Filed Pursuant to Rule 424(b)(5)

Registration No. 333-283819

Prospectus Supplement

(To Prospectus Dated February 12, 2025)

Energous

Corporation

Up

to $80,000,000 of

Common

Stock

We have entered into an At-the-Market Offering

Agreement, dated June 21, 2024 (the “Sales Agreement”), with H.C. Wainwright & Co., LLC (“Wainwright”

or the “sales agent”) relating to shares of our common stock, par value $0.00001 per share (“common stock”), offered

by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Sales Agreement, we may from time to

time offer and sell shares of our common stock having a maximum aggregate offering price of up to $80,000,000 through Wainwright as our

sales agent or principal under this prospectus supplement and the accompanying prospectus.

Sales of the shares of common stock, if any,

under this prospectus supplement and the accompanying prospectus may be made by means of transactions that are deemed to be “at-the-market”

offerings, as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including sales

made directly on or through the Nasdaq Stock Market (“Nasdaq”), or any other existing trading market in the United States

for our common stock, sales made to or through a market maker other than on an exchange or otherwise, directly to Wainwright as principal,

in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices and/or

in any other method permitted by law. If we and Wainwright agree on any method of distribution other than sales of shares of our common

stock on or through the Nasdaq or another existing trading market in the United States at market prices, we will file a further prospectus

supplement providing all information about such offering as required by Rule 424(b) under the Securities Act. The sales agent

will receive from us a cash commission of 3.0% based on the gross sales price per share for any shares sold through the sales agent

under the Sales Agreement. See “Plan of Distribution” below for additional information regarding the

compensation to be paid to Wainwright. Under the terms of the Sales Agreement, we also may sell shares of our common stock to the sales

agent as principal for its own account at a price agreed upon at the time of sale. If we sell shares to the sales agent as principal,

we will enter into a separate terms agreement with the sales agent and we will describe the agreement in a separate prospectus supplement

or pricing supplement providing all information about such offering as required by Rule 424(b) under the Securities Act.

In connection with the sale of shares of our common

stock on our behalf, the sales agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and the

compensation paid to the sales agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to the sales agent against certain liabilities, including civil liabilities under the Securities Act. This offering pursuant

to this prospectus supplement and the accompanying prospectus will terminate upon the earlier of (a) the sale of our common stock

pursuant to this prospectus supplement and the accompanying prospectus having an aggregate sales price of $80,000,000, or (b) the

termination by us or Wainwright of the Sales Agreement pursuant to its terms.

The sales agent is not required to sell any specific

number or dollar amount of shares of our common stock, but, subject to the terms and conditions of the Sales Agreement and unless otherwise

agreed by us and the sales agent, the sales agent will use its commercially reasonable efforts consistent with its normal trading and

sales practices to sell the shares of common stock offered as our sales agent. There is no arrangement for funds to be received in any

escrow, trust or similar arrangement.

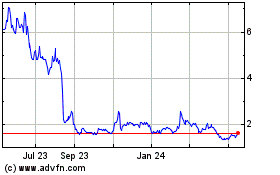

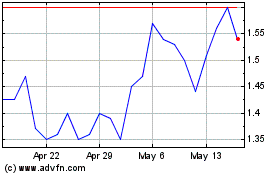

Our common stock is traded on the Nasdaq Capital

Market under the symbol “WATT.” On February 12, 2025, the last reported sale price of our common stock on the Nasdaq Capital

Market was $0.4623 per share.

We are a “smaller reporting company”

as defined under Rule 405 of the Securities Act, and as such, we have elected to comply with certain reduced public company reporting

requirements. See “Prospectus Supplement Summary—Implications of Being a Smaller Reporting Company.”

Investing in our securities involves a high

degree of risk. Before buying any securities, you should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page S-7 of this prospectus supplement, on page 3 of the accompanying prospectus and in the

documents incorporated by reference into this prospectus supplement and accompanying prospectus.

Neither the U.S. Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

H.C.

Wainwright & Co.

The date of this prospectus supplement is February 13, 2025.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus are part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”)

under the Securities Act, utilizing a “shelf” registration process. This prospectus supplement and the accompanying prospectus

relate to the offer by us of shares of our common stock to certain investors. Under the shelf registration process, we may offer shares

of our common stock having a maximum aggregate offering price of up to $80,000,000 from time to time under this prospectus supplement

and the accompanying prospectus at prices and on terms to be determined by market conditions at the time of the offering.

We provide information to you about this offering

of shares of our common stock in in two separate documents that are bound together: (1) this prospectus supplement, which describes

the specific details regarding this offering, and (2) the accompanying prospectus, which provides general information, some of which

may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined.

If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement.

In addition, to, the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and

the information contained in any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement,

on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date - for example, a document incorporated by reference in this prospectus supplement

- the statement in the document having the later date modifies or supersedes the earlier statement.

This prospectus supplement and the accompanying

prospectus, including the documents incorporated by reference herein and therein, describes the specific terms of this offering. We urge

you to carefully read this prospectus supplement and the accompanying prospectus, and the documents incorporated by reference herein and

therein, before buying any of the securities being offered under this prospectus supplement. This prospectus supplement may add to or

update information contained in the accompanying prospectus and the documents incorporated by reference therein. To the extent that any

statement we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated

by reference therein that were filed before the date of this prospectus supplement, the statements made in this prospectus supplement

will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference therein.

You should rely only on the information contained

in this prospectus supplement and the accompanying prospectus or incorporated by reference herein or therein.

We have not, and the sales agent has not, authorized

anyone to provide any information or to make any representations other than those contained in this prospectus supplement, the accompanying

prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We and the sales agent

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This

prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where

it is lawful to do so. The information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated

by reference herein and therein or in any applicable free writing prospectus is current only as of its date, regardless of its time of

delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since

that date. You should read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein in their entirety before making an investment decision. You should also read and consider the information in the documents

to which we have referred you in the sections of this prospectus supplement entitled “Where You Can Find Additional Information”

and “Incorporation of Certain Documents by Reference.” These documents contain important information that

you should consider when making your investment decision

For investors outside of the United States:

we have not, and the sales agent has not, done anything that would permit this offering or possession or distribution of this prospectus

supplement, the accompanying prospectus or any free writing prospectuses in any jurisdiction where action for that purpose is required,

other than in the United States. Persons outside of the United States who come into possession of this prospectus supplement, the accompanying

prospectus or any free writing prospectuses must inform themselves about, and observe any restrictions relating to, the offering of our

securities and the distribution of this prospectus supplement, the accompanying prospectus or any free writing prospectuses outside of

the United States.

