Exela Technologies, Inc. Reports Second Quarter 2024 Results

August 15 2024 - 3:15PM

Exela Technologies, Inc. (“Exela” or the “Company”)

(NASDAQ: XELA, XELAP), a global business process automation

(“BPA”) leader, announced today its financial results for the

quarter ended June 30, 2024.

“Our increased operating leverage and continued focus on cost

management and rationalization of our real estate footprint are

reflected in the solid expansion of our gross margin. We continue

to add new logos and remain cautiously optimistic as we head into

the second half of the year,” noted Par Chadha, Executive

Chairman.

- Revenue: Revenue for 2Q 2024 was $245.7

million, a decline of 10.0% compared to $272.9 million in 2Q 2023

(or a decline of 9.3% when excluding the sale of the high-speed

scanner business in June 2023).

- Revenue for the Information and Transaction Processing

Solutions segment was $156.8 million, a decline of 15.2%

year-over-year (or a decline of 14.0% on a pro forma basis when

adjusted for the sale of the high-speed scanner business that

occurred in June 2023).

- Healthcare Solutions generated $62.9 million in revenue, a 1.1%

decline year-over-year.

- Legal & Loss Prevention Services generated $25.9 million in

revenue, a 6.3% increase year-over-year.

- Gross margin of 23.5%, up 1.2% year-over-year

due to lower costs.

- Interest Expense of $23.1M, down 48.7%

year-over-year due to the Company’s debt modification in July

2023.

- SG&A of $41.8M, up 30.5% year-over-year

due to profit on the sale of our high-speed scanner business of

$6.6M recognized in 2Q 2023. Other SG&A expenses were higher by

$9.0 million, due to $10.1 in Q2FY24 write-downs, predominantly

driven by a partner contract amendment, which provides for higher

pricing and service expansion but resulted in a non-cash write down

of the original contract’s straight-line revenue recognition and

related contract assets. The SG&A increase was further offset

by lower legal and professional fees and employee related

costs.

- Operating Loss: Operating loss of $2.4

million, versus an Operating profit of $11.2 million in 2Q 2023,

primarily driven by lower revenue and higher SG&A, partially

offset by higher gross profits.

- Net Loss: Net loss of $26.9 million ($25.7

million attributable to Exela Technologies, Inc.), an improvement

of $4.0 million year-over-year, primarily driven by lower interest

expense following debt modification in July 2023, partially offset

by higher SG&A.

- Adjusted

EBITDA(1):

Adjusted EBITDA was $13.7 million compared to $22.5 million in 2Q

2023, a decline of 39.0% year-over-year, while up 6.7%

sequentially. Adjusted EBITDA margin was 5.6%, a decrease of 260

basis points from 2Q 2023.

Below is the note referenced

above:(1) Adjusted EBITDA is a non-GAAP

measure. A reconciliation of Adjusted EBITDA is attached to this

release.

About ExelaExela Technologies is a business

process outsourcing and automation leader, leveraging a global

footprint and proprietary technology to help turn the complex into

the simple through user friendly software platforms and solutions

that enable our customers’ digital transformation. With decades of

experience operating mission-critical processes, Exela serves a

growing roster of more than 4,000 customers worldwide, including

many of the world’s largest enterprises and over 60% of the

Fortune® 100. Utilizing foundational technologies spanning

information management, workflow automation, and integrated

communications, Exela’s software and services include

multi-industry, departmental solution suites addressing finance and

accounting, human capital management, and legal management, as well

as industry-specific solutions for banking, healthcare, insurance,

and the public sector. Through cloud-enabled platforms, built on a

configurable stack of automation modules, and approximately 13,100

employees operating in 20 countries, Exela rapidly deploys

integrated technology and operations as an end-to-end digital

journey partner.

