17 Education & Technology Group Inc. (NASDAQ: YQ) (“17EdTech”

or the “Company”), a leading education technology company in China,

today announced its unaudited financial results for the first

quarter of 2023.

First Quarter 2023

Highlights1

- Net revenues were

RMB9.3 million (US$1.4 million), representing a year-over-year

decrease of 96.0% from RMB233.4 million in the first quarter of

2022.

- Gross margin was

24.4%, decreasing from 60.7% in the first quarter of 2022.

- Net loss was

RMB92.5 million (US$13.5 million), significantly increasing from

net loss of RMB24.8 million in the first quarter of 2022.

- Net loss as a percentage of

net revenues was negative 997.9% in the first quarter of

2023, compared with negative 10.6% in the first quarter of

2022.

- Adjusted net

loss2 (non-GAAP), which

excluded share-based compensation expenses of RMB28.5 million

(US$4.1 million), was RMB64.0 million (US$9.3 million), compared

with adjusted net income (non-GAAP) of RMB9.9 million in the first

quarter of 2022.

- Adjusted net loss

(non-GAAP) as a percentage of net revenues was negative

690.6% in the first quarter of 2023, compared with 4.2% of adjusted

net income (non-GAAP) as a percentage of net revenues in the first

quarter of 2022.

Mr. Andy Liu, Founder, Chairman and Chief

Executive Officer of the Company, commented, “The COVID outbreak in

China in the fourth quarter of 2022 caused delays in the bidding

and delivery processes of our major projects which adversely

affected our financial performance in the last two quarters.

However, our in-school SaaS business continues to advance beyond

the financial results might indicate.”

“Year to date, our teaching and learning SaaS

business has won multiple landmark projects across China, including

the RMB116 million Shanghai Minhang District smart-pen and

intelligent homework project and the RMB20 million Beijing Xicheng

District cloud classroom evaluation system project. These winnings

demonstrate our competitive advantages in the space and the

market’s recognition of our offerings, all rooted in our deep

insights into classroom and homework scenarios, accumulated AI

capability technology and data insights, and exceptional ability to

achieve large-scale regular use by teachers and students.”

Mr. Michael Du, Director and Chief Financial

Officer of the Company, commented, “Our revenue and gross profit in

the first quarter of 2023 were impacted due to the delays in

bidding and delivery of several projects. However, the recent

winning of major projects have marked another key milestone in the

Company’s new business strategies. These projects are expected to

be delivered gradually over the upcoming quarters and reflected it

in our financial statements.”

________________1 For a reconciliation of

non-GAAP numbers, please see the table captioned “Reconciliations

of non-GAAP measures to the most comparable GAAP measures” at the

end of this press release. 2 Adjusted net income (loss) represents

net income (loss) excluding share-based compensation expenses.

First Quarter 2023 Unaudited Financial

Results

Net Revenues

Net revenues for the first quarter of 2023 were

RMB9.3 million (US$1.4 million), representing a year-over-year

decrease of 96.0% from RMB233.4 million in the first quarter of

2022, mainly due to the significant delays in the bidding and

delivery processes of major projects which affected revenue

recognition in the quarter.

Cost of Revenues

Cost of revenues for the first quarter of 2023

was RMB7.0 million (US$1.0 million), representing a year-over-year

decrease of 92.4% from RMB91.8 million in the first quarter of

2022, which was largely in line with the decrease in net

revenues.

Gross Profit and Gross

Margin

Gross profit for the first quarter of 2023 was

RMB2.3 million (US$0.3 million), representing a year-over-year

decrease of 98.4% from RMB141.7 million in the first quarter of

2022.

Gross margin for the first quarter of 2023 was

24.4%, compared with 60.7% in the first quarter of 2022.