You should assume that the information in this

prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of the applicable document and that

any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless

of the date of delivery of this prospectus supplement or the accompanying prospectus, or the date of any sale of a security.

Unless otherwise mentioned or unless the context

requires otherwise, all references in this prospectus supplement to the “Company,” “we,” “us,” “our,”

and “Energous” refer to Energous Corporation, a Delaware corporation.

On August 15, 2023, we effected a 1-for-20

reverse stock split (the “2023 Reverse Stock Split”) of our issued and outstanding shares of common stock. Unless indicated

or the context otherwise requires, all per share amounts and numbers of common stock in this prospectus supplement have been retrospectively

adjusted for the 2023 Reverse Stock Split. Documents incorporated by reference into this prospectus supplement and the accompanying prospectus

that were filed prior to August 15, 2023, do not give effect to the 2023 Reverse Stock Split.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying

prospectus and documents incorporated by reference herein and therein contain “forward-looking statements” within the

meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), that are intended to be covered by the “safe harbor” created by those sections.

Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can

generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,”

“will,” “would,” “should,” “could,” “seek,” “intend,”

“plan,” “continue,” “estimate,” “anticipate” or other comparable terms. All

statements other than statements of historical facts included in this report regarding our strategies, prospects, financial

condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include,

among others, statements we make regarding proposed business strategy; market opportunities; regulatory approval; expectations for

current and potential business relationships; expectations for revenues, liquidity cash flows and financial performance; the

anticipated results of our research and development efforts; the timing for receipt of required regulatory approvals and product

launches; compliance with Nasdaq listing standards; and the impact of geopolitical, macroeconomic, health and other world events.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our

current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future conditions. Forward-looking statements relate to the future and are

subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and generally outside of our

control, so actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Important factors that could cause our actual

results and financial condition to differ materially from those indicated in the forward-looking statements include, among others: our

ability to develop commercially feasible technology; timing of customer implementations of our technology in consumer products; timing

and receipt of regulatory approvals in the United States and internationally; our ability to find and maintain development partners; market

acceptance of our technology; competition in our industry; our ability to protect our intellectual property; competition; and other risks

and uncertainties described in Part I, Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2023, or in other periodic and current reports we file with the SEC. as well as those discussed in this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. You are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of the date of this prospectus supplement or, in the case of documents

referred to or incorporated by reference, the date of those documents.

All subsequent written or oral forward-looking

statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking

statements to reflect events or circumstances after the date of this prospectus supplement or to reflect the occurrence of unanticipated

events, except as may be required under applicable U.S. securities laws. If we do update one or more forward-looking statements, no inference

should be drawn that we will make additional updates with respect to those or other forward-looking statements.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights information

contained elsewhere in this prospectus supplement and the accompanying prospectus and does not contain all of the information that you

should consider in making your investment decision. Before investing in our securities, you should read this entire prospectus supplement

and the accompanying prospectus carefully, including the documents incorporated by reference herein and therein, including the section

entitled “Risk Factors” included elsewhere in this prospectus supplement and the accompanying prospectus, the

sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our audited financial statements and the related notes thereto, each included in

our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 28, 2024, which

is incorporated by reference herein, our most recent Quarterly Report on Form 10-Q, and any subsequent Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus supplement which is

incorporated by reference herein Some of the statements in this prospectus supplement, the accompanying prospectus and in the documents

incorporated by reference herein and therein, constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking

Statements.”

Company Overview

We have developed a scalable, over-the-air Wireless

Power Network ("WPN") technology that integrates advanced semiconductor chipsets, software controls, hardware designs, and antenna

systems to enable radio frequency ("RF")-based charging for Internet of Things ("IoT") devices. Our WPN technology

provides a comprehensive suite of capabilities designed to power the next generation of wireless energy networks, seamlessly delivering

power and data across diverse, battery-free device ecosystems. This innovation enhances operational visibility, control, and intelligent

business automation.

Our solutions support both near-field and at-a-distance

wireless charging, supplying power at multiple levels across varying distances. By enabling continuous wireless power transmission, our

transmitter and receiver technologies facilitate the use of battery-free IoT devices, transforming asset and inventory tracking across

multiple industries. Key applications include retail sensors, electronic shelf labels, asset trackers, air quality monitors, motion detectors,

and other smart monitoring solutions

We believe our technology

represents a breakthrough in wireless power delivery, offering a differentiated approach to charging IoT devices via RF technology. To

date, we have developed and released multiple transmitter and receiver solutions, including prototypes and partner production designs.

Our transmitters vary in form factor, power specifications, and operating frequencies, while our receivers are engineered to support a

wide range of wireless charging applications across multiple device categories. including:

| Device Type |

Application |

| RF Tags |

Cold Chain, Asset Tracking, Medical IoT |

| IoT Sensors |

Cold Chain, Logistics, Asset Tracking |

| Electronic Shelf Labels |

Retail and Industrial IoT |

The first WPN-enabled

end product featuring our technology entered the market in 2019. In the fourth quarter of 2021, we commenced shipments of our first at-a-distance

wireless PowerBridge transmitter systems for commercial IoT applications and proof-of-concept deployments. As we continue to innovate

our technology applications, we anticipate the release of additional wireless power-enabled products.

Reverse Stock Split

On August 15, 2023, we effected the 2023

Reverse Stock Split. Unless indicated or the context otherwise requires, all per share amounts and numbers of common stock in this prospectus

supplement have been retrospectively adjusted for the 2023 Reverse Stock Split. Documents incorporated by reference into this prospectus

supplement and the accompanying prospectus that were filed prior to August 15, 2023, do not give effect to the 2023 Reverse Stock

Split.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company,”

meaning that the market value of our stock held by non-affiliates is less than $700 million and our annual revenue was less than $100

million during the most recently completed fiscal year. We may continue to be a smaller reporting company if either (i) the market

value of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during

the most recently completed fiscal year and the market value of our stock held by non-affiliates was less than $700 million. For so long

as we remain a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure. As a result, the

information that we provide to our stockholders may be different than you might receive from other public reporting companies in which

you hold equity interests.