To automatically receive Exela financial news by email, please

visit the Exela Investor Relations website at

http://investors.exelatech.com/ and subscribe to E-mail

Alerts. About Non-GAAP Financial

Measures

This press release includes constant currency, EBITDA and

Adjusted EBITDA, each of which is a financial measure that is not

prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). Exela believes that the presentation of these

non-GAAP financial measures will provide useful information to

investors in assessing our financial performance, results of

operations and liquidity and allows investors to better understand

the trends in our business and to better understand and compare our

results. Exela’s board of directors and management use constant

currency, EBITDA and Adjusted EBITDA to assess Exela’s financial

performance, because it allows them to compare Exela’s operating

performance on a consistent basis across periods by removing the

effects of Exela’s capital structure (such as varying levels of

debt and interest expense, as well as transaction costs resulting

from capital markets-based activities). Adjusted EBITDA also seeks

to remove the effects of integration and related costs to

achieve the savings, asset base (such as depreciation and

amortization) and other similar non-routine items outside the

control of our management team. All of these costs are

variable and dependent upon the nature of the actions being

implemented and can vary significantly. Accordingly, due to that

significant variability, we exclude these charges since we do not

believe they truly reflect our past, current or future operating

performance. The constant currency presentation excludes the impact

of fluctuations in foreign currency exchange rates. We calculate

constant currency revenue and Adjusted EBITDA on a constant

currency basis by converting our current-period local currency

financial results using the exchange rates from the corresponding

prior-period and compare these adjusted amounts to our

corresponding prior period reported results. Exela does not

consider these non-GAAP measures in isolation or as an alternative

to liquidity or financial measures determined in accordance with

GAAP. A limitation of these non-GAAP financial measures is that

they exclude significant expenses and income that are required by

GAAP to be recorded in Exela’s financial statements. In addition,

they are subject to inherent limitations as they reflect the

exercise of judgments by management about which expenses and income

are excluded or included in determining these non-GAAP financial

measures and therefore the basis of presentation for these measures

may not be comparable to similarly-titled measures used by other

companies. These non-GAAP financial measures are not required to be

uniformly applied, are not audited and should not be considered in

isolation or as substitutes for results prepared in accordance with

GAAP. Net loss is the GAAP measure most directly comparable to the

non-GAAP measures presented here. For reconciliation of the

comparable GAAP measures to these non-GAAP financial measures, see

the schedules attached to this release.

Forward-Looking Statements Certain statements

included in this press release are not historical facts but are

forward-looking statements for purposes of the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995. Forward-looking statements generally are accompanied by words

such as “may”, “should”, “would”, “plan”, “intend”, “anticipate”,

“believe”, “estimate”, “predict”, “potential”, “seem”, “seek”,

“continue”, “future”, “will”, “expect”, “outlook” or other similar

words, phrases or expressions. These forward-looking statements

include statements regarding our industry, future events, estimated

or anticipated future results and benefits, future opportunities

for Exela, and other statements that are not historical facts.

These statements are based on the current expectations

of Exela management and are not predictions of actual

performance. These statements are subject to a number of risks and

uncertainties, including without limitation the network outage

described in this press release and those discussed under the

heading “Risk Factors” in our Annual Report and in subsequent

filings with the U.S. Securities and Exchange

Commission (“SEC”). In addition, forward-looking statements

provide Exela’s expectations, plans or forecasts of future events

and views as of the date of this

communication. Exela anticipates that subsequent events

and developments will cause Exela’s assessments to change. These

forward-looking statements should not be relied upon as

representing Exela’s assessments as of any date subsequent to the

date of this press release.

For more Exela news, commentary, and industry perspectives,

visit:Website:

https://investors.exelatech.com/X:

@ExelaTechLinkedIn:

exela-technologiesFacebook:

@exelatechnologiesInstagram:

@exelatechnologies

The information posted on the Company’s website and/or via its

social media accounts may be deemed material to investors.

Accordingly, investors, media and others interested in the Company

should monitor the Company’s website and its social media accounts

in addition to the Company’s press releases, SEC filings and public

conference calls and webcasts.