Total Operating Expenses

The following table sets forth a breakdown of

operating expenses by amounts and percentages of revenue during the

periods indicated (in thousands, except for percentages):

|

|

|

For the three months ended March 31, |

|

|

|

|

2022 |

|

|

2023 |

|

|

|

|

|

Year- |

|

|

|

|

RMB |

|

|

% |

|

|

RMB |

|

|

USD |

|

|

% |

|

|

over-year |

|

|

Sales and marketing expenses |

|

|

21,997 |

|

|

|

9.4 |

% |

|

|

21,828 |

|

|

|

3,178 |

|

|

|

235.4 |

% |

|

|

-0.8 |

% |

|

Research and development expenses |

|

|

97,476 |

|

|

|

41.8 |

% |

|

|

44,273 |

|

|

|

6,447 |

|

|

|

477.4 |

% |

|

|

-54.6 |

% |

|

General and administrative expenses |

|

|

51,301 |

|

|

|

22.0 |

% |

|

|

40,182 |

|

|

|

5,851 |

|

|

|

433.3 |

% |

|

|

-21.7 |

% |

|

Total operating expenses |

|

|

170,774 |

|

|

|

73.2 |

% |

|

|

106,283 |

|

|

|

15,476 |

|

|

|

1,146.1 |

% |

|

|

-37.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses for the first quarter

of 2023 were RMB106.3 million (US$15.5 million), including RMB28.5

million (US$4.1 million) of share-based compensation expenses,

representing a year-over-year decrease of 37.8% from RMB170.8

million in the first quarter of 2022.

Sales and marketing expenses for the first

quarter of 2023 were RMB21.8 million (US$3.2 million), including

RMB5.1 million (US$0.7 million) of share-based compensation

expenses, representing a year-over-year decrease of 0.8% from

RMB22.0 million in the first quarter of 2022.

Research and development expenses for the first

quarter of 2023 were RMB44.3 million (US$6.4 million), including

RMB7.0 million (US$1.0 million) of share-based compensation

expenses, representing a year-over-year decrease of 54.6% from

RMB97.5 million in the first quarter of 2022. The decrease was

primarily attributable to workforce optimization in line with

business adjustment and continuous expenses management.

General and administrative expenses for the

first quarter of 2023 were RMB40.2 million (US$5.9 million),

including RMB16.5 million (US$2.4 million) of share-based

compensation expenses, representing a year-over-year decrease of

21.7% from RMB51.3 million in the first quarter of 2022. The

decrease was primarily due to workforce optimization in line with

business adjustment and continuous expenses management.

Loss from Operations

Loss from operations for the first quarter of

2023 was RMB104.0 million (US$15.1 million), compared with RMB29.1

million in the first quarter of 2022. Loss from operations as a

percentage of net revenues for the first quarter of 2023 was

negative 1,121.8%, compared with negative 12.5% in the first

quarter of 2022.

Net Loss

Net loss for the first quarter of 2023 was

RMB92.5 million (US$13.5 million), compared with net loss of

RMB24.8 million in the first quarter of 2022. Net loss as a

percentage of net revenues was negative 997.9% in the first quarter

of 2023, compared with negative 10.6% in the first quarter of

2022.

Adjusted Net Loss

(non-GAAP)

Adjusted net loss (non-GAAP) for the first

quarter of 2023 was RMB64.0 million (US$9.3 million), compared with

adjusted net income (non-GAAP) of RMB9.9 million in the first

quarter of 2022. Adjusted net loss (non-GAAP) as a percentage of

net revenues was negative 690.6% in the first quarter of 2023,

compared with 4.2% of adjusted net income (non-GAAP) as a

percentage of net revenues in the first quarter of 2022.

Please refer to the table captioned

“Reconciliations of non-GAAP measures to the most comparable GAAP

measures” at the end of this press release for a reconciliation of

net loss under U.S. GAAP to adjusted net income (loss)

(non-GAAP).

Cash and Cash Equivalents, Restricted Cash,

and Short-term Investments

Cash and cash equivalents, restricted cash, and

short-term investments were RMB639.5 million (US$93.1 million) as

of March 31, 2023, compared with RMB737.7 million as of December

31, 2022.

Conference Call Information

The Company will hold a conference call on

Wednesday, June 14, 2023 at 9:00 p.m. U.S. Eastern Time (Thursday,

June 15, 2023 at 9:00 a.m. Beijing time) to discuss the financial

results for the first quarter of 2023.

Please note that participants need to

pre-register for the conference call participation by navigating to

https://register.vevent.com/register/BIce1be812566a42809928eca0ce5a00e2.