Nasdaq Continued Listing Requirements

On December 4, 2024, we received notice from

the staff of the Listing Qualifications department (the “Staff”) of The Nasdaq Stock Market (“Nasdaq”) indicating

we were not in compliance with the minimum stockholders’ equity requirement for continued listing as set forth in Nasdaq Listing

Rule 5550(b)(1) (the “Stockholders’ Equity Requirement”), because our stockholders’ equity of $434,000, as reported

in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2024, was below the required minimum of $2.5 million,

and we did not meet either the alternative compliance standards relating to market value of listed securities of at least $35 million

or net income from continuing operations of at least $500,000 in the most recently completed fiscal year or in two of the last three

most recently completed fiscal years. On January 21, 2025, we were notified by the Staff that we regained compliance with the Stockholders’

Equity Requirement. The Staff noted, however, that we may be subject to future delisting if we fail to evidence compliance with the Stockholders

Equity Requirement in our quarterly report for the first quarter of 2025.

In addition, as previously reported, on August

29, 2024, we received a notice from the Staff indicating that we were not in compliance with the $1.00 minimum bid price requirement for

continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). In

accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have a period of 180 calendar days, or until February 25, 2025, to regain compliance

with the Bid Price Rule.

We intend to continue to actively monitor the bid price of

shares of our common stock and may, if appropriate, consider implementing available options to regain compliance with the Bid Price Rule,

which options may include effecting a reverse stock split, if necessary, to attempt to regain compliance. There can be no assurance that

we will be able to regain compliance with the Bid Price Rule or will otherwise be in compliance with other Nasdaq Listing Rules,

including the Stockholders’ Equity Requirement. Our failure to regain compliance with any Nasdaq Listing Rule could

result in delisting.

For more information, please see our Current

Reports on Form 8-K filed with the SEC on December 6, 2024 and January 23, 2025, which are incorporated by reference herein as well as “Risk

Factors—Risks Related to this Offering and Our Common Stock —We may not satisfy the Nasdaq Capital Market’s

requirements for continued listing of our common stock in the future. If we cannot satisfy these requirements, the Nasdaq Capital

Market could delist our common stock” in this prospectus supplement.

Corporate Information

We were incorporated in Delaware in 2012. Our

corporate headquarters is located at 3590 North First Street, Suite 210, San Jose, CA 95134. Our website can be accessed at www.energous.com.

The information contained on or accessible through our website does not constitute part of this prospectus supplement or the accompanying

prospectus. You should not rely on any such information in making your decision whether to purchase our securities.

The Offering

| Common stock offered by us |

|

Shares of common stock having an aggregate offering price of up to $80,000,000 (not to exceed the number of shares of common stock authorized,

unissued and available for issuance). |

| |

|

|

| Common stock outstanding immediately following the offering |

|

Up to 203,232,310 shares, assuming sales of 173,074,804 shares in this

offering at an assumed offering price of $0.4623 per share, which was the last reported sale price of our common stock on the Nasdaq Capital

Market on February 12, 2025. The actual number of shares issued will vary depending on how many shares of our common stock we choose to

sell, if any, from time to time and the prices at which such sales occur, and in no event will the actual number of shares of common stock

issued and sold pursuant to the Sales Agreement exceed the number of shares we have available and authorized for issuance under our certificate

of incorporation, as the same may be amended and restated from time to time. |

| |

|

|

| Plan of distribution |

|

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made by any method permitted by law deemed to be an “at-the-market” offering as defined in Rule 415 of the Securities Act, including without limitation sales made directly on Nasdaq, on any other existing trading market for the common stock in the United States. The sales agent is not required to sell any certain number of shares or dollar amount of our common stock but will act as a sales agent and use commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be sold by us, consistent with its normal trading and sales practices and applicable laws and regulations, subject to the terms of the Sales Agreement. We may sell shares of our common stock, if any, to Wainwright as principal for its own account, at a price per share agreed upon at the time of sale. If we sell shares to Wainwright as principal, we will enter into a separate terms agreement setting forth the terms of such transaction, and we will describe the agreement in a separate prospectus or pricing supplement. See “Plan of Distribution” below. |

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from this offering for general and administrative expenses and other general corporate purposes, research and product development efforts, potential acquisition of complementary technologies and companies, regulatory activities, business development and support functions. See “Use of Proceeds” below. |

| |

|

|

| Nasdaq Capital Market symbol |

|

WATT |

| |

|

|

| Risk factors |

|

Investing in our securities involves significant risks. See “Risk Factors,” beginning on page S-7 in this prospectus supplement as well as the other information included in or incorporated by reference in this prospectus supplement and the accompanying prospectus, for a discussion of risks you should carefully consider before investing in our securities. |

The number of shares of our common stock to be

outstanding immediately after this offering as shown above is based on 30,184,506 shares of common stock outstanding as of February 12,

2025 and excludes the following:

| ● | 1,432,909 shares of common stock

issuable upon exercise of warrants outstanding as of February 12, 2025 at a weighted average

exercise price of $1.40 per share; |

| ● | 440,062

shares of common stock subject to restricted stock units outstanding as of February 12, 2025;

and |

| ● | 337,133

shares of common stock reserved and available for future issuance under our 2024 Equity Incentive

Plan as of February 12, 2025. |

Except as otherwise indicated, all information

in this prospectus supplement assumes no exercise of the outstanding warrants, no shares of our common stock are issued pursuant to restricted

stock units and no shares of common stock are issued pursuant to our 2024 Equity Incentive Plan or our Employee Stock Purchase Plan described

above.

RISK FACTORS

An investment in our securities involves a

high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the following risks and

uncertainties, as well as those discussed under the caption “Risk Factors” in the accompanying prospectus and

in the documents incorporated by reference herein and therein. If any of the risks described in this prospectus supplement, the accompanying

prospectus or the documents incorporated by reference herein and therein, actually occur, our business, prospects, financial condition

or operating results could be harmed. In that case, the trading price of our securities could decline, and you may lose all or part of

your investment. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also impair

our business operations and our liquidity. You should also refer to the other information contained in this prospectus supplement and

the accompanying prospectus, or incorporated by reference herein and therein, including our financial statements and the related notes

thereto and the information set forth under the heading “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to this Offering and Our Common

Stock

We may not satisfy the Nasdaq Capital Market’s

requirements for continued listing of our common stock. If we cannot satisfy these requirements, the Nasdaq Capital Market

could delist our common stock.