Investor and/or Media Contacts:

ir@exelatech.com

|

|

|

|

Exela Technologies, Inc. and

SubsidiariesCondensed Consolidated Balance

SheetsAs of June 30, 2024 and December 31,

2023(in thousands of United States dollars except share

and per share amounts) |

|

|

|

|

| |

|

June 30, |

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

| |

|

(Unaudited) |

|

(Audited) |

|

|

Assets |

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

30,327 |

|

|

$ |

23,341 |

|

|

|

Restricted cash |

|

|

20,933 |

|

|

|

43,812 |

|

|

| Accounts

receivable, net of allowance for credit losses of $6,813 and

$6,628, respectively |

|

|

61,501 |

|

|

|

76,893 |

|

|

| Related

party receivables and prepaid expenses |

|

|

449 |

|

|

|

296 |

|

|

|

Inventories, net |

|

|

13,251 |

|

|

|

11,502 |

|

|

| Prepaid

expenses and other current assets |

|

|

30,140 |

|

|

|

25,364 |

|

|

|

Total current assets |

|

|

156,601 |

|

|

|

181,208 |

|

|

|

Property, plant and equipment, net of accumulated depreciation of

$216,695 and $213,142, respectively |

|

|

58,448 |

|

|

|

58,366 |

|

|

|

Operating lease right-of-use assets, net |

|

|

31,421 |

|

|

|

33,874 |

|

|

|

Goodwill |

|

|

170,354 |

|

|

|

170,452 |

|

|

|

Intangible assets, net |

|

|

148,364 |

|

|

|

164,920 |

|

|

| Deferred

income tax assets |

|

|

2,990 |

|

|

|

3,043 |

|

|

| Other

noncurrent assets |

|

|

19,775 |

|

|

|

24,474 |

|

|

|

Total assets |

|

$ |

587,953 |

|

|

$ |

636,337 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Deficit |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