Once preregistration has been completed, participants will receive

dial-in numbers, an event passcode, and a unique registrant ID.

Upon registration, you will receive an email

containing participant dial-in numbers, and PIN number. To join the

conference call, please dial the number you receive, enter the PIN

number, and you will be joined to the conference call

instantly.

Additionally, a live and archived webcast of

this conference call will be available at

https://ir.17zuoye.com/.

Non-GAAP Financial Measures

17EdTech’s management uses adjusted net income

(loss) as a non-GAAP financial measure to gain an understanding of

17EdTech’s comparative operating performance and future

prospects.

Adjusted net income (loss) represents net loss

excluding share-based compensation expenses and such adjustment has

no impact on income tax.

Adjusted net income (loss) is used by 17EdTech’s

management in their financial and operating decision-making as a

non-GAAP financial measure, because management believes it reflects

17EdTech’s ongoing business and operating performance in a manner

that allows meaningful period-to-period comparisons. 17EdTech’s

management believes that such non-GAAP measure provides useful

information to investors and others in understanding and evaluating

17EdTech’s operating performance in the same manner as management

does, if they so choose. Specifically, 17EdTech believes the

non-GAAP measure provides useful information to both management and

investors by excluding certain charges that the Company believes

are not indicative of its core operating results.

The non-GAAP financial measure has limitations.

It does not include all items of income and expense that affect

17EdTech’s income from operations. Specifically, the non-GAAP

financial measure is not prepared in accordance with GAAP, may not

be comparable to non-GAAP financial measures used by other

companies and, with respect to the non-GAAP financial measure that

excludes certain items under GAAP, does not reflect any benefit

that such items may confer to 17EdTech. Management compensates for

these limitations by also considering 17EdTech’s financial results

as determined in accordance with GAAP. The presentation of this

additional information is not meant to be considered superior to,

in isolation from or as a substitute for results prepared in

accordance with US GAAP.

Exchange Rate Information

The Company’s business is primarily conducted in

China and all of the revenues are denominated in Renminbi (“RMB”).

However, periodic reports made to shareholders will include current

period amounts translated into U.S. dollars (“USD” or “US$”) using

the exchange rate as of balance sheet date, for the convenience of

the readers. Translations of balances in the consolidated balance

sheets and the related consolidated statements of operations,

comprehensive loss, change in shareholders’ deficit and cash flows

from RMB into USD as of and for the three months ended March 31,

2023 are solely for the convenience of the readers and were

calculated at the rate of US$1.00=RMB6.8676 representing the noon

buying rate set forth in the H.10 statistical release of the U.S.

Federal Reserve Board on March 31, 2023. No representation is made

that the RMB amounts could have been, or could be, converted,

realized or settled into US$ at that rate on March 31, 2023, or at

any other rate.

About 17 Education & Technology

Group Inc.

17 Education & Technology Group Inc. is a

leading education technology company in China. The Company provides

a smart in-school classroom solution that delivers data-driven

teaching, learning and assessment products to teachers, students

and parents. Leveraging its extensive knowledge and expertise

obtained from in-school business over the past decade, the Company

provides teaching and learning SaaS offerings to facilitate the

digital transformation and upgrade at Chinese schools, with a focus

on improving the efficiency and effectiveness of core teaching and

learning scenarios such as homework assignments and in-class

teaching. The Company also provides a personalized self-directed

learning product to Chinese families. The product utilizes the

Company’s technology and data insights to provide personalized and

targeted learning and exercise content that is aimed at improving

students’ learning efficiency.

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be

identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates” and similar

statements. Statements that are not historical facts, including

statements about 17EdTech’s beliefs and expectations, are

forward-looking statements. 17EdTech may also make written or oral

forward-looking statements in its periodic reports to the SEC, in

its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Forward-looking statements

involve inherent risks and uncertainties. A number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to the

following: 17EdTech’s growth strategies; its future business

development, financial condition and results of operations; its

ability to continue to attract and retain users; its ability to

carry out its business and organization transformation, its ability

to implement and grow its new business initiatives; the trends in,

and size of, China’s online education market; competition in and

relevant government policies and regulations relating to China's

online education market; its expectations regarding demand for, and

market acceptance of, its products and services; its expectations

regarding its relationships with business partners; general

economic and business conditions; and assumptions underlying or

related to any of the foregoing. Further information regarding

these and other risks is included in 17EdTech’s filings with the

SEC. All information provided in this press release is as of the

date of this press release, and 17EdTech does not undertake any

obligation to update any forward-looking statement, except as

required under applicable law.