Our common stock is listed on the Nasdaq Capital

Market under the symbol “WATT.” To continue to be listed on the Nasdaq Capital Market, we are required to satisfy a number

of conditions. As previously disclosed and described elsewhere in this prospectus supplement, on December 4, 2024, we received notice

from the Staff that we were not in compliance with the Stockholders’ Equity Requirement, and on August 29, 2024, we received a separate

notice that we were not in compliance with the Bid Price Rule. While we were notified by the Staff on January 21, 2025 that we regained

compliance with the Stockholders’ Equity Requirement, we may be subject to future delisting if we fail to evidence compliance with

the Stockholders Equity Requirement in our quarterly report for the first quarter of 2025. We cannot assure you that we will be able to

maintain compliance with the Stockholders’ Equity Requirement or that we will regain compliance with the Bid Price Rule, which are

conditions for continued listing on the Nasdaq Capital Market, or that we will continue to satisfy these or other Nasdaq Capital Market

listing requirements in the future. Our failure to maintain or regain compliance, as applicable, with any Nasdaq Listing Rule could result

in delisting. If we are delisted from the Nasdaq Capital Market, trading in our shares of common stock may be conducted, if available,

on the “OTC Bulletin Board Service” or, if available, via another market. In the event of such delisting, an investor would

likely find it significantly more difficult to dispose of, or to obtain accurate quotations as to the value of the shares of our common

stock, and our ability to raise future capital through the sale of the shares of our common stock or other securities convertible into

or exercisable for our common stock could be severely limited. This could have a long-term impact on our ability to raise future capital

through the sale of our common stock and adversely affect any investment in our common stock.

Management will have broad discretion as

to the use of the net proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the

application of the net proceeds from this offering, if any, and could spend the proceeds in ways that do not improve our results of operations

or enhance the value of our common stock. You will be relying on the judgment of our management concerning these uses and you will not

have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The failure of

our management to apply these funds effectively could result in unfavorable returns and uncertainty about our prospects, each of which

could cause the price of our common stock to decline.

The common stock offered hereby will be

sold in “at-the market” offerings, and investors who buy shares at different times will likely

pay different prices.

Investors who purchase shares under this offering

at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have

discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales

price. Investors may experience declines in the value of their shares as a result of share sales made at prices lower than the prices

they paid.

If you purchase shares of common stock

in this offering, you may suffer immediate and substantial dilution in the book value of your investment.

The

shares sold in this offering, if any, will be sold from time to time at various prices; however, at the assumed offering price of our

common stock, which is substantially higher than the as adjusted net tangible book value per share of our common stock after giving effect

to this offering, investors purchasing shares of our common stock in this offering will pay a price per share that substantially exceeds

the as adjusted net tangible book value per share. Assuming that an aggregate of 173,047,804 shares of our common stock are sold

at an assumed offering price of $0.4623 per share, the closing price of our common stock on the Nasdaq Capital Market on February 12,

2025 for aggregate net proceeds of approximately $77.45 million, after deducting sales commissions and estimated offering expenses payable

by us, new investors in this offering will experience immediate dilution of $0.0037 per share, representing the difference between the

assumed offering price per share and our as adjusted net tangible book value per share after giving effect to this offering. See “Dilution”

below.

The actual number of shares we will issue under the Sales Agreement

and the gross proceeds resulting from those sales, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement

and compliance with applicable law, we have the discretion to deliver a sales notice to Wainwright at any time throughout the term of

the Sales Agreement. The number of shares that are sold by Wainwright after delivering a sales notice will fluctuate based on the market

price of the common stock during the sales period and limits we set with Wainwright. Because the price per share of each share sold will

fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number

of shares that will be ultimately issued by us under the Sales Agreement or the gross proceeds to be raised in connection with those sales.

The market price of our common stock may

be adversely affected by the future issuance and sale of additional shares of our common stock, including pursuant to the Sales Agreement,

or by our announcement that such issuances and sales may occur.

As of February 12, 2025, there were 30,184,506

shares of our common stock outstanding. All of our issued and outstanding shares may be sold in the market, including any shares of common

stock issued pursuant to the Sales Agreement, and will be freely tradeable, except for any shares held by our “affiliates,”

as that term is defined in Rule 144 under the Securities Act. We cannot predict the size of future issuances or sales of shares of our

common stock, including those made pursuant to the Sales Agreement with the sales agent or in connection with future acquisitions or capital

raising activities, or the effect, if any, that such issuances or sales may have on the market price of our common stock. The issuance

and sale of substantial amounts of shares of our common stock, including issuances and sales pursuant to the Sales Agreement, or announcement

that such issuances and sales may occur, could adversely affect the market price of our common stock. If there are more shares of common

stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at

which buyers are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares.

In addition, sales of stock by any of our executive

officers or directors could have a material adverse effect on the trading price of our common stock.

Future issuances of our common stock or

instruments convertible or exercisable into our common stock may materially and adversely affect the price of our common stock and cause

dilution to our existing stockholders.

Historically, we have raised capital by issuing

common stock and warrants in public offerings because no other reasonable sources of capital were available. These public offerings of

common stock and warrants have materially and adversely affected the prevailing market prices of our common stock and caused significant

dilution to our stockholders. We have also historically raised capital or refinanced outstanding debt through the issuance of convertible

notes.

We may need to raise capital through additional

public offerings of common stock, preferred stock, warrants and convertible debt in the future. We may obtain additional funds through

public or private debt or equity financings, subject to certain limitations in the agreements governing our indebtedness outstanding at

such time. If we issue additional shares of common stock or instruments convertible into common stock, it may materially and adversely

affect the price of our common stock. In addition, the exercise of some or all of our warrants may dilute the ownership interests of our

stockholders, and any sales in the public market of any of our common stock issuable upon such conversion or exercise could adversely

affect prevailing market prices of our common stock.

Our stock price may be volatile and your

investment in our securities could suffer a decline in value.

The market price of shares of our common stock

has experienced significant price and volume fluctuations. We cannot predict whether the price of our common stock will rise or fall.

The market price of our common stock may be highly volatile and could fluctuate widely in price in response to various factors, many of

which are beyond our control, including the following:

| ● | we may not be able to compete successfully against current and future competitors; |

| ● | competitive pricing pressures; |

| ● | additions or departures of key personnel; |

| ● | additional sales of our common stock and other securities; |

| ● | our ability to execute our business plan; |

| ● | operating results that fall below expectations; |

| ● | loss of any strategic relationship; |

| ● | continued access to working capital funds; |

| ● | economic and other external factors; and |

| ● | the threat of terrorism, geopolitical tensions, and general disruptions in the global economy. |

In addition, the securities markets have from

time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies.

These market fluctuations may also materially and adversely affect the market price of our common stock. As a result, you may be unable

to resell your shares at a desired price.

Raising additional capital may cause dilution

to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies.