| Current

portion of long-term debt |

|

$ |

53,723 |

|

|

$ |

30,029 |

|

|

| Accounts

payable |

|

|

68,628 |

|

|

|

61,109 |

|

|

| Related

party payables |

|

|

3,047 |

|

|

|

1,938 |

|

|

| Income

tax payable |

|

|

4,211 |

|

|

|

2,080 |

|

|

| Accrued

liabilities |

|

|

57,611 |

|

|

|

63,699 |

|

|

| Accrued

compensation and benefits |

|

|

71,192 |

|

|

|

65,012 |

|

|

| Accrued

interest |

|

|

55,776 |

|

|

|

52,389 |

|

|

| Customer

deposits |

|

|

27,898 |

|

|

|

23,838 |

|

|

| Deferred

revenue |

|

|

14,018 |

|

|

|

12,099 |

|

|

|

Obligation for claim payment |

|

|

38,913 |

|

|

|

66,988 |

|

|

| Current

portion of finance lease liabilities |

|

|

6,422 |

|

|

|

4,856 |

|

|

| Current

portion of operating lease liabilities |

|

|

9,590 |

|

|

|

10,845 |

|

|

|

Total current liabilities |

|

|

411,029 |

|

|

|

394,882 |

|

|

|

Long-term debt, net of current maturities |

|

|

1,015,252 |

|

|

|

1,030,580 |

|

|

| Finance

lease liabilities, net of current portion |

|

|

8,203 |

|

|

|

5,953 |

|

|

| Pension

liabilities, net |

|

|

12,879 |

|

|

|

13,192 |

|

|

| Deferred

income tax liabilities |

|

|

12,516 |

|

|

|

11,692 |

|

|

|

Long-term income tax liabilities |

|

|

6,511 |

|

|

|

6,359 |

|

|

|

Operating lease liabilities, net of current portion |

|

|

24,676 |

|

|

|

26,703 |

|

|

| Other

long-term liabilities |

|

|

5,621 |

|

|

|

5,811 |

|

|

|

Total liabilities |

|

|

1,496,687 |

|

|

|

1,495,172 |

|

|

|

Commitments and Contingencies (Note 8) |

|

|

|

|

|

|

|

|

Stockholders' deficit |

|

|

|

|

|

|

|

| Common

Stock, par value of $0.0001 per share; 1,600,000,000 shares

authorized; 6,365,363 shares issued and outstanding at June 30,

2024 and 6,365,355 shares issued and outstanding at December 31,

2023 |

|

|

261 |

|

|

|

261 |

|

|

|

Preferred stock, $0.0001 par value per share, 20,000,000 shares

authorized at June 30, 2024 and December 31, 2023 |

|

|

|

|

|

|

|

|

Series A Preferred Stock, 2,778,111 shares issued and outstanding

at June 30, 2024 and December 31, 2023 |

|

|

1 |

|

|

|

1 |

|

|

|

Series B Preferred Stock, 3,029,900 shares issued and outstanding

at June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

| Additional paid in

capital |

|

|

1,237,687 |

|

|

|

1,236,171 |

|

|

| Accumulated deficit |

|

|

(2,134,670 |

) |

|

|

(2,084,114 |

) |

|

| Accumulated other

comprehensive loss: |

|

|

|

|

|

|

|

| Foreign currency translation

adjustment |

|

|

(7,282 |

) |

|

|

(7,648 |

) |

|

| Unrealized pension actuarial

gains (losses), net of tax |

|

|

215 |

|

|

|

(174 |

) |

|

| Total accumulated other

comprehensive loss |

|

|

(7,067 |

) |

|

|

(7,822 |

) |

|

| Total stockholders’