For investor and media inquiries, please

contact:

17 Education & Technology Group

Inc. Ms. Lara ZhaoInvestor Relations ManagerE-mail:

ir@17zuoye.com

|

|

|

17 EDUCATION & TECHNOLOGY GROUP INC. |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(In thousands of RMB and USD, except for share and per ADS

data, or otherwise noted) |

|

|

|

As of December 31, |

|

|

As of March 31, |

|

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

707,895 |

|

|

418,395 |

|

|

60,923 |

|

|

Restricted cash |

|

10,231 |

|

|

20,415 |

|

|

2,973 |

|

|

Short-term investments |

|

19,531 |

|

|

200,714 |

|

|

29,226 |

|

|

Accounts receivable |

|

34,824 |

|

|

33,438 |

|

|

4,869 |

|

|

Prepaid expenses and other current assets |

|

140,894 |

|

|

160,916 |

|

|

23,431 |

|

|

Total current assets |

|

913,375 |

|

|

833,878 |

|

|

121,422 |

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

32,295 |

|

|

28,482 |

|

|

4,147 |

|

|

Right-of-use assets |

|

30,052 |

|

|

24,773 |

|

|

3,607 |

|

|

Long-term investment |

|

— |

|

|

4,984 |

|

|

726 |

|

|

Other non-current assets |

|

4,802 |

|

|

4,391 |

|

|

639 |

|

|

TOTAL ASSETS |

|

980,524 |

|

|

896,508 |

|

|

130,541 |

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities |

|

153,023 |

|

|

136,909 |

|

|

19,935 |

|

|

Deferred revenue and customer advances, current |

|

42,385 |

|

|

44,053 |

|

|

6,415 |

|

|

Operating lease liabilities, current |

|

18,719 |

|

|

16,142 |

|

|

2,350 |

|

|

Total current liabilities |

|

214,127 |

|

|

197,104 |

|

|

28,700 |

|

|

|

|

As of December 31, |

|

As of March 31, |

|

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities, non-current |

|

7,534 |

|

|

7,232 |

|

|

1,053 |

|

|

TOTAL LIABILITIES |

|

221,661 |

|

|

204,336 |

|

|

29,753 |

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

Class A ordinary shares |

|

300 |

|

|

301 |

|

|

44 |

|

|

Class B ordinary shares |

|

38 |

|

|

38 |

|

|

6 |

|

|

Treasury stock |

|

(21 |

) |

|

(23 |

) |

|

(3 |

) |

|

Additional paid-in capital |

|

10,954,822 |

|

|

10,985,530 |

|

|

1,599,617 |

|

|

Accumulated other comprehensive income |

|

62,689 |

|

|

57,828 |

|

|

8,419 |

|

|

Accumulated deficit |

|

(10,258,965 |

) |

|

(10,351,502 |

) |

|

(1,507,295 |

) |

|

TOTAL SHAREHOLDERS' EQUITY |

|

758,863 |

|

|

692,172 |

|

|

100,788 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

980,524 |

|

|

896,508 |

|

|

130,541 |

|

|

|

|

17 EDUCATION & TECHNOLOGY GROUP INC. |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In thousands of RMB and USD, except for share and per ADS