We may seek additional capital through a combination

of public and private equity offerings, debt financings, strategic partnerships and licensing arrangements. To the extent that we raise

additional capital through the sale or issuance of equity, warrants or convertible debt securities, the ownership interest of our existing

stockholders will be diluted, and the terms of such securities may include liquidation or other preferences that adversely affect your

rights as a stockholder. If we raise capital through debt financing, it may involve agreements that include covenants further limiting

or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures or declaring dividends.

If we raise additional funds through strategic partnerships or licensing agreements with third parties, we may have to relinquish valuable

rights to our technologies or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds when needed,

we may be required to delay, limit, reduce or terminate our development and commercialization efforts. Any such event could have an adverse effect on and reduce the value of an investment in our common stock.

USE OF PROCEEDS

We may issue and sell shares of our common stock

having maximum aggregate sales proceeds of up to $80,000,000 from time to time, before deducting sales agent commission and expenses. The

amount of proceeds from this offering will depend upon the number of shares of our common stock sold, if any, and the market price at

which they are sold. Because there is no minimum offering amount required as a condition to close this offering, the actual total public

offering amount, commissions and proceeds to us, if any, are not determinable at this time.

We intend to use the net proceeds from this offering

for general and administrative expenses and other general corporate purposes, research and product development efforts, potential acquisition

of complementary technologies and companies, regulatory activities, business development and support functions.

As of the date of this prospectus supplement,

we cannot specify with certainty all of the particular uses of the proceeds from this offering. Accordingly, we will retain broad discretion

over the use of such proceeds.

DILUTION

If you purchase securities in this offering, your

ownership interest will be immediately diluted. Dilution represents the difference between the amount per share paid by purchasers in

this offering and the as adjusted net tangible book value per share of our common stock immediately after this offering. Historical net

tangible book value per share is equal to our total tangible assets, less total liabilities, divided by the number of outstanding shares

of our common stock.

As of September 30, 2024, our historical net

tangible book value was approximately $(0.3) million, or $(0.03) per share of our common stock, based upon 7,774,275 shares of our common

stock outstanding as of September 30, 2024. Our pro forma net tangible book value was $15.7 million, or $0.5226 per share, after giving

effect to the sale of 22,218,990 shares of our common stock for approximately $15.9 million in net proceeds under our at-the-market offering

programs from October 1, 2024 through February 12, 2025.

After giving effect to the sale by us of 173,047,804

shares of common stock in this offering at an assumed public offering price of $0.4623 per share, which is the last reported sale price

of our common stock on the Nasdaq Capital Market on February 12, 2025, and after deducting commissions and estimated aggregate offering

expenses payable by us, our pro forma as adjusted net tangible book value as of September 30, 2024 would have been approximately $93.1

million, or $0.4586 per share of our common stock. This represents an immediate decrease in pro forma net tangible book value of $0.0640

per share to our existing stockholders and an immediate dilution of $0.0037 per share to new investors in this offering.

The following table illustrates this per share

dilution to new investors in this offering

| Assumed public offering price per share |

|

|

|

|

|

$ |

0.4623 |

|

| Historical net tangible book value per share as of September 30, 2024 |

|

$ |

(0.0336 |

) |

|

|

|

|

| Pro forma increase in net tangible book value per share attributable to sales of our common stock under our at-the-market offering programs from October 1, 2024 to February 12, 2025 |

|

|

0.5562 |

|

|

|

|

|

| Pro forma net tangible book value per share |

|

|

0.5226 |

|

|

|

|

|

| Decrease in net tangible book value per share attributable to new investors |

|

$ |

(0.0640 |

) |

|

|

|

|

| Pro forma as adjusted net tangible book value per share after giving effect to this offering |

|

|

|

|

|

$ |

0.4586 |

|

| Dilution per share to investors in this offering |

|

|

|

|

|

$ |

0.0037 |

|

The table above is based on 7,774,275 shares of common stock outstanding

as of September 30, 2024 and excludes the following:

| · | 1,432,909 shares of common stock issuable upon

exercise of warrants outstanding as of September 30, 2024 at a weighted average exercise price of $1.47 per share; |

| · | 517,303 shares of common stock subject to restricted

stock units outstanding as of September 30, 2024; |

| · | 284,758 shares of common stock reserved and available

for future issuance under our 2024 Equity Incentive Plan as of September 30, 2024; and |

| · | 17,166 shares of common stock reserved and available

for future issuance under our Employee Stock Purchase Plan as of September 30, 2024. |

To the extent that any of these outstanding warrants

are exercised, or we issue additional shares under equity incentive plans, employee stock purchase plans or restricted stock units, there

may be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic

considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital

is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution

to our stockholders.

DESCRIPTION OF OUR COMMON STOCK

Authorized and Outstanding Capital Stock

Our authorized capital stock consists of 200,000,000

shares of common stock, $0.00001 par value per share, and 10,000,000 shares of undesignated preferred stock, $0.00001 par value per share.

As of February 12, 2025, there were 30,184,506 shares of common stock and no shares of preferred stock outstanding.

Common Stock

Holders of our common stock are entitled to such

dividends as may be declared by our board of directors out of funds legally available for such purpose. The shares of common stock are

neither redeemable nor convertible. Holders of common stock have no preemptive or subscription rights to purchase any of our securities.

Each holder of our common stock is entitled to

one vote for each such share outstanding in the holder’s name. No holder of common stock is entitled to cumulate votes in voting

for directors. In the event of our liquidation, dissolution or winding up, the holders of our common stock are entitled to receive pro

rata our assets, which are legally available for distribution, after payments of all debts and other liabilities. All of the outstanding

shares of our common stock are fully paid and non-assessable.

Preferred Stock

Our board of directors is authorized, subject

to limitations prescribed by Delaware law, to issue from time to time up to 10,000,000 shares of preferred stock in one or more series,

to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and

rights of the shares of each series and any of their qualifications, limitations or restrictions, in each case without further vote or

action by our stockholders. Our board of directors is also able to increase or decrease the number of shares of any series of preferred

stock, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our

board of directors may be able to authorize the issuance of preferred stock with voting or conversion rights that could adversely affect

the voting power or other rights of the holders of our common stock. The issuance of preferred stock, while providing flexibility in connection

with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing

a change in control of our company and might adversely affect the market price of our common stock and the voting and other rights of

the holders of our common stock.

Anti-Takeover Effects of Certain Provisions of Delaware Law and

Our Charter Documents

The following is a summary of certain provisions

of Delaware law, our second amended and restated certificate of incorporation (our “certificate of incorporation”) and our

amended and restated bylaws (our “bylaws”). This summary does not purport to be complete and is qualified in its entirety

by reference to the corporate law of Delaware and our certificate of incorporation and bylaws.