deficit attributable to Exela Technologies, Inc. |

|

|

(903,788 |

) |

|

|

(855,503 |

) |

|

| Noncontrolling interest in XBP

Europe |

|

|

(4,946 |

) |

|

|

(3,332 |

) |

|

|

Total stockholders’ deficit |

|

|

(908,734 |

) |

|

|

(858,835 |

) |

|

|

Total liabilities and stockholders’ deficit |

|

$ |

587,953 |

|

|

$ |

636,337 |

|

|

|

|

|

Exela Technologies, Inc. and

SubsidiariesCondensed Consolidated Statements of

OperationsFor the three and six months ended

June 30, 2024 and 2023(in thousands of United States

dollars except share and per share amounts)(Unaudited) |

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

245,653 |

|

|

$ |

272,938 |

|

|

$ |

504,464 |

|

|

$ |

546,558 |

|

| Cost of

revenue (exclusive of depreciation and amortization) |

|

|

187,964 |

|

|

|

212,059 |

|

|

|

389,952 |

|

|

|

428,526 |

|

| Selling,

general and administrative expenses (exclusive of depreciation and

amortization) |

|

|

41,778 |

|

|

|

32,026 |

|

|

|

82,632 |

|

|

|

76,407 |

|

|

Depreciation and amortization |

|

|

14,983 |

|

|

|

14,890 |

|

|

|

28,490 |

|

|

|

31,450 |

|

| Related

party expense |

|

|

3,282 |

|

|

|

2,739 |

|

|

|

5,673 |

|

|

|

5,851 |

|

|

Operating profit (loss) |

|

|

(2,354 |

) |

|

|

11,224 |

|

|

|

(2,283 |

) |

|

|

4,324 |

|

|

Other expense (income), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

23,129 |

|

|

|

45,092 |

|

|

|

44,217 |

|

|

|

89,272 |

|

|

Debt modification and extinguishment costs (gain), net |

|

|

— |

|

|

|

(6,785 |

) |

|

|

— |

|

|

|

(15,558 |

) |

|

Sundry (income) expense, net |

|

|

(204 |

) |

|

|

1,500 |

|

|

|

1,677 |

|

|

|

2,248 |

|

|

Other income, net |

|

|

(423 |

) |

|

|

(232 |

) |

|

|

(874 |

) |

|

|

(514 |

) |

|

Loss before income taxes |

|

|

(24,856 |

) |

|

|

(28,351 |

) |

|

|

(47,303 |

) |

|

|

(71,124 |

) |

|

Income tax expense |

|

|

(2,049 |

) |

|

|

(2,535 |

) |

|

|

(5,175 |

) |

|

|

(5,198 |

) |

|

Net loss |

|

|

(26,905 |

) |

|

|

(30,886 |

) |

|

|

(52,478 |

) |

|

|

(76,322 |

) |

| Net loss

attributable to noncontrolling interest in XBP Europe, net of

taxes |

|

|

(1,228 |

) |

|

|

— |

|

|

|

(1,922 |

) |

|

|

— |

|

|

Net loss attributable to Exela Technologies,

Inc. |

|

$ |

(25,677 |

) |

|

$ |

(30,886 |

) |

|

$ |

(50,556 |

) |

|

$ |

(76,322 |

) |

|

Cumulative dividends for Series A Preferred Stock |

|

|

(1,067 |

) |

|

|

(967 |

) |

|

|

(2,120 |

) |

|

|

(1,921 |

) |

|

Cumulative dividends for Series B Preferred Stock |

|

|

(1,242 |

) |

|

|

(1,171 |

) |

|

|

(2,466 |

) |

|

|

(2,324 |

) |

|

Net loss attributable to common stockholders |

|

$ |

(27,986 |

) |

|

$ |

(33,024 |

) |

|

$ |

(55,142 |

) |

|

$ |

(80,567 |

) |

|

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(4.40 |

) |

|

$ |

(5.19 |

) |

|

$ |

(8.66 |

) |

|

$ |

(14.40 |

) |

|

|

|

Exela Technologies, Inc. and

SubsidiariesCondensed Consolidated Statements of

Cash FlowsFor the six months ended June 30,

2024 and 2023(in thousands of United States dollars) |

|

|

| |

|

Six Months Ended June 30, |

| |

|

2024 |

|

|

2023 |

|

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(52,478 |

) |

|

$ |

(76,322 |

) |

|

| Adjustments to reconcile net

loss to cash used in operating activities |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

28,490 |

|

|

|

31,450 |

|

|

|

Original issue discount, debt premium and debt issuance cost

amortization |

|

|

(20,022 |

) |

|

|

16,064 |

|

|

|

Interest on BR Exar AR Facility |

|

|

(2,558 |

) |

|

|

(5,066 |

) |

(1) |

|

Debt modification and extinguishment gain, net |

|

|

— |

|

|

|

(16,964 |

) |

|

|

Credit loss expense |

|

|

14,683 |

|

|

|

2,865 |

|

|

|

Deferred income tax provision |

|

|

757 |

|

|

|

776 |

|

|

|

Share-based compensation expense |

|

|

1,560 |

|

|

|

314 |

|

|

|

Unrealized foreign currency (gain) loss |

|

|

(131 |

) |

|

|

521 |

|

|

|

Gain on sale of assets |

|

|

(533 |

) |

|

|

(5,831 |

) |

|

|

Fair value adjustment for private warrants liability of XBP

Europe |

|

|

(40 |

) |

|

|

— |

|

|

|

Change in operating assets and liabilities |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

