 |

|

|

Retained earnings |

|

|

20,886,777 |

|

|

|

|

13,738,979 |

|

|

Accumulated other comprehensive income |

|

|

1,693,033 |

|

|

|

|

895,390 |

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

|

50,690,261 |

|

|

|

|

20,802,904 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

67,272,889 |

|

|

|

$ |

28,804,298 |

|

UNIVERSE PHARMACEUTICALS INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE

INCOME(UNAUDITED)

|

|

|

For the six months endedMarch

31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

REVENUE |

|

$ |

24,292,948 |

|

|

$ |

16,388,865 |

|

|

COST OF REVENUE |

|

|

12,304,678 |

|

|

|

7,868,761 |

|

|

GROSS PROFIT |

|

|

11,988,270 |

|

|

|

8,520,104 |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

1,109,287 |

|

|

|

646,241 |

|

|

General and administrative expenses |

|

|

985,498 |

|

|

|

743,813 |

|

|

Research and development expenses |

|

|

310,668 |

|

|

|

547,627 |

|

|

Total operating expenses |

|

|

2,405,453 |

|

|

|

1,937,681 |

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

|

9,582,817 |

|

|

|

6,582,423 |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME(EXPENSES) |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(46,671 |

) |

|

|

(63,709 |

) |

|

Other expense, net |

|

|

(8,227 |

) |

|

|

(674 |

) |

|

Equity investment income |

|

|

30,626 |

|

|

|

21,805 |

|

|

Total other expense, net |

|

|

(24,272 |

) |

|

|

(42,578 |

) |

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX PROVISION |

|

|

9,558,545 |

|

|

|

6,539,845 |

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX PROVISION |

|

|

2,410,747 |

|

|

|

1,465,769 |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

|

7,147,798 |

|

|

|

5,074,076 |

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

797,643 |

|

|

|

18,877 |

|

|

COMPREHENSIVE INCOME |

|

$ |

7,945,441 |

|

|

$ |

5,092,953 |

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

0.44 |

|

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

16,168,956 |

|

|

|

16,000,000 |

|

UNIVERSE PHARMACEUTICALS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(UNAUDITED)

|

|

|

For the six months ended March 31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

| Cash

flows from operating activities |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,147,798 |

|

|

$ |

5,074,076 |

|

|

Adjustments to reconcile net income to cash provided by operating

activities |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

243,466 |

|

|

|

205,654 |

|

|

Changes in allowance for doubtful accounts |

|

|

(203,253 |

) |

|

|

9,038 |

|

|

Inventory reserve |

|

|

(76,734 |

) |

|

|

(25,483 |

) |

|

Deferred income tax provision |

|

|

71,221 |

|

|

|

6,442 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(6,322,074 |

) |

|

|

2,089,969 |

|

|

Inventories |

|

|

(2,864,911 |

) |

|

|

(2,354,137 |

) |

|

Prepaid expenses and other current assets |

|

|

(3,098,993 |

) |

|

|

(10,267 |

) |

|

Accounts payable |

|

|

5,801,410 |

|

|

|

3,189,657 |

|

|

Taxes payable |

|

|

55,105 |

|

|

|

140,942 |

|

|

Accrued expenses and other current liabilities |

|

|

305,094 |

|

|

|

54,012 |

|

| Net cash

provided by operating activities |

|

|

1,058,129 |

|

|

|

8,379,903 |

|

|

|

|

|

|

|

|

|

|

|

| Cash

flows from investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(50,875 |

) |

|

|

(47,512 |

) |

| Net cash

used in investing activities |

|

|

(50,875 |

) |

|

|

(47,512 |

) |

|

|

|

|

|

|

|

|

|

|

| Cash

flows from financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from short-term bank loans |

|

|

1,220,800 |

|

|

|

- |

|

|

Repayment of bank loans |

|

|

(1,220,800 |

) |

|

|

- |

|

|

Net proceeds from initial public offerings |

|

|

21,941,916 |

|

|

|

- |

|

|

Deferred initial public offering costs |

|

|

- |

|

|

|

(90,698 |

) |

|

Proceeds from related party borrowings |

|

|

2,194,640 |

|

|

|

446,731 |

|

| Net cash

provided by financing activities |

|

|

24,136,556 |

|

|

|

356,033 |

|

|

|

|

|

|

|

|

|

|

|

| Effect

of changes of foreign exchange rates on cash |

|

|

797,117 |

|

|

|

(69,293 |

) |

| Net

increase in cash |

|

|

25,940,927 |

|

|

|

8,619,131 |

|

| Cash,

beginning of period |

|

|

10,058,202 |

|

|

|

3,177,321 |

|

| Cash,

end of period |

|

$ |

35,999,129 |

|

|

$ |

11,796,452 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

Cash paid for income tax |

|

$ |

3,364,769 |

|

|

$ |

1,289,194 |

|

|

Cash paid for interest expense |

|

$ |

65,775 |

|

|

$ |

71,447 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental non-cash financing activities: |

|

|

|

|

|

|

|

|

|

Subscription receivable from issuance of ordinary shares under

initial public offerings |

|

$ |

3,571,241 |

|

|

$ |

- |

|

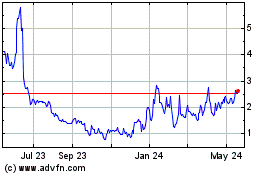

Universe Pharmaceuticals (NASDAQ:UPC)

Historical Stock Chart

From Dec 2024 to Jan 2025

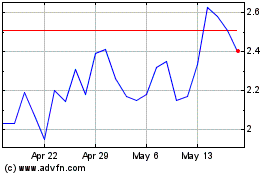

Universe Pharmaceuticals (NASDAQ:UPC)

Historical Stock Chart

From Jan 2024 to Jan 2025