Effect of Delaware Anti-Takeover Statute.

We are subject to Section 203 of the Delaware

General Corporation Law, an anti-takeover law. In general, Section 203 prohibits a Delaware corporation from engaging in any business

combination (defined below) with any interested stockholder (defined below) for a period of three years following the date that the stockholder

became an interested stockholder, unless:

| ● | prior to that date, the board of directors of the corporation approved either the business combination

or the transaction that resulted in the stockholder becoming an interested stockholder; |

| ● | upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced,

excluding for purposes of determining the number of shares of voting stock outstanding (but not the voting stock owned by the interested

stockholder) those shares owned by persons who are directors and officers and by excluding employee stock plans in which employee participants

do not have the right to determine whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| ● | on or subsequent to that date, the business combination is approved by the board of directors of the corporation

and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3%

of the outstanding voting stock that is not owned by the interested stockholder. |

Section 203 defines “business combination”

to include:

| ● | any merger or consolidation involving the corporation and the interested stockholder; |

| ● | any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving

the interested stockholder; |

| ● | subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation

of any stock of the corporation to the interested stockholder; |

| ● | subject to limited exceptions, any transaction involving the corporation that has the effect of increasing

the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or |

| ● | the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or

other financial benefits provided by or through the corporation. |

In general, Section 203 defines an “interested

stockholder” as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation, or who

beneficially owns 15% or more of the outstanding voting stock of the corporation at any time within a three-year period immediately prior

to the date of determining whether such person is an interested stockholder, and any entity or person affiliated with or controlling or

controlled by any of these entities or persons.

Our Charter Documents

Our certificate of incorporation and bylaws include

provisions that may have the effect of discouraging, delaying or preventing a change in control or an unsolicited acquisition proposal

that a stockholder might consider favorable, including a proposal that might result in the payment of a premium over the market price

for the shares held by our stockholders. Certain of these provisions are summarized in the following paragraphs.

| ● | Effects of Authorized but Unissued Common Stock. One of the effects of the existence of

authorized but unissued common stock may be to enable our board of directors to make more difficult or to discourage an attempt to obtain

control of our Company by means of a merger, tender offer, proxy contest or otherwise, and thereby to protect the continuity of management.

If, in the due exercise of its fiduciary obligations, the board of directors were to determine that a takeover proposal was not in our

best interest, such shares could be issued by the board of directors without stockholder approval in one or more transactions that might

prevent or render more difficult or costly the completion of the takeover transaction by diluting the voting or other rights of the proposed

acquirer or insurgent stockholder group, by putting a substantial voting block in institutional or other hands that might undertake to

support the position of the incumbent board of directors, by effecting an acquisition that might complicate or preclude the takeover,

or otherwise. |

| ● | Action by Written Consent. Our certificate of incorporation provides that our stockholders

may not act by written consent. |

| ● | Advanced Notice. Our bylaws provide that stockholders who wish to bring nominations or other

business before an annual meeting of the stockholders or a special meeting of the stockholders must provide us with notice of such proposed

nomination or business within specified time frames and must provide us with information regarding the potential nominee or proposal. |

| ● | Blank Check Preferred Stock. As noted above, our certificate of incorporation allows our board of directors to fix the designation, powers, preferences and rights

of the shares of each series of preferred stock and any of their qualifications, limitations or restrictions, in each case without further

vote or action by our stockholders. |

| ● | Bylaw Amendment. Our certificate of incorporation provides our board of directors the ability to amend our bylaws without further vote or action by our

stockholders. |

| ● | Cumulative Voting. Our certificate of incorporation does not provide for cumulative voting

in the election of directors, which would allow holders of less than a majority of the stock to elect some directors. |

| ● | Exclusive Venue. Our certificate of incorporation provides that unless the Company consents

in writing to the selection of an alternative forum, the sole and exclusive forum for (i) any derivative action or proceeding brought

on behalf of the Company, (ii) any action asserting a claim of breach of a fiduciary duty owed to the Company or the Company’s

stockholders by any director, officer or other employee of the Company, (iii) any action asserting a claim arising pursuant to any

provision of the Delaware General Corporation Law, or (iv) any action asserting a claim governed by the internal affairs doctrine

shall be the Delaware Court of Chancery, or if the Delaware Court of Chancery determines that it does not have subject matter jurisdiction,

the U.S. District Court for the District of Delaware or any court of the State of Delaware having subject matter jurisdiction regarding

the matter. |

| ● | Special Meeting of Stockholders. Our certificate of incorporation provides that a special

meeting of stockholders may only be called by the President, the Chief Executive Officer, or the board of directors at any time and for

any purpose or purposes as shall be stated in the notice of the meeting. |

| ● | Vacancies. Our certificate of incorporation provides that all vacancies may be filled by

the affirmative vote of a majority of directors then in office, even if less than a quorum. |

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust

Company, N.A.

Listing

Our common stock is listed on the Nasdaq Capital

Market under the symbol “WATT.”

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES

The following is a summary of the material U.S. federal

income tax consequences of the acquisition, ownership and disposition of shares of our common stock.

Scope of this Summary

This summary is for general information purposes

only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax consequences of the acquisition,

ownership and disposition of shares of our common stock. Except as specifically set forth below, this summary does not discuss applicable

tax reporting requirements. In addition, this summary does not take into account the individual facts and circumstances of any particular

holder that may affect the U.S. federal income tax consequences to such holder.

Accordingly, this summary is not intended to

be, and should not be construed as, legal or tax advice with respect to any particular holder. Each holder should consult its own tax

advisors regarding the U.S. federal, state and local, and non-U.S. tax consequences of the acquisition, ownership and disposition of shares

of our common stock.

No legal opinion from U.S. legal counsel or ruling

from the Internal Revenue Service (the “IRS”) has been requested, or will be obtained, regarding the U.S. federal income tax

consequences of the acquisition, ownership and disposition of shares of our common stock. This summary is not binding on the IRS, and

the IRS is not precluded from taking a position that is different from, or contrary to, the positions taken in this summary.

Authorities

This summary is based upon provisions of the Internal

Revenue Code of 1986, as amended (the “Code”), regulations, rulings and judicial decisions as of the date hereof. Those authorities

may be changed, perhaps retroactively, or be subject to differing interpretations, so as to result in U.S. federal tax considerations

different from those summarized below.