6,379 |

|

|

|

(7,703 |

) |

|

|

Prepaid expenses and other current assets |

|

|

(6,842 |

) |

|

|

6,495 |

|

|

|

Accounts payable and accrued liabilities |

|

|

13,427 |

|

|

|

(639 |

) |

|

|

Related party payables |

|

|

955 |

|

|

|

(403 |

) |

|

|

Additions to outsource contract costs |

|

|

(573 |

) |

|

|

(298 |

) |

|

|

Net cash used in operating activities |

|

|

(16,926 |

) |

|

|

(54,741 |

) |

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

| Purchase of property, plant

and equipment |

|

|

(4,033 |

) |

|

|

(3,357 |

) |

|

| Additions to internally

developed software |

|

|

(1,947 |

) |

|

|

(1,976 |

) |

|

| Proceeds from sale of

assets |

|

|

2,893 |

|

|

|

29,811 |

|

|

|

Net cash (used in) provided by investing

activities |

|

|

(3,087 |

) |

|

|

24,478 |

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

| Proceeds from issuance of

Common Stock from at the market offerings |

|

|

— |

|

|

|

69,260 |

|

|

| Cash paid for equity issuance

costs from at the market offerings |

|

|

— |

|

|

|

(2,232 |

) |

|

| Payment for fractional shares

on reverse stock split |

|

|

— |

|

|

|

(31 |

) |

|

| Borrowings under factoring

arrangement and Securitization Facility |

|

|

496 |

|

|

|

62,858 |

|

|

| Principal repayment on

borrowings under factoring arrangement and Securitization

Facility |

|

|

(511 |

) |

|

|

(63,577 |

) |

|

| Cash paid for debt issuance

costs |

|

|

(237 |

) |

|

|

(6,398 |

) |

|

| Principal payments on finance

lease obligations |

|

|

(3,837 |

) |

|

|

(2,150 |

) |

|

| Borrowings from senior secured

term loans and BRCC revolver |

|

|

— |

|

|

|

9,600 |

|

|

| Borrowings from other

loans |

|

|

20,594 |

|

|

|

4,289 |

|

(1) |

| Cash paid for debt

repurchases |

|

|

— |

|

|

|

(11,858 |

) |

|

| Proceeds from Second Lien

Note |

|

|

— |

|

|

|

31,500 |

|

|

| Borrowing under BR Exar AR

Facility |

|

|

30,614 |

|

|

|

20,000 |

|

(1) |

| Repayments under BR Exar AR

Facility |

|

|

(25,580 |

) |

|

|

(12,484 |

) |

(1) |

| Repayment of BRCC term

loan |

|

|

— |

|

|

|

(44,775 |

) |

|

| Principal repayments on senior

secured term loans, BRCC revolver and other loans |

|

|

(17,763 |

) |

|

|

(15,441 |

) |

(1) |

|

Net cash provided by financing activities |

|

|

3,776 |

|

|

|

38,561 |

|

|

| Effect of exchange rates on

cash, restricted cash and cash equivalents |

|

|

344 |

|

|

|

145 |

|

|

|

Net (decrease) increase in cash, restricted cash and cash

equivalents |

|

|

(15,893 |

) |

|

|

8,443 |

|

|

| Cash, restricted cash, and

cash equivalents |

|

|

|

|

|

|

|

| Beginning of period |

|

|

67,153 |

|

|

|

45,067 |

|

|

| End of period |

|

$ |

51,260 |

|

|

$ |

53,510 |

|

|

| Supplemental cash flow

data: |

|

|

|

|

|

|

|

| Income tax payments, net of

refunds received |

|

$ |

1,978 |

|

|

$ |

2,898 |

|

|

| Interest paid |

|

|

38,694 |

|

|

|

72,608 |

|

|

| Noncash investing and

financing activities: |

|

|

|

|

|

|

|

| Assets acquired through

right-of-use arrangements |

|

$ |

7,673 |

|

|

$ |

405 |

|

|

| Accrued PIK interest paid

through issuance of PIK Notes |

|

|

23,342 |

|

|

|

— |

|

|

| Waiver and consent fee payable

added to outstanding balance of Senior Secured Term Loan |

|

|

1,000 |

|

|

|

— |

|

|

| Accrued capital

expenditures |

|

|

288 |

|

|

|

2,167 |

|

|

(1) Exela restated the condensed consolidated

statement of cash flows for the six months ended June 30, 2023 by

reclassifying borrowing and repayments under BR Exar AR Facility as

separate line items which were previously included in borrowings

from other loans and principal repayments on senior secured term

loans and other loans, respectively under cash flow from financing

activities. Interest on BR Exar AR Facility which was previously

included in principal repayments on senior secured term loans and

other loans under cash flow from financing activities is restated

by reclassification as cash flow from operating activities.