data, or otherwise noted) |

|

|

|

For the three months ended March 31, |

|

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

Net revenues |

|

233,446 |

|

|

9,273 |

|

|

1,350 |

|

|

Cost of revenues |

|

(91,785 |

) |

|

(7,010 |

) |

|

(1,021 |

) |

|

Gross profit |

|

141,661 |

|

|

2,263 |

|

|

329 |

|

|

Operating expenses (Note 1) |

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

(21,997 |

) |

|

(21,828 |

) |

|

(3,178 |

) |

|

Research and development expenses |

|

(97,476 |

) |

|

(44,273 |

) |

|

(6,447 |

) |

|

General and administrative expenses |

|

(51,301 |

) |

|

(40,182 |

) |

|

(5,851 |

) |

|

Total operating expenses |

|

(170,774 |

) |

|

(106,283 |

) |

|

(15,476 |

) |

|

Loss from operations |

|

(29,113 |

) |

|

(104,020 |

) |

|

(15,147 |

) |

|

Interest income |

|

2,065 |

|

|

7,774 |

|

|

1,132 |

|

|

Foreign currency exchange gain |

|

203 |

|

|

13 |

|

|

2 |

|

|

Other income, net |

|

2,079 |

|

|

3,712 |

|

|

541 |

|

|

Loss before provision for income tax and Loss from equity

method investments |

|

(24,766 |

) |

|

(92,521 |

) |

|

(13,472 |

) |

|

Income tax expenses |

|

— |

|

|

— |

|

|

— |

|

|

Loss from equity method investments |

|

— |

|

|

(16 |

) |

|

(2 |

) |

|

Net loss |

|

(24,766 |

) |

|

(92,537 |

) |

|

(13,474 |

) |

|

Net loss available to ordinary shareholders of

17 |

|

(24,766 |

) |

|

(92,537 |

) |

|

(13,474 |

) |

|

Education & Technology Group Inc. |

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

(0.05 |

) |

|

(0.19 |

) |

|

(0.03 |

) |

|

Net loss per ADS (Note 2) |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

(0.50 |

) |

|

(1.90 |

) |

|

(0.30 |

) |

|

Weighted average shares used in calculating net loss

per ordinary share |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

508,608,858 |

|

|

486,558,988 |

|

|

486,558,988 |

|

|

|

|

Note 1: Share-based compensation expenses were included in the

operating expenses as follows: |

|

|

|

|

|

For the three months ended March 31, |

|

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

Share-based compensation expenses: |

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

3,980 |

|

|

5,067 |

|

|

738 |

|

|

Research and development expenses |

|

7,185 |

|

|

6,964 |

|

|

1,014 |

|

|

General and administrative expenses |

|

23,480 |

|

|

16,464 |

|

|

2,397 |

|

|

Total |

|

34,645 |

|

|

28,495 |

|

|

4,149 |

|

|

|

|

Note 2: Each one ADS represents ten Class A ordinary shares.

Effective on November 17, 2021, the Company changed the ratio of

its ADS to its Class A ordinary shares from two ADSs

representing five Class A ordinary shares to one ADS

representing ten Class A ordinary shares. All earnings per ADS

figures in this report give effect to the foregoing ADS to share

ratio change. |

|

|

|

17 EDUCATION & TECHNOLOGY GROUP INC. |

|

Reconciliations of non-GAAP measures to the most comparable

GAAP measures |

|

(In thousands of RMB and USD, except for share, per share

and per ADS data) |

|

|

|

|

|

For the three months ended March 31, |

|

|

|

2022 |

|

2023 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

USD |

|

Net Loss |

|

(24,766 |

) |

|

(92,537 |

) |

|

(13,474 |

) |

|

Share-based compensation |

|

34,645 |

|

|

28,495 |

|

|

4,149 |

|

|

Income tax effect |

|

— |

|

|

— |

|

|

— |

|

|

Adjusted net income (loss) |

|

9,879 |

|

|

(64,042 |

) |

|

(9,325 |

) |

|

|

|

|

|

|

|

|

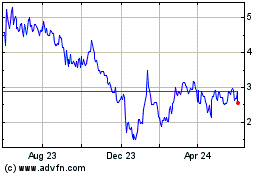

17 Education and Technol... (NASDAQ:YQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

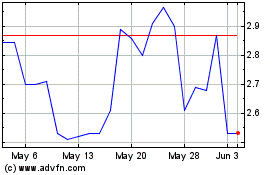

17 Education and Technol... (NASDAQ:YQ)

Historical Stock Chart

From Mar 2024 to Mar 2025