U.S. Holders

As used in this summary, the term “U.S.

Holder” means a beneficial owner of shares of our common stock acquired pursuant to this prospectus supplement that is, for U.S.

federal income tax purposes:

| ● | an individual who is a citizen or resident of the U.S.; |

| ● | a corporation (or other entity taxable as a corporation) organized under the laws of the U.S., any state thereof or the District of

Columbia; |

| ● | an estate whose income is subject to U.S. federal income taxation regardless of its source; or |

| ● | a trust that (1) is subject to the primary supervision of a court within the U.S. and the control of one or more U.S. persons

for all substantial decisions or (2) has a valid election in effect under applicable Treasury Regulations to be treated as a U.S.

person. |

Non-U.S. Holders

For purposes of this summary,

a “Non-U.S. holder” means a beneficial owner of shares of our common stock acquired pursuant to this prospectus supplement

that is neither a U.S. Holder nor a partnership (or an entity or arrangement treated as a partnership for U.S. federal income tax purposes).

A Non-U.S. Holder should review the discussion under the heading “Non-U.S. Holders” below for more information.

Holders Subject to Special U.S. Federal Income

Tax Rules

This summary deals only with

persons or entities who hold shares of our common stock as a capital asset within the meaning of Section 1221 of the Code (generally,

property held for investment purposes). This summary does not address all aspects of U.S. federal income taxation that may be applicable

to holders in light of their particular circumstances or to holders subject to special treatment under U.S. federal income tax law, such

as: banks, insurance companies, and other financial institutions; dealers or traders in securities, commodities or foreign currencies;

regulated investment companies; U.S. expatriates or former long-term residents of the U.S.; persons required for U.S. federal income tax

purposes to conform the timing of income accruals to their financial statements under Section 451(b) of the Code; persons holding

shares of our common stock as part of a straddle, appreciated financial position, synthetic security, hedge, conversion transaction or

other integrated investment; persons holding shares of our common stock as a result of a constructive sale; real estate investment trusts;

U.S. Holders that have a “functional currency” other than the U.S. dollar; holders that acquired shares of our common stock

in connection with the exercise of employee stock options or otherwise as consideration for services; or holders that are “controlled

foreign corporations” or “passive foreign investment companies.” Holders that are subject to special provisions under

the Code, including holders described immediately above, should consult their own tax advisors regarding the U.S. federal, state and local,

and non-U.S. tax consequences of the acquisition, ownership and disposition of shares of our common stock.

If an entity classified as

a partnership for U.S. federal income tax purposes holds shares of our common stock, the tax treatment of a partner generally will

depend on the status of the partner and the activities of the partnership. This summary does not address the tax consequences to any such

owner or entity. Partners of entities or arrangements that are classified as partnerships for U.S. federal income tax purposes should

consult their own tax advisors regarding the U.S. federal income tax consequences of the acquisition, ownership and disposition of shares

of our common stock.

Tax Consequences Not Addressed

This summary does not address

the U.S. state and local, U.S. federal estate and gift, U.S. federal alternative minimum tax, or non-U.S. tax consequences to holders

of the acquisition, ownership and disposition of shares of our common stock. Each holder should consult its own tax advisors regarding

the U.S. state and local, U.S. federal estate and gift, U.S. federal alternative minimum tax, and non-U.S. tax consequences of the

acquisition, ownership and disposition of shares of our common stock.

U.S. Holders

Distributions on Shares of Our Common Stock

We have never declared or paid any cash dividends

on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future. If we were to pay cash

dividends in the future, such distributions made on shares of our common stock generally would be included in a U.S. Holder’s income

as ordinary dividend income to the extent of our current or accumulated earnings and profits (determined under U.S. federal income tax

principles) as of the end of our taxable year in which the distribution occurred. Dividends received by certain non-corporate U.S. Holders

may be eligible for taxation at preferential rates provided certain holding period and other requirements are satisfied. Distributions

in excess of our current and accumulated earnings and profits would be treated as a return of capital to the extent of a U.S. Holder’s

adjusted tax basis in the shares and thereafter as capital gain from the sale or exchange of such shares, which would be taxable according

to rules discussed under the heading “Sale, Certain Redemptions or Other Taxable Dispositions of Shares of Our Common Stock,”

below. Dividends received by a corporate holder may be eligible for a dividends received deduction, subject to applicable limitations.

Sale, Certain Redemptions or Other Taxable

Dispositions of Shares of Our Common Stock

Upon the sale, certain qualifying redemptions,

or other taxable disposition of shares of our common stock, a U.S. Holder generally will recognize capital gain or loss equal to the difference,

if any, between (i) the amount of cash and the fair market value of any property received upon such taxable disposition and (ii) the

U.S. Holder’s adjusted tax basis in the shares of our common stock sold or otherwise disposed of. Such capital gain or loss will

be long-term capital gain or loss if a U.S. Holder’s holding period in the shares of our common stock is more than one year at the

time of the taxable disposition. Long-term capital gains recognized by certain non-corporate U.S. Holders (including individuals) may

be eligible for taxation at preferential rates. Deductions for capital losses are subject to limitations under the Code.

Additional Tax on Passive Income

Individuals, estates and certain trusts whose

income exceeds certain thresholds will be required to pay a 3.8% Medicare surtax on “net investment income” including, among

other things, dividends and net gain from the disposition of property (other than property held in certain trades or businesses). U.S.

Holders should consult their own tax advisors regarding the effect, if any, of this tax on their ownership and disposition of shares of

our common stock.

Information Reporting and Backup Withholding

Information reporting requirements generally will

apply to payments of dividends on shares of our common stock and to the proceeds of a sale of shares of our common stock paid to a U.S.

Holder unless the U.S. Holder is an exempt recipient (such as a corporation). Backup withholding will apply to those payments if the U.S.

Holder fails to provide its correct taxpayer identification number, or certification of exempt status, or if the U.S. Holder is notified

by the IRS that it has failed to report in full payments of interest and dividend income. Backup withholding is not an additional tax.

Any amounts withheld under the backup withholding rules generally will be allowed as a refund or a credit against a U.S. Holder’s

U.S. federal income tax liability, if any, provided the required information is furnished in a timely manner to the IRS.

Non-U.S. Holders

Distributions on Shares of Our Common Stock

We have never declared or paid any cash dividends

on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future. If we were to pay cash

dividends in the future on our common stock, such distributions would be subject to U.S. federal income tax in the manner described

below.

Cash distributions on shares of our common stock

generally would constitute dividends for U.S. federal income tax purposes to the extent paid out of our current or accumulated earnings

and profits, as determined under U.S. federal income tax principles as of the end of our taxable year in which the distribution occurred.

Distributions in excess of current and accumulated earnings and profits would be applied against and reduce a Non-U.S. Holder’s

tax basis in shares of our common stock, to the extent thereof, and any excess would be treated as capital gain realized on the sale or

other disposition of the shares and subject to tax in the manner described under the heading “Sale or Other Taxable Disposition

of Shares of Our Common Stock,” below.

Any dividends paid to a Non-U.S. Holder with

respect to shares of our common stock that constitute dividends under the rules described above generally would be subject to withholding

of U.S. federal income tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty. However, dividends

that are effectively connected with the conduct of a trade or business by a Non-U.S. Holder within the U.S. , would not be subject

to this withholding tax, but instead would be subject to U.S. federal income tax on a net income basis at applicable individual or

corporate rates, subject to an applicable treaty that provides otherwise. A Non-U.S. Holder generally must deliver an IRS Form W-8ECI

certifying under penalties of perjury that such dividends are effectively connected with a U.S. trade or business of the holder in order

for effectively connected dividends to be exempt from this withholding tax. Any such effectively connected dividends received by a foreign

corporation may be subject to an additional “branch profits tax” at a 30% rate or such lower rate as may be specified by an

applicable income tax treaty.

A Non-U.S. Holder of shares of our common

stock who is entitled to and wishes to claim the benefits of an applicable treaty rate (and avoid backup withholding as discussed below)

with respect to dividends received generally must (i) complete an IRS Form W-8BEN or W-8BEN-E (or an acceptable substitute form)

and make certain certifications, under penalty of perjury, to establish its status as a non-U.S. person and its entitlement to treaty

benefits or (ii) if the stock is held through certain foreign intermediaries, satisfy the relevant certification requirements of

applicable U.S. Treasury regulations. Special certification and other requirements apply to certain Non-U.S. Holders that are

entities rather than individuals.

The certification requirements described above

must be satisfied prior to the payment of dividends and may be required to be updated periodically. A Non-U.S. Holder eligible for

a reduced rate of U.S. federal withholding tax pursuant to an income tax treaty may obtain a refund of any excess amounts withheld

by timely filing an appropriate claim for refund with the IRS.

Sale or Other Taxable Disposition of Shares

of Our Common Stock

In general, a Non-U.S. Holder of shares of

our common stock will not be subject to U.S. federal income tax with respect to gain recognized on a sale or other disposition of

such shares of our common stock, unless: (i) the gain is effectively connected with a trade or business of the Non-U.S. Holder

in the U.S. and, where a tax treaty applies, is attributable to a U.S. permanent establishment of the Non-U.S. Holder (in which

case, the special rules described below apply), (ii) in the case of a Non-U.S. Holder who is an individual, such holder is present

in the U.S. for 183 or more days in the taxable year of the sale or other disposition and certain other conditions are met, in which

case the gain would be subject to a flat 30% tax, or such reduced rate as may be specified by an applicable income tax treaty, which may

be offset by U.S. source capital losses, even though the individual is not considered a resident of the U.S., or (iii) subject to

certain exceptions, we are or have been a “U.S. real property holding corporation,” as such term is defined in Section 897(c) of

the Code, during the shorter of the five-year period ending on the date of disposition or the holder’s holding period of our shares

of our common stock.

We believe we currently are not, and do not anticipate

becoming, a “U.S. real property holding corporation” for U.S. federal income tax purposes.

Any gain described in (i) above will be subject

to U.S. federal income tax on a net income basis at applicable individual or corporate rates. If the Non-U.S. Holder is a corporation,

under certain circumstances, that portion of its earnings and profits that is effectively connected with its U.S. trade or business, subject

to certain adjustments, generally would be subject to an additional “branch profits tax” at a 30% rate or such lower rate

as may be specified by an applicable income tax treaty.

Information Reporting and Backup Withholding

We must report annually to the IRS and to each

Non-U.S. Holder the amount of dividends paid to such holder on the shares of our common stock and the tax withheld (if any) with

respect to such dividends, regardless of whether withholding was required. Copies of the information returns reporting such dividends

and any withholding may also be made available to the tax authorities in the country in which the Non-U.S. Holder resides under the

provisions of an applicable income tax treaty or information sharing agreement. In addition, dividends paid to a Non-U.S. Holder

may be subject to backup withholding unless applicable certification requirements are met.

Payment of the proceeds of a sale of shares of

our common stock within the U.S. or conducted through certain U.S. related financial intermediaries is subject to information reporting

and, depending upon the circumstances, backup withholding unless the Non-U.S. Holder certifies under penalties of perjury that it

is not a U.S. person (and the payor does not have actual knowledge or reason to know that the holder is a U.S. person) or the holder otherwise

establishes an exemption.

Any amounts withheld under the backup withholding

rules may be allowed as a refund or a credit against such holder’s U.S. federal income tax liability provided the required

information is timely furnished to the IRS.

Foreign Account Tax Compliance Act (“FATCA”)

Legislation commonly referred to as the Foreign

Account Tax Compliance Act and associated guidance, or FATCA, generally will impose a 30% U.S. federal withholding tax on any “withholdable

payment” (as defined below) paid to (i) a “foreign financial institution” (as specifically defined in the legislation),

whether such foreign financial institution is the beneficial owner or an intermediary, unless such foreign financial institution agrees

to verify, report and disclose its U.S. “account” holders (as specifically defined in the legislation) and meets certain other

specified requirements, or (ii) a non-financial foreign entity, whether such non-financial foreign entity is the beneficial owner

or an intermediary, unless such entity provides a certification that the beneficial owner of the payment does not have any substantial

U.S. owners or provides the name, address and taxpayer identification number of each such substantial U.S. owner and certain other specified

requirements are met. In certain cases, the relevant foreign financial institution or non-financial foreign entity may qualify for an

exemption from, or be deemed to be in compliance with, these rules. Under final regulations and other current guidance, “withholdable

payments” generally include dividends on shares of our common stock, and (subject to the proposed Treasury regulations discussed

below) the gross proceeds of a disposition of shares of our common stock. Proposed Treasury regulations eliminate withholding under FATCA

on payments of gross proceeds. Taxpayers may rely on these proposed Treasury regulations until final Treasury regulations are issued,

but such Treasury regulations are subject to change. Investors are urged to consult their own tax advisors regarding the possible application

of these rules to their investment in shares of our common stock.

PLAN OF DISTRIBUTION