|

|

|

Exela Technologies, Inc. and

SubsidiariesSchedule 1: Reconciliation of Adjusted

EBITDA and constant currency revenues |

|

|

| Non-GAAP

constant currency revenue reconciliation |

| |

| ($ in millions) |

|

Three months ended June 30, |

|

Year ended (YTD) June 30, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

|

2023 |

| Revenues, as reported

(GAAP) |

|

$245.7 |

|

$272.9 |

|

$504.5 |

|

|

$546.6 |

| Foreign currency exchange

impact (1) |

|

|

|

0.3 |

|

|

|

0.4 |

|

|

|

(0.4 |

) |

|

|

|

3.6 |

| Revenues, at constant

currency (Non-GAAP) |

|

$246.0 |

|

$273.3 |

|

$504.1 |

|

|

$550.2 |

(1) Constant currency excludes the impact of

foreign currency fluctuations and is computed by applying the

average exchange rates for the three months and six months ended

June 30, 2023, to the revenues during the corresponding period in

2024.

Reconciliation of Adjusted EBITDA

| ($ in

millions) |

|

Three months ended June 30, |

|

Year ended (YTD) June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss

(GAAP) |

|

|

($26.9 |

) |

|

|

($30.9 |

) |

|

|

($52.5 |

) |

|

|

($76.3 |

) |

| Income tax expense |

|

|

2.0 |

|

|

|

2.5 |

|

|

|

5.2 |

|

|

|

5.2 |

|

| Interest expense, net |

|

|

23.1 |

|

|

|

45.1 |

|

|

|

44.2 |

|

|

|

89.3 |

|

| Depreciation and

Amortization |

|

|

15.0 |

|

|

|

14.9 |

|

|

|

28.5 |

|

|

|

31.5 |

|

| EBITDA

(Non-GAAP) |

|

$13.3 |

|

|

$31.6 |

|

|

$25.4 |

|

|

$49.6 |

|

| Transaction and integration

costs |

|

|

0.0 |

|

|

|

2.9 |

|

|

|

0.2 |

|

|

|

8.1 |

|

| Non-cash equity

compensation |

|

|

0.4 |

|

|

|

0.2 |

|

|

|

1.6 |

|

|

|

0.3 |

|

| Other charges including

non-cash |

|

|

- |

|

|

|

0.3 |

|

|

|

- |

|

|

|

0.2 |

|

| Loss/(gain) on sale of

assets |

|

|

0.1 |

|

|

|

0.7 |

|

|

|

(0.5 |

) |

|

|

0.8 |

|

| Loss/(gain) on business

disposals |

|

|

- |

|

|

|

(6.5 |

) |

|

|

- |

|

|

|

(6.5 |

) |

| Debt modification

and extinguishment costs (gain), net |

|

- |

|

|

|

(6.8 |

) |

|

|

- |

|

|

|

(15.6 |

) |

| Adjusted

EBITDA |

|

$13.7 |

|

|

$22.5 |

|

|

$26.6 |

|

|

$37.0 |

|

Source: Exela Technologies, Inc.

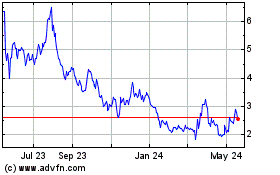

Exela Technologies (NASDAQ:XELA)

Historical Stock Chart

From Jan 2025 to Feb 2025

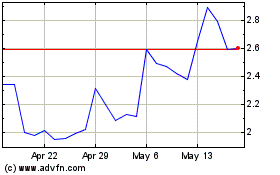

Exela Technologies (NASDAQ:XELA)

Historical Stock Chart

From Feb 2024 to Feb